The biggest cup&handle of all times: silver targets $50The data suggests a cup&handle:

Cup was between 1980-2011

Handle is still in progress and probably may finish by 2025 or earlier.

For the short run: a re-test of low re-accumulation range of $23 can be seen.

The next mid-term target will be $25.

Final target will be $50.

Cup And Handle

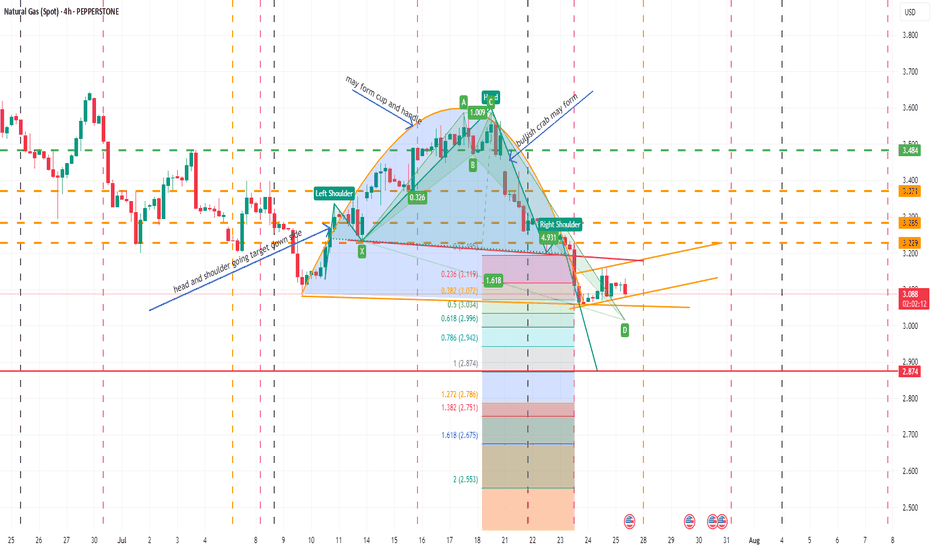

NATURAL GAS SPOTMay form inverse cup and handle, bullish crab also about to form , after completing one head and shoulder pattern already posted earlier new head and shoulder going on. In daily and 4 hr chart below ichimoku cloud. In weekly within cloud. Moving averages showing weakness in daily and weekly, monthly candle also no bearish. May be in such scenario bullish crab pattern may fail but need to be careful as over sold territory. Let see how all works in future though so far all as per analysis. I am not SEBI registered analyst.

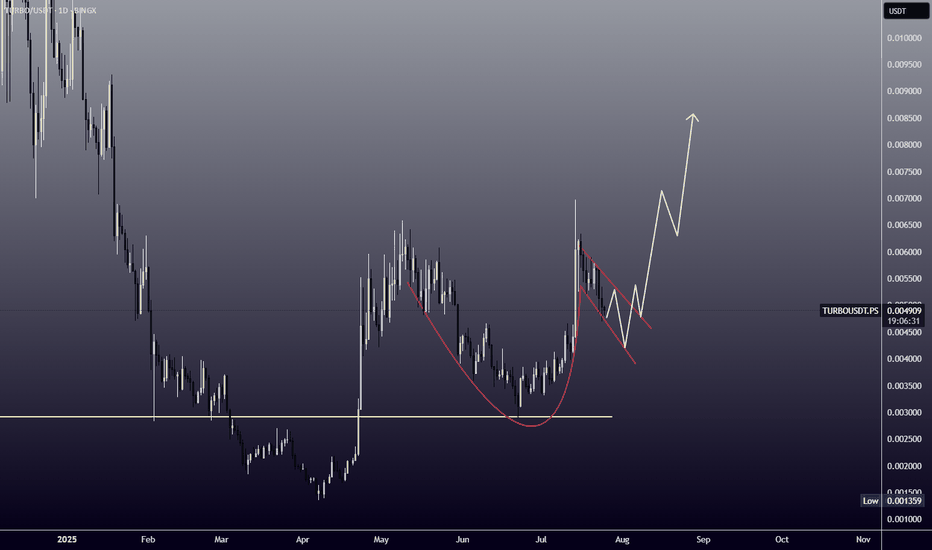

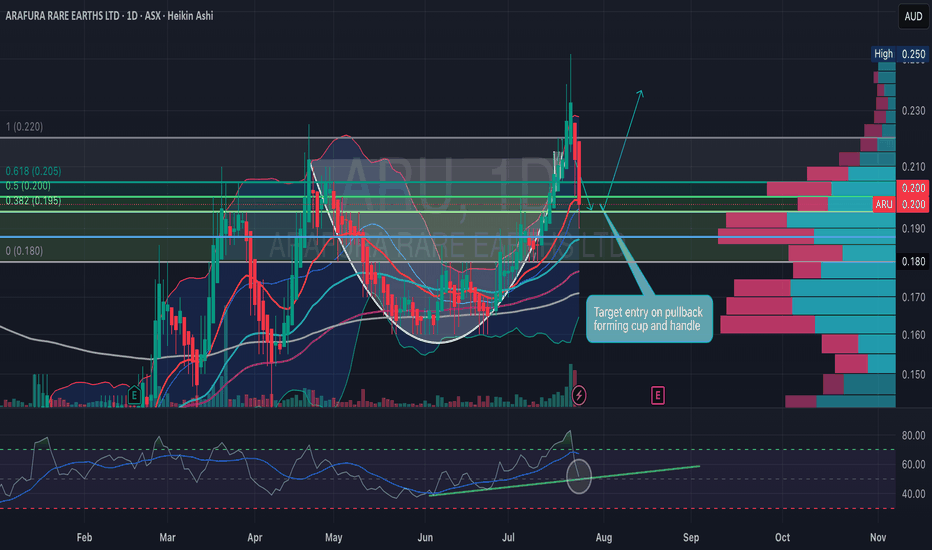

Bullish Cup and Handle setup for Arafura Rare EarthsARU is setting up beautifully with a classic cup and handle formation on the daily chart. This is a well-defined bullish continuation pattern with strong convergence across technical indicators, price action, and volume structure.

Key pattern breakdown :

- Rounded cup base formed over April–June.

- Price rallied into resistance (~0.22-0.23c AUD), forming the right side of the cup.

- Currently in a healthy pullback phase, building the handle.

Watching for support at 0.195–0.200 to hold, which aligns with:

38.2–50% Fibonacci retracement

Mid-Bollinger Band

High-volume node on the visible range volume profile

RSI remains in a bullish uptrend, now cooling off and testing trendline support.

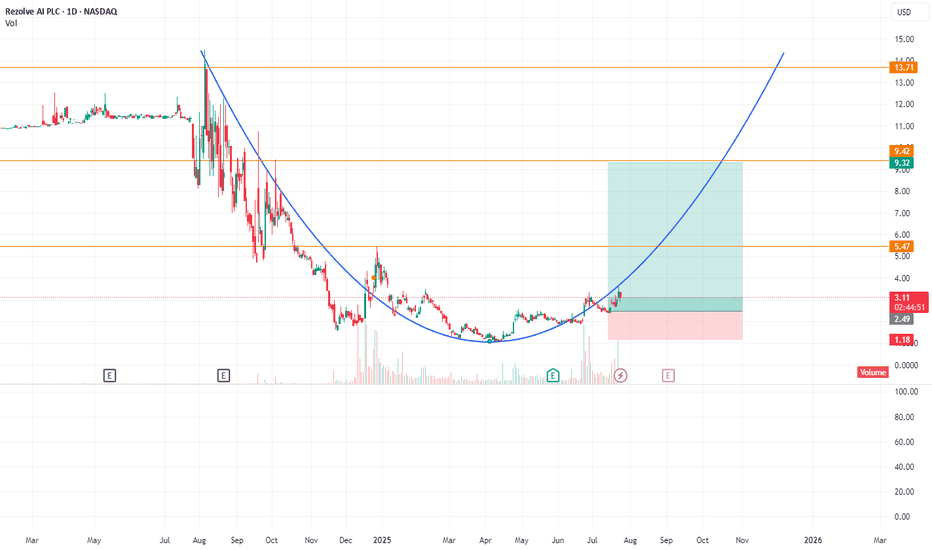

RZLV formed round bottomBusiness Model: AI SaaS for retail—mobile-first, gen‑AI conversational commerce and checkout.

Financials: Very low revenue base, heavily loss-making, but building enterprise footprint and usage.

Balance Sheet: Strengthened via equity conversions, debt facility, and capital raises; dilution risk remains.

Traction: Growing client deployments across major brands; usage and GMV accelerating in 2025.

Leadership: Experienced team, led by a founder-CEO and a seasoned global CTO/product head drawn from tech‑commerce backgrounds.

Despite minimal current revenue, Rezolve AI is betting on rapid scaling through partnerships with Microsoft, Google, and enterprise clients. Execution and monetization in 2025 will be pivotal to its valuation trajectory.

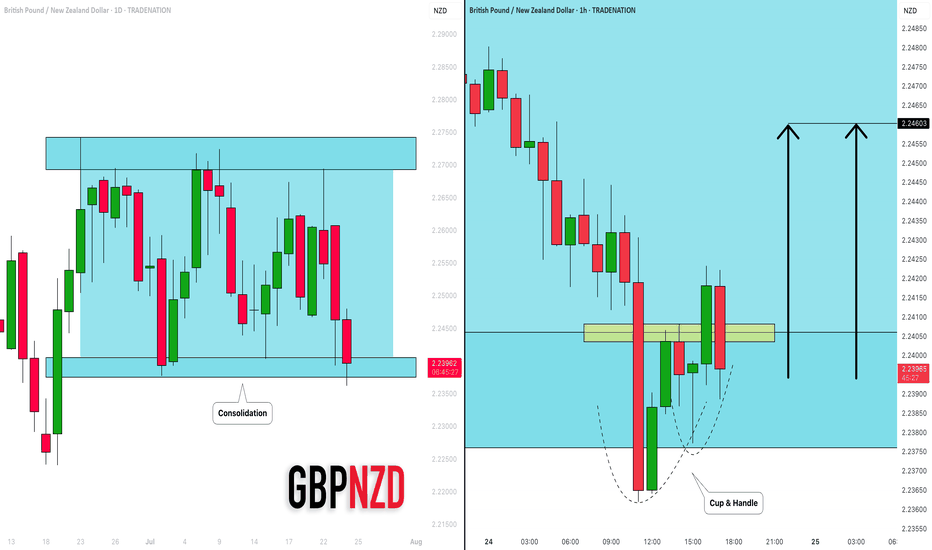

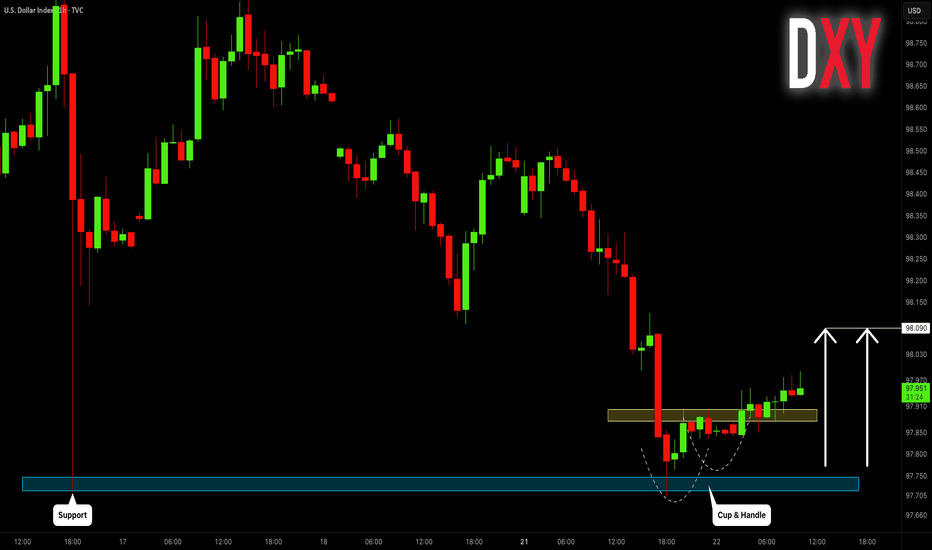

GBPNZD: Bullish Move in a Channel 🇬🇧🇳🇿

I see a horizontal parallel channel on GBPNZD on a daily.

The price is currently testing its support.

On an hourly time frame, a cup & handle pattern was formed on that.

Its neckline was violated with the today's high impact news.

I think that the price may bounce at least to 2.246 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

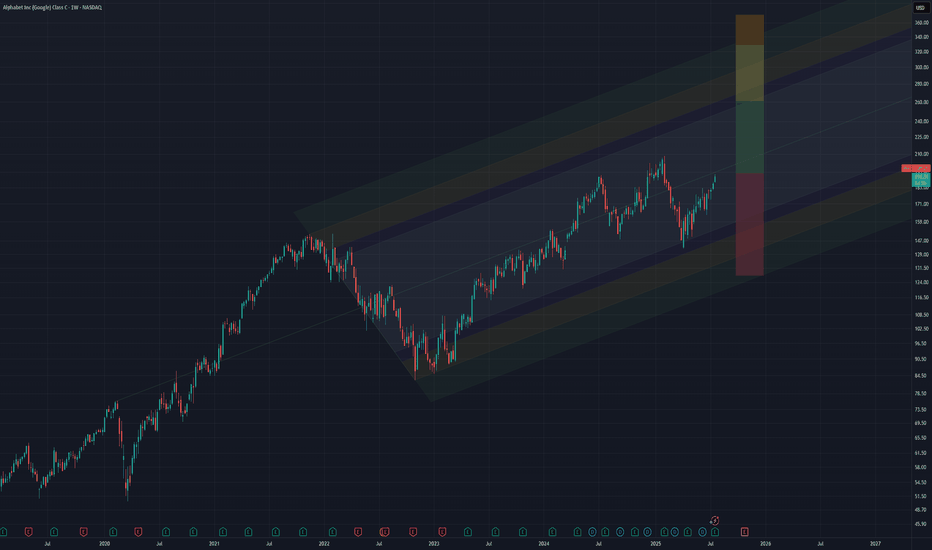

EOY based on yesterday's earnings and the flywheel effect# Alphabet's Accelerating Flywheel: Q2 2025 Earnings Validate the Strategy

technicals grounded in an anchored pitchfork hinged on the pre-covid levels (covid bottom just makes the path too aggressive for EOY) and fib retracements of the 2022 bear market decline. General and simple targets since moving averages aren't providing much clarity. Single stock analysis is even more voodoo than large sector indexes, so I'll focus on fundamentals instead:

## The Flywheel In Action: Q2 2025 Results

Alphabet's blowout Q2 2025 earnings provide concrete evidence that their integrated AI flywheel is already spinning faster. **Revenue grew 14% to $96.4 billion, crushing expectations**, while the company raised its 2025 capital expenditures from $75 billion to **$85 billion**—a bold investment that initially spooked some investors but actually signals the flywheel's acceleration.

### Why the $85 Billion Capex Increase is Strategic Genius

The additional $10 billion isn't just spending—it's **strategic reinvestment in the flywheel's core components**:

**Infrastructure Dominance:** Google Cloud revenue surged 32% to $13.6 billion, now approaching a $50+ billion annual run rate. The capex increase funds the massive data centers and TPU clusters needed to serve exploding AI demand.

**Competitive Validation:** Even OpenAI, Google's biggest AI rival, is now renting Google's TPU chips to power ChatGPT—choosing Google's proprietary hardware over Nvidia GPUs for cost-effective inference. This partnership alone validates the integrated hardware-software advantage.

**Market Leadership:** With AI Overviews reaching 2+ billion users (up from 1.5B last quarter) and Gemini hitting 450+ million users, Google is proving it can deploy AI at unprecedented scale while generating immediate revenue.

## The Core Flywheel System

**The Engine:** World-class AI research (DeepMind, Google AI) creating increasingly capable models that serve as tools for invention, not just products. Gemini's rapid user growth proves the models are competitive.

**The Fuel:** Search and YouTube revenue provides patient capital for long-term moonshots, while diverse data from billions of users continuously improves AI models. Q2's strong advertising performance ($64B+) funds the entire system.

**Custom Hardware Advantage:** Proprietary TPUs optimized for their AI software create faster, more efficient training and inference than competitors using general-purpose chips. OpenAI's adoption proves TPUs offer superior cost-performance.

**The Multiplier:** Quantum computing research that could eventually solve problems impossible for classical computers, creating step-change advantages in materials science and optimization.

## AI Integration Across the Ecosystem: The Ultimate Moat

Alphabet's true competitive advantage lies in **embedding AI across their existing billion-user platforms**, creating compound defensibility:

**Search Dominance:** AI Overviews now appear in 2+ billion monthly searches across 200+ countries, fundamentally changing how users interact with information while maintaining Google's search monopoly. Users increasingly expect AI-powered results, making switching costs even higher.

**Productivity Lock-in:** Gmail's Smart Compose, Google Docs' AI writing assistance, and Sheets' intelligent data analysis create sticky enterprise and consumer habits. Once teams adopt AI-enhanced workflows in Google Workspace, migration becomes exponentially more difficult.

**Developer Ecosystem:** Google's coding tools (Colab, Android Studio) now feature AI pair programming, while languages like Go and Dart benefit from AI-optimized development. This creates a generation of developers trained on Google's AI tools.

**Educational Moat:** Chromebooks in schools now include AI tutoring and personalized learning, creating habits among students who will become tomorrow's decision-makers. Google for Education's AI features make alternative platforms seem primitive.

**Entertainment Integration:** YouTube's AI-powered recommendations, creator tools, and content moderation have become so sophisticated that creators and viewers alike can't imagine the platform without them. This strengthens YouTube's dominance over TikTok and other competitors.

**Mobile and Browser Dominance:** Android and Chrome's AI features (Smart Reply, intelligent autofill, predictive text) create seamless experiences that competitors struggle to match without Google's data advantages.

## Near-Term Flywheel Accelerators

**Physical AI & Robotics:** Moving from digital-only AI to robots that can perceive and manipulate the physical world. Waymo has now driven 100+ million autonomous miles, generating unique physical-world training data.

**AI Biology:** DeepMind's protein folding breakthroughs and Isomorphic Labs' drug discovery pipeline could create massive pharmaceutical revenues while advancing the core AI engine.

**AI Materials Science:** Already discovering thousands of new materials that could dramatically improve batteries, semiconductors, and other hardware across all ventures—feeding back into better TPUs and infrastructure.

## The Compounding Network Effects

**Data Flywheel:** More users → More training data → Better AI models → Better products → More users. AI Overviews now drive 10%+ more queries for the types of searches that show them.

**Revenue Flywheel:** AI success → Higher cloud/advertising revenue → More R&D investment → Better AI → Market expansion. Google Cloud's 32% growth funds continued AI leadership.

**Talent Flywheel:** Best AI infrastructure → Attracts top researchers → Better models → More ambitious projects → Attracts even better talent. The recent $2.4B Windsurf acquisition shows Alphabet winning the talent war.

**Infrastructure Flywheel:** More AI demand → Larger TPU deployments → Better hardware optimization → Lower costs → More competitive offerings → More demand.

**Ecosystem Lock-in:** AI features across Gmail, Docs, YouTube, Search, and Android create switching costs that compound across products. Users don't just leave Google Search—they'd have to abandon their entire digital workflow.

## The Strategic Moat Widens

While competitors excel in individual areas, Alphabet's advantage comes from **deep integration creating compound effects**:

- **Capital Moat:** The $85B capex commitment (13% increase from 2024) exceeds most competitors' total revenues

- **Integration Moat:** OpenAI using Google TPUs despite being competitors proves the hardware-software integration is unmatched

- **Scale Moat:** 2+ billion AI Overview users and $50B+ cloud run rate create network effects competitors can't replicate

- **Ecosystem Moat:** AI embedded across Search, Gmail, YouTube, Android, Chrome, and Workspace creates compounding switching costs

- **Innovation Velocity:** Time from AI research to deployed products at billion-user scale continues compressing

## The Key Insight

The Q2 earnings reveal that Alphabet isn't just building an AI company—**they're building the infrastructure that accelerates invention itself**. Each breakthrough feeds back into the system: new discoveries generate revenue that funds more research, create better tools for the next breakthrough, and attract top talent.

More importantly, they're embedding AI so deeply into users' daily workflows—from Gmail to YouTube to Search—that switching becomes not just inconvenient but practically impossible. When your email, documents, entertainment, and information all work seamlessly together through AI, why would you ever leave?

The $85 billion capex increase signals management's confidence that they're approaching "escape velocity"—where their innovation rate becomes impossible for competitors to match. While others debate AI spending, Alphabet is already demonstrating profitable AI deployment at unprecedented scale while simultaneously investing in the next acceleration phase.

**The Bottom Line:** Alphabet's integrated flywheel of AI research, proprietary hardware, massive data, and patient capital is creating an innovation velocity that competitors are finding increasingly difficult to match. But their true moat is embedding AI so deeply into billions of users' daily habits that the entire Google ecosystem becomes indispensable—and the Q2 results prove this strategy is already working.

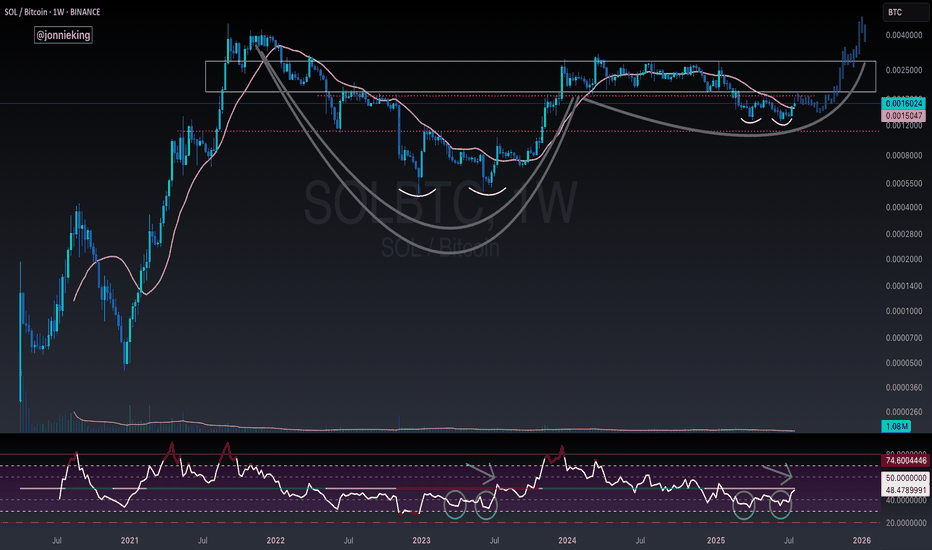

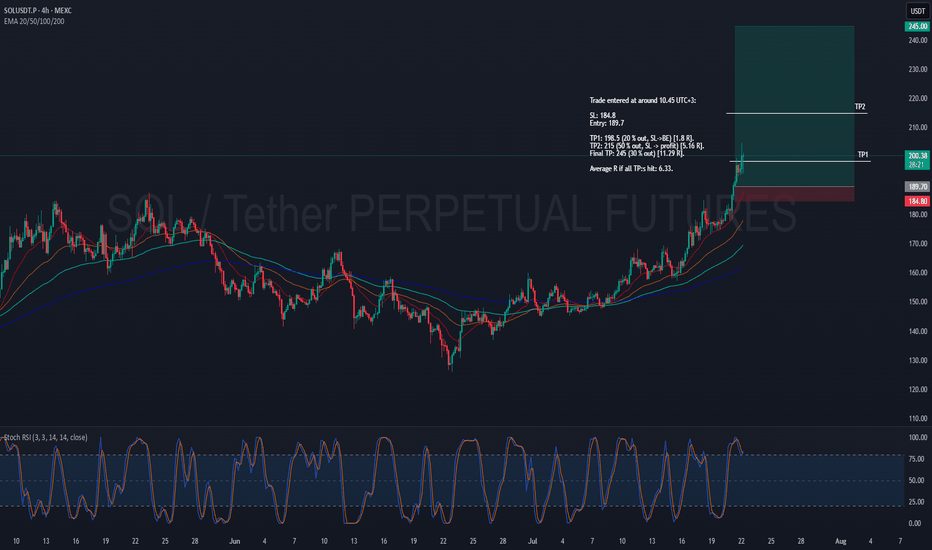

SOL long running - follow up on the Cup & Handle ideaPrice closed above both key levels I mentioned — 181 and the HTF S&R at 188 — with momentum and structure confirmation. That gave me enough conviction to enter a long.

🎯 Final TP aligns closely with the measured move target: 245.

📈 SL is already at breakeven after TP1 hit — risk-free from here.

Let’s see if SOL completes the full handle breakout.

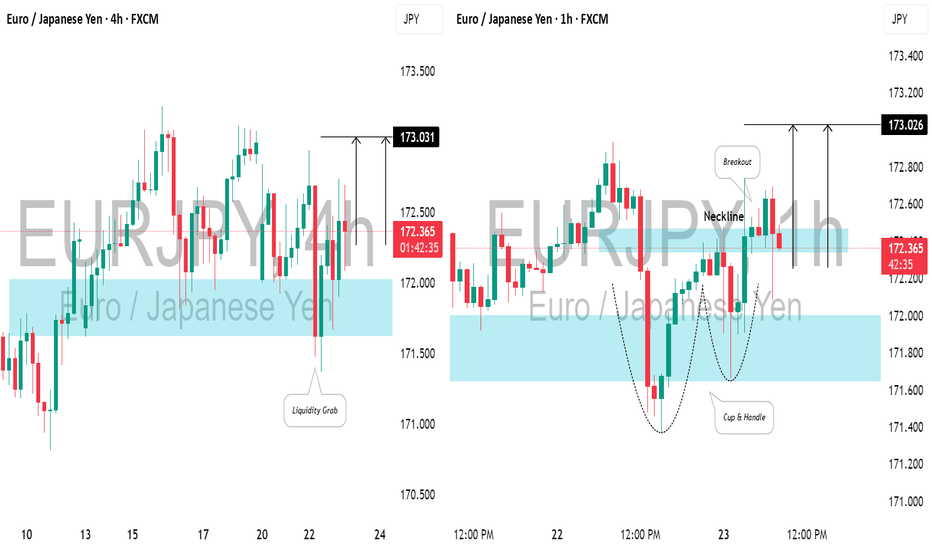

EURJPY: Bullish Move After Liquidity Grab📈EURJPY created a bearish high-range candle beneath a crucial support level in a horizontal trading range on the 4-hour chart.

However, a subsequent recovery and a bullish opening in the Asian session indicate a strong likelihood of an upward movement today, targeting 173.00.

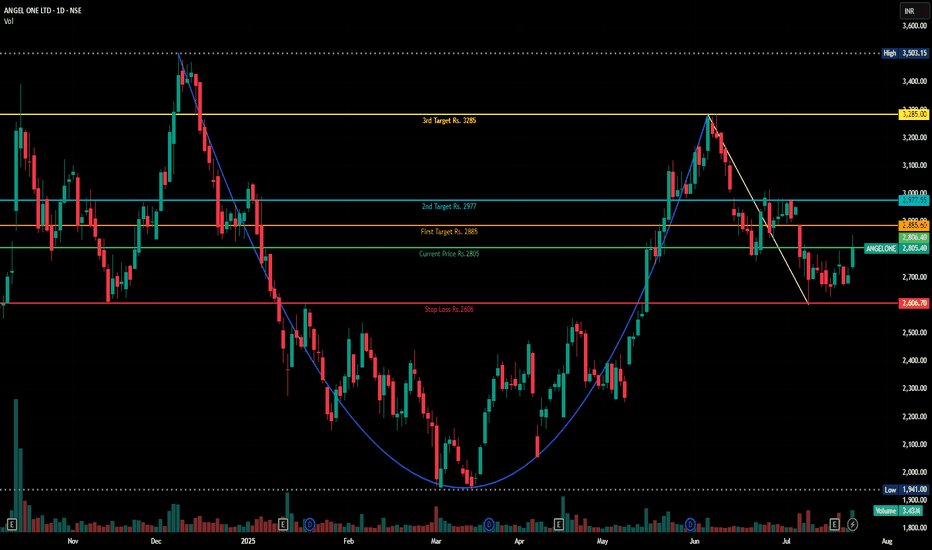

Cup and Handle Formation in Angelone ChartDisclaimer : Do your own research before investing. This is just a chart analysis for education purpose only. No recommendation to buy and sell.

In Dec 2024, AngelOne made high of Rs.3500 and pull back to level of Rs.1941 in March 2025.

After touching level of Rs. 3288 , its now trading at Rs. 2805.

I can see a cup and handle chart pattern formation in this stock. to me , it will be bullish in near to long term.

I have mentioned my targets along with stop loss.

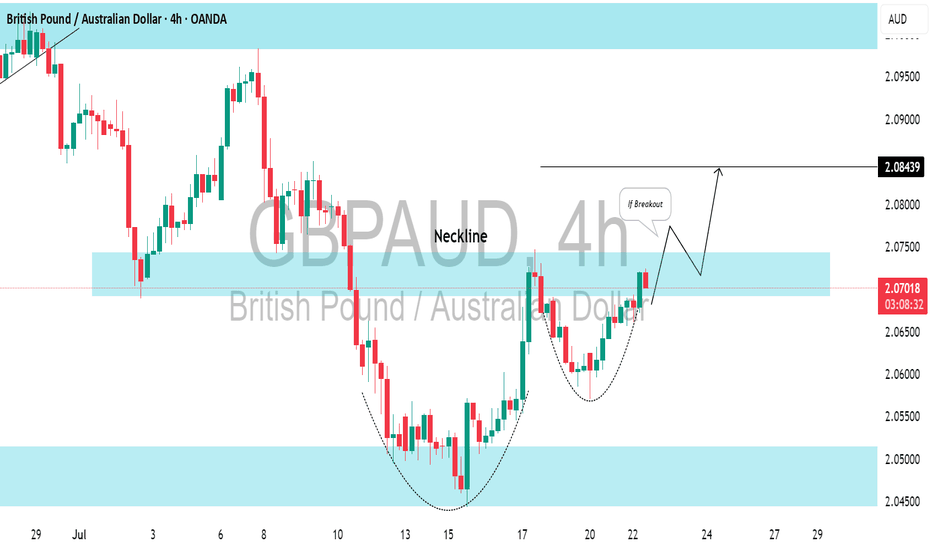

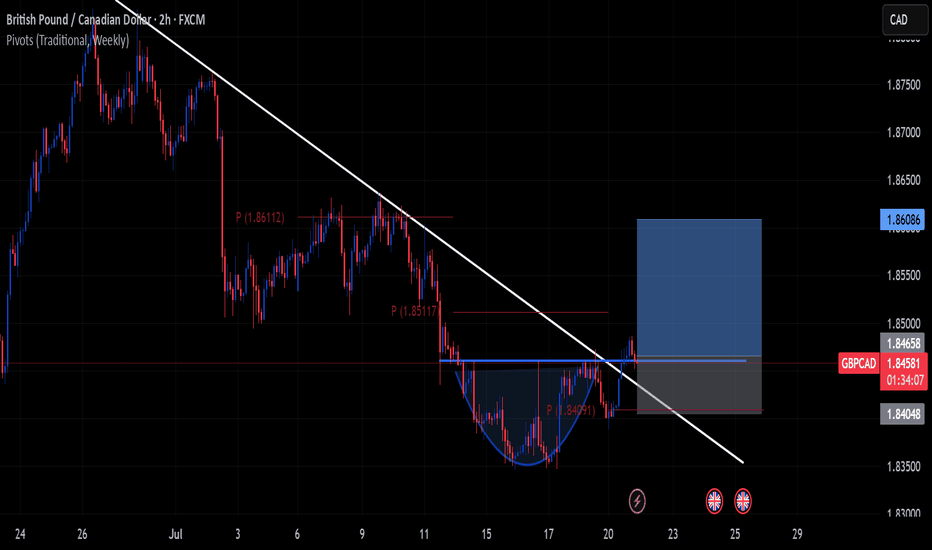

GBPAUD: Another Bullish Pattern⚠️GBPAUD has adhered to a horizontal support level on the intraday chart and has bounced back from it, revealing a strong bullish pattern.

The price has formed a cup and handle pattern and is currently testing its neckline.

Look for a breakout confirmation; a 4-hour candle closing above the 2.0750 level will validate this breakout, leading to an anticipated bullish continuation.

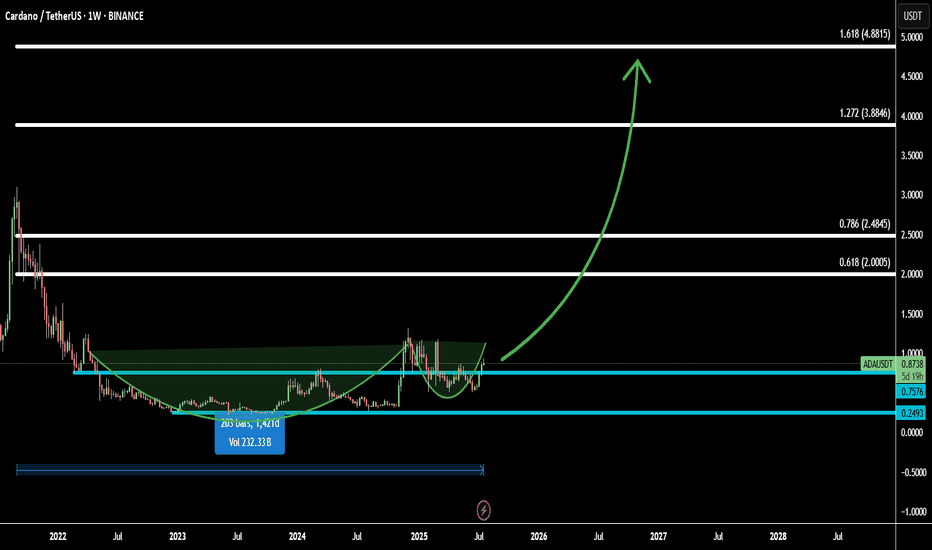

ADA Ready to Fly: Cup & Handle Pattern + Fibonacci TargetsCardano (ADAUSD) is forming a classic cup and handle pattern on the higher timeframe, signaling a bullish continuation setup that often precedes strong upward moves.

Combined with Fibonacci extensions, the breakout potential is high, with multiple target levels mapped out:

Target 1: 0.618 Fib – 2.0005 - confirms breakout strength

Target 2: 0.786 Fib – 2.4845 - momentum continuation zone

Target 3: 1.272 Fib – 3.8846 - full extension based on pattern measurement

Target 4: 1.618 Fib – 4.8815 - aggressive bull target for long-term holders

If ADA breaks the handle with strong volume, it could initiate a powerful rally. This setup is ideal for swing traders looking for a high-probability entry.

Let’s catch the next big move together! 🚀

ASAN – Cup & Handle Breakout SetupASAN NYSE:ASAN has formed a classic Cup & Handle pattern and has broken above the neckline, turning previous resistance into new support. However, the price is still trading below both the 50 and 200 SMAs, which calls for cautious confirmation.

📌 Entry: Wait for a confirmed retest of the breakout level (new support) with healthy volume.

🔒 Stop Loss (SL): Just below the newly established support zone, in case of a failed retest.

🎯 Take Profit (TP):

First TP: Next visible resistance zone above.

If this level breaks and holds (confirmed by retest),

Next TP: The large gap overhead could potentially be filled.

This setup provides a strong risk-reward structure if confirmation aligns with volume and momentum. Avoid early entry without retest.

⚠️ DYOR (Do Your Own Research) – This is not financial advice.

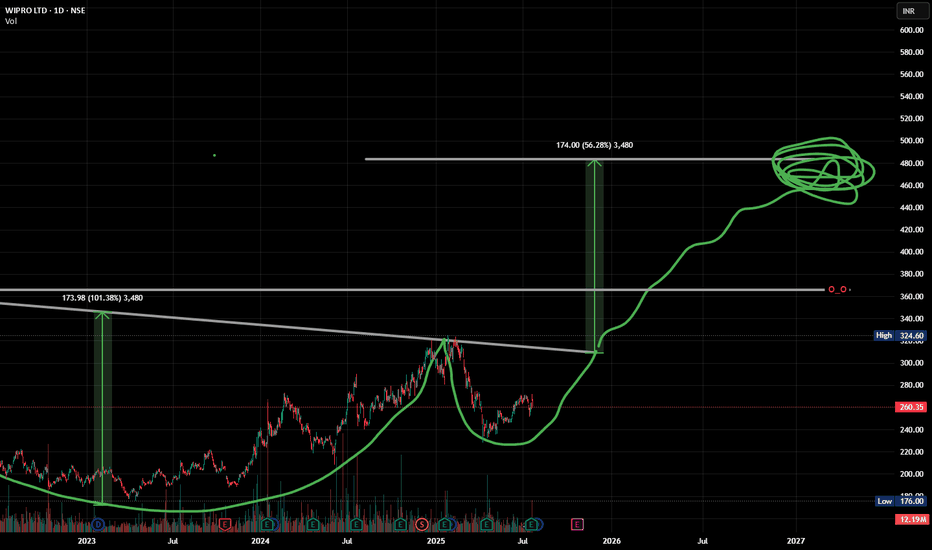

WIPRO & the Squiggle Prophecy Drew this green curve a year ago just for vibes… and WIPRO said “bet.”

Now it’s casually forming a monstrous cup, heading toward the ₹320 neckline.

If that breaks, we might see ₹370+, and maaaybe ₹480-ish… ish. Idk. Don’t ask me. Ask the squiggle.

Hopefully the squiggle squiggle prophecy holds true and I make more money lmao 💸

📈 When price action meets prophecy.