Nasdaq 100: Institutional Move Toward 22,680 Unfolding📊 Nasdaq 100 Smart Money Breakdown

Current Price: 22,103

Target Price: 22,680

🔼 Upside Potential: +577 points

The market is currently positioned for a premium retracement move after a recent liquidity sweep below short-term equal lows, which likely triggered sell-side liquidity. This setup hints at Smart Money Accumulation, with institutions entering long positions at discount pricing.

We're now seeing:

✅ Break of Structure (BOS) to the Downside

✅ Internal liquidity sweep

✅ Price reacting from a discounted OB (Order Block)

✅ Potential drive toward the next liquidity pool sitting above the 22,680 level.

This move aligns with a bullish market structure shift, suggesting Smart Money is engineering price higher to target buy-side liquidity above recent highs.

🎯 Target: 22,680 – a key liquidity area where Smart Money may look to offload positions.

Nasdaqsignals

NAS100 (CASH100) Short - Double top 30minThe 15min head and shoulders setup got invalidated.

However, my double top variables are currently being met.

Still need confirmation before entering trade.

Risk/reward = 2.7

Entry price = 23 284

Stop loss price = 23 331

Take profit level 1 (50%) = 23 173

Take profit level 2 (50%) = 23 129

What does everyone thing the NASDAQ is going to do today?

NASDAQ (CASH100) SHORT - head and shoulders 15minPotential short on nas100 (cash100) with head and shoulders on the 15min.

Still waiting for confirmation on some of my variables before I enter.

Risk/reward = 3.3

Entry price = 23 262

Stop loss price = 23 287.3

Take profit level 1 (50%) = 23 184

Take profit level 2 (50%) = 23 153

What do you guys and girls think the nasdaq is going to do?

NASDAQ Week 32 OutlookOn the US Nas 100 1-hour chart, a bearish breakout from a symmetrical triangle suggests downward momentum. The Fair Value Gap at 23,500.0 is a pivotal level—watch for a breakout and retest here to confirm sell entries. Aim for the target at 22681.1, with a stop-loss at 23,740.4 to protect against adverse moves.

Technical Analysis Forecast for NAS100Open Price: 23242.3 (UTC+4)

1. Japanese Candlestick Analysis

4H/1H: Price opened at 23242.3 near resistance (23250–23300). Recent candles show bearish harami (4H) and dark cloud cover (1H), signaling rejection.

30M/15M: Gravestone doji at 23242.3 and three black crows indicate strong bearish momentum.

5M: Shooting star formation suggests exhaustion. Failure to close above 23250 confirms weakness.

Outlook: Bearish reversal likely if 23200 breaks.

2. Harmonic Patterns

4H/1H: Bearish Butterfly Pattern completing at 23242.3 (D-point).

PRZ: 23240–23250 (confluence of 127.2% XA and 161.8% BC).

Fibonacci Ratios: AB=CD symmetry (23240–23250).

30M: Bullish Crab forming at 23100, but secondary to larger bearish setup.

Outlook: High-probability short entry at 23240–23250 with target 23000.

3. Elliott Wave Theory

4H: Wave 5 of impulse cycle peaked at 23242.3.

Structure: Completed 5-wave sequence from 22800 → 23242.3.

Corrective Phase: ABC pullback targeting 23000 (Wave A) and 22850 (Wave C).

1H: Sub-wave (v) of 5 ending at 23242.3. RSI divergence confirms exhaustion.

Outlook: Bearish correction to 22850–23000 within 24 hours.

4. Wyckoff Theory

Phase: Distribution (after markup from 22800 → 23242.3).

Signs: High volume at 23242.3 (supply), upthrust above 23300 failed.

Schematic: Phase C (markdown) initiating.

1H/30M: Spring at 23200 failed to hold, indicating weak demand.

Outlook: Break below 23200 triggers markdown to 23000.

5. W.D. Gann Theory

Time Theory

24H Cycle: Key reversal windows:

UTC+4: 08:00–10:00 (resistance test), 14:00–16:00 (trend reversal).

Square of 9: 23242.3 aligns with 0° angle (resistance).

Square of 9

23242.3 → Resistance Angles:

0° (23250), 90° (23350), 180° (23450).

Support: 45° (23000), 315° (22850).

Price Forecast: Reversal at 23250 (0° angle).

Angle Theory

4H Chart: 1x1 Gann Angle (45°) from 22800 low at 23000. Price above angle = bullish, but overextended.

1H Chart: 2x1 Angle (63.75°) at 23242.3 acting as resistance.

Squaring of Price & Time

Price Range: 22800 → 23242.3 (442.3 points).

Time Squaring: 442.3 hours from 22800 low → 23250 resistance (442.3 points ≈ 442.3 hours).

Harmony: 23242.3 = Time Cycle Peak (24H from open).

Ranges in Harmony

Primary Range: 22800–23500 (700 points).

50% Retracement: 23150 (support).

61.8% Retracement: 23000 (critical support).

Secondary Range: 23000–23300 (300 points).

Key Levels: 23150 (50%), 23000 (61.8%).

Price & Time Forecasting

Price Targets:

Short-Term: 23000 (61.8% Fib, Gann 45° angle).

Extension: 22850 (100% of prior correction).

Time Targets:

First Reversal: 8–12 hours from open (UTC+4 12:00–16:00).

Second Reversal: 20–24 hours (UTC+4 00:00–04:00 next day).

Synthesized 24H Forecast

Bearish Scenario (High Probability)

Trigger: Break below 23200 (confirmed by 1H/30M close).

Targets:

T1: 23000 (61.8% Fib, Gann 45° angle).

T2: 22850 (Wyckoff markdown, Elliott Wave C).

Timeline:

8–12H: Drop to 23000 (UTC+4 12:00–16:00).

20–24H: Test 22850 (UTC+4 00:00–04:00 next day).

Confirmation: RSI <50 on 1H, volume spike >25% average.

Bullish Scenario (Low Probability)

Trigger: Sustained close above 23300 (Gann 0° angle).

Targets: 23350 (90° angle), 23450 (180° angle).

Timeline: 12–16 hours (if 23300 breaks).

Is the NASDAQ Vault Open for a Full Bullish Heist?🧠 NASDAQ Heist Masterplan: Thieves Eye on 24,500 🎯💰

🚨 Asset: NASDAQ100 / US100 / NDX

📊 Plan: Bullish | 🔁 Layering Strategy

🎯 Target: 24,500

🛑 Stop Loss: 22,600

📍 Entry: Any level – the vault’s wide open!

💼 Thief Trader's NASDAQ High-Stakes Robbery Is LIVE! 🤑📈

Welcome, money bandits & market looters! 💼💰

The time has come to launch a full-scale bullish raid on the NASDAQ fortress. We’re not just taking entries — we’re stacking them like a pro with our layered limit order strategy across swing zones. 🔫📉➡️📈

🔓 Entry:

Pick any price! We break in anytime, anywhere.

🔁 Stack your buy limits on 15m–30m swing lows.

🔔 Set your alerts – don’t let the opportunity slip.

🛑 Stop Loss:

Guard your loot at 22,600.

Risk management is the bulletproof vest in this raid. 🎯

Adjust your SL based on lot size and order volume. 📏🔐

🎯 Profit Target:

Thieves retreat at 24,500.

But hey – smart robbers use trailing SL to squeeze every last drop of gold! 🏆💸

💡 Scalpers & Swingers:

Stick to the long side only.

If your pockets are deep – full-send mode ON.

If not, tag along with swing entries. Patience pays big! 💎⏳

📢 Heads Up, Heist Crew:

News drops = landmines. Step carefully.

🚷 No new entries during major announcements.

🛡️ Use trailing SL to defend your profit bags.

🚨 Daily Reminder:

This market isn’t a playground. It’s a battlefield.

Use COT data, macro reports, sentiment scans, and index-specific triggers to fortify your robbery blueprint. Stay smart, stay updated! 📊🧠

💥 Boost Our Loot Crew 💥

Hit that LIKE ❤️ to support the Thief Army!

Stronger visibility = Bigger Loots = More Victory Runs.

See you at the next robbery – we move in silence, but the market hears us loud! 🐱👤💸🔥🚀

NAS - TIME FOR JUICYTeam, hope you all making a killing on SHORT tonight.

as we expected. Thank you for asking and be patience

TIME TO MAKE NAS100 GREAT AGAIN.

Sorry my entry was 23240, but now the market is 23332

you should entry small volume at the current price 23332 - if a little pull back below 23300 add more

STOP LOSS at 23230-50

TARGET 1 at 23385-23400

TARGET 2 at 23475-23515

LETS go - time to make ACTIVE TRADER ROOM GREAT AGAIN.!

NAS100 Buy Setup – VSA & Multi-Zone Demand Analysis✅ Primary Entry Zone: Major support for current week (around 23,325–23,350)

✅ Secondary Entry Zone: Potential reversal zone if primary support is broken (around 23,200–23,230)

🎯 Target 1 (TP1): Previous swing high near 23,500

🎯 Target 2 (TP2): Extension above 23,550

🛑 Stop Loss (SL): Below 23,170 (beyond secondary reversal zone to avoid false breaks)

📊 Technical Insight (VSA & Price Action Structure)

Support Structure:

The current major support zone has been tested multiple times with no follow-through selling, indicating strong buying interest from larger players.

Volume Spread Analysis Observations:

On the recent decline into the major support zone, we see wider spreads on high volume followed by narrow range candles on lower volume, a classic sign of stopping volume and supply exhaustion.

Within the secondary reversal zone, historical reactions show climactic volume spikes leading to sharp reversals, suggesting this level is watched closely by smart money.

Any test back into the zone on low volume would confirm the No Supply (NS) condition.

Trade Pathways:

Scenario 1: Price respects the major support and begins to climb, confirming demand dominance → target TP1 then TP2.

Scenario 2: Support is temporarily breached, triggering a liquidity grab into the secondary reversal zone, followed by a bullish reversal bar on high volume → strong buy signal with potentially faster move toward TP levels.

📍 Bias: Bullish as long as price holds above the secondary reversal zone.

📌 Execution Tip: Wait for a wide spread up-bar on increased volume from either zone to confirm the start of the markup phase.

NAS - LET'S MAKE MILLIONS Team, last night NAS I was expect the FALL BACK as I predicted rate un-change will get NASTY on both DOW AND NAS.

So I have a set up entry LONG, i didnt expect the NAS flying to the moon.

both target hit so fast in 15 minutes

However, today is another opportunity to SHORT NAS on the current market at 23613-23625

STOP LOSS AT 23720

Once the NAS pull back toward 23580-65 - BRING STOP LOSS TO BE

TARGET 1: at 23540-20

TARGET 2: at 23480-65

LETS GO

NAS100 - EXPECTING THE DUMPTeam, we got short well today with AUS200 - both target hit

we have set up the NAS entry , this is the entry price 23268 - 23200

STOP LOSS at 23100

Once it break above 23320 - bring stop loss to BE

Target 1 at 23320-60 - take 50%-70& partial

Target 2 at 23380-23400

LETS GO

NAS/TEC100 - LETS GET NASTY ON NAS100Team, NAS currently sitting at 23480, before the US market open

however during the market open, please be aware of the volatility that may hit your stop loss

You have 2 options to trade on this NAS- NASTY

Option 1: wait for market open, if it hits 23500-23515 - then short with stop loss at 23580

Option 2: Short at the current market with small volume - and if the market open with volatile, you can take another advantage of shorting more volume as per option 1 instructed.

OK, pick your strategy! do NOT be shy.

I am going to have small short position and will consider adding more during US market opening after 5-10 minutes, much easier to see the direction of the market - we do LIVE trading everyday. Please note: if NAS fall below 23450-40 bring stop loss to BE (Break even)

1st TARGET range: 23435-23416 - make sure take 70% volume

2nd target at 23390 to 23376

Why do I short on NAS when tomorrow rate decision, i think this quarter report, market will not be the same as last quarter, even rate cut!

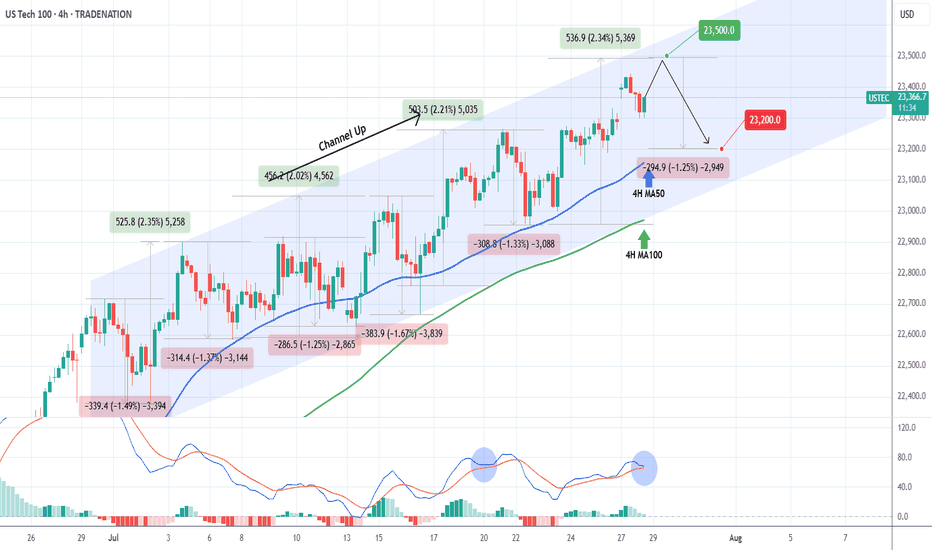

NASDAQ Channel Up to be rejected soon.Nasdaq (NDX) has been trading within a Channel Up since the start of the month. The primary Support level has been the 4H MA50 (blue trend-line), which hasn't closed a 4H candle below it since July 14.

Right now the index is on its latest Bullish Leg, which can technically extend by +2.35% (max such Leg within the Channel Up).

We expect a rejection targeting the 4H MA50 again at 23200, which would represent a -1.25% decline, the weakest such Bearish Leg we had within the Channel Up.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

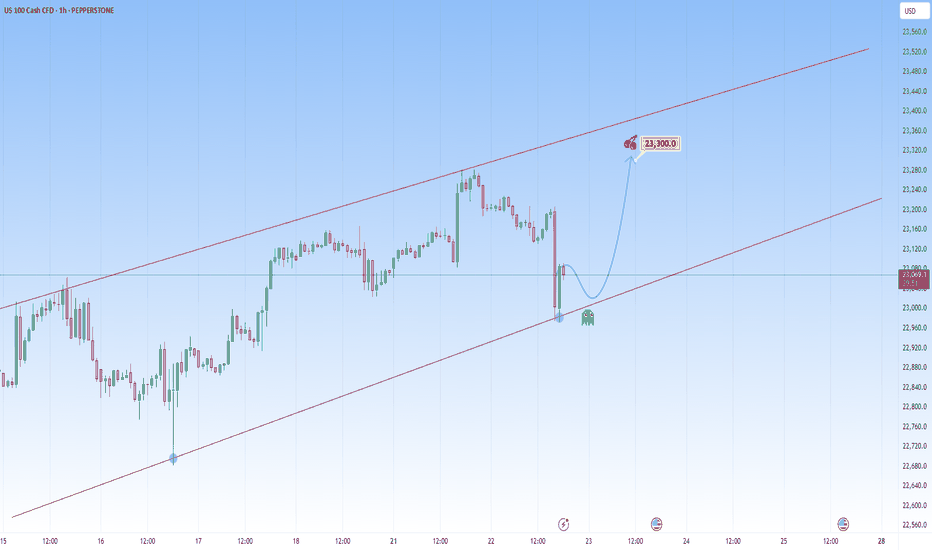

NAS100 steadies at high levels, pay attention nextThe most recent move on NAS100 saw a sharp drop that briefly recovered, likely triggering stops before aggressively reversing from the lower boundary of the newly projected channel. This isn't a cause for concern, on the contrary, it's another opportunity to get involved.

That is because this drop and recovery is a common behavior in strong uptrends before resuming bullish momentum.

The market is likely in the early stages of a new impulsive leg to the upside right here.

We could either have short-term consolidation or pullback, then a continuation toward the upper channel boundary or straight upwards, and with NAS100, the latter is more plausible.

My target will be at 23,300 around the upper boundary of the projected channel resistance.

In this context, the market remains bullish clearly. The most interesting aspect is the emotional flush on the last drop, trapping sellers before fueling what could be another big leg up.

NASDAQ (CASH100) SHORT - double top H6Risk/reward = 4.3

Entry price = 23 282

Stop loss price = 23 398

Take profit level 1 (50%) = 22 871

Take profit level 2 (50%) = 22 663

If current H6 goes back into range, I will open short position.

All variables on checklist have been met.

I was out last night so I missed my initial entry. Hoping for a second chance.

Hopefully this short works because the last few higher time frame short setups have failed, although because of exit plan I have made very little losses.

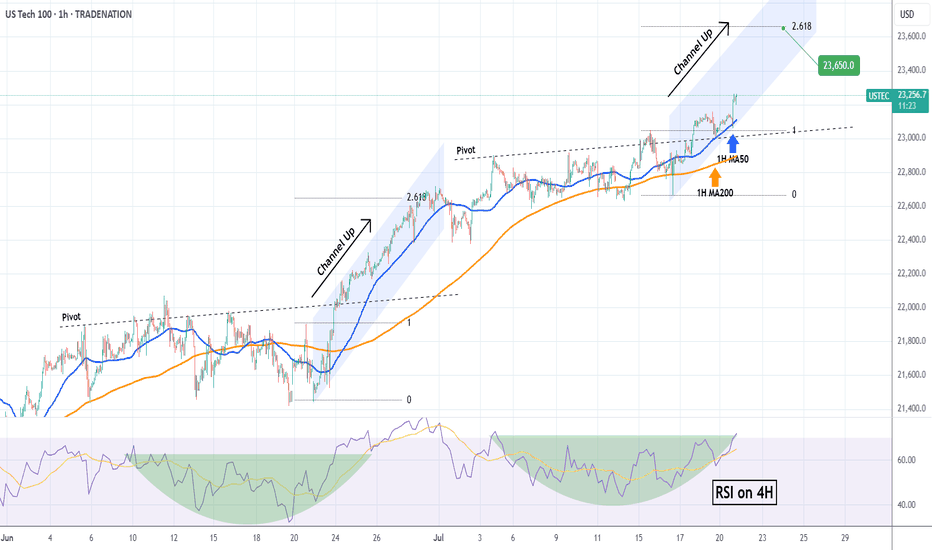

NASDAQ Rebounding on its 1H MA50.Nasdaq (NDX) rebounded today on its 1H MA50 (blue trend-line), third time since Friday's and Thursday's bounce. A Channel Up is emerging and based on the 4H RSI it is a medium-term bullish reversal off the Pivot trend-line, similar to June 20 - 30.

As you can see, that Channel Up targeted the 2.618 Fibonacci extension before breaking below the 1H MA50 to start a lengthy consolidation. Based on that, we are targeting 23650 (Fib 2.618 ext) on the short-term.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

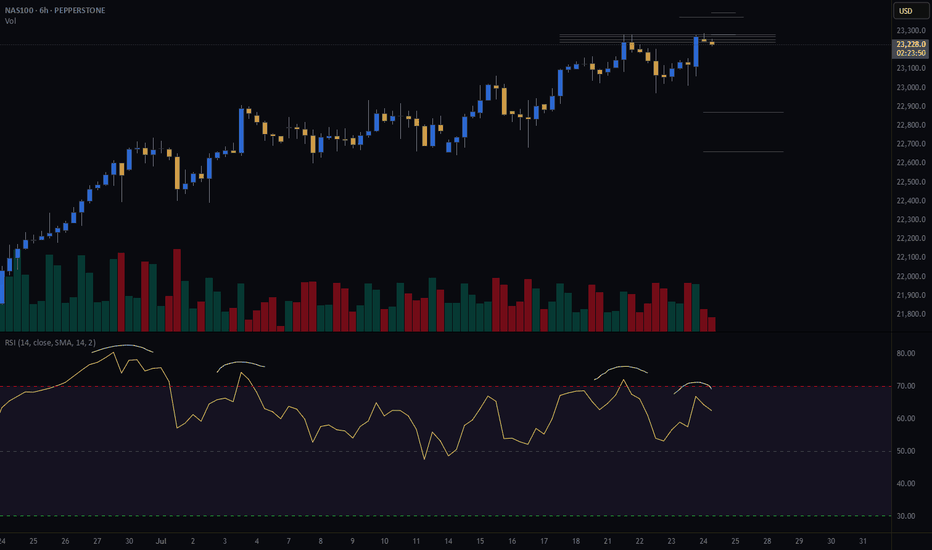

Nasdaq 100: Market Optimism Builds Ahead of Big Tech EarningsNasdaq 100: Market Optimism Builds Ahead of Big Tech Earnings

The earnings season is gaining momentum. This week, major technology companies such as Alphabet (GOOGL) and Tesla (TSLA) are scheduled to release their quarterly results.

Given that 85% of the 53 S&P 500 companies that have already reported have exceeded analysts’ expectations, it is reasonable to assume that market participants are also anticipating strong results from the big tech names. The Nasdaq 100 index (US Tech 100 mini on FXOpen) set an all-time high last week — a level that may be surpassed (potentially more than once) before the end of August.

Technical Analysis of the Nasdaq 100 Chart

Price movements have formed an upward channel (marked in blue), with the following dynamics observed:

→ The bearish signals we highlighted on 7 July did not result in any significant correction. This may be interpreted as a sign of a strong market, as bearish momentum failed to materialise despite favourable technical conditions.

→ Buyers have shown initiative by gaining control at higher price levels (as indicated by the arrows): the resistance at 22,900 has been invalidated, while the 23,050 level has flipped to become support.

→ A long lower shadow near the bottom boundary of the channel (circled on the chart) underscores aggressive buying activity.

Should the earnings and forward guidance from major tech firms also come in strong, this could further reinforce the sustainable bullish trend in the US equity market.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

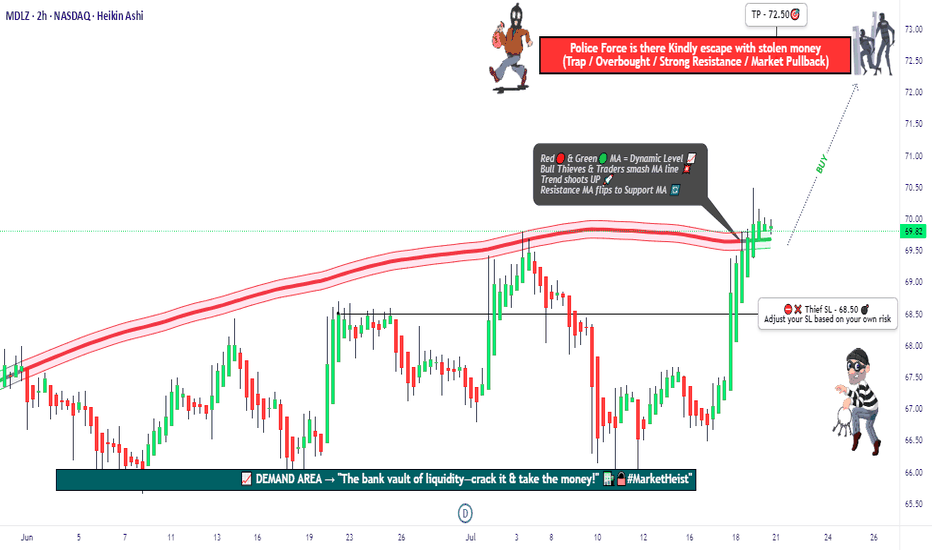

"MDLZ Heist LIVE! Quick Profit Grab Before Reversal!"🚨 MONDELEZ HEIST ALERT: Bullish Loot Zone! (Swing/Day Trade Plan) 🚨

Thief Trading Strategy | High-Risk, High-Reward Play

🌟 Greetings, Market Pirates! 🌟

Hola! Oi! Bonjour! Hallo! Marhaba!

To all Money Makers & Strategic Robbers 🤑💸—this is your blueprint to plunder "MONDELEZ INTERNATIONAL, INC" with precision.

🔎 THIEF TRADING ANALYSIS (Technical + Fundamental)

The Vault is Open! Bullish momentum detected, but caution—this is a high-risk police barricade zone (resistance level).

Overbought? Consolidation? Reversal? Yes. Bears lurk here, but we’re stealing profits before the trap snaps.

🎯 Target: 72.50 (or escape earlier if momentum fades).

🚨 Scalpers: Long-only! Use trailing stops to protect gains.

📈 ENTRY: How to Swipe the Loot

"Buy the Dip" Strategy: Optimal entries on pullbacks (15m/30m timeframe).

DCA/Layering Tactics: Spread limit orders for better risk control.

Aggressive Robbers: Enter now. Patient Thieves: Wait for retests.

🛑 STOP LOSS: Survival Rules

SL at 68.50 (nearest swing low wick on 2H chart).

Adjust based on risk/lot size—protect your capital!

⚡ CRITICAL ALERTS

📰 News Volatility: Avoid new trades during major releases. Lock profits with trailing stops!

📊 Fundamental Drivers: Check COT reports, macro trends, and sector sentiment Klick the 🔗.

⚠️ Reminder: This is NOT financial advice. DYOR and manage risk!

💥 BOOST THE HEIST!

Like 👍 + Boost 🔄 to fuel our next market robbery plan. Together, we trade smarter, steal bigger, and profit faster!

🚀 Stay tuned—more heists coming soon! 🤑🔥

NASDAQ Is looking for a massive break-out to 24000!Nasdaq (NDX) is most likely taking advantage of the 4H MA50 (blue trend-line) as a Support and after hitting it, it appears that the price will look for a way above the Parabola.

This might be similar to what took place after the May 07 test of the 4H MA50. The price broke above that parabolic pattern and peaked on the 2.0 Fibonacci extension. As a result, we are looking for 24000 as a potential Target in the next 2 weeks.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

"NASDAQ 100: THE TECH ROBBERY! – Quick Profits Before Reversal?"🔥 "The NDX NASDAQ 100 INDEX Heist: Bullish Loot & Escape Before the Trap!" 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to heist the NDX - NASDAQ 100 INDEX. Follow the strategy on the chart—long entry is the play! Aim to escape near the high-risk RED Zone (overbought, consolidation, potential reversal). The bears are lurking, so take profits and treat yourself—you’ve earned it! 💪🏆🎉

🚀Entry (The Vault is Open!)

"Swipe the bullish loot at any price!"

For precision, place buy limit orders within 15-30min timeframe (recent swing lows/highs).

Set alerts! Don’t miss the heist.

🛑 Stop Loss (Safety Net)

Thief-style SL at nearest swing low (4H timeframe) → 21,770.00 (adjust based on risk/lot size).

🏴☠️ Target 🎯: 22,800.00

Bullish momentum is fueling this heist—ride the wave but exit before the trap!

📰 Fundamental Backing (Why This Heist Works)

Macroeconomic trends, COT data, geopolitics, and sentiment align for bullish moves.

Full analysis? Check 👉🔗🌎

⚠️ Trading Alerts (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = danger).

Use trailing stops to lock profits and dodge sudden reversals.

💥 Boost This Heist!

Hit 👍 (Boost Button) to strengthen our robbery squad!

More heists = More profits—stay tuned for the next steal! 🚀🤑

See you soon, fellow thieves! 🤝🎉