Investment

Portfolio Update Aug 20 2025I sold all ORCL stocks yesterday as I see the market topped. Big tech companies are retracing now, so this might be the peak for now.

We have Jackson Hole symposium in the upcoming days which may lead to policy changes. We also waiting to see tariff effect in the 3rd quarter earnings. Plus Ukraine war updates.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

S&P500: Losing Momentum !I see the rally comes to end, the recent upside move has no momentum. The stocks need a new catalysts to continue, but I do not think this to happen. I suggest that US500 to go down in the next 30 days or so.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

Analysis for the next weekHello traders.

The market is going to open tonight, are you ready for the next week??

The gold is falling like a crazy from the last week. Gold can fly from 3327 - 3301. Next week will be bullish. Gold can touch 3413 next week.

Kindly share your thoughts, where will be the next move for gold according to your analysis??

CRCL on the Edge: Bearish Play Loading… 📉 CRCL Weekly Options Alert (Aug 12, 2025)**

**Bias:** ⚠ **Neutral → Bearish** — Weak volume + bearish weekly RSI

📊 **Quick Stats:**

* **Daily RSI:** 40.8 ↗ (bullish divergence from oversold)

* **Weekly RSI:** 58.7 ↘ (bearish drift)

* **Options Flow:** Call/Put = **1.19** → neutral

* **Volume:** 1.0× last week — no institutional conviction

* **Gamma Risk:** Moderate — 3 DTE & rising time decay

💡 **Consensus Take:**

* Lack of strong buying pressure + bearish weekly trend = higher downside risk short term.

**Trade Idea:**

* **Type:** Naked PUT

* **Strike:** \$155.00

* **Expiry:** Aug 15, 2025

* **Entry:** \$6.22

* **PT:** \$10.90 (+75%)

* **SL:** \$2.80

* **Confidence:** 68%

* **Entry Timing:** Open

⚠ **Risks:**

* Earnings news could swing price violently

* Daily RSI divergence could spark short-term bounces against your position

---

**📈 TL;DR:**

Weekly trend still weak, volume flat, options flow balanced → bearish skew.

\#CRCL #OptionsTrading #WeeklyOptions #PutOptions #OptionsFlow #StockMarket #TradingSetup #BearishTrade #TechnicalAnalysis #OptionsAlert

NLB Banka Vision: Achieving €2 B Revenue and €1 B ProfitNLB Banka stands at a pivotal moment in its journey. Guided by a bold vision set forth by its Board of Directors, the bank is primed to transform into a leading financial powerhouse across Southeastern Europe (SEE). This vision is not merely aspirational; it is rooted in a clear, actionable roadmap that leverages the synergies of mergers and acquisitions (M&A) and organic growth, even amidst a challenging macroeconomic environment. By aligning its strategic initiatives with its core strengths, NLB Banka is well-positioned to achieve its ambitious targets of €2.2 billion in revenue and €1 billion in profit.

The Current Landscape

As of today, NLB Banka operates in a market characterized by both opportunities and challenges. While the SEE region offers significant growth potential due to underpenetrated financial markets, the current economic environment presents hurdles such as declining interest rates and inflationary pressures. The growth of the bank’s loan portfolio has been a bright spot, but it has faced challenges in fully offsetting the compression in net interest margins.

Nevertheless, NLB Banka's resilience and adaptability are evident. Its robust digital transformation initiatives, enhanced risk management frameworks, and customer-centric approach have provided a solid foundation to capitalize on growth opportunities. The Board recognizes that achieving its revenue and profit targets requires not only sustaining the current momentum but also scaling its operations strategically.

The Strategic Roadmap

To achieve €2.2 billion in revenue and €1 billion in profit, the Board has outlined a three-pronged strategy:

1. Accelerated Growth through M&A

The SEE region remains fragmented, with numerous mid-sized banks and financial institutions operating across borders. NLB Banka sees this as an opportunity to establish itself as a consolidator in the region. By acquiring strategically aligned banks and integrating their operations seamlessly, NLB Banka can expand its market share, customer base, and product offerings.

Target Markets: Focused acquisitions in high-potential markets such as Serbia, Croatia, and North Macedonia.

Synergies: Realizing cost efficiencies through operational integration and leveraging economies of scale.

Cross-Selling: Expanding the reach of its digital platforms and diversified product portfolio to acquired customer bases.

The successful execution of these M&A activities will enable NLB Banka to accelerate revenue growth while creating a strong competitive moat in the SEE region.

2. Organic Growth Through Innovation and Customer Focus

Organic growth remains a cornerstone of the bank’s strategy. By deepening relationships with existing customers and attracting new ones, NLB Banka aims to drive sustainable growth.

Digital Transformation: Continued investment in cutting-edge digital banking solutions to enhance customer experience and operational efficiency.

SME and Retail Expansion: Growing its SME and retail loan portfolios in underbanked areas of SEE.

Green and Sustainable Financing: Aligning with global trends by offering products such as green bonds and sustainable investment options, catering to environmentally conscious customers and businesses.

Customer-Centric Approach: Leveraging data analytics to personalize product offerings and improve customer retention.

3. Operational Excellence and Cost Optimization

Achieving the profit target of €1 billion requires more than just revenue growth; it demands a relentless focus on operational efficiency.

Streamlined Processes: Continued simplification of internal workflows to reduce costs.

Automation and AI: Using advanced technologies to enhance decision-making and automate routine operations.

Cost Synergies from M&A: Realizing savings through shared resources and consolidated systems.

Overcoming Challenges

The Board is acutely aware of the challenges that lie ahead. Declining interest rates, inflationary pressures, and regulatory hurdles require proactive measures to mitigate risks. NLB Banka’s strong capital position and risk management expertise will play a pivotal role in navigating these challenges. Additionally, the diversification of revenue streams—including fee income from wealth management, insurance, and payments—will further insulate the bank from macroeconomic volatility.

The Vision Realized

By 2028, NLB Banka envisions itself as the undisputed leader in SEE banking, with a robust footprint across the region. The successful execution of its M&A and organic growth strategies will not only drive financial performance but also position the bank as a key partner in the economic development of the SEE region.

At €2.2 billion in revenue and €1 billion in profit, NLB Banka will have proven that a clear vision, combined with strategic execution and operational excellence, can overcome even the most challenging of economic landscapes. This is not just a story of growth; it is a testament to the resilience, innovation, and leadership that define NLB Banka.

Analysis for the CPI News

Good Morning Traders,

Here is my analysis for the CPI News, as you seen the waterfall of gold, price has filled the FVG according to the D1 time frame, there is SSL, the price can hit the SSL and can fly during the news impact, here is our trade entry, Stop loss and Target.

Good Luck Mates!!

SHOP Bulls Are Back!

**SHOP Bulls Are Back! \$128 Calls Flash 80% Confidence Ahead of Earnings 🚀**

---

### 📋 **Post Body (TradingView Viral Format):**

**SHOP Weekly Options Alert — Aug 8 Expiry 💥**

📈 **Momentum Check:**

* RSI (Daily/Weekly): 🔼 Rising

* Call/Put Ratio: **1.35** (Bullish)

* Volume: Confirmed Institutional Support

* Confidence Level: **80%**

---

📊 **Recommended Trade:**

* **Type:** Buy Call

* **Strike:** \$128

* **Entry:** \$5.70

* **Stop Loss:** \$2.85

* **Targets:** 🎯 \$8.55 / 💰 \$11.40

* **Expiry:** Aug 8, 2025

* **Entry Timing:** Market Open

---

⚠️ **Key Risk:**

Major earnings event approaching — **exit before earnings** if holding through volatility isn’t part of your plan. Position sizing is **crucial**.

---

💡 **Strategy Insight:**

Strong consensus across models (Grok, Gemini, Claude, Llama, DeepSeek) aligns on bullish bias. This is a **premium setup** — watch for confirmation early in the week.

---

📦 **Trade JSON (for automation nerds):**

```json

{

"instrument": "SHOP",

"direction": "call",

"strike": 128.00,

"expiry": "2025-08-08",

"confidence": 0.80,

"profit_target": 8.55,

"stop_loss": 2.85,

"size": 1,

"entry_price": 5.70,

"entry_timing": "open",

"signal_publish_time": "2025-08-05 07:05:45 UTC-04:00"

}

```

---

### 🏷️ **Recommended Tags (TradingView Style):**

`#SHOP #OptionsTrading #WeeklyOptions #CallOptions #SHOPStock #BullishBreakout #TechnicalAnalysis #EarningsPlay #TradingStrategy #MomentumTrade #RSI #VolumeAnalysis #SmartMoney #TradingView`

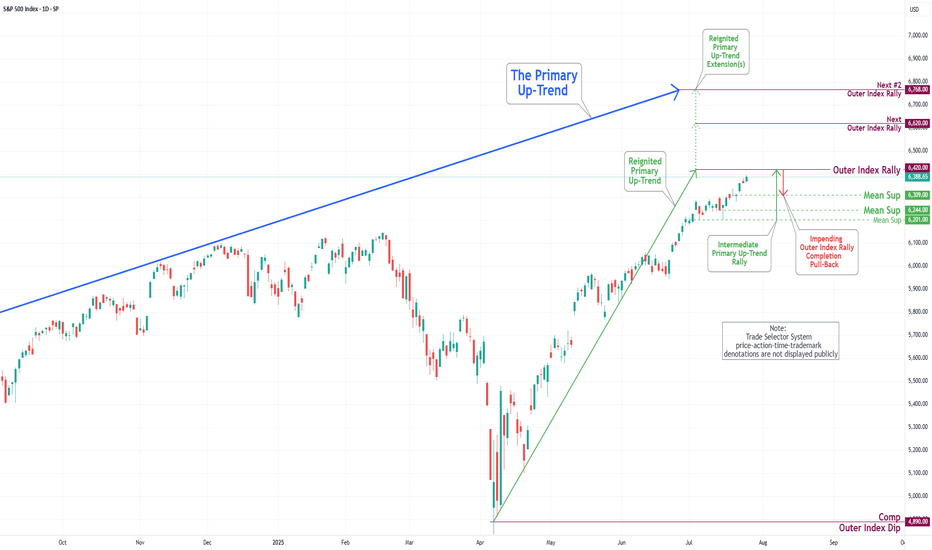

S&P 500 Daily Chart Analysis For Week of July 25, 2025Technical Analysis and Outlook:

In the trading activity observed last week, the S&P 500 Index exhibited a predominantly upward trajectory. It traded around the Key Resistance level of 6314. It successfully broke through this level, with the primary objective being to complete the Outer Index Rally at 6420, as outlined in the previous week's Daily Chart Analysis.

It is crucial to acknowledge that the current price movement may prompt a substantial pullback following the completion of the Outer Index Rally, with the main target identified as the Mean Support level of 6309. Following this potential downward adjustment, it is anticipated that the index will resume its upward trend, targeting a retest of the forthcoming completion of the Outer Index Rally at 6420.

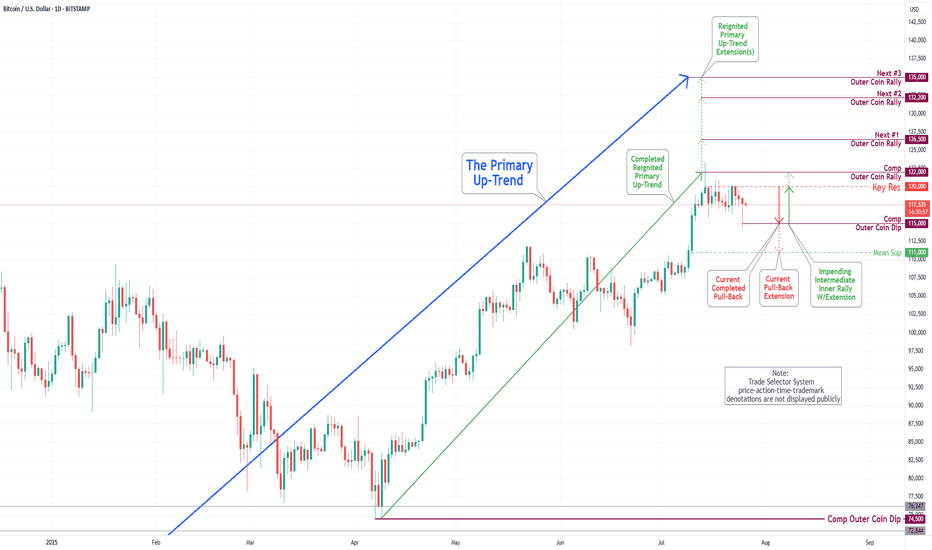

Bitcoin(BTC/USD) Daily Chart Analysis For Week of July 25, 2025Technical Analysis and Outlook:

In the trading session of the previous week, the Bitcoin market exhibited considerable volatility as it retested the Key Resistance level at 120000. On the lower end of the spectrum, the market engaged with the Mean Support levels at 117500 and 115900, culminating in the completion of the Outer Coin Dip at 115000. Currently, the coin is poised to retest the Key Resistance at 120000 once again. This anticipated rebound will necessitate a retest of the completed Outer Coin Rally at 122000. The additional target levels for the renewed Primary Up-Trend are 126500, 132200, and 135000.

$RCAT Momentum Play – Institutional Money, Defense Narrative, an

🚀 NASDAQ:RCAT Momentum Play – Institutional Money, Defense Narrative, and a Chart Screaming Higher 📈

📅 Posted: July 18, 2025

💡 Five AI models, one trade idea: follow the smart money, manage the risk.

⸻

🧠 AI Consensus Summary (Multi-Model Breakdown)

Model Bias Highlights

DeepSeek (DS) ⚠️ Bullish, Cautious +78% over 5 days. RSI 83.39. Weak volume = risk of cool-down.

Llama (LM) ✅ Moderately Bullish Above all EMAs. MACD strong. Caution: near upper Bollinger Band.

Grok (GK) 🔥 Strong Bullish Pentagon catalyst. EMAs bullish. Ignore RSI — momentum matters.

Gemini (GM) 🔥 Strong Bullish Institutional buying. Clean breakout path to $15.00.

Claude (CD) ⚠️ Modestly Bullish Overbought but structurally sound. Supports small, well-managed long.

⸻

🔍 Trade Setup – RCAT LONG

🎯 Entry Price: $12.15 (Market open)

💰 Take Profit: $15.00

🛑 Stop Loss: $10.80

📊 Position Size: 166 shares

⚖️ Risk Amount: ~$200 on $10,000 account

📆 Max Hold Time: 3–4 weeks

📈 Confidence Level: 80%

📌 Entry Timing: Open (or first pullback toward 12.00 if gapping)

⸻

🧭 Why It Works

• ✅ Narrative Power: Pentagon spending = sector tailwind

• ✅ Institutional Flow: Smart money is already positioned

• ✅ EMA Alignment: Above 10/50/200 on most timeframes

• ⚠️ RSI Hot Zone: Manage risk — but this can stay hot longer than expected

⸻

📌 Levels to Watch

• 📉 Support: $11.50 short-term; $10.80 technical invalidation

• 📈 Resistance: $13.20 (minor) → $15.00 (major target)

⸻

⚠️ Risk Management Reminder

Don’t let green candles fool you. Overbought doesn’t mean reversal, but it does mean tighter stops and no oversizing.

Let the setup breathe — don’t chase.

⸻

📊 TRADE SNAPSHOT

{

"instrument": "RCAT",

"direction": "long",

"entry_price": 12.15,

"stop_loss": 10.80,

"take_profit": 15.00,

"size": 166,

"confidence": 0.80,

"entry_timing": "open"

}

⸻

💬 RCAT running hot — but too hot? Or just getting started?

🚀 Follow for more AI-powered trades.

🔁 Like • Share • Save for later

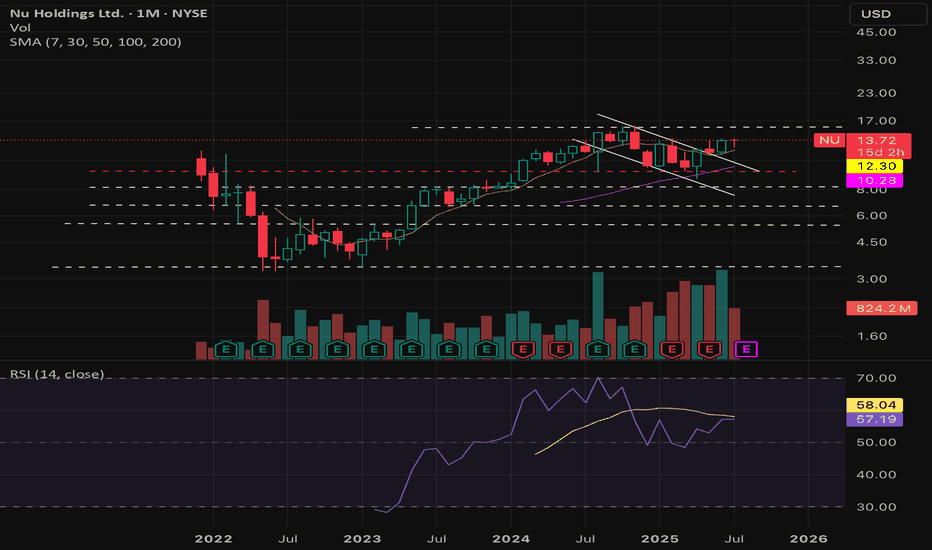

$NU : 30% CAGR for your portfolio for the next 3-5 years!- NYSE:NU is a big name in the LATAM.

- LATAM is expected to grow significantly in next decade with digitalization as the strongest theme.

- Let's talk about fundamentals:

Year | 2025| 2026| 2027 | 2028

EPS | 0.56 | 0.77 | 1.05 | 1.45

EPS growth% | 31.99% | 37.71% | 36.05% | 38.58%

For a company growing EPS at 30%+ deserves a forward p/e of 30

Base Case Stock Value ( Forward p/e = 30 ):

Year | 2025| 2026| 2027 | 2028

fair value | $16.8 | $23 | $31 | $43

Bear Case ( Forward p/e = 20 )

Year | 2025| 2026| 2027 | 2028

fair value | $11.2 | $15.4 | $21 | $29

Bull Case ( Forward p/e = 35 )

Year | 2025| 2026| 2027 | 2028

fair value | $19.6 | $26.95 | $36.75 | $50

AAPL Significant Event NASDAQ:AAPL

1. Bullish Breakout :

In the daily chart bullish breakout has been seen. If the bullish momentum is strong, the price may follow the upward.

2. Target Price : Potential target price 214

3. Risk Factors:

A. Failure to breakout the resistance 206

B. Sideways trend may be started.

C. Broader market weakness or correction

D. False Breakouts

---------------------

Note :

If you’re interested in receiving detailed technical analysis reports on your selected stocks, feel free to reach out to me. I can provide you with customized reports covering trends, key levels, momentum, patterns, and price projections to support your trading or investment decisions.

Airbnb: Proof that even stocks love to traveThe analysis of Airbnb (ABNB) stock reveals an intriguing setup following the breakout and retest of a key resistance level, which previously acted as a trendline on the daily chart. After successfully breaking above this line and confirming it with a retest, the price is now showing potential for further upside — aligning with a bullish scenario that targets the $164 area, which also coincides with the 1.0 Fibonacci level (164.12).

The current structure suggests the beginning of an upward movement after a period of consolidation, with both the 50-day and 200-day moving averages (MA50 and MA200) positioned to support further growth, reinforcing the overall bullish outlook.

Notably, trading volume has increased in line with the breakout and continued price movement, adding confidence to the scenario playing out toward the higher targets. Key Fibonacci resistance levels to watch next include 0.786 (150.37) and 1.272 (181.61), with a long-term extension target at 1.618 (203.85).

Luxury, War, and Clarity – This Is the Golden Reset.🟨 The Real Gold Era: Clarity While the World Burns 🟨

"While some bleed in the streets, others sip cocktails in the Bahamas. This is not a coincidence. This is the new world."

Right now, we live in a time like no other.

People are dying in wars they never chose.

Currencies collapse. Nations threaten each other.

And yet — capital flows, gold climbs, and the rich get richer.

🕰️ A war started long ago — and most never saw it:

2020–2022: They printed trillions. COVID shut down the world. Fiat was silently devalued.

2022–2023: Russia was cut off from SWIFT. BRICS started buying gold. The dollar was no longer untouchable.

2023–2024: Gold broke $2100… then $2400… now $3400+. Even high interest rates can't stop it.

2025: U.S. and Israel strike Iran. BRICS discuss a gold-backed currency. Trust in fiat? Gone.

The Gold Era is no longer just metaphor. It’s the new battlefield.

💣 "War is loud. Wealth is silent."

While bombs fall in the East,

✨ capital quietly moves to safe havens.

While families flee,

✨ smart money finds gold, data, and sovereign positioning.

While headlines scream chaos,

✨ traders make decisions in silence.

🌍 But here's the paradox:

We also live in a world of unmatched abundance:

You can build a brand from a phone.

You can trade gold from a beach.

You can learn SMC, AI, geopolitics — and use it to build freedom.

You can escape the system, if you understand the structure.

In this gold era, the true asset isn't just metal.

It's mental clarity. Information. Sovereignty.

The gold is you.

📉 This isn’t just about trading.

It’s about knowing where we are in the timeline of collapse and rebirth.

The markets don’t lie — they expose what’s really coming.

And those who read them… can rise while others fall.

🧠 Final note:

Not everyone survives a reset.

But those who think in structure, who lead with clarity — they don’t just survive.

They reposition.

They build.

They lead.

🟡 Welcome to the Real Gold Era.

Where charts speak louder than news.

Where truth is a position.

Where you don’t wait for safety — you create it.

—

✍️ GoldFxMinds – where structure meets truth.

📢 Disclosure: This analysis was created using TradingView charts through my Trade Nation broker integration. As part of Trade Nation’s partner program, I may receive compensation for educational content shared using their tools.