Eurjpysell

EURJPY – Yen Strength Builds as Euro Momentum FadesEURJPY is showing signs of exhaustion after a strong October rally, with lower highs forming as yen demand rebuilds on growing expectations that the Bank of Japan could slowly move toward policy normalization. The euro, while still supported by relatively higher yields, is beginning to lose its edge as growth in the Eurozone cools and traders rotate into safer assets. The pair now looks poised for a measured pullback toward key support zones around 175.90 and 175.10.

Current Bias

Bearish in the short term, with the potential for a deeper correction if the yen continues to attract safe-haven demand and BOJ expectations remain firm.

Key Fundamental Drivers

BOJ Policy Shift: Governor Ueda’s subtle hawkish tone has kept market participants cautious, as inflation remains near target and policymakers hint at a gradual reduction of yield curve control.

Eurozone Data: Growth remains stagnant and inflation continues to moderate, reducing the likelihood of any further ECB tightening.

Global Risk Sentiment: Heightened geopolitical and trade tensions (tariff headlines, global policy uncertainty) are reviving JPY demand as a defensive asset.

Macro Context

The macro picture increasingly favors JPY stability. Japanese bond yields have risen modestly as the BOJ signals more flexibility, narrowing the interest rate gap that previously supported EURJPY. Meanwhile, Eurozone industrial output is slowing, and Germany’s manufacturing data continues to drag regional growth expectations lower.

Commodity flows are neutral, though risk-sensitive currencies like the AUD and NZD remain under pressure, indirectly benefiting the yen. Europe’s reliance on external energy imports and weaker export activity keep the euro capped.

Interest rate expectations:

BOJ: Market pricing leans toward an early 2026 policy adjustment or an incremental tightening if inflation holds above 2%.

ECB: Rates are expected to remain unchanged well into 2026, but forward guidance has turned notably neutral.

Primary Risk to the Trend

A reversal could occur if BOJ policymakers emphasize patience or dismiss near-term tightening expectations, weakening the yen. On the flip side, any stronger-than-expected Japanese inflation data could accelerate JPY gains and deepen the EURJPY correction.

Most Critical Upcoming News/Event

BOJ policy meeting minutes and Governor Ueda’s upcoming comments

Eurozone GDP and inflation revisions

Global equity and bond yield direction (key risk sentiment drivers)

Leader/Lagger Dynamics

EURJPY typically acts as a leader among yen crosses due to its liquidity and yield sensitivity. It often influences moves in GBPJPY and CADJPY, while loosely following the broader EURUSD trend during high-volatility sessions.

Key Levels

Support Levels: 175.90 / 175.10

Resistance Levels: 177.50 / 178.80

Stop Loss (SL): 178.90

Take Profit (TP): 175.90 (initial), 175.10 (extended)

Summary: Bias and Watchpoints

EURJPY’s structure suggests a bearish bias, with potential for a measured move lower as market sentiment tilts toward the yen. The focus remains on 175.90 as the first key target, followed by 175.10 if downside momentum accelerates. The stop-loss at 178.90 allows for short-term volatility while protecting against false reversals.

Fundamentally, BOJ policy dynamics and Eurozone growth stagnation remain the dominant forces. Unless the BOJ backtracks sharply or Eurozone data surprises to the upside, the path of least resistance points lower. Traders should monitor upcoming BOJ commentary and Eurozone inflation figures as key catalysts for confirming continuation or reversal signals.

EURJPY - Looking To Sell Pullbacks In The Short TermH4 - Strong bearish move.

Bearish convergence.

No opposite signs.

Expecting bearish continuation after pullback until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

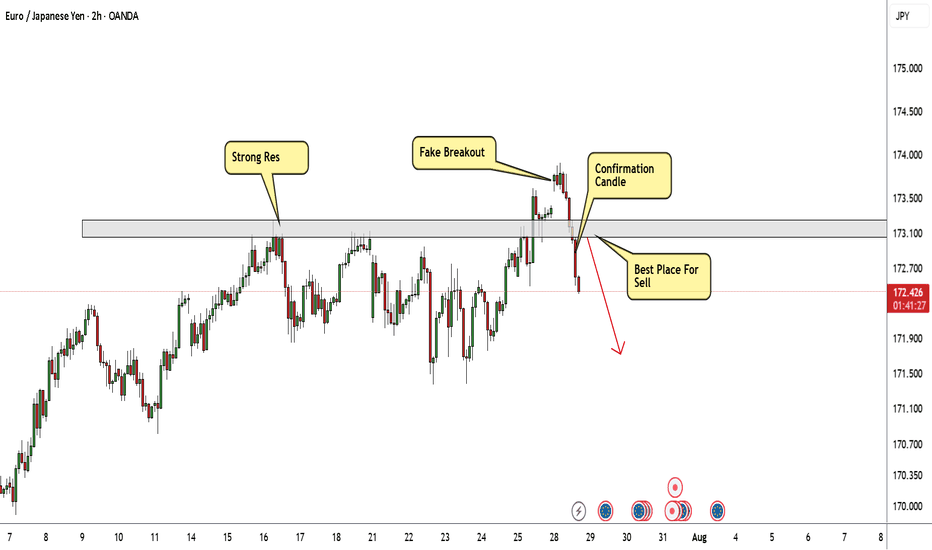

EUR/JPY Gave Fake Breakout , Short Setup Valid To Get 200 Pips !Here is my 2H Chart on EUR/JPY , We Have A Fake Breakout and then the price Back below my old res and we have a very good bearish Price Action on 2 And 4 Hours T.F Also the price playing very good around my res and i`m waiting the price to retest the broken area and giving me a good bearish price action on smaller time frames to can get a confirmation to enter , So i see it`s a good chance to sell this pair if it go up a little to retest the broken area and then we can sell it and targeting 100 to 200 pips . and if we have a daily closure again above my new res then this idea will not be valid anymore .

Reasons To Enter :

1- Perfect Breakout .

2- Clear Bearish Price Action .

3- Bigger T.F Giving Good Bearish P.A .

4 - Perfect 15 Mins Closure .

5- The Price Respect The Res Again .

EURJPY - Looking To Sell Pullbacks In The Short TermH1 - Strong bearish move.

Bearish convergence.

No opposite signs.

Expecting bearish continuation after pullback until the strong resistance zone holds.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

EURJPY: Pullback or Pause? Eye 178.40 as Yen Stays DefensiveEURJPY has pulled back after hitting fresh highs near 178, but the underlying momentum still favors the euro. With the Bank of Japan maintaining its ultra-loose stance while the ECB holds rates high, the policy divergence continues to support upside pressure. As long as buyers defend the 175–176 zone, the pair looks set to resume its push toward the 178.40 region.

Current Bias

Bullish – Recent dip is corrective, not a full reversal, while fundamentals favor further euro strength over yen.

Key Fundamental Drivers

ECB Policy: Rates remain elevated, with officials stressing caution on premature cuts. This supports the euro.

BOJ Policy: Despite rising Japanese yields, the BOJ is still dovish compared to peers, leaving JPY weaker.

Risk Sentiment: Political risk in Europe tempers gains slightly, but yen safe-haven demand has been muted.

Macro Context

Interest Rate Expectations: ECB is expected to keep rates restrictive longer than the BOJ, reinforcing policy divergence.

Economic Growth Trends: Eurozone growth is sluggish but inflation concerns keep policy tight; Japan is facing rising wage expectations but not enough to force the BOJ into tightening aggressively.

Commodity & Trade Flows: Stronger European trade resilience supports EUR, while JPY continues to weaken with capital outflows tied to low yields.

Geopolitical Themes: Political risks in Europe (French fiscal strains, EU cohesion) are factors, but global macro risk still weighs more on JPY than EUR.

Primary Risk to the Trend

If BOJ signals a surprise tightening or wage growth accelerates more than expected, the yen could stage a sharp rebound.

Most Critical Upcoming News/Event

ECB speeches and Eurozone PMIs – signals on inflation and growth will guide EUR.

BOJ rhetoric – any policy shift hint could shock the market.

Leader/Lagger Dynamics

EURJPY acts as a leader in cross-yen moves, often setting the tone for GBPJPY and AUDJPY. It reflects global risk appetite and monetary divergence, making it a benchmark pair for yen crosses.

Key Levels

Support Levels:

175.10

173.70

Resistance Levels:

176.45

178.40

Stop Loss (SL): 173.70

Take Profit (TP): 178.40

Summary: Bias and Watchpoints

EURJPY remains bullish, with the current pullback offering a potential entry zone if support near 175.10 holds. Policy divergence between the ECB and BOJ continues to drive upside bias. A stop loss sits at 173.70 to protect against deeper reversals, while take profit is targeted at 178.40. Watch ECB communications and BOJ rhetoric closely, as either could provide the catalyst for the next leg of movement.

EUR/JPY Trade signal show downtrendBearish Scenario:

Failure to break above 50 SMA → price may retest 200 SMA at ~172.300.

A break below 172.300 opens the path to 171.500–171.000.

Summary

EUR/JPY is in short-term bearish correction after a recent uptrend.

Immediate support: 172.300, resistance: 173.500.

RSI rebound suggests a minor recovery, but major trend remains cautious until price clears 50–100 SMA.

Trading Signal Suggestion:

Conservative Buy: Near 172.300–172.500 with tight stop-loss below 172.200, target 173.500.

Aggressive Sell: Below 172.300 for continuation of bearish correction toward 171.500.

EURJPY - Short Term Sell IdeaM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

-------------------------------------------------------------------------------------------------------------------

EURJPY Bulls Eye 175 as Yen Weakness PersistsEURJPY continues to grind higher, fueled by persistent yen weakness and relative euro strength. The pair has broken through consolidation zones and is now pressing against higher resistance. With the Bank of Japan sticking to ultra-loose policy while the ECB maintains a comparatively tighter stance, buyers remain in control. The question now is whether the rally has enough momentum to test the next key levels around 175.

Current Bias

Bullish – momentum favors buyers as yen remains fundamentally weak.

Key Fundamental Drivers

Bank of Japan: Still hesitant to tighten policy meaningfully, keeping JPY on the back foot.

European Central Bank: Policy remains less dovish than the BoJ, offering EUR support.

Yield Differentials: Eurozone yields remain far more attractive compared to near-zero JGB yields, attracting capital flows into EUR over JPY.

Macro Context

Interest Rates: ECB rate expectations are anchored at restrictive levels, while BoJ remains ultra-dovish.

Growth Trends: Eurozone faces slower growth but still steadier than Japan, where corporate profits and consumer spending remain weak.

Commodity & Trade Flows: Japan’s reliance on energy imports weighs on JPY when oil prices are elevated.

Geopolitics: Rising global risk has not given JPY its usual safe-haven lift, showing structural weakness in its haven appeal.

Primary Risk to the Trend

A sudden BoJ policy shift, verbal intervention from Japanese officials, or a sharp global risk-off shock could send JPY sharply higher and cap EURJPY’s rally.

Most Critical Upcoming News/Event

BoJ commentary or intervention headlines

ECB policy updates and speeches

Eurozone inflation data

Leader/Lagger Dynamics

EURJPY is often a leader among yen pairs, as it reflects both European policy dynamics and yen weakness. Its moves frequently set the tone for other JPY crosses like GBPJPY and AUDJPY.

Key Levels

Support Levels: 173.50, 172.55

Resistance Levels: 174.50, 175.35

Stop Loss (SL): 172.55 (below key structural support)

Take Profit (TP): 174.50 (first target), 175.35 (extended target)

Summary: Bias and Watchpoints

EURJPY maintains a bullish bias, underpinned by yield spreads and ECB-BoJ policy divergence. Buyers are eyeing 174.50 and 175.35, with a stop loss below 172.55 to guard against reversals. The pair is a leader among yen crosses, meaning any sharp shifts in its direction could spill over into GBPJPY and AUDJPY. Traders should watch for BoJ intervention risks and eurozone inflation data as the most likely catalysts for near-term volatility.

EUR /JPY Near Strongest Res Area , Short Valid To Get 200 Pips !Here is my opinion on 4H EUR/JPY Chart , the price touch a very strong res area that forced the price to respect it and go down for more than 400 pips for 2 times , and Last Week the price touch it and moved 150 pips to downside so now i`m waiting the price to go back to retest the same area again and give me a good bearish price action to can enter a sell trade and we can targeting from 100 : 200 pips . if we have a daily closure above my res area this idea will not be valid anymore .

Entry Reasons :

1- Very Strong Daily Res Area .

2- Perfect Bearish Price Action .

3- Bigger Time Frames Confirmed .

EURJPY Bulls Struggle Near 174, Bears Eye Room to Push LowerEURJPY has been testing the upper resistance near 174.00, but repeated failures to hold above suggest exhaustion. With the euro under pressure from softening European growth data and the yen showing signs of life as BOJ policies evolve, this area looks like a pivot zone. The chart structure points toward potential downside back into the 172.40 and 171.30 supports if sellers step in.

Current Bias

Bearish – Price rejected near 174.00 and is showing signs of topping.

Key Fundamental Drivers

Eurozone: Weakening growth signals (stagnation in Germany and Italy CPI moderation) weigh on the euro.

Japan: Higher JGB yields and BOJ’s quiet policy shift toward tighter conditions give JPY some support.

Global risk sentiment: If equity markets retreat, yen demand could rise as a safe haven.

Macro Context

Interest rate expectations: ECB is unlikely to hike further, with markets leaning toward cuts in 2025; BOJ may gradually tighten through yield control tweaks.

Economic growth: Eurozone is flatlining, while Japan shows modest resilience through services PMI strength.

Geopolitical themes: Energy-driven inflation in Europe and tariff uncertainties continue to cloud EUR outlook.

Primary Risk to the Trend

A sudden rebound in euro sentiment (better PMI data or ECB hawkish signals) could invalidate bearish bias.

Most Critical Upcoming News/Event

Eurozone PMI & inflation updates – key for EUR direction.

BOJ communications and JGB auctions – important for JPY momentum.

Leader/Lagger Dynamics

EURJPY tends to be a lagger, reflecting flows from broader EURUSD and USDJPY moves. However, shifts in Japanese yields can make it temporarily a leader in JPY crosses.

Key Levels

Support Levels: 172.40, 171.30

Resistance Levels: 173.90, 174.30

Stop Loss (SL): 174.30 (above resistance and recent highs)

Take Profit (TP): 171.30 (major support level)

Summary: Bias and Watchpoints

EURJPY bias is bearish with SL at 174.30 and TP at 171.30. The euro is weighed down by stagnant growth and subdued inflation, while the yen is supported by creeping BOJ policy adjustments and higher yields. The main risk is an upside surprise from eurozone data or ECB rhetoric. If sellers hold below 174.00, downside momentum could accelerate toward 171.30.

EURJPY Double-Top Rejection Signals Potential DownsideEURJPY has stalled after testing the 173.80–174.00 resistance zone, with sellers stepping in to defend this multi-week high. The rejection aligns with fading Euro momentum and renewed strength in the yen as safe-haven demand returns. With price action showing a clean rejection candle at resistance, the pair looks vulnerable to a deeper pullback toward key support levels.

Current Bias

Bearish downside favored after rejection at resistance with momentum shifting toward sellers.

Key Fundamental Drivers

Eurozone: Inflation is cooling, and growth remains sluggish, keeping ECB policy dovish in tone.

Japan: Wages and household spending recently turned positive y/y, with BOJ maintaining a cautious stance but under pressure from rising JGB yields.

Risk Sentiment: Ongoing geopolitical tensions (Middle East and Russia sanctions) support yen as a safe-haven.

Macro Context

Interest Rates: ECB leaning dovish with little scope to tighten further; BOJ cautious but rising yields keep pressure for policy adjustment.

Growth Trends: Eurozone faces weak industrial output; Japan showing modest resilience in services.

Commodity Flows: Lower oil prices benefit Japan’s import bill, slightly yen-positive.

Geopolitical Themes: Uncertainty in Israel-Gaza conflict, U.S. tariff battles, and OPEC+ supply risks continue to drive safe-haven demand for JPY.

Primary Risk to the Trend

A sudden ECB hawkish shift or stronger-than-expected Eurozone CPI could flip the bias bullish.

Rapid improvement in global risk appetite would weaken yen demand.

Most Critical Upcoming News/Event

ECB commentary on inflation expectations and growth outlook.

Japan’s wage and CPI data alongside BOJ policy signals.

Leader/Lagger Dynamics

EUR/JPY often acts as a lagger, following EUR/USD direction and broader risk sentiment. Yen moves are highly correlated with USD/JPY and gold, meaning strong flows into havens could amplify downside.

Key Levels

Support Levels: 172.65, 171.36

Resistance Levels: 173.87, 174.38

Stop Loss (SL): 174.38

Take Profit (TP): 172.65 (first), 171.36 (extended)

Summary: Bias and Watchpoints

EURJPY has rejected resistance near 174.00, setting up a bearish bias toward 172.65 and possibly 171.36. A stop above 174.38 protects against upside risk. Fundamentals favor yen strength via safe-haven demand and weaker Eurozone growth momentum. The key watchpoint is whether upcoming ECB commentary reinforces dovish policy; if so, downside pressure should continue. For now, sellers maintain the upper hand as risk-off dynamics align with technical rejection.

EURJPY Testing Supply Zone Can Bears Regain Control?EURJPY has climbed back into a key resistance area near 172.40–172.50, a zone that previously triggered sharp selling pressure. Price action suggests exhaustion at these highs, with a possible rotation back toward support if sellers defend this zone again. Given the yen’s safe-haven role and the euro’s sensitivity to ECB policy shifts, this setup is primed for a potential reversal play.

Current Bias

Bearish – The pair is showing rejection signs at resistance, favoring downside toward lower support levels.

Key Fundamental Drivers

ECB Outlook: The ECB is cautious, with slowing eurozone growth limiting room for further tightening, reducing euro strength.

BOJ Policy & Yen Flows: Yen remains supported by safe-haven demand and speculation around BOJ gradually tightening, even if modestly.

Risk Sentiment: Global equity volatility and tariff/geopolitical risks support yen buying when risk-off flows emerge.

Macro Context

Interest Rates: ECB is holding policy steady but leans dovish relative to other central banks. Japan remains ultra-loose, but any hint of normalization sparks yen strength.

Economic Growth: Eurozone growth is fragile, with Germany’s industrial sector under pressure. Japan’s economy is steady, though export-driven, making it vulnerable to global demand.

Geopolitics: Trade tariffs, US-China tensions, and Middle East risks all lean supportive for the yen as a safe haven.

Primary Risk to the Trend

A hawkish ECB surprise or strong eurozone inflation rebound could shift bias back to the upside, invalidating the bearish setup.

Most Critical Upcoming News/Event

ECB Minutes & Eurozone CPI Flash Estimate

BOJ Commentary on Yield Curve Control (YCC)

Leader/Lagger Dynamics

EURJPY tends to act as a lagger, following flows in broader yen crosses like USDJPY (as a leader) and EURUSD (for euro sentiment). Movements in EURJPY often confirm rather than lead directional bias in FX markets.

Key Levels

Support Levels: 171.42, 170.99, 170.65, 170.08, 169.73

Resistance Levels: 172.47, 173.31

Stop Loss (SL): 173.31 (above resistance zone)

Take Profit (TP):

TP1: 171.42

TP2: 170.65

TP3: 170.08

Summary: Bias and Watchpoints

Bias on EURJPY is bearish, with sellers looking to defend the 172.40–172.50 resistance area. A stop loss is best placed above 173.31, while downside targets stretch toward 171.42 → 170.65 → 170.08. Fundamentally, the euro faces growth headwinds while the yen benefits from safe-haven demand, though BOJ policy risks remain in play. The most important watchpoint is ECB and Eurozone CPI data, which could either reinforce the bearish case or shift sentiment sharply. For now, EURJPY looks vulnerable to a deeper correction, with price action aligned to favor sellers.

EURJPY – Bearish Reversal Looming from Key Resistance ZoneAfter a strong recovery rally, EURJPY has once again hit the 172.30 resistance zone a level that has repeatedly acted as a ceiling for price action. This latest retest comes with signs of momentum fading, and I’m eyeing a potential reversal that could send the pair back toward key support zones. With broader yen strength creeping in on safe-haven flows and the euro’s upside capped by a cautious ECB, this setup is looking primed for sellers to step in.

Current Bias

Bearish – The pair is struggling to break and hold above the 172.30 resistance zone. Price action is showing rejection wicks on the H4 chart, indicating potential distribution before a move lower.

Key Fundamental Drivers

Euro Side: The ECB remains cautious on further tightening, with growth concerns in the eurozone limiting the upside for EUR. Recent industrial production softness and muted inflation expectations cap bullish momentum.

Yen Side: The BoJ’s shift toward a slightly less accommodative stance, combined with safe-haven demand amid global trade tensions and Trump’s tariff rhetoric, supports JPY strength.

Risk Sentiment: Ongoing uncertainty around global growth and trade flows benefits JPY as a defensive asset, putting downside pressure on EURJPY.

Primary Risk to the Trend

A surprise hawkish tilt from the ECB or strong eurozone economic data could fuel renewed buying pressure, forcing a breakout above 172.98.

A sudden drop in risk-off sentiment or a rebound in global equities could weaken JPY demand and negate the bearish bias.

Most Critical Upcoming News/Event

Eurozone GDP and Industrial Production data – Any significant beat could temporarily lift EUR.

Japan CPI and BoJ commentary – Inflation beats or hawkish language could accelerate JPY gains.

Geopolitical headlines – Trade tensions between the US and China remain a key driver for yen demand.

Leader/Lagger Dynamics

EURJPY is acting as a lagger in the current yen move, with USDJPY leading the direction for JPY crosses. Any decisive move in USDJPY—especially a break lower—would likely spill over into EURJPY. The pair also tends to mirror risk sentiment shifts seen in equity indices like US500, making global sentiment a secondary driver.

Summary: Bias and Watchpoints

I’m maintaining a bearish bias on EURJPY as long as price stays below the 172.30 resistance zone. My stop-loss is placed just above the 172.98 swing high to protect against a bullish breakout. First targets sit at 171.43, then 170.65, with an extended downside target near 169.73 if momentum builds. A clean break below 170.65 would open the path for deeper declines, while any sustained break above 172.98 would invalidate this setup. In short, I’m watching for rejection confirmation from resistance and will be tracking USDJPY closely as the leader for yen sentiment.

EURJPY: Bullish Rebound from Key Demand ZoneEURJPY has bounced off a critical demand zone and is showing signs of a bullish recovery. Despite the recent pullback, the pair’s structure remains fundamentally and technically bullish, driven by JPY weakness and EUR resilience.

Technical Analysis (4H Chart)

Pattern: Price tested a strong demand zone near 170.35–170.50 and rejected it aggressively.

Current Level: 170.77, starting a potential bullish leg toward higher resistance levels.

Key Support Levels:

170.35 – key demand zone and invalidation level for bulls.

169.90 – deeper support if demand zone breaks.

Resistance Levels:

172.17 – first bullish target and interim resistance.

173.64 – major target if bullish continuation sustains.

Projection: A successful rebound from 170.35 could drive price toward 172.17 initially, then 173.64 if momentum holds.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

EUR: ECB’s slower path toward easing supports EUR stability relative to JPY.

JPY: Weakness persists as BoJ maintains dovish bias, though FX intervention risk limits JPY downside speed.

Global Sentiment: Mild risk-on mood supports EUR strength against JPY.

Risks:

BoJ verbal intervention or actual FX intervention could trigger temporary JPY strength.

Sharp reversal in global risk sentiment could weaken EUR/JPY.

Key Events:

ECB speeches and data (CPI, growth updates).

BoJ FX comments and broader market risk appetite.

Leader/Lagger Dynamics

EUR/JPY is a leader among JPY pairs, often moving in sync with GBP/JPY and CHF/JPY. Its movement also tends to precede confirmation in risk-sensitive JPY crosses.

Summary: Bias and Watchpoints

EUR/JPY is bullish from the 170.35 demand zone, with a potential move toward 172.17 and 173.64. Key watchpoints include ECB communication, BoJ stance, and market risk sentiment. As long as 170.35 holds, bulls remain in control.

EUR/JPY Again Below My Res , Short Setup Valid To Get 150 Pips !Here is my opinion on EUR/JPY On 2H T.F , We have a fake breakout and Gap and the price back again below my res area and closed with 4H Candle below it , so i have a confirmation and i`m waiting the price to go back to retest this strong res and give me any bearish price action and then we can enter a sell trade and targeting 100 : 150 pips . if we have a daily closure above my res then this analysis will not be valid anymore .

EURJPY: A Big Move In Making, Please Share Your Views! Date: 22/06/2025

Hello everyone,

I hope you’re all having a good weekend. As we previously discussed, we expected a sharp decline in Europe/JPY, but unfortunately, it didn’t work out in our favour due to the extremely bullish US dollar. This led to the crossing and invalidation of our two selling zones.

Looking at next week’s price projection, we can confirm that the price is heading towards 170.50 and may be selling at this level. Therefore, we will be keeping a stop loss at 171.50.

Once the trade is activated, we can set our target at 166.0, 163.50, and the final target will be placed at 158.50.

If you like our work, please like our idea.

Good luck and trade safely next week.

EUR/JPY Short✅ EUR/JPY Swing Short Setup (Multi-Entry)

🎯 Entries:

Entry 1: 169.00 (light position)

Entry 2: 170.10 (core entry)

Entry 3: 170.90 (final top entry)

🛡️ Stop Loss (Unified):

171.50

Placed above the entire resistance zone and previous all-time wick highs, allowing for normal trap behavior without overexposure.

🎯 Take Profits:

TP1: 164.00

TP2: 157.50

You can scale out partially at TP1 or run the full position to TP2 depending on how momentum builds.

#EURJPY: Major Swing Sell +1100 Pips, One Not To Miss! The Japanese Yen (JPY) is most likely to continue its bullish trend, as the Dollar Index (DXY) is expected to decline due to the ongoing conflict between Israel and Iran. Historically, JPY and CHF, alongside gold and silver, have been favoured by global investors and remain bullish. Strong fundamentals and technical support further support our analysis.

The 167-169 price region remains a critical point for sellers, where we anticipate significant selling volume. There are two entry points to consider: one near the current price and another slightly further away. Please monitor volume and use smaller time frames for entries.

Our Swing Target is at 154, but you can also target smaller zones once the trade is activated. For instance, set take-profit levels at 164, 160, and finally, at 154.

To encourage and support us, you can like the idea, comment on it, or share it.

Team Setupsfx_

❤️❤️🚀🚀