ZETA: when a wedge isn’t just a wedge — it’s a launchpadTechnically, this setup is textbook clean. Price completed the fifth wave within a falling wedge and instantly reacted with a bullish breakout. The expected breakdown didn’t happen — instead, buyers stepped in, confirmed by rising volume. All EMAs are compressed at the bottom of the structure, signaling a clear shift in momentum. The volume profile shows strong accumulation around $14, while the area above current levels is a vacuum — ideal conditions for acceleration.

The key resistance zone is $16.70–17.20 — former base highs and the 0.236 Fibonacci retracement. If price breaks this area with volume, the next stop is likely $24.48 (0.5 Fibo). Classical wedge targets land at $38.28 and $55.33 (1.272 and 1.618 extensions). If a trending leg begins, it could move fast — because there’s simply no supply overhead.

Fundamentals:

ZETA isn’t a profitable company yet, but it shows consistent revenue growth and aggressive expansion. Capitalization is rising, debt is manageable, and institutional interest has increased over recent quarters. In an environment where tech and AI are regaining momentum, ZETA could be a speculative second-tier breakout candidate.

Tactical plan:

— Entry: market or after a retest of $14.00–14.30

— First target: $17.20

— Main target: $24.48

— Continuation: $38.28+

— Stop: below $13.00 (bottom wedge boundary)

When the market prints a wedge like this and the crowd ignores it — that’s often the best trap setup. Only this time, it’s not for retail buyers. It’s for the shorts. Because when a falling wedge breaks to the upside with volume — it’s time to buckle up.

Chartanalysis

ChainLink: Poised for Further GainsWe still locate ChainLink in an ongoing wave expansion. During this move, we expect price to climb well above the resistance level at $30.95. At present, we see a 30% probability that the altcoin could dip below support at $10.07 to complete turquoise wave alt.2 within the alternative Target Zone between $8.65 and $4.77.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

BTCUSD Technical Analysis – Smart Money Concept Based

🔍 BTCUSD Technical Analysis – Smart Money Concept Based

🕒 Timeframe: Intraday (likely 1H or 4H)

📅 Date: August 5, 2025

📉 Price: ~114,445 USD

📌 Key Zones and Observations

🔴 Previous Resistance (117,000–119,000)

This area has a strong high formed after multiple equal highs (EQH), indicating a liquidity pool above.

Price sharply rejected this zone, validating it as a significant supply zone.

🔵 Support Zone & Liquidity Pool (~112,600–113,200)

This is a high-volume node (visible on VRVP) where price consolidated previously.

Market structure suggests liquidity resting below, as indicated by the marked “Target” area at 112,648.

Smart Money may aim to sweep liquidity below this support zone before any meaningful reversal.

🟤 Order Block & Rejection at 115,210–116,065

Price tapped into a bearish order block, creating a minor change of character (ChoCH) and then started to decline.

Rejection from this zone signals distribution by institutions or Smart Money, leading toward bearish continuation.

🟢 Value Gap and Imbalance (Above 115,000)

A visible value gap still remains unfilled; however, current momentum is bearish, and price failed to reclaim it, hinting downside continuation.

🔄 Market Structure

BOS (Break of Structure) to the upside confirmed short-term bullish momentum.

CHoCH back to the downside near current price reflects bearish shift in order flow.

Price is respecting lower highs, and failing to break above 115,210 confirms a bearish bias.

🎯 Target and Outlook

Primary Bearish Target: 112,648 USD

This is a liquidity pool and previous support area where institutions may look to rebalance and accumulate.

Scenario:

If price retests 115,000–115,210 again and fails, expect strong continuation downward toward the 112,648 target.

If price breaks and holds above 116,065, bullish invalidation may occur, and we can look for higher retracement toward 117,000–119,000.

✅ Conclusion

BTCUSD is currently respecting a bearish order block, with Smart Money likely targeting liquidity resting below at 112,648 USD. Unless price breaks above 116,065 with strong volume, the bias remains bearish short-term.

Technical Analysis of US100 on TradingView A trader is analyzing the US100 (Nasdaq 100 Index) using a 4-hour chart on TradingView. The chart displays a clear upward channel, with price action bouncing off the lower boundary and heading toward the upper trendline. A blue arrow indicates a bullish prediction, anticipating further upward movement. Support and resistance zones are highlighted, and the setup suggests a continuation of the bullish trend.

📊 Chart Overview:

Timeframe: 4-hour (H4)

Instrument: US100 (Nasdaq 100 Index)

Platform: TradingView via Capital.com

Date/Time in Chart: 25th August, 10:00 (likely UTC)

---

📈 Trend Analysis:

The price is moving within an upward parallel channel, indicating a strong bullish trend.

The chart shows multiple touches of both the upper and lower bounds of the channel, confirming its validity.

---

🟩 Support and Resistance:

Support Zone: Around 22,850–23,050 (highlighted by the green rectangular box).

Price bounced sharply from this area, showing buyers are defending it.

Resistance Area (Projected): Upper bound of the channel, which aligns with the 24,000 level.

---

🕊️ Current Market Behavior:

The price recently bounced off the lower channel boundary and the key support zone.

A strong bullish candle broke through a mini pullback area, suggesting momentum is favoring buyers.

The blue arrow indicates an expected continuation upward toward the upper resistance line.

---

📌 Technical Implications:

Bullish Bias: As long as price remains inside the channel and above the support zone, the bullish trend is intact.

A retest of the upper channel line (~24,000) is a realistic target if momentum continues.

Invalidation Level: A clean break below the support zone (~22,850) and out of the channel could shift sentiment to bearish.

---

✅ Possible Trade Idea (for Educational Purposes):

Entry: Around 23,400–23,500 (already in motion)

Target: 23,900–24,000 (upper channel line)

Stop-loss: Below 22,850 (beneath the support zone)

Breakout Alert: PVR Gearing Up for a Strong MoveThis is the daily chart of PVR INOX.

PVRINOX is forming a broadening pattern within a larger broadening structure.

The smaller pattern has a breakout target of ₹1200, which coincides with the major resistance level of the larger pattern.

PVRINOX having a strong support zone near at 970-990 zone.

If this level is sustain then we may see higher prices in PVRINOX.

Thank You !!

"Gold Rejected at Resistance – Eyes Set on $3,350 Support"This 45-minute chart of Gold Spot (XAU/USD) highlights a possible bearish reversal pattern. After testing and rejecting resistance around the $3,400 level twice, price action shows signs of weakening bullish momentum. The chart suggests a corrective move is likely, targeting the support zone around $3,350, which aligns with the previous breakout level and horizontal support. Traders should watch for confirmation signals near the resistance before entering short positions. Keep an eye on volume and candlestick patterns to validate the move.🔍 Overview

Current Price: $3,380.32

Timeframe: 45-minute chart

Instrument: Gold Spot (XAU/USD)

Trend: Sideways to bearish bias near resistance

Key Zones:

Resistance: ~$3,400

Support (Target): ~$3,350

Major Support: ~$3,295–$3,300 (prior consolidation low)

---

🧱 Chart Structure & Key Observations

1. Double Top Formation

Price has tested the $3,400 zone twice and failed to break higher.

This creates a potential double top – a bearish reversal pattern.

2. Price Rejection

Long upper wicks near the top suggest strong selling pressure.

The recent move downward signals a shift in sentiment.

3. Bearish Impulse & Projection

The forecasted arrow shows a corrective move toward $3,350.

This level coincides with previous breakout structure and acts as a logical support retest.

Electronic Arts: Upward Momentum PersistsDespite notable bearish attempts, upward momentum in Electronic Arts has remained strong, once again pushing price toward resistance at $169.82. If the stock breaks above this level, this will suggest that the major correction concluded with the low of beige wave alt.IV at $114.60, and that a sustainable rally as part of wave alt. V is now underway. However, in our primary scenario, we still see EA in a downward impulse, which is expected to eventually break below support at $114.60.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

Gold Trading Strategy XAUUSD August 6, 2025Gold Trading Strategy XAUUSD August 6, 2025:

Spot gold edged lower in Asian trading yesterday (August 5), currently trading around $3,380/ounce. On Tuesday, the US ISM Services PMI came in at 50.1, below the forecast of 1.4 and below the previous month's reading of 0.7; the news sent gold prices soaring in the US session.

Fundamentals: Gold prices surged after weak jobs data increased the likelihood of a rate cut by the Federal Reserve. Data released last Friday showed that the number of new jobs in the US non-farm sector was much lower than expected, indicating a sharp deterioration in the labor market. The probability of the Fed cutting interest rates in September increased to 87%, up from 63% last week.

Technical analysis: Gold price is still in the uptrend channel in the H1 frame, the 3365 - 3370 area is supporting the gold price to continue following the price channel. If the gold price continues to fluctuate according to the price channel, the next prospective area could be 3400 - 3405 or even 3420 - 3425. However, the RSI and MA lines have shown signs that the buyers are weakening, so the gold price is very likely to have a strong correction from today until the end of the week.

Important price zones today: 3365 - 3370, 3400 - 3405 and 3420 - 3425.

Today's trading trend: SELL.

Recommended order:

Plan 1: SELL XAUUSD zone 3403 - 3405

SL 3408

TP 3400 - 3390 - 3380 - 3350 - OPEN.

Plan 2: SELL XAUUSD zone 3423 - 3425

SL 3428

TP 3420 - 3420 - 3400 - 3380 - OPEN.

Plan 3: BUY XAUUSD zone 3365 - 3367

SL 3362

TP 3370 - 3380 - 3390 - 3400.

Wish you a safe, successful and profitable trading day.🥰🥰🥰🥰🥰

Crude Oil Bouncing from Demand Zone – Eyes on UpsideThis is the daily chart of Crudeoil!

CRUDEOIL1! having a good law of polarity (support)near at 5550-5600 range.

CRUDEOIL1! is taking support on RSI and sustain above 45 level.

If this level is sustain then we may see higher prices in CRUDEOIL1!.

Thank You !!

Hang Seng: Sharp Sell-Off Likely AheadAfter the Hang Seng marked the top of turquoise wave 3, we now see the index entering the subsequent wave 4. Although the HSI has edged higher again recently, we continue to anticipate a significant sell-off ahead. During this downward move, we expect the low of turquoise wave 4 to form near the lower boundary of the pink trend channel. Afterward, wave 5 is likely to spark another upward trend. Meanwhile, our 35% likely alternative scenario suggests that the index will continue to rise and break above the upper edge of the pink trend channel. In that case, the high of turquoise wave alt.5 would be reached much earlier. Even in this scenario, however, we expect a subsequent downward move.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

USD/JPY 4H –analysis Buy setupUSD/JPY (U.S. Dollar / Japanese Yen)

Timeframe: 4-Hour (4H)

Trend: Bullish Trendline Support – Price is respecting a strong ascending trendline.

Indicators: Ichimoku Cloud is visible; current price is above the cloud = bullish bias.

Current Price: Around 147.95.

---

✅ Buy Entry:

Entry Zone: Between 147.90 – 148.10

(As price is bouncing from the trendline support and Ichimoku cloud.)

🎯 Buy Targets:

1. Target 1: 148.99 (Previous structure resistance)

2. Target 2: 150.50 (Next resistance level)

3. Target 3 (Swing): 152.00+ (If momentum continues)

🛑 Stop Loss:

Below trendline + Ichimoku support = 146.80 (safe zone)

---

🔖 Chart Title Suggestion:

"USD/JPY 4H – Trendline Rebound with Bullish Momentum Targeting 150+"

GOLD Weekly Recap & Outlook (Week 31 | July 28 – Aug 01)Note: Some elements may shift depending on your screen size. View the full snapshot in perfect layout:

📈 CAPITALCOM:GOLD

Timeframe: 30m | MJTrading View

⸻

🔹 Weekly Performance

• Open: 3,320.06

• High: 3,363.63

• Low: 3,268.05

• Close: 3,363.05

Gold delivered a classic Smart Money move this week: liquidity sweep, structural shift, and bullish expansion.

⸻

🔹 Price Action Breakdown

1️⃣ Early Week: Bearish Continuation

• Price opened around 3,320 with a gap and extended last week’s bearish leg.

• Formed lower lows (LL) and a bearish flag, signaling continuation.

2️⃣Midweek: Liquidity Grab, Reversal Point and

• Last Bearish leg marks the exhaustion gap and stop run.

• Market printed a liquidity sweep below 3,310 then 3,280 (weekly low), trapping late sellers.

• Smart Money likely absorbed sell-side liquidity before initiating the reversal leg.

• This aligns perfectly with SMC principles: sweep → accumulation → expansion.

3️⃣ Late Week Rally

• Following NFP & Unemployment Rate news, price broke 3,333 and rallied strongly to 3,363.63 confirming a Bullish Market Structure Shift (MSS).

• Resistance turned into support, validating the accumulation phase.

• Price rallied strongly to 3,363.63,.

• The weekly candle flipped bullish, closing near the high, with Smart Money leaving a clear footprint of accumulation and expansion.

⸻

🎯 Key Levels & Outlook

• Support: 3,355 → 3,333 - 3,340

• Resistance: 3,377 → 3,380+

• Bias: Bullish above 3,333.

• Watch for liquidity sweeps of intraday lows to catch new long entries, targeting 3420-3440.

⸻

💡 MJTrading View:

A structural shift and weekly strong close confirms bullish intent into next week.

As long as 3,333 holds, dips are buying opportunities.

⸻

Please share your opinions...

#MJTrading #GoldAnalysis #SmartMoney #LiquiditySweep #PriceAction #MarketStructure #Forex #TradingView #ChartDesigner #BullishMarket

Fortnight Overview:

Psychology Always Matters:

"BTC Sweeps Liquidity – Eyeing 115K Reclaim?""BTC Sweeps Liquidity – Eyeing 115K Reclaim?"

🔍 Technical Analysis – BTC/USD

On the 1H chart, Bitcoin (BTC) is currently displaying a textbook smart money structure, with price action following key institutional footprints.

🔑 Key Observations:

Liquidity Grab at Weak Low

Price dipped below the local support (~112,500), sweeping sell-side liquidity and tapping into a possible reversal zone.

Rejection from Demand Zone (Support Area)

A strong reaction occurred right at the support level, suggesting buyer interest is still present.

Order Block & Fair Value Gap

A visible Fair Value Gap (FVG) sits above current price action, aligning with an Order Block near the 115,000 level — this is a key magnet for price to rebalance.

Target Zone

Immediate upside target is 115,000, where an order block lies. If price reaches that level, expect potential short-term resistance or reversal.

Break of Structure (BOS) Confirmations

Multiple BOS and CHoCHs indicate bearish-to-bullish attempts, but the current structure still needs confirmation above 113,500+ for bullish continuation.

🧠 Conclusion & Expectation:

BTC has swept liquidity to the downside and may now seek to fill the FVG and revisit the 115K order block. However, confirmation is required — watch for bullish engulfing candles, volume spikes, or a CHoCH above 113,500.

“Smart money doesn’t chase — it waits for liquidity, then repositions. BTC may be following the same script.”

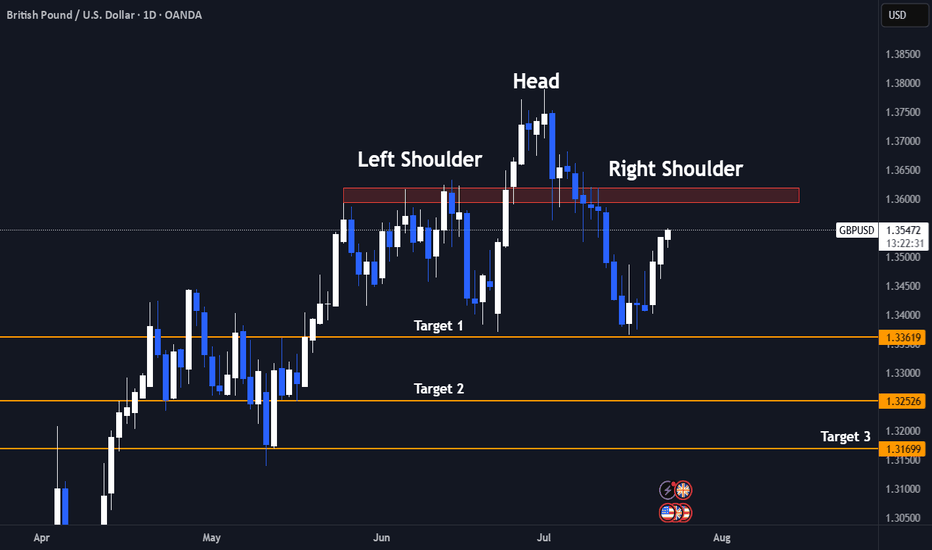

GBP/USD 4H Chart – Head and Shoulders Breakdown with Bearish Currency Pair: GBP/USD (British Pound vs US Dollar)

Timeframe: 4-Hour (4H)

Platform: TradingView

---

🔍 Pattern Identified:

Head and Shoulders Pattern

Left Shoulder, Head, and Right Shoulder are marked.

The neckline is broken, confirming a bearish trend reversal.

The trendline from March to June was also broken, supporting a downtrend.

---

📍 Current Price (at screenshot time):

Around 1.32778

---

🎯 Sell Setup – Target Levels:

🔻 First Target:

Price: 1.30072

Labelled: "1st TARGET POINT"

This is a near-term support level or conservative projection of the Head and Shoulders move.

🔻 Second Target:

Price: 1.28023

Labelled: "2nd TARGET POINT"

This is a deeper target, likely the full measured move of the pattern.

---

📈 Entry & Risk Management:

Suggested Sell Entry Zone: Around 1.32778

Stop-Loss (SL): Consider placing above the Right Shoulder area (around 1.3350–1.3380)

Take-Profit (TP):

TP1: 1.30072

TP2: 1.2802

AUD/USD Bearish Breakout – Retest & Sell Continuation SetupAUD/USD (Australian Dollar vs. US Dollar)

Likely a 4H (4-hour) timeframe based on candlestick density and scale.

---

2. Structure & Patterns:

Rising wedge/ascending channel: Already broken to the downside.

Breakout zone: Around 0.6480–0.6500, clearly marked and now acting as resistance.

Retest confirmed: Price returned to the broken zone, touched resistance, and dropped.

Ichimoku Cloud: Price is below the cloud → strong bearish signal.

Downward projection: You’ve drawn a possible bearish path with lower highs and lower lows.

---

3. Key Support & Target Levels:

✅ Current Price (as per chart):

Around 0.6468

🎯 Target Points (as per your drawing):

1. First Target Point → 0.6400

This aligns with previous minor support.

2. Second Target Point → 0.6370

Likely based on a Fibonacci or historical support level.

---

✅ Clear Trade Setup Summary:

Component Value

Direction Sell (Short)

Entry 0.6475–0.6485

Stop-Loss 0.6520

TP1 0.6400

TP2 0.6370

---

📌 Conclusion:

You are currently in a bearish setup after a breakdown from a rising structure. The market structure favors lower prices with clearly marked TP1 at 0.6400 and TP2 at 0.6370. Your entry zone (0.6475–0.6485) is technically sound, especially if there's a minor retracement.

Let me know if you want:

A Fibonacci analysis

RSI/MACD confirmation

BTC/USDT Bearish Continuation SetupChart Identification:

Timeframe: Likely 1H or 4H

Pair: BTC/USDT

Indicators: Ichimoku Cloud

Pattern: Price broke down from cloud resistance and is retesting previous support

Setup: Bearish continuation with consolidation before next leg down

---

✅ Trade Setup (Sell):

🔹 Entry Point:

Sell Entry: Below 113,500.84

This level marks the neckline of a small consolidation zone.

Wait for clean candle close below this level.

---

🎯 Target Levels (Take Profit):

1. TP1: 110,955.16

Previous minor support

2. TP2: 108,091.84

Key support/demand area

---

🧠 Optional Confirmation:

You can wait for:

Bearish candlestick pattern at 112.1K zone

Rejection of retest near 113.7K–114.3K (top of cloud)

---

📌 Summary:

> BTC/USDT Short Setup

🟢 Entry: Below 113,500.84

🎯 Target 1: 110,955.16

🎯 Target 2: 108,091.84

Bearish bias as price remains below the Ichimoku cloud and shows signs of continuation.

Bull Trap Confirmed: GBPUSD's 8% Rally Faces ExhaustionLets Face it we had a great 6 months already clocking 60%+ Returns already.

And after sitting ducks for almost 2 months now we finally have a trade.

- Its a very self explanatory chart

- Trading at resistance

- Head & Shoulder pattern

And the best part the right shoulder is still yet to be formed! My favourite type of entry.

1.It gives a better risk reward ratio (1:7 expected)

2.Better Entry (No long red candles)

3. And even if the pattern fails it we may still reach the neck line which is target 1.

Entry Criteria

- A Red candle at the entry Line Marked

- Stoploss Above the Entry Candle

Target 1- 1.3361

Target 2- 1.3252

Target 3- 1.3169

Keep Your Risk Reward Intact! Not An investment Advice