Nifty Analysis EOD - September 1, 2025 - Monday🟢 Nifty Analysis EOD - September 1, 2025 - Monday 🔴

Baby steps, big conviction — bulls tighten their grip!

🗞 Nifty Summary

Nifty opened with a 47-point gap-up, carrying a positive vibe. The index extended gains by nearly 80 points, marking a high of 24,560.85 before slipping back to 24,500. There it found strong support and gradually climbed to break IB High and later breach PDH.

Step by step, bulls showcased steady dominance, ultimately closing at 24,624.15, a solid 190-point gain. The daily timeframe formed a Bullish Marubozu candle, breaking out and closing above the Previous Day High — a decisive statement from buyers.

🛡 5 Min Intraday Chart with Levels

🚶 Intraday Walk

Opened gap-up +47 points.

Climbed ~80 points, touched 24,560.85.

Pulled back to 24,500, took support.

Gradually rose, broke IB High, then PDH.

Closed at 24,624.15, strong bullish grip intact.

📉 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 24,432.70

High: 24,635.60

Low: 24,432.70

Close: 24,625.05

Change: +198.20 (+0.81%)

🏗️ Structure Breakdown

Green candle (Close > Open).

Body: 192.35 points → strong, dominant.

Upper wick: ~10.55 points (negligible).

Lower wick: 0 (open = low).

🕯Candle Type

Bullish Marubozu (near perfect).

📚 Interpretation

Market opened at low, never looked back.

Strong buying all day, closing at peak.

After 3 days of selling (23–25 Aug), this candle marks first solid bullish comeback.

Short-Term View

Support: 24,430 (today’s low & open).

Resistance: 24,635 (today’s high) → breakout may target ~24,800.

Trend Context: After a bearish continuation, today signals a bullish reversal. Needs follow-through buying in the next 1–2 sessions.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 201.88

IB Range: 93.05 → Medium

Market Structure: Balanced

Trade Highlights

12:25 → Long trade triggered - Trailing SL hit ( R:R = 1 : 1.16 )

📌 Support & Resistance Levels

Resistance Zones

24,675 ~ 24,695

24,745

24,805

24,855

Support Zones

24,575

24,520

24,490 ~ 24,465

🔮 What’s Next? / Bias Direction

Momentum has shifted in favour of bulls, with today’s Marubozu breakout signalling strong conviction. As long as Nifty sustains above 24,500–24,520 zone, buyers remain in control. A clean break above 24,635 opens the gates for 24,800 and beyond.

💭 Final Thoughts

Today’s action reminded us: “Trends don’t announce themselves, they whisper first — and today’s candle was a loud hint.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty50intraday

Nifty Analysis EOD – August 28, 2025 – Thursday🟢 Nifty Analysis EOD – August 28, 2025 – Thursday 🔴

Bulls Tried, But Bears Closed the Table

🗞 Nifty Summary 🗞

Nifty started almost flat but below the prior low, and selling pressure hit from the first tick — falling 195 points in just 10 minutes to mark the day low at 24,507. Support came in, leading to a 170-point recovery, almost touching the day high near 24,675–24,695, but the support zone flipped into resistance. A sharp rejection dragged the index back to the lows, even breaching them to mark a new day low at 24,481.60.

By the close, a mild 50-point recovery couldn’t change the tone, with Nifty finishing at 24,533.10, down −211.15 points (−0.85%).

Over the last 5 sessions, Nifty has lost 672 points, slipping below the Fib 0.786 retracement of the recent swing high-low range.

🛡 5 Min Intraday Chart with Levels

📊 Intraday Walk

Gap-down, immediate 195-point fall to 24,507.

Bulls attempt recovery, index climbs 170 points.

Faces rejection at 24,675–24,695, prior support turned resistance.

Sellers regain control, Nifty revisits lows.

Breach of earlier low, new low at 24,481.60.

Small 50-point bounce, closes weak at 24,533.10.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,695.80

High: 24,702.65

Low: 24,481.60

Close: 24,500.90

Change: −211.15 (−0.85%)

🏗️ Structure Breakdown

Candle: Red (Close < Open)

Body: 194.90 points (large bearish body)

Upper wick: ~7 points → no strength above open

Lower wick: ~19 points → weak recovery attempt

📚 Interpretation

Gap-down open, below PDL.

Buyers failed to sustain upside; day’s high just 7 points above open.

Persistent selling throughout, only a minor bounce at close.

Another strong bearish candle, very similar to yesterday’s.

🕯Candle Type

Bearish Marubozu–style (big red body, tiny wicks).

Signifies trend-confirming, decisive selling pressure.

🔎 Short-Term View

Support: 24,480–24,450 (tested today). Break → 24,365–24,335.

Resistance: 24,695–24,720 (gap-down + rejection zone).

📌 The market is clearly moving in phases:

21st → Pause and alert

22nd → trend reversal confirmation

25th → pullback rejection

26th → confirmation

28th → bearish extension

Bulls must defend 24,350 to prevent a deeper correction.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 204.83

IB Range: 195.45 → Medium

Market Structure: ImBalanced

Trade Highlights

9:45 AM – Long Trigger → Target achieved (R:R 1:1.5)

12:55 PM – Short Trigger → Target achieved (R:R 1:1.5)

📌 Support & Resistance Levels

Resistance Zones:

24,585 ~ 24,600

24,675 ~ 24,695

24,745

Support Zones:

24,665 ~ 24,650

24,365 ~ 24,335

🏹 Final Thoughts

“Markets don’t lie. When a support flips to resistance, the message is loud and clear — respect the structure.”

✏️ Disclaimer ✏️

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – August 22, 2025 – Friday🟢 Nifty Analysis EOD – August 22, 2025 – Friday 🔴

Bears finally break the wall — wiping out 4 sessions’ gains

🗞 Nifty Summary

Yesterday, we noted:

“Though the close is higher by +33 points vs the previous day, it left behind a red daily candle (close < open). This indicates fading bullish momentum, even though HH-HL structure is still intact. The range was narrow (≈98 points), categorising the day as range-bound, not sideways. The previous weekly expiry was also narrow yet sideways.”

That caution proved valid today. Right from the opening candle, Nifty broke the PDL + S1 zone, invalidating the HH-HL structure and giving bears a clean entry. The past two sessions’ range contraction added fuel to the breakdown, resulting in a 225-point fall.

The attempted defense at 24,995, 24,955, 24,920, and 24,890 provided only temporary halts, but the downside momentum was too strong. The day ended at 24,869.45, erasing gains of the last 4 sessions.

On the weekly chart, the index now resembles a bearish pin bar / inverted hammer, a sign of exhaustion at the top.

📌 For Monday:

If Nifty fails to hold 24,850–24,820, then 24,745 and 24,650 come into play.

Bulls must reclaim and close above 24,955 to hold their fort.

🛡 5 Min Intraday Chart with Levels

📌 Intraday Walk

Opened at 25,064.15 with mild optimism.

First 1-min candle → broke PDL + S1 decisively → bears in control.

Gradual fall → temporary fights at 24,995 → 24,955 → 24,920 → 24,890, but all failed.

Closing print at 24,870.10, almost at the day’s low.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,064.15

High: 25,084.85

Low: 24,859.15

Close: 24,870.10

Change: −213.65 (−0.85%)

🏗️ Structure Breakdown

Strong red candle (Close < Open)

Body: 194.05 points

Upper wick: 20.70 points

Lower wick: 10.95 points

Full-body bearish bar → strong downside momentum

📚 Interpretation

Sellers seized control after three days of stalling at 25,150–25,180.

Break below 25,000 confirms supply dominance.

Closing near day’s low = no recovery attempt → decisive distribution.

🕯️Candle Type

Bearish Marubozu-style → clear trend shift to sellers.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 198.19

IB Range: 134.25 → Medium

Market Structure: ImBalanced

Trade Highlight:

9:20 → Short Trigger → Target Achieved (R:R = 1:2).

🕵️Range & Bias

Support zone: 24,850–24,820

Resistance zone: 25,000–25,080

Bias: Bearish momentum → “Sell on rise” until 25k is reclaimed.

📌 Support & Resistance Levels

🎚️ Resistance Zones

24,920

24,955

24,995 ~ 25,005

25,080 ~ 25,090

🎚️ Support Zones

24,850 ~ 24,820

24,770

24,745

24,695 ~ 24,675

💡 Final Thoughts

The market has shifted gears from cautious bullish to outright bearish, with 25,000 now acting as a supply zone. Unless bulls reclaim lost ground above 24,955–25,000, the slide toward 24,745–24,650 seems inevitable.

“Markets climb the stairs but take the elevator down — today, the elevator arrived.”

✏️ Disclaimer

This is my personal analysis — not investment advice. Please consult your financial advisor before trading.

Nifty Analysis EOD – August 21, 2025 – Thursday🟢 Nifty Analysis EOD – August 21, 2025 – Thursday 🔴

Bulls holding the line, but fading strength visible near 25,150

🗞 Nifty Summary

Nifty opened with a gap-up of 98 points at 25,144.85, continuing its bullish tone above the previous day’s high. But from the very first tick, it slipped lower to fill the gap and found support at 25,055, where it formed the IB range. A sharp recovery took it back toward the open, but multiple attempts failed to cross Day Open / Day High / IB High.

Around 2:15 pm, another breakout attempt was strongly rejected, pushing the index below the PDH, and Nifty finally closed at 25,076.95.

Though the close is higher by +33 points vs the previous day, it left behind a red daily candle (close < open). This indicates fading bullish momentum, even though HH-HL structure is still intact.

The range was narrow (≈98 points), categorising the day as range-bound, not sideways. The previous weekly expiry was also narrow yet sideways.

🛡 5 Min Intraday Chart with Levels

🛡 Intraday Walk

Gap-up opening at 25,144.85, above PDH → bullish continuation vibe.

Early dip → support at 25,055 → IB formed.

Recovery attempt back to day’s open, but rejection at 25,150 zone.

Second breakout attempt at 2:15 pm → harder rejection.

Index slipped below PDH → closed at 25,076.95, above support.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,142.00

High: 25,153.65

Low: 25,054.90

Close: 25,083.75

Change: +33.20 (+0.13%)

🏗️ Structure Breakdown

Red candle (Close < Open)

Body: 58.25 points

Upper wick: 11.65 points

Lower wick: 28.85 points

📚 Interpretation

Sellers defended 25,150 again.

Close still above 25,050 → buyers alive.

Lower wick shows dip-buying at 25,055.

Net effect: Mild profit booking, not a reversal.

🕯️ Candle Type

Small bearish body with lower tail → selling pressure at top, hidden demand at support.

🛡 5 Min Intraday Chart

🛡 Gladiator Strategy Update

ATR: 195.14

IB Range: 89.95 → Medium

Market Structure: ImBalanced

Trade Highlight: No trade trigger today.

🕵️ Range & Bias

Support Zone: 24,955 – 24,920

Resistance Zone: 25,100 – 25,140

Bias: Cautiously Bullish → above 25k, but conviction is weak.

📌 Support & Resistance Levels

🎚️ Resistance Zones

25,100

25,155

25,190 (pattern target)

25,240

🎚️ Support Zones

25,050 ~ 25,030

24,995

24,955

24,920

24,890 – 24,880

💡 Final Thoughts

The market is respecting 25,050 as demand and 25,150 as supply, leaving price action compressed in a tight zone. Bulls are still holding ground, but repeated failures near resistance hint at fading strength.

📌 “Markets often whisper before they roar — repeated rejections are the whisper, the breakout will be the roar.”

✏️ Disclaimer

This is my personal analysis — not investment advice. Please consult your financial advisor before trading.

Nifty50 Trade setup (conditional long)Market Update & Plan

Yesterday, price tested our HTF POI and showed a slight rejection. Toward the end of the session, we also saw a strong bearish 15m candle.

For today, the safer approach is to wait for a pullback into the 24,973 – 24,929 zone and look for a bullish rejection candle there. The higher-timeframe trend for this week remains bullish, and since today is Thursday, it’s better not to trade against the trend. If the setup doesn’t align, we simply skip the trade just like we did last Thursday.

Nifty Analysis EOD – August 18, 2025 – Monday🟢 Nifty Analysis EOD – August 18, 2025 – Monday 🔴

Gap-Up Glory Meets 25K Roadblock

🗞 Nifty Summary

Nifty opened with a massive 300+ point gap-up, but early profit booking dragged it down by 58 points. A sharp rebound from the day’s low in the first 5 min carried it to a new high of 25,022, just testing the psychological 25K level.

However, that zone acted as a ceiling; profit booking and fresh selling kicked in, pulling Nifty not only below the high or mean but also beneath the opening print and morning day low. After a brief 100-point bounce from a fresh day low, rejection from the VWAP kept the index suppressed.

By the close, Nifty settled near the day’s bottom at 24,876.95, still up +245.65 points (+1.00%) but printing a red candle due to closing below the open.

👉 A textbook gap-up exhaustion session: bullish sentiment upfront, intraday dominated by selling pressure.

📊 Intraday Walk

🚀 Gap-Up Start: Open at 24,938.20 (up >300 points).

📉 Early Booking: Dragged down ~58 points.

🔄 Quick Rebound: Buyers drove Nifty to the day high at 25,022.

⛔ 25K Blocked: Profit booking intensified, breaking below opening levels.

⚡ Second Bounce: +100 points recovery attempt from new day low.

📉 VWAP Rejection: Sellers regained control; close near the bottom at 24,876.95.

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,938.20

High: 25,022.00

Low: 24,852.85

Close: 24,876.95

Change: +245.65 (+1.00%)

Candle Structure

Type: Red candle (close < open) despite a strong % gain.

Body: 61.25 pts

Upper Wick: 83.80 pts

Lower Wick: 24.10 pts

Interpretation

Market opened strong but gave back intraday gains.

Candle resembles an Inverted Hammer / Shooting Star in a gap-up.

Signals loss of bullish momentum, but needs next session confirmation.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 218.49

IB Range: 137.7 → Medium

Market Structure: imBalanced

Trade Highlight: No trade triggered

📌 Support & Resistance Levels

Resistance Zones

24,955

24,995

25,030 – 25,050

25,100

25,240

Support Zones

24,850 – 24,820

24,770 – 24,745

24,695 – 24,675

24,600 – 24,585

🎯 What’s Next?

If 24820 ~ 24,850 holds, buyers may regroup and reattempt a breakout above 25,000.

If broken, expect deeper profit booking toward 24,745 – 24,675.

Psychological pressure at 25K remains the key battle zone.

💡 Final Thoughts

Today was a classic gap-up exhaustion day — the market showed enthusiasm, but sellers ruled intraday.

“Markets love to test conviction. What looks like strength at open can often be weakness by close.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – August 14, 2025 – Thursday 🟢 Nifty Analysis EOD – August 14, 2025 – Thursday 🔴

Quiet Expiry Day on the Surface, Wild Moves Beneath

🗞 Nifty Summary

Nifty opened neutral, and within the first 1 minute carved a 60-point range — a range that turned out to be almost the entire day’s action. For the rest of the session, the index stayed locked inside this band, repeatedly attempting to break above the PDH + R1 zone, but each time failing to sustain. Similarly, the lower boundary provided reliable support, keeping Nifty trapped.

While the overall weekly expiry felt silent in terms of range, the price action inside the band was anything but quiet — wild intraday swings offered ample opportunities for scalpers and quick traders. Structurally, today’s range stayed inside the previous day’s range, aside from a few points of false breakout shadows.

The game plan for the next session remains the same as discussed yesterday — we’re still waiting for a decisive breakout from this coiling structure.

Refere the game plan here:

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Candle Data:

Open: 24,607.25

High: 24,673.65

Low: 24,596.90

Close: 24,631.30

Change: +11.95 (+0.05%)

Structure Breakdown:

Green candle (Close > Open)

Body size: 24.05 points → very small → low momentum

Upper wick: 42.35 points

Lower wick: 10.35 points

Interpretation:

Market opened near yesterday’s close, tried pushing higher but failed to hold gains.

Small green body signals sideways indecision; buyers still defended the 24,600 zone.

Longer upper wick vs lower wick → selling pressure near highs.

Candle Type:

Small-bodied Spinning Top / Doji-like candle → indecision, no clear trend control.

📊 Short-Term View

Consolidation persists in 24,600–24,650 zone.

Break above 24,675 = bullish strength.

Break below 24,595 = bearish momentum toward 24,535–24,460.

Range & Bias:

Support: 24,595 – 24,535

Resistance: 24,675 – 24,700

Bias: Neutral-to-mildly bullish above 24,600

🛡 5 Min Intraday Chart

⚔ Gladiator Strategy Update

ATR: 199.36

IB Range: 68.25 → Medium

Market Structure: Balanced

Trade Highlight: No Trade Triggered

📌 Support & Resistance Levels

Resistance Zones:

24,660

24,690 ~ 24,700

24,735

24,780

Support Zones:

24,585

24,560

24,525 ~ 24,515

24,500

24,475

💡 Final Thoughts

"The tighter the coil, the sharper the breakout."

Nifty is compressing hard — a breakout is inevitable, and expiry’s quietness might just be the calm before a directional move.

✏️ Disclaimer

This is a personal market observation, not financial advice.

Nifty Analysis EOD – August 13, 2025 – Wednesday🟢 Nifty Analysis EOD – August 13, 2025 – Wednesday 🔴

Volatile Inside Day Keeps Traders Guessing Before Expiry

🗞 Nifty Summary

Nifty opened with a 102-point gap-up, driven by early bullish sentiment. However, the 24,600 zone acted as resistance right from the start, pushing prices down by 64 points to mark the day’s low at 24,535.25. Support emerged from the CPR zone, fueling a rebound that broke through 24,600 and set a new day high at 24,614.20, completing the Initial Balance (IB).

Once again, Nifty failed to sustain above 24,600, drifting between the IB range and VWAP. Around 12:40 PM, IB high was breached, but the index had to fight hard to stay above it. After an extended struggle to reach the previous day’s high, the index finally topped at 24,664.55, then retreated back toward the IB high before closing at 24,630.40.

Price action was highly volatile with no clear directional conviction, reflected in the long wicks on 5-minute candles. Structurally, the day remained balanced and inside the previous day’s range, forming an Inside Bar pattern on the daily chart — a setup known for potential breakout opportunities.

🛡 5 Min Intraday Chart with Levels

🎯 Tomorrow’s Game Plan

Tomorrow is weekly expiry, and my bias starts bullish:

💡 Bullish Plan:

If the market opens inside today’s range, I’ll wait for a breach and hold above 24,660 for long opportunities.

First hurdle: 24,700

Targets: 24,780 → 24,825 → 24,890

💡 Bearish Plan:

Not my primary view, but I’ll consider shorts if 24,525 ~ 24,515 breaks and sustains below.

First hurdle: 24,475 ~ 24,465

Targets: 24,425 → 24,350 → trail for deeper dips

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

OHLC: Open 24,586.20 | High 24,664.55 | Low 24,535.25 | Close 24,619.35

Change: +131.95 (+0.54%)

Body: 33.15 points (small)

Upper Wick: 45.20 points

Lower Wick: 50.95 points

📌 Interpretation:

Small-bodied green Spinning Top → market hesitation despite a positive close.

Close above the midpoint hints at a mild recovery attempt.

Buyers need follow-through above 24,665 to build momentum; losing 24,535 could shift bias bearish.

📊 Short-Term View

Bias: Mildly bullish above 24,585

Support: 24,500 – 24,475

Resistance: 24,660 – 24,700

🛡 5 Min Intraday Chart

⚔ Gladiator Strategy Update

ATR: 212.98

IB Range: 78.95 → Medium

Market Structure: Balanced

Trade Highlight:

12:40 PM – Long Entry → SL Hit

📌 Support & Resistance Levels

📌 Resistance Zones:

24,660

24,690 ~ 24,700

24,735

24,780

📌 Support Zones:

24,585

24,560

24,525 ~ 24,515

24,500

24,475

💡 Final Thoughts

"Inside Bars before expiry can be like coiled springs — they can snap in either direction, and fast."

Patience in the morning and disciplined level play will be key tomorrow.

✏️ Disclaimer

This is my personal market view for educational purposes — not financial advice.

Nifty Analysis EOD – August 12, 2025 – Tuesday🟢 Nifty Analysis EOD – August 12, 2025 – Tuesday 🔴

24700 Attempt, But Bulls Lose Steam at Resistance

🗞 Nifty Summary

Nifty opened 18 points lower and slipped further by 12 points to hit the day’s low at 24,530.75. From there, a steady and confident rally took it one-sided to the 24,700 zone, marking the high at 24,702.60.

As highlighted in yesterday’s note, 24,725 was expected to be a key resistance zone — and right near 24,700, selling pressure emerged. The index slipped back toward the previous day’s close, tried to hold, but dipped again to the day’s low.

A positive sign was that the day’s low held, forming a double bottom pattern, followed by a rise above VWAP. However, failure to sustain above 24,620 saw bulls lose momentum, and bears dragged Nifty to 24,475, finally closing at 24,485.20.

We were expecting a close above 24,660–24,675 to keep bullish momentum intact, but such expectations may be premature while base-building is underway at lower levels.

Today’s price action suggests higher levels are attracting selling pressure, and sentiment shifted despite breaking the previous day’s high. Still, holding the day’s low at the Fib 0.618 retracement of the previous session means tomorrow’s opening above and sustaining this level could lead to a retest of 24,700 — with 24,620 and 24,650 acting as interim hurdles.

Interestingly, since 31st July, price action has shown random intraday swings without clear news or events — a cautionary sign for traders in the coming days.

🛡 5 Min Intraday Chart with Levels

🚶 Intraday Walk

Opened slightly negative, extended minor losses to the day’s low at 24,530.75.

Strong, steady upside rally to 24,700 zone.

Resistance selling kicked in right before the key 24,725 zone.

Sharp fall back toward the previous day’s close, followed by a double-bottom intraday structure.

VWAP break failed to sustain, leading to late-day selling pressure.

Closed well below the morning’s highs, losing bullish momentum.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Today’s Candle Type: Inverted Hammer on a down day.

OHLC:

Open 24,563.35

High 24,702.60

Low 24,465.65

Close 24,487.40

Change −97.65 (−0.40%)

Body: 75.95 points (small)

Upper Wick: 139.25 points (long)

Lower Wick: 21.75 points (small)

Key Observation:

Buyers pushed strongly early but failed to hold — sellers dominated into the close.

What it Implies:

Near-term bearish bias below 24,500; rejection at 24,700 confirms supply zone pressure.

🛡 5 Min Intraday Chart

⚔ Gladiator Strategy Update

ATR: 216.97

IB Range: 171.85 → Medium

Market Structure: ImBalanced

Trade Highlights:

09:20 AM: Long Entry → Target Hit (R:R = 1:1.5)

🎯 What’s Next? / Bias Direction

Bias: Bearish below 24,500.

Supports: 24,460 – 24,420, then 24,350.

Resistances: 24,640 – 24,700.

A sustained open above 24,500 with holding could invite a retest of 24,700, but the path remains choppy.

📌 Support & Resistance Levels

Resistance Zones:

24,620

24,660 ~ 24,675

24,725 ~ 24,735

24,780

Support Zones:

24,475 ~ 24,445

24,410 ~ 24,400

24,350

💡 Final Thoughts

"The market doesn’t care about your hopes — it moves where the pressure flows."

Until the base solidifies, upside rallies will face headwinds. Respect the zones, trade the levels, and let price prove itself.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – August 11, 2025 – Monday🟢 Nifty Analysis EOD – August 11, 2025 – Monday 🔴

Bulls Strike Back — Friday’s Damage Erase

📝 Nifty Summary

Nifty opened 29 points higher and quickly filled the gap. At the previous day’s close, it took support and marked the day’s low at 24,347.45 — which remained untouched for the rest of the session. From there, it fought through each resistance level, climbed to the previous day’s high, and marked a day high of 24,600.85.

A mild 40-point dip followed, but the index still closed strong at 24,560.45, reclaiming all of Friday’s losses and nearly matching Thursday’s close (just 11 points short).

The question now:

a) Was this just a dead cat bounce?

b) Or the start of a base-building phase after oversold conditions?

c) Or was it fueled by some positive news? (No major news tracked today)

Whatever the cause, bulls are back in the zone. To maintain positive momentum, tomorrow’s close needs to be above 24,650.

🛡 5 Min Intraday Chart with Levels

📉 Daily Time Frame Chart with Intraday Levels

📉 Daily Candle Breakdown

Open: 24,371.50

High: 24,600.85

Low: 24,347.45

Close: 24,585.05

Change: +221.75 (+0.91%)

Structure Breakdown

Candle Type: Green (Close > Open)

Body Size: 213.55 points (near-full body)

Upper Wick: 15.80 points (tiny)

Lower Wick: 24.05 points (small)

Interpretation

Strong bullish control: Open near the low, close near the high.

Minimal wicks show decisive directional movement with little intraday rejection.

Fully recovered from Friday’s sell-off — almost engulfing it.

Candle Pattern: Bullish Marubozu (near-full body) — often a sign of potential upside continuation if volume supports the move.

📊 Short-Term View (from August 8, 2025 reference)

Price reclaimed the 24,460 resistance zone and closed above it.

Momentum shifted from bearish to bullish.

Next watch: 24,620-24,675 supply zone, and 24,700 psychological mark.

Range & Bias

Support Zone: 24,475 – 24,445

Resistance Zone: 24,660, 24,725

Bias: Bullish above 24,460

Trading Insight

If buyers hold above 24,460, next target is 24,725.

Rejection there may trigger a quick pullback toward 24,500.

🛡 5 Min Intraday Chart

⚔ Gladiator Strategy Update

ATR: 214.75

IB Range: 80.95 → Medium

Market Structure: Balanced

Trade Summary:

10:20 AM: Long Entry → Target Hit (R:R = 1:2.65)

🗺 Support & Resistance Levels

Resistance Zones:

24,620

24,660 ~ 24,675

24,725 ~ 24,735

24,780

Support Zones:

24,500

24,475 ~ 24,445

24,410 ~ 24,400

24,350

💭 Final Thoughts

Strong comeback by the bulls today, erasing Friday’s weakness in one swift move. Whether it’s a one-off bounce or the start of something bigger will be clearer after tomorrow’s close.

"Structure is key. When levels hold, momentum follows — when they break, so does conviction."

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – August 8, 2025 – Friday🟢 Nifty Analysis EOD – August 8, 2025 – Friday 🔴

From Yesterday’s Glory to Today’s Gloom — Bulls Knocked Off the Board

Today’s market was a textbook case of how quickly momentum can flip. Yesterday’s 289-point bullish surge was completely erased, with Nifty ending deep in the red and closing at the day’s low. Sellers clearly had the upper hand, leaving little room for bulls to breathe.

🗞 Nifty Summary

Friday opened with a 65-point gap-down — right below the crucial 24,580 support zone — and that level instantly showed rejection.

In the first 45 minutes, Nifty slipped 150 points from the day high and 200 points from the previous day high. The key Fibonacci retracement level from yesterday’s range — 24,406 ~ 24,412 — played the role of intraday savior multiple times, offering support and holding the market within a narrow zone for most of the day.

However, the bulls’ defense cracked after 3:00 PM. The support broke, triggering a sharp slide below 24,380 and even the Previous Day Low (PDL).

The upside was capped by 24,470 ~ 24,460, while 24,406 ~ 24,412 remained the battleground for most of the day until the breakdown.

In a single session, yesterday’s dramatic 289-point recovery rally was completely erased — with Nifty closing at the bottom of the PDL and CDL.

Today’s close is now below the low of 12th May, marking a 64-session (88-day) low.

Now the question for Monday: will bearish momentum extend, or will some positive news bring bulls back into play?

🛡 5 Min Intraday Chart with Levels

Intraday Walk

🔻 Gap-down open below major support at 24580.

⏳ First 45 minutes: Steep drop of 150 points from the day high.

🛡️ Fib support at 24406–24412 holds multiple times… until the late break.

🔻 Post 3 PM: Support collapse leads to fresh lows below PDL.

📉 Close near day’s low — erasing yesterday’s bullish rally.

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,544.25

High: 24,585.50

Low: 24,337.50

Close: 24,363.30

Change: −232.85 (−0.95%)

Structure:

Real Body: 180.95 pts (Red Candle — Close < Open)

Upper Wick: 41.25 pts

Lower Wick: 25.80 pts

Interpretation:

Strong bearish sentiment — sellers maintained control from open to close.

Very small lower wick — indicates conviction from sellers in closing near the low.

Wiped out prior day’s gains — buyers have lost the short-term edge.

Candle Type:

Bearish Marubozu (near-full body) — signals decisive selling pressure, often a continuation pattern after weakness.

🛡 5 Min Intraday Chart

🥷 Gladiator Strategy Update

ATR: 210.45

IB Range: 134.05 → Medium

Market Structure: Balanced

Trade Summary:

10:35 AM – Short Entry → SL Hit

📌 What’s Next? / Bias Direction

Below 24,400: Bearish momentum likely to extend toward 24,250–24,200.

Above 24,470: Only a strong reclaim can shift bias back to neutral.

Gap-down/weak open on Monday may accelerate selling; bounce attempts will face resistance at 24,400–24,470.

🔍 Support & Resistance Levels

Resistance Zones:

24,406 ~ 24,412

24,460 ~ 24,470

24,500

24,580

Support Zones:

24,315

24,280

24,240 ~ 24,225

24,185

💬 Final Thoughts

"Markets don’t turn on hope — they turn on price. Respect the levels, and let price lead the story."

Bulls had the glory on Thursday, but Friday flipped the script completely. The market now sits at a multi-month low — momentum favors bears, but Monday’s open will decide if we see follow-through selling or a sharp dead-cat bounce.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – August 7, 2025 – Thursday🟢 Nifty Analysis EOD – August 7, 2025 – Thursday 🔴

A Trap, a Reversal, and a Breathless Rally — Did You Catch It?

🗞 Nifty Summary

Today was expected to be volatile, but few were prepared for how wildly Nifty behaved.

After a gap-down of 110 points on the back of negative global cues, Nifty immediately started filling the gap and reached the Previous Day Low (PDL). However, strong rejection at PDL sent prices tumbling — slicing below the Open, IB Low, and even the Current Day Low, marking a sharp low at 24,387.

Then came the bear trap.

A brief breakdown to 24,344.15 looked like a breakdown, but instead triggered a sharp liquidity grab, launching a vertical move upward. From that bottom, Nifty surged in a breathtaking rally — not a single 5-min candle broke its previous candle’s low, signaling relentless buying. Almost every resistance zone — Swing High, VWAP, PDL/S1, CPR, Weekly Low — got taken out in one single breath.

Did you ride it?

Honestly — I didn’t. I was frozen watching this dramatic reversal unfold.

Still, today’s super recovery puts the index back within its known range. Now, bulls need a close above 24,660–24,675 to confirm momentum.

📉 Intraday 5 Min Chart Overview

🧭 Intraday Price Action Flow

9:15 AM: Opens 110 points down at 24,467.10

9:15–10:30 AM: Recovers swiftly to PDL, but fails there.

10:25 AM – 11:05 PM: Sharp fall — breaches CDL & IB Low → makes new day low at 24,387

1:20 PM Onwards: Attempts consolidation; false breakdown at 24,344.15

2:00 PM – 3:30 PM: Monster rally → No candle breaks prior low; bulls dominate to close at 24,626.65

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,464.20

High: 24,634.20

Low: 24,344.15

Close: 24,596.15

Change: +21.95 (+0.09%)

🔍 Candle Structure:

Real Body: Green → +131.95 pts

Upper Wick: 38.05 pts

Lower Wick: 120.05 pts

🧠 Interpretation:

Strong rejection from intraday lows near 24,344

Long lower wick shows dip buying strength

Closed near the highs = bulls dominated the end

Still within larger range → needs breakout above 24,675 for follow-through

🔥 Candle Type:

A bullish recovery candle, hammer-like, but within a sideways structure — shows aggressive buying near important demand zone (24,340–24,380).

📈 Updated Short-Term View – 7th August 2025

Support Zone: 24,340 – 24,380

Resistance Zone: 24,620 – 24,675

Bias: Neutral with a bullish tilt, unless 24,340 breaks decisively.

🎯 Trading Insight

A close above 24,660–24,675 may lead to further upside — possibly testing 24,735–24,780

Failure to hold above 24,460 will shift bias back to bearish

🛡 5 Min Intraday Chart

🥷 Gladiator Strategy Update

ATR: 205.09

IB Range: 82.85 → Medium

Market Structure: ImBalanced

⚔️ Trade Summary:

🕙 10:25 AM – Short Entry → Trail SL Hit (R:R = 1:1.8)

🧱 Support & Resistance Levels

🔼 Resistance Zones:

24,620

24,660 ~ 24,675

24,725 ~ 24,735

24,780 ~ 24,795

24,860 ~ 24,880

🔽 Support Zones:

24,542 ~ 24,535

24,500

24,470 ~ 24,460

24,380 ~ 24,344

💬 Final Thoughts

"Markets reward patience and punish rigidity."

Today was a masterclass in trap-reversal-breakout structure. While many were either trapped or missed the move, this type of price action reminds us — be ready, but never rigid.

Now all eyes on 24,675 — can bulls push above it and sustain?

✏️ Disclaimer:

This analysis reflects personal views and is not trading advice. Please consult your financial advisor before making decisions.

Nifty Analysis EOD – August 5, 2025 – Tuesday 🟢 Nifty Analysis EOD – August 5, 2025 – Tuesday 🔴

🌀 Double Inside Day – Calm Before the Storm?

📊 Nifty Summary

In the wind of negative news, yet Nifty starts neutral at the resistance zone of 24,725 ~ 24,735 but was unable to hold there and fell 140 points within the first 45 minutes.

After this initial sell-off, Nifty found support around 24,590, which coincided with yesterday's Fib 0.786 level, R1, and Previous Week Low (PWL).

These levels were well-defended throughout the session. Near the end, the index recovered ~80 points and closed at 24,649.55, close to yesterday’s Fib 0.5.

Can we consider today's move a retracement or a pullback of yesterday's move?

Same as Monday, today’s action stayed inside the previous session’s range, forming an Inside Bar. Now it appears as a Double Inside Bar on the daily chart.

📉 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,720.25

High: 24,733.10

Low: 24,590.30

Close: 24,649.55

Change: −73.20 (−0.30%)

Candle Structure Breakdown:

🔴 Red Candle (Close < Open):

24,720.25 − 24,649.55 = 70.70 points

🔼 Upper Wick:

24,733.10 − 24,720.25 = 12.85 points

🔽 Lower Wick:

24,649.55 − 24,590.30 = 59.25 points

Interpretation:

After a flat open, the index tried to move higher but faced resistance near 24,730, then reversed.

Buying interest was seen near the 24,590 zone, but sellers remained in control.

It closed below the open with a decent lower wick, indicating some buying support but overall weakness.

Candle Type:

🕯 A pullback candle with a moderate real body and long lower wick – suggests buyers attempted to support the fall, but sellers dominated.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 202.71

IB Range: 139.95 → 🟠 Medium

Market Structure: Balanced

Trade Summary:

❌ No entry triggered by system

📌 Support & Resistance Levels

🔼 Resistance Zones:

24,725 ~ 24,735

24,780 ~ 24,795

24,860 ~ 24,880

🔽 Support Zones:

24,675 ~ 24,660

24,620

24,542 ~ 24,535

24,500

24,470 ~ 24,460

🧠 Final Thoughts

Today's double inside bar structure signals contraction and indecision — markets are waiting for a decisive breakout.

“The tighter the coil, the bigger the breakout.”

Keep an eye on these tight ranges. Patience before power!

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – August 4, 2025 – Monday🟢 Nifty Analysis EOD – August 4, 2025 – Monday 🔴

A Monday full of mind games.

Nifty opened with a slight positive gap and immediately tested the TC of CPR, but that optimism didn’t last long — sharp rejection took it to day’s low (24,554). What followed was a rollercoaster: a 100-point recovery, a 50-point pullback — all within 10 minutes. This wild price action defined the rest of the day.

Throughout the session, Nifty remained trapped within the CPR zone. Both sides experienced multiple fakeouts, especially around initial balance (IB) zones. Even when prices nudged toward R1, repeated failed attempts to break above reflected the market’s indecisiveness. The day finally closed near the high, but conviction was still lacking.

Many option buyers likely struggled due to deceptive shadows and unexpected fractal breakouts. The entire price action stayed within Friday’s range — forming an Inside Bar structure on the daily chart. This suggests a potential range breakout trade tomorrow.

The market faced resistance near the Fibonacci 0.618–0.786 retracement of the prior fall — aligning with 24,740–24,780 zones. A close above 24,780 tomorrow could shift momentum back in the bulls’ favour. If not, bears still hold the upper ground.

📈 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 24,596.05

High: 24,736.25

Low: 24,554.00

Close: 24,722.75

Change: +157.40 (+0.64%)

Candle Type:

🟢 Bullish Marubozu-like — reflects a strong control by buyers after early weakness.

Structure Breakdown:

Real Body: 126.70 pts (Bullish)

Upper Wick: 13.50 pts (Minor resistance near close)

Lower Wick: 42.05 pts (Early dip got bought aggressively)

Key Insight:

Closed near the high of the day — positive bias for tomorrow

Inside Bar formed – Expect a breakout trade

24,780+ closing will turn sentiment bullish

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 209.36

IB Range: 115.95 → Medium

Market Structure: Balanced

Trade Summary:

🕚 11:30 AM – Long Entry → SL Hit

🕛 12:30 PM – Long Entry → SL Hit

🕐 13:10 PM – Short Entry → SL Hit

Tough day — strategy got chopped in noise-heavy moves.

🔍 Support & Resistance Levels

Resistance Zones:

24,725 ~ 24,735

24,780 ~ 24,795

24,860 ~ 24,880

Support Zones:

24,675 ~ 24,660

24,620

24,542 ~ 24,535

24,500

24,470 ~ 24,460

💭 Final Thoughts

"Markets love to test your patience before they reward your conviction."

Today was a lesson in restraint — avoid overtrading when structure lacks clarity. Inside bar gives us a clean slate for tomorrow. Let price lead.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – August 1, 2025 – Thursday🟢 Nifty Analysis EOD – August 1, 2025 – Thursday 🔴

🎢 Illusion Rally: What You See, Isn’t What It Was!

🧾 Nifty Summary

As we all expected, a negative gap-down opening occurred due to external news. Nifty opened 183 points lower, tested the 24,660–24,675 support zone, then rebounded sharply after a symmetrical triangle + VWAP breakout. The rally pierced through all key levels like a hot knife through butter, topping at 24,950, only to reverse with equal intensity. Closed at 24,765.

📌 Despite the technical structure, today’s move had no clear technical reasoning — more likely triggered by a mix of tariff news, confidence in Modi, weekly + monthly expiry, and manipulation.

📌 in spite of a bullish candle, strong upper rejection from 24,950 hints weakness. Candle appears bullish on colour, but bears dominated intraday close — forming a bearish Moboroshi Candle (illusion of strength).

📌 Bearish Moboroshi Candle Structure : close > open and close < Previous Close

🔍 Intraday Walk

📉 Gap down of 183 pts

🟢 Support held at 24,660–24,675

🔺 Symmetrical triangle + VWAP breakout

🚀 Sharp upmove to 24,950 zone

🔁 Reversal with same intensity

📉 Closed at 24,765 — below prior close

🖼 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,642.25

High: 24,956.50

Low: 24,635.00

Close: 24,768.35

Change: −86.70 (−0.35%)

Candle Structure:

✅ Green Candle (Close > Open) → +126.10 pts real body

⬆️ Upper Wick → 188.15 pts (Very Long)

⬇️ Lower Wick → 7.25 pts (Tiny)

Interpretation:

Opened near yesterday's low

Intraday sharp rally towards 24,950+

Faced strong selling at highs

Closed above open, but way below high — signals clear rejection

Candle Type:

📌 Bearish Moboroshi Candle — Appears bullish but hides weakness

🧠 Buyers strong initially, but sellers took control at the top

Key Insight:

Bulls need decisive close above 24,880–24,910

Else, expect drift back toward 24,660–24,675

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 208.29

IB Range: 93.95 → Medium

Market Structure: Unbalanced

Trades Triggered:

✅ 10:40 AM – Long Entry → Trailing Target Hit (R:R – 1:6.25)

📌 Trade Summary: Big R:R win today on breakout with trailing logic execution!

🧱 Support & Resistance Levels

🔺 Resistance Zones:

24,820 ~ 24,830

24,850

24,880 ~ 24,890

24,910

🔻 Support Zones:

24,780

24,725 ~ 24,715

24,660 ~ 24,650

24,620 ~ 24,600

💭 Final Thoughts

"When the move can’t be explained, the best position is caution."

Today's market behavior reinforces the idea that not all moves are technical. Keep your tools sharp, but don’t ignore contextual chaos.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – July 30, 2025 – Wednesday🟢 Nifty Analysis EOD – July 30, 2025 – Wednesday 🔴

Trapped in Illusion – A Day of Decoy Moves

Nifty moved 130 points today, falling short of the 2-week average range of 196 points. It formed its IB by 11:40 AM, marking the day's high and low early. For the rest of the session, it hovered between the IB high and the previous day high, eventually closing near the mean.

Despite a close below the open, Nifty managed a green close vs. the previous day—making it a classic "moboroshi candle" day, where visuals deceive sentiment.

📉 Intraday 5 Min Time Frame Chart

🪜 Intraday Walk

IB formed by 11:40 AM

False breakout on both sides trapped traders badly

Nifty stayed stuck between IB high and PDH

Closed slightly above the previous close, but below open

Eyes on breakout of 24,910 for targets of 24,995 and 25,090–25,110

🔄 Trend & Zone Update

📈 Resistance Zone Shifted To: 25,110 ~ 25,090

📉 Support Zone Shifted To: 24,520 ~ 24,480

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Candle Type: Small Red Hammer‑Like Candle (Decoy / Moboroshi)

Today’s OHLC:

🟢 Open: 24,890.40

🔺 High: 24,902.30

🔻 Low: 24,771.95

🔴 Close: 24,855.05

📈 Change: +33.95 (+0.14%)

📌 Candle Structure:

Real Body: 35.35 pts (Small bearish body)

Upper Wick: 11.90 pts (Very small)

Lower Wick: 83.10 pts (Long)

📌 Key Observations:

Buyers stepped in near 24,770 zone

Closed near open but slightly lower → mild net selling

Long lower wick indicates dip buying support

📌 Implication:

Buyers defended 24,770–24,780 zone

A reclaim of 24,900–24,920 may resume bullish move

A close below 24,770 weakens support

🛡 5 Min Intraday Chart

🛡️ Gladiator Strategy Update

ATR: 195.72

IB Range: 78.15 → Medium

Market Structure: Balanced

💥 Trades Triggered:

🕙 10:25 AM – Short Entry → SL Hit

📌 Trade Summary:

False IB breakouts on both sides led to a stop loss hit—typical trap in a tight consolidation phase.

📌 Support & Resistance Levels

📈 Resistance Zones:

24,880 ~ 24,890

24,910

24,995

25,090 ~ 25,110

📉 Support Zones:

24,830 ~ 24,820

24,780

24,725 ~ 24,715

24,660 ~ 24,650

🔮 What’s Next? / Bias Direction

Awaiting breakout above 24,910 for potential targets of 24,995 and 25,090–25,110. Consolidation may reward patient breakout players in upcoming sessions.

🧠 Final Thoughts

“Structure is key. When levels work, respect them. When they break, adapt.”

Today's range was narrow, but traps show signs of buildup. Be ready when the market unwinds.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

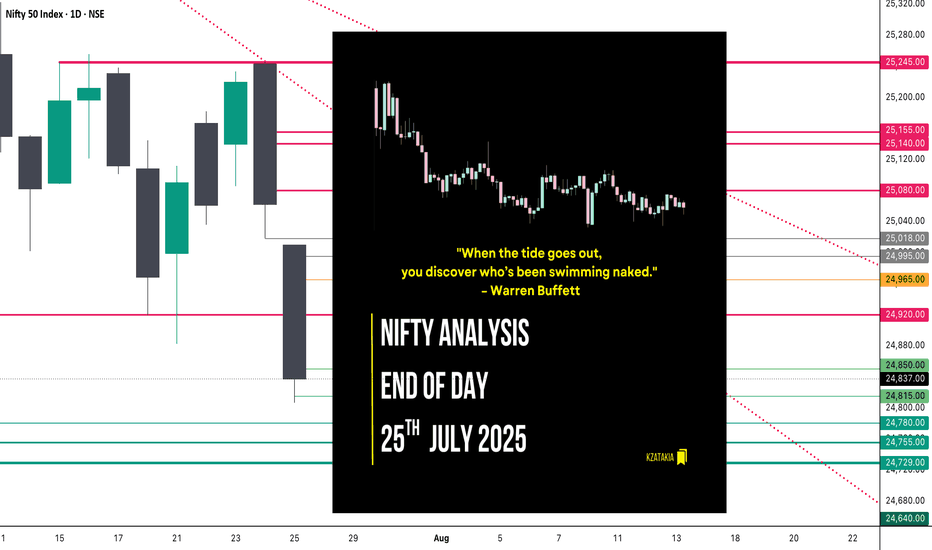

Nifty Analysis EOD – July 25, 2025 – Friday🟢 Nifty Analysis EOD – July 25, 2025 – Friday 🔴

"When the tide goes out, you discover who’s been swimming naked." – Warren Buffett

Nifty GapDowns Below Key Support and Slips Further

The market opened with a sharp GapDown, breaching the previous day's low and instantly shedding 150 points within the first hour. Nifty attempted to find footing near the crucial 21st July low zone of 24,850–24,880, but the support gave way, slipping an additional 50 points.

The day mostly drifted around these lower levels with bearish dominance. Though bulls made an effort to recover late in the session, it lacked strength. The index finally settled at 24,837, decisively closing below the 21st July low — signalling a deeper structural breakdown.

📉 Trend & Zone Update

Resistance Zone Shifted To: 25,144 ~ 25,155

Support Zone Shifted To: 24,729 ~ 24,755

📊 What If Plans – 28th July Outlook

🅰️ Plan A (Contra Long Setup)

If market opens inside the previous day range and finds support at 24,815 ~ 24,850

Then potential targets are 24,920, 24,965, and 25,020

🅱️ Plan B (Trend is Friend – Short Continuation)

If market opens inside range and faces resistance around 24,965 ~ 24,995

Then aim for 24,850, 24,815, 24,780, and 24,730

⏸️ On-the-Go Plan

If market Gaps Up/Down outside previous day’s range

Then wait for the Initial Balance (IB) to form and act based on structure and S/R levels.

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,010.35

High: 25,010.35

Low: 24,806.35

Close: 24,837.00

Candle Structure

Body: Strong red candle (−173.35 pts)

Upper Wick: None (open = high)

Lower Wick: 30.65 pts

Interpretation:

A textbook bearish Marubozu — shows sellers had control throughout.

Bears stepped in immediately from open, preventing any bullish response.

Minimal lower wick implies limited buyer defense even at the session low.

Key Insight:

Bears are in command; bulls must reclaim 25,000+ quickly to prevent further downside.

If 24,800–24,820 breaks, eyes shift to 24,700–24,750 zone next.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 192.95

IB Range: 87.4 → Medium

Market Structure: Imbalanced

Trades Triggered:

🕙 10:10 AM – Short Entry → 🎯 Target Hit (1:2.4 R:R)

🧭 Support & Resistance Levels

Resistance Zones

24,920

24,965

24,995 ~ 25,018

25,080

25,140 ~ 25,155

Support Zones

24,780

24,755 ~ 24,729

24,640

📌 Final Thoughts

When strong candles appear back-to-back with no meaningful recovery in between, it’s not just a correction — it’s a statement. In this market phase, reacting to price structure rather than assumptions will keep you on the right side. Stay nimble, stay prepared.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

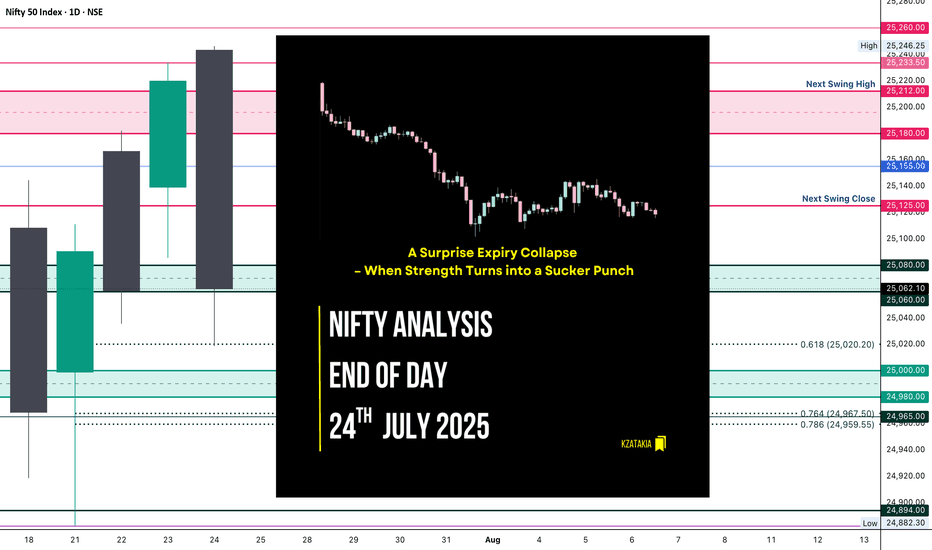

Nifty Analysis EOD – July 24, 2025 – Thursday 🟢 Nifty Analysis EOD – July 24, 2025 – Thursday 🔴

📉 A Surprise Expiry Collapse – When Strength Turns into a Sucker Punch

Today’s session was an unexpected twist.

Nifty opened above the previous day’s high, giving early hope to the bulls—but within the first hour, it slipped to 25,155 and formed its IB. What followed was a sharp 136-point fall, breaking not just yesterday’s low, but also the July 22nd low. This sudden bearish momentum was completely news-driven, and expiry-day long unwinding only added fuel to the fire.

Despite a strong close yesterday, today’s fall erased all of July 23rd’s gains and brought us right back to July 22nd’s close—neutralizing the recent upward effort.

The day closed at 25,062, marginally above key support. Technically, today’s low respected the 0.618 Fib retracement level drawn from July 21st’s low to July 23rd’s high—so a dead cat bounce is possible if no further bad news hits. But if we open below 25,050 tomorrow, expect more downside pressure toward 24,960–24,890 zones.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,243.30

High: 25,246.25

Low: 25,018.70

Close: 25,062.10

Change: −157.80 (−0.63%)

Candle Structure Analysis:

🔴 Body: Large red body (181.2 pts) shows strong intraday selling.

☁️ Upper Wick: Tiny (2.95 pts) → sellers dominated from the start.

🌊 Lower Wick: Moderate (43.4 pts) → small recovery near close.

Candle Type:

Almost a bearish Marubozu — clear domination by sellers with barely any upper shadow, signaling intense sell pressure.

Key Insight:

Bulls lost control after open.

Bears took charge below 25,155.

Close near support, but bias cautious.

Bulls must reclaim 25,150+ for recovery, else 25,000 may give way.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 185.97

IB Range: 83.55 → Medium

Market Structure: Balanced

Trades Triggered:

⏰ 10:05 AM – Short Entry → SL Hit

⏰ 11:10 AM – Short Entry → Target Hit (1:3.6 Risk:Reward)

📊 Support & Resistance Levels

Resistance Zones:

25,125

25,155

25,180 ~ 25,212

25,233

Support Zones:

25,080 ~ 25,060

25,020

25,000 ~ 24,980

24,967 ~ 24,959

24,882

🔮 What’s Next?

A gap-up or stable open may trigger a dead cat bounce toward 25,150–25,180.

A gap-down below 25,050 confirms bearish continuation → next targets: 24,960 / 24,890.

Watch price action around the 25,020–25,060 zone closely.

🧠 Final Thoughts

“Markets are never wrong – opinions often are.”

— Jesse Livermore

Today was a reminder of how expiry day surprises and news flows can flip the narrative. Stay flexible, and keep a bias—but not a blind one.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

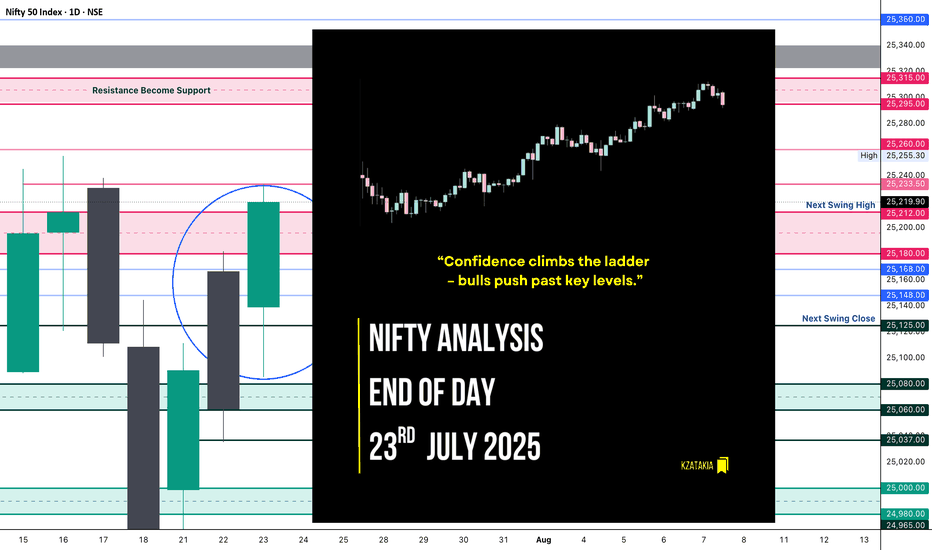

Nifty Analysis EOD – July 23, 2025 – Wednesday 🟢 Nifty Analysis EOD – July 23, 2025 – Wednesday 🔴

“Confidence climbs the ladder – bulls push past key levels.”

Nifty opened with a Gap Up of 78 points and initially retraced 54 points, finding solid footing around the CPR Zone. Once reclaimed VWAP, the index climbed in a methodical, low-volatility uptrend, breaking one resistance after another: CDH, R1, 25150, PDH, and the key zone 25200~25212 — finally touching the anticipated resistance at 25333, and closing just below that at 25219.90, close to the day’s high.

📌 Flashback from Yesterday's Note:

“If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.”

👉 This expectation played out to perfection today — gradual yet confident bullish strength led Nifty to reclaim 25200 and close above it.

🔍 Today’s close of 25220 is higher than the last 7 sessions, suggesting a bullish shift in structure. However, bulls now face the real test — breaching the 25300 ~ 25350 resistance zone.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 25,139.35

High: 25,233.50

Low: 25,085.50

Close: 25,219.90

Change: +159.00 (+0.63%)

Candle structure analysis:

Real body: Green body = 80.55 pts → strong bullish body

Upper wick: 13.60 pts → very small

Lower wick: 53.85 pts → moderate

Candle Interpretation:

The session opened stable, dipped to 25,085, but strong buyers showed up, helping price climb throughout the day and close near high. A firm green candle, signaling buyers in control.

Candle Type:

A Bullish Marubozu–like candle, not perfectly clean but represents strong continuation momentum.

Key Insight:

Close above 25200 confirms a bullish grip

If price holds above 25220–25250, next push could be towards 25280–25330

Immediate support now moves to 25,120–25,140

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.35

IB Range: 64.35 → Medium

Market Structure: Balanced

Trades Triggered:

⏱️ 10:45 AM – Long Entry → Trailing SL Hit (1:2.65 RR)

🔁 Support & Resistance Levels

Resistance Zones:

25,180 ~ 25,212

25,233

25,260

25,295 ~ 25,315

25,340 ~ 25,322 (Gap Zone)

Support Zones:

25,168

25,125

25,080 ~ 25,060

25,037

🧠 Final Thoughts

“Momentum is not magic—it’s built one level at a time.”

Bulls showed strength with control and consistency today. With 25200 reclaimed, they now hold the ball — next challenge lies at the gates of 25300–25350. Will they break through or pause for breath? Tomorrow holds the answer.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

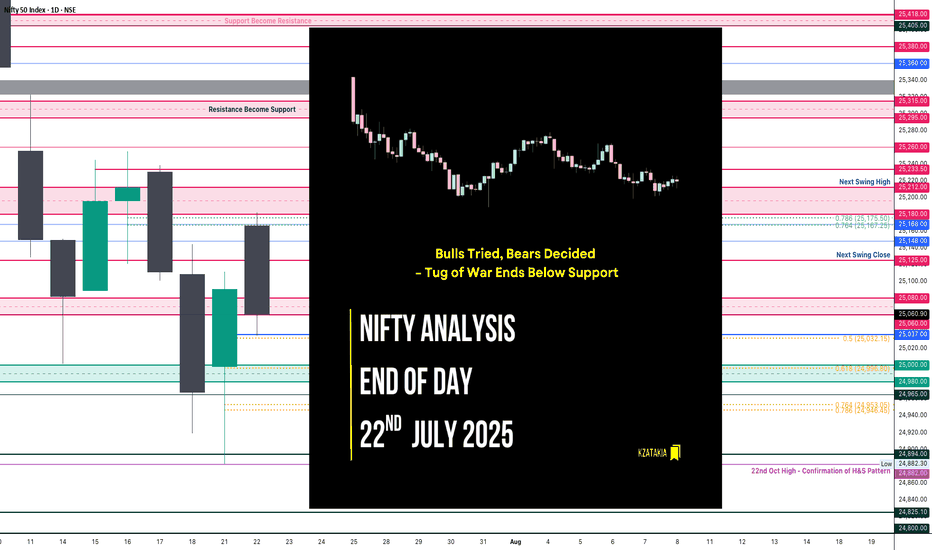

Nifty Analysis EOD – July 22, 2025 – Tuesday🟢 Nifty Analysis EOD – July 22, 2025 – Tuesday 🔴

"Bulls Tried, Bears Decided – Tug of War Ends Below Support"

Nifty opened with an 88-point gap-up, continuing the bullish sentiment, right at the resistance zone of 25,180 ~ 25,212. However, the market opened at the high (OH) and quickly slipped around 100 points to form the Initial Balance (IB). After a brief bounce back to the mean, it faced resistance, leading to a breakdown of IB and further losses of 77 points.

A supportive bounce emerged near 25,060 ~ 25,080, but the price was pushed down again by PDH + VWAP + R1. The day closed below PDC and under the support zone at 25,065, showing bearish dominance despite a volatile tug-of-war between bulls and bears.

Today’s low tested the 0.5 Fibonacci retracement level (from yesterday’s low to today’s high). If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 25,166.65

High: 25,182.00

Low: 25,035.55

Close: 25,060.90

Change: −29.80 (−0.12%)

Candle Structure:

Real Body: Red (−105.75 pts) → Decent bearish body

Upper Wick: 15.35 pts → Small

Lower Wick: 25.35 pts → Moderate

Interpretation:

Price opened strong but faced selling near 25,180, leading to a steady drop throughout the session. The lower wick shows some buying attempt near 25,035, but the close below open signals bears dominated.

Candle Type:

Bearish candle with moderate lower wick – resembles a Bearish Engulfing setup after a green candle, suggesting profit-booking or fresh selling.

Key Insight:

Sellers defending 25,180–25,200 firmly

Holding above 25,030–25,050 is critical; breaking this could retest 24,950–25,000

Bulls must reclaim 25,120–25,150 for momentum revival

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 182.32

IB Range: 92.6 → Medium

Market Structure: Balanced

Trades Triggered:

10:45 AM – Short Trade → Trailing SL Hit (1:0.8)

12:45 PM – Long Trade → SL Hit

📌 Support & Resistance Levels

Resistance:

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support:

25,037

25,000 ~ 24,980

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

🧠 Final Thoughts:

"Markets often dance between zones of power — where bulls flex and bears press. It's not chaos, it's the choreography of sentiment."

The 25,000–25,212 zone continues to be the battlefield. Let’s see who seizes the upper hand tomorrow.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

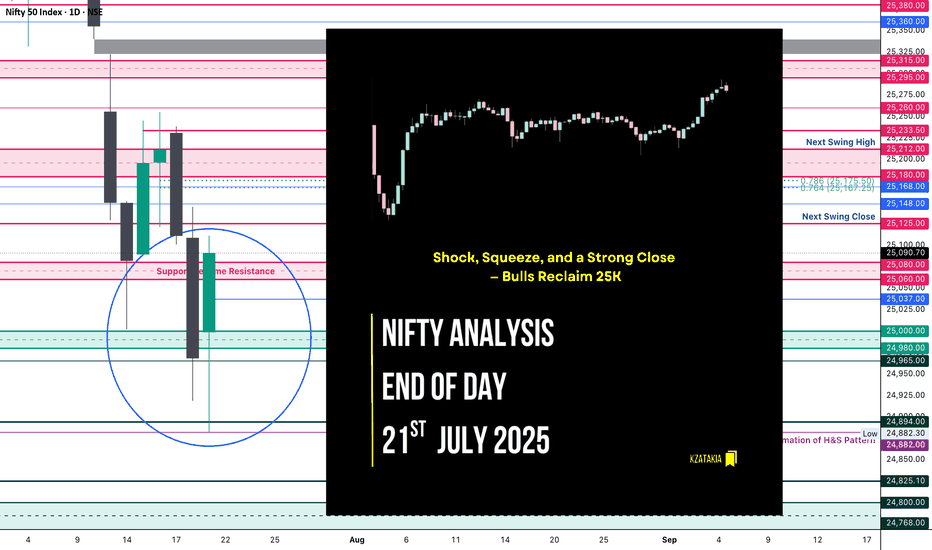

Nifty Analysis EOD – July 21, 2025 – Monday 🟢 Nifty Analysis EOD – July 21, 2025 – Monday 🔴

“Shock, Squeeze, and a Strong Close — Bulls Reclaim 25K”

Today’s move was nothing short of shocking. In the first 45 minutes, Nifty plunged more than 150 points, breaking through key levels and touching 24,882. But what followed was a V-shaped recovery that caught both Friday’s shorts and those who shorted below PDC/PDL completely off guard.

The index powered up to mark a day high of 25,080, and sustained above CPR and VWAP throughout most of the session. A final push came around 2:55 PM, breaking the intraday trendline and CDH, registering a fresh high before closing near the top at 25,090.70.

✅ Bulls not only held 25K — they dominated the battlefield all day, recovering almost everything lost during Friday’s drop.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,999.00

High: 25,111.40

Low: 24,882.30

Close: 25,090.70

Change: +122.30 (+0.49%)

📊 Candle Structure Breakdown

Real Body: 91.70 points → strong bullish body

Upper Wick: 20.70 points → slight hesitation near highs

Lower Wick: 116.70 points → deep intraday buying from the lows

🔍 Interpretation

Mildly negative open, followed by a sharp 150-point fall

Buyers stepped in strongly near 24,880, triggering a sharp reversal

V-shape recovery sustained above CPR & VWAP, closing near high

Close is not just above open — it’s above Friday’s close and 25K mark

🕯 Candle Type

Hammer-like Bullish Reversal Candle — Long lower wick with green body, signaling strong dip buying and possible short-term trend reversal

📌 Key Insight

Strong defense at 24,880–24,900 created the base for reversal

Close above 25,090 shifts near-term bias in favor of bulls

25,110–25,140 is the next resistance to watch

As long as we stay above 24,900, buyers hold the edge

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.31

IB Range: 166.8 → Wide IB

Market Structure: 🟡 Balanced

📉 Trades Triggered:

10:09 AM – Long Trade → ❌ SL Hit

📌 Support & Resistance Levels

Resistance Levels:

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

25,037

25,000 ~ 24,980

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

🧠 “Volatility doesn’t confuse the market — it reveals who’s in control.”Today’s V-shaped reversal erased all doubts from Friday’s fall. Buyers didn’t just defend — they counterattacked and reclaimed 25K with authority.Follow-through above 25,125 on Monday could confirm trend resumption.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

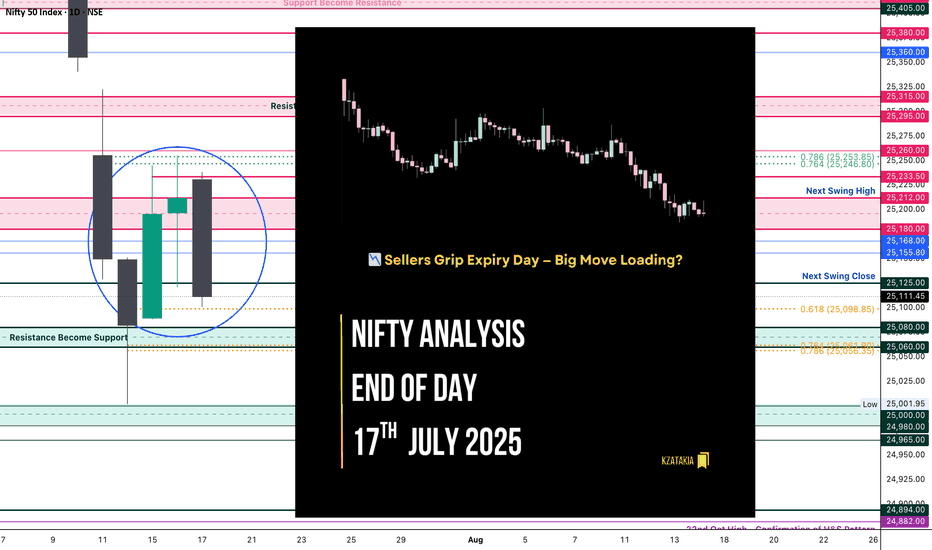

Nifty Analysis EOD – July 17, 2025 – Thursday🟢 Nifty Analysis EOD – July 17, 2025 – Thursday 🔴

📉 Sellers Grip Expiry Day — Big Move Loading?

Nifty started again with an OH (Open = High) formation and slipped down 94 points before 10:30 AM, marking the day’s low at 25,144. During this fall, it broke the support zone of 25,212 ~ 25,180. Although a retracement followed, it couldn’t sustain above the mean and eventually broke below the previous day’s low (PDL), closing at 25,111.45.

The weekly expiry was wild and volatile — especially from 12:30 to 2:30 PM. Interestingly, if we consider the total range of the last three sessions, it is just 166 points — well below average. This suggests a phase of consolidation. A significant move may emerge once Nifty decisively breaks the broader zone of 25,000 to 25,255.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 25,230.75

High: 25,238.35

Low: 25,101.00

Close: 25,111.45

Change: −100.60 (−0.40%)

Candle structure breakdown:

Real body:

Red candle (Close < Open): 25,230.75 − 25,111.45 = 119.30 points → Decent-sized bearish body

Upper wick:

25,238.35 − 25,230.75 = 7.60 points → Very small

Lower wick:

25,111.45 − 25,101.00 = 10.45 points → Small

Interpretation:

Nifty opened slightly lower, made a weak attempt upward, then saw consistent selling throughout the day, closing near the session’s low. The negligible wicks indicate that sellers were in full control, and buyers had little room to fight back.

Candle Type:

A strong bearish candle (almost Marubozu) with very small wicks → Clear dominance by sellers.

Key Insight:

The test of the 25,100 zone again shows weakening bullish strength.

If the next session breaks below 25,100, the fall may extend toward 25,000–25,050.

For bulls to regain short-term momentum, a close above 25,200–25,220 is necessary.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 176.62

IB Range: 60.85 → Medium IB

Market Structure: Balanced

Trades Triggered:

🕒 10:53 AM – Long Trade → Trailed SL Hit Profit (R:R = 1:0.42)

🧭 What’s Next? / Bias Direction

The market is coiling within a narrow range across multiple sessions, hinting at a potential breakout move.

📌 Watch Zone: 25,000 to 25,255

🔻 A break below 25,000 may open 24,950–24,900

🔺 A close above 25,260 could drive price toward 25,350+

Bias remains neutral-to-bearish unless bulls reclaim 25,220 decisively.

🧱 Support & Resistance Levels

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

🧠 Final Thoughts

"Structure is key. When levels work, respect them. When they break, adapt."

Three sessions of compression hint at expansion soon — stay alert and trade level-to-level with discipline.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

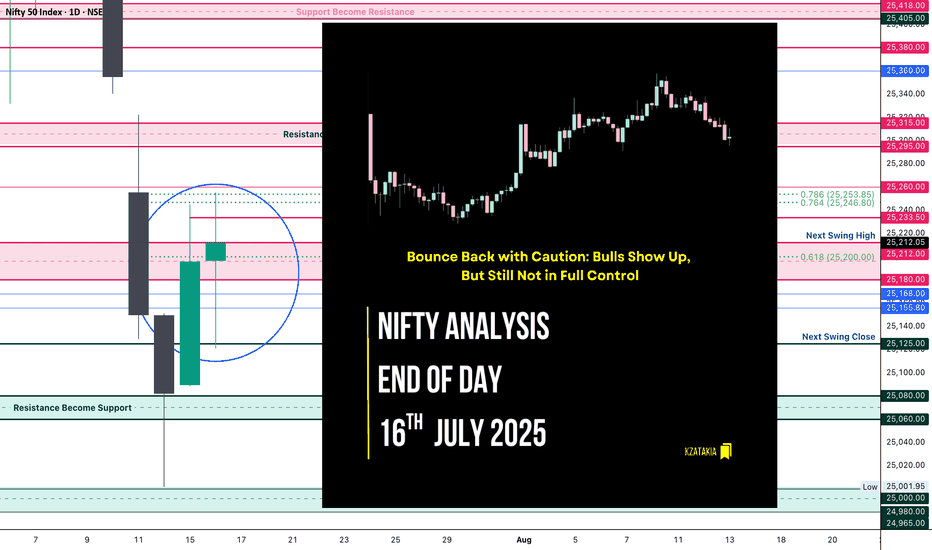

Nifty Analysis EOD – July 16, 2025 – Wednesday🟢 Nifty Analysis EOD – July 16, 2025 – Wednesday 🔴

"Bounce Back with Caution: Bulls Show Up, But Still Not in Full Control"

Nifty started the day on a flat note, but the opening candle turned out to be the day’s high, and from there, it quickly lost 91 points, marking the day’s low at 25,121 within the first hour. The early pressure gave a bearish opening tone, but bulls gradually stepped in.

Around 11:45 AM, Nifty broke above the VWAP–Day Low range, crossed the CPR zone, and then pushed toward PDH. It did make one attempt to break PDH, but failed, resulting in a slow drift downward toward VWAP and CPR into the close. The day ended at 25,212.05, nearly at CPR — a zone of indecision.

📉 The structure shows sharp reversal from the lows, but also clear hesitation near resistance zones. The session was volatile, forming a typical pre-expiry pattern with mixed sentiment. Bulls must take charge tomorrow by crossing the 25,250–25,260 zone to regain strength.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,196.60

High: 25,255.30

Low: 25,121.05

Close: 25,212.05

Change: +16.25 (+0.06%)

📊 Candle Structure Breakdown

Real Body: 15.45 points → small green body

Upper Wick: 43.25 points

Lower Wick: 75.55 points → significant downside recovery

🔍 Interpretation

Market opened flat, dropped quickly to test 25,120 zone

Strong buying emerged after initial fall

Buyers lifted the index above CPR, but failed to hold breakout above PDH

Candle closes with long lower wick → buyers defended dip, but lacked closing dominance

🕯 Candle TypeSpinning Top with Long Lower Wick — often a neutral to mildly bullish candle, suggesting buying interest at lower levels, but with uncertain momentum.

📌 Key Insight

Bulls clearly defended the 25,120–25,125 support zone

Momentum will only resume above 25,250–25,260, leading to targets around 25,300–25,315

Failure to hold 25,120 could reopen downside toward 25,000–25,050

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 180.99

IB Range: 91.20 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

11:34 AM – Long Trade → ✅ Target Achieved, Trailed SL Hit (R:R 1:2.42)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Structure is forming — but conviction is lacking. Let expiry day bring clarity. Above 25,260 we fly, below 25,120 we fall.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.