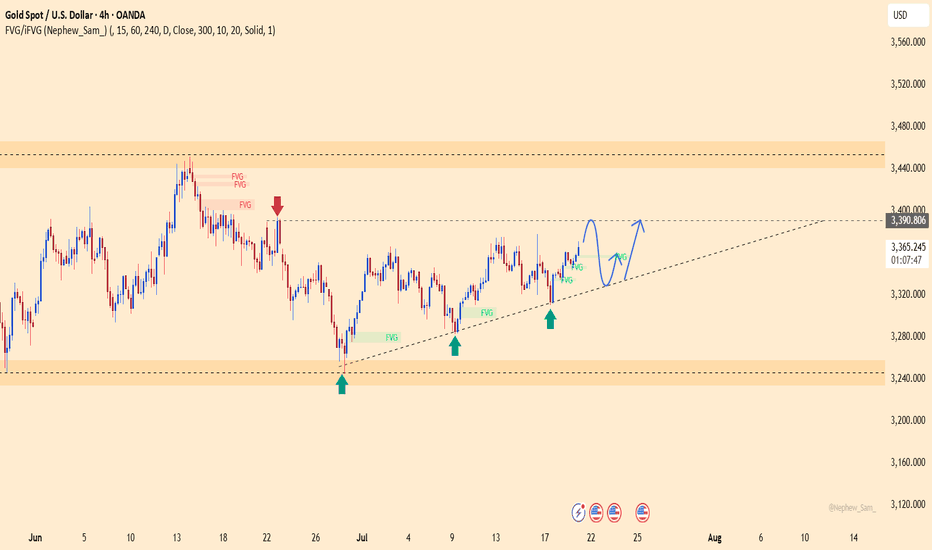

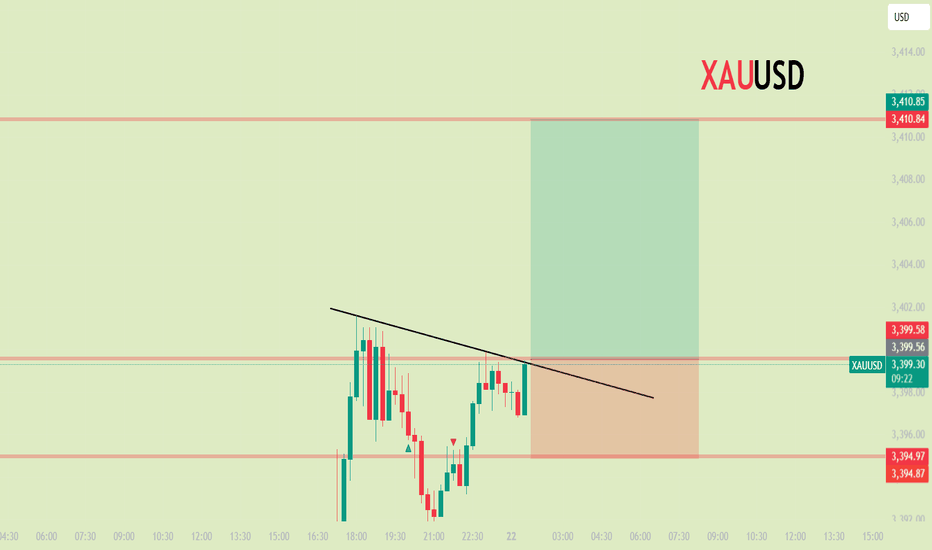

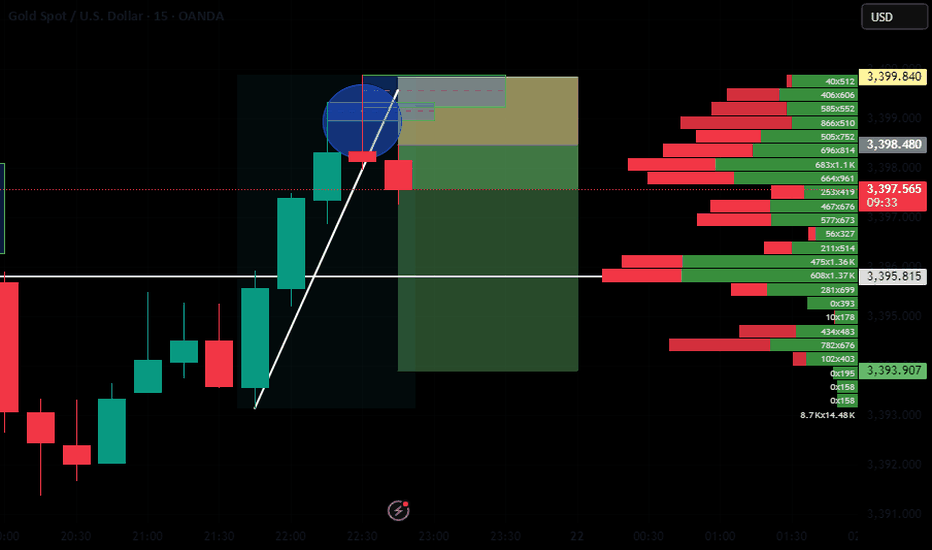

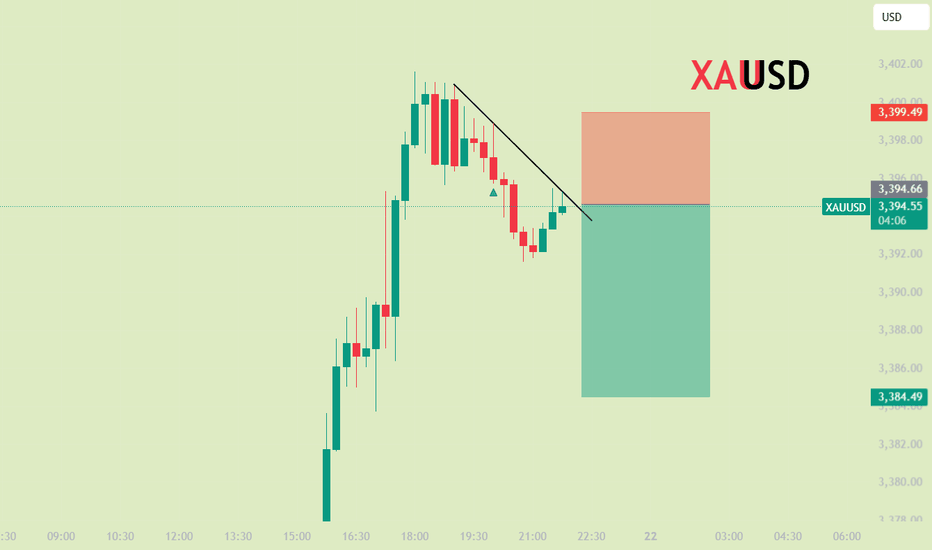

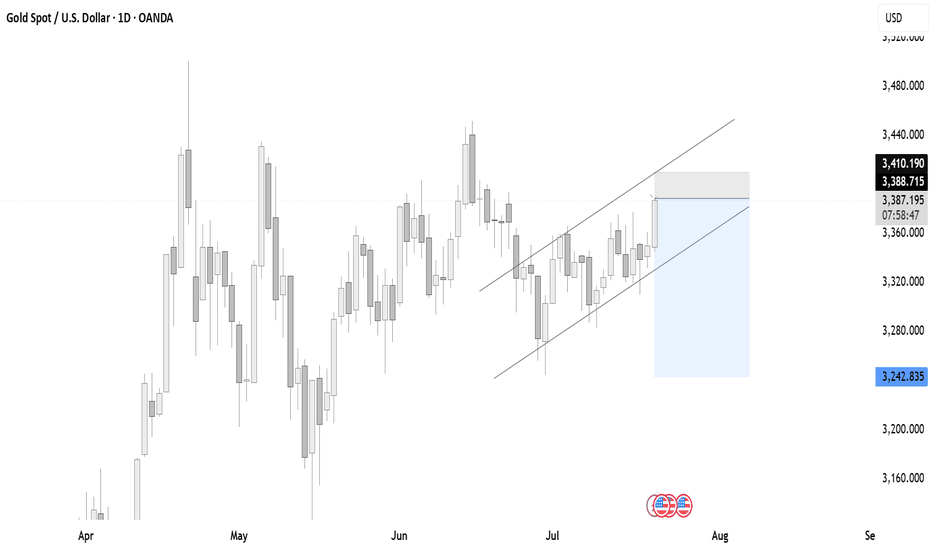

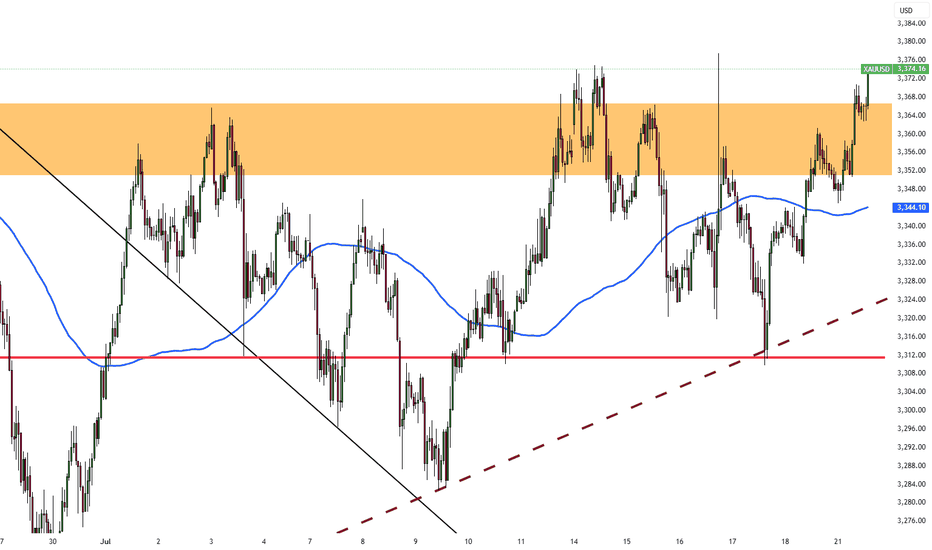

XAUUSD – Strong bullish structure, buyers in control!Gold is trading within a well-defined ascending channel, with each higher low being consistently respected – indicating strong buying pressure. The recent move broke through a fair value gap (FVG) and is approaching short-term resistance. High-probability scenario: a pullback toward the rising trendline, followed by a strong rebound aiming for the previous highs.

RSI remains in a positive zone, supporting the bullish bias. If the trendline support holds, the next target is the upper resistance area.

Supporting news: The US dollar has stalled after a sharp rally, while persistent inflation concerns and renewed hopes for a mild Fed rate cut are boosting gold’s appeal.

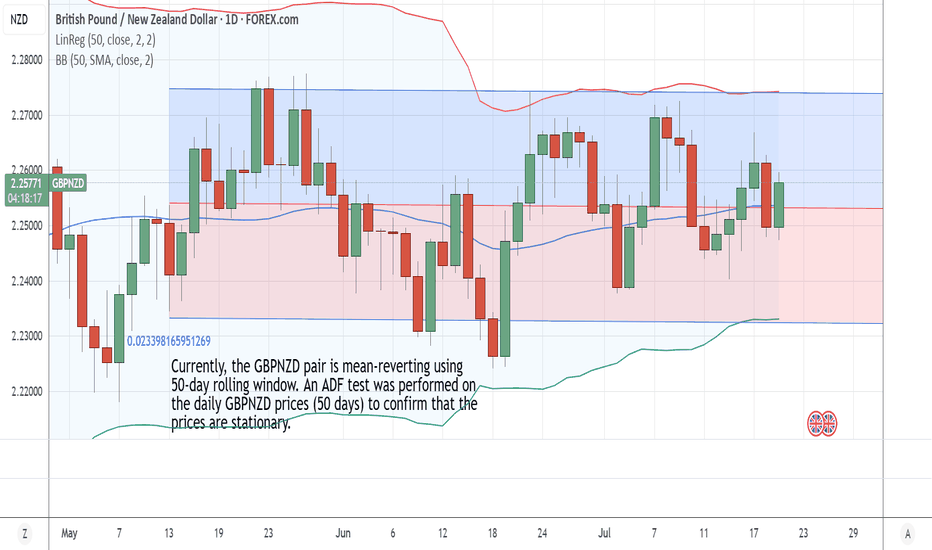

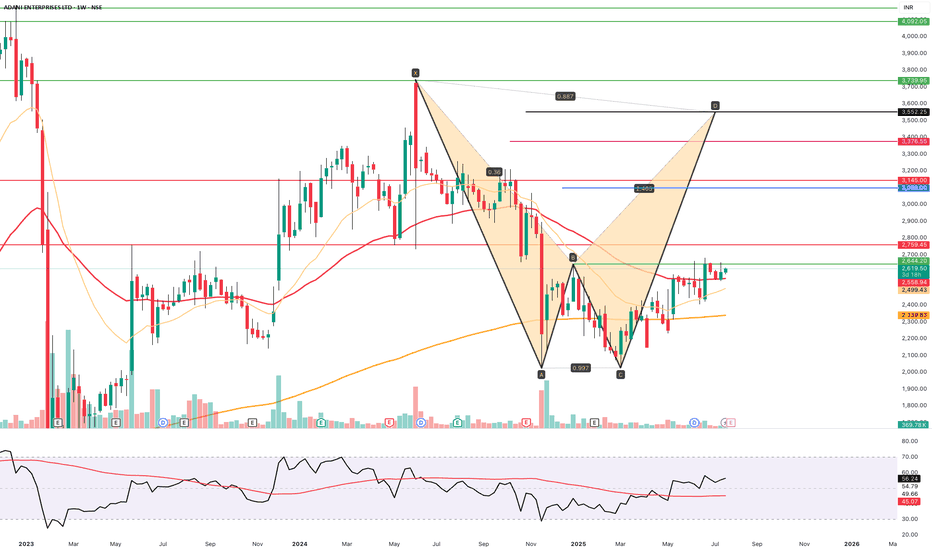

Harmonic Patterns

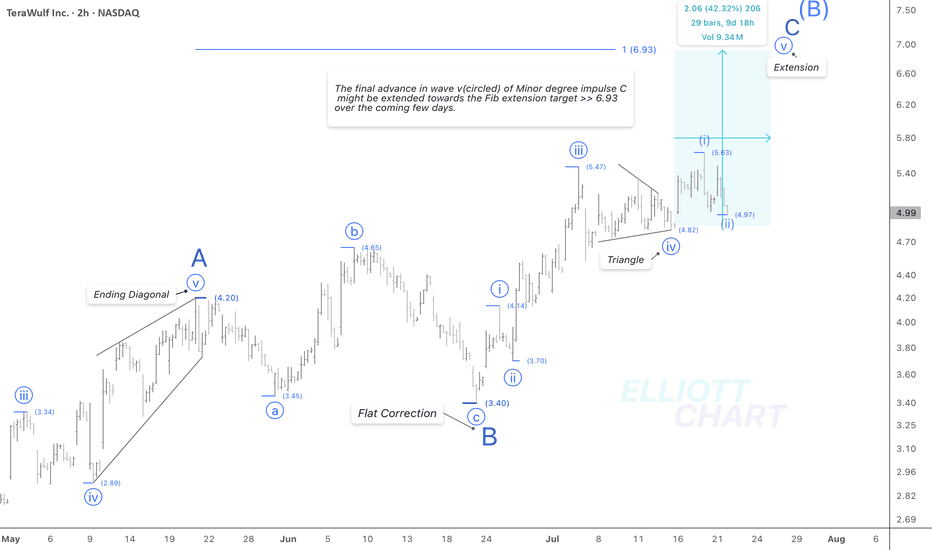

WULF / 2hThere is no change in the NASDAQ:WULF 's analysis; it might extend its final advance in an impulsive extension of wave v(circled) of the ongoing Minor degree wave C, in which the first and second subdivisions were done. An impulsive 3rd wave is anticipated.

Trend Analysis >> After completion of the Minor degree wave C, the countertrend advance of Intermediate degree wave (B), which has developed since April 9, will probably change to decline in the same degree wave (C) in the coming few days! And it'll likely last until the end of the year!!

$Crypto $Stocks CRYPTOCAP:BTC MARKETSCOM:BITCOIN BITSTAMP:BTCUSD

#CryptoStocks #WULF #BTCMining #Bitcoin #BTC

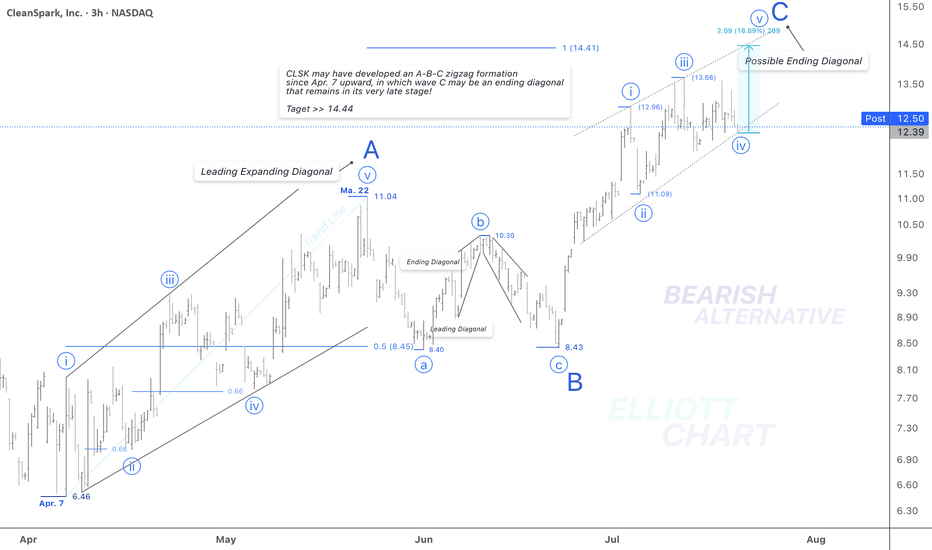

CLSK / 3hAccording to a bearish alternative in my weekly frame(not posted!), I'd analyzed the rising wave since April 7 as an A-B-C zigzag formation in correction of the Intermediate degree wave (B) >> Not shown in this 3h-frame.

Wave Analysis >> As depicted in the 3h-frame above, the Minor degree wave C of the countertrend advance in wave (B) may thoroughly develop in an ending diagonal, which remains in its very late stage, and a final advance of 17% lies ahead to conclude the ending diagonal wave C of the entire correction of wave (B).

Trend Analysis >> After completion of the possible ending diagonal as Minor degree wave C, the trend will change soon to downward in a decline of Intermediate degree wave (C).

#CryptoStocks #CLSK #BTCMining #Bitcoin #BTC

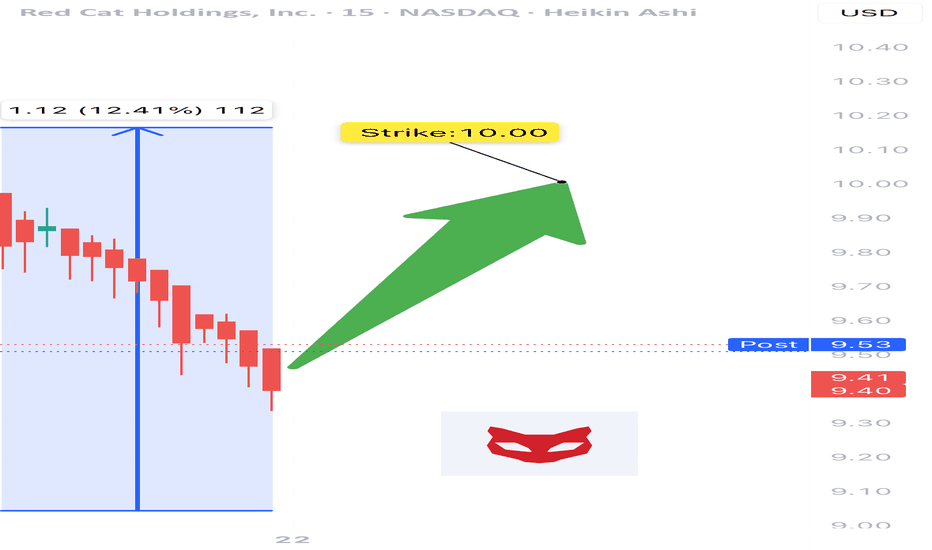

RCAT LEAP Options Play – Long-Term Bullish Setup (7/21/2025)

🚀 RCAT LEAP Options Play – Long-Term Bullish Setup (7/21/2025)

⚡ Weekly Momentum 🔼 | 💰 LEAP Premiums Cheap | ⚖️ Legal Overhang = Risk/Reward Opportunity

⸻

📊 Macro Sentiment Snapshot

📈 Weekly RSI: 60.7 – Momentum Building

📉 Monthly RSI: 38.7 – Neutral → Bullish bias forming

💤 Volatility (VIX 16.4): Low → Ideal for long-dated call buying

🔍 Call/Put OI Ratio: 1.00 → Institutional indecision, but no distribution

⸻

🎯 TRADE IDEA – RCAT $10 LEAP CALL

💥 Direction: Long

🧾 Strike: $10.00 Call

📆 Expiry: Jan 15, 2027 (543 days out)

💵 Entry: $5.20

🛑 Stop: $3.50

🎯 Target: $15.00

📈 Confidence: 65%

⏰ Entry Time: Market Open

⸻

📎 Why This Trade?

✅ Long runway = low decay + big upside

✅ Premiums cheap due to low implied vol

⚠️ Risk: Ongoing litigation = short-term turbulence

🧠 Play the momentum, but stay alert for fundamental headlines

⸻

📊 TRADE_DETAILS JSON

{

"instrument": "RCAT",

"direction": "call",

"strike": 10.00,

"expiry": "2027-01-15",

"confidence": 0.65,

"profit_target": 15.00,

"stop_loss": 3.50,

"size": 1,

"entry_price": 5.20,

"entry_timing": "open",

"signal_publish_time": "2025-07-21 14:38:56 UTC-04:00"

}

⸻

🔥 #RCAT #LEAPOptions #BullishSetup #MomentumTrade #OptionsStrategy #LongTermPlay #CheapVolatility #SmallCapMomentum

📌 Screenshot this, log it, and track it. You’re early. 🎯

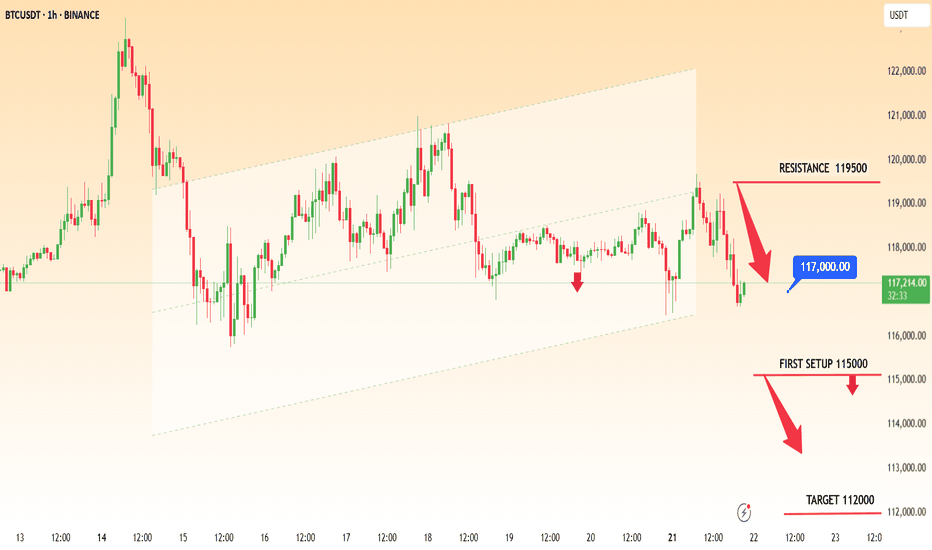

BTCUSDT BEARISH LONG CHART ANALYSIS📉 BTCUSDT – Bearish Setup in Play (1H)

Bitcoin faces rejection near 119500 resistance and is currently trading around 117000. If price breaks below 115000, bearish momentum may extend toward the 112000 target zone.

🔸 Resistance: 119500

🔸 Support Zone: 115000

🔸 Bearish Target: 112000

Structure remains weak unless buyers reclaim 119500. Watch price action closely.

---

📌 This analysis is for educational purposes only. Trade safe and manage risk properly.

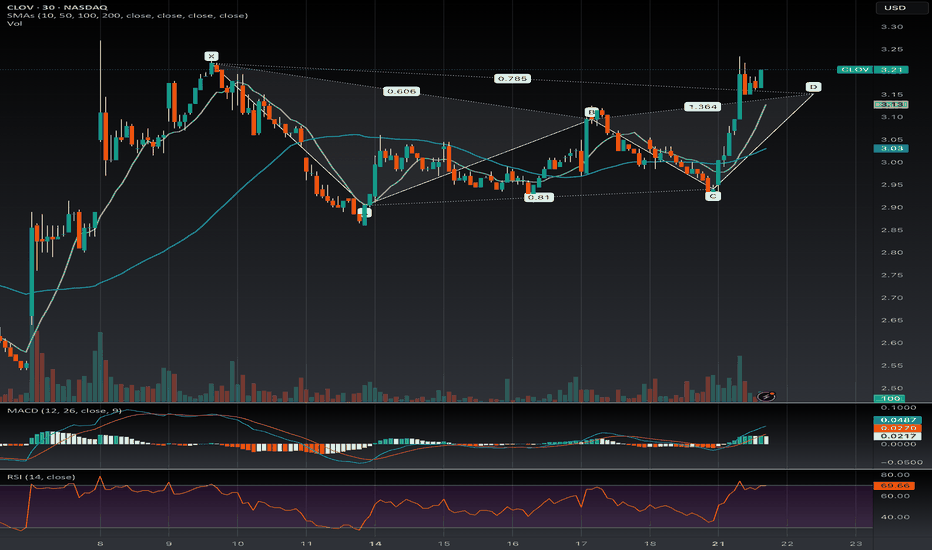

$CLOV Short Term Bearish Gartley NASDAQ:CLOV is forming a Bearish Gartley pattern with the D point projected at $3.10, nearing a potential reversal as of Monday, July 21, 2025. The RSI at 68.46 is close to overbought territory, adding support to the possibility of a bearish move if confirmed below $3.10. Keep an eye on a break below $3.10 with increased volume.

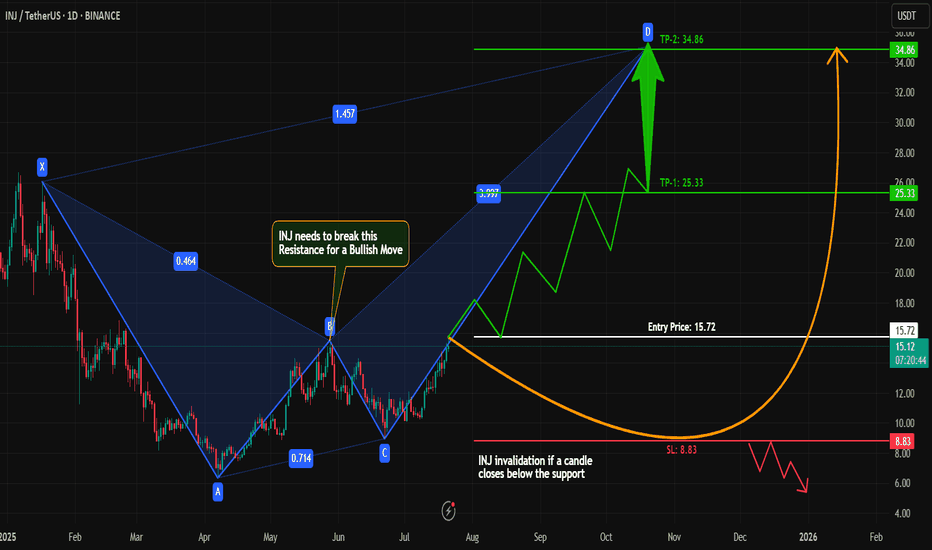

INJ Bullish Harmonic Pattern Setup – Breakout Loading?Hey traders! 👋

#INJ is forming a classic bullish harmonic pattern on the 1D timeframe, and what’s exciting is — no bearish divergence or rejection signals yet!

🔍 Key Technical:

Currently respecting the harmonic structure perfectly

B Point at $16 is acting as a major resistance

No bearish signs = bullish bias stays valid

💡 Trade Idea:

We’re watching closely for a clean breakout and retest of the $16 level (also the B point).

📌 On successful retest, this could trigger a strong long entry with a favorable risk-to-reward ratio.

🎯 Targets and stop-losses should be managed as per harmonic structure levels and price action.

📢 Let me know in the comments if you're tracking #INJ too!

🗨️ Drop your charts and analysis below — let’s discuss!

🔥 Don't forget to like, follow, and share if you found this helpful. Let’s grow together 💪

#INJ #HarmonicPattern #CryptoTrading #Altcoins #BreakoutSetup #TradingView #TechnicalAnalysis #BullishSetup #ChartAnalysis

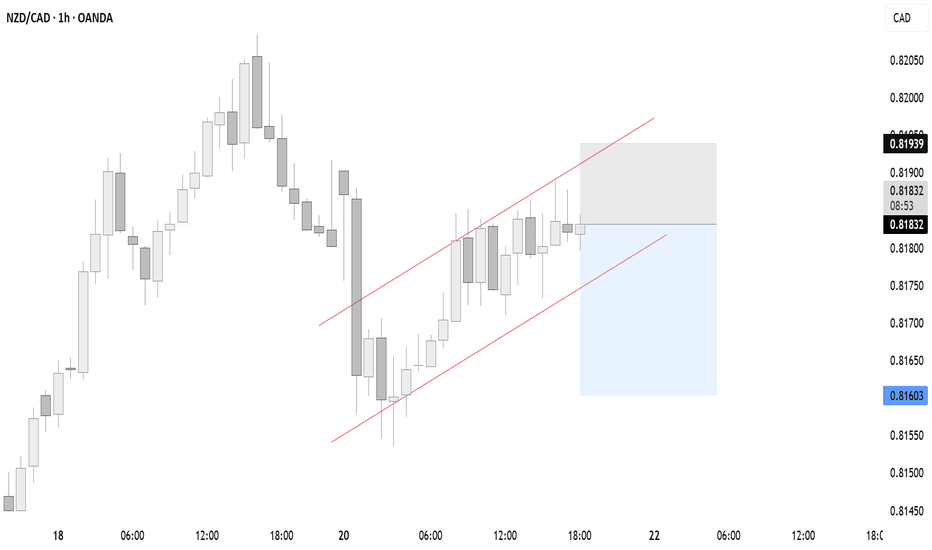

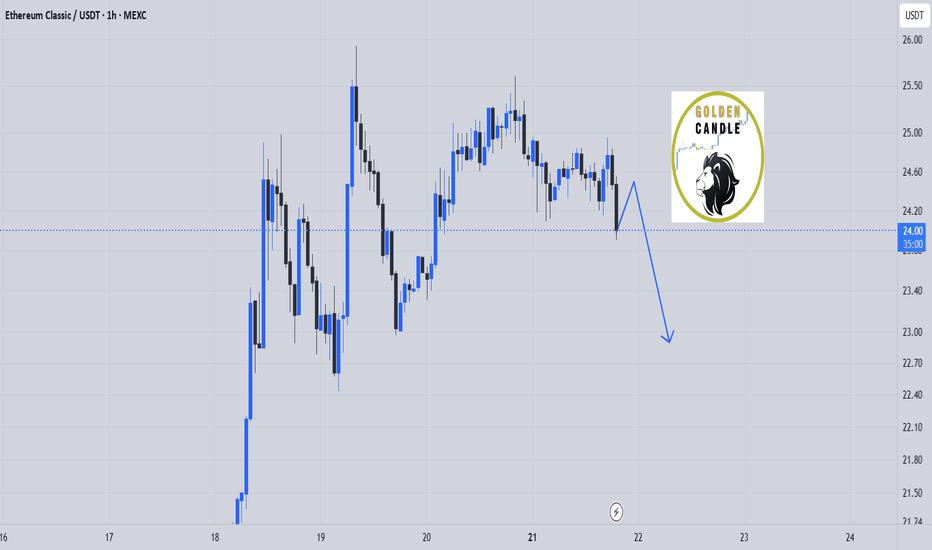

etc sell shortterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

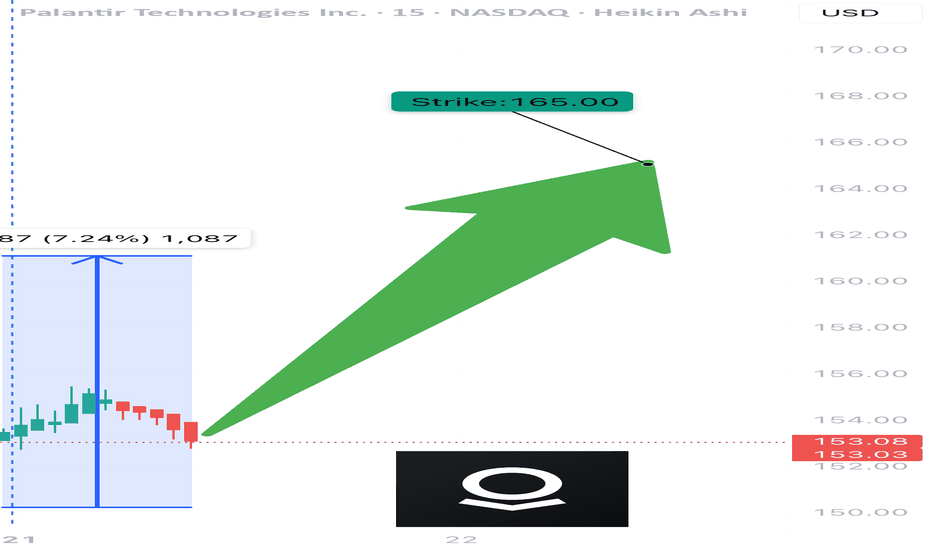

PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025

🔥 NASDAQ:PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025 🔥

Bullish Momentum + Strong Options Flow = Prime Setup 📈

⸻

📊 TRADE SETUP

🎯 Instrument: NASDAQ:PLTR

📈 Direction: CALL (LONG)

💵 Strike Price: $165.00

🟢 Entry Price: $0.59

🛑 Stop Loss: $0.30 (50% risk cap)

🎯 Profit Target: $1.18 (2x reward)

📅 Expiry: July 25, 2025 (Weekly)

📏 Size: 1 contract

💪 Confidence: 75%

⏰ Entry Timing: Market Open

⸻

📌 Why This Trade?

✅ RSI Strength: Daily RSI = 71.0 | Weekly RSI = 75.3 → Bullish continuation

✅ Weekly Range Positioning: Trading at 96.6% of weekly high

✅ Options Flow: Call/Put ratio = 1.47 — institutional bullish bias

✅ Strike Interest: Heavy OI @ $162.50 & $165.00 = strong magnet zones

🟡 VIX = 16.6 → Favorable volatility for short-term premium plays

⚠️ Volume is flat (1.0x) — no surge confirmation, so keep stops tight

⸻

🧠 Execution Plan

• Open position at the bell

• Mental stop at -50%, or ~$0.30

• Target 100% return = ~$1.18

• Exit ahead of Friday’s expiration unless the trade hits target early

⸻

💡 Key Levels to Watch

🔹 Resistance Zone: $155.68 – $156.59

🔹 Support Watch: Below $152 could break structure

🔹 Earnings Risk: Check calendar — volatility can spike unexpectedly

⸻

🏁 Verdict

• Momentum = 🔥

• Flow = 🚀

• Volume = 😐

➡️ Net Bias: MODERATE BULLISH — Risk-managed call with solid R:R

⸻

NASDAQ:PLTR Call @ $165 — Entry $0.59 → Risk $0.30 → Target $1.18 💥

Clean setup for disciplined bulls. Don’t overstay. Ride momentum. 🎯

⸻

#PLTR #OptionsTrading #WeeklyOptions #MomentumPlay #CallOptions #FlowTrade #TradingView #StockSignals #TradeSetup #RiskReward #SwingTrade #SmartMoneyFlow

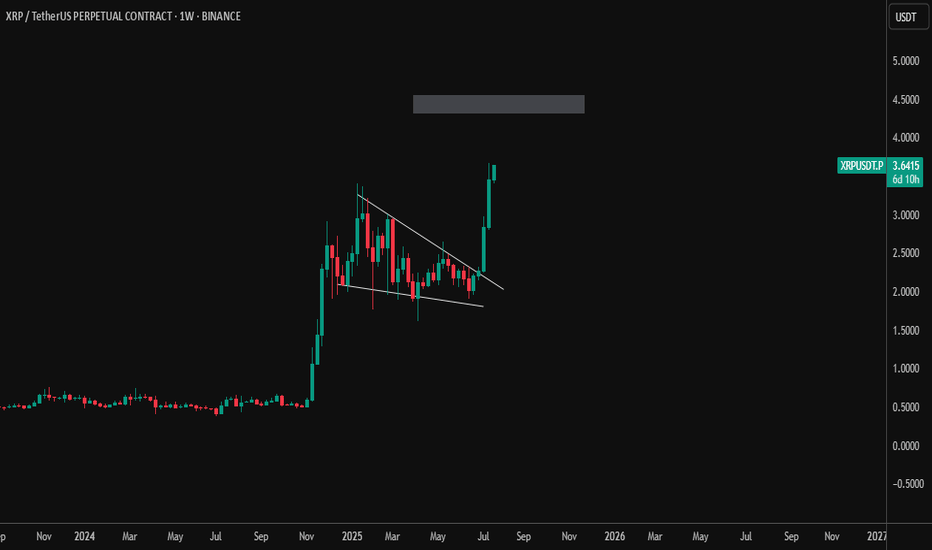

#XRPUSDT – Massive Breakout from Bullish Pennant | Eyeing $4.80+XRP has exploded out of a multi-month bullish pennant formation on the weekly timeframe, confirming a strong continuation pattern after a period of consolidation.

🔹 Key Technical Insights:

✅ Bullish pennant structure formed after a parabolic run

✅ Strong breakout candle with volume confirmation

🔼 Price now testing $3.60+ area

🎯 Target zone next: $4.80–$5.00, aligned with previous price inefficiencies and psychological resistance

📌 Why This Matters:

XRP is showing one of the cleanest technical breakouts among large-cap altcoins

Weekly breakout from consolidation = high probability continuation

Ideal for swing traders looking for momentum plays

As long as the breakout structure holds, XRP could continue its rally toward the upper target range.

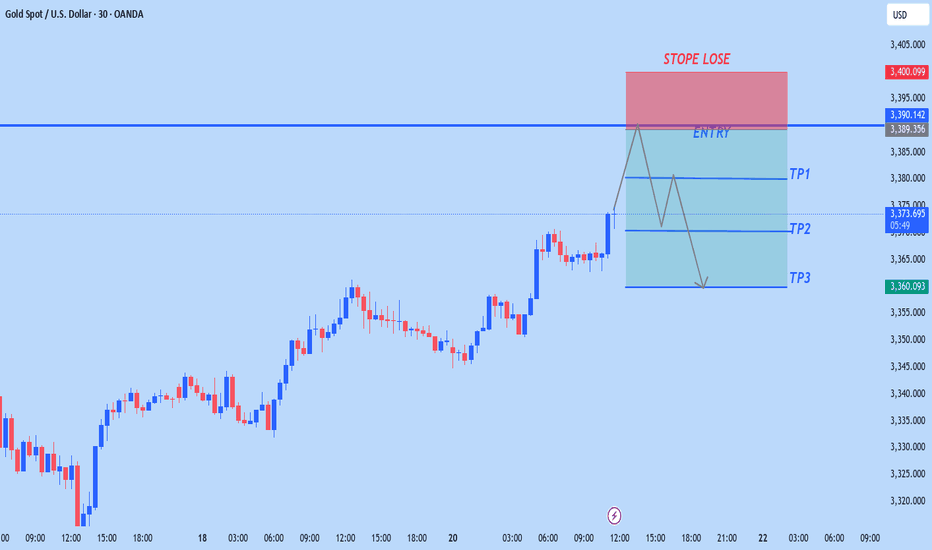

Gold Nears $3,350 as Tariff Risks PersistGold rose to around $3,350 per ounce on Monday, extending its gains for a second session amid concerns over Trump’s tariff strategy. Commerce Secretary Howard Lutnick said a deal with the EU is likely but confirmed the August 1 tariff deadline. He also suggested smaller countries could face at least a 10% tariff, with some rates reaching 40%. Strong US data last week reduced expectations for an immediate Fed rate cut, capping gold’s gains. Markets now await comments from Fed Chair Powell and Governor Bowman for policy signals.

Gold faces resistance at 3380, with additional barriers at 3400 and 3430. Support levels are positioned at 3330, followed by 3295 and extending down to 3250.