Multi-Time Frame Analysis (MTF) — Explained SimplyWant to level up your trading decisions? Mastering Multi-Time Frame Analysis helps you see the market more clearly and align your trades with the bigger picture.

Here’s how to break it down:

🔹 What is MTF Analysis?

It’s the process of analyzing a chart using different time frames to understand market direction and behavior more clearly.

👉 Example: You spot a trade setup on the 15m chart, but you confirm trend and structure using the 1H and Daily charts.

🔹 Why Use It?

✅ Avoids tunnel vision

✅ Aligns your trades with the larger trend

✅ Confirms or filters out weak setups

✅ Helps you find strong support/resistance zones across time frames

🔹 The 3-Level MTF Framework

Use this to structure your chart analysis effectively:

Higher Time Frame (HTF) → Trend Direction & Key Levels

📅 (e.g., Daily or Weekly)

Mid Time Frame (MTF) → Structure & Confirmation

🕐 (e.g., 4H or 1H)

Lower Time Frame (LTF) → Entry Timing

⏱ (e.g., 15m or 5m)

🚀 If you’re not using MTF analysis, you might be missing critical market signals. Start implementing it into your strategy and notice the clarity it brings.

💬 Drop a comment if you want to see live trade examples using this method!

Learntotrade

GBPUSD LIVE TRADE AND EDUCATIONAL BREAKDOWN FOR BEGINNERS 218PIPGBP/USD holds recovery gains near 1.3350 as US Dollar loses further ground

GBP/USD is trading near 1.3350 in Wednesday’s European session, extending Tuesday's 1% rally. The pair capitalizes on renewed US Dollar sell-off even as risk sentiment turns negative. Fedspeak and trade talks remain in focus.

WEEKLY ANALYSIS FOR BITCOIN/BT/BTCBitcoin is one everyone's radar with analysts expecting another bullish run. Prices are definitely looking bullish and I'm on board with the thesis that new highs will soon be delivered, but for now I'm bearish on the next week and think you can enter on better prices.

WEEKLY ANALYSIS TO HELP YOUR TRADING: Nasdaq, NQ, NAS100A pretty accurate week from my last video analysis if I do say so myself.

This week, I'm anticipating more bullish price action, however, there's also a strong chance for an inside bar which could have price working within last week's trading range. Based on the levels discussed in this video, price has reason to try and close bullish yet again, so I'll be watching price action for entries into longs and managing my risk accordingly.

Happy Trading,

The Meditrader

EURUSD LIVE TRADE AND EDUCATIONAL BREAKDOWNEUR/USD remains offered around 1.1350

EUR/USD trades well on the defensive for the second day in a row, revisinting the mid-1.1300s on the back of the continuation of the upside impulse in the US dollar. The move followed firmer US PMI data and news indicating the White House may be considering tariff cuts on Chinese imports.

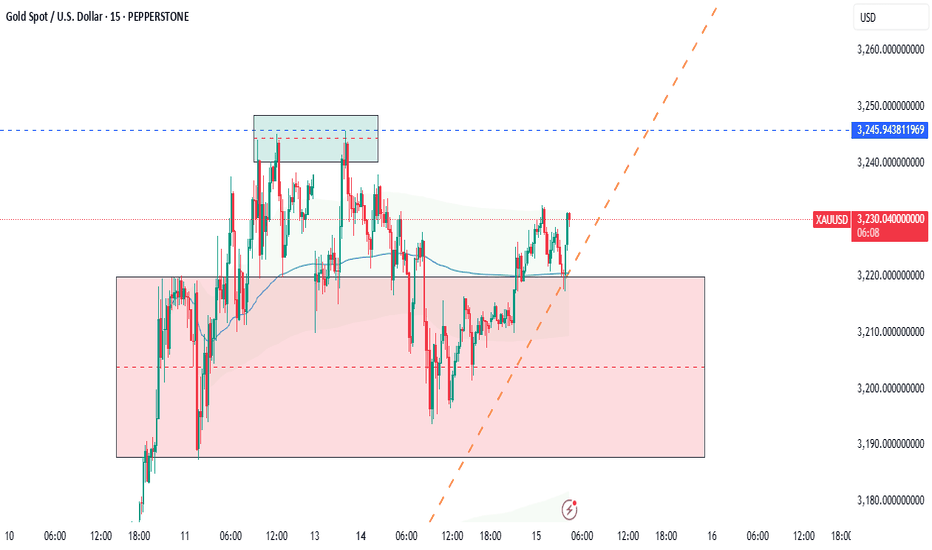

XAU LIVE TRADE AND EDUCATIONAL BREAKDOWNGold price approaches $3,300 mark amid persistent safe-haven demand

Gold price continues scaling new record highs through the Asian session on Wednesday and has now moved well within striking distance of the $3,300 round-figure mark. Persistent worries about the escalating US-China trade war and US recession fears amid the ongoing US tariff chaos continue to boost demand for gold.

GOLD LIVE TRADE AND EDUCATIONAL BREAKDOWN 18K PROFITGold price retains its positive bias above $3,200 amid US-China trade war, bearish USD

Gold price regains positive traction as US tariff uncertainty continues to underpin safe-haven assets. Bets for aggressive Fed rate cuts in 2025 keep the USD depressed and also benefit the XAU/USD pair.

EURUSD LIVE TRADE AND EDUCATIONAL BREAK DOWN SHORTEUR/USD bounces off 1.1300, Dollar turns red

After bottoming out near the 1.1300 region, EUR/USD now regains upside traction and advances to the 1.1370 area on the back of the ongoing knee-jerk in the US Dollar. Meanwhile, market participants continue to closely follow news surrounding the US-China trade war.

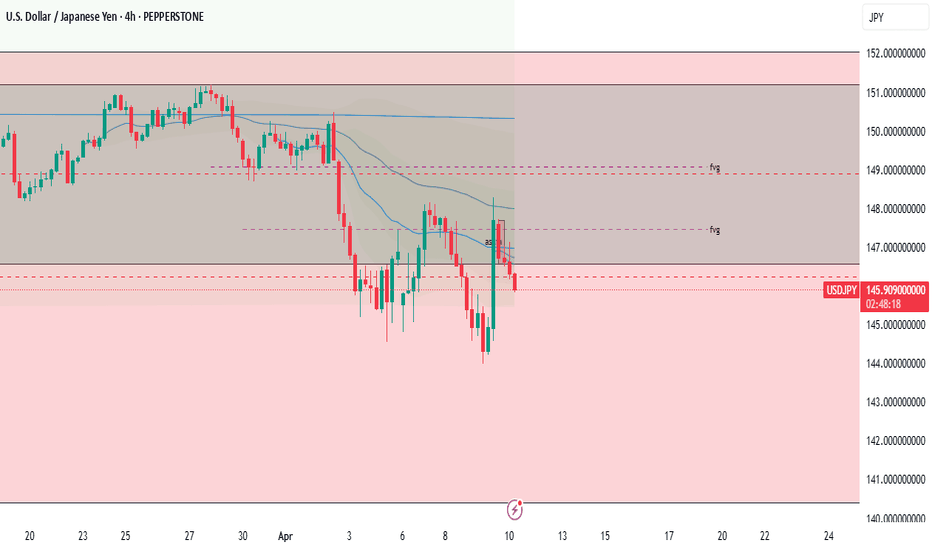

USDJPY SHORT LIVE TRADE AND EDUCATIONAL BREAKDOWNUSD/JPY tumbles below 147.00, awaits US CPI for fresh impetus

USD/JPY has come under intense selling presure and drops below 147.00 in the Asian session on Thursday. The US-China trade war escalation and the divergent BoJ-Fed policy expectations underpin the Japanese Yen and weigh heavily on the pair amid a renewed US Dollar downtick. US CPI awaited.

EURUSD LIVE TRADE EDUCATIONAL BREAK DOWNEUR/USD holds gains below 1.1000 ahead of US CPI release

EUR/USD is tirmimng gains while below 1.1000 in the European session on Thursday. The Euro gains on the German coalition deal and Trump's 90-day pause on reciprocal tariffs. Meanwhile, the US Dollar finds demand on profit-booknig ahead of the US CPI data release.

XAU QUICK SHORT TRADE LIVE TRADE AND EDUCATIONAL BREAKDOWN Gold price (XAU/USD) touches a fresh weekly top, around the $3,132-3,133 area heading into the European session as concerns about escalating US-China trade tensions continue to drive safe-haven flows. Moreover, fears that tariffs would hinder economic growth and boost inflation turn out to be another factor that benefits the precious metal's status as a hedge against rising prices. Apart from this, bets for multiple interest rate cuts by the Federal Reserve (Fed) push the non-yielding higher for the second successive day.

XAU LONG LIVE TRADE AND EDUCATIONAL BREAKDOWN Gold extends rally to $3,050 area as safe-haven flows dominate markets

Gold preserves its bullish momentum and trades near $3,050 in the second half of the day. Further escalation in the trade conflict between the US and China force markets to remain risk-averse midweek, allowing the precious metal to capitalize on safe-haven flows.

EURUSD LONG 100 PIP MOVE LIVE TRADE AND EDUCATIONAL BREAK DOWNEUR/USD trades decisively higher on the day above 1.1000 on Wednesday as the US Dollar (USD) stays under persistent selling pressure on growing fears over a recession as a result of the US trade war with China. Later in the American session, the Federal Reserve will release the minutes of the March policy meeting.

EURUSD LIVE TRADE 100 PIP MOVE EUR/USD trades decisively higher on the day above 1.1000 on Wednesday as the US Dollar (USD) stays under persistent selling pressure on growing fears over a recession as a result of the US trade war with China. Later in the American session, the Federal Reserve will release the minutes of the March policy meeting.

EURCHF LONG LIVE TRADE AND EDUCATIONAL BREAK DOWN LONGCentral Bank Policies:

The Swiss National Bank (SNB) policy decisions significantly impact the CHF. Recent SNB rate cuts are a key factor influencing the EUR/CHF pair.

Conversely, the European Central Bank (ECB) policies regarding the Eurozone also have a large impact on the EUR side of the pairing.

CADCHF SHORT LIVE TRADE AND BREAKDOWN EXPLANATION 9K PROFITThe CHF/CAD pair tells the trader how many Canadian Dollar (the quote currency) are needed to purchase one Franc Swiss (the base currency). These two economies are quite intensely linked because Canada is an important producer of gold while Switzerland is a great importer of that same commodity - a quart part of the overall commodities imported by Switzerland is gold and there is a solid tradition of gold refineries/gold mining companies in the country. Switzerland can be considered as a stable and safe country. The same accounts for its currency, the Swiss Franc (CHF). The currency is often referred to as the “safe-haven” currency, as it is a backup for investors during times of geopolitical tensions or uncertainty: it is expected to increase its value against other currencies in times of volatility.

JPY | USDJPY Weekly FOREX Forecast: Feb 10-14thThis forecast is for the upcoming week, Feb 10-14th.

The Yen has been week for an extended amount of time, underperforming against the USD. But the tide is changing over the last 6 weeks. As the USD is reacting to a HTF selling zone over the this period of time, the Yen has been getting stronger. The potential is there for the YEN to start retracing to the upside.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

123 Quick Learn Trading Tips #2: Stay Cool, Trade Smart🎯 123 Quick Learn Trading Tips #2: Stay Cool, Trade Smart

"Don't let anger empty your pockets. Trade with a cool head."

Navid Jafarian

❓ Ever get mad when you lose a game?

❓ Want to try again and win RIGHT AWAY?

Trading can feel like that, but with real money. It's easy to blame losses on things you can't control, like the news or bad luck.

✅ Truth is, everyone loses sometimes in trading. The best traders don't get angry. They learn from their mistakes and move on.💪

‼️ Don't try to "get even" with the market after a loss. That's how you lose even more!

🗝 Take charge, learn, and make the next trade better.

❗️Remember:

The best traders stay calm and focused. Just like a pro!

Top 5 Tips to Increase Your Profits in Trading

In this educational article, I will share with you very useful tips how to improve your profitability in trading the financial markets.

1. Decrease the number of financial instruments in your watch list. ⬇️

Remember that each individual instrument in your watch list requires attention. The more of them you monitor on a daily basics, the harder it is to keep focus on them.

In order to not miss early confirmation signals and triggers, it is highly recommendable to reduce the size of your watch list and pay closer attention to the remaining instruments.

2. Avoid taking too many positions. ❌

For some reason, newbie traders are convinced that they should constantly trade and keep many trading positions.

Firstly, I want to remind you that the management of an active position is a quite tedious process that requires time and attention.

Therefore, more positions are opened, more time and effort is required.

Secondly, if the newbies can not spot a good setup, they assume that they are obliged to open some positions and they start forcing the setups.

Remember, that in trading, the quality of the trading setup beats the quantity. I advise taking less trades, but the better ones.

3. Let winners run if the market is going in the desired direction. 📈

Once you caught a good trade and the market is moving where you predicted, do not let your emotions close the trade preliminary.

Try to get maximum from your trade, closing that only after the desired level is reached.

4. Open a trade after multiple confirmations.✅

Analyzing a certain setup remember, that more confirmations you spot, higher is the accuracy of the trade that you take. In order to increase your win rate, it is recommendable to wait for at least 2 confirmations.

5. Don't trade on your cellphone. 📱

A good trade always requires a sophisticated analysis that is impossible to execute on the small screen of the cellphone.

A lot of elements and nuances simply will not be noticed. For that reason, trade only from a computer with a wide screen.

Relying on these tips, you will substantially increase your profits.

Take them into the consideration and good luck to you in your trading journey.

❤️Please, support my work with like, thank you!❤️

The Hardest Part About Trading Isn't The Charts-Its Your MindWhen I first started trading, I thought the key to success was all about the strategy. If I could just figure out the right indicators or master technical analysis, I’d be unstoppable.

But the truth hit me hard. I wasn’t losing because I didn’t understand the charts—I was losing because I didn’t understand myself.

Here’s how I learned that the biggest battle in trading isn’t with the market—it’s with your own mind.

Lesson 1: Stop Obsessing Over Results

I used to get way too caught up in the outcome of every single trade. A win would make me feel on top of the world, but a loss? That would send me into a spiral. I’d overanalyze, doubt myself, and sometimes even swear I was done trading altogether.

One day, I realized I was focusing on the wrong thing. Instead of asking, “Did I win or lose?” I started asking, “Did I follow my plan?”

That simple shift changed everything for me. I started measuring success by how consistent I was, not by whether every trade was a winner. The funny thing? Once I started doing that, the wins came more naturally.

Lesson 2: Losses Aren’t Failures

I’ll never forget the trade that wiped out 30% of my account. It was gut-wrenching. I felt like I’d failed—not just as a trader, but as a person.

It took me a long time to understand that losses are part of trading. Even the best traders take hits. What separates the pros from the rest is how they handle those losses.

Now, instead of beating myself up, I treat losses as a chance to learn. Did I miss something in my analysis? Did I break my rules? Sometimes, the market just didn’t cooperate, and that’s okay.

Lesson 3: Don’t Let Emotions Run the Show

I can’t tell you how many times I’ve let emotions wreck me. Chasing losses, revenge trading, doubling down on bad positions—I’ve done it all. And every single time, it made things worse.

The biggest game-changer for me was journaling my trades. Not just the technical stuff, but how I felt during the trade.

-Was I calm or anxious?

-Was I trading because it was a good setup or because I felt like I had to?

It was eye-opening to see how much my emotions were driving my decisions. Now, if I feel frustrated or off, I don’t even touch the charts. I’d rather miss a trade than make a bad one.

My Biggest Takeaway I Learned

Trading isn’t just about the market—it’s about you. The strategies, the charts, the setups—they’re important, but they’re not enough. You need to master your mind if you want to master the market.

I’m not perfect, and I still have tough days. But every step I’ve taken to manage my emotions, stay consistent, and focus on the process has brought me closer to where I want to be.

If you’re struggling with the mental side of trading, I get it. I’ve been there. Send me a DM or check my profile—I’m happy to share what worked for me and help however I can. You don’t have to do this alone.

Kris/Mindbloome Trading

Trade What You See