EUR/NZD Builds Bullish Structure – Will Buyers Dominate?💶💚 EUR/NZD “EURO VS KIWI DOLLAR” — Profit Pathway Setup (Day Trade)

🎯 Market Bias:

Bullish momentum confirmed ✅ following a 786 LSMA breakout, showing potential continuation strength on intraday structure.

🧩 Entry Plan (Layering Strategy Style)

This setup uses a layered entry method (multi-limit strategy) to build position strength on pullbacks.

🟢 Buy Limits: 2.01000 / 2.01200 / 2.01400

(You can increase or fine-tune limit layers based on your risk management plan.)

💡 This approach helps catch liquidity dips before the main impulse move.

🛡️ Stop Loss:

📍 “Thief SL” positioned at 2.00800 — designed for tight risk control within short-term volatility.

⚠️ Note: Fellow traders (Thief OG’s 👀), this is not financial advice — you may adjust SL as per your personal plan. Trade smart, take money, move clean.

🎯 Target Zone (Police Barricade Ahead!)

🚧 2.03000 is marked as our resistance checkpoint — an area of previous overbought pressure and liquidity traps.

Plan to secure profits once price approaches this zone.

⚠️ Again — you’re the boss of your take-profit. My setup, your decision!

🧠 Technical Context & Market Insight

LSMA breakout above 786 retracement confirms bullish bias.

RSI mid-zone recovery supports upward momentum.

MACD histogram crossover indicates renewed buying pressure.

Watch for volatility spikes during London & NY overlap session.

🔗 Correlated Pairs to Watch

💷 $GBP/NZD → Similar Kiwi reaction strength; strong upward momentum often mirrors EUR/NZD.

💶 $EUR/AUD → Positive correlation; Euro performance gauge.

💵 $USD/NZD → Inverse bias; weakness in Kiwi could strengthen this play.

💸 $AUD/NZD → Regional flow confirmation; helps validate Kiwi strength/weakness patterns.

Monitoring these can provide inter-market confirmation before scaling in or adding layers.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

🔖 #EURNZD #Forex #DayTrading #PriceAction #EUR #NZD #TradingView #TechnicalAnalysis #ThiefStrategy #BullishSetup #MarketInsights #LSMABreakout #SwingTrading #TradePlan #LiquidityZones #ForexTrader #RiskManagement

Eurnzdbuy

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD: Building Momentum for a Fresh Upside LegEURNZD has been trading within a rising channel, and the recent pullback looks more like consolidation than a breakdown. With the euro gaining relative support from firmer ECB inflation signals and the kiwi weighed down by soft global growth and commodity challenges, the setup leans toward a bullish continuation. A rebound from current levels could unlock another push toward the upper channel boundary.

Current Bias

Bullish – the pair remains inside an ascending channel, and price action suggests a recovery from support levels.

Key Fundamental Drivers

EUR: Supported by sticky inflation in the eurozone and a cautious ECB stance, limiting the case for rapid rate cuts.

NZD: Pressured by weak export demand, dairy price softness, and vulnerability to Chinese trade risks.

Relative Policy Outlook: ECB’s relatively firmer tone versus RBNZ’s limited room to tighten favors upside in EURNZD.

Macro Context

Interest Rates: ECB is not rushing into aggressive easing, while the RBNZ is largely on hold, with little upside for NZD rates.

Economic Growth: Eurozone showing patchy but stable data, while NZ faces housing and export-related headwinds.

Commodities: Dairy weakness drags NZD, while oil-driven inflation could indirectly support EUR through energy import pressures.

Geopolitics: Trade war risks add downside pressure on NZD, while safe-haven flows in Europe offer EUR some resilience.

Primary Risk to the Trend

A sharp rebound in Chinese growth or a dovish surprise from the ECB could weaken the bullish momentum and drive EURNZD lower.

Most Critical Upcoming News/Event

Eurozone inflation and GDP data.

RBNZ commentary and NZ CPI releases.

Trade-related headlines from China that impact NZD sentiment.

Leader/Lagger Dynamics

EURNZD tends to be a lagger, moving in response to broader eurozone policy shifts and NZD risk appetite. It often follows moves in EURUSD and NZDUSD, making those key drivers to monitor.

Key Levels

Support Levels: 2.0115, 1.9941

Resistance Levels: 2.0299, 2.0483

Stop Loss (SL): 1.9941

Take Profit (TP): 2.0483

Summary: Bias and Watchpoints

EURNZD is bullish within a rising channel, with near-term upside toward 2.0299 and 2.0483. A protective stop sits below 1.9941 in case of a breakdown. The euro’s relative strength against the kiwi remains supported by ECB caution and NZD’s dependence on global growth momentum. Watch eurozone inflation updates and NZ data releases closely, as they could dictate whether this bullish momentum extends or stalls.

EUR/NZD Made Clear Reversal Pattern,Long Setup To Get 150 Pips !Here is my 4H Chart On EUR/NZD , The price creating a very clear reversal pattern ( Inverted Head & Shoulders pattern ) and the price made a very good bullish price action now And the price confirmed the pattern by closing above the neckline. so we can enter a buy trade when the price go back to retest the broken neckline to can use a small stop loss , and we can targeting from 50 to 100 pips with a decent stop loss .

Reasons To Enter :

1- Perfect Touch For The Area .

2- Clear Bullish Price Action .

3- Bigger T.F Giving Good Bullish P.A .

4- Clear Reversal Pattern .

5- Pattern Confirmed .

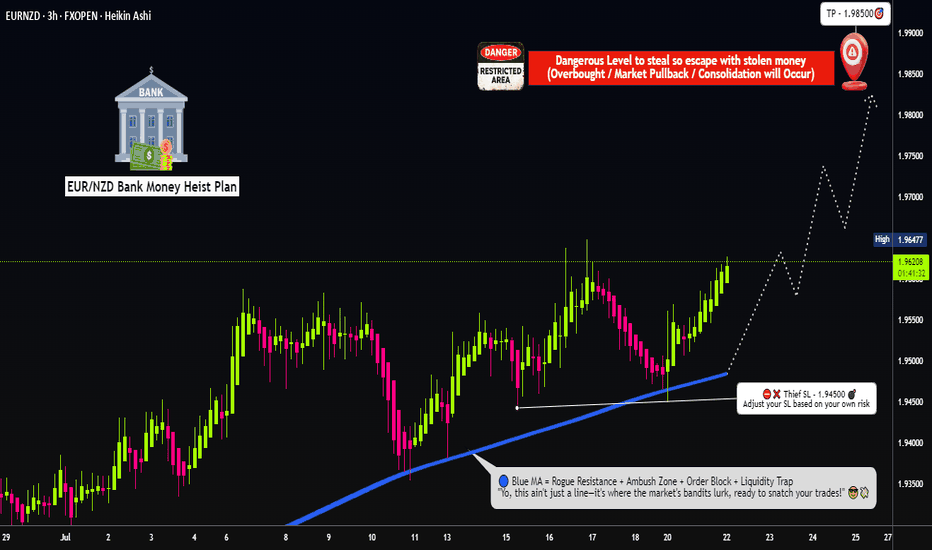

Is EUR/NZD Setting Up The Ultimate Swing Trade Opportunity?🎭 The Great Euro Heist: EUR/NZD Cash Flow Caper

💼 Mission Brief: Operation Bull Run

Asset Under Surveillance: EUR/NZD (Euro vs Kiwi - yes, I said "Aussie" in the title for the vibes, mate 🦘)

Market: FOREX

Strategy Type: Swing/Day Trade Cash Flow Management

Risk Level: Thief Mode Activated

📊 The Intelligence Report

Market Setup: Bullish momentum confirmed! 🐂

Hull Moving Average retest looking clean

Bullish Heikin Ashi doji candle formation spotted (that's our signal, folks!)

Bulls are warming up for the ride

🎯 The Heist Plan (Entry Strategy)

The "Thief Layering" Method

We're using multiple limit orders (layering strategy) to sneak into this trade like pros:

Sell Limit Layers (Scale-In Entries):

🎯 Layer 1: 2.01000

🎯 Layer 2: 2.01500

🎯 Layer 3: 2.02000

Pro Tip: You can add more layers based on your own risk appetite and account size. The more layers, the smoother the average entry price!

Alternative Entry: Any current market price works too if you're feeling bold! 🚀

🛡️ Risk Management (The Exit Plan)

🚨 Stop Loss (Emergency Escape Route)

Thief SL: 2.00000

⚠️ Important Note: Fellow Thief OGs, this is MY stop loss level. You're the captain of your own ship! Set your SL based on your risk tolerance. Manage your money, make your money, at your own risk.

💰 Take Profit (The Getaway Target)

Target Zone: 2.05000

🚧 Market Intelligence: Police barricade (strong resistance) detected at this level + oversold conditions + potential trap zone. Smart thieves escape with the loot before things get dicey!

⚠️ Important Note: This is MY take profit target. You call the shots on when to secure your gains. Take partials, trail stops, or go full send - your vault, your rules!

🔗 Related Pairs to Watch (Correlation Play)

Keep an eye on these pairs for confirmation:

Direct Correlations:

FX:EURUSD - Euro strength indicator

OANDA:NZDUSD - Kiwi weakness/strength gauge

OANDA:AUDNZD - Trans-Tasman sibling rivalry (similar commodity currency behavior)

Inverse Correlations:

FX:USDJPY - Risk sentiment barometer

TVC:DXY (US Dollar Index) - Overall dollar strength

Key Point: If EUR is strengthening across the board AND NZD is showing weakness, our setup gets extra confirmation! 💪

🎓 Why This Setup Works

1️⃣ Technical Confluence: Hull MA + Heikin Ashi alignment = high probability setup

2️⃣ Layer Entry Strategy: Reduces risk by averaging into the position

3️⃣ Clear Risk/Reward: Defined exit points keep emotions in check

4️⃣ Cash Flow Management: Scale in, scale out = professional trade management

⚡ Quick Action Items

Set your limit orders (or enter at market)

Place your stop loss (adjust to YOUR comfort zone)

Set alerts at target level

Monitor correlated pairs for confirmation

Manage position size according to your risk tolerance

📢 Community Engagement

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

⚖️ Disclaimer

CRITICAL: This is a "thief style" trading strategy presented for entertainment and educational purposes. This is NOT financial advice. Trading FOREX involves substantial risk of loss. Past performance does not guarantee future results. Always do your own research, manage your risk properly, and never trade with money you cannot afford to lose. This analysis is shared in a fun, creative format but should be treated with the seriousness that trading requires. Trade at your own risk!

#EURNZD #FOREX #SwingTrading #DayTrading #PriceAction #TechnicalAnalysis #ForexSignals #TradingStrategy #HullMA #HeikinAshi #LayeringStrategy #RiskManagement #ForexTrading #CurrencyTrading #TradingIdeas #MarketAnalysis #ForexLife #TradingCommunity #ChartAnalysis #ForexSetup

Trade smart, stay stealthy, and may the pips be ever in your favor! 🎩💰

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EUR/NZD Swing Plan: Dynamic Support Fuels Bulls😂 Steal the Pips with EUR/NZD: The Great "Thief" Swing Strategy! 💰📈

Asset: EUR/NZD (Euro vs. New Zealand Dollar)

Market: ForexStrategy: Swing/Day Trading with a Bullish "Thief" Layering Plan 😎

📊 Market Analysis & Setup

The EUR/NZD is primed for a bullish breakout! 🚀 The Hull Moving Average (HMA) has confirmed a strong bullish trend, with price action retesting the 786 Fibonacci level, acting as dynamic support.

This setup screams opportunity for savvy traders ready to "steal" some pips! 🕵️♂️

🗺️ Wealth Strategy Map

Trend Confirmation: Bullish momentum validated by the Hull Moving Average (HMA) with a clean retest of the 786 Fib level as dynamic support. 📈

Market Context: Strong bullish structure with potential to hit a liquidity pool near resistance. Watch for traps at overbought levels!

Thief Strategy: A layering approach using multiple buy limit orders to maximize entry precision and capitalize on pullbacks. 🧠

🕵️♂️ The "Thief" Entry Plan

This strategy uses a layered entry approach to stack the odds in your favor. Place buy limit orders at the following levels:

🎯 1.98000

🎯 1.98500

🎯 1.99000

🎯 1.99500

🎯 2.00000

Pro Tip: Feel free to add more layers based on your risk appetite and market conditions. The more layers, the merrier the "heist"! 😜

Flexible Entry: You can enter at any price level within this range, depending on your style. Just keep an eye on price action to confirm momentum.

🛑 Stop Loss (SL)

Thief SL: Set at 1.97000 to protect your capital from unexpected reversals.

Note: Dear Ladies & Gentlemen (Thief OGs), this SL is a suggestion. Adjust it based on your risk tolerance and account size. Trade at your own risk, and always secure your loot! 💼

🎯 Take Profit (TP) Target

Target Zone: Aim for 2.04000, where we expect a strong resistance zone, potential overbought conditions, and a liquidity pool that could trigger a trap.

Escape Plan: Exit with your profits before the market turns! This is a high-probability zone, so don’t get greedy — grab your pips and run! 🏃♂️

Note: As always, Thief OGs, this TP is a guide. Set your targets based on your strategy and risk management. Take the money when it’s there! 💸

🔍 Related Pairs to Watch

Keep an eye on these correlated pairs (priced in USD) to gauge broader market sentiment:

FX:EURUSD : A strong EUR/USD often supports bullish moves in EUR/NZD due to Euro strength. Watch for similar bullish patterns or divergences.

FX:NZDUSD : Weakness in NZD/USD can amplify EUR/NZD’s bullish momentum. Monitor for bearish signals in NZD/USD to confirm our setup.

OANDA:AUDNZD : As a closely related antipodean pair, AUD/NZD can provide clues about NZD weakness. A rising AUD/NZD may align with our bullish EUR/NZD outlook.

Key Correlation Insight: EUR/NZD often moves inversely to NZD/USD due to the NZD component. Confirm Euro strength across pairs for higher conviction! 📊

🚨 Risk Disclaimer

Trading is a high-stakes game, Thief OGs! Always manage your risk, use proper position sizing, and never bet the farm. The market is full of traps, so stay sharp and trade responsibly. 😎

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#️⃣ #EURNZD #ForexTrading #SwingTrading #ThiefStrategy #HullMovingAverage #Fibonacci #PipHeist #TradingView

#EURNZD:Price accumulated now time for distribution! Price completed accumulated and now we expecting a strong bullish price distribution. Next week we can see price going and crossing our target with strong bullish volume kicking in the market. Price may go beyond 2.20 region; let's see how it goes.

Good luck and trade safe!

Team Setupsfx_

EURNZD - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

EURNZD Daily Analysis: Watching Support for a Bullish Break💶🇳🇿 EURNZD on the daily timeframe is clearly in a bullish trend 📈.

Right now, price is experiencing a deep pullback 🔽, and I’ll be watching closely to see if it holds at the key support level 🛑📊.

If we get a bullish break of structure 🔓🟢 from here, it could open up a long opportunity 🎯🚀.

⚠️ This is for educational purposes only and not financial advice 📚

EURNZD - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

eurnzd analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

Euro vs Kiwi Bull Raid: High Reward Target Strategy🏴☠️EUR/NZD Heist Plan: "Robbing the Kiwi Vault with Thief Trading Style" 💰🔥

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Dear Money Makers, Chart Bandits & Market Strategists! 🤑💸✈️

Here’s the EUR/NZD (Euro vs Kiwi) blueprint crafted using the signature 🔥Thief Trading Style🔥 — a blend of bold technicals, insightful fundamentals, and pure tactical precision. We’re setting our sights on a potential bullish breakout — targeting the high-security resistance zone where big money hides.

💡The Robbery Plan (Thief Entry Setup):

🟢 Entry Point:

"The vault is wide open — time to extract the bullish loot!"

⚔️ Entry can be taken at market price, but the smarter thieves use a layered Buy Limit strategy at pullback zones (near swing lows/highs on the 15-30 min TF) to snipe the best entries with reduced exposure.

🔁 Scaling in = DCA-style Thief Method: split entries for efficiency, just like robbing in waves.

🔻 Stop Loss Plan (Escape Route):

🔒 Place SL below the recent swing low using 3H timeframe (1.94500 for scalpers/day traders).

🛡️ Adjust based on risk appetite, lot size, and number of entries in play.

🎯 Take Profit Target:

🏁 Exit the heist near 1.98500, where strong resistance awaits. That’s the Danger Zone — the edge of our mission.

🔍EUR/NZD Outlook Snapshot:

This pair is flashing bullish vibes due to:

🏛️ Macro & Fundamental tailwinds

📊 COT positioning & Sentiment readings

🔗 Intermarket influences

📈 Price structure & liquidity zones

For more depth: dive into external analysis tools, COT reports, and sentiment dashboards to fine-tune your view. The direction is clear — the bulls are assembling.

⚠️ Trading Alerts & Risk Management Reminders:

🚨 News releases = volatility mines.

Before entering, make sure to:

Avoid new positions near red-flag economic events

Protect your open trades with trailing SLs or partial exits

Stay alert — the market shifts fast, adapt faster

💬 Final Word from the Vault Boss:

📢 Smashing likes = boosting the crew. 💥

Support the Thief Trading Style by hitting the BOOST button and keep the robbery crew rolling strong 💪💸

We're here to outsmart the market — one clean chart raid at a time.

Stay tuned for the next master plan. Until then, rob smart, rob safe. 🧠🔐💥

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

eurnzd sell signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

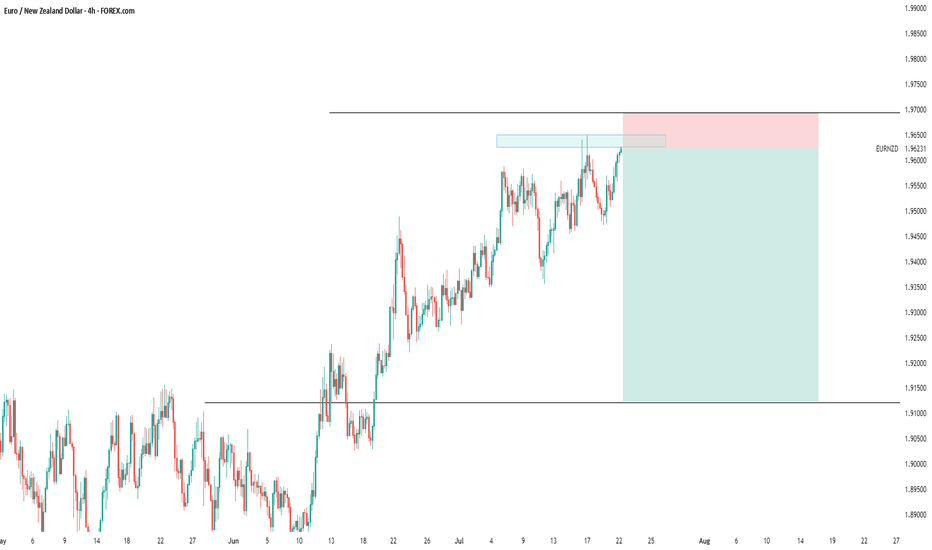

EUR/NZD Robbery Blueprint – Targeting Pink Zone Profits💰EUR/NZD Robbery Setup: The Bullish Breakout Blueprint for Euro vs Kiwi Heist! 🚨📈

(Targeting High-Risk Zones With Dynamic Entry & Exit Tactics – Long Setup Explained)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Market Pirates & Chart Bandits, 🏴☠️💸📊

Ready to rob the Kiwi vaults with precision? Based on our 🔥Thief Trading Strategy🔥 (technical + fundamental), here’s the grand blueprint for the EUR/NZD Long Heist. We’ve scoped the market, sniffed out consolidation traps, and locked eyes on that Pink Zone of high-risk, high-reward. The bulls are regrouping. This is our moment. 📍

🎯 ENTRY PLAN – “The Breakout Is The Lock Pick”

📈 Strike Price: 1.93900

Wait for a clean candle close above the Major Dynamic Resistance (MA level).

Once breached, place buy stop orders above the MA line — entry must align with breakout rules.

🔁 Optional: For early robbers, place buy limits on the nearest swing low within the 15M or 30M timeframe (confirmation from wick rejections).

📌 Set alerts (📳) at breakout zones. Stay sharp. Opportunity doesn't knock—it smashes doors.

🛑 STOP LOSS – “Protection Is Power”

Set your SL near the previous swing High/Low wick (4H chart zone), aligning it with your personal lot size, risk %, and number of trades.

📍“SL is your vault lock. Set it smart, not soft. You’re not gambling — you’re robbing with logic.”

🔥 Reminder: No premature SL on pending orders—wait for breakout validation.

🧨 TARGET – “Escape Plan”

🎯 Profit Target: 1.97500

Or dip out early if resistance alarms start ringing. 🏃♂️💨

⚖️ OVERVIEW – “The Scoreboard”

The EUR/NZD is currently in a neutral chop, but multiple trend reversal signs are emerging.

🔥 Oversold zones, squeeze structure, and a potential bull charge all support this heist-worthy long setup.

📚 BONUS INTEL

Unlock the deeper story:

🧠 Sentiment Analysis

💼 COT Report Data

🌍 Macro Insights

🔍 Intermarket Correlations

📊 Quant Metrics

👉 Followw the 🔗 in the idea for more details and thief-style scoring!

🚨 NEWS ALERTS & POSITION MANAGEMENT

🗞 Avoid new trades during high-impact news. Use trailing SL to protect and lock in gains as the plan moves. Stay adaptive — markets shift fast.

💥 FINAL WORD – “Boost The Gang, Fuel The Plan”

If this heist plan fuels your trading journey, smash the Boost button 💥💖

Help more traders rob the market, not each other.

We operate clean, with precision and thief-style logic.

Let’s get this bag. 💰💼🎉

🧠 Stay tuned for the next operation. Till then — rob smart, rob safe. 🐱👤🤑📈

EURNZD analysis elliot. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

EURNZD Potential Breakout or Reversal? | Technical Analysis EURNZD Potential Breakout or Reversal? | Technical Analysis 🚀🔄

The chart illustrates a key technical setup on the EURNZD pair with both bullish and bearish possibilities depending on price action near critical zones.

🔍 Technical Highlights:

Bearish Harmonic Pattern Completed 📉

A harmonic structure has formed and completed near the resistance zone (~1.9500), triggering a bearish move towards the target at 1.90688.

Major Resistance Zone 🔺

Marked between 1.9450 - 1.9500, where previous price action showed strong rejection (highlighted by the red arrow). This remains the key zone to break for further upside.

Support & Breakout Zone 🟦

The price bounced off the support zone around 1.9068 - 1.9100, aligning with trendline support and a previous structure level. This zone also aligns with the target of the bearish harmonic move.

Trendline Retest & Bullish Continuation Possibility 🔼

The price broke above the bearish leg and is now consolidating. If price closes above 1.9350-1.9400, a potential breakout toward the 1.9500 resistance zone is expected (blue arrow).

🔄 Scenarios to Watch:

✅ Bullish Case:

Break and hold above 1.9400

Target: 1.9500 Resistance Zone

Confirmation: Strong bullish candles with volume above current range

❌ Bearish Case:

Rejection at current level (near 1.9350-1.9400)

Target: 1.9068, the harmonic completion target and support zone

Confirmation: Bearish engulfing/rejection candle with trendline break

📌 Conclusion:

EURNZD is at a crucial decision point. Watch closely for a breakout above or rejection from the current price range to determine whether the pair will retest highs or complete the bearish target move.

EUR/NZD Breakout Done , Long Setup Valid To Get 250 Pips !Here is my EUR/NZD 4H Chart and my opinion is we have now a very good breakout after a lot of time in sideway so we can buy this pair if the price go back to retest the broken res and new support , so we should wait the price to go back to retest it and if we have a good bullish price action then we will enter a buy trade and targeting a new high .

eurnzd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade