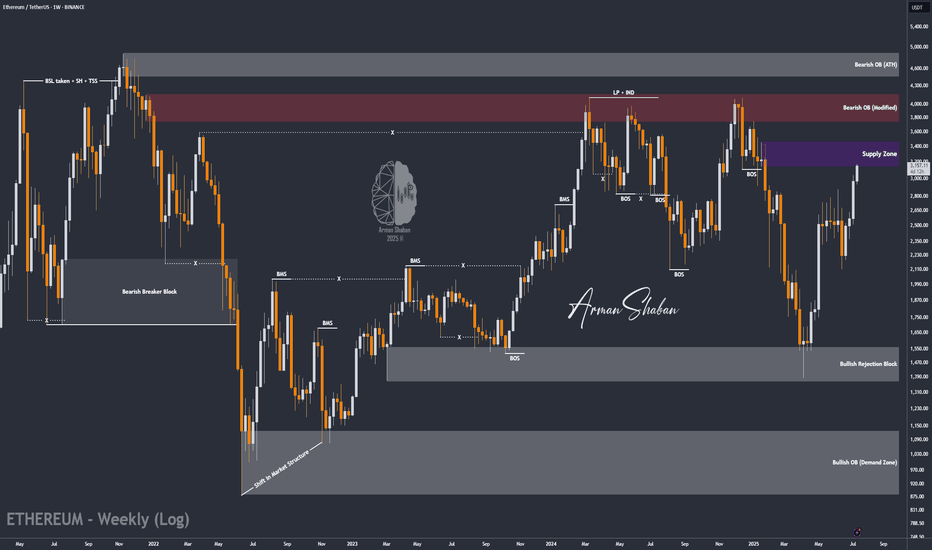

ETH/USDT : $3000 Reached, It's time foe $4000? (READ)By analyzing the Ethereum chart on the weekly timeframe, we can see that the price has finally broken the strong $2700 resistance and pushed toward the next target at $3000! Currently trading around $3150 and now within the $3130–$3440 zone, I expect a short-term rejection from this area. However, given the overall market trend, this level may not hold for long, and we could soon see a breakout toward the next targets at $3500, $3740, $4100, and $4470!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

THE LATEST ANALYSIS :

Cardano

HolderStat┆ADAUSD seeks to $0.774KUCOIN:ADAUSDT recently broke out of a multi-week triangle formation on the 4H chart. The clean break above 0.66 has invalidated the previous downtrend and triggered a new leg higher. With ADA currently riding within an ascending channel, the path toward 0.73–0.75 remains open as momentum continues building.

ADA - Beginning of something crazy- ADA is looking forward to the successfully breakout of the trendline resistance.

- A clean breakout from this resistance must to fuel the bullish trend.

- I'm expecting a target of 3$ from this trend.

Entry Price: 0.72

Stop Loss: 0.4838

TP1: 0.8602

TP2: 1.0342

TP3: 1.3379

TP4: 2.0144

TP5: 2.4818

TP6: 3.0329

Stay tuned for more updates

Cheers

GreenCrypto

Can we break above the 0.8063-0.8836 range?

Hello, traders.

If you "Follow", you can always get the latest information quickly.

Have a nice day today.

-------------------------------------

(ADAEUSDT 1D chart)

ADA is forming a long-term rising channel and is showing an upward trend as it breaks above the mid-term high downtrend line.

We need to see if it can rise above 0.8836 and maintain the price to rise above the previous mid-term low trend line.

-

The DOM(60) indicator is showing signs of being newly created.

Accordingly, we need to see where the DOM(60) indicator is formed.

Since the HA-High indicator is formed at 0.8063, in order to continue the upward trend, it must rise at least above 0.8063 to maintain the price.

Accordingly, the key is whether the price can be maintained above 0.6328.

-

It is possible to show a mid- to long-term upward trend only if it breaks through the HA-High ~ DOM(60) section of the 1W chart upward.

Therefore, the 0.8836-1.1936 section is likely to be the resistance section.

-

Based on the current price position, the support section is the 0.5824-0.6328 section.

However, since the positions of the HA-Low indicator and the DOM(-60) indicator are switched, if it shows a downward trend, there is a possibility that a new HA-Low indicator will be created.

If a new HA-Low indicator is created, it is important to determine whether there is support near it.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain the details again when the bear market starts.

------------------------------------------------------

🐋 Deep Dive Part II: Whale Behavior & Market Mastery! 🌊📚Hey Crypto Enthusiasts! 🚀

In a recent analysis, I not only nailed Bitcoin's (BTC) movement but also illuminated the subsequent altcoin surge, driven by insightful whale behavior observations. Let's merge these insights with a focus on ADA (Cardano), OP (Optimism), SOL (Solana), and BTC. 📊

Cardano's (ADA) Meteoric Rise 🌟

ADA's journey began with a break above a pivotal support-resistance level. My entry point at 0.256 turned into a remarkable rally, hitting 52 cents. This movement was a classic case of altcoin buoyancy following Bitcoin's pause.

Optimism (OP) and the Altcoin Breakouts 🌈

In the shadow of Bitcoin's stagnation, altcoins like OP exhibited significant breakouts, showcasing the shifting focus of market whales from Bitcoin to promising altcoins.

Bitcoin (BTC) and Whale Dynamics 📉

Bitcoin's behavior provided a crystal ball into the whale activities. As BTC approached a major resistance level, it signaled a strategic move by whales to divert funds towards altcoins, catalyzing their surge.

Solana (SOL) and Market Trends ☀️

Solana's chart also mirrored this trend, highlighting the broader market dynamics influenced by these significant players.

🔍 Insight on Whale Behavior:

My analysis delved deep into the whale behavior, highlighting how Bitcoin's rally and subsequent pause was a precursor to altcoin dominance. This strategic pause in Bitcoin's ascent was a clear signal for the whales to redistribute their focus and capital, sparking a remarkable rise in altcoins like ADA, OP, and SOL. 🔄

The Bigger Picture - Understanding Market Shifts: What this trend teaches us is the importance of reading between the lines. Whale movements often precede major market shifts, and by understanding these patterns, we position ourselves to make informed decisions. 🧠

Future Outlook: As we continue to monitor these market dynamics, it's crucial to stay vigilant. The crypto market is known for its volatility, and while the current trend favors altcoins, it's essential to be prepared for any shifts that may arise. Always keep an eye on key resistance and support levels, market sentiment, and global economic factors that could influence the next big move. 🌐

Together, let's stay ahead of the curve in this fascinating and ever-evolving world of cryptocurrency. Your insights and engagement are what make this journey exciting and rewarding!

One Love,

The FXPROFESSOR 💙

part 1:

ADABTC – Long-Term Demand ZoneThe green box is a multi-year demand zone, tested multiple times, with each test producing strong upward moves.

Current structure aligns with previous cycle bottoms.

If BTC dominance stalls or rotates, alt/BTC pairs like ADA/BTC could rotate sharply upward.

📌 Risk Management:

A weekly close below 0.0000450 invalidates the long thesis. Until then, the risk-reward favors accumulation.

If market conditions align, ADA could be preparing for one of its classic ratio expansions — especially if Bitcoin cools and capital rotates into majors.

ADA Daily Update · Moving Averages · 262% Target ExposedGood morning my fellow Cryptocurrency trader, I know you are having a wonderful day because the market is doing great. We looked at Cardano together on the weekly timeframe and this is a big picture but what about short-term? Where are prices headed next? The next target, resistance/support and the moving averages of course.

I've been looking at the moving averages lately and this is a theme that I will continue for a few days, or weeks, once we exhaust it we use other indicators. You know we also like the RSI and MACD, candlestick reading, volume, chart structure, chart patterns, market cycle, etc. Marketwide action, subtle signals, market sentiment, on and on.

Cardano is already trading above many major moving averages but this is a recent event. First consider the fact that in late 2024 ADAUSDT grew 320% right after breaking above the same EMAs that I am showing you now.

ADA closed just recently above EMA89, EMA233, EMA55, etc. Only MA200 is missing and this is an important one but will soon break. I am not showing it here because the action is still happening below.

There is a rounded bottom. This alone is a reversal signal already confirmed because the action is happening above the base of the pattern. In April we had a triangular bottom and here we can see an alternation. In February it was a straight line. A straight line, a triangle and then a circle; interesting.

The bullish bias is confirmed and we are seeing straight up, the next target is 0.8194. Cardano has been green four days straight. Go back to November 2024... The possibility exist for continued growth. Day after day after day. At some point there will be a stop, can be a retrace or correction. Know that when this stop happens it is not the end. There will be several stops along the way but we are set for a strong new all-time high. You will need to be patient while holding but just make sure to aim high. Don't get greedy of course. If at some point you start to feel anxious, read on the topic, go out into nature or simple sell a small portion until you feel better. The best choice is to be prepared and this can be done by studying the charts and the market. If you have a good plan and a nice map you will do fine. If you are an advanced trader, I am sorry, let's get back to the chart.

$1.01, $1.30, $1.15. These are all resistance. So there will be some challenge around this price zone. Once it is conquered though the advance should be swift until 1.83. Another stop and then 2.65 which is the main target for 262%. Depending on how this level is handled we will update the chart and the targets. For higher targets look at earlier analyses or those on the weekly timeframe.

Thank you for reading.

Namaste.

Cardano Forming Potential Reversal Structure Inside TriangleHello guys!

Cardano’s been stuck inside this big descending triangle for months. We had a fake breakout a while back that totally failed.

Now, price is back at support and showing bullish divergence. That’s usually a sign sellers are getting tired.

If buyers step in here, I’m expecting a move back up toward 0.67–0.70 (top of the triangle). But if it loses the 0.53 support, that setup’s off the table.

Bias: Leaning bullish

🎯 Target: 0.67–0.70

Invalidation: Clean break below 0.53

Let’s see how this plays out.

ADA/USDT : ADA Rally in Motion – Over 20% Gain and More to Come?By analyzing the Cardano (ADA) chart on the 3-day timeframe, we can see that after revisiting the $0.57 zone, the price once again followed the previous analysis and encountered strong buying pressure—rallying up to $0.61 so far.

The return from the previous entry has now exceeded 8%, and the overall gain from the full move stands above 20%.

The next bullish targets are $0.76, $0.93, $1.05, and $1.33.

(A deeper and more detailed analysis is recommended for long-term investment decisions.)

THE MAIN ANALYSIS :

Cardano Ultra Bullish Confirmed, $1.83 Next (Easy) TargetThis is it. This is the signal you've been waiting for and the strongest possible signal across the Cryptocurrency market. Cardano is now moving above MA200 on the weekly timeframe, on a full green candle, as Bitcoin produces a very strong new all-time high. Simply put, this is the best ever.

Cardano has been testing the same low since early February, for five months. Five months and this support held nicely and now the action is turning green. The correction is over; consolidation is over, now comes the resumption of the bullish wave.

The bullish wave will produce a major, major, higher high compared to early December 2024, a target of $1.83 in the coming months and this is not all. This is not the end of the bull market nor the bullish wave, this is just the start, mid-portion, we are set to experience growth long-term.

You can go all-in now. The altcoins bull market is already confirmed. Bullish momentum will start to grow. Feel free to buy and hold.

Thanks a lot for your continued support.

Namaste.

Cardano: Eyeing Alternative Rally ScenarioCardano’s ADA token has realized further gains. As a result, we’ve increased the probability of our alternative scenario—in which the low of the wave (ii) correction is already in place—to 40%. For ADA to take this “shortcut,” the next step would be to break above resistance at $0.86, followed by a move past the $1.32 level. For now, however, we’re maintaining our primary outlook and are preparing for a new low in blue wave (ii). In this scenario, the price should hold above support at $0.31.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

TradeCityPro | ADA Eyes Breakout from Bearish Channel Top👋 Welcome to TradeCity Pro!

In this analysis, I want to review the ADA coin for you. The Cardano project is one of the oldest and most popular projects in crypto.

🔍 The coin of this project has a market cap of 22.21 billion dollars and is ranked 10 on CoinMarketCap.

📅 Daily Timeframe

On the daily timeframe, ADA is moving downward within a descending channel and is currently trying to break out of the channel from the top after reaching a support zone.

⭐ One positive sign for buyers is that they didn’t let the price reach the bottom of the channel. Instead, they used the overlap between the midline of the channel and the key 0.5579 zone (marked as a support area) to stop the price from falling.

✨ However, as long as the coin is fluctuating inside this channel, the trend remains bearish. Holding the midline is not a sign of trend reversal yet, but it does indicate weakening of the current trend and may act as one of the bases for a future reversal.

✅ Looking at the RSI oscillator, we can see that each time the price tried to break the channel’s top, RSI reached the 70 area and got rejected, causing the price to drop.

⚡️ Currently, the price is very close to the top of the channel, but RSI has just broken above the 50 line and is moving upward. This is a bullish sign for buyers, as it shows there is still room for upward momentum, which increases the chance of a breakout.

🎲 The nearest trigger for confirming the breakout from the channel is the 0.7212 zone, which is a bit far, and the price will likely form a higher low and high before reaching it, confirming the breakout earlier.

💥 But based on the current data, the breakout trigger remains at 0.7212, and for spot buying, this is the first valid entry level.

👀 Personally, I’m not adding any altcoins to my portfolio right now, as Bitcoin Dominance is still in an uptrend. As long as this trend continues, large capital flows into altcoins are unlikely.

🛒 More reasonable triggers for spot entries would be a breakout above the 0.8414 supply zone. If I were to buy, I’d enter at this level. The final trigger is 1.1325, which is quite far from the current price, and if BTC Dominance continues upward, it could take several months to reach this zone.

🔽 If you already hold this coin in spot, your stop-loss can be set at a break below the 0.5579 level. A breakdown here would also provide a good short setup in futures, as the price could move toward the bottom of the box or the static level at 0.4322.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

ADA/USDT – Possible ShortADA/USDT – Bearish Reaction from Key Channel Resistance | Short Opportunity

Bias: Short Setup (Counter-Trend)

Cardano (ADA) has reached a significant technical juncture following a strong bullish impulse. Price has tapped into a critical resistance zone marked by:

The upper boundary of a broadening ascending channel

A horizontal liquidity pocket at 0.6195, labeled as “Level 1”

An extended impulsive move without consolidation, suggesting potential overextension

📌 Key Price Levels

Resistance (Short Entry Zone):

Level 1: 0.6195 USDT

Bearish Targets (Take Profits):

TP1: 0.6017 – Local support & minor demand

TP2: 0.5939 – Mid-range value zone

TP3: 0.5842 – Confluence of wedge support & previous demand

The structure resembles a rising broadening wedge, typically a bearish reversal formation, especially after a sharp leg into resistance.

The breakout from the smaller consolidation wedge has now run into major supply, where early short entries may begin to scale in.

TON/USDT : TON at a Key Breakout Level – Will $3 Hold or Break?By analyzing the TON Coin chart on the 3-day timeframe, we can see that after climbing back to the $3 level, this zone has now turned into a key resistance area. The most important condition for further bullish movement is a strong breakout and confirmation above $3. If that scenario plays out, the next potential upside targets are $3.15, $3.63, $4.20, and $4.68.

⚠️ (A deeper and more detailed analysis is recommended for long-term investment considerations.)

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

HolderStat┆ADAUSD rising topBINANCE:ADAUSDT is breaking out of a falling channel, following a long consolidation period and bullish wedge development. Price action is coiling around 0.58–0.60 and may rally toward 0.65 if the breakout sustains. Historical patterns suggest continued strength from this structure.

Cardano Eyes 16% Gain, Main Target Set Firmly At 0.65Hello and greetings to all the crypto enthusiasts, ✌

All previous targets were nailed ✅! Now, let’s dive into a full analysis of the upcoming price potential for Cardano 🔍📈.

📉 Cardano is currently trading inside a descending channel, hovering near a key historical support — the strong daily level at the psychological 0.50 mark. This zone could act as a solid base for a potential bounce.

🚀 I’m targeting at least a 16% upside, with a primary resistance around 0.65.

🧨 Our team's main opinion is: 🧨

Cardano is holding a strong daily support near 0.50 within a down channel, setting up for a potential 16%+ rally toward 0.65. 📈

✨ Need a little love!

We put so much love and time into bringing you useful content & your support truly keeps us going. don’t be shy—drop a comment below. We’d love to hear from you! 💛

Big thanks , Mad Whale 🐋

ADA/USDT : First Target Reached, Ready for Next ? (READ)By analyzing the #Cardano chart on the 3-day timeframe, we can see that the price is currently trading around $0.57. After reaching the first target at $0.61, a slight correction occurred, but ADA has managed to hold above the key support level of $0.55 — which is a significant sign of strength. As long as this level holds, we can expect further bullish continuation.

The next potential targets are $0.76, $0.93, $1.05, and $1.33.

The Latest Analysis (Tap for More Details) :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Cardano vs Bitcoin, 3800% Potential Profits—The 2025 Bull MarketCardano grew non-stop in 2021. After a bottom in August 2019 and 8 months of consolidation, it started a strong bull market. Total growth reached almost 1,500%. The peak happened August 2021. The bullish signal here comes from the fact that after the August 2021 peak, ADABTC went down and continued to produced lower and lower lows, all of the time, for years.

Them, in November 2024 we have the market bottom. In June 2025 we have a higher low. The first higher low long-term since December 2020. A low in March 2020 and then a higher low in December 2020 that produced the last bull market.

The situation now is similar. A low in November 2024 and a higher low June 2025 that will produce a new bull market.

ADABTC produced another bull market late 2017 through January 2018. If we go by Elliott's law of alternation, this bull market wave should be similar to 2017 vs 2021. So it should be really strong but also fast. I prefer the prolonged one but we will have to wait and see.

The good news is that massive growth will happen and this cannot be avoided. It will be the best experience for an entire generation of Cryptocurrency holders, buyers, investors and traders. It will be awesome for the entire market and we are blessed to be part of this game. We are blessed for all the great opportunities and we love to see the world and humanity evolve. We love Crypto and we will continue to buy and hold.

Thanks a lot for your continued support.

Boost if you enjoy the content. Do it often.

Namaste.