U.S. Econ Shocks: Bitcoin & Profit SignalsThe latest U.S. economic data has brought significant impacts. The core PCE inflation witnessed a 0.4% month - on - month increase, hitting the highest growth in a year, with a year - on - year rise of 2.8%, exceeding market anticipations. Meanwhile, the long - term inflation expectation from the University of Michigan has soared to a 32 - year high, intensifying market concerns about inflation's resurgence. Currently, the market remains enveloped in macro - risks, pending a softening of market sentiment.

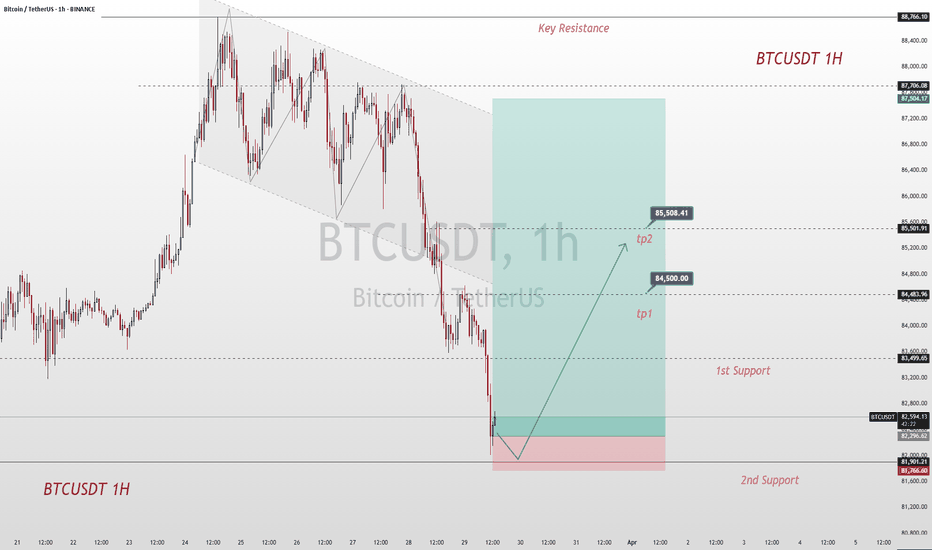

Turning to the Bitcoin market, as depicted in today's price trend (the current BTCUSDT price is $82,338.01, dropping by $2,086.37, a 2.47% decline), the K - line chart analysis indicates a downward trend. The Williams indicator signals an oversold condition. Additionally, trading volume has contracted recently, with both price and volume decreasing, suggesting a sluggish and inactive market.

Nevertheless, if Bitcoin can stabilize above $82,000 and there are signs of capital reflux, gradual position - building may be considered, with a target price set above $90,000. Investors must recognize that the Bitcoin market brims with uncertainties. Variables such as forthcoming U.S. economic data, regulatory policies, and geopolitical scenarios will all sway Bitcoin prices. In this volatile financial landscape, meticulous analysis and judicious decision - making are of utmost importance for investors navigating the Bitcoin market.

BTCUSDT

buy@82000-83000

tp:84500-86500

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

Btcusdtrade

BTC:Seize the opportunity to go long

BTC broke below 83,000 and continued to decline, reaching around the lowest level of 82,000. Currently, it generally shows a downward trend.

In my opinion, the entire bearish trend is merely a well-structured catalyst. Its function is to attract breakout sellers, create the illusion of a sustained downward trend, and trap liquidity at the low points before the true direction becomes apparent. Retail traders who short this structure are providing momentum for the next upward rally.

Before that, BTC can still be regarded as bullish, and each pullback to the demand zone can be considered as an opportunity to go long.

BTC Trading strategy:

buy@82000-82300

TP:83000-85000

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

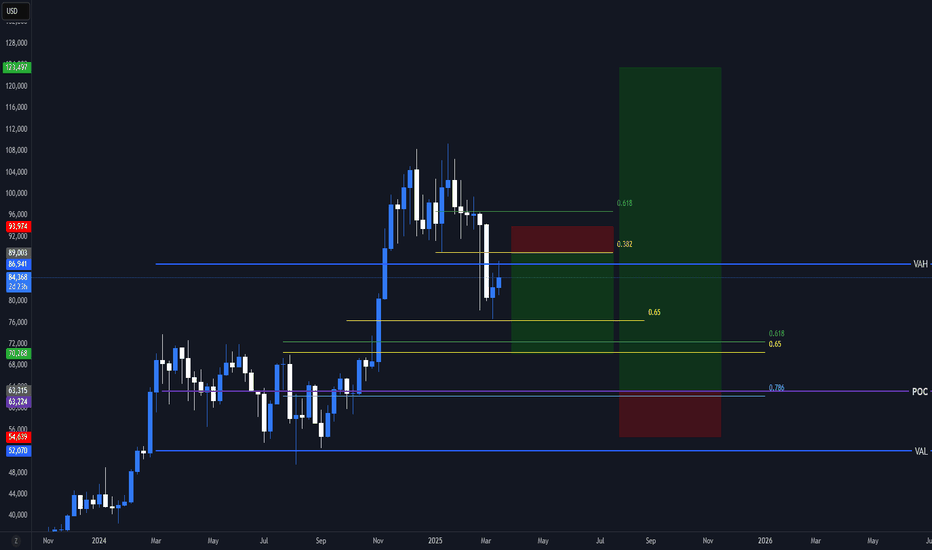

Bitcoin Next two SwingMy next two swing for btc, is simple, I am using the basic strategy of a fibonacci retracement, combined with VAH, VAL, POC.

I want to clarify that I am short from 98k, this is just road plays for me

Remember that trading is a game of probabilities, stick to the highest probabilities.

BTCUSDT:Consider going long at a lower priceIt can be seen from the chart that BTC has successfully broken through the support level of 86,000 over the past few days and has approached the historical resistance level. We can monitor the latest support level around 83,500. If this level is not broken through within a short period of time, one may consider initiating a long position at a relatively low price.

BTC Trading strategy:

buy@83500-84000

TP:86500-87500

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

BTC:Today's Profit-making StrategyThe price of BTCUSDT has been moving steadily for many days and is now forming a potential bullish continuation setup.

A retracement to the 86,500 area is expected. If the price respects this area and shows a bullish reaction, a long - position opportunity emerges.

BTC Trading strategy:

buy@86500

TP:87500-88500

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

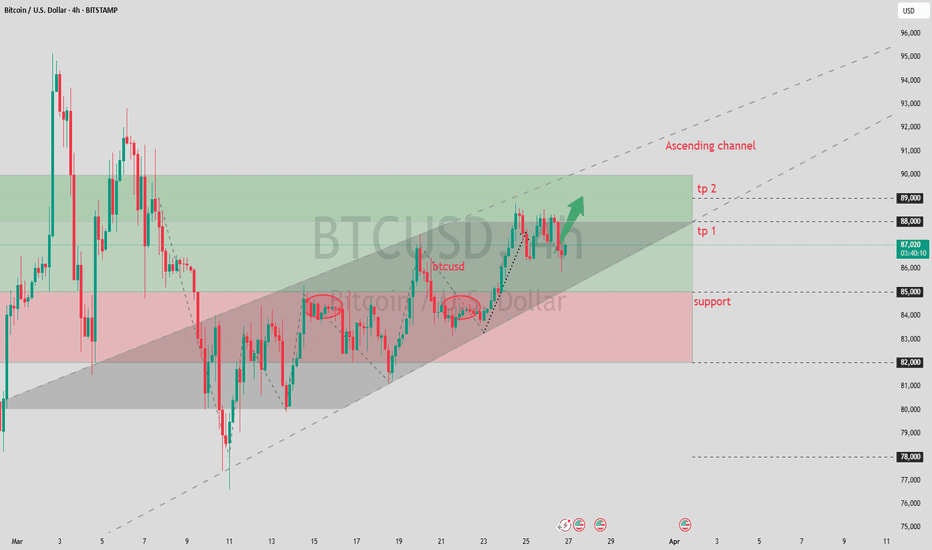

Bitcoin Nears Breakout: Can Bulls Push Past $89K?Currently, the key support level for the price of Bitcoin is around $86,000. This level has played a supporting role several times in the recent price fluctuations. If the price can hold this position, it will provide strong support for subsequent upward movements. The key resistance level above is at $89,000. If the price of Bitcoin can break through and firmly stand above this resistance level, it is highly likely to initiate a new round of upward market; if it fails to break through, the price may continue to experience small - scale oscillatory rebounds within the current range.

From a technical indicator perspective, the moving average indicates that Bitcoin has a short - term upward trend. The price has broken through the area where the signal line is located, indicating that the pressure from "digital gold" buyers is relatively high, and the asset value is likely to continue the upward momentum from the current level. However, the MACD indicator experienced a bearish crossover at the beginning of this week. Although the signal line is currently downward, the MACD line has started to move upward. Nevertheless, a trend reversal is unlikely to occur in the short term. In terms of the Relative Strength Index (RSI), this indicator has moved out of the oversold area and is currently in the neutral zone, indicating that the seller's market may have ended. The price of Bitcoin is expected to maintain its current position and may further rise within the next 5 - 7 days.

BTCUSDT

buy@86000-86500

tp:87500-88500

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

BTC:Today's trading strategyBitcoin is currently in a continuous fluctuating situation. Yesterday's temporary rally also indicates that it is still unable to break through the resistance level of 89,000 for the time being, and there is a downward extension trend.

The strategy of shorting at the high level yesterday has already yielded profits. Today, on the rebound at a high level, continue to take short positions.

BTC Trading strategy:

Sell@88000-88500

TP1:85500

TP2:84000

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

BTC/USDT:Pay attention to the resistance zone.BTC fluctuated within the forecast and reached the profit point. However, the 88K-89K resistance area needs to be watched, and if it cannot be effectively broken this week, then it will fall

This week, the BTC trading strategy was completely correct and the account made more than 200% profit in two weeks

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income,You can follow the link below this article

BTC Rejected at $89K, Uptrend Holds. Bullish Bets?BTC faced rejection at the $89,000 resistance level yesterday, triggering a pullback. However, the overall uptrend remains intact. Investors may consider long positions on signs of stabilization after this corrective move.

BTCUSDT

buy@84500-85500

tp:87000-88000

I will share trading signals every day. All the signals have been accurate for a whole month in a row. If you also need them, please click on the link below the article to obtain them.

BTCUSD:Wait for a rebound before going shortThe fluctuations are not big now, judging from the structure of the 30M icon. The probability of rebounding and then falling later is relatively high. My trading idea is to wait for the rebound to go short. The short orders entered near 88K yesterday are now generally profitable. They can be closed first and then entered after the rebound to prevent the price from rising directly.

Losing profits is a trivial matter, but turning from profit to loss would be very uneconomical.

BTC Today's strategyYesterday's chart already shows an upward channel for BTC, let's continue to hit the resistance area of 88K-89K

btcusdt buy@85.5K-86K

tp:88K-89K

We share various trading signals every day with over 90% accuracy

Fans who follow us can get high rewards every day

If you want stable income, you can contact me

Asymmetrical Triangle (Neutral) or AB=CD (Bullish) for BTC?BINANCE:BTCUSDT has formed bullish divergence on Daily TF and continues its upward momentum. BTC has also formed two trading patterns:

1. Asymmentrical Triangle: This neutral pattern can break out in either direction

2. Bullish AB=CD: This continuation pattern on the weekly tf coupled with bullish divergence on daily tf indicates imminent continuation of the bullish trend.

Buy stop order on break of LH could be a good trading idea!

BTC Today's strategyHi guys, it's a new week and the charts show it's moving up the channel

Looking back on the trading strategy we developed last week, we were undoubtedly successful. Now that the price has exceeded 87K, we still need to pay attention to the resistance of 88K, as it is the determinant of whether the upside can be

btcusdt buy@84.5K-85K

tp:87.5K-88K

We share various trading signals every day with over 90% accuracy.

Fans who follow us can get high rewards every day

If you want stable income, you can contact me.

BTC:Short at high levelsAs per my previous strategy, Bitcoin is on an upward trend. It witnessed a strong rally at today's opening and faced short - term resistance around 88,000. If it fails to break through 88,000 in the short term, one can seize the opportunity of the price pullback from the high level to initiate short positions.

BTC Trading strategy:

Sell@88000-88500

TP1:85500

TP2:84000

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!