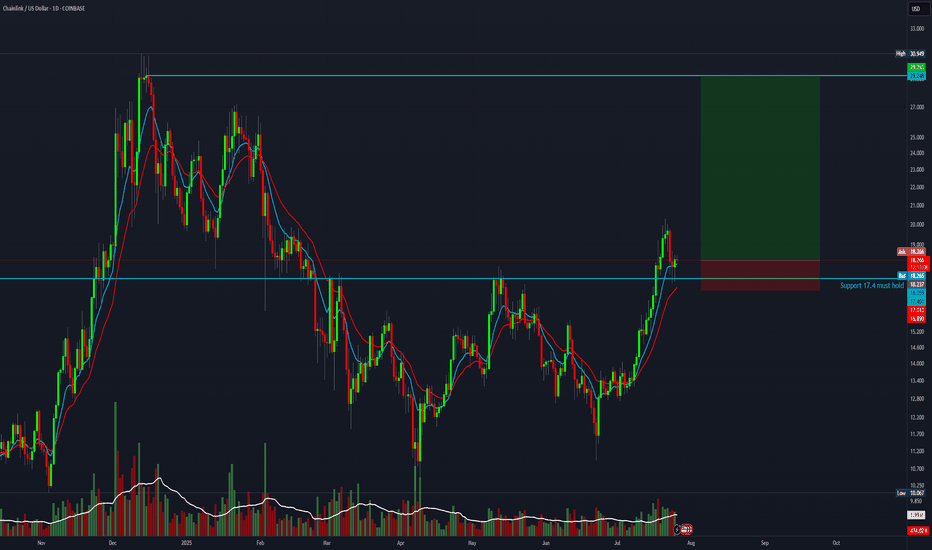

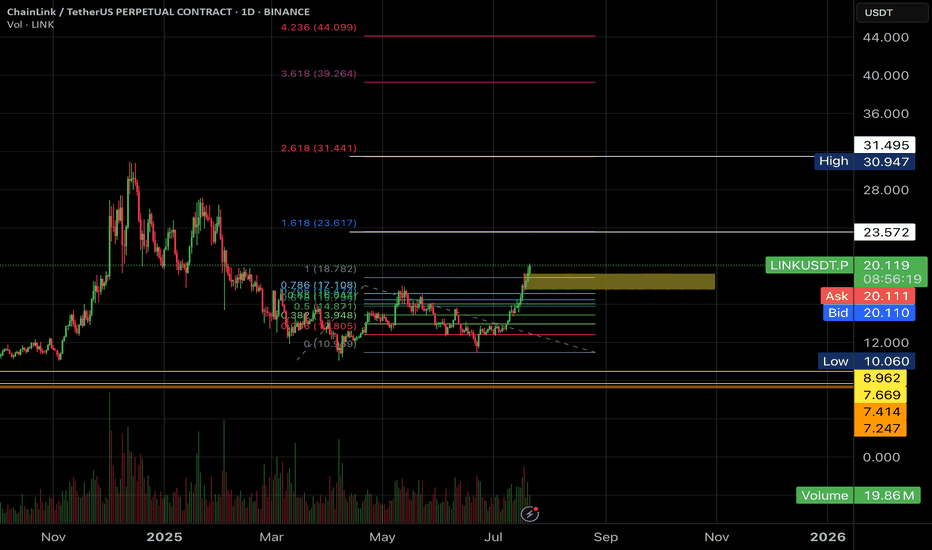

ChainLink: Poised for Further GainsWe still locate ChainLink in an ongoing wave expansion. During this move, we expect price to climb well above the resistance level at $30.95. At present, we see a 30% probability that the altcoin could dip below support at $10.07 to complete turquoise wave alt.2 within the alternative Target Zone between $8.65 and $4.77.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Chainlink

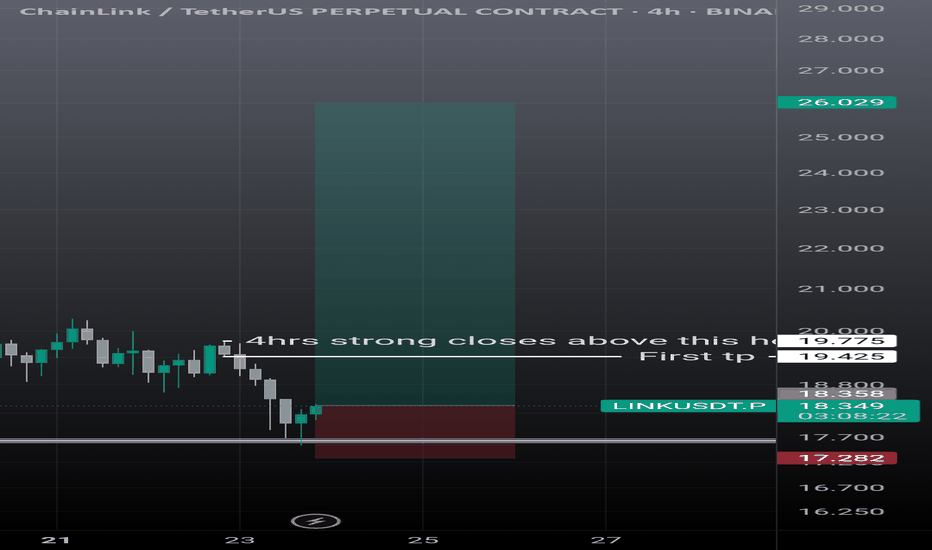

Almost $100 - Chainlink weekly update August 5 - 11thFrom an Elliott Wave perspective, there are currently three valid scenarios for Chainlink’s price action. Two of them are bullish across the short-, mid-, and long-term timeframes, while one scenario allows for a deeper correction in the short- to mid-term before the broader uptrend resumes.

The favoured scenario suggests we are in the early stages of a Wave 3 impulse, following a clean Wave 2 retracement that reached the 0.5 Fibonacci level — a textbook technical setup. This interpretation is supported not only by the internal wave structure but also by similarities to other crypto assets showing impulsive characteristics. Additionally, there is notable liquidity sitting above the current price, which could act as a magnet for a Wave 3 extension. Accumulation zones and bullish order blocks are also forming on correlated assets like Solana, and Cardano is showing a near-identical wave structure — a setup that has proven reliable in previous cycles.

The shift in funding rates from negative to positive supports this bullish thesis, indicating growing confidence among long-positioned traders. However, it’s worth noting that open interest has not yet increased in parallel, suggesting a lack of conviction or participation from larger players at this stage — a divergence that deserves close monitoring.

The liquidity heatmap shows clusters of stop liquidity above the current price — consistent with a bullish breakout — but also highlights resting liquidity below. In this context, it is crucial that the current local low holds. Ideally, price should break above both the Wave B and Wave 1 highs to confirm upward momentum and invalidate the bearish alternative.

In the bearish scenario, the structure would still be considered corrective, targeting a retest of the $12 region before any sustainable bullish continuation. This would represent a deeper Wave 2 or Wave B retracement, shaking out weaker hands before the next leg up.

From a risk/reward perspective, current levels still offer a compelling long opportunity — but invalidation below the recent low would open the door to the $12 area. Until then, the impulsive structure remains intact and favoured.

Where could Bitcoin and the rest of the market be headed?Just a brief overview of my thoughts on bitcoin and the rest of the market. We are currently sitting around the area that I had suspected may be our weekly low. Where we go from here is still unclear but I wanted to take time for a good overview and share my plans and how to trade it so that I could still be profitable even if we just chop for a while. Also, the potential for a true alt season may really be right around the corner. This is the type of term that has been thrown around so much lately but it has been years since we have had one. Alts have been lagging so I have some suspicion of what may happen next and share the things to look for to confirm this, and how I plan to trade accordingly.

ChainLink · Short-Term Correction (Retrace) · 2025 Bull MarketWe have evidence that ChainLink won't be moving much lower. There are mainly two reasons: 1) There aren't that many sellers and 2) we have strong support. We have an active support range between $14.5 and $15.95. This is the reversal point. Either current prices or this lower range which shows an intersection between two strong moving averages as well as Fib. retracement levels.

The rise between June and July has a stronger slope compared to the one before. The April-May rise was more spread out and so the correction lasts longer. The present one has a stronger slope, it is more steep, and thus a retrace will have a shorter duration because prices will continue growing.

Volume is extremely low on the drop and bearish momentum is not present. There can be one final flush reaching the levels mentioned above or lower on a wick and the market turns. The flush would make everything seen pretty bad and red but the truth is that this would be the end. When the major sell is in, the market turns around and moves the other way.

LINKUSDT is retracing within a bullish bias mid-term. Long-term growth is possible based on the bigger picture.

LINKUSDT is facing an intersection of multiple support zones, if these levels hold, we can see a resumption of the bullish move and prices grow. Each time a retrace is over, the bullish wave that follows will be many times stronger than the previous one until the bull market ends.

We are still looking at bottom prices. The best is yet to come.

Namaste.

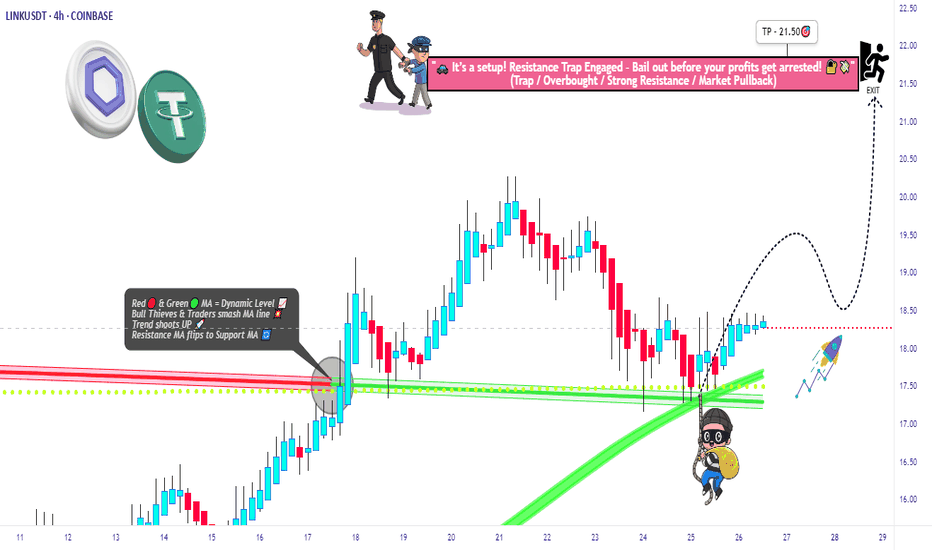

Smart Robbery Plan: LINK/USDT Long Setup | Swing/Day Trade Idea🚨CHAINLINK HEIST PLAN 🚨 | LINK/USDT Market Robbery (Thief Trader Style) 💰🔐

🌍 Hola! Bonjour! Hallo! Marhaba! What’s up, Money Makers & Market Robbers?! 🕶️💵

Get ready to raid the LINK/USDT vault with Thief Trader’s high-precision strategy based on 🔥 Technical & Fundamental fusion 🔥.

This is not your regular setup. This is a robbery roadmap. Designed for swing & day traders, and spiced with smart DCA entries, risk control, and a bold vision. Let's get into the game plan before the market alarms go off! 🚓📉📈

🎯 Master Plan – LINK/USDT | Bullish Setup

Entry:

📌 “The vault is open – grab the loot!”

Start entering long anywhere within the nearest price pullback zone. Use 15m to 30m TFs for sniper-style limit entries.

🛠️ Deploy DCA-style multiple limit orders (layered strategy), preferably around recent swing lows or major liquidity zones.

Stop Loss:

🔐 Place SL just below the 4H swing low wick (Currently at $16.50), adjusting for your risk, lot size, and how many limit orders you're stacking.

Take Profit:

🎯 Main TP target: $21.50

⛔ Or bail early if momentum weakens. Your profit, your decision.

⚡️Scalper’s Memo:

Only scalp on the bullish side – stay with the smart money.

Have deep pockets? Jump in now.

On a budget? Join swing traders and follow the full heist plan.

📉 Use trailing SL to secure profits during volatile rallies.

🔍 Fundamental & Sentiment Snapshot:

LINK is gaining bullish traction due to a combo of strong sentiment, favorable macro outlook, and on-chain flows aligning.

📊 Keep eyes on COT reports, intermarket data, and liquidity metrics.

🧠 Sentiment leans bullish while late bears are trapped in the supply zones above.

🛑 Risk & News Management Alert:

🚨 News releases can spike volatility and mess with clean entries.

📵 Avoid placing trades during high-impact events.

📍 Use trailing stop-loss to protect your running profits and preserve capital.

💖Support the Plan, Join the Heist:

Love the trade idea? 💥Hit the BOOST💥 button and show some love to the strategy that lets traders "rob the market" with confidence.

Every like helps build the strongest heist crew on TradingView.

✅ Stay sharp. Stay patient. Stay profitable.

👤 Thief Trader signing out… until the next raid. 🐱👤💰🚀

#LINK #LINKUSDT #CryptoTrading #ThiefTrader #SwingTrade #DayTrade #DCA #BullishSetup #TradingPlan #TA #RobTheMarket #ChainlinkHeist #SmartMoneyMoves

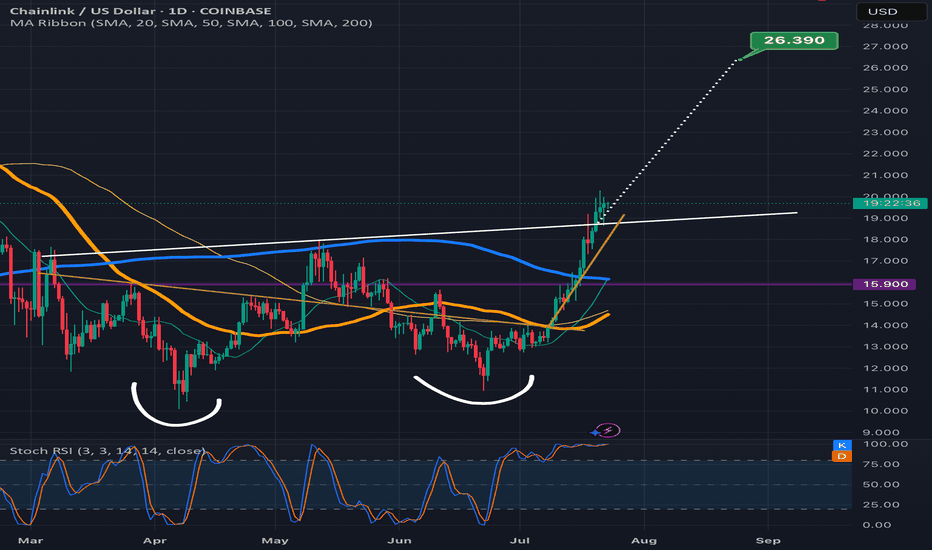

Chainlink climbing the measured move line staircaseLooks like Chanlink is ready to confirm the double bottom breakout here as the past few candles have already started to climb up the measured move line like a staircase.Always possible for a dip back below the neckline at this point but probability slightly favors the readout being validated instead for now. *not financial advice*

The Oracle Singularity: CHAINLINK is Inevitable or Cooked?How many marines are tracking this ascending channel?

How many are watching this Fibonacci time sequence unfold?

How many are following the mirrored bar fractal that might just be a crystal ball into the future?

Today you get all three in one TA. The value here is absurdly high . Even though I offloaded most of my LINK a while back it continues to act like a compass for future macro crypto moves.

You really need to look at the TA to understand what I mean

Now look at this

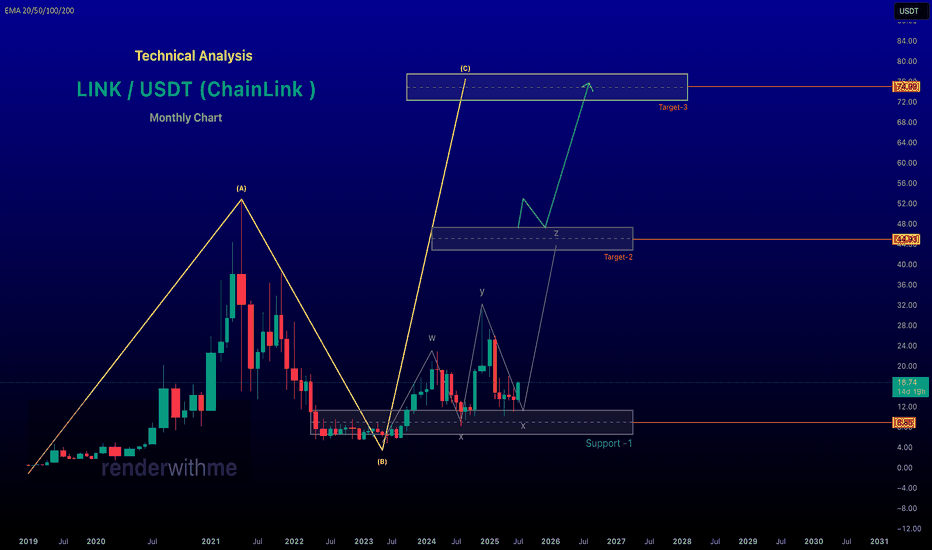

The deviation in the LINK bar pattern seems to be reaching its conclusion around mid October 2025 and if you’ve seen my last Bitcoin TA you know I’ve been targeting that same mid October 2025 window for a potential BTC top. That’s a serious timeline confluence.

But here's the twist

The main chart projects a $200 LINK by April 2026. If that plays out then I have to entertain the possibility that this cycle extends past my original thesis and that my Bitcoin top call may come in earlier than Chainlink's final move.

If Bitcoin does in fact top in mid October then LINK likely won’t have the legs to hit those upper targets.

Back in 2021 when LINK was trading at a similar price it only took 119 days to reach $50 that would put us at November 2025 for a repeat. Something doesn’t quite add up

Now check the main chart again

This Fibonacci time sequence is liquid gold. It’s nailed major tops and bottoms for years (see the blue circles). Every major move has hit right on time except for the 3.618 in October 2022 which was a rare miss.

But here's the kicker

There’s no Fib time event between October and December 2025. The next ones are in August 2025 and then April 2026

So is LINK trying to tell us the cycle extends into 2026?

Maybe. All I’ll say is this

If the cycle doesn’t extend into 2026 then LINK IS COOKED

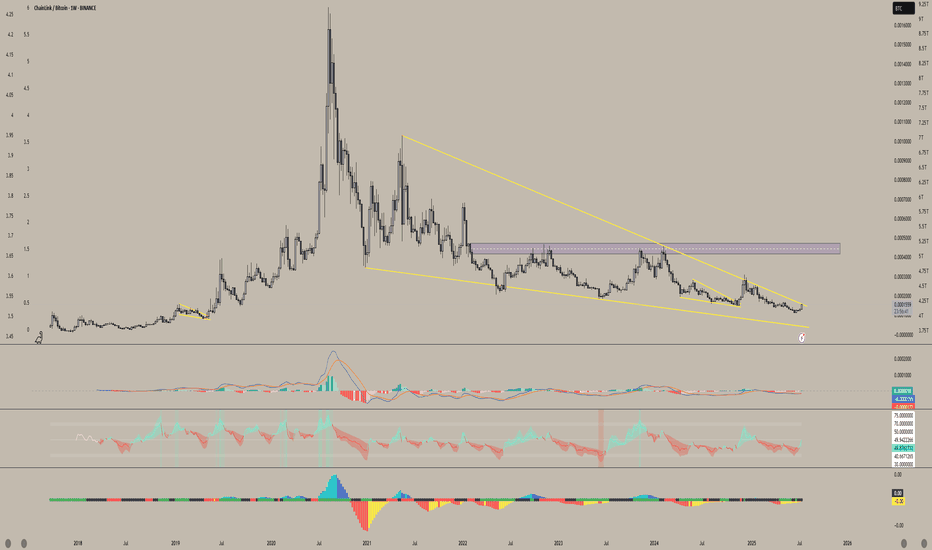

Link/BTC When will we see the pump Chainlink has always been one of my favorite cryptos—and pairing it with BTC just makes sense. I have strong faith in this project, and I believe the days when trendline resistance and support hold Chainlink back are numbered. This beast looks ready to break free.

We’re possibly just weeks, maybe even days, away from a breakout of this 4-year falling wedge. Once that happens, I see LINK/BTC teleporting upward—especially as quantitative tightening ends and Jerome Powell stops being a hater. The stars are aligning for Chainlink to soar. With everything going on behind the scenes between swift and Mastercard and the many more I can list I see this being the underdog.

renderwithme | The unbreakable bond of Chainlink TechnicalBelow is a technical analysis of Chainlink (LINK/USD) based on the provided real-time financial data and general market insights. Please note that cryptocurrency markets are highly volatile, and this analysis is for informational purposes only, not financial advice. Always conduct your own research before making investment decisions.

# Current Price and Market Overview

Current Price: $16.70 USD at the time of posting

24-Hour Trading Volume: Not specified in the provided data, but recent sources indicate significant trading activity, with volumes around $422.74M to $672.42M.

52-Week Range: $3.25 (low) to $10.90 (high)

Previous Day Close: $16.67

chart for your reference

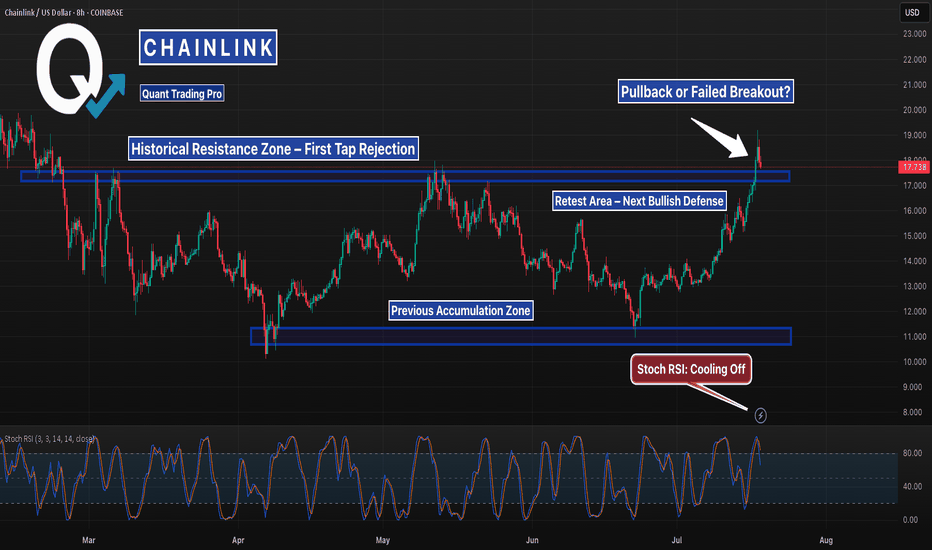

LINKUSD – Mid-Range Reclaim | Push Toward $18-20?Chainlink has reclaimed the mid-range supply zone between $14.50–$15.50 and is now pushing higher.

The structure looks clean with a potential target near $18.80 if bulls maintain strength.

Key support now sits around the breakout zone. Watching for continuation or a failed retest.

#LINKUSD #Chainlink #RangeBreakout #SupportResistance #QuantTradingPro #TradingView

Chainlink Just Broke Out — Is $30 The Next Stop?After nearly 250 days of compression inside a falling wedge, Chainlink has officially broken out. The chart shows a textbook breakout with clean structure, higher lows, and a confirmed break of structure (BOS). A retest zone between $12.8–$14.0 could offer a “buy the dip” opportunity before any continuation.

With momentum shifting and sentiment improving, bulls have eyes on the $30 target — a prior high and wedge-measured move. This is a breakout you don’t want to ignore.

Chainlink Grows Above MA200, The Path is Clear To $65 (333% PP)Yes LINKUSDT broke a minor consolidation pattern but that's not all. The action this week is happening right above MA200. This level being conquered last week.

Good evening my fellow Cryptocurrency trader, how are you feeling in this wonderful day?

Chainlink is bullish now and has been bullish for months. Bullish doesn't necessarily means rising prices but potential for growth. Bullish happens at the bottom, when prices are low. Chainlink is bullish now and ready to grow.

For some people it might still be too early. "Anything can happen." "The bull market is not confirmed." "Wait for confirmation." "How do you know?"

I know because of the signals coming from the charts. I know based on marketwide action, Bitcoin's halving, the broader cycle, related markets, intuition, experience, astrology and so on. There are so many signals that it is impossible to mention them all. All these signals and systems point to the exact same thing, the same conclusion; Crypto is bullish, Bitcoin is bullish and Chainlink is set to grow next, now.

Now is the time for growth, it cannot go in any other way. Nothing else is possible, we are going up. It is still early. Not early for confirmation or certainty, early because we will have really strong growth.

It is still early because LINKUSDT is set to hit $44 followed by $65 in the coming months.

Just imagine the energy, the feeling, the euphoria, the market sentiment, your portfolio... Just try and visualize the market six months into the future. What do you see?

Maybe it is hard to feel for sure what is going to be like, but you can be certain that prices will increase. If you are holding Crypto, you will be happy with the results.

You deserve everything that will come to you because you were in when others were gone.

You deserve success and profits because you earned it by making the right choice.

You trusted Crypto, you trusted the market and now you will reap the reward.

Thanks a lot for your continued support.

Namaste.

Link long - zoom in on weekly closeWe are approaching a breakout.

Maybe this week's close is the trigger that all the bulls (and altcoins) have been waiting for.

Generally speaking, I don't like trading Chainlink. Although if we see a weekly close just above 14.2, above the 20 MA, I think it could be a good investment entry.

I think Chainlink will be one of the utility coins that completely explodes before retail has time to react. A good weekly close is something that smart money probably would appreciate. If you think long-term, I think Chainlink is in a good position with good upside without any immediate big risk.