JBL Jabil Options Ahead of EarningsIf you haven`t bought JBL before the rally:

Now analyzing the options chain and the chart patterns of JBL Jabil prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2025-12-19,

for a premium of approximately $8.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Buysellsignals

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LAZR Luminar Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LAZR Luminar Technologies prior to the earnings report this week,

I would consider purchasing the 1usd strike price Puts with

an expiration date of 2026-2-20,

for a premium of approximately $0.58.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CSCO Cisco Systems Options Ahead of EarningsIf you haven`t bought CSCO before the previous earnings:

Now analyzing the options chain and the chart patterns of CSCO Cisco Systems prior to the earnings report this week,

I would consider purchasing the 74usd strike price Calls with

an expiration date of 2025-11-14,

for a premium of approximately $1.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DLR Digital Realty Trust Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DLR Digital Realty Trust prior to the earnings report this week,

I would consider purchasing the 190usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $7.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought INTC before the recent rally:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.83.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Plan Day: 24-sep-25Related Information:!!!

This has heightened concerns about a broader regional conflict in the Middle East and kept geopolitical risks in play, providing another factor supporting safe-haven assets. Traders are now looking to U.S. New Home Sales data for fresh momentum.

Later this week, U.S. economic reports will also feature the final Q2 GDP and Durable Goods Orders on Thursday, followed by the U.S. Personal Consumption Expenditures (PCE) Price Index on Friday. These data releases are expected to drive the U.S. Dollar and the XAU/USD pair in the near term.

personal opinion:!!!

Gold price retraced to the 0.618 Fibonacci level before rising to 3800.

Important price zone to consider : !!!

Resistance zone point: 3741 zone

Why AI Could Rise Sharply Before Friday's Options ExpirationIn a market where enterprise AI spending is projected to hit $100B+ by 2026, C3.ai's 130+ turnkey apps (from supply chain optimization to ESG tracking) position it as a must-have for Fortune 500 digital transformations.

Trading at around $17.27 as of midday September 15, down a staggering 33% over the past month, the stock has been battered by leadership turmoil and disappointing quarterly results.

But for options traders eyeing the September 19 expiration, this could be the setup for a sharp rebound. Last month, we loaded up on those $25 strike calls, a tough grind to profitability amid the sell-off, but with fresh tailwinds emerging.

From a charting perspective on TradingView, the stock is testing support near its 200-day moving average around $16.50, with volume spiking on the downside but showing signs of capitulation.A bounce from here isn't just wishful thinking—it's backed by historical patterns. In similar drawdowns earlier this year, NYSE:AI rebounded 15-20% within a week on lighter selling pressure. With the broader Nasdaq futures pointing higher amid cooling inflation data, a risk-on rotation could propel NYSE:AI toward $20+ resistance by expiration, putting those $25 calls back in the money.

Smart money appears to be accumulating; recent options flow shows unusual call volume at the $20 and $22 strikes, hinting at bets on a quick snapback.

New CEO Stephen Ehikian: A Stabilizing Force with Proven PedigreeThe elephant in the room has been the abrupt CEO transition. Founder Thomas Siebel stepped aside for health reasons in late July, triggering a sales slowdown and the withdrawn full-year guidance that spooked investors.

Ehikian isn't just a placeholder; he's a serial innovator with deep ties to enterprise software giants. He built RelateIQ (acquired by Salesforce to form Einstein) and Airkit.ai (now core to Salesforce's Agentforce), and most recently served as Acting Administrator of the U.S. General Services Administration under President Trump.

His track record in scaling AI integrations could accelerate C3.ai's federal deals, which already made up a chunk of Q1 wins (e.g., expansions with the U.S. Air Force).

In his first comments, Ehikian emphasized capturing the "immense market opportunity in Enterprise AI," and whispers from the Street suggest he's fast-tracking partner integrations with Microsoft and AWS—key channels that drove 155% YoY growth in partner-sourced deals last quarter.

This leadership reset screams "buy the dip" for contrarians.3. Solid Q1 Fundamentals Amid AI TailwindsDon't let the headlines fool you—C3.ai's fiscal Q1 2026 results (ended July 31) weren't a disaster; they were a pause in an otherwise accelerating growth story. Revenue hit a record $87.2 million, up 21% YoY, with subscription revenue (86% of total) climbing to $60.3 million.

The company closed 71 deals—more than double last year's tally—and federal expansions highlight sticky demand for its Agentic AI platform.

Options Expiration Gamma Squeeze: The Friday Catalyst With September 19 OPEX looming, NYSE:AI 's options chain is primed for fireworks. Open interest is heavy on out-of-the-money calls around $20-$25, mirroring last month's setup where we rode the $25 strikes through volatility.

As delta hedging ramps up, a modest 5-10% pop in the underlying could trigger gamma squeezes, forcing market makers to buy shares and amplifying the move.

If NYSE:AI clears $18.50 early this week (a key pivot on the daily chart), momentum could carry it to $22+ by Friday.

UAL United Airlines Holdings Options Ahead of EarningsIf you haven`t exited UAL before the recent selloff:

Now analyzing the options chain and the chart patterns of UAL United Airlines Holdings prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $5.12.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TME Tencent Music Entertainment Group Options Ahead of EarningsIf you haven`t bought TME before the rally:

Now analyzing the options chain and the chart patterns of TME Tencent Music Entertainment Group prior to the earnings report this week,

I would consider purchasing the 23usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $1.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SE Sea Limited Options Ahead of EarningsIf you haven`t bought SE before the rally:

Now analyzing the options chain and the chart patterns of SE Sea Limited prior to the earnings report this week,

I would consider purchasing the 150usd strike price at the money Calls with

an expiration date of 2025-9-12,

for a premium of approximately $9.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BABA Alibaba Options Ahead of EarningsIf you haven`t bought BABA before the rally:

Now analyzing the options chain and the chart patterns of BABA Alibaba Group Holding Limited prior to the earnings report this week,

I would consider purchasing the 135usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $10.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RIOT: Lagging Behind Peers, Ready to Catch Up?RIOT Platforms is showing an interesting setup right now. While the broader crypto mining sector has already seen strong moves higher, RIOT is still trading at a relative discount compared to peers like Iris Energy (IREN).

Key Points:

Relative Valuation Gap: IREN and other Bitcoin miners have rallied strongly in recent weeks, yet RIOT has lagged behind. Historically, these names tend to move in cycles together, and RIOT often plays catch-up when the spread gets too wide.

Strong Fundamentals: RIOT continues to expand its hash rate and energy efficiency, positioning itself as one of the top U.S.-based miners. With Bitcoin consolidating above key levels, miners with scale like RIOT stand to benefit disproportionately.

Technical Setup: On the chart, RIOT is building a base with higher lows, showing accumulation. A breakout above recent resistance could trigger momentum buyers and fuel a sharp move higher.

Bullish Outlook:

If Bitcoin maintains its strength and the miner sector rotation continues, RIOT has plenty of room to the upside just to close the gap with peers. Traders looking for lagging plays in the sector may see RIOT as the next mover.

CRM Salesforce Options Ahead of EarningsIf you ahven`t bought CRM before the rally:

Now analyzing the options chain and the chart patterns of CRM Salesforce prior to the earnings report this week,

I would consider purchasing the 300usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $7.52.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AI c3ai Bullish Reversal Ahead of EarningsAI C3.ai has been in the spotlight recently, following a series of notable developments that set the stage for a potential bullish reversal. The company recently announced that founder and CEO Thomas Siebel is stepping down due to health reasons. While this initially caused some market jitters, it coincides with a broader operational transformation that could act as a catalyst for a turnaround.

Earlier this month, C3ai reported preliminary fiscal first-quarter revenues below expectations, raising short-term concerns. However, the company continues to invest in AI-driven solutions and expand strategic partnerships, including a notable collaboration with Eletrobras in Brazil. These moves demonstrate that the firm is actively diversifying its offerings and positioning itself as a leading player in enterprise AI.

From an options market perspective, there is evidence of bullish sentiment building ahead of earnings. The $25 strike price out-of-the-money calls expiring on September 19 suggest that traders are betting on a near-term upside, signaling expectations of a possible recovery or positive surprise in the upcoming earnings report.

Leadership changes, while initially unsettling, often create opportunities for strategic shifts. A new CEO could accelerate operational efficiency, focus on high-growth initiatives, and highlight C3ai’s AI innovation, which has been a core strength of the company. Combined with ongoing product launches and partnership expansions, these factors could serve as a catalyst for a technical and fundamental reversal in the stock.

Traders may want to watch key support levels and the $25 strike options activity closely, as these indicators suggest that a bullish reversal could be on the horizon. With a renewed leadership team and continued AI innovation, C3.ai has the potential to regain momentum in the weeks leading up to earnings.

Gold 1H - test of 0.618 and possible reversalOn the hourly gold chart, price continues to correct after breaking out of the broadening channel. Current consolidation is forming below the 0.5 Fibo (3338), and the structure suggests a high probability of a drop toward the key 0.618 Fibo support zone at 3322–3310. This level also aligns with a previous major reversal point, adding to its significance. If the market reaches this zone and prints a reversal pattern, technical conditions will be set for a potential bullish move back toward 3370 and higher.

From a fundamental standpoint, gold trades in an environment of uncertainty, with the market assessing the Fed’s monetary policy outlook and reacting to shifts in inflation expectations. The absence of strong USD pressure leaves room for a recovery if large-scale buying appears near 3322.

Tactical plan: watch for price action in the 3322–3310 zone - a confirmed bullish signal could trigger longs targeting 3370 and 3400. A break below 3310 invalidates the bullish setup. As often happens with gold, the most interesting moves start right where most traders run out of patience.

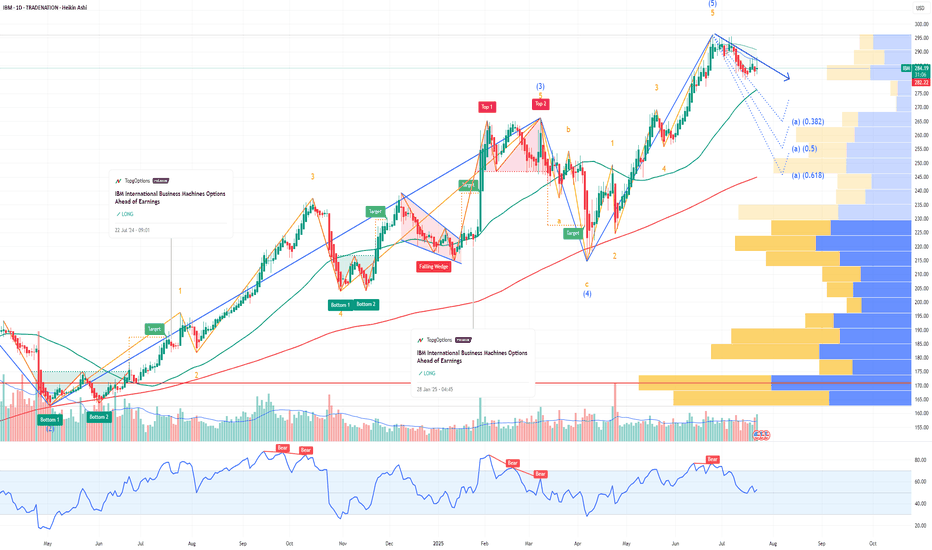

IBM International Business Machines Options Ahead of EarningsIf you haven`t bought IBM before the rally:

Now analyzing the options chain and the chart patterns of IBM International Business Machines prior to the earnings report this week,

I would consider purchasing the 290usd strike price Puts with

an expiration date of 2025-9-19,

for a premium of approximately $17.30.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AI Insider Trading Before the Buyout? $5.8Million block of callsOn Friday, after the close, C3. ai announced CEO Thomas Siebel is stepping down, with a new leadership team taking over. The stock dropped almost 14% on the news, slashing its market cap and potentially making it irresistible for a takeover bid. They are looking for a new CEO!

Why this matters:

1. Perfect M&A Timing: C3. ai has proven AI tech, including contracts with the U.S. Department of Defense. The right acquirer could turn this into the next Palantir-style success story. Leadership changes often make buyouts easier.

2. Valuation Reset: The 14% drop gives strategic buyers a cheaper entry point, exactly when they might be circling.

3. Massive Call Buying Before News: Just last week, someone dropped $5.8M on Sept 19 $25 strike calls. That’s a high-conviction, short-dated bet. Nobody throws around that kind of money without expecting a big move, possibly insider knowledge of a deal or major contract.

4. Strategic Fit: Defense contractors or big tech companies could instantly expand their AI footprint by acquiring C3.ai.

Palantir built its empire by combining cutting-edge data analytics with deep government and defense relationships. C3. ai is following a similar blueprint and may be earlier in the curve:

1. Strong Defense Footprint: C3. ai already holds contracts with the U.S. Department of Defense and other government agencies, positioning it in the same secure, high-margin niche that powered Palantir’s growth.

2. Mission-Critical AI Solutions: Just like Palantir’s Gotham and Foundry platforms became embedded in government workflows, C3. ai’s AI suite is designed for enterprise and defense applications that are hard to replace once integrated.

3. Massive TAM (Total Addressable Market): The AI defense and enterprise analytics market is projected to grow exponentially over the next decade, mirroring the macro tailwinds Palantir rode after 2020.

4. Sticky Contracts: Government and defense clients tend to lock in long-term, high-value contracts once a system is deployed, creating predictable recurring revenue streams.

5. Potential for Commercial Expansion: Palantir went from mostly government to a healthy commercial mix. C3. ai could follow the same path, leveraging its defense credibility to win private-sector deals.

6. Strategic Acquisition Target: Big tech and defense primes would love to own a proven AI platform with federal clearance — just as Palantir’s unique positioning has made it a darling of Wall Street and a fortress against competition.

In short: C3. ai today could be where Palantir was a few years ago!

If acquired or scaled correctly, the upside could be just as explosive!

PLUG Plug Power Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PLUG Plug Power prior to the earnings report this week,

I would consider purchasing the 6usd strike price in the money Calls with

an expiration date of 2027-1-15,

for a premium of approximately $0.0.49.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AMZN Amazon Options Ahead of EarningsIf you ahven`t bought the recent dip on AMZN:

Now analyzing the options chain and the chart patterns of AMZN Amazon prior to the earnings report this week,

I would consider purchasing the 245usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $7.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

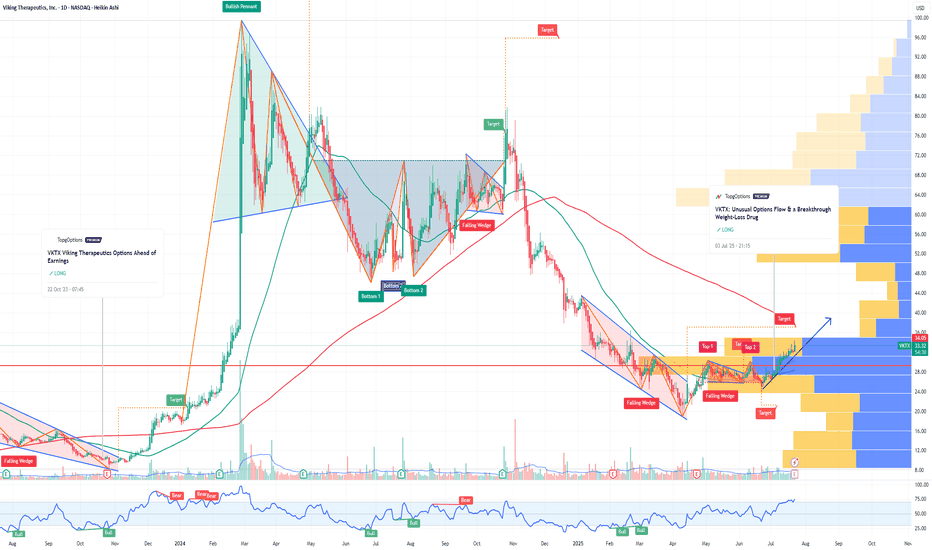

VKTX Viking Therapeutics Options Ahead of EarningsIf you haven`t bought VKTX before the breakout:

Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Bitcoin Breaks All-Time High: What’s Next?Bitcoin (BTC) has once again captured the world’s attention by smashing through its previous all-time high (ATH). This milestone has sparked excitement and speculation across the crypto community and beyond. But the key question remains: Will BTC continue its upward trajectory, or is a correction on the horizon?

Long-Term Outlook: The Bullish Case

In the long run, the fundamentals for Bitcoin remain strong. Several factors support a positive outlook:

Institutional Adoption: More institutional investors are entering the market, providing greater liquidity and legitimacy.

Scarcity and Halving Cycles: Bitcoin’s fixed supply and periodic halving events historically drive long-term price appreciation.

Macro Trends: Ongoing concerns about inflation and fiat currency devaluation continue to make BTC an attractive hedge.

Given these dynamics, we believe Bitcoin’s long-term trajectory remains upward.

Short-Term Caution: A Correction May Be Coming

While the long-term view is optimistic, the short-term picture may be less rosy:

Overheated Market Indicators: Rapid price surges often lead to overbought conditions, increasing the likelihood of a pullback.

Profit-Taking: After breaking ATH, some investors may lock in gains, adding selling pressure.

Technical Resistance: Historical patterns suggest that corrections often follow major breakouts.

We anticipate a potential correction, possibly pulling BTC back to the $90,000 range. This adjustment could unfold in the coming week or weeks as the market digests recent gains.

What Should Investors Do?

Stay Calm: Volatility is part of the crypto landscape. Corrections are healthy for sustainable growth.

Focus on Fundamentals: Remember why you invested in BTC in the first place.

Consider Dollar-Cost Averaging: Spreading out purchases can help mitigate the impact of short-term swings.

Conclusion

Bitcoin’s break above its all-time high is a testament to its enduring appeal and the growing confidence of investors. While a short-term correction may be likely, the long-term case for BTC remains compelling. As always, prudent risk management and a focus on fundamentals are key to navigating the exciting—and sometimes turbulent—world of crypto.

Do not consider it as investment advice.

#crypto #bitcoin #analysis