New Week on Gold and we could continue strong!Im looking for price to give more indication on what it wants to do but we are bullish until proven otherwise. for now its is not in a position that I would like to enter cause it can go either way. All moves are scalps untill we get some more breaks on levels.

GC

Gold Futures – Momentum Strong but Eyes on Jobs DataPrice pushed extremely bullish yesterday, with little chance for pullbacks. I admittedly got stopped out a few times from reacting too quickly to impulses, so today I’m focused on patience and waiting for confirmation.

Currently, Gold is holding above recent levels after breaking higher. There’s still a clean 4H/8H FVG below that price could revisit, but as long as momentum stays intact, buyers remain in control.

⚠️ Important: Tomorrow brings ADP Non-Farm Employment, Jobless Claims, and ISM Services PMI — all of which could drive volatility. Friday is the heavyweight NFP release. Until then, we may see liquidity hunts or choppy price action.

Scenarios I’m watching:

✅ Bullish continuation toward new highs if support holds.

🔄 Deeper pullback into the FVG if momentum stalls.

Staying patient, letting the market show its hand, and keeping risk tight ahead of news.

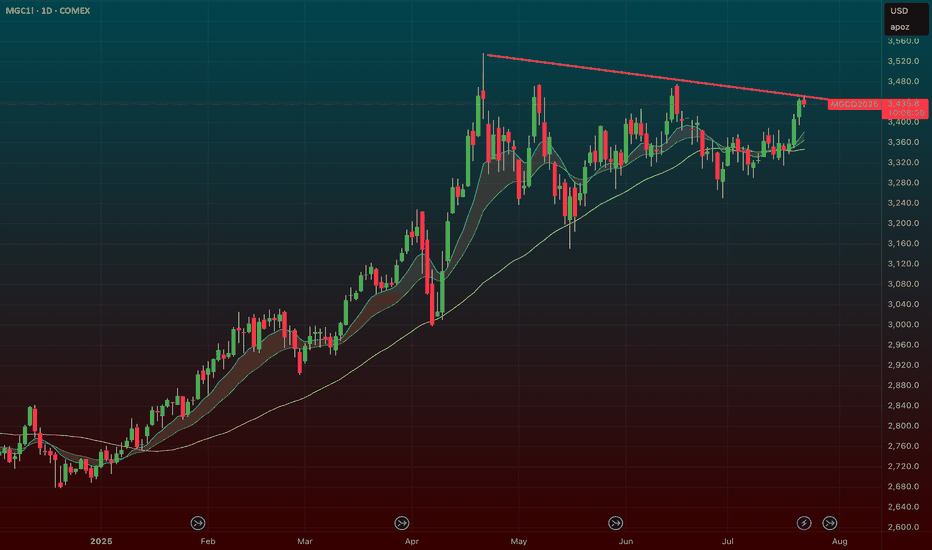

Gold Futures (MGC / GC) — Daily Outlook (Wed)Price just broke the previous ATH (3,578) and is in new price discovery. Momentum is bullish, but there are key imbalances below that could attract price before continuation.

🔍 Key Levels

ATH (3,578) → breakout level to watch

1H FVG (3,565–3,575) → short-term support zone

4H + 8H FVG stack (3,515–3,535) → deeper liquidity target

Immediate resistance → 3,610–3,620 zone

⚖️ Scenarios for Wednesday

1️⃣ Bullish Continuation (primary bias)

If ATH (3,578) holds → look for continuation into 3,610–3,620+

1H FVG may provide a bounce if tested

2️⃣ Deeper Pullback (secondary bias)

Failure to hold ATH → watch for a drop into 3,515–3,535 (4H/8H FVGs) before bullish continuation

✅ Trade Plan Idea

Continuation play:

Buy on ATH retest / 1H FVG bounce (3,575 zone) → target 3,610–3,620+

Deeper retrace play:

If ATH breaks clean → wait for price inside 3,515–3,535 zone → look for reversal confirmation long

📌 Notes

Momentum = bullish until proven otherwise

Don’t chase → wait for either ATH defense or clean retrace into imbalances

Manage risk → this is price discovery, expect volatility

📊 What’s your bias here? Do you see price holding ATH for continuation, or do you think we dip first into the deeper FVGs?

Gold Holding Asian 50% -- Bulls Gearing up for London Push?Price retraced cleanly to the Asian session 50% midpoint after yesterday’s strong rally. With the London Killzone approaching, I’m watching for bullish confirmation and a potential continuation higher.

Macro backdrop adds fuel:

Markets are pricing a 90% chance of a September Fed rate cut.

JPMorgan now forecasting four cuts starting this month, reinforcing bullish momentum in Gold.

⚠️ Holiday liquidity could create sharp stop-hunts, so confirmation is key. Looking for orderflow strength before stepping in.

Gold Futures | ADX Heating Up – Continuation or Trap at MH?Price has pushed away from the untested H4 FVG, showing strong bullish pressure. With ADX > 25 on the 15m and close to crossing on 1H/4H, momentum is shifting into trend mode.

My watch:

Break + retest of yesterday’s high and MH level for continuation longs.

Only looking for shorts if liquidity sweeps above MH and we see strong rejection.

Question is: do we run higher with ADX confirmation, or is this just a trap before a deeper pullback?

GC Midweek Outlook – Daily Imbalance Tested, H4 FVG Still in PlaPrice has now completed the move into the Daily FVG (~3425–3443) that I highlighted earlier this week. This is the critical mid-week decision point.

Bearish Case: If price rejects here, downside rotation into the untouched H4 FVG (3377–3396) remains possible before any larger move higher.

Bullish Case: If buyers defend the H1 imbalance and hold above 3412, continuation toward the Monthly High (3451) is on the table.

ADX remains under 25, suggesting no strong trending conditions yet — market is still liquidity-driven.

I’ll be watching the Daily FVG reaction and how price handles the H1 imbalance as key intraday signals.

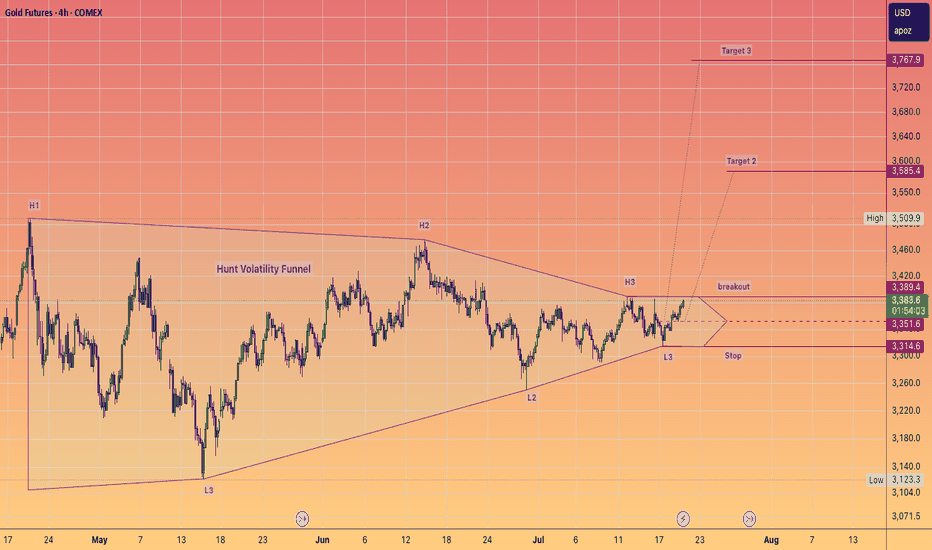

Gold Update 26AUG2025: Bullish Confirmation Above $3,534 The gold futures price has made a U-turn as it didn't trigger Triangle's invalidation at $3,300

This bounce back could be a harbinger of wave 3 within the larger degree wave 5

It will be confirmed once upmove breaks above the top of wave 1 beyond $3,534

I erased the complex correction scenario as the price might be taking off right now

I added the breakdown of the upcoming large wave 5 into smaller 5 waves inside

Target range remains intact between $3,900 and $4,300

GC 8/26 Outlook – Filling the H4 FVG, Trend Not Ready YetPrice is finally working down into the H4 FVG (3377–3396 zone) after rejecting the Daily FVG overhead (~3425–3440). This is the key area of interest going into Tuesday’s trading sessions.

🔑 Context:

Daily FVG above → unfilled liquidity magnet for the future.

H4 FVG below → currently being filled, acting as the main battleground.

Daily Low (3405) already taken; price now sitting between liquidity pools.

ADX < 25 (HTFs) → No strong trending environment yet, so expect more range-like behavior until a side commits.

📌 What I’m Watching:

Reaction inside the H4 FVG → Looking for either absorption/reversal (bullish case) or continuation through to lower liquidity.

Liquidity Levels:

Midpoint of H4 FVG (~3394).

Bottom of H4 FVG (~3377).

Weekly/Monthly Lows (3353 / 3347) if downside momentum extends.

Killzones:

Asian: Likely to set the range.

London: Could raid deeper into FVG.

NY: Potential reaction leg (either reversal or continuation).

📊 Bias: Neutral → short-term bearish into H4 FVG completion. Waiting for a clear reaction to confirm the next trending move.

Gold Futures | H4 FVG Fully Filled – What’s Next Into Weekly CloEarlier this week I was watching for price to pull back into the new H4 FVG after we closed above the Daily High. Price rejected from the Asian range mid and dropped cleanly into that zone, ultimately filling the H4 FVG completely.

Now on Friday, price sits right at the Weekly Low (3775.9) and the bottom of that H4 gap. This is a key decision point going into the weekly close.

📌 Scenarios I’m Watching:

✅ Bullish: If price holds this filled H4 FVG / W-L zone, we could see a re-accumulation and a push back toward 3388–3392 rejection block and possibly the Daily High (3394.6) next week.

❌ Bearish: If price fails to hold here, the next liquidity pools below are 3367.4 (D-L) and 3362.5.

📌 Key Levels:

Daily High: 3394.6

Weekly Low: 3775.9

Daily Low: 3367.4

Into Friday close, I’ll be watching whether we get acceptance above this zone (bullish continuation setup) or rejection that opens the door to new weekly lows.

👉 What do you think? Will this area hold as support, or do we see a deeper flush before the week closes?

GC Futures – Will Bulls Defend the Daily/H4 FVG Overlap?Gold Futures opened the week pressing directly into a stacked Daily + H4 FVG demand zone (3350–3360). Price action is sitting just above this level, making it the key battleground for the week.

Support: 3350 (FVG low), 3332 liquidity sweep

Resistance: 3377 → 3394 (prior D-H), 3451 (M-H)

Scenarios: Bounce off demand could target 3380–3394, with a reclaim opening 3420–3450. Failure here points to deeper liquidity at 3332.

Asian session may set the early range, but real direction likely comes during London/NY killzones. Watching closely for reaction inside the FVG overlap.

Gold Futures – Waiting for the Flush Before the Long (Asian KillMarket Context:

Gold is sitting right inside a confluence zone — overlapping Daily + H4 Fair Value Gaps at 3,375–3,380. This zone also aligns with the lower boundary of last week’s range (W-L at 3,397).

What I’m Watching:

Going into the Asian Killzone, I’m looking for an impulsive spike down into this FVG.

This move would ideally push below 3,375, tag liquidity, and create DOM excess — the kind of aggressive selling that often marks exhaustion before reversal.

ADX is above 25 and rising, signaling momentum is strong — but we’re at a potential pivot level.

Bullish Setup Criteria:

Flush down into 3,375 or slightly below.

DOM excess showing absorption (stuck sellers).

Strong rejection candle (M1/M5) followed by bullish follow-through.

Targets if Triggered:

T1: 3,397 (Weekly Low)

T2: 3,423 (Daily High)

Stretch: 3,451 (Monthly High)

Invalidation:

1H close below 3,375 without immediate reclaim.

Summary:

Patience is key. I want to see sellers press in during Asia, fail to break down with continuation, and then get run over on a squeeze higher. If we get the right reaction, this could be the start of a strong move into Weekend.

Gold Futures – Bearish Target Hit… But the H4 Gap Still WaitsYesterday’s sessions made their move for the higher bearish target, leaving the H4 & Daily FVG untouched below. This sets up an interesting scenario: will price roll over to fill the gap next, or keep hunting liquidity above?

Key levels and volume profile zones are adjusted for today.

Premium supply zone reached ✅

H4/Daily FVG still in play 📉

Watching London Killzone for impulsive confirmation

Patience is the edge — no clean setup, no trade.

Gold’s Two-Zone Patience Play – Wait for the FVGs to SpeakPrice action on GC is sitting in no-man’s land, caught between two key imbalances.

Above: 1H Bearish FVG at $3,470–$3,480.

Below: H4 Bullish FVG at $3,350–$3,375, aligned with the Weekly Low.

I’m waiting for price to step into one of these “Patience Zones” before committing.

A push up into the 1H FVG during a killzone could set up shorts targeting the W-L and the H4 FVG fill.

A drop into the H4 FVG first — especially with a sweep of $3,397 — could provide the low of the week and a strong bullish reversal.

No mid-range chasing here — let liquidity do the heavy lifting.

GOLD | XAU/GC - Weekly Recap & Gameplan - 03/08/25📈 Market Context:

Gold is currently trading within an accumulation zone as the market begins to price in a potential 0.25% rate cut by the Fed.

This macro expectation is supporting the broader bullish bias in the commodities market.

🧾 Weekly Recap:

• Price broke below the HTF bullish trendline — a key sign of weakness and potential structural shift.

• However, a sharp drop in the DXY (US Dollar Index) provided a bullish tailwind for gold, resulting in a mid-week bounce.

• This mixed action sets the stage for two potential outcomes next week.

📌 Technical Outlook & Game Plan:

I’m preparing for two possible scenarios:

1️⃣ Bearish Scenario (Red Path):

→ Price retests the broken trendline and rejects it

→ Continuation to the downside

→ Play: Short setup

2️⃣ Bullish Scenario (Green Path):

→ Price reclaims the broken trendline and closes above it

→ Continuation higher toward next resistance

→ Play: Long setup

🎯 Setup Trigger:

I will wait for a clear break of structure (BOS) on the 1H–4H timeframe to confirm directional bias.

📋 Trade Management:

• Stoploss: Below the demand zone (for longs) or above supply (for shorts) on the 1H–4H chart

• Target:

→ Bullish: $3,536

→ Bearish: $3,305

💬 Like, follow, and comment if this breakdown supports your trading! More updates, setups, and educational posts coming soon — stay tuned!

Close out the Week STRONGLooks like price has found its bottom and is ready to push from here. We are looking for a strong forceful break out from this zone so we can go for the higher levels. Everything looks right from here and value keeps shifting up. I know we should get a solid entry but waiting for it to line up with time.

GOLD - GC Weekly Recap & Outlook | 27.07.2025🧾 Weekly Recap:

• Price tapped into the 1H Demand Zone (red box) and ran the 4H swing liquidity before bouncing to clear internal range liquidity.

• This move was followed by a retracement which led to a break of the bullish trendline.

This may signal the beginning of a broader accumulation phase. Expect choppy price action targeting internal liquidity both above and below, before a clear trend resumes.

📌 Technical Analysis:

Price has closed below the bullish trendline, leading to two possible scenarios:

1. Bullish scenario (black path):

– Price runs the W C DOL (3313$) →

– Finds rejection →

– Retests broken trendline →

– Breaks above the trendline →

– Continues toward 3444$ and potentially 3474$

2. Bearish scenario (orange path):

– Price runs W C DOL (3313$) →

– Rejects from the broken trendline →

– Fails to reclaim it →

– Continues downward to target M C DOL (3256$)

📈 Setup Trigger:

Wait for clear 1H–4H supply/demand zone creation and structure shift before initiating a trade.

🎯 Trade Management:

• Stoploss: Above/below relevant supply-demand zone

• Targets:

– Bullish: 3444$, 3474$

– Bearish: 3256$

🟡 If you liked the idea, feel free to drop a like & comment — and don’t forget to follow for more weekly updates.

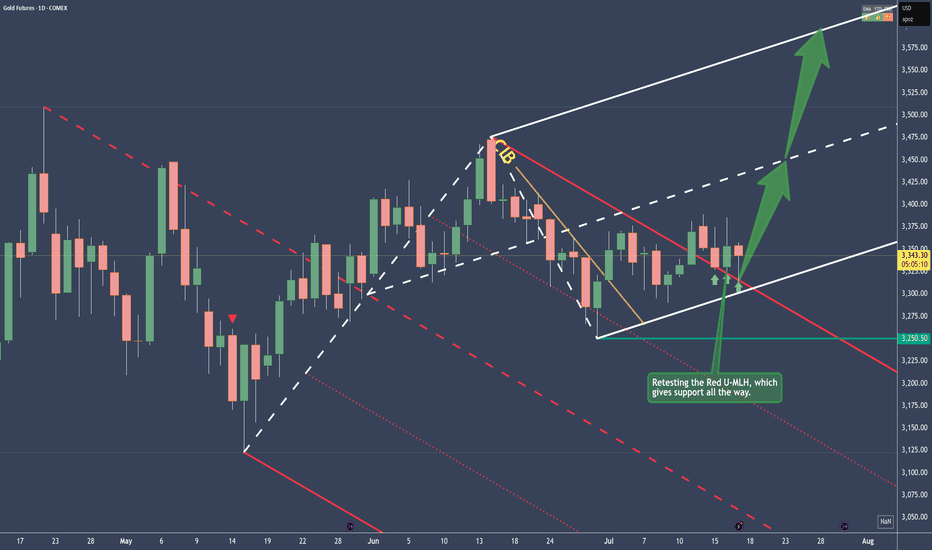

Gold - Bullish and here's whyPrice traveled within the Red Fork, until it broke the CIB Line, which is indicating a Change In Behavior.

From there on, sideways action, until the break of the Red U-MLH happened.

After the close above the Red U-MLH, price has tested it the 3rd time now. At the time of writing, the Bar looks like a PinBar. So it has good sepparation from the bottom, or a long Down-Wick. That's indicates good strenght.

To me this looks like a good long trade, but as everytime, play it save and don't let greed eat your brain ;-)

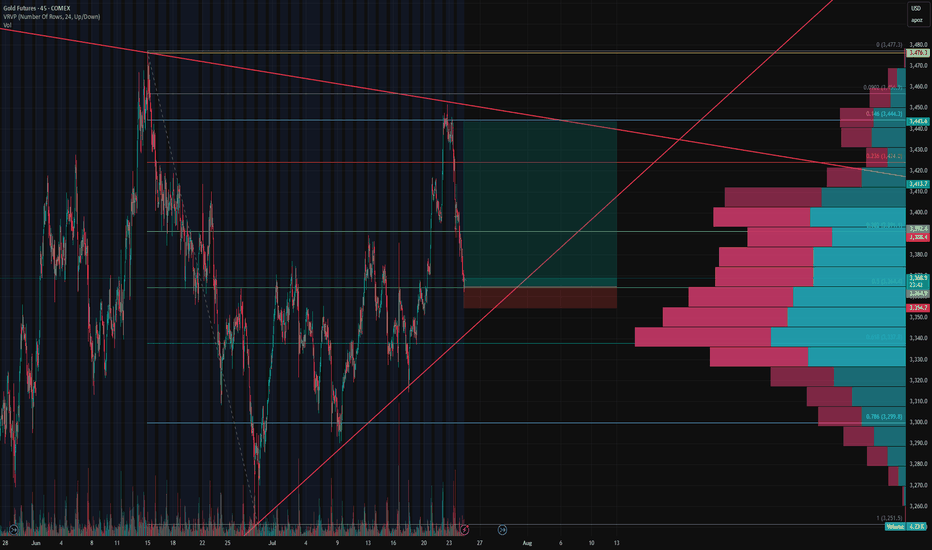

Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce🟡 Gold Futures (GC1!) Long Setup – 0.5 Fib Bounce

After nailing the long from the bottom and perfectly shorting the top, we’re stepping back in for another calculated move.

📉 Price pulled back to the 0.5 Fibonacci retracement, aligning perfectly with the upward trendline support and a key HVN on the Volume Profile.

📈 Entered long at 3,365 with a tight stop below 3,354 (0.3% risk), targeting the descending trendline near 3,444 for a clean 7.7R setup.

🧠 Context:

Price reacted hard at resistance, but volume support and structure still lean bullish.

Clear invalidation if we break trend and lose 3,350 support cluster.

Let’s see if this bounce gets legs. 🚀

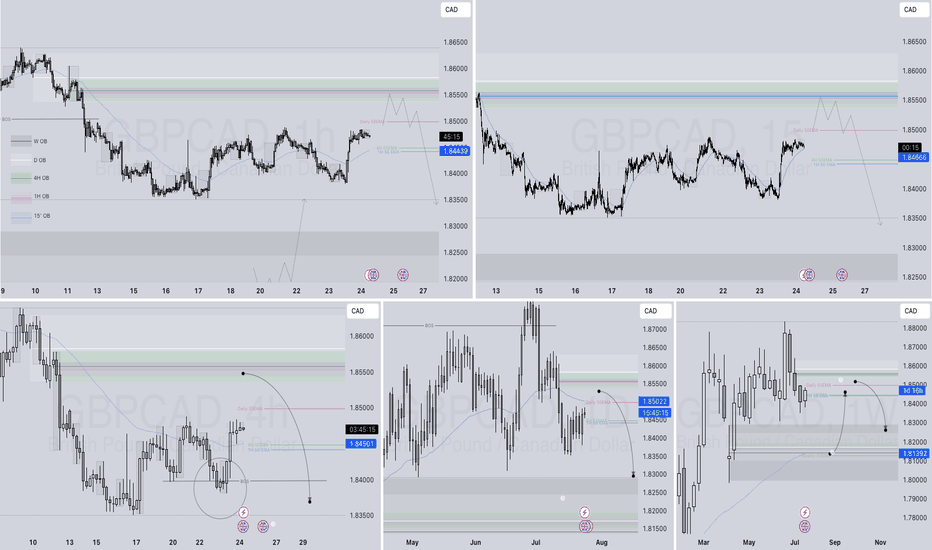

GBPCAD Q3 | D24 | W30 | Y25📊GBPCAD Q3 | D24 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

$GLD / $GC – Gold Poised for Breakout as Hard Assets FlexAMEX:GLD / SET:GC – Gold Poised for Breakout as Hard Assets Flex

Gold is setting up for a major breakout, and the broader market is finally catching on to the hard asset trade. Whether it’s inflation ticking up or the never-ending government deficit spending, the market is starting to signal something big.

🔹 Macro Tailwinds:

Inflation pressures + record deficit = a perfect storm for gold.

The dollar is under pressure — metals ( AMEX:GLD , AMEX:SLV , SET:GC ) are responding.

This theme isn’t going away anytime soon.

🔹 Technical Setup:

AMEX:GLD and SET:GC (Gold Futures) are coiled tightly just under breakout levels.

Volume is steady, and momentum is building under the surface.

A move through current resistance could send this entire trade into overdrive.

🔹 My Positioning:

1️⃣ Options: Long AMEX:GLD calls with 1-month expiration — slow mover, but clean structure.

2️⃣ Futures: Trading SET:GC contracts on the breakout side.

3️⃣ Silver Exposure: Still holding partials in AMEX:SLV — it’s following gold’s lead but with more juice.

Why I’m Focused Here:

This is not a one-day theme — hard assets are becoming a rotation trade.

If this confirms, we could see multi-week upside in precious metals.

It’s rare to get clean technicals that align this well with macro.

GOLD: Pre-market PrepSo for gold today, I see a lot of confluence around the prior week's high, prior day's high, and the prior value area high. We also had a poor high last Friday that we've clearly broken through.

Right now, we're in balance up above these key levels. My immediate plan is to continue going long up to the prior month's value area high. If we get a pullback to the confluence area, I want to take it up from there.

If the market opens and we accept back into the previous area, I'll be looking to go short from that area and take it down. That's my main analysis for gold today. Let’s trade smart, peace!