Double Top or Bottom

XAGUSD Overextended: Watching 40.50 NecklineIn the past months I argued that Silver should rise and reach 40, and the market not only achieved that but even exceeded the level, printing a high at 41.50.

However, just like Gold, this move looks overextended and vulnerable to correction.

📌 Technically, price has tapped 41.50 twice. While it cannot yet be called a confirmed double top, the possibility exists. The neckline of this potential pattern is at 40.50.

• A break below 40.50 could trigger a deeper correction.

• First target: under 40, toward the 39 technical support zone.

🔑 Trading Plan: I remain cautious at these levels.

If 40.50 gives way, I will look for shorts targeting the 39 area. Counter-trend trades carry very high risk, but the setup is worth monitoring. 🚀

DUOL - NOT FOR TREND-FOLLOWING TRADERS DUOL - CURRENT PRICE : 271.28

Duolingo, Inc. (DUOL) is in a downtrend since 14 May 2025. The stock has recently tested the support level near USD 263, which coincides with a previous demand zone. This bounce from support highlights buying pressure, indicating the likelihood of a short-term reversal.

The Relative Strength Index (RSI) has moved near 30 level, signaling that the stock is in oversold territory. Oversold conditions often precede a technical rebound as selling pressure eases.

The confluence of oversold momentum and price stabilization at support suggests a possible bounce play. If buying volume increases, the stock could recover toward USD 297 – 325, its next resistance zone.

ENTRY PRICE : 271.00 - 272.00

TARGET : 297.00 and 325.00

SUPPORT : 260.00 (CUTLOSS below 260.00 on closing basis)

Notes : As the dominant trend is clearly bearish (downtrend) since 14 May 2025, this setup is not for trend-following traders.

GBPUSD Observing The Major Resistance AreaAs we can see in this chat, the pair respected the resistance zone and as expected it is heading down 1.3382 as the next partial support.

Possible outline:

hold on short position with 1.3458 as first Tp and 1.3382 as the second take profit.

Like and share your thoughts

Thanks for reading.

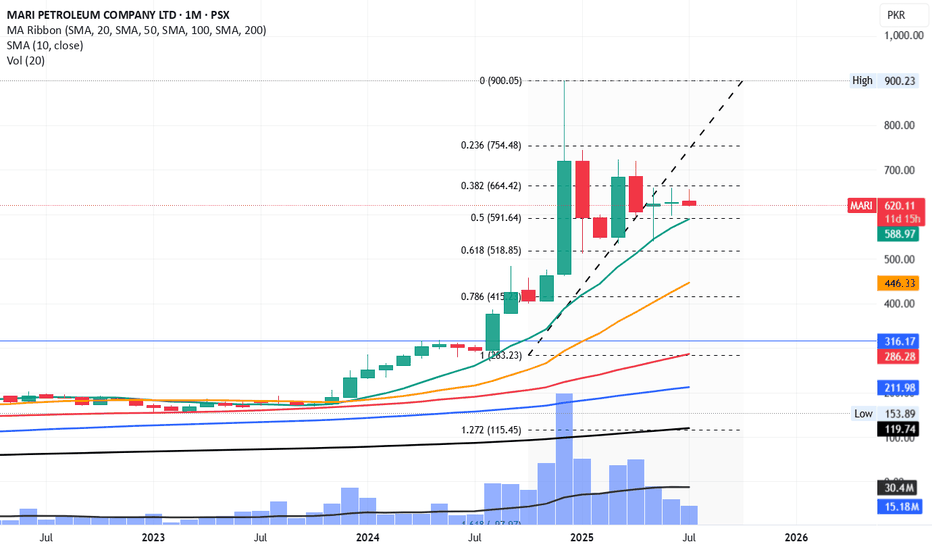

MARI ShortSince July 2023, Mari has never breached and closed below SMA10 on monthly timeframe.

If it breaches it and closes below 588, the downfall will be sharp.

Its first stop would be 519 and then 446 and 415 can also be on cards.

Sorry for Mari lovers but it can become a harsh reality.

However, 415 to 446 can be an ideal time for accumulation for long term investment purpose.

its not a buy / sell call, just my personal opinion.

Sell Signal on GBPJPYThe GBPJPY is forming beautiful and obvious Lower Lows. It already formed its first LL which indicating the Bearish Signal below its previous LL below 199.34.

Further the Bearish divergence is confirming the selling point. I am 95% sure for the bearish move towards TP 1 and TP 2.

I have still an eye on Pound Index. If the BXY closes above its resistance at 135.54 then the above Idea may heart yet we have to stick to our Risk to reward ratio.

My risk on two trades is 1% each if TP1 Hit, I will move my SL into Breakeven and let the price move to my TP or revised SL with 0 risk.

CHFJPY: Time to Sell?! 🇨🇭🇯🇵

CHFJPY may continue falling after a confirmed breakout

of a neckline of a double top pattern.

I opened short position on its retest.

Goal - 185.0 psychological level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CADJPY: Another Gap 🇨🇦🇯🇵

One more peculiar gap that I see is on CADJPY.

A confirmed bearish Change of Character CHoCH

on an hourly, confirms a local strength of the sellers.

With a high probability, the price will drop to gap

opening level.

Goal - 106.65

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GOLD (XAUUSD): Bullish Continuation ConfirmedI believe that the price of 📈GOLD is likely to rise.

The formation of a double bottom pattern on a significant hourly support level, along with a bullish breakout of its neckline, indicates substantial buying interest.

It appears that the market will revisit the 3666 level.

ABCL 4H support test and triangleAbCellera Biologics stock is trading inside a triangle pattern and testing the key support at 3.90–4.00.

Signals are showing that sellers are losing momentum: CCI prints a bullish divergence and the volume profile highlights accumulation above the current level. A breakout above the descending trendline around 4.30 could open the way towards 4.80 and even 5.60.

From a fundamental perspective the company remains an important biotech player focusing on antibody-based drug development. The sector is highly news driven and any announcement on trials or partnerships could trigger sharp moves.

As long as support holds buyers keep the advantage and the market looks like a spring that has been compressed too long and is ready to release.

GOLD– Market Outlook

🔼 Bullish Scenario:

• If the price holds above 3635, the upward momentum is expected to continue.

• Target: 3675 (main resistance level).

• If 3675 breaks, the price may rise further and enter the bullish zone.

🔽 Bearish Scenario:

• If the price stabilizes below the retracement level, a temporary correction may start.

• Target: 3595 (strong support).

• If the price breaks below 3595 and closes under it (especially on the 1h or 4h timeframe):

→ The next bearish target will be 3546.

⚠️ However, if 3595 holds and is not broken, the price will likely bounce and resume the bullish trend.

⸻

Double Bottom Breakout with Gap-Up — Target 1081) Pattern + Breakout Confirmation

The chart has formed a double bottom structure, a classic reversal setup that signals the end of a downtrend and potential start of an uptrend. After testing the support zone twice and holding firm, price opened with a strong gap-up above the neckline , confirming bullish intent.

2) Trade Plan — Path Toward 108

The measured move from the double bottom formation projects an upside target of 108 , aligning with a prior resistance zone . Traders can consider entry on the breakout or wait for a pullback to the neckline for a safer risk-reward setup. The invalidation level lies just below the neckline gap, while momentum favors continuation higher. Holding above the breakout zone keeps the bullish bias intact until the target at 108 is approached.

Double-Top Breakdown + Bearish MACD — Target 206Idea type: Short (breakdown) — setup confirmed by gap-down open + MACD bearish crossover

Target: 206

1) Setup — What I see

Price formed a classical double-top: two near-equal peaks with a clear neckline between them.

Break of the neckline happened on a gap-down open (strong bearish sentiment, high short interest/liquidity sweep).

MACD (12,26,9) shows a bearish crossover (MACD line crossing below signal) on the daily — momentum has turned to the downside and confirms the breakdown.

2) Primary Target:

206 — intended as the measured-move projection from the double-top pattern and reinforced by a nearby historical support zone.

Measured-move method: (Peak height) = Peak price − Neckline price. Project that distance downward from the neckline to get the target. (Use your chart’s exact peak & neckline prices to verify that this projection aligns with 206.)

$FARTCOIN 50% Correction IncomingSomeone opened the bathroom window and let the air out 🪟

$FARTCOIN appears to have found a local top and closed its 2nd consecutive week below the .236 Fib

If someone doesn't shut the window this week, FARTCOIN could face ~50% correction to its next support.

that stinks 💩

USDJPY Heading Up..Usdjpy weekly outllok this review is going for a long term trade as we can see in this structure the pair is moving towards a partial resistance with target at 152.30 where it is expected to meet next reversal before breakout.

Key Points;

Hold a long position with a target 151.65,a confirmed breakout above this resistance area would activate long continuation.

Like and follow

Thanks for taking a look.

Tata Steel – Multi-Year Base Breakout Setting UpThesis

Tata Steel is testing a major resistance zone around ₹169 after consolidating in a wide range (115–170) for nearly 2 years. A decisive breakout here would mark the completion of a multi-year rounding base, opening the path to higher levels.

Technical Setup

Structure: Multi-year consolidation / rounding base since mid-2023

Breakout Level: ₹169 (tested repeatedly)

Primary Target: ₹185–190 (nearest supply zone)

Extended Target: ₹210–215 (measured move of base depth)

RSI: ~63, rising but not overbought

Volume: Needs strong confirmation to validate breakout

Invalidation: Breakdown below ₹160

Fundamental Context

Recent quarters show earnings recovery from cost control and safeguard duties.

Valuations elevated (P/E ~46–51×), margins thin, leverage moderate.

Interpretation: Fundamentals are mixed, but cyclical tailwinds and government protection provide near-term support.

Disclaimer

For educational purposes only. Not investment advice.

GBPUSD: Overbought Market & Pullback 🇬🇧🇺🇸

GBPUSD is going to retrace more, following a strong

bearish reaction to an intraday/daily horizontal resistance.

Goal - 1.3487

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDUSD Expect A Long BreakoutNzdusd; this pair have been moving within this region of lower highs and lower lows,in regards to the NFP news we await a long breakout within the major resistance level with a target above 0.5994.for the moment we are likely to buy and keep a close eye within this tight region of support and resistance.

Possible outline

Bullish scenario: buy with a target near 0.5950 as first Tp and 0.5994 as second Tp

Meanwhile a confirmed reversal at this point will trigger move below 0.5785 as the next support.

What is your idea on this my fellow traders.?

follow up thanks