ROSE/USDT: 150-200% Easy Profit Potential?BINANCE:ROSEUSDT is showing strong bullish signals on the daily chart , with a potential reversal from its long-term downward trend. Key points include a higher low formation , indicating building buyer momentum , dabble bottom pattern in 1week chart , and the EMA 500 at 0.02765 acting as a dynamic support level .

The cumulative short liquidation zone suggests trapped sellers could fuel a squeeze upward. For entry, focus on the specified ranges in the chart (around 0.028), which offer optimal buy opportunities near support.

Targets aim for 150-200% gains , with stop loss below the higher low to protect capital—these ranges are ideal for precise risk management.

⚠️Note : This signal is for spot trading only . A break above resistance with volume could ignite this move.

Ready to hunt this ROSE? Share your view!

#ROSEUSDT #CryptoTrading #TechnicalAnalysis #TradingView #Altcoins #DayTrading #MarketSignals #Altseason

Longtrade

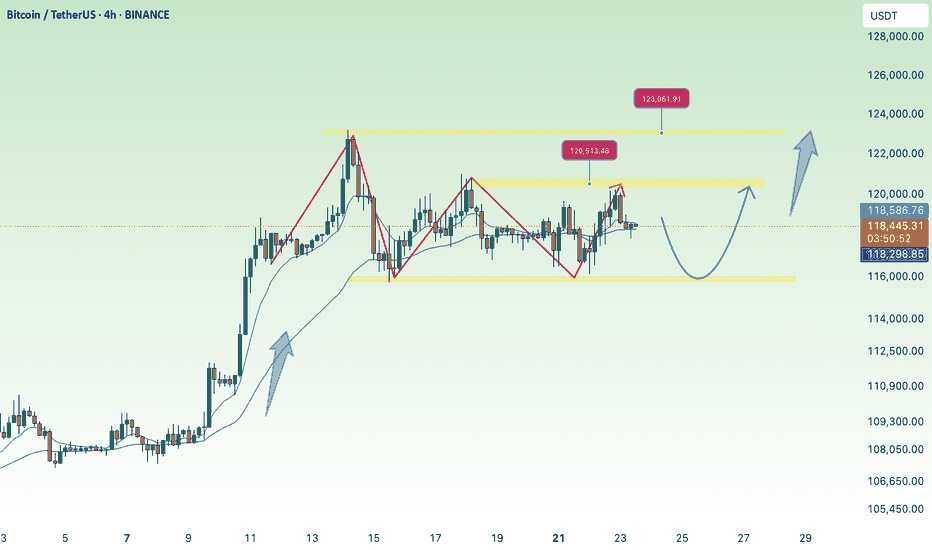

BTC recovers, maintains long-term growth💎 MIDWEEK BTC PLAN UPDATE (20/08)

BTC Technical Outlook (Daily)

Current Trend:

BTC is in a corrective phase after failing to break above the 120,000 – 120,500 zone. The price has tested the key support area around 112,000 – 113,000, where it converges with the 200 EMA and the 0.5 Fibonacci retracement.

Main Scenario:

If the 112,000 – 113,000 zone holds, BTC is likely to rebound, first targeting 116,000 – 117,500, and then 120,000 – 120,500. This will be a strong resistance area to watch.

Alternative Scenario:

If 112,000 breaks, BTC could drop deeper to the 108,000 – 109,000 zone, and potentially further down to 104,000 (Fibo 0.786).

Key Levels to Watch:

• Resistance: 116,000 – 117,500 and 120,000 – 120,500

• Support: 113,000 – 112,000 and 108,000 – 109,000

Overall Outlook:

BTC is currently at a sensitive level. If the 112k support holds, the bullish trend remains intact, but a deeper break below this zone could extend the downside risk toward 108k and lower.

Gold price accumulates above 3300 next week ✍️ NOVA hello everyone, Let's comment on gold price next week from 08/18/2025 - 08/22/2025

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) held steady in the North American session on Friday, with traders awaiting the outcome of U.S. President Donald Trump’s meeting with Russian President Vladimir Putin. In-line U.S. Retail Sales data did little to lift the Dollar, allowing the metal to remain firm around $3,340, up 0.17% on the day.

Since late Thursday, gold has been confined to a narrow $3,330–$3,350 range. Market expectations for a breakthrough at the Trump-Putin summit in Alaska remain subdued, though the White House suggested that “something has to come out of it” and emphasized that ending the war is a prerequisite before discussing business.

⭐️Personal comments NOVA:

Gold price continues to move sideways, price range 3300 - 3400. Waiting for new moves from FED on interest rate policy in September.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3353, $3384

Support: $3307, $3270

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

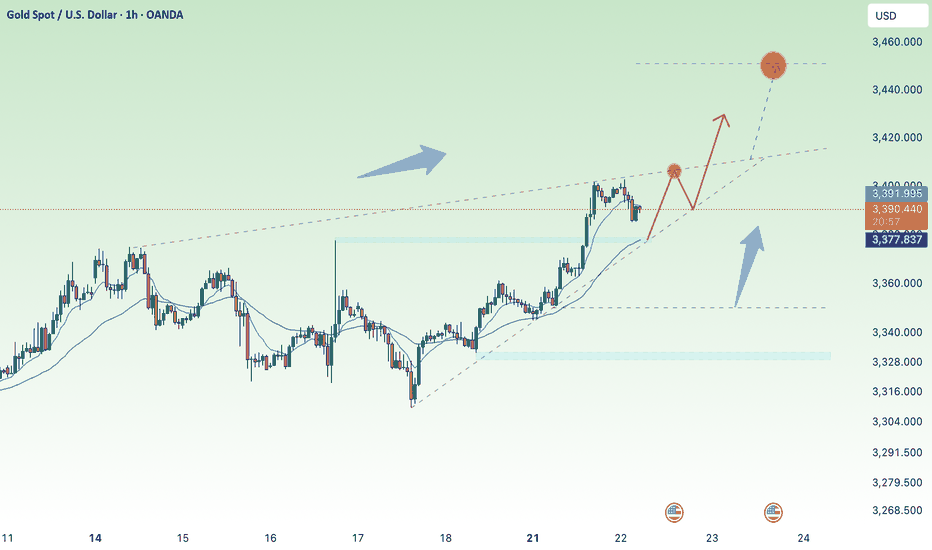

Breaking resistance - gold price continues to recover⭐️GOLDEN INFORMATION:

Gold (XAU/USD) edged up to around $3,365 in early Asian trading on Thursday, marking its third straight day of gains as a softer U.S. Dollar lent support. Market participants now turn their attention to the U.S. Producer Price Index (PPI) and weekly Initial Jobless Claims data, both due later in the day, for fresh direction.

This week’s softer U.S. inflation figures have strengthened expectations for a Federal Reserve rate cut in September and increased the likelihood of further easing before year-end. The resulting pressure on the Greenback has underpinned demand for the Dollar-denominated metal. Lower interest rates tend to reduce the opportunity cost of holding gold, making the non-yielding asset more attractive to investors.

⭐️Personal comments NOVA:

Gold price recovers in bullish pattern, still maintaining accumulation price range 3300 - 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3388- 3390 SL 3395

TP1: $3380

TP2: $3367

TP3: $3350

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3340

TP2: $3352

TP3: $3365

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

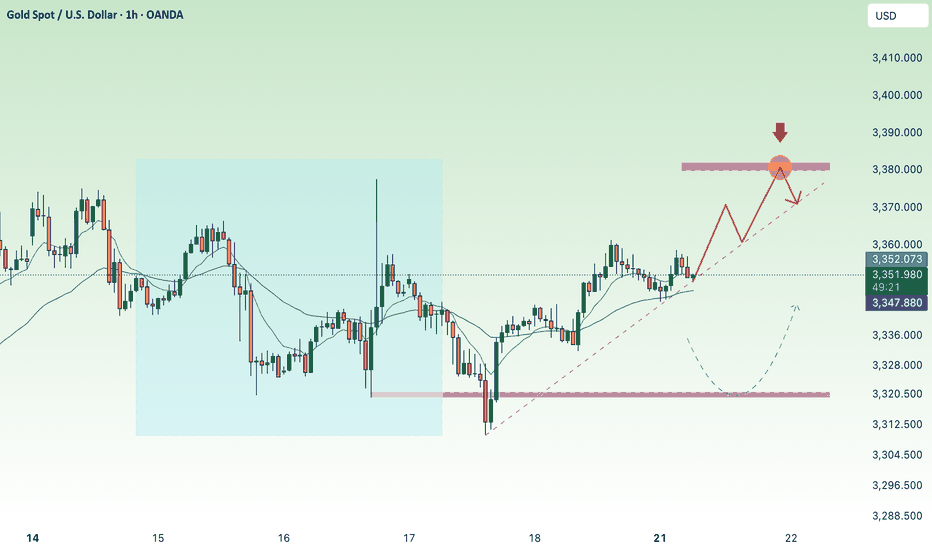

3331 liquidity scan complete, recovery⭐️GOLDEN INFORMATION:

Gold (XAU/USD) traded with a positive tone in Wednesday’s Asian session, extending Tuesday’s rebound from the $3,331 level — its lowest in a week and a half. July’s U.S. consumer inflation data, which came in broadly in line with expectations, strengthened market bets on a September rate cut by the Federal Reserve. This has kept the U.S. Dollar on the defensive, providing a tailwind for the non-yielding metal.

That said, optimism surrounding an extension of the U.S.–China trade truce and the U.S.–Russia summit aimed at ending the war in Ukraine could limit safe-haven demand and cap gold’s upside. Moreover, repeated failures to hold above the $3,400 mark suggest that stronger follow-through buying is needed before confirming a near-term bottom. Traders now await comments from key FOMC policymakers later on Wednesday for fresh directional cues.

⭐️Personal comments NOVA:

Gold price moves sideways 3330 - 3360, liquidity sweep completed 3330, recovery

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3389- 3391 SL 3396

TP1: $3380

TP2: $3367

TP3: $3350

🔥BUY GOLD zone: $3304-$3302 SL $3297

TP1: $3315

TP2: $3325

TP3: $3338

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

A2Z / USDT : Keep a close watch on retest progressA2Z/USDT Breakout + Retest in Progress 🚀

We’ve seen a solid breakout from the downtrend resistance line. Currently, A2Z/USDT is in the process of retesting the breakout zone. If this retest is successful, we are likely to see a strong upward move targeting a 12%+ gain as shown in the chart.

Keep an eye on the price action around the retest zone. A successful retest could set the stage for a nice bullish move.

Stay alert and trade wisely!

Gold price drops, selling pressure and CPI news⭐️GOLDEN INFORMATION:

Gold (XAU/USD) found some buying interest in the Asian session, rebounding from Monday’s steep drop to the $3,341 level — its lowest in over a week. The U.S. Dollar struggled to build on its two-day advance as traders stepped to the sidelines ahead of the release of the latest U.S. consumer inflation data later today.

The Consumer Price Index (CPI) report will be pivotal in shaping expectations for the Federal Reserve’s rate-cut trajectory, which will, in turn, influence the Greenback’s direction and could provide fresh momentum for the non-yielding yellow metal.

⭐️Personal comments NOVA:

CPI expected to increase, DXY increases, selling pressure on gold. Market recovers briefly before US trading session

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3379- 3381 SL 3386

TP1: $3367

TP2: $3355

TP3: $3342

🔥BUY GOLD zone: $3320-$3318 SL $3313

TP1: $3332

TP2: $3344

TP3: $3356

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price accumulates above 3340⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eased toward $3,390 in early Asian trading on Monday, as a modest rebound in the U.S. Dollar weighed on the precious metal ahead of Tuesday’s U.S. inflation report.

A firmer Greenback, coupled with a broader risk-on mood, kept prices capped below the key $3,400 psychological level. However, growing expectations for a Federal Reserve rate cut in September continue to offer underlying support for the non-yielding asset.

On Saturday, Fed Governor Michelle Bowman noted that recent soft employment data reinforced her concerns about labor market fragility and bolstered her view that three rate cuts could be appropriate in 2025. Markets are now pricing in an 89% probability of a September rate cut, with at least two reductions expected by year-end.

⭐️Personal comments NOVA:

At the beginning of the week, gold price slightly decreased below 3380. It is still mainly accumulating, waiting for an increase reaction to return to 3400 and move sideways.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3336-$3338 SL $3331

TP1: $3345

TP2: $3357

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price continues to increase above 3400, next week✍️ NOVA hello everyone, Let's comment on gold price next week from 08/11/2025 - 08/15/2025

⭐️GOLDEN INFORMATION:

Spot gold held steady on Friday, while futures surged to a record high of $3,534 following reports that the United States will impose tariffs on imported gold bars. Traders also continued to digest recent U.S. economic data as they looked ahead to next week’s key inflation release. XAU/USD last traded near $3,397, little changed on the day.

Overnight, the price spread between New York COMEX futures and spot prices widened by more than $100, Reuters reported, after the Financial Times revealed that the U.S. had levied tariffs on one-kilo gold bars, citing a letter from U.S. Customs & Border Protection.

⭐️Personal comments NOVA:

Gold price accumulates around 3400, buying power remains good as interest rate cut expectations approach

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3418, $3437, $3500

Support: $3344, $3310

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Bulls maintain weekend above 3400⭐️GOLDEN INFORMATION:

Gold (XAU/USD) eased back from a more than two-week high near $3,409–3,410 during Friday’s Asian session, as traders booked profits ahead of the weekend. A broadly positive tone in equity markets, coupled with a modest rebound in the U.S. Dollar, added to the downward pressure on bullion. Even so, several factors continue to underpin the metal, urging caution for aggressive bearish positioning.

Lingering trade-related uncertainty—intensified by President Donald Trump’s latest tariff threats this week—has helped maintain gold’s safe-haven appeal. At the same time, growing expectations that the Federal Reserve will resume its rate-cut cycle in September are likely to cap any sustained dollar strength, encouraging dip-buying interest around the $3,380 level.

⭐️Personal comments NOVA:

Tariff tensions, along with a very positive market about the possibility of interest rate cuts, helped gold prices return above the 3400 zone.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3373-$3371 SL $3366

TP1: $3382

TP2: $3395

TP3: $3410

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price maintains upward trend to 3400⭐️GOLDEN INFORMATION:

Gold (XAU/USD) edged lower during the North American session, pressured by rising U.S. Treasury yields, profit-taking, and reports that President Donald Trump may announce a replacement for Fed Governor Adriana Kugler later this year. The precious metal is trading around $3,372, down 0.23%.

After a three-day rally, bullion struggled to gain further traction as investors locked in profits. This came despite Trump signing an executive order imposing a 25% tariff on India in response to its continued imports of Russian oil. The new duties—set to take effect 21 days after August 7—will raise tariffs on select Indian exports to as much as 50%.

⭐️Personal comments NOVA:

Gold prices continue to increase, heading towards 3400. The context of trade tensions heats up again, along with increasing expectations of interest rate cuts.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3429- 3431 SL 3436

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3342

TP2: $3355

TP3: $3368

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Continue to return above 3400, gold price increases⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slipped slightly during Wednesday’s Asian session, pulling back from a nearly two-week high near $3,390 reached the day before, effectively ending a four-day winning streak. The precious metal came under pressure as Asian equities advanced, tracking a solid rebound in U.S. equity futures—dampening demand for safe-haven assets.

Additionally, a mild uptick in the U.S. Dollar further weighed on gold. However, the downside appears limited, as broader market caution continues to support the metal’s underlying appeal.

⭐️Personal comments NOVA:

Maintain the upward momentum, the same scenario as the beginning of this week. Adjust down in Asian and European sessions and continue to increase in US session. Aim for 3400

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3428- 3430 SL 3435

TP1: $3418

TP2: $3408

TP3: $3392

🔥BUY GOLD zone: $3331-$3329 SL $3324

TP1: $3340

TP2: $3352

TP3: $3365

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bulls continue to be active following NFP data⭐️GOLDEN INFORMATION:

Gold (XAU/USD) slips toward $3,360 in early Asian trading on Monday, snapping a two-day winning streak. However, disappointing U.S. job data and lingering tariff concerns could pressure the U.S. Dollar and help cushion the downside for the Dollar-denominated metal.

The yellow metal is under pressure from a recovering Greenback, though gains may remain capped as weaker-than-expected Nonfarm Payrolls (NFP) data has strengthened expectations of a Federal Reserve rate cut in the near term.

⭐️Personal comments NOVA:

Buyers maintained early in the week, continuing to move towards higher resistances: 3374, 3387

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3374- 3376 SL 3381

TP1: $3365

TP2: $3350

TP3: $3333

🔥BUY GOLD zone: $3328-$3326 SL $3321

TP1: $3335

TP2: $3348

TP3: $3360

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

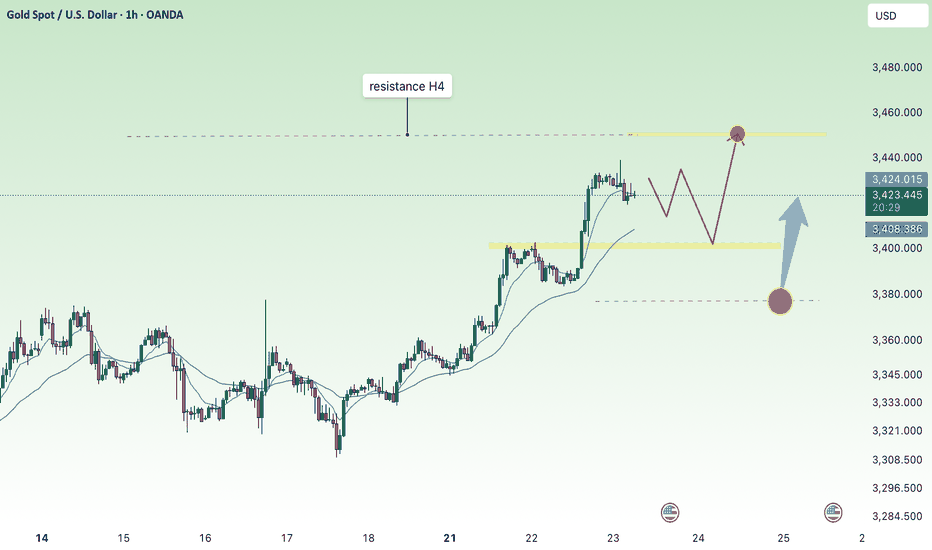

Continued recovery, positive after NFP news✍️ NOVA hello everyone, Let's comment on gold price next week from 08/04/2025 - 08/8/2025

⭐️GOLDEN INFORMATION:

Gold prices surged over 1.5% on Friday, climbing toward $3,350, as a weaker-than-expected U.S. Nonfarm Payrolls (NFP) report signaled a faster-than-anticipated slowdown in the labor market. Heightened geopolitical tensions between the U.S. and Russia further boosted safe-haven demand for the precious metal.

Following the disappointing July jobs data, markets began pricing in a potential interest rate cut by the Federal Reserve. While the Unemployment Rate held relatively steady, signs of labor market softness supported recent comments from Fed officials Michelle Bowman and Christopher Waller, who advocated for a 25-basis-point rate cut at the July 29–30 meeting.

Additional data added to the cautious sentiment: the ISM’s July report confirmed that U.S. manufacturing activity remains in contraction territory, while consumer confidence took a hit, according to the University of Michigan’s latest survey.

⭐️Personal comments NOVA:

Gold prices continue to be positively affected after last week's NFP news, market expectations of an early rate cut are rising

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3384, $3434

Support: $3331, $3307, $3268

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

C / USDT : Watch closley to a retest for better Entry and profitC/USDT is currently retesting the breakout area. Expecting a short-term rally of 15-20% if the retest holds.

Bullish Scenario: If the retest is successful, we could see a continuation of the uptrend towards higher targets.

Bearish Scenario: A failure to hold the breakout level could lead to a pullback towards key support levels.

Pro Tip: Keep a tight stop loss around the breakout level to manage risk while targeting potential gains in the rally.

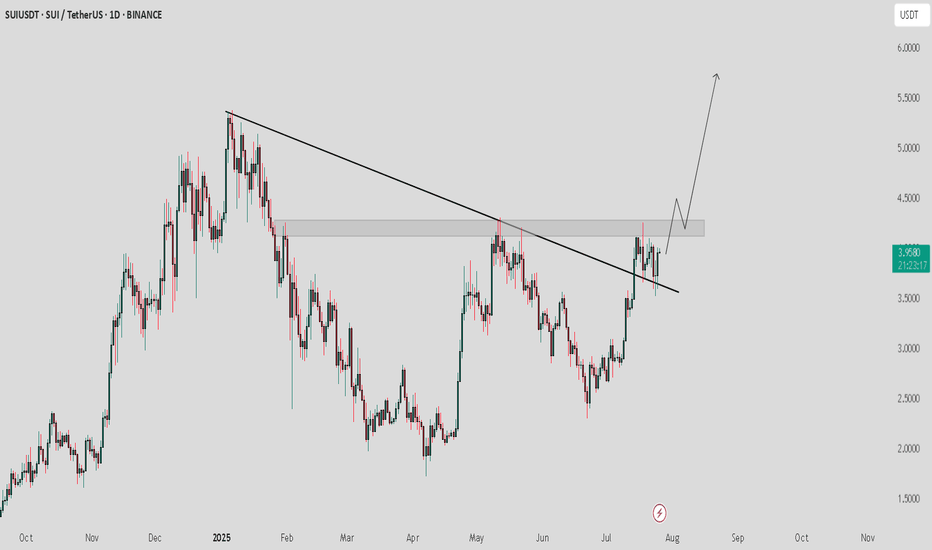

SUI / USDT : Looking bullish SUI/USDT chart shows a breakout from a descending trendline, confirming upward momentum. Current price tests the resistance zone around $4.00. BTC is receiving support from the FVG, indicating short-term bullish potential.

Bullish Scenario: If price breaks above the resistance zone, a rally towards $4.50 to $5.00 is possible. Watch for confirmation of higher highs on shorter timeframes.

Invalid Setup: If price fails to break the resistance and falls back below $3.50, the bullish setup would be invalidated.

Pro Tip: Always wait for a clear confirmation candle above the resistance zone before entering a trade to minimize risk.

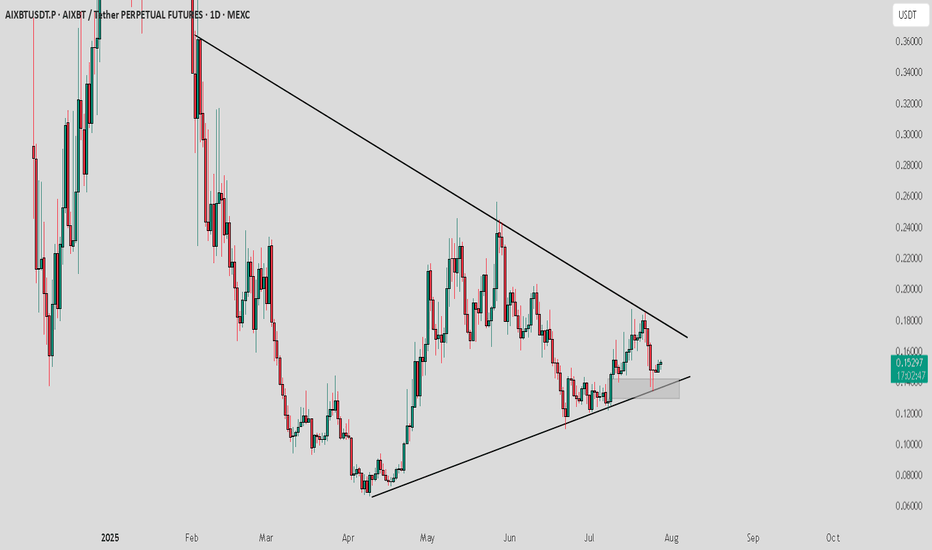

AIXBT / USDT : Getting support and moving towards resistance AIXBT/USDT is currently forming a symmetrical triangle pattern and testing a key support zone. A short-term rally of around 10% towards the upper resistance is expected, leading to a potential breakout.

Bullish Scenario:

A solid breakout above the upper trendline could initiate a major rally, targeting levels around $0.18 and higher.

Watch for confirmation of the breakout for a sustained move.

Targets for the short-term rally:

Expect a move towards $0.18 before the breakout happens. A major rally will commence once the breakout occurs. 🚀

Stay patient and keep an eye on the price action for potential entry points! 📈

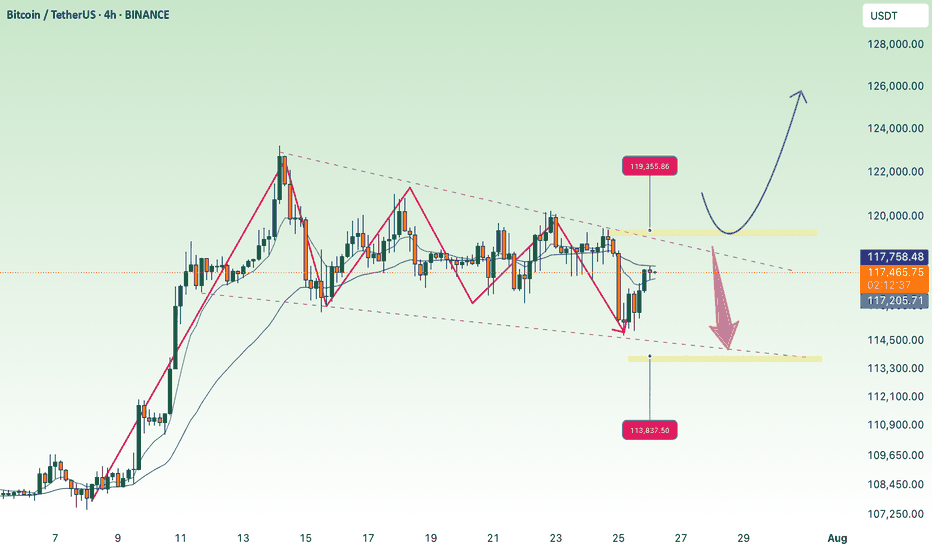

BTC Consolidates Below 119,300 Over the Weekend💎 BTC WEEKEND PLAN UPDATE (26/07)

NOTABLE BTC NEWS

The cryptocurrency market is attempting to stabilize after a wave of sell-offs during Friday’s Asian session, when Bitcoin (BTC) dropped to an intraday low of $114,723. A recovery trend is gradually strengthening, with BTC trading at $115,868 at the time of writing, indicating that buying interest at lower levels may increase in upcoming sessions.

TECHNICAL ANALYSIS PERSPECTIVE

Symmetrical Triangle Pattern

BTC is currently fluctuating within a symmetrical triangle pattern, with converging upper and lower trendlines. This pattern typically signals a strong consolidation phase before a decisive breakout.

Scenario unfolded as planned:

• The price failed to break the resistance zone around $120,000 (previously forecasted as a likely failed breakout zone).

• BTC then dropped sharply to the support zone around $115,000, touching the lower trendline and the potential breakout zone.

• At this level, the price rebounded as expected, indicating strong buying pressure at support.

MA lines supporting the trend:

• The price is currently moving around the 200-day MA (red line), showing that the dynamic support is working effectively.

• The 50-day MA (yellow line) is acting as short-term resistance. If broken, it could support the recovery momentum.

Two potential upcoming scenarios:

🔼 If BTC breaks above the $119,500 – $120,000 zone with strong volume, it may continue to test higher levels around $123,000 – $125,000.

🔽 Conversely, if it faces strong rejection around $119K and turns downward, BTC may retest the support zone at $114,000 – $115,000 once again.

Stay tuned to the channel for the latest and continuous updates on XAUUSD, CURRENCIES, and BTC.

Continued price increase - gold increased to 3450⭐️GOLDEN INFORMATION:

Gold prices climbed for a second straight session on Tuesday, gaining over 0.9% as sliding US Treasury yields continued to weigh on the US Dollar. Investors remained cautious amid lingering uncertainty over upcoming US trade agreements. At the time of writing, XAU/USD is trading at $3,427, having rebounded from an intraday low of $3,383.

Yields on US government bonds have now declined for five consecutive days, pressuring the Greenback—reflected in the softer US Dollar Index (DXY). Heightened speculation that the US and European Union (EU) may fail to secure a trade agreement before the looming August 1 deadline has intensified demand for safe-haven assets. As a result, gold surged to a five-week high of $3,433.

⭐️Personal comments NOVA:

Gold price continues to increase, FOMO from the market is good and positive. Heading towards 3450

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3449- 3451 SL 3456

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3380-$3378 SL $3373

TP1: $3390

TP2: $3400

TP3: $3415

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Accumulate BTC over 115K💎 BTC PLAN UPDATE (July 23rd)

NOTABLE NEWS ABOUT BTC

Bitcoin (BTC) and Ripple (XRP) are approaching their all-time highs, while Ethereum (ETH) continues to grow steadily toward the important $4,000 mark. These top three cryptocurrencies by market capitalization are showing signs of a new bullish momentum, supported by strong technical structures and increasing investor interest.

TECHNICAL ANALYSIS PERSPECTIVE

1. Main Trend

The overall trend remains bullish, with a clearly rising price channel (black diagonal line).

However, BTC is currently in a short-term correction phase, consolidating sideways after the recent strong surge.

2. Key Price Levels

🔵 Strong Support Zone: 116,000 – 117,000 USDT

This zone includes the 200-day moving average (MA200), horizontal support, and a previous bottom — making it a decisive area for the short-term trend.

If this zone breaks, BTC could fall to a deeper support area around 111,000 USDT.

🔴 Resistance Zone: 122,000 – 123,000 USDT

This is a previous peak and a recently “false breakout” area — a strong psychological resistance.

If broken convincingly, BTC could surge to the 130,000 USDT zone (Fibonacci extension 1.618).

3. Possible Scenarios

✅ Bullish Scenario:

Price retests the 116,000 – 117,000 support zone and then bounces.

If it breaks through the 122K resistance, the next target is 130,000 USDT.

❌ Bearish Scenario:

If price breaks below MA200 and the 116K support zone → it could drop to the deeper zone around 111,000 USDT.

4. Technical Signals

There is a triangle accumulation pattern (with flat tops and bottoms).

The “false breakout” at the resistance zone shows that buyers are not yet strong enough and a retest of support is needed.

Follow the channel for the latest and continuous updates on XAUUSD, CURRENCIES, and BTC.

Gold price maintained above 3400⭐️GOLDEN INFORMATION:

Gold prices surged over 1% on Monday as both the US Dollar and Treasury yields declined sharply, driven by ongoing uncertainty surrounding trade negotiations, despite a generally positive risk tone in broader markets. At the time of writing, XAU/USD trades at $3,397, having rebounded from daily lows of $3,338.

While risk sentiment has improved ahead of upcoming US corporate earnings releases, anxiety lingers as the August 1 tariff deadline set by the White House approaches. Investors remain cautious about potential trade disruptions between the US and its key partners—the European Union (EU), Canada, and Mexico.

Meanwhile, reports from Bloomberg indicate that EU officials are preparing to convene this week to finalize a retaliation strategy, should trade talks with President Trump collapse. This backdrop of trade tension continues to support gold’s safe-haven appeal.

⭐️Personal comments NOVA:

Gold price continues to increase before FED's statement, market's expectation of early interest rate cut, setting new ATH in Q4/2025

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3450- 3452 SL 3457

TP1: $3435

TP2: $3422

TP3: $3405

🔥BUY GOLD zone: $3332-$3330 SL $3325

TP1: $3345

TP2: $3358

TP3: $3370

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

3380 gold price recovered at the beginning of the week⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) trade with modest gains around $3,350 in early Asian hours on Monday, supported by persistent uncertainty surrounding global trade negotiations as the US tariff deadline approaches. Lingering concerns over fresh levies are likely to sustain demand for the safe-haven metal. Investors now look ahead to comments from Federal Reserve (Fed) Chair Jerome Powell, scheduled for Tuesday, for clearer policy direction.

On Sunday, US Commerce Secretary Howard Lutnick confirmed that August 1 remains the firm deadline for countries to comply with Washington’s tariff demands. While President Trump’s earlier announcements saw shifting deadlines, the White House now insists this date is final. This cloud of uncertainty continues to bolster gold’s appeal as a hedge in volatile markets.

⭐️Personal comments NOVA:

Gold prices continued to recover last weekend, mainly still accumulating above 3300.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3380- 3382 SL 3387

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3322-$3320 SL $3315

TP1: $3333

TP2: $3345

TP3: $3356

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price maintains accumulation below 3400✍️ NOVA hello everyone, Let's comment on gold price next week from 07/21/2025 - 07/25/2025

⭐️GOLDEN INFORMATION:

Gold prices edge higher in Friday’s North American session as a softer US Dollar and pre-weekend profit-taking lend support. Dovish remarks from a Federal Reserve (Fed) Governor, hinting at a possible rate cut as early as July, further bolster the yellow metal. At the time of writing, XAU/USD is trading around $3,353, gaining 0.43%.

Improved market sentiment also underpins bullion, following the University of Michigan’s report showing that US consumers are growing more optimistic about the economy, with inflation expectations easing. Meanwhile, Fed Governor Christopher Waller’s call for rate cuts weighed on US Treasury yields, adding positive momentum to gold.

The US Dollar Index (DXY) weakens to 98.48, down 0.13%, making USD-priced gold more attractive to foreign buyers and helping sustain the current uptrend.

⭐️Personal comments NOVA:

Gold price remains in the accumulation range of 3300 - 3400, the market awaits information on upcoming interest rate policy

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $3367, $3392

Support: $3305, $3280, $3246

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest