BTC.D, expected roadmap!Hi fellow traders,

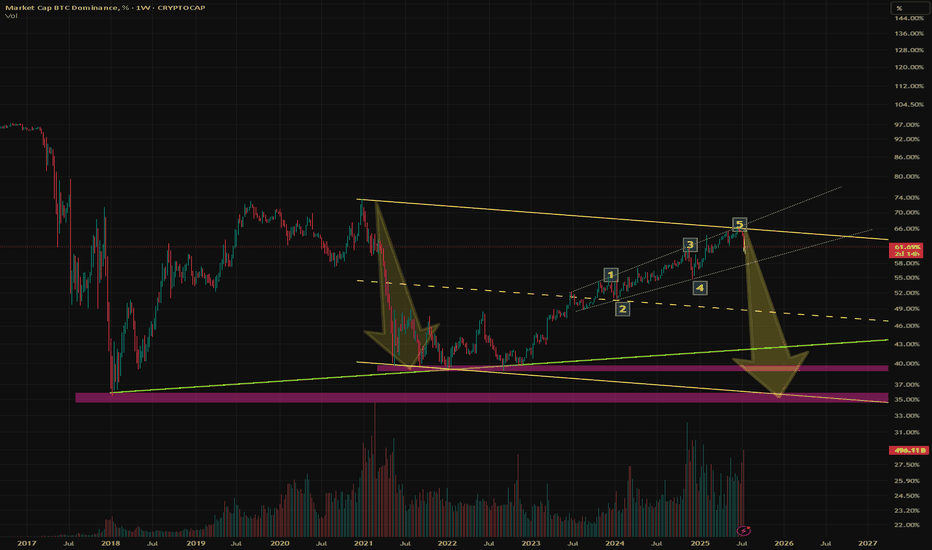

On this chart I’m analyzing the Bitcoin Dominance (BTC.D) on the weekly timeframe using Elliott Wave principles.

Looking at the structure, I expect a major corrective phase to unfold in the coming years. Historically, we have seen two big Altseasons (1 and 2), followed by smaller rallies. My projection suggests we could first experience a “Mini-Altseason” when BTC.D enters the lower golden box, before heading higher again.

This move up could then create the conditions for a much larger Altseason, similar in magnitude to the previous major ones, once BTC.D reaches the higher golden box zone.

Mini Altseason: Potential short-term relief for alts as dominance corrects lower into the first golden box.

Big Altseason: A larger, more powerful move, expected after BTC.D completes a strong retracement into the upper golden box region.

The invalidation levels are clearly marked, and as long as the structure remains intact, I expect BTC.D to respect these Fibonacci-based zones and follow this corrective path.

This analysis indicates that while we may see a temporary bounce in BTC.D the long-term outlook still favors another significant Altseason ahead.

Good luck and trade safe!

Dominancebtc

BTC-DOM- BTC dominance can't keep rising indefinitely.

-If we see a BTC dip, BTC dominance could climb to around 66% (71.8% Fibonacci), but in my opinion, that’s likely the maximum.

- If BTC surges too quickly and too high, altcoins will be suppressed, causing BTC dominance to potentially rise also to around 66%. However, once again, I believe that's would be the max.

- After any of both cases, altcoins will start to moon fly.

- 36-bar, 1096-day uptrend on the BTC dominance chart. That’s a significant duration from 2018 to 2021. The timespan from 2022 to 2025 could mirror the previous one.

- Take note also on the Bearish Divergence between the trend and the RSI. ( i will post weekly graphic also to show a more clear view ).

- An uptrend of this length indicates strong, sustained interest in BTC compared to altcoins. However, long-term trends like this are prone to exhaustion.

For now, just hold your alts and practice golden patience.

Happy Tr4Ding !

Dominance - Deep dive into Dominance chart!Did you know that dominance is on the verge of collapsing in the coming days? Let me tell you why.

🔸On the 3-day dominance chart:

- We have the beginning of a break of the ascending channel, a close below it, and a retest.

- There’s also a break of an important support level at 0.618 Fibonacci, followed by a retest, and it’s currently trading below it.

- Plus, we have a death cross where the EMA25 crossed below the EMA50.

That’s three confirmations on one chart — can you imagine?

The coming days will likely see a strong pump in altcoins. Remember my words.

Best Regards:

Ceciliones🎯

Altcoin Bulls Watching This Retest CloselyBTC Dominance has cleanly retested the breakdown from its rising wedge pattern after failing to break the key resistance zone.

This retest is a critical point if sellers maintain control here, dominance could trend lower toward the next support range, potentially sparking an altcoin relief rally.

However, a reclaim above this breakdown zone would invalidate the bearish setup and shift momentum back in Bitcoin’s favor.

DYOR, NFA

is AltSeason Started ????"The altcoin season has likely begun! We're currently witnessing Bitcoin's dominance chart breaking down at a critical juncture, and this cycle may surpass even our most optimistic expectations. The technical signals are remarkably clear and verifiable for most seasoned traders. In these market conditions, the wisest strategy is to hold strong with conviction – maintain your positions and trust in the assets you've carefully accumulated. This could very well be the start of an extended altcoin rally that rewards patience and strategic positioning. #AltSeason #CryptoMarket #BTCDominance #HODLStrategy"

Rising Wedge on Bitcoin Dominance - [BROKEN DOWNWARDS] The MASSIVE Rising Wedge on Bitcoin Dominance was broken downwards during the past week, most likely the 1W candle will also close below the support of the wedge.

What does it mean? The dominance will dump from 64% to at least 59%. This move can already provide us with the huge Altcoin Season! After this there more likely be a small correction towards 60%, and then we can freely dump further towards 54% zone.

I expect not only small cap, but major altcoins to be sent to new highs as well. Mark my words & be prepared for the last opportunity of this bull cycle!

BTC Dominance (BTC.D) — Weekly Failed AuctionChart Context

• Instrument: CRYPTOCAP:BTC.D

• Time-frame: 1-Week

• *Key vLevels (dashed):

• 68 % – 2021 supply pivot

• 66-68 % zone – recorded a Weekly Failed Auction (wick above, close back below)

• 62.50 % – mid-range support / prior breakout shelf

Failed Auction at the Top

Price wicked into the 66-68 % vLevel but closed lower.

On a weekly chart that pattern often marks exhaustion; bulls couldn’t maintain control.

First Support = 62.50 %

If BTC.D trades < 62.50 % and closes a weekly bar there, odds rise that capital rotates out of BTC and into alt-coins.

Historically this breakdown triggers the early stages of alt-season (see 2021 analogue).

Invalidation

Weekly close > 68 % negates the failed auction and points to renewed BTC strength (alts lag).

How I’ll trade / allocate

Spot BTC bias – overweight BTC while dominance holds > 62 %.

Alt-coin rotation – shift 20-35 % into high-conviction alts only after a confirmed weekly close < 62 % and follow-through below 60 %.

Risk checks – trim alt exposure back to cash/BTC if dominance reclaims 62 % after a breakdown (failed alt-season).

BEARISH DOM + BULLISH CAP = ALT SEASONsimple TA analysis with simple arithmetic operation :

decline of bitcoin Dominance with the rise of market capitale = the season of altcoins and price explosions.

the year 2025 will be profitable, enjoy the summer

CRYPTOCAP:BTC.D CRYPTOCAP:TOTAL BINANCE:BTCUSDT INDEX:BTCUSD BITFINEX:BTCUSD COINBASE:BTCUSD

BTC.D (Dominance at Critical Fibonacci Confluence) 2025 Weekly

**Summary:**

Bitcoin Dominance (BTC.D) is testing a major Fibonacci confluence near the 66% level. This zone historically acts as a major pivot and may signal either a continued dominance rally or a potential reversal setting the stage for altseason. We use three layered Fibonacci retracements to outline dominant trend zones, key resistances, and projected targets.

**Chart Context:**

This chart uses **three distinct Fibonacci retracements** to map the historical and projected behavior of BTC dominance:

1. **Primary Fib** (100% to 0%): Captures the macro move from BTC.D \~100% down to its 0% level at \~0%, which aligns with the first altseason (2018–2019).

2. **Secondary Fib** (100% to 38.88%): Maps the first bearish wave to identify potential recovery levels. BTC.D retraced up to the 61.8% (\~73.68%) but failed to break further.

3. **Third or the Current Fib** (73.68% to 38.88%): Maps the latest bearish fall in BTC.D. As of now, BTC.D is hovering at the 78.6% retracement level of this move, indicating heavy resistance.

**Key Technical Observations:**

* **1st TP (Resistance):** 66% — Strong Fibonacci confluence zone:

* Fib2 48.6% ≈ Fib3 78.6%

* Major reversal zone historically

* **2nd TP (Support):** 52.25% — Multi-Fib confluence:

* Fib1 48.6%, Fib2 61.8%, Fib3 38.2%

* **3rd TP (Ultimate Support):** 38.88% — Historical BTC.D bottom, aligned with the first altseason.

* Intermediate Fibonacci confluences between 48%–60% serve as layered support during decline phases.

**Indicators:**

* No external indicators used; pure multi-frame Fibonacci confluence.

* Price action structure and historical patterns highlight potential market rotation zones.

**Fundamental Context:**

The current phase of the market reflects increasing speculative activity in altcoins while Bitcoin consolidates. Historically, high BTC.D correlates with Bitcoin-led rallies, while a sharp drop often triggers altseason.

* Growing inflows into ETH, SOL, and possible now XRP, and mid-cap alts suggest capital rotation.

* If BTC.D faces rejection from 66%, the market could enter a new altseason phase.

* Macro tailwinds (e.g., easing monetary policy, risk-on sentiment) support altcoin performance in the medium term.

**Philosophical or Narrative View:**

BTC.D acts as a barometer of market risk preference. As confidence expands beyond Bitcoin, money flows into altcoins—like tributaries branching off the main river. The rejection from major confluences signals this psychological shift, marking phases of creative decentralization.

**Related Reference Charts:**

* TOTAL3 Fibonacci Setup (Altcoin market excluding BTC & ETH):

* TOTAL2 Correction Probabilities:

**Bias & Strategy Implication:**

* **Primary Bias:** Bearish rejection from 66% followed by correction to 52% and potentially 38.88%.

* **Alternative Scenario:** Brief breach above 66% before reversal.

* Traders may consider rotating into altcoin exposure if BTC.D confirms reversal at the confluence zone.

**Time Horizon:**

* Mid to Long Term (1–6 months outlook)

* Weekly timeframe tracking

**Notes & Disclaimers:**

* This analysis is for educational purposes. Market conditions may evolve rapidly.

* Use proper risk management when acting on dominance signals.

Dominance is currently engaged in a battle to move downward.Bitcoin dominance is currently in a strong downward battle, facing increasing pressure from altcoins which are gaining momentum. Despite some resistance trying to push dominance higher, the overall trend suggests a weakening grip of Bitcoin over the crypto market. This decline indicates growing investor interest in alternative cryptocurrencies, especially as sector-specific tokens and new projects start to outperform BTC. If this downward movement continues and breaks key support levels, we could see a more significant rotation into altcoins, fueling a broader rally across the market.

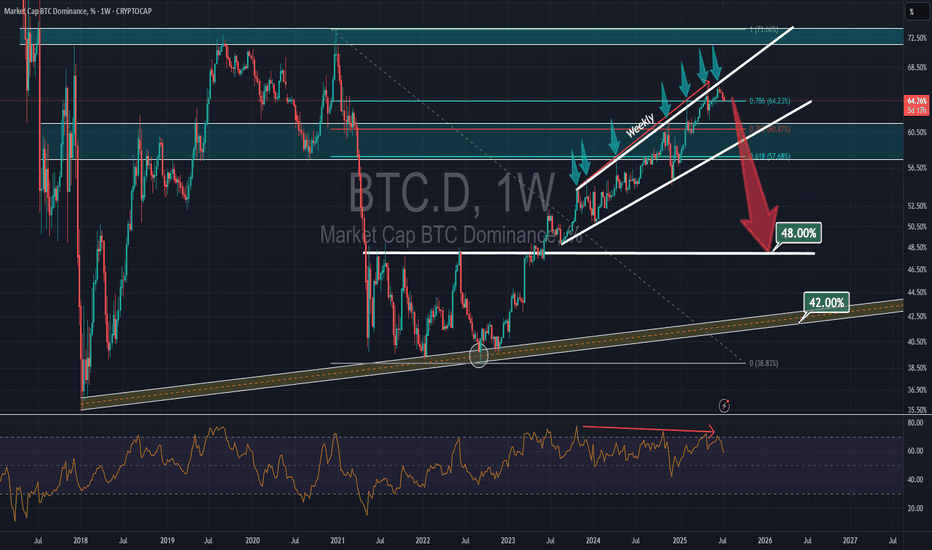

Bitcoin Dominance - the two scenarios!Bitcoin dominance continues to rise after breaking out of a rising wedge pattern on the weekly chart. It has now also broken through the 0.786 Fibonacci level.

Next stop is Rectangle 1, where Bitcoin dominance is expected to reach 68% — and most likely, this will mark the top of dominance before it starts to drop, triggering a historic altcoin season.

Scenario 2:

Dominance keeps pushing higher toward Rectangle 2, potentially surpassing 70%. At that point, many altcoins may form new lows, and weak projects could get wiped out.

Fear in the market will hit extreme levels —

but that could signal the beginning of an altseason and the collapse of BTC dominance.

Best regards Ceciliones 🎯

Bitcoin - The path to 170K

- Still enough NQ correlation to drag BTC

- No new highs unless QE (regime shift)

- Rangebound but stronger "decoupling rally" possible due to global liq etc. Fade unless real QE

- Front runs end of year (early Q4 stocks late Q4)

All of this could change, but one thing the charts keep telling me—

$170K Bitcoin this cycle is still very much a possibility.

Please check out my bear market Bitcoin-to-100K chart.

Thanks, feel free to leave a boost if you have found this helpful.

Dominance the system core- for me it has always been very complicate to explain BTC.D to peoples, because it's complicate ! lol

- it's weird to understand the moves and many factors have to be compared together an alchemy have to happen to see something happening.

- So basically to explain it, i will tell you what "we want to see" or "what we don't want to see" in the future. if the story repeats again.

1/ BTC.D have to grow up, then Altcoins will struggle down trying to find a potential bottom.

- While BTC.D grow up, BTC price have to grow up also or at least stabilize ( this is a good sign )

2 / if BTC price down and BTC.D up, it's bad, it's just the normal way ( No Divergence )

- When BTC price + BTC.D both up together, it's a kind of " inversed divergence ", it means something good gonna happens. ( get it ?)

- Basically also if USDT/USDC Dom Grow and BTC price stabilize and not goes down anymore, it's a good sign.

- Normality the normal way is : BTC up / USDT/USDC.D Down OR BTC Down / USDT/USDC.D up.

- Before we had no reason to check those Stables coins because they had not much DOM in markets, but now have to count with them.

- So While BTC.D is growing, altcoins will just make some weak moves.

- When BTC will reach is next Dominance's ATH ( witch have to be lower than last years because more concurrence )

- BTC.D will crash and ALT SEASON will start.

- it took me many years to understand that, but it's pure logic ( Fibonacci is working perfectly on it )

- again it's not easy to get it.

- if you have any questions feel free to add a comment.

Happy Tr4Ding !

BTC.D BITCOIN DOMINANCE near trendlineBTC.D is near the trendline.

Will we see a bounce right of the trendline? If so we could get the altseason we all are waiting for. However due too the massive growth in the number of altcoins and the many rugpulls in the meme sector and even liquidations as in CRYPTOCAP:OM for example, we could be in for a complete other scenario.

BTC could also keep the higher levels of dominance due to new ETF inflows and reserves by country's and the negative new in the alts. FUD could build up on the alts. So will we see an alt season in that case.... Even CRYPTOCAP:ETH is dropping so low.....

If we will see an altseason it will be different. Other bullruns there were just a few hundred altcoins so it was easy to pump them all. New we have milions of coins and the money supply is limmited. The inflows in BTC are stuck there in ETF's and reserves... So that looks nice but it won't flow back into alts in my opinion.

So what can we expect from the so called altseason.... Well i believe we will see rotation from narrative to narrative. The mass (retail) will first jump on the train with trading the pairs they know. In taht case we will see the first pumps in the bigger MEME's and DINO coins (coins that have survived several bullrun cycles like XRP, LTC, ADA, ETH, BNB, LINK).

Why DINO coins will pump? Because retail knows these coins and all the new coins are just too many to deal with. They just won't understand. Off course we will see projects like SOL, SUI, HBAR, ATH and several others pump with the coins but not every coin has the same visibility.

After these two narratives the rest could follow. A few a quite certain. Like AI, RWA, DeFi and a few others. But also in these narratives it will be cherry picking the good and proven projects.

So choose your darlings with care and don't mary your coins! All alts will drop 90% in the bearmarket!

BTC dominance hinting at one last push?Hello everyone

We all are looking for a way how the BTC dominance can go down to 40% area. If we somehow can predict it correctly then we can make some money in the process.

Here is a (maybe not so) wild idea for medium term.

We are on a weekly chart.

Let's check some facts first:

- Stoch RSI is currently high (near 100).

- RSI is at 68

- Chart is making a new higher high - keep in mind previous dominance high (Feb 3rd) was a result of a flash crash of the market so I am referring to previous high as Nov 18th

So we are witnessing a bearish divergence (RSI making lower highs while chart is making higher highs). Hence drop in BTC dominance should just be a matter of time.

What if the universe aligns and following happens:

We are in economically unstable times. Markets are volatile, politicians are unpredictable so further drop in Crypto space is not impossible. BTC drops less then ALTs, BTC dominance reaches top somewhere between now and 67-68% area. In the meantime traditional markets also crash some more. After that the economic situation stabilises, we get Quantitative Easing and this drives price of ETH up, followed by other ALTs.

For reference: ETHBTC has reached strong support between 0.002300 and 0.001700 Satoshi, RSI is at 24 (same level as Sept 2019 when ETHBTC was at a longterm low).

This scenario would ignite Altseason, bringing BTC dominance down for a reset and start of a new cycle.

There are other bearish scenarios as well, keep that in mind. So trade safe and smart.

I am not predicting any of this, I am not even mentioning any possibilities for this to happen. I am just giving you some food for thought.

Good luck!