IPCA Labs looking forward to cross a few slabs..Ipca Laboratories Ltd. engages in the manufacturing, marketing, research, and development of pharmaceutical products.

Ipca Laboratories Ltd. Closing price is 1418.40. The positive aspects of the company are Companies with Zero Promoter Pledge, Company with Low Debt, Rising Net Cash Flow and Cash from Operating activity, Annual Net Profits improving for last 2 years and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are high Valuation (P.E. = 46.2), Increasing Trend in Non-Core Income, RSI indicating price weakness, Companies with growing costs YoY for long term projects and MFs decreased their shareholding last quarter.

Entry can be taken after closing above 1422 Historical Resistance in the stock will be 1479, 1524 and 1564. PEAK Historic Resistance in the stock will be 1602 and 1656. Stop loss in the stock should be maintained at Closing below 1340 or 1278s depending upon your risk taking ability.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Ipca

IPCA Laboratories – Weekly Technical Analysis 📈 IPCA Laboratories – Weekly Technical Analysis (For Study Purpose Only)

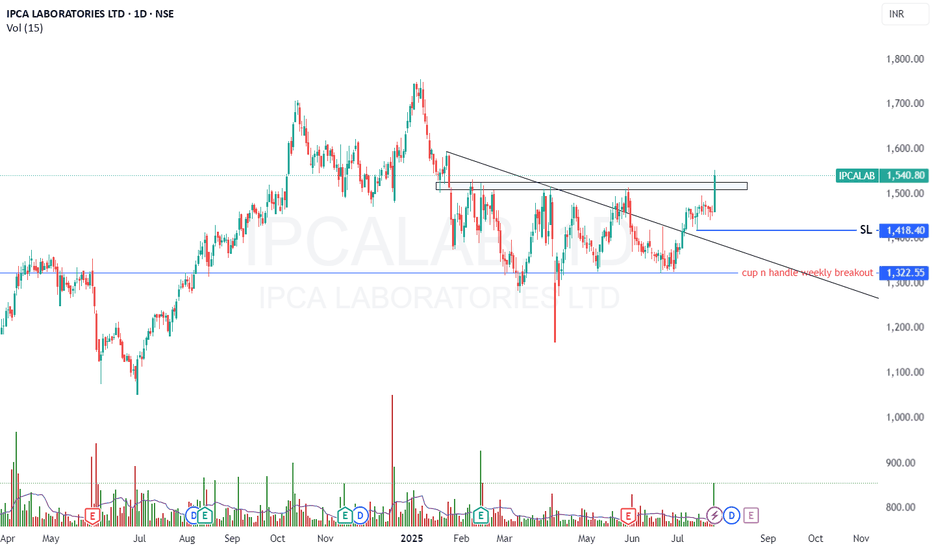

Ipca Labs has successfully completed a Cup and Handle breakout on the weekly chart, indicating a strong bullish setup after a prolonged consolidation phase.

After forming a double top and undergoing a nearly 6-month consolidation, the stock recently broke out above the neckline and range of ₹1320–₹1510, followed by a textbook retest of the breakout zone, which further strengthens the breakout's validity.

🔍 Key Technical Highlights:

✅ Pattern Formed: Weekly Cup and Handle retest and 6 month range breakout

📉 Previous Structure: Double top ➜ breakdown ➜ 6-month range consolidation

🔼 Breakout & Retest Zone: ₹1320–₹1510

✅ Retest Completed: Confirmed on weekly chart with supportive volume and price stability

🎯 Upside Targets:

Short-term: ₹1600

Medium-term: ₹1700

Long-term: New All-Time High (above ₹1750+)

🛑 Risk Management:

Stop-Loss: ₹1480 or (below retest zone)

📊 Supporting Indicators:

RSI trending upward, currently above 60 (bullish zone)

MACD crossover confirms positive momentum

Volume confirms strength during breakout

📌 Disclaimer: This analysis is for educational and study purposes only. Not a buy/sell recommendation.

Can IPCA Break the trend?Ipca Laboratories Ltd. engages in the manufacturing, marketing, research, and development of pharmaceutical products. Its products include Hydroxychloroquine Sulphate, Artemether and Lumefantrine and Acceclofenac and its combinations. The Company has 18 manufacturing units in India manufacturing API's and formulations for the world market.

Ipca Laboratories Ltd CMP 1220.75. The positive aspects of the company are Mutual Funds Increased Shareholding in Past Month, Company with Low Debt, Company with Zero Promoter Pledge and FII / FPI or Institutions increasing their shareholding. The Negative aspects of the company are High PE (PE=56.6), MFs decreased their shareholding last quarter, Declining Net Cash Flow : Companies not able to generate net cash and De-growth in Revenue, Profits and Operating Profit Margin in recent results.

Entry can be taken after closing above 1225. Targets in the stock will be 1252 and 1294. The long-term target in the stock will be 1328 and 1357. Stop loss in the stock should be maintained at Closing below 1136.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

IPCALAB Low Risk Big Profit IdeaAs per my analysis, 707 level was strong resistance of NSE:IPCALAB . Now resistance has been brake and sustained above 707. My idea is to take buy entry at level of 707 with stop loss of 666 (-41 Points Risk). My expected upside target would be 766 (+59) & 966 (+259 Points).

It could be jackpot idea.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.