USD/JPY 160 is the Big Deal for 2026Even with the US Dollar showing considerable weakness in DXY and against many major currencies like the Euro or British Pound, USD/JPY is roughly flat on the year.

After coming into 2025 riding a wave of strength a dramatic sell-off developed in the first quarter of the year, with the pair plunging down for another test of the 140.00 handle. But, like the two tests before that, sellers suddenly shied away, and prices began to push-higher although it wasn't until later in the year that buyers were able to push a bullish trend.

And then, in H2 of 2025, even as USD held near lows, USD/JPY rallied and another shot of life showed up in October on the heels of Japanese elections. The pair even rallied through the December rate hike, and this sets the stage for an interesting tangle as we go into 2026.

The recently elected Japanese government was very much supported by a pro-growth economic policy that seems to run counter to rate hikes and policy tightening, but one look at Japanese government bonds highlights that we may soon be nearing a point where the BoJ has to decide whether to defend Japanese bond rates or defend the Yen. Hiking rates more aggressively could possibly slow the run in yields, but then threatens a JPY reversal, which could have some pretty considerable collateral damage. Or, taking a looser approach to policy could allow the Yen to continue to sell-off, and USD/JPY to continue to break out, which can also drive Japanese borrowing costs higher.

There's also the Finance Ministry to consider, as it's their task to monitor the currency and as we've seen multiple times in the now almost five years of USD/JPY strength, they can and will order the Bank of Japan to intervene to stem the bleeding in JPY. This doesn't necessarily 'work,' however, as we can see from the example in April of 2024, when the BoJ intervened following a test of the 160.00 handle, only for buyers to bid the pullback and drive the pair right back above the big figure just weeks later.

The example a few months later, in July, shows what the consequence can be, as another intervention hit on the morning of a below-expected CPI print, and that sent the pair spiraling lower, along with many other global risk markets. It didn't take long for the headlines to make the connection, alleging the sell-off in US equities as a repurcussion of the unwinding Japanese Yen carry trade. This helped to produce the third-highest spike in the VIX index - ever - on the morning of August 5th, 2024.

So there's not really an easy path forward here for the BoJ, or for Japanese markets in 2026. But, for now, the look is at what happens after that next test of 160.00, and whether the MoF orders the BoJ to fire a shot across the bow to try to shake speculators out of long USD/JPY positions. - js

Jpy

USDJPY is Nearing a Strong Resistance!Hey Traders,

In today’s trading session, we are monitoring USDJPY for a potential selling opportunity around the 156.200 zone.

Technically, the pair remains in a broader downtrend and is currently in a corrective move, retracing back toward the 156.20 area, which aligns with trend resistance and a key support/resistance flip. This zone has previously acted as a reaction level and now serves as a potential area for sellers to re-engage.

As long as price remains capped below this region, the prevailing bearish structure stays intact, with rallies viewed as corrective rather than impulsive.

Watching closely for price reaction and bearish confirmation around 156.200 before any continuation lower.

Trade safe,

Joe

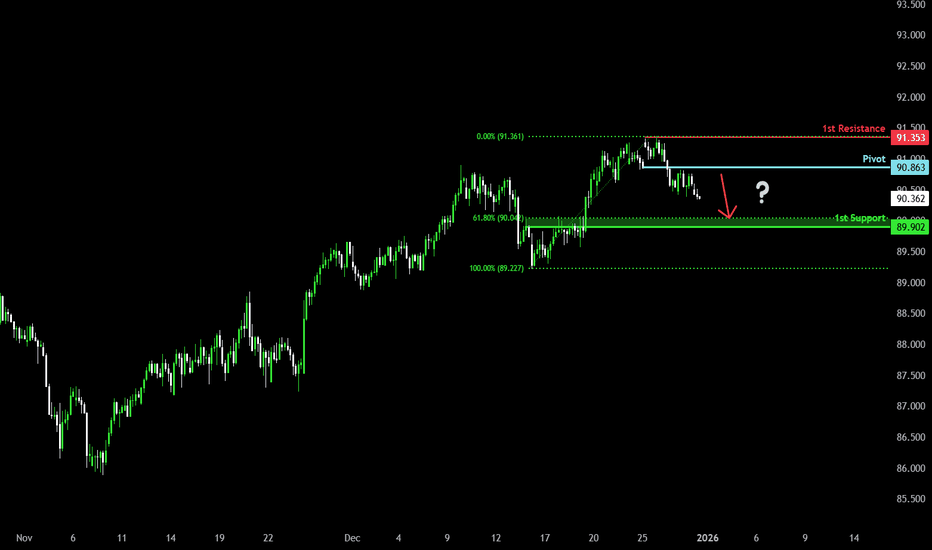

Bearish drop off?NZD/JPY has rejected off the pivot and could potentially drop to the 1st support.

Pivot: 90.86

1st Support: 89.90

1st Resistance: 91.35

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USD/JPY BULLISH CONTINUATION TREND CHART ANALYISISTechnical Breakdown

Trend Context:

Price previously moved in a rising channel → bullish structure intact on higher timeframe.

Pullback Phase:

The drop from the channel top looks like a healthy correction, not a trend reversal.

Demand Zone / Support:

Price is reacting from a strong demand + horizontal support zone (≈ 155.70–155.85).

Liquidity Sweep:

Stop-loss hunt below support suggests smart money accumulation before continuation.

Market Structure Shift (LTF):

Rejection wicks + consolidation indicate buyers stepping back in.

Trade Plan (Bullish Continuation)

Entry Zone: 155.80 – 155.85

Stop Loss: 155.60 (below demand & structure)

Target 1: 156.11

Target 2: 156.39

Confirmation Signals to Watch

Bullish engulfing / strong bullish close on 15–30 min

Break & close above 156.00

Volume expansion on upside

Bearish drop off 50% Fib resistance?USD/JPY has rejected off the pivot and could drop to the 1st support, which has been identified as an overlap support.

Pivot: 156.68

1st Support: 155.31

1st Resistance: 157.26

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish reversal off 61.8% Fib support?NZD/JPY has bounced off the support level, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could rise from this level to our take profit.

Entry: 90.05

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 89.74

Why we like it:

There is a pullback support that aligns with the 78.6% Fibonacci retracement.

Take profit: 90.49

Why we like it:

There is a pullback resistance level that is slightly below the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish bounce off?AUD/JPY has bounced off the pivot, which is a pullback support, and could rise to the 1st resistance, which aligns with the 127.2% Fibonacci extension.

Pivot: 104.26

1st Support: 103.43

1st Resistance: 105.48

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USD/JPY LONG: BoJ rate cut move. Hey everyone,

I'm buying the dip on USD/JPY at 156.10 – 156.30. The Yen had a brief moment of strength after the December 19th BoJ hike, but it’s struggling to maintain momentum as we close out 2025.

Why I’m Long (Fundamentals)

BoJ "Hawkish" Fatigue: The BoJ raised rates to 0.75% on Dec 19th.

US Resilience: While the Fed is cooling, US GDP is still printing above 4%. This "US Exceptionalism" keeps the Dollar bid on every major dip.

Fiscal Concerns: PM Takaichi’s record 122T Yen budget is raising debt concerns. This fiscal "looseness" devalues the Yen even if the central bank tries to tighten.

Year-End Flows: Liquidity is thin. I expect a relief bounce back toward the 157+ area (highlighted) as shorts cover before the 2026 open.

Technical Levels

Entry: 156.15 area

SL: 154.40 (Tight stop below the monthly swing low)

TP1: 157.50 (Recent resistance)

TP2: 158.20 (Double top target)

Bullish momentum to extend further?GBP/JPY is falling towards the support level, which serves as a pullback support that aligns with the 50% Fibonacci retracement, and could bounce from this level to our take-profit target.

Entry: 208.83

Why we like it:

There is a pullback support level that lines up with the 50% Fibonacci retracement.

Stop loss: 207.21

Why we like it:

There is an overlap support level.

Take profit: 212.84

Why we like it:

There is a resistance level at the 61.8% Fibonacci projection.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop off?AUD/JPY could rise towards the resistance level which is an overlap resistance and could reverse from this level to our take profit.

Entry: 104.69

Why we like it:

There is an overlap resistance level.

Stop loss: 105.18

Why we like it:

There is a swing high resistance level.

Take profit: 104.02

Why we like it:

There is an overlap support levle that is slightly below the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY H4 | Heading into 61.8% Fib ResistanceBased on the H4 chart analysis, we can see the price rise to our sell entry level at 156.90, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Our take profit is at 155.48, which is a pullback resistance, which is slightly below the 61.8% Fibonacci retracement.

Our stop loss is at 157.70, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish momentum to extend?USD/JPY is falling towards the pivot, which is an overlap support, and could bounce to the 1st resistance.

Pivot: 154.41

1st Support: 151.03

1st Resistance: 160.23

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Heading towards 61.8% Fib resistance?USD/JPY is rising towards the pivot point of 156.92, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 156.92

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 157.48

Why we like it:

There is a pullback resistance level

Take profit: 156.03

Why we like it:

There is an overlap support level

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDJPY Approaches Key Sell Zone at 156.60!!Hey Traders,

In today’s trading session, we’re closely watching USDJPY for a potential selling opportunity around the 156.600 zone.

From a technical perspective, the pair remains in a clear downtrend. Price is currently in a corrective rebound, retracing toward a key trendline and support/resistance confluence near 156.600—an area that could attract renewed selling pressure if the broader bearish structure holds.

This zone is critical: rejection here would reinforce the downside bias and open the door for trend continuation lower.

Waiting for confirmation and price reaction at the level before engaging.

Trade safe,

Joe

Bearish reversal off pullback resistance?NZD/JPY is reacting off the resistance level, which is a pullback resistance and could drop from this level to our take profit.

Entry: 90.97

Why we like it:

There is a pullback resistance level.

Stop loss: 91.22

Why we like it:

There is a pullback resistance level.

Take profit: 90.62

Why we like it:

There is a swing low support

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Elite | USDJPY | 1H – Liquidity Grab & Range Rejection SetupFX:USDJPY

After consolidating near the lower range, price aggressively expanded upward, taking out sell-side liquidity and tapping into a premium resistance zone. Such moves often attract profit-taking and corrective pullbacks, especially when the impulsive leg reaches prior distribution levels.

Key Scenarios

❌ Bearish Case 📉

Rejection from the current resistance zone could trigger a corrective move back toward the prior demand base.

🎯 Target 1: 155.80

🎯 Target 2: 155.40

✅ Bullish Case 🚀

A clean acceptance and strong close above 157.80 invalidates the bearish pullback and opens continuation toward higher highs.

🎯 Upside Target: 158.40+

Current Levels to Watch

Resistance 🔴: 157.70 – 158.40

Support 🟢: 155.80 – 155.40

⚠️ Disclaimer: This analysis is for educational purposes only. It is not financial advice.

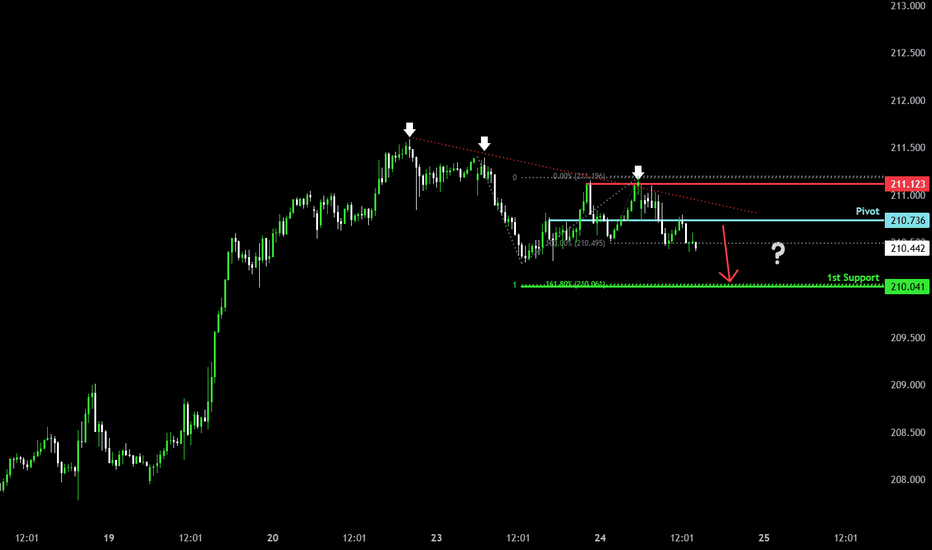

Bearish drop?GBP/JPY has rejected off the pivot and could drop to the 1st support.

Pivot: 210.73

1st Support: 210.04

1st Resistance: 211.12

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GBPJPY H4 | Bullish ContinuationMomentum: Bullish

The price is falling towards the buy entry, which aligns with the 61.8% Fibonacci retracement.

Buy entry: 208.72

Pullback support

61.8% Fibonacci retracement

Stop loss: 207.72

Pullback support

78.6% Fibonacci retracment

Take profit: 211.40

Swing high resistance

High Risk Investment Warning

Stratos Markets Limited (tradu.com ), Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 70% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.