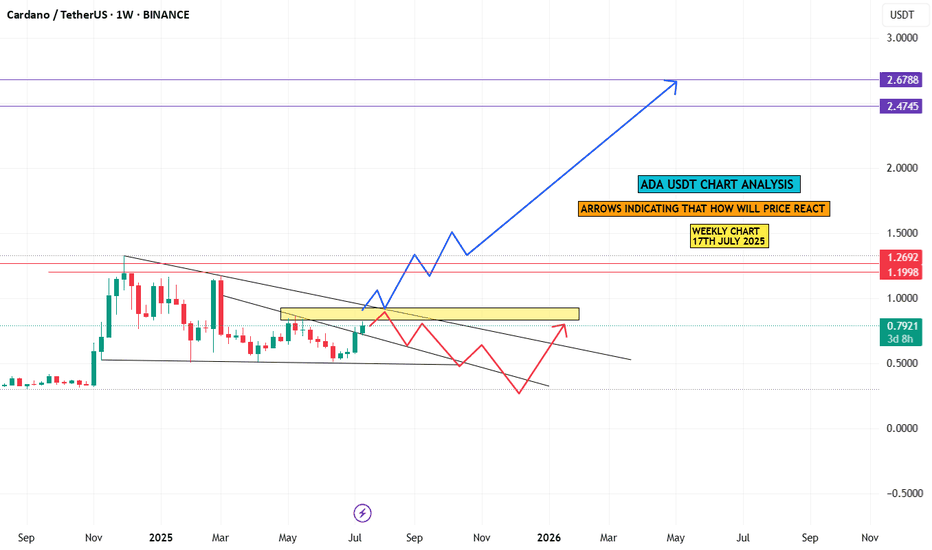

ADA : LIVE TRADE

Hello friends

According to the channel in which the price is located, you can see that every time it reached support, we had a growth, and now that it has reached the same support, we can expect another growth.

This analysis is purely technically reviewed and is not a buy or sell recommendation, so do not act emotionally and observe risk and capital management.

*Trade safely with us*

Cardanobtc

Cardano Finds Opportunity Zone—Buyers Step InCardano’s price stands at $0.641 at the time of writing, holding above the $0.623 support. The altcoin remains under the $0.661 resistance, where repeated rejections have hindered its upward progress over the past week.

If current conditions persist, ADA could breach $0.661 and aim for $0.696. However, for Cardano to mark a true recovery, it must reach and sustain levels above $0.754. Such a move would confirm renewed market strength and investor optimism.

Conversely, if ADA faces renewed selling, the price could drop below $0.623 and test $0.608. A failure to hold these supports would invalidate the bullish outlook and potentially trigger further downside pressure.

Cardano Inflows Jump To 3-Month High As Holders Rescue ADA PriceCardano’s price currently hovers above the $0.66 support level but risks slipping below it if bearish momentum continues. A drop under this line could push ADA down to $0.60 in the coming days.

Continued whale selling could exacerbate downward pressure even if inflows remain strong. Persistent profit-taking from large holders would make sustained recovery more difficult.

However, if ADA manages to hold $0.66 and attract renewed buying interest, the altcoin could rise above $0.69 and potentially reach $0.75. Such a move would invalidate the bearish outlook and mark the start of a short-term rebound.

Cardano Price Gains Capped by Long-Term Holder PressureCardano’s price currently trades at $0.87, hovering just below its immediate resistance of $0.88. The token remains approximately 14% away from the psychologically important $1.00 level, a threshold that could reignite market enthusiasm if successfully breached.

Given the mixed outlook from investors and technical indicators, ADA is likely to continue its sideways movement. The cryptocurrency may remain rangebound between $0.83 and $0.88 until decisive buying volume emerges.

However, if long-term holders pause their selling and market sentiment improves, ADA could break past the $0.88 barrier and rise toward $0.93. Such a move would restore bullish confidence and potentially pave the way for a broader recovery phase in the weeks ahead

ADA/USDT; FREE SIGNALHello friends

According to the market cycle, you can see that every time after the price growth we had a correction and now it seems that the price wants to exit the correction and have a new growth. If the support levels continue, the price can move to the specified targets.

*Trade safely with us*

Cardano Price To Bounce As IOHK Audit Report Nears ReleaseBINANCE:ADAUSDT price is currently $0.85 , holding steady above the $0.83 support level. The Ichimoku Cloud shows a bullish outlook, suggesting positive momentum for ADA. Investors are keeping a close eye on price movements, with potential for further gains if market conditions remain favorable for the altcoin.

A key catalyst for potential price growth is the upcoming audit report of Input Output Global’s ADA holdings. Charles Hoskinson, BINANCE:ADAUSDT founder, requested the audit to address transparency concerns after allegations of $600 million in misappropriated ADA . The report could play a crucial role in boosting investor confidence and market sentiment.

If the audit report meets investor expectations, BINANCE:ADAUSDT could see a price increase, potentially pushing it to $0.90. Successfully securing this level as support may pave the way for further gains, reaching $1.00. Such a move would solidify Cardano's position and help avoid a drop below the $0.83 support level.

Is it time to buy Cardano?Hello friends

According to the analysis and review we conducted on ADA, we reached almost definitive results:

This currency has fallen, which has caused the price to reach important and fundamental supports, and here we can buy in steps at the supports, depending on the level of risk and our capital management, and move with it to the specified goals.

*Trade safely with us*

Breaking: $ADA Set for 100% Surge Amidst Launching of VeridianCardano the proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change, is set to breakout of a bullish symmetrical triangle with a 100% surge in sight amidst The Cardano Foundation launching "Veridian", an open-source identity wallet for secure, verifiable credentials on iOS and Android.

The asset is already up 2.24% despite the general crypto and stock market turmoil that saw over $1.5 trillion wiped out from US stock market at open today and over $2.85 trillion wiped out from the US stock market yesterday.

For Cardano ( CRYPTOCAP:ADA ), a breakout above the ceiling of the symmetrical triangle could catalyze the bulls to step in and push the asset to new highs. Similarly, should CRYPTOCAP:ADA fail to pull that stunt and selling pressure increases, CRYPTOCAP:ADA might cool-off in the $0.50 region.

Cardano Price Live Data

The live Cardano price today is $0.660668 USD with a 24-hour trading volume of $868,773,182 USD. Cardano is up 6.97% in the last 24 hours. The current CoinMarketCap ranking is #9, with a live market cap of $23,300,460,393 USD. It has a circulating supply of 35,268,011,575 ADA coins and a max. supply of 45,000,000,000 ADA coins.

Just In: Cardano ($ADA) Broke Out of a Falling Wedge Surge 10% The renown altcoin that is known to move in tandem with CRYPTOCAP:XRP saw a noteworthy uptick in price with the native asset surging 10% amidst breaking out of a falling wedge pattern. With the RSI at 57 are we going to witness a lip to the $1 pivot or beyond?

Presently, CRYPTOCAP:ADA is trading within the trendline of the wedge a small thrust above the resistance could be the catalyst CRYPTOCAP:ADA needs to cement a move to $2.

What Is Cardano (ADA)?

Cardano is a proof-of-stake blockchain platform that says its goal is to allow “changemakers, innovators and visionaries” to bring about positive global change. The open-source project also aims to “redistribute power from unaccountable structures to the margins to individuals” — helping to create a society that is more secure, transparent and fair.

Cardano Price Live Data

The live Cardano price today is $0.936263 USD with a 24-hour trading volume of $5,369,546,196 USD. We update our ADA to USD price in real-time. Cardano is up 8.62% in the last 24 hours. The current CoinMarketCap ranking is #8, with a live market cap of $32,968,087,133 USD. It has a circulating supply of 35,212,423,444 ADA coins and a max. supply of 45,000,000,000 ADA coins.

ADA order limitThis chart for ADA/USDT highlights a consolidation phase within a symmetrical triangle pattern 📐. The price is narrowing, signaling a potential breakout. Key zones and trend lines

guide this analysis:

Trendline Break: The triangle's upper trendline represents resistance, and a break above it could trigger bullish momentum 📈. Conversely, a break below the lower trendline might lead to further downside 📉.

Resistance Levels:

First resistance at $1.0323 🚩. Breaking this level could propel ADA to $1.1000 and then $1.1400, where significant sell pressure may appear.

These zones align with the highlighted red resistance bands.

Support Levels:

Immediate support at $1.0022 🛡️. If broken, the price may test lower zones at $0.9730 and $0.9380.

Signal:

Bullish Entry: Wait for a confirmed breakout above $1.0323 with strong volume 📊. Target levels: $1.1000 and $1.1400.

Stop Loss: If the price breaks below $1.0022, consider shorting with targets of $0.9730 and $0.9380.

Risk Management: Keep stops tight ⛑️. For longs, place a stop-loss below $1.0022; for shorts, keep it above $1.0323.

Wait for confirmation to avoid false breakouts. Monitor volume and candlestick patterns near breakout levels for the best signal 🎯.

Will Cardano Finally Break Free? Key Levels to Watch Right Now!Yello, Paradisers! Are #ADA bulls about to reclaim their dominance? Let’s break it all down because #Cardano is approaching a critical moment you cannot afford to miss!

💎Cardano has been consolidating after a massive rally, but here’s the kicker—it’s now forming an ascending triangle. If this bullish formation plays out, ADA could finally break out of its range and reignite its upward momentum.

💎ADA faces a pivotal challenge at the $1.15–$1.20 resistance region. This area has been a brick wall for ADA’s upside potential since December 9th. This zone isn’t just horizontal resistance—it’s also reinforced by the 0.618 Fibonacci retracement level, making it a major decision point for the bulls.

💎For ADA to reignite its hyper-bullish phase, the bulls must decisively break and hold above the $1.15–$1.20 region, which remains a significant roadblock. If they succeed in flipping this zone into support, the price is likely to target the 52-week high at $1.327 as the first major milestone. Beyond this, the upside target extends further, stretching toward the $1.38 level.

💎On the downside, there’s solid ascending support between $0.93–$0.918, which the bulls have been defending consistently for weeks. As long as this level holds, the bullish structure remains intact. However, if this support breaks, the horizontal support at $0.865–$0.85 comes into play as the next line of defense.

Trade smart, Paradisers! Stay focused, and don’t chase the market.

MyCryptoParadise

iFeel the success🌴

Significance of the 100-Day SMA for CardanoCardano (ADA) has recently demonstrated a strong bullish trend, surging past its 100-day Simple Moving Average (SMA) and fueling optimism among investors. This move signals a potential shift in momentum, with bulls now setting their sights on the $1.26 price target. This article delves into the significance of this breakout, the factors driving Cardano's resurgence, and the potential challenges that lie ahead.

Understanding the Significance of the 100-Day SMA

The 100-day SMA is a widely used technical indicator in financial markets, representing the average price of an asset over the past 100 days. It serves as a crucial trend indicator, helping traders and investors identify the overall direction of an asset's price movement.

When an asset's price crosses above its 100-day SMA, it is often seen as a bullish signal, suggesting that the asset is gaining positive momentum and may continue to rise in value. Conversely, a drop below the 100-day SMA is typically considered a bearish signal.

Cardano's recent breach of this key indicator is, therefore, a significant development, indicating a potential shift from a bearish or sideways trend to a more bullish outlook.

Factors Driving Cardano's Resurgence

Several factors appear to be contributing to Cardano's recent price surge:

1. Increased Network Activity: Cardano has seen a significant increase in network activity in recent months, with a growing number of projects building on its blockchain and a rise in transaction volume. This increased adoption and usage is a positive sign for the long-term health of the Cardano ecosystem.

2. Positive Developments and Upgrades: The Cardano development team has been actively working on improving the network, with several successful upgrades and developments implemented recently. These improvements enhance the network's scalability, security, and functionality, making it more attractive to developers and users.

3. Growing Institutional Interest: Cardano has also been attracting growing interest from institutional investors, with several major players expressing support for the project. This institutional backing provides further validation for Cardano's potential and can contribute to increased investment and adoption.

4. Overall Market Sentiment: The broader cryptocurrency market has also been experiencing a period of positive momentum, with Bitcoin and other major cryptocurrencies showing strong gains. This positive market sentiment can spill over on altcoins like Cardano, contributing to their price appreciation.

Potential Challenges and Resistance Levels

While the recent breakout above the 100-day SMA is a positive sign for Cardano, it is important to acknowledge that challenges and resistance levels may still lie ahead.

The $1.26 price target represents a key resistance level, and Cardano may face some resistance at this point. If the bulls can successfully push through this level, it could pave the way for further gains.

Additionally, the cryptocurrency market is known for its volatility, and sudden price swings are always possible. Investors must remain cautious and not get carried away by short-term price movements.

Conclusion

Cardano's recent rally above its 100-day SMA is a significant development, signaling a potential shift in momentum and fueling bullish optimism. The factors driving this resurgence include increased network activity, positive developments and upgrades, growing institutional interest, and overall market sentiment.

While challenges and resistance levels may still exist, the current trend suggests that Cardano is well-positioned for further growth. Investors and enthusiasts will be closely watching to see if the bulls can maintain this momentum and push Cardano towards the $1.26 target and beyond.

ADA - 4h - Accumulation RangeADA - 4h - Accumulation Range

REMEMBER that a lot of investors sell stocks or crypto for fiscal conditions in 2024 to close the year.

For that, we have low buy liquidity , and even with that pressure on the price , ADA is trying to remaning in the same range as 1 week ago, so a breakout can restart a new HH , so patience.

Im bullish on it if the 1usd resistance its broken and became a support.

Exploring the Factors Driving Cardano's Bullish TrajectoryCardano (ADA), a blockchain platform known for its robust security and energy efficiency, has been steadily gaining traction in the cryptocurrency market. Analysts are increasingly bullish on ADA's future price movements, with some predicting that the token could reach as high as $9+ in the coming months. This optimistic outlook is fueled by a combination of strong fundamentals, positive market sentiment, and historical price patterns.

Strong Fundamentals Powering ADA's Rise

Cardano's underlying technology, Ouroboros, is a proof-of-stake (PoS) consensus mechanism that offers several advantages over traditional proof-of-work (PoW) systems, including lower energy consumption and improved scalability. Additionally, Cardano's layered architecture enables the platform to handle complex smart contracts and decentralized applications (dApps).

The Cardano community is actively developing a diverse range of projects, including decentralized finance (DeFi) protocols, non-fungible token (NFT) marketplaces, and supply chain solutions. As the ecosystem continues to grow and mature, the demand for ADA is likely to increase.

Positive Market Sentiment Boosts ADA's Prospects

The broader cryptocurrency market is currently experiencing a bullish phase, with Bitcoin and Ethereum leading the charge. This positive market sentiment has spilled over into altcoins like Cardano, driving increased investor interest and capital inflows.

Moreover, the recent surge in interest in blockchain technology and decentralized applications has further fueled the bullish sentiment surrounding ADA. As more and more people become aware of the potential benefits of blockchain, the demand for ADA is likely to rise.

Technical Analysis: A Bullish Outlook

A technical analysis of ADA's price chart suggests that the token may be on the cusp of a significant breakout. Historical price patterns indicate that ADA tends to form support and resistance levels. By breaking through these levels, ADA can enter a new uptrend and potentially reach higher price targets.

Key technical indicators, such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), are also signaling bullish momentum. The RSI, which measures the speed and change of price movements, is currently in the overbought territory, suggesting strong buying pressure. The MACD, which compares two moving averages, is also trending upwards, indicating a bullish crossover.

Potential Challenges and Risks

While the outlook for ADA is positive, it's important to acknowledge potential challenges and risks. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Regulatory uncertainty, economic downturns, and negative market sentiment can all impact ADA's price.

Additionally, Cardano's network performance and scalability will be crucial factors in determining its future success. As the number of users and transactions on the network increases, it will be essential for Cardano to maintain its performance and avoid congestion.

Conclusion

Cardano's strong fundamentals, positive market sentiment, and bullish technical indicators suggest that the token has the potential to reach new heights. However, investors should approach ADA with a long-term perspective and be prepared for short-term volatility. By carefully considering the risks and rewards, investors can make informed decisions about their ADA investments.

Cardano ADA Will Outperform Cryptocurrency MarketHello, Skyrexians!

Yesterday we considered the Bitcoin analysis where concluded that the potential growth is not going to be insane, bull market will be finished soon. At the same time on the BINANCE:ADAUSDT weekly chart we can see that price is charged for the flight.

Let's notice, that Cardano has the specific bear market structure, where the corrective wave C has been finished in October 2023. Growth from the bottom was impulsive, so it could not be the wave B, in our opinion it's wave 1 of the new bull market. Since March 2024 most of crypto assets continued the bear market, but drop on ADA was not so big. It means that wave 2 has been formed already.

Look at the green dot on the Bullish/Bearish Reversal Bars Indicator . This is strong bullish signal that this correction is likely to be finished, in conjunction with Elliott waves analysis we can see that the impulsive wave 3 is about to happen soon! Targets can be calculated using Fibonacci Extension. 1.61 and 2.61 corresponds to the area between $1.2 and $1.77. Note that this zone is not likely going to be the end of bull run. This is just wave 3 in this rally. Finally, we expect the new ATH for ADA in 2025.

Best regards,

Skyrexio Team

Can Cardano's (ADA) Rally Reach $2? A Deep Dive

Cardano (ADA) has undeniably been one of the standout performers in November 2023, surging over 140% and reaching a multi-year high of $0.80. This impressive rally has sparked renewed optimism among investors, with many wondering if ADA can maintain its momentum and even reach the coveted $2 price point.

The Drivers Behind Cardano's Rally

Several factors have contributed to Cardano's recent price surge:

1. Network Upgrades and Developments: Cardano has consistently focused on technological advancements, with key developments like the Vasil hard fork enhancing its scalability and efficiency. These upgrades have positioned Cardano as a strong contender in the smart contract platform space.

2. Growing Ecosystem: The Cardano ecosystem has seen significant growth, with a growing number of decentralized applications (dApps) being built on the platform. This increased adoption has bolstered Cardano's utility and potential for future growth.

3. Positive Market Sentiment: The broader cryptocurrency market has experienced a resurgence in recent months, driven by factors such as declining inflation rates and potential regulatory clarity. This positive sentiment has spilled over into altcoins like Cardano.

4. Institutional Interest: Institutional investors have shown increasing interest in Cardano, recognizing its potential as a long-term investment. This institutional adoption can provide stable support to ADA's price.

The Road to $2: Challenges and Opportunities

While Cardano's rally has been impressive, several factors could impact its ability to reach the $2 price target:

1. Market Volatility: The cryptocurrency market is inherently volatile, and sudden price swings can occur due to various factors, including macroeconomic events, regulatory changes, and market sentiment shifts.

2. Technical Resistance Levels: As Cardano's price rises, it may encounter significant technical resistance levels. Overcoming these levels will be crucial for sustaining the uptrend.

3. Competition from Other Blockchains: Cardano faces competition from other established and emerging blockchains like Ethereum, Solana, and Polygon. These competitors offer unique advantages and could attract investor interest away from Cardano.

4. Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, and any negative regulatory developments could impact the price of ADA.

Technical Analysis: A Glimpse into the Future

Technical analysis provides valuable insights into potential price movements. Key technical indicators to watch for Cardano include:

• Moving Averages: The 50-day and 200-day moving averages can provide support or resistance levels. A bullish crossover, where the 50-day MA crosses above the 200-day MA, could signal a strong uptrend.

• Relative Strength Index (RSI): The RSI measures the speed and change of price movements. An RSI above 70 indicates overbought conditions, while an RSI below 30 suggests oversold conditions.

• MACD: The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator. A bullish crossover, where the MACD line crosses above the signal line, can signal a potential uptrend.

Conclusion

Cardano's recent rally has been fueled by strong fundamentals and positive market sentiment. While reaching the $2 price target is not impossible, it will require sustained momentum, overcoming technical hurdles, and navigating potential market challenges. Investors should conduct thorough research and consider consulting with financial advisors before making any investment decisions.

Understanding the Cardano (ADA) Surge: Comprehensive Analysis

Cardano (ADA), the native cryptocurrency of the Cardano blockchain, has recently exhibited a notable uptrend, breaking above the crucial $0.8800 support level. The price has since rallied to trade above the $0.9500 mark, surpassing the 100-hourly Simple Moving Average (SMA).

Technical Analysis: A Bullish Outlook

A closer look at the hourly chart of the ADA/USD pair reveals a key bearish trend line forming resistance near the $1.0200 level. However, a decisive breakout above this trend line could trigger a significant upward move, potentially propelling the price towards the $1.0500 resistance zone.

Key Technical Indicators:

• Relative Strength Index (RSI): The RSI is currently hovering above the 50 level, indicating bullish momentum. A sustained increase in the RSI could signal further price appreciation.

• Moving Averages: The 100-hourly SMA has been acting as a strong support level, and a break above it has confirmed the bullish bias.

• Momentum Indicators: Momentum indicators like the Moving Average Convergence Divergence (MACD) and the Stochastic Oscillator are also showing bullish signals, suggesting that the upward trend may continue.

Fundamental Factors Driving ADA's Price Increase

While technical analysis provides insights into short-term price movements, it's essential to consider the underlying fundamental factors driving ADA's price increase:

• Network Upgrades: Cardano's ongoing network upgrades, such as the Vasil hard fork, have significantly improved the network's scalability and efficiency. These upgrades have attracted more developers and investors to the Cardano ecosystem.

• Growing DeFi Ecosystem: The Cardano blockchain is rapidly emerging as a hub for decentralized finance (DeFi) applications. The increasing number of DeFi projects and protocols built on Cardano can boost demand for ADA.

• Institutional Adoption: Institutional investors and corporations are increasingly recognizing the potential of blockchain technology and cryptocurrencies. As more institutions allocate capital to Cardano, it can further fuel price appreciation.

• Positive Market Sentiment: The overall positive sentiment in the cryptocurrency market, driven by factors such as increasing institutional adoption and regulatory clarity, can also contribute to ADA's price increase.

Potential Risks and Challenges

While the technical and fundamental outlook for ADA appears bullish, it's important to acknowledge potential risks and challenges:

• Market Volatility: The cryptocurrency market is highly volatile, and prices can fluctuate rapidly due to various factors, including macroeconomic events, regulatory changes, and market sentiment.

• Competition from Other Blockchains: Cardano faces competition from other blockchain platforms like Ethereum and Solana. These competing platforms may offer advantages in terms of scalability, transaction fees, and developer ecosystem.

• Regulatory Uncertainty: Regulatory uncertainty remains a significant risk for the cryptocurrency industry. Strict regulations or unfavorable policies could negatively impact the price of ADA.

Conclusion

Cardano's recent price surge and positive technical indicators suggest that the bullish trend may continue in the short term. However, it's crucial to approach investments in cryptocurrencies with caution and consider diversifying your portfolio. As with any investment, conducting thorough research and consulting with financial advisors can help you make informed decisions.

Cardano (ADA) Reclaims $1, Eyes Crucial Resistance Zone

Cardano (ADA), the popular layer-1 blockchain platform, has once again surged above the significant $1 price level. In the past 24 hours, the altcoin has witnessed a remarkable seven percent increase, fueling optimism among investors. As ADA approaches a crucial resistance zone, analysts closely monitor its price action to gauge its potential future trajectory.

A Closer Look at the Technical Analysis

A technical analysis of ADA's price chart reveals a bullish sentiment. The recent surge has pushed the altcoin above several key resistance levels, including the 200-day moving average. This positive price action indicates a potential shift in market sentiment, with investors becoming more optimistic about ADA's prospects.

However, ADA still faces a significant challenge in the form of a strong resistance zone between $1.10 and $1.15. This zone has historically proven to be a formidable obstacle for the altcoin. If ADA can successfully break through this resistance, it could pave the way for further upside potential.

On the other hand, a failure to overcome this resistance zone could lead to a potential price correction. In such a scenario, ADA might retest the $1 support level. Therefore, it is crucial to monitor the price action around this critical resistance zone in the coming hours.

Factors Driving ADA's Recent Surge

Several factors have contributed to ADA's recent price surge:

1. Network Upgrades: Cardano has been actively working on various network upgrades and improvements, including the Vasil hard fork. These upgrades have enhanced the network's scalability and performance, making it more attractive to developers and users.

2. Growing Developer Community: The Cardano ecosystem has witnessed a significant increase in developer activity. More and more projects are being built on the Cardano blockchain, which could drive demand for ADA.

3. Positive Market Sentiment: The broader cryptocurrency market has been experiencing a period of relative stability and growth. This positive market sentiment has benefited ADA and other altcoins.

4. Institutional Interest: Institutional investors are increasingly showing interest in Cardano. This growing institutional adoption could provide long-term support for ADA's price.

What's Next for ADA?

The short-term outlook for ADA is cautiously optimistic. If the altcoin can successfully break through the $1.10 to $1.15 resistance zone, it could potentially rally towards the next major resistance level at $1.25. However, a failure to overcome this resistance could lead to a price correction.

Long-term, ADA's success will depend on its ability to attract and retain developers, as well as its ability to deliver on its technological promises. If Cardano can continue to innovate and grow its ecosystem, it has the potential to become a major player in the cryptocurrency market.

Conclusion

Cardano's recent price surge and the potential for further upside have generated excitement among investors. However, it is essential to approach this development with caution and conduct thorough research before making any investment decisions.

As always, it is crucial to diversify your portfolio and manage risk effectively. By staying informed about the latest market trends and developments, investors can make informed decisions and maximize their returns.

Cardano's Resurgence: A $1 Reclaim and a Bullish OutlookCardano (ADA), the blockchain platform known for its scientific approach and focus on sustainability, has recently made significant strides.1 The cryptocurrency has not only reclaimed the crucial $1 price level but has also witnessed a surge in network growth, sparking optimism among investors and analysts alike.2

Reclaiming the $1 Mark

After a period of consolidation, ADA successfully broke through the psychologically significant $1 resistance level.3 This achievement marks a significant milestone for the cryptocurrency, which has been steadily gaining momentum in recent months.4 The price surge can be attributed to several factors, including increased network activity, positive market sentiment, and growing institutional interest.5

Network Growth and Adoption

One of the key drivers behind Cardano's recent price appreciation is the substantial growth in its network activity.6 The number of daily active addresses on the Cardano blockchain has surged, indicating increased user engagement and adoption.7 This uptick in user activity is a strong indicator of the network's health and potential for future growth.8

Furthermore, Cardano's Total Value Locked (TVL) has also experienced significant growth, reflecting the increasing popularity of decentralized applications (dApps) and other projects built on the platform. As more projects and users choose Cardano, the network's value proposition strengthens, attracting further investment and attention.9

Technical Analysis: A Bullish Outlook

From a technical perspective, Cardano's price action appears to be forming a bullish pattern. The recent breakout above the $1 resistance level has provided strong confirmation of the uptrend. Additionally, key technical indicators such as the Relative Strength Index (RSI) and Moving Averages (MAs) are signaling bullish momentum.

However, it is important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.10 While the technical indicators suggest a potential for further upside, conducting thorough research and considering risk management strategies is crucial before making any investment decisions.

Future Potential and Challenges

As Cardano continues to mature and evolve, it has the potential to become a leading player in the blockchain industry. The platform's focus on sustainability, scalability, and security positions it well to address the challenges faced by other blockchains.11

However, Cardano still faces several challenges, including competition from other established and emerging platforms.12 Additionally, the regulatory environment for cryptocurrencies remains uncertain, which could impact the adoption and growth of the industry.13

Conclusion

Cardano's recent price surge and increased network activity are positive signs for the future of the platform. The cryptocurrency's strong fundamentals, coupled with a growing community and a dedicated development team, position it well for long-term growth.14

While the short-term price movements may be subject to market volatility, the long-term outlook for Cardano remains bullish.15 As the network continues to mature and attract more users and developers, ADA has the potential to reach new heights and solidify its position as a leading blockchain platform.16

Cardano's Resurgence: A $1 Reclaim and a Bullish OutlookCardano (ADA), the blockchain platform known for its scientific approach and focus on sustainability, has recently made significant strides.1 The cryptocurrency has not only reclaimed the crucial $1 price level but has also witnessed a surge in network growth, sparking optimism among investors and analysts alike.2

Reclaiming the $1 Mark

After consolidation, ADA successfully broke through the psychologically significant $1 resistance level.3 This achievement marks a significant milestone for the cryptocurrency, steadily gaining momentum in recent months.4 The price surge can be attributed to several factors, including increased network activity, positive market sentiment, and growing institutional interest.5

Network Growth and Adoption

One of the key drivers behind Cardano's recent price appreciation is the substantial growth in its network activity.6 The number of daily active addresses on the Cardano blockchain has surged, indicating increased user engagement and adoption.7 This uptick in user activity strongly indicates the network's health and potential for future growth.8

Furthermore, Cardano's Total Value Locked (TVL) has also experienced significant growth, reflecting the increasing popularity of decentralized applications (dApps) and other projects built on the platform. As more projects and users choose Cardano, the network's value proposition strengthens, attracting further investment and attention.9

Technical Analysis: A Bullish Outlook

From a technical perspective, Cardano's price action appears to be forming a bullish pattern. The recent breakout above the $1 resistance level has provided strong confirmation of the uptrend. Additionally, key technical indicators such as the Relative Strength Index (RSI) and Moving Averages (MAs) are signaling bullish momentum.

However, it is important to note that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly.10 While the technical indicators suggest a potential for further upside, conducting thorough research and considering risk management strategies is crucial before making any investment decisions.

Future Potential and Challenges

As Cardano continues to mature and evolve, it has the potential to become a leading player in the blockchain industry. The platform's focus on sustainability, scalability, and security positions it well to address the challenges faced by other blockchains.11

However, Cardano still faces several challenges, including competition from other established and emerging platforms.12 Additionally, the regulatory environment for cryptocurrencies remains uncertain, which could impact the adoption and growth of the industry.13

Conclusion

Cardano's recent price surge and increased network activity are positive signs for the future of the platform. The cryptocurrency's strong fundamentals, coupled with a growing community and a dedicated development team, position it well for long-term growth.14

While the short-term price movements may be subject to market volatility, the long-term outlook for Cardano remains bullish.15 As the network continues to mature and attract more users and developers, ADA has the potential to reach new heights and solidify its position as a leading blockchain platform.16

Is Cardano Heading Towards $6? Expert Analysis and Bullish SignsCardano (ADA), the blockchain platform known for its scientific approach to blockchain development, has recently shown significant bullish signs. The cryptocurrency has experienced a surge in price, breaking key resistance levels and attracting increased investor attention.

Cardano Price Rumbles On, Breaks $1 For The First Time Since 2022

One of the most notable developments is Cardano's recent price surge, which has pushed the token above the $1 mark for the first time since 2022. This significant milestone has ignited optimism among investors and analysts alike.

Key Factors Driving Cardano's Bullish Momentum

Several factors are contributing to Cardano's bullish momentum:

1. Network Upgrades and Developments:

o Vasil Hard Fork: The successful implementation of the Vasil hard fork brought significant performance and scalability improvements to the Cardano network. This upgrade enhanced the network's capacity to handle increased transaction volume and smart contract activity.

o Djed Stablecoin: The launch of Djed, a decentralized stablecoin, has added a new dimension to Cardano's ecosystem. Djed aims to provide stability and facilitate financial transactions within the Cardano network.

2. Growing Developer Activity:

o The number of developers building on the Cardano platform has been steadily increasing. This growing developer community is a strong indicator of the network's potential and future growth.

o The development of dApps (decentralized applications) on Cardano is gaining momentum, expanding the platform's utility and attracting new users.

3. Positive Market Sentiment:

o The broader cryptocurrency market has been experiencing a positive trend, with many cryptocurrencies showing significant price gains. This positive sentiment has spilled over to Cardano, driving its upward momentum.

o Increased institutional interest in the cryptocurrency market has also contributed to the positive sentiment surrounding Cardano.

Expert Forecast: $6 Price Target

In light of these positive developments, experts have issued bullish forecasts for Cardano's future price. Some analysts believe that Cardano could reach a price target of $6 in the coming months or years.

Potential Challenges and Risks

While the outlook for Cardano appears promising, it's important to acknowledge potential challenges and risks:

• Market Volatility: The cryptocurrency market is inherently volatile, and sudden price swings can occur.

• Regulatory Uncertainty: Changes in regulatory policies can impact the cryptocurrency market, including Cardano.

• Competition from Other Blockchains: Cardano faces competition from other blockchain platforms, such as Ethereum and Solana, which could impact its growth and adoption.

Conclusion

Cardano's recent price surge and positive developments suggest a bullish outlook for the cryptocurrency. However, it's crucial to approach investments with caution and conduct thorough research before making any decisions. As with any investment, there are risks involved, and past performance is not indicative of future results.

By staying informed about the latest developments in the Cardano ecosystem and the broader cryptocurrency market, investors can make informed decisions and potentially benefit from Cardano's future growth.

How Will the Record-High Value of Cardano's ADA Impact CryptoCardano's native cryptocurrency, ADA, has recently experienced a significant price surge, reaching a 2.5-year high of 90 cents. Factors, including increased institutional interest, growing on-chain activity, and positive developments within the Cardano ecosystem have fueled this impressive rally.

Whale Accumulation and Institutional Interest

One of the key drivers of ADA's price surge has been the accumulation of large amounts of ADA by whales and institutional investors. On-chain data reveals that whale holdings have surpassed $12 billion, indicating significant institutional interest in the project.

These large-scale investors are often attracted to Cardano's unique features, such as its proof-of-stake consensus mechanism, which is more energy-efficient than proof-of-work. Additionally, Cardano's focus on sustainability and its commitment to scientific research and peer-reviewed development have further enhanced its appeal to institutional investors.

Growing On-Chain Activity

Alongside whale accumulation, increased on-chain activity has also contributed to ADA's price rally. The number of active addresses on the Cardano network has been steadily rising, indicating growing adoption and usage of the platform.

This surge in on-chain activity can be attributed to several factors, including the launch of new decentralized applications (dApps) on the Cardano network, the increasing number of projects utilizing Cardano's smart contract functionality, and the growing popularity of Cardano-based non-fungible tokens (NFTs).

Positive Developments Within the Cardano Ecosystem

Several positive developments within the Cardano ecosystem have also contributed to the recent price surge. These include:

• Vasil Hard Fork: The successful implementation of the Vasil hard fork, which introduced significant performance and scalability improvements to the Cardano network, has boosted investor confidence and attracted new developers to the ecosystem.

• DApp Development: The growing number of dApps being built on Cardano, ranging from decentralized exchanges to gaming platforms, has increased the utility of the ADA token and attracted new users to the network.

• NFT Market: The thriving NFT market on Cardano, with projects like CNFTs, has generated significant interest and driven demand for ADA.

Future Outlook

Given the positive developments within the Cardano ecosystem, the strong institutional interest, and the increasing on-chain activity, many analysts are bullish on the future of ADA. Some experts predict that ADA could reach $1.25 shortly, provided that the current positive momentum continues.

However, it is important to note that the cryptocurrency market is highly volatile, and ADA's price could fluctuate significantly in the short term. Investors should conduct thorough research and consider consulting with a financial advisor before making any investment decisions.1

Despite the inherent risks associated with cryptocurrency investments, Cardano's strong fundamentals, growing ecosystem, and increasing institutional interest position it as a promising long-term investment. As the Cardano network continues to evolve and mature, ADA's price could experience further significant growth in the years to come.