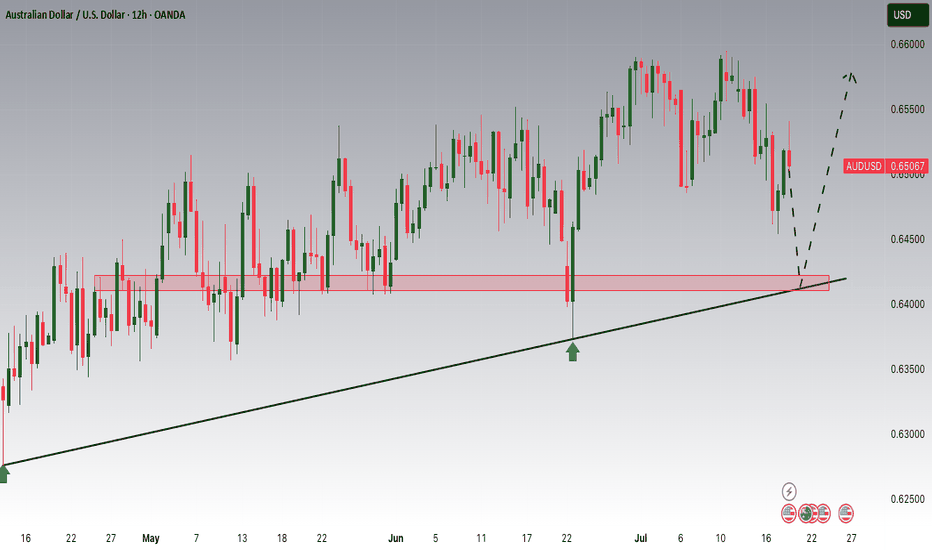

AUDUSD Potential UpsidesHey Traders, in tomorrow's trading session we are monitoring AUDUSD for a buying opportunity around 0.64200 zone, AUDUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.64200 support and resistance area.

Trade safe, Joe.

Elliott Wave

$SHIB Ready to Move?CRYPTOCAP:SHIB has printed confirmed weekly bullish divergence in RSI and is now attempting to overcome the weekly 200EMA resistance.

A High Volume Node lies just above but a close above this will signal a bullish trend ready to move the initial target of the weekly pivot point followed by the 0.0003579 High Volume Node.

Price completed its retracement to the 'alt-coin' golden pocket 0.786 Fibonacci retracement.

Bearish divergence is currently growing on the weekly RSI but will be diverted with a thrust high!

Is it MEME season? CRYPTOCAP:DOGE also looks ready to go!

Safe trading

$DOGE Flipping to Bullish Structure!CRYPTOCAP:DOGE is coming to life after a second test of the weekly 200EMA as support and about to make a higher high, cementing in that higher low and flipping the macro structure bullish!

If the count is correct wave 3 of (III) should be powerful! The weekly pivot should put up a challenge as the first resistance before the High Volume Node at $0.45

Safe Trading

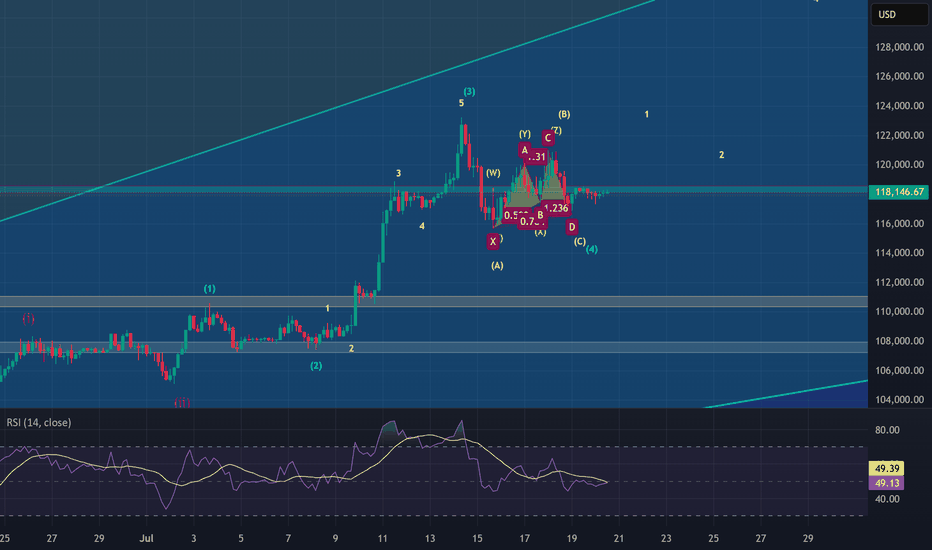

BTC Ready for the new impulse ? Elliott wave analysis 20/7/2025In my view, Bitcoin (BTC) has completed its micro correction and is now poised to move toward the $135,000–$139,000 target zone. This expectation is supported by the following factors:

1. Completion of the Sub-Waves in Wave (4)

My analysis of wave (4) indicates that it consists of an ABC correction, where wave B formed a WXYXZ pattern.

Additionally, I have counted the sub-waves within wave C of wave (4) and observed a complete 5-wave structure, suggesting that the fifth wave of wave C has ended, confirming the completion of wave (4).

2. Cypher Harmonic Pattern Pivot Point

I have identified a Cypher harmonic pattern with a pivot point around $116,600.

The termination of wave (4) occurred close to this pivot level, followed by a new impulsive move that made a higher high and formed a clear 5-wave structure—further confirming that wave (4) has likely ended.

3. Hidden Bullish Divergence on the 4-Hour Timeframe

A hidden bullish divergence can be observed on the 4-hour chart, particularly at the end of wave (a) and wave (c).

Historically, 4-hour hidden bullish divergences have often preceded strong bullish impulses. For instance, a similar setup occurred during the bullish rally from April 9, 2025, to May 22, 2025.

4. Failure to Make a New Low After Resistance Retest

The new impulse wave that emerged after the end of wave (4) has met resistance but failed to make a new low, suggesting that a fresh upward impulse is underway.

How Far Could Wave (5) Extend?

It is important to note that the wave (5) (blue) impulse is a sub-wave of wave (5) (purple).

The lengths of wave (3) (purple) and wave (5) (purple) are currently similar, which is unlikely because both are part of the major wave V (green), where typically only one wave should extend.

Since wave (3) has already completed, wave (5) is likely to be the extended wave, with a target length between 1.272 and 1.618 times the length of wave (3).

Interestingly, two Gann fan projections point to resistance levels in the $135,000–$139,000 range, which perfectly aligns with this 1.272–1.618 extension zone.

Invalidation Point

The invalidation level is around $117,000, as the micro correction within the new impulse should not drop this low.

If BTC falls below $117,000, it could imply that wave (4) has not yet completed and may be taking another corrective form.

For example, the wave (c) we currently see might only be wave 1 of a larger wave (c), or the correction in wave (b) may still be ongoing.

However, this scenario seems unlikely given the weight of evidence suggesting that wave (4) has already ended.

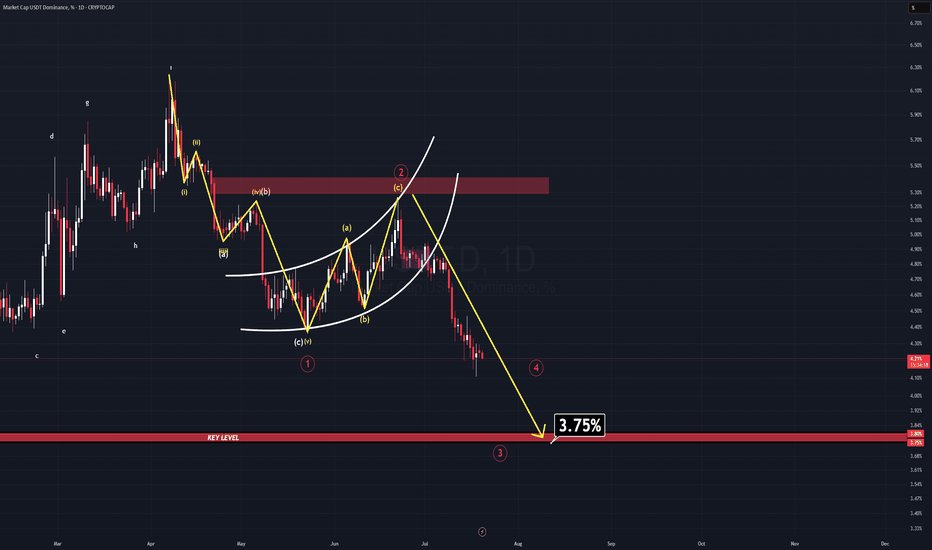

USDT DOMINANCE NEW UPDATE (1D)In a previous analysis, I mentioned that the long-term outlook for this parameter (USDT.D) remains extremely bearish. At the time, a bear flag was clearly visible—but it hadn’t been broken yet.

Well, now it has.

The breakdown confirms the bearish continuation, and there’s still more room to fall. As USDT.D continues to descend towards the projected target for Wave 3, we are likely to see a new All-Time High in Bitcoin, accompanied by a strong rally in many altcoins.

The main target for Wave 3 sits at 3.75%—a historically critical level. For years, USDT.D has never fallen below this zone, making it an extremely strong support area.

⚠️ Reminder: Consider taking profits when USDT.D approaches the 3.80–3.75% region. A reversal or temporary bounce is highly likely there.

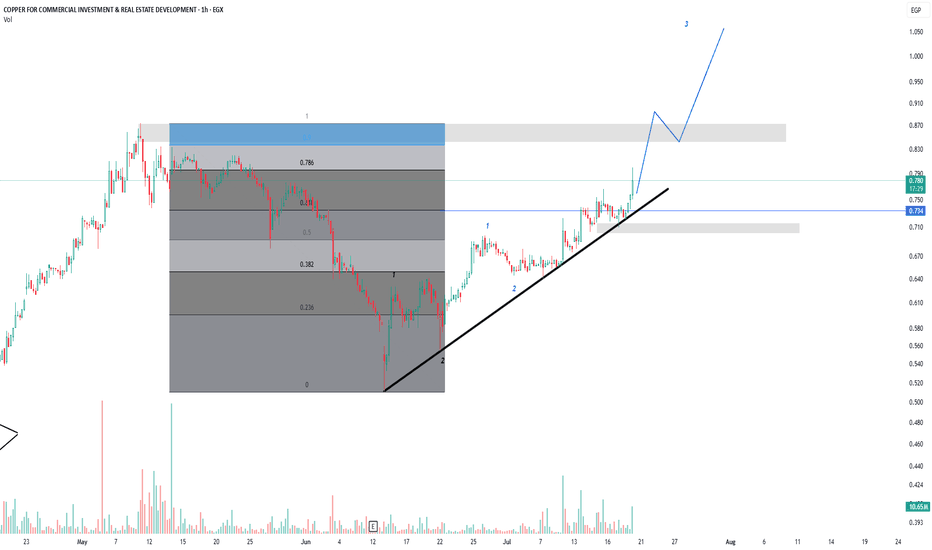

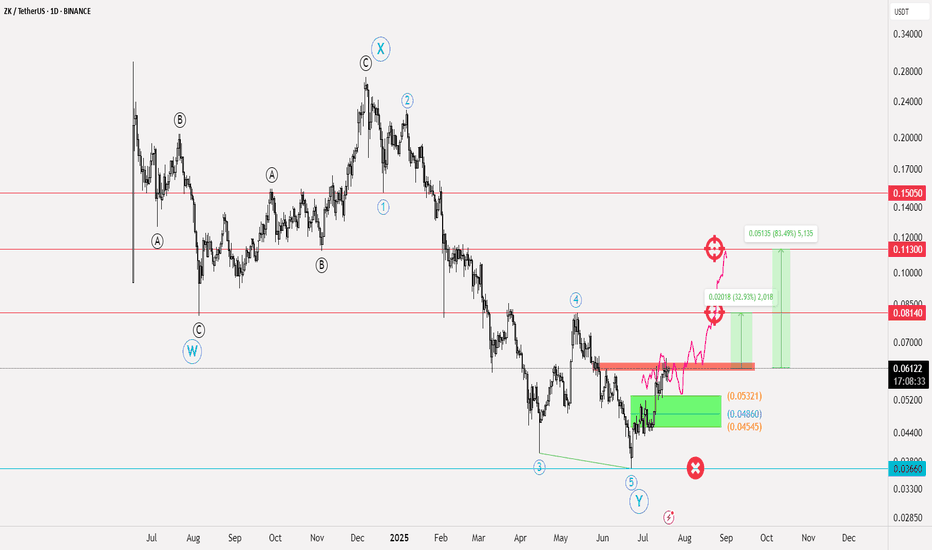

ZKUSDT Elliott Waves analysis📝 Currency NYSE:ZK

✅ Entry points for the currency: at the current price of 0.06135, the reinforcement should be within the range of 0.05321 - 0.04860

🔴 Stop loss is below 0.03660

💹 Potential targets: first target 0.08140 and if the currency enters a bullish wave, the target will be towards 0.1130, reaching up to 0.150

📊 The profit-to-loss ratio is 5:1

📝 This idea is based on Elliott Waves analysis, especially since the beginning of the currency's listing, where a WXY pattern formed, and this pattern was confirmed after the upward rebound from 0.03660, which we considered as our stop loss. The liquidity range is the range we defined for reinforcement; its stability will give momentum and strength to the currency to complete an upward path, at least achieving a trend towards the peak of wave 4

❤️ Good luck to everyone - do not enter any currency before studying the risk ratio you will undertake

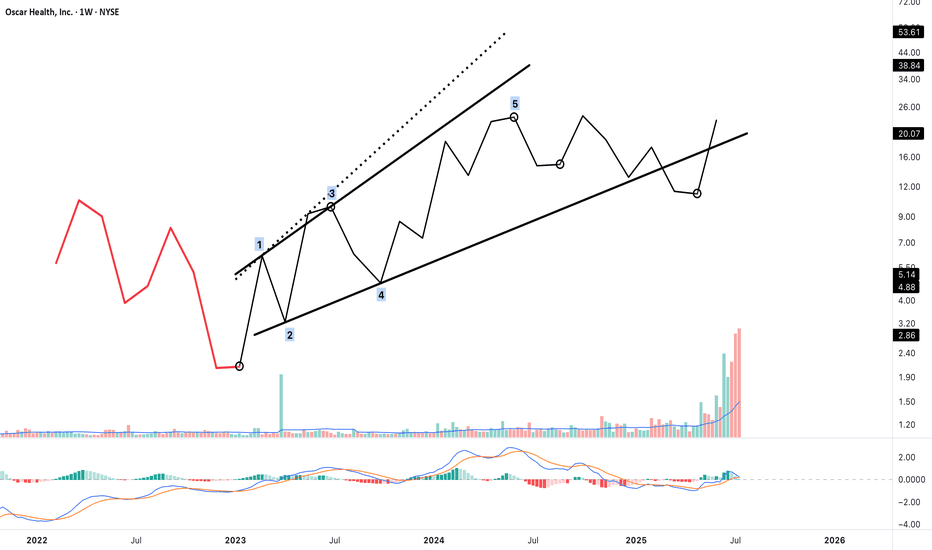

Possible Terminal Impulse as Wave 1 or A — Structure Completion?This chart presents a potential 5-wave terminal impulse structure — most likely a 5-extension terminal, where waves 1, 3, and 5 display impulsive character.

This move may represent the beginning of a new sequence — either as:

"Wave 1 of a larger motive structure"

"or Wave A of a corrective formation"

🔹 The wave is segmented using 12-bar intervals on a weekly chart.

🔹 Wave 3 and Wave 5 both meet the price extension and structural criteria of Neely’s Rule 4.

🔹 The final wave (5) reaches just above 141.4% of Wave 3, consistent with a 5-extension terminal.

🔹 Channel boundaries and post-terminal retracement suggest a completed structure.

According to NeoWave guidelines, the structure meets both:

Impulsive appearance, and

Overlap conditions required for a terminal.

The current focus shifts to analysing the post-terminal movement to determine whether it is part of a:

"2nd wave correction (if terminal was Wave 1)"

"or B wave retracement (if terminal was Wave A)"

🔍 Further bar-by-bar and structural analysis will be applied to this segment next, likely starting from m10 and beyond.

SUI: Calm Before the Wave 3 Surge?CRYPTOCAP:SUI is shaping up to be one of those charts that makes you lean in a little closer.

Right now, it appears to be sitting inside a potential wave 3, but something feels off. It hasn’t exploded yet. And when you’re looking for wave 3 behavior, that’s what you want: speed, commitment, follow-through. A clean surge, ideally in a straight line, that clears doubts and leaves the doubters behind.

We’re not seeing that yet. Right now the move is decipherable at many nested degrees making this move feel cautious.

And that opens the door to some possibilities:

It is a wave 3, just one that hasn’t lit the match yet.

We’re still nesting, multiple wave 1s and 2s stacking before the actual move hits.

Or it's a wave C of a Zig Zag.

As for levels, $4.20 stands out. Whether this turns into a rocket or a reset likely hinges on how price reacts there.

Stay nimble. If this is a true wave 3, it’ll leave no time for hesitation.

Be early, but not reckless.

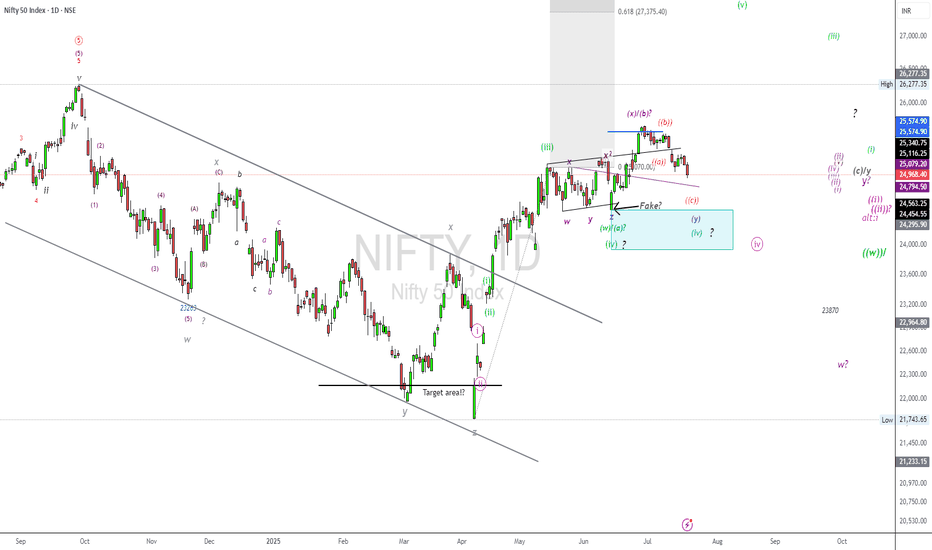

NIFTY50.....Where are the targets?Hello Traders,

The NFTY50 failed to make new high's, but has achieved my long-term target @25577 points.

It also broke below the trend-line, connecting the high's of 25116 to 25222. This is a bearish sign!

I have labelled the chart as a w-x-y pattern, that could also morph into an a-b-c!

But what to expect for the coming sessions?

Chart analysis.

The weakness at chart is not done to my view!

In normal, a corrective move, here a possible wave ((iv)), pink, will return to a wave 4 of lower degree. So we should expect a target range at or around the 24000 points! If so to come, this would be potentially buy_area! A break to the upside is not in (my) the cards. Too much overlapping waves, buy and immediately sell-orders..... This is not how an impulse look like!

Of course; a wave iv correction can morph into a w-x-y pattern. And if so, the price would extend to an 2.618 Fibo after it was complete!

Again. The correction look like not complete, and it will be interesting how markets will answer on Monday.

So, that's it for today!

Have a great weekend.....

Ruebennnase

Please ask or comment as appropriate.

Trade on this analysis at your own risk.

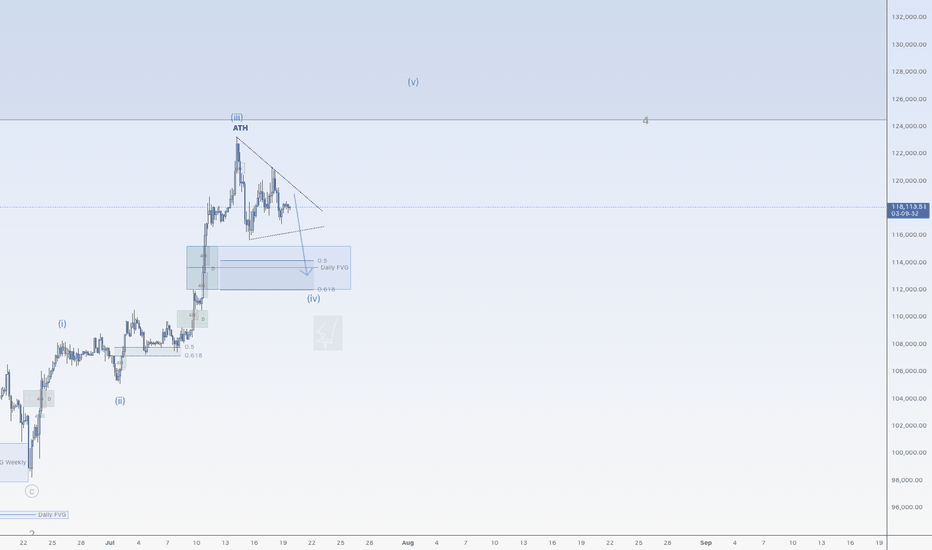

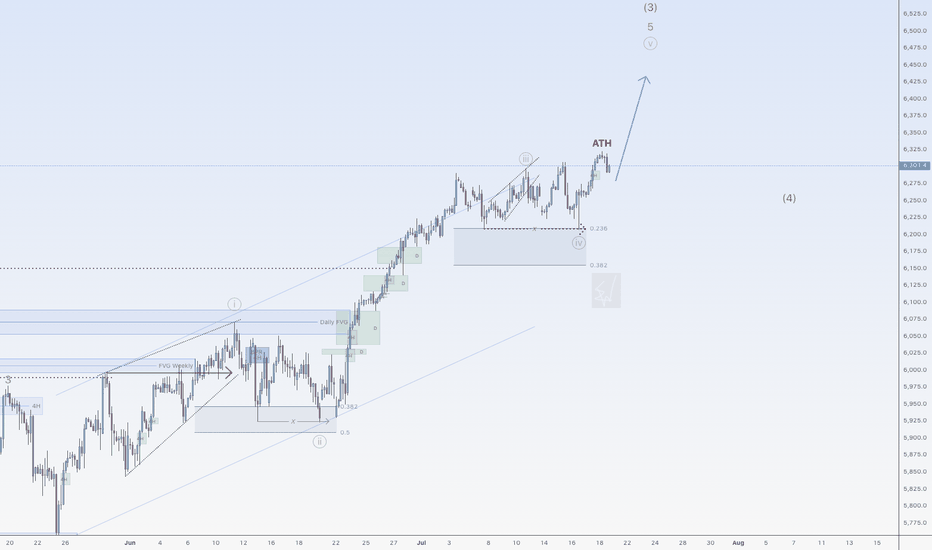

Correction down for BitcoinHi traders,

Last week Bitcoin made a small correction down and up again to finish wave 3 (blue).

After that it started a bigger correction down for wave 4 (blue). This could be a Triangle (no break of previous low) or Zigzag (break of previous low into the bullish Daily FVG).

After the finish of the correction down we could see more upside again.

Let's see what the market does and react.

Trade idea: Wait for the correction down to finish.

Then after an impulse wave up, a small correction down on a lower timeframe and a change in orderflow to bullish you could trade longs.

If you want to learn more about trading FVG's with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my analysis.

Don't be emotional, just trade your plan!

Eduwave

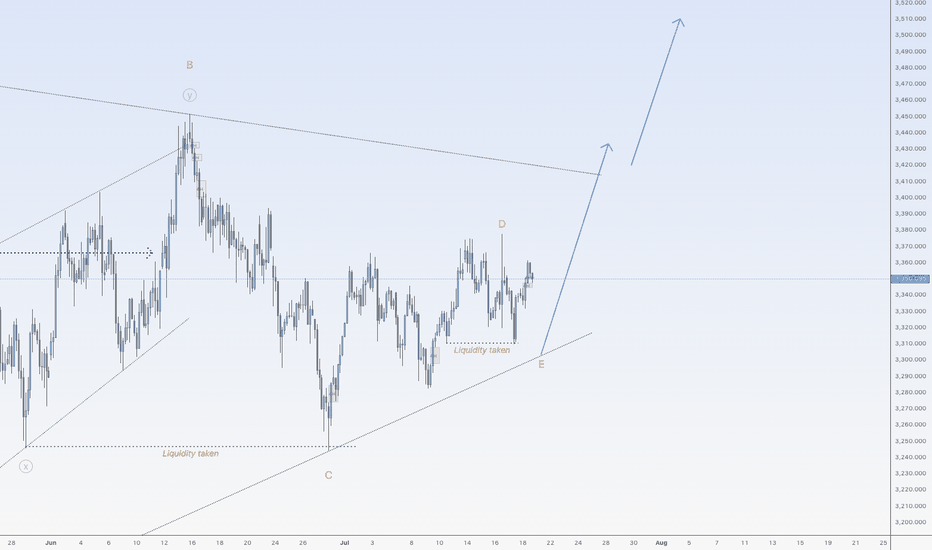

Gold is ready to go upHi traders,

Last week gold made another correction down for Wave E but after that it broke the low again. This could be wave 2 of the next impulsive wave up and gold will continue to rise next week.

Or price makes one more move down for wave E and then start the next impulsive wave up.

Let's see what price does and react.

Trade idea: Wait for a small correction down on a lower timeframe and a change in orderflow to bullish to trade longs.

If you want to learn more about trading FVG's & liquidity sweeps with wave analysis, please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

More upside for SPX500USDHi traders,

Last week SPX500USD made a small correction down (grey wave 4) and after it swept the dotted trendline it went up again. This could be the next impulse wave 5 (grey).

If this is true, then next week we could see more upside for this pair.

Let's see what the market does and react.

Trade idea: Wait for a small pullback and a change in orderflow to bullish on a lower timeframe to trade longs.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

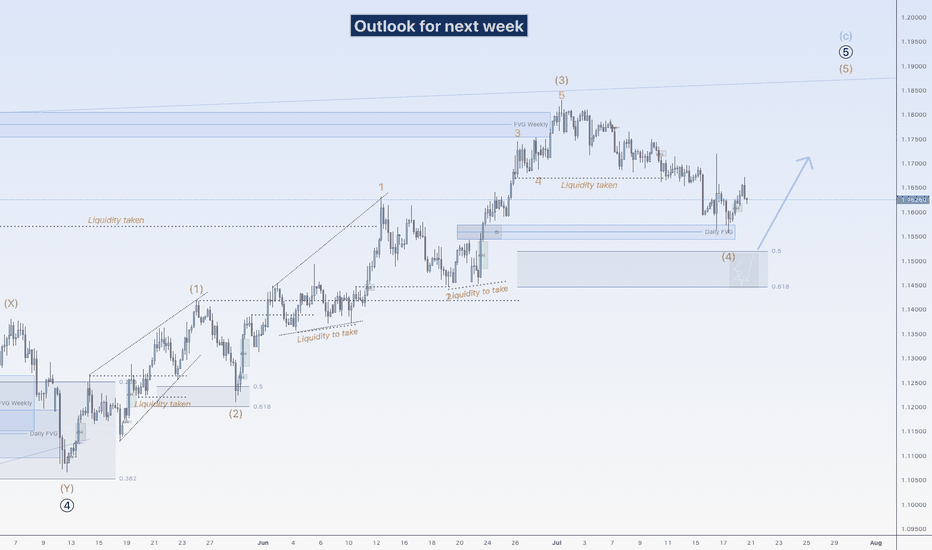

EU could go up againHi traders,

Last week EU continued the slowly down movement to the next bullish Daily FVG. Price rejected from there and swept the low of the rejection. After that it slowly went up again.

Next week we could see price go higher for the start of the next (impulsive or corrective) wave up.

Let's see what the market does and react.

Trade idea: Wait for the finish of a correction down and a change in orderflow to bullish on a lower time frame to trade longs.

If you want to learn more about trading with FVG's, liquidity sweeps and Wave analysis, then make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

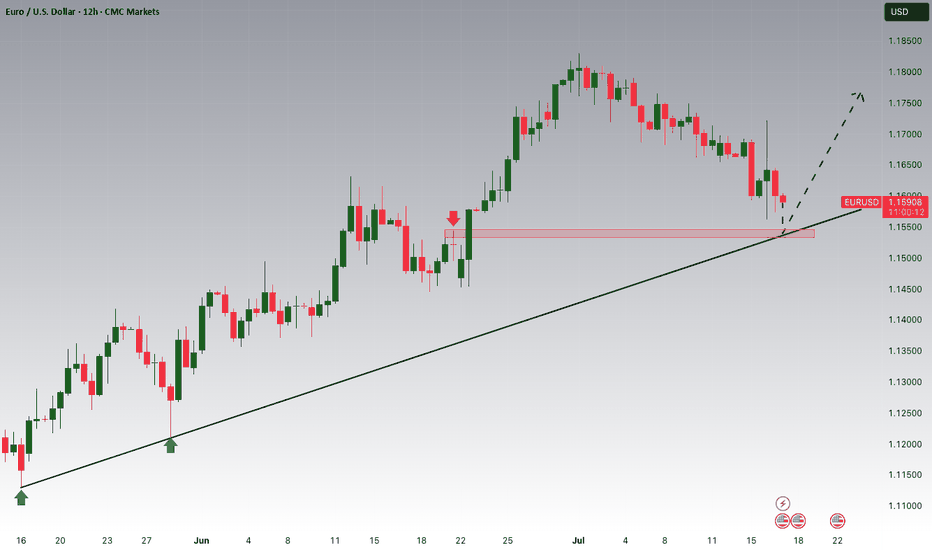

EURUSD is Nearing an Important Support!!Hey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.15400 zone, EURUSD is trading in an uptrend and currently is in a correction phase is in a correction phase in which it is approaching the trend at 1.15400 support and resistance area.

Trade safe, Joe.

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

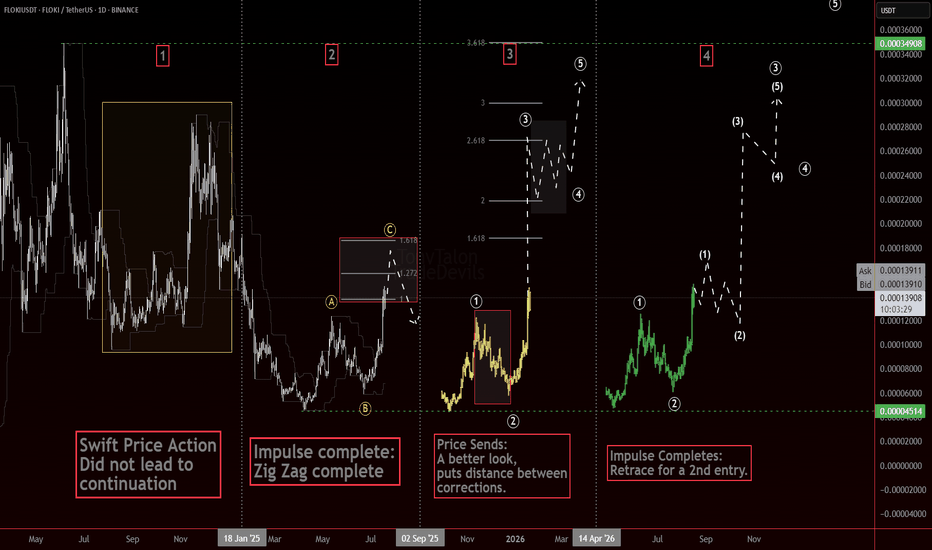

APA!? Always Plan Ahead! Are you ready!?Which number will play? 🤔

Swift price action makes the chart light up. It grabs your attention, makes it feel like something big is happening. And often it is. But sometimes, those sharp moves stall out just as quickly as they started.

That’s why we Always Plan Ahead.

Some alts gave us a clean #ElliottWave anchor. Structurally, it looks like a potential wave 3. Strong momentum, hitting projection zones, and solid separation from prior corrections at the smaller degree. Exactly what you want to see.

But fast doesn’t always mean forward.

Without a proper follow-through or a complete structure, one wave doesn’t tell the whole story. That’s why it’s key to wait for the next pieces to print. A wave 3 might be in play, but we still need confirmation—whether it unfolds into a 5-wave impulse, stalls into a correction, or pivots entirely.

The chart shows a few possibilities.

1 A swift move that didn’t lead to continuation.

2 A Zig Zag that completing.

3 A better-looking impulse with space between the corrective moves.

4 An impulse that completes but sets us up for a 2nd entry

The question now:

Which number will play? … or something else entirely?

That’s where planning comes in. You don’t need to know the outcome to be ready for it.

Stay sharp. Stay patient. And most of all—

Always Plan Ahead.

Gold elliot wave countMarket Structure – Corrective Wave 2 Still in Progress

We're currently in a Wave 2 correction, unfolding as a classic ABC structure – labeled with Circle A → Circle B → Circle C.

✅ Circle A and Circle B are already complete.

We're now in the move from Circle B → Circle C, which itself is unfolding as a:

→ (A) → (B) → (C) (in parentheses)

Currently, we are in the move from (B) to (C), which again is breaking down as a smaller A → B → C move.

🔍 Key Levels to Watch:

📈 We might now be completing Wave A of (C) around the 3362 level.

🔁 A pullback to around 3322 could follow as Wave B,

➡️ leading to a final Wave C (of (C), of Circle C, completing Wave 2) targeting around 3405.

⏳ What’s Next?

Once we hit the 3405 zone, that would potentially complete the entire Wave 2 correction.

From there, I expect a trend reversal to the downside, beginning the next impulsive wave down.

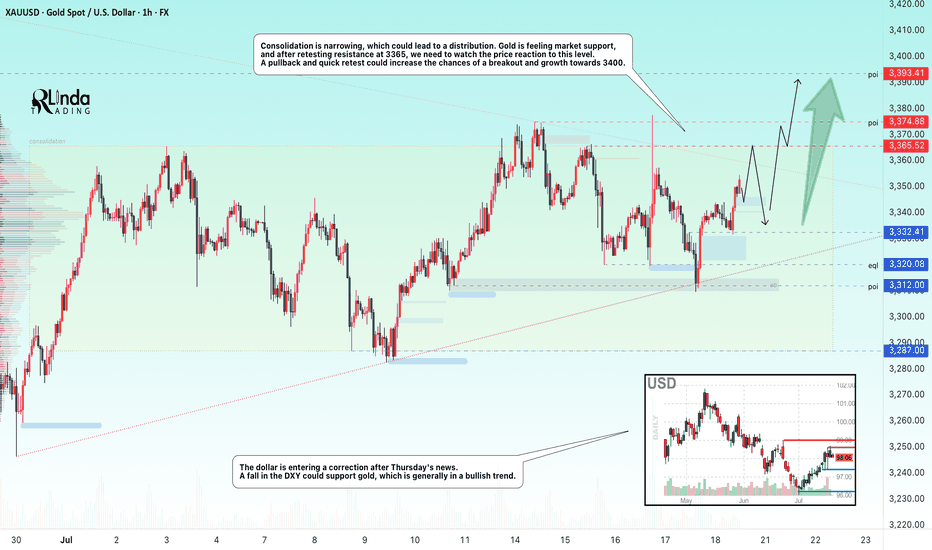

GOLD → Retest of consolidation resistance. Chances of a breakoutFX:XAUUSD bounces off support at 3312, forming a false breakdown at 3320. The price is heading towards consolidation resistance. The chances of continued growth are increasing...

Gold rebounded from its low amid statements by Fed member Waller about a possible rate cut in July. However, strong US sales and labor market data strengthened the dollar and held back XAU/USD growth. Despite statements by some Fed members about maintaining a tight policy, traders continue to expect rate cuts before the end of the year. The focus is on new economic data that could affect the dollar and gold prices.

Technically, consolidation is narrowing, which could lead to distribution. Gold is feeling market support, and after retesting resistance at 3365, we need to watch the price reaction to the level. A pullback and quick retest could increase the chances of a breakout and growth to 3400.

Resistance levels: 3365, 3375

Support levels: 3332, 3320, 3312

There is a high probability that there will be an attempt to break through the consolidation resistance amid expectations of a rate cut. This phase may be accompanied by either a correction to retest and return for a breakout, or a breakout and consolidation of the price above the level. Today, Friday, I expect a retest and correction, as there may not be enough local potential for a breakout of this level, and the price has already lost some of its momentum since the opening of the session...

Best regards, Linda!

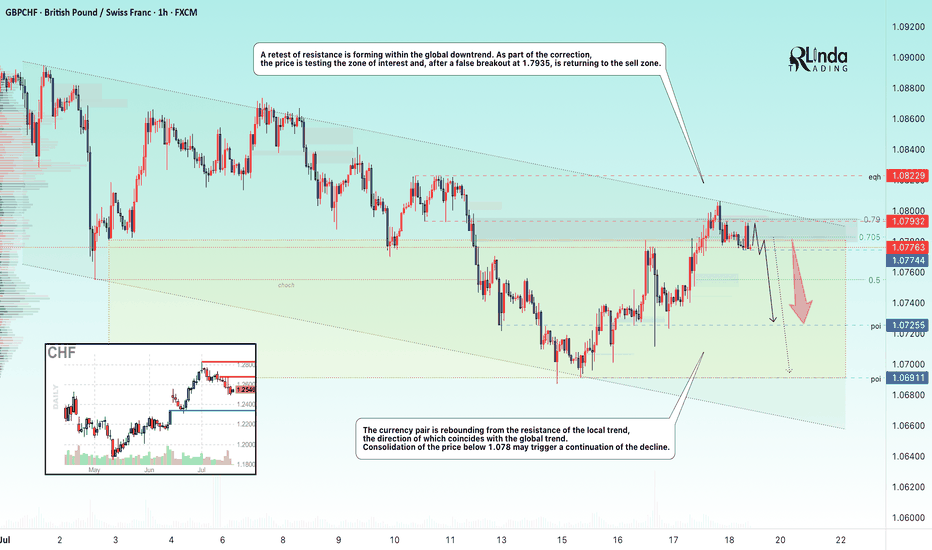

GBPCHF → Retest of resistance to the global downtrendFX:GBPCHF is facing resistance from the local trend, which is aligned with the global bearish trend. The trend may continue...

A retest of resistance is forming within the global downtrend. As part of the correction, the price is testing the zone of interest and, after a false breakout of 1.7935, is returning to the selling zone.

The currency pair is rebounding from the resistance of the local trend, which coincides with the global trend. Consolidation of the price below 1.078 may trigger a continuation of the decline

Resistance levels: 1.07932, 1.0823

Support levels: 1.07744, 1.07255

Price consolidation in the selling zone followed by a break of the local structure could strengthen the bearish sentiment, which could trigger a further decline overall.

Best regards, R. Linda!

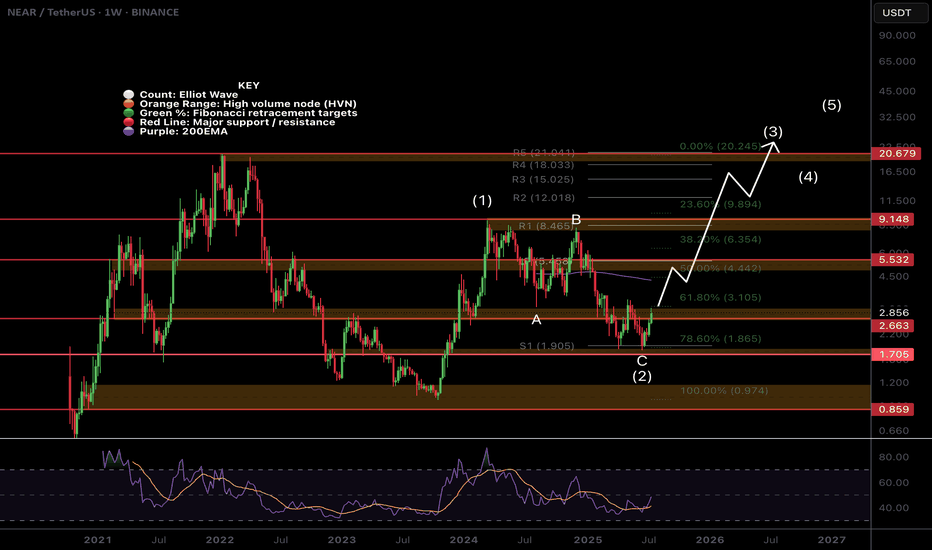

$NEAR Weekly TextBook Elliot Wave!CBOE:NEAR Weekly chart is a great demonstration of the text book motif wave followed by ABC corrective wave.

Bullish divergence has printed on the weekly RSI at the S1 weekly pivot support and the 'alt-coin golden pocket' 0.786 Fibonacci retracement. Price is closing in the major resistance High Volume Node.

The upside target is the newly printed weekly 200EMA followed by the weekly pivot and major resistance HVN just above $5.

A terminal target for this cycle may only see NEAR hitting all time highs around $21, the R5 weekly pivot point.

Safe trading

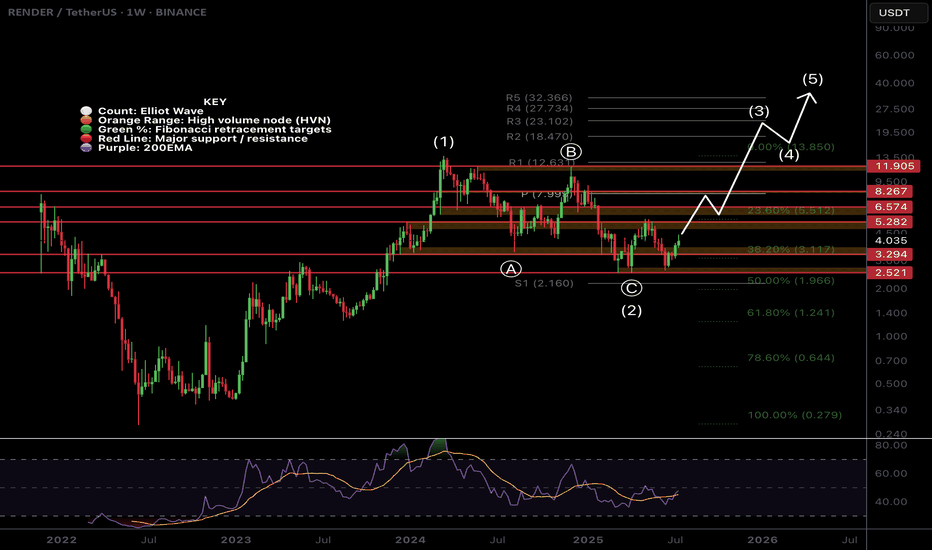

$RENDER Weekly Brings Clarity!CRYPTOCAP:RENDER weekly chart shows long term strength through the depth of the Fibonacci retracement not even reaching 0.5.

The depth of the recent swing low been so close wave (C) does concern me that the larger correction is not yet over and maybe price does want to visit the 'alt-coin' golden pocket of the 0.618-0.768 Fib retracement Where the would be a High Volume Node (not drawn).

For now the upside target is the weekly pivot but the local chart has a lot of work to do first with daily 200EMA!

Safe trading