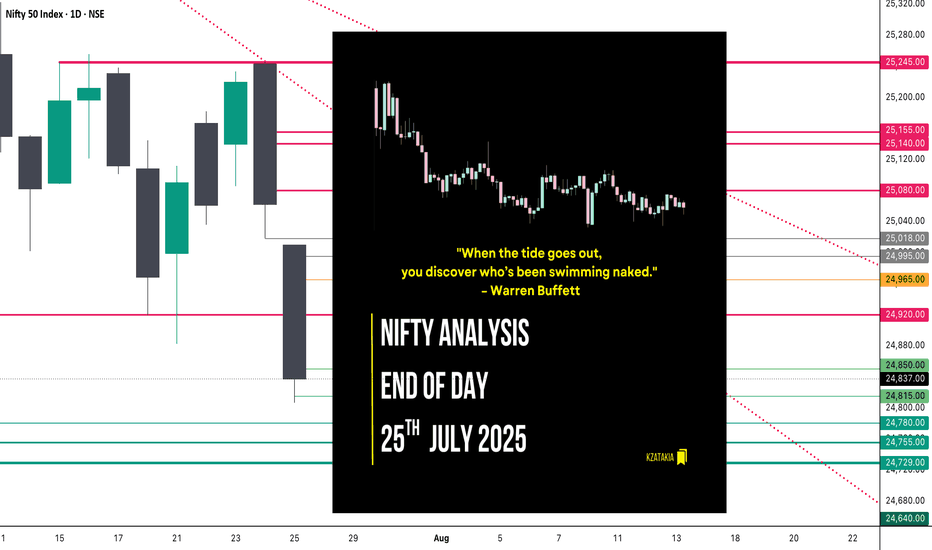

Nifty Analysis EOD – July 25, 2025 – Friday🟢 Nifty Analysis EOD – July 25, 2025 – Friday 🔴

"When the tide goes out, you discover who’s been swimming naked." – Warren Buffett

Nifty GapDowns Below Key Support and Slips Further

The market opened with a sharp GapDown, breaching the previous day's low and instantly shedding 150 points within the first hour. Nifty attempted to find footing near the crucial 21st July low zone of 24,850–24,880, but the support gave way, slipping an additional 50 points.

The day mostly drifted around these lower levels with bearish dominance. Though bulls made an effort to recover late in the session, it lacked strength. The index finally settled at 24,837, decisively closing below the 21st July low — signalling a deeper structural breakdown.

📉 Trend & Zone Update

Resistance Zone Shifted To: 25,144 ~ 25,155

Support Zone Shifted To: 24,729 ~ 24,755

📊 What If Plans – 28th July Outlook

🅰️ Plan A (Contra Long Setup)

If market opens inside the previous day range and finds support at 24,815 ~ 24,850

Then potential targets are 24,920, 24,965, and 25,020

🅱️ Plan B (Trend is Friend – Short Continuation)

If market opens inside range and faces resistance around 24,965 ~ 24,995

Then aim for 24,850, 24,815, 24,780, and 24,730

⏸️ On-the-Go Plan

If market Gaps Up/Down outside previous day’s range

Then wait for the Initial Balance (IB) to form and act based on structure and S/R levels.

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,010.35

High: 25,010.35

Low: 24,806.35

Close: 24,837.00

Candle Structure

Body: Strong red candle (−173.35 pts)

Upper Wick: None (open = high)

Lower Wick: 30.65 pts

Interpretation:

A textbook bearish Marubozu — shows sellers had control throughout.

Bears stepped in immediately from open, preventing any bullish response.

Minimal lower wick implies limited buyer defense even at the session low.

Key Insight:

Bears are in command; bulls must reclaim 25,000+ quickly to prevent further downside.

If 24,800–24,820 breaks, eyes shift to 24,700–24,750 zone next.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 192.95

IB Range: 87.4 → Medium

Market Structure: Imbalanced

Trades Triggered:

🕙 10:10 AM – Short Entry → 🎯 Target Hit (1:2.4 R:R)

🧭 Support & Resistance Levels

Resistance Zones

24,920

24,965

24,995 ~ 25,018

25,080

25,140 ~ 25,155

Support Zones

24,780

24,755 ~ 24,729

24,640

📌 Final Thoughts

When strong candles appear back-to-back with no meaningful recovery in between, it’s not just a correction — it’s a statement. In this market phase, reacting to price structure rather than assumptions will keep you on the right side. Stay nimble, stay prepared.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Niftyintradaylevels

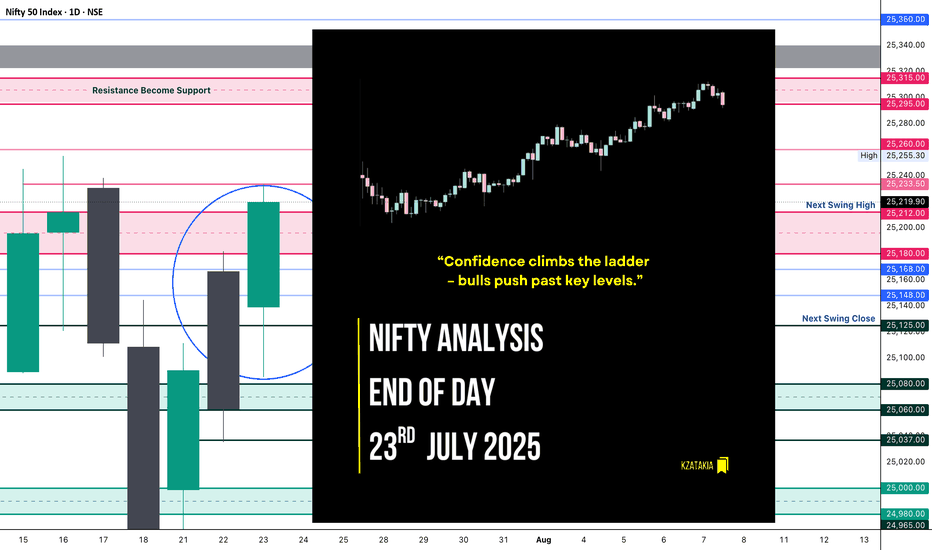

Nifty Analysis EOD – July 23, 2025 – Wednesday 🟢 Nifty Analysis EOD – July 23, 2025 – Wednesday 🔴

“Confidence climbs the ladder – bulls push past key levels.”

Nifty opened with a Gap Up of 78 points and initially retraced 54 points, finding solid footing around the CPR Zone. Once reclaimed VWAP, the index climbed in a methodical, low-volatility uptrend, breaking one resistance after another: CDH, R1, 25150, PDH, and the key zone 25200~25212 — finally touching the anticipated resistance at 25333, and closing just below that at 25219.90, close to the day’s high.

📌 Flashback from Yesterday's Note:

“If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.”

👉 This expectation played out to perfection today — gradual yet confident bullish strength led Nifty to reclaim 25200 and close above it.

🔍 Today’s close of 25220 is higher than the last 7 sessions, suggesting a bullish shift in structure. However, bulls now face the real test — breaching the 25300 ~ 25350 resistance zone.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 25,139.35

High: 25,233.50

Low: 25,085.50

Close: 25,219.90

Change: +159.00 (+0.63%)

Candle structure analysis:

Real body: Green body = 80.55 pts → strong bullish body

Upper wick: 13.60 pts → very small

Lower wick: 53.85 pts → moderate

Candle Interpretation:

The session opened stable, dipped to 25,085, but strong buyers showed up, helping price climb throughout the day and close near high. A firm green candle, signaling buyers in control.

Candle Type:

A Bullish Marubozu–like candle, not perfectly clean but represents strong continuation momentum.

Key Insight:

Close above 25200 confirms a bullish grip

If price holds above 25220–25250, next push could be towards 25280–25330

Immediate support now moves to 25,120–25,140

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.35

IB Range: 64.35 → Medium

Market Structure: Balanced

Trades Triggered:

⏱️ 10:45 AM – Long Entry → Trailing SL Hit (1:2.65 RR)

🔁 Support & Resistance Levels

Resistance Zones:

25,180 ~ 25,212

25,233

25,260

25,295 ~ 25,315

25,340 ~ 25,322 (Gap Zone)

Support Zones:

25,168

25,125

25,080 ~ 25,060

25,037

🧠 Final Thoughts

“Momentum is not magic—it’s built one level at a time.”

Bulls showed strength with control and consistency today. With 25200 reclaimed, they now hold the ball — next challenge lies at the gates of 25300–25350. Will they break through or pause for breath? Tomorrow holds the answer.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

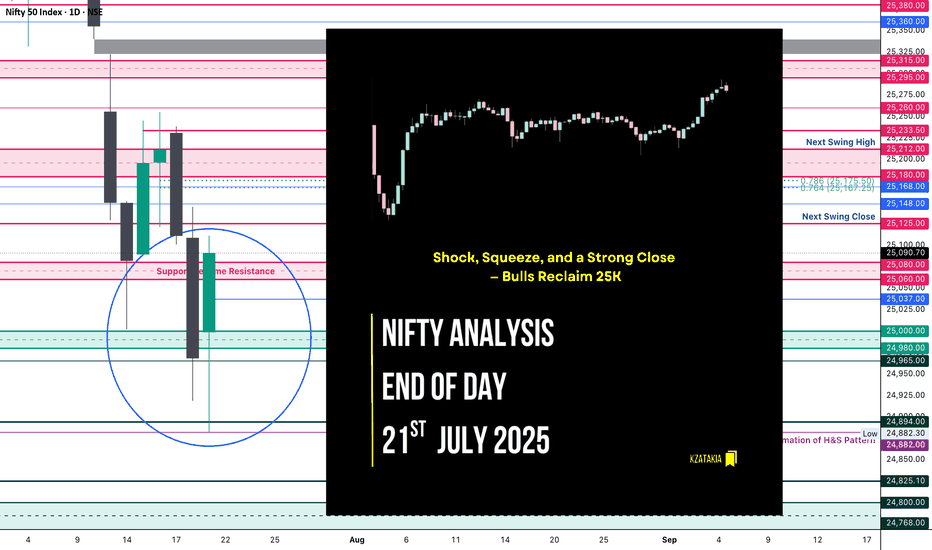

Nifty Analysis EOD – July 21, 2025 – Monday 🟢 Nifty Analysis EOD – July 21, 2025 – Monday 🔴

“Shock, Squeeze, and a Strong Close — Bulls Reclaim 25K”

Today’s move was nothing short of shocking. In the first 45 minutes, Nifty plunged more than 150 points, breaking through key levels and touching 24,882. But what followed was a V-shaped recovery that caught both Friday’s shorts and those who shorted below PDC/PDL completely off guard.

The index powered up to mark a day high of 25,080, and sustained above CPR and VWAP throughout most of the session. A final push came around 2:55 PM, breaking the intraday trendline and CDH, registering a fresh high before closing near the top at 25,090.70.

✅ Bulls not only held 25K — they dominated the battlefield all day, recovering almost everything lost during Friday’s drop.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,999.00

High: 25,111.40

Low: 24,882.30

Close: 25,090.70

Change: +122.30 (+0.49%)

📊 Candle Structure Breakdown

Real Body: 91.70 points → strong bullish body

Upper Wick: 20.70 points → slight hesitation near highs

Lower Wick: 116.70 points → deep intraday buying from the lows

🔍 Interpretation

Mildly negative open, followed by a sharp 150-point fall

Buyers stepped in strongly near 24,880, triggering a sharp reversal

V-shape recovery sustained above CPR & VWAP, closing near high

Close is not just above open — it’s above Friday’s close and 25K mark

🕯 Candle Type

Hammer-like Bullish Reversal Candle — Long lower wick with green body, signaling strong dip buying and possible short-term trend reversal

📌 Key Insight

Strong defense at 24,880–24,900 created the base for reversal

Close above 25,090 shifts near-term bias in favor of bulls

25,110–25,140 is the next resistance to watch

As long as we stay above 24,900, buyers hold the edge

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 186.31

IB Range: 166.8 → Wide IB

Market Structure: 🟡 Balanced

📉 Trades Triggered:

10:09 AM – Long Trade → ❌ SL Hit

📌 Support & Resistance Levels

Resistance Levels:

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support Levels:

25,037

25,000 ~ 24,980

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

💭 Final Thoughts

🧠 “Volatility doesn’t confuse the market — it reveals who’s in control.”Today’s V-shaped reversal erased all doubts from Friday’s fall. Buyers didn’t just defend — they counterattacked and reclaimed 25K with authority.Follow-through above 25,125 on Monday could confirm trend resumption.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

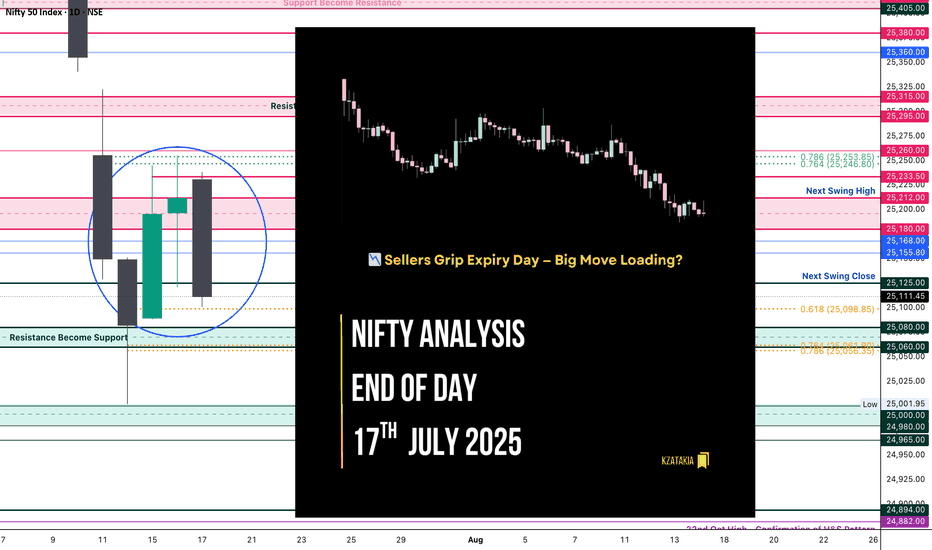

Nifty Analysis EOD – July 17, 2025 – Thursday🟢 Nifty Analysis EOD – July 17, 2025 – Thursday 🔴

📉 Sellers Grip Expiry Day — Big Move Loading?

Nifty started again with an OH (Open = High) formation and slipped down 94 points before 10:30 AM, marking the day’s low at 25,144. During this fall, it broke the support zone of 25,212 ~ 25,180. Although a retracement followed, it couldn’t sustain above the mean and eventually broke below the previous day’s low (PDL), closing at 25,111.45.

The weekly expiry was wild and volatile — especially from 12:30 to 2:30 PM. Interestingly, if we consider the total range of the last three sessions, it is just 166 points — well below average. This suggests a phase of consolidation. A significant move may emerge once Nifty decisively breaks the broader zone of 25,000 to 25,255.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 25,230.75

High: 25,238.35

Low: 25,101.00

Close: 25,111.45

Change: −100.60 (−0.40%)

Candle structure breakdown:

Real body:

Red candle (Close < Open): 25,230.75 − 25,111.45 = 119.30 points → Decent-sized bearish body

Upper wick:

25,238.35 − 25,230.75 = 7.60 points → Very small

Lower wick:

25,111.45 − 25,101.00 = 10.45 points → Small

Interpretation:

Nifty opened slightly lower, made a weak attempt upward, then saw consistent selling throughout the day, closing near the session’s low. The negligible wicks indicate that sellers were in full control, and buyers had little room to fight back.

Candle Type:

A strong bearish candle (almost Marubozu) with very small wicks → Clear dominance by sellers.

Key Insight:

The test of the 25,100 zone again shows weakening bullish strength.

If the next session breaks below 25,100, the fall may extend toward 25,000–25,050.

For bulls to regain short-term momentum, a close above 25,200–25,220 is necessary.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 176.62

IB Range: 60.85 → Medium IB

Market Structure: Balanced

Trades Triggered:

🕒 10:53 AM – Long Trade → Trailed SL Hit Profit (R:R = 1:0.42)

🧭 What’s Next? / Bias Direction

The market is coiling within a narrow range across multiple sessions, hinting at a potential breakout move.

📌 Watch Zone: 25,000 to 25,255

🔻 A break below 25,000 may open 24,950–24,900

🔺 A close above 25,260 could drive price toward 25,350+

Bias remains neutral-to-bearish unless bulls reclaim 25,220 decisively.

🧱 Support & Resistance Levels

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

🧠 Final Thoughts

"Structure is key. When levels work, respect them. When they break, adapt."

Three sessions of compression hint at expansion soon — stay alert and trade level-to-level with discipline.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

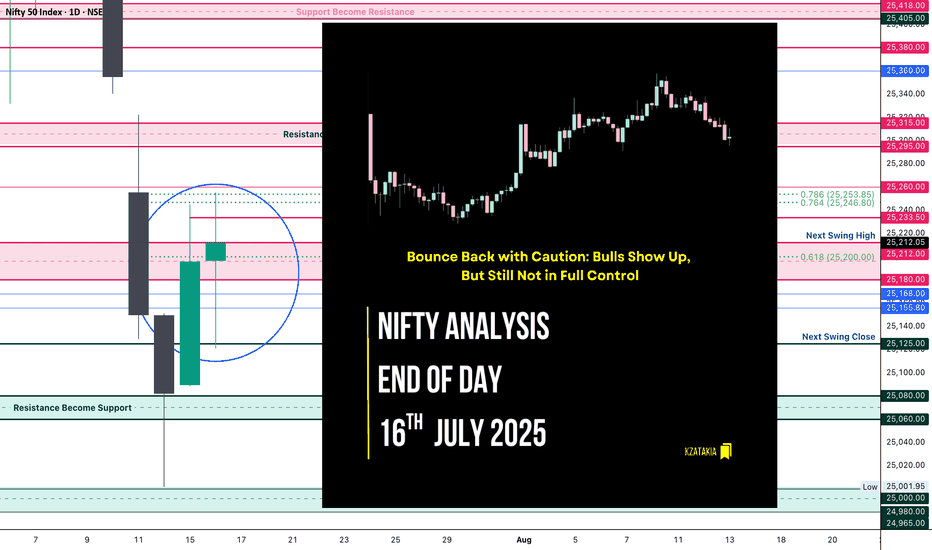

Nifty Analysis EOD – July 16, 2025 – Wednesday🟢 Nifty Analysis EOD – July 16, 2025 – Wednesday 🔴

"Bounce Back with Caution: Bulls Show Up, But Still Not in Full Control"

Nifty started the day on a flat note, but the opening candle turned out to be the day’s high, and from there, it quickly lost 91 points, marking the day’s low at 25,121 within the first hour. The early pressure gave a bearish opening tone, but bulls gradually stepped in.

Around 11:45 AM, Nifty broke above the VWAP–Day Low range, crossed the CPR zone, and then pushed toward PDH. It did make one attempt to break PDH, but failed, resulting in a slow drift downward toward VWAP and CPR into the close. The day ended at 25,212.05, nearly at CPR — a zone of indecision.

📉 The structure shows sharp reversal from the lows, but also clear hesitation near resistance zones. The session was volatile, forming a typical pre-expiry pattern with mixed sentiment. Bulls must take charge tomorrow by crossing the 25,250–25,260 zone to regain strength.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,196.60

High: 25,255.30

Low: 25,121.05

Close: 25,212.05

Change: +16.25 (+0.06%)

📊 Candle Structure Breakdown

Real Body: 15.45 points → small green body

Upper Wick: 43.25 points

Lower Wick: 75.55 points → significant downside recovery

🔍 Interpretation

Market opened flat, dropped quickly to test 25,120 zone

Strong buying emerged after initial fall

Buyers lifted the index above CPR, but failed to hold breakout above PDH

Candle closes with long lower wick → buyers defended dip, but lacked closing dominance

🕯 Candle TypeSpinning Top with Long Lower Wick — often a neutral to mildly bullish candle, suggesting buying interest at lower levels, but with uncertain momentum.

📌 Key Insight

Bulls clearly defended the 25,120–25,125 support zone

Momentum will only resume above 25,250–25,260, leading to targets around 25,300–25,315

Failure to hold 25,120 could reopen downside toward 25,000–25,050

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 180.99

IB Range: 91.20 → Medium IB

Market Structure: 🟡 Balanced

Trades Triggered

11:34 AM – Long Trade → ✅ Target Achieved, Trailed SL Hit (R:R 1:2.42)

📌 Support & Resistance Zones

Resistance Levels

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,125

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Structure is forming — but conviction is lacking. Let expiry day bring clarity. Above 25,260 we fly, below 25,120 we fall.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – July 14, 2025 – Monday🟢 Nifty Analysis EOD – July 14, 2025 – Monday 🔴

"Broken Support, Fought Resistance – Tug of War in Play"

Nifty began the day with a classic Open = High (OH) setup, instantly rejecting any bullish intent. The crucial support zone of 25,080–25,060 was taken out early, and the market went on to mark the day's low at 25,001.95, a level that quickly turned into a decisive battleground.

After a bounce from the low, 25,125 emerged as a stiff resistance that pushed the index back below the broken support zone. For most of the session, the same support zone turned into resistance — a textbook polarity flip. However, in the final hour, Nifty showed resilience and finally closed back above 25,080, ending the session at 25,082.30.

🔄 The structure was full of failed intraday breakouts, signaling confusion and conflict — likely fueled by a wider CPR, imbalanced market structure, and medium IB of 109 pts. It was a low-volatility session, but packed with psychological tests.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,149.50

High: 25,151.10

Low: 25,001.95

Close: 25,082.30

Change: −67.55 (−0.27%)

📊 Candle Structure Breakdown

Real Body: 67.20 points – small to moderate bearish body

Upper Wick: 1.60 points – negligible upside attempt

Lower Wick: 80.35 points – strong defense from day’s low

🔍 Interpretation

Opened higher but got instantly rejected (OH formation).

Sellers took charge early but failed to hold momentum all the way.

The long lower wick reflects buyer presence at key 25,000 zone.

The close below open but above reclaimed support suggests tug of war — with bulls slightly redeeming themselves by EOD.

🕯 Candle Type

Hammer-like red candle — while bearish on close, the long lower shadow indicates potential exhaustion of selling and hints at reversal if follow-through buying emerges next session.

📌 Key Insight

25,000–25,020 has emerged as crucial near-term support.

A strong open or close above 25,150–25,180 may confirm a bullish reversal setup.

Breakdown below 25,000 opens the door for a fall toward 24,950 or lower.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 188.77

IB Range: 109.20 → Medium IB

Market Structure: 🔴 Imbalanced

Trades Triggered

09:50 AM – Long Trade → ❌ SL Hit

01:05 PM – Short Trade → ❌ SL Hit

📉 Tough day for directional trades — false breakouts dominated.

📌 Support & Resistance Zones

Resistance Levels

25,125

25,168

25,180 ~ 25,212

25,260

25,295 ~ 25,315

Support Levels

25,080 ~ 25,060

25,000 ~ 24,980

24,965

💭 Final Thoughts

“Reclaimed ground doesn’t mean victory – yet. Watch the next move. Rejection below 25,000 ends the bulls' narrative; a strong move above 25,180 rewrites it.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

24 June nifty breakout & breakdown levels 🔺 Bullish (Call Option / CE) Strategy:

✅ Buy CE (Call Option) when:

Above 24,710 → Entry for bullish trade

"Above 10m hold CE by buy level"

Above 24,870 → Stronger confirmation

"Above Opening S1 10M Hold CE By level"

Above 25,020 → Positive trade view

"Above 10M hold positive trade view"

Above 25,130 → Safer CE entry zone

"Above 10M hold CE by entry level"

Above 25,233 → Closing shot level

"Above 10M Closing Shot cover level"

🔻 Bearish (Put Option / PE) Strategy:

✅ Buy PE (Put Option) when:

Below 24,710 → Entry for bearish trade

"Below 10m hold PE By level"

Below 24,870 → Bearish confirmation

"Below Opening R1 10M Hold PE By level"

Below 25,020 → Negative trade view

"Below 10M hold nigeative trade view"

Below 25,130 → Risky PE zone

"Below 10M hold PE By Risky Zone"

Below 25,233 → Safer PE Zone

"Below 10M hold PE By Safe Zone"

Nifty Analysis EOD – June 23, 2025 – Monday🟢 Nifty Analysis EOD – June 23, 2025 – Monday 🔴

👊 Tug of War Between Optimism and Pessimism

Nifty opened with a sharp 140-point gap-down, weighed by geopolitical tensions and negative news cues. The mood was clearly pessimistic — yet, from the deep low of 24,824.85, bulls made a bold comeback.

What followed was a classic textbook reversal:Price clawed back up, cutting through multiple key resistances — S1, VWAP, CDH, CPR BC, and Central CPR — before kissing the CPR TC, where it marked the day high at 25,057. This level acted as a supply zone and pushed Nifty back down toward the CPR BC, where it managed to close above the open — a quiet victory for the bulls, even in a red session overall.

The level 24,825 has now proven itself once again — the market’s respect for this support zone grows stronger with every bounce.

Today’s candle was a spinning top-style doji and also formed an inside bar, with all movement inside Friday’s wide-range candle (352 pts). Despite a smaller 232-point range today, this still requires caution — inside bars after large-range candles often result in false breakouts, especially amid macro noise.

📌 When the world looks bearish, and the chart looks bullish — trust your system.And that’s exactly what I did today — sticking to the Gladiator Strategy, a simple, disciplined intraday price action-based option buying framework.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,939.75

High: 25,057.00

Low: 24,824.85

Close: 24,971.90

Change: −140.50 (−0.56%)

📊 Candle Structure Breakdown

Real Body: 32.15 pts (small green body)

Upper Wick: 85.10 pts

Lower Wick: 114.90 pts

🔍 Interpretation

Despite a lower close than Friday, it was a green-bodied candle (close > open).

Long lower wick shows strong buying near 24,825.

Long upper wick signals resistance near 25,050–25,060.

🕯 Candle Type

📍 Spinning Top with Long Wicks — Sign of indecision, but slight bullish bias due to buying off the lows.

📌 Key Insight

Support at 24,825 holds strong.

Upper rejection near 25,050 indicates tight overhead pressure.

Watch closely:

Break above 25,060 → May trigger bullish continuation.

Break below 24,820 → Could open downside to 24,735–24,660 zone.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 254.95

IB Range: 163.25 → Medium IB

Market Structure: ⚖️ Balanced

Trades Triggered:

🟢 10:14 AM – Long Trade → ✅ Target Achieved (Trailing Exit, R:R 1:4.51)

🔴 2:16 PM – Short Signal → ❌ Discarded (RR not favorable)

📌 Support & Resistance Zones

Resistance Levels

24,980 ~ 25,000

25,060 ~ 25,080

25,125 ~ 25,150

25,180 ~ 25,212

25,285

Support Levels

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

24,735 ~ 24,725

💭 Final Thoughts

Markets are currently walking a tightrope — with bearish headlines on one side and bullish price action on the other.The Gladiator approach today helped sidestep the noise and focus on what matters: price structure and clean levels.

📌 Trade the chart, not the news. And when in doubt — zoom out.

🧠 “Uncertainty is the playground of the disciplined.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 20, 2025 – Friday🟢 Nifty Analysis EOD – June 20, 2025 – Friday 🔴

🚀 Bull Run Out of the Blue 🚀 – A Masterclass in Price Action

Nifty kicked off the session with a +56-point gap-up — surprising many, especially since Gift Nifty hinted flat to negative and yesterday’s close was weak. The real jolt came when, in the very first minute, price broke above the Previous Day High (PDH) and opened directly above the CPR zone — a rare occurrence when geopolitical tensions are peaking.

As I often say:

📌 “Market rarely follows the obvious. It thrives in the unexpected.”

Today was a textbook example of that.

Luckily, we were prepped. In yesterday’s note, I mentioned the bullish trigger above 24,862 — and right from the open, Nifty respected every level, offering "hope-on" and "hope-off" trades. What seemed like a 25K test turned into a blast to 25,136, with 100 points added in the last 30 minutes, leaving even seasoned traders awestruck.

The intraday close at 25,079.75 and the adjusted close at 25,112.40 — both above the 15th May closing levels — give a bullish vibe heading into the weekend. 🤞

💬 Personal Note:

Today was special — I sat with my elder daughter, helping her understand real-time market behavior. And what a day it was! From trend reversals, cup & handle, head & shoulders, wedges, shallow pullbacks, to aggressive one-way rallies — everything aligned perfectly to make this a live-action lesson in intraday trading.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,787.65

High: 25,136.20

Low: 24,783.65

Close: 25,112.40

Change: +319.15 (+1.29%)

📊 Candle Structure Breakdown

Real Body: 324.75 pts → ✅ Strong Green Candle

Upper Wick: 23.80 pts

Lower Wick: 4.00 pts

🔍 Interpretation

Opened flat and never looked back.

Minimal wicks = clear directional strength.

Buyers in full control from open to close.

🕯 Candle Type

📈 Bullish Marubozu-like — One of the strongest bullish signals. A powerful sign of trend continuation or breakout momentum.

📌 Key Insight

Today’s candle reinforces bullish strength.

Holding above 25,100 is key going forward.

A move above 25,136 could invite fresh upside targets — possibly 25,180+ and beyond.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 251.32

IB Range: 116.6 → Medium IB

Market Structure: 📈 ImBalanced

Trades Triggered:

🔹 9:41 AM – Long Trade → Target Achieved (Trailing Exit, R:R 1:4.79)

🔹 12:18 PM – Short Contra Trade → Target Achieved (R:R 1:2)

🔹 1:07 PM – Long Trade → Target Achieved (Trailing Exit, R:R 1:2.62)

📌 Support & Resistance Zones

Resistance Levels

25,125 ~ 25,150

25,180 ~ 25,212

25,285

Support Levels

25,080 ~ 25,060

25,000 ~ 24,980

24,965

24,894 ~ 24,882

💭 Final Thoughts

The market surprised today — not just in movement but in clarity.The clean break, follow-through strength, and intraday structure hint at momentum continuation — but weekends can bring surprise news.

📌 Watch 25,100 as line in the sand on Monday.

🧠 “Markets are teachers. Today’s lesson? Expect the unexpected, but prepare like it’s already here.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 19, 2025 – Thursday🟢 Nifty Analysis EOD – June 19, 2025 – Thursday 🔴

📉 Bookish Spinning Top Doji – Another Day of Indecision on Expiry

Nifty opened with a mild +16-point gap-up and immediately dipped to test the Previous Day Low (PDL), marking the day low at 24,738.10. A quick reversal took the index 125 points higher, reaching a high of 24,863, only to settle back into theta-eating mode around VWAP.

Just as things looked ready to turn, a 13:50 breakout attempt fizzled as the price faced rejection above the CPR zone, leading to a final dip below the previous low, touching a new intraday low at 24,733.

Though the intraday close was at 24,744.70, the settlement close was 24,793.25 — a 47.65-point difference that’s not trivial, especially on expiry day.

The entire day remained a narrow-range, rollercoaster ride — clearly showing neither bulls nor bears could take charge. The total range was just 130 points, forming a textbook Spinning Top, which reflects market contraction.

📌 Now what?

Keep a close eye on the range:

🟢Bullish Breakout ➤ above 24,862 (CDH)

🔴Bearish Breakdown ➤ below 24,733 (CDL)

The squeeze is on. Expansion is near.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,803.25

High: 24,863.10

Low: 24,733.40

Close: 24,793.25

Change: −18.80 (−0.08%)

📊 Candle Structure Breakdown

Real Body: 10.00 pts → 🔻 Small Red Candle

Upper Wick: 59.85 pts

Lower Wick: 59.85 pts

🔍 Interpretation

Equal wicks show balanced buying and selling.

Small real body signals strong indecision.

Intraday volatility was neutral despite expiry impact.

🕯 Candle Type

⚖️ Perfect Spinning Top / Doji-like Candle – Indicates market contraction, waiting for directional resolution.

📌 Key Insight

The market continues its tight range-bound structure.

Any breakout beyond 24,865 or breakdown below 24,730 could trigger directional moves.

Till then: “Wait and watch mode.”

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 240.08

IB Range: 125.00 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 No Trade Triggered by System

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

The market is compressing like a coiled spring.Spinning tops near resistance often signal upcoming volatility.Let the breakout come to you — don’t pre-empt, participate.

🧠 “When the market sleeps in narrow ranges, it dreams of big moves.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 18, 2025 – Wednesday🟢 Nifty Analysis EOD – June 18, 2025 – Wednesday 🔴

⚖️ Dhamakedar Start, But Indecisive Close – Weekly Expiry Caution Ahead

Nifty opened with a 65-point gap-down at 24,788.35, but what followed was a power-packed bullish start — within just 25 minutes, it surged over 150 points, hitting a day high of 24,947.55.

However, the euphoria didn’t last.

As the session progressed, the index gradually gave up all its gains, slipped below the previous day’s low, and finally found support at 24,750, a critical level. By the end of the day, Nifty settled around the opening zone at 24,812.05, just +23 points above open, while net change remained −41.35 points from the previous close.

The day showcased both strength and weakness — a typical "everyone-expected-fall-but-it-didn't-fall-enough" kind of day. The long upper wick reflects failed attempts by bulls, while the lack of breakdown keeps the bears in check.

Tomorrow is weekly expiry — caution is advised.

🕯 5 Min Time Frame Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,788.35

High: 24,947.55

Low: 24,750.45

Close: 24,812.05

Change: −41.35 (−0.17%)

📊 Candle Structure Breakdown

Real Body: 23.70 pts → ✅ Green Candle (tiny body)

Upper Wick: 135.50 pts

Lower Wick: 37.90 pts

🔍 Interpretation

Strong bullish momentum early on, but buyers failed to hold above 24,900.

Long upper wick signals supply or profit-booking at higher levels.

Price closed near open despite wide range → indecision between bulls and bears.

🕯 Candle Type

🟨 Spinning Top – A textbook indecisive candle, often seen at turning points or during pauses in trend.

📌 Key Insight

Buyers couldn’t reclaim or close above 24,950 — resistance strengthened.

Support held at 24,750 — but barely.

Watch 24,950 on upside and 24,750 on downside — a breakout from either may decide expiry-day trend.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 252.34

IB Range: 170.65 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 Short Trigger at 12:45 : Trapped - SL Hit

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

When price travels 200 points but closes flat, it tells you something: Smart money is waiting.Weekly expiry ahead could bring unexpected moves.✅ Stay nimble. Stay alert.

🧠 “When in doubt, let the market shout — not whisper. Listen for the breakout.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

18 june Nifty50 brekout and Breakdown leval

CALL (CE) – Bullish triggers

↑ 24,437 – 24,547 : Safe‑zone long entry

↑ 24,672: Hold CE while above this mark

↑ 24,780 : Opening‑S1 breakout, keep holding CE

↑ 24,930.00 : Turns bias positive; fresh CE can be added

↑ 25,083.00 : Entry level for aggressive longs

↑ 25,318.00 : Short‑cover zone; strong upside momentum possible

PUT (PE) – Bearish triggers

↓ 25,318.00 : If price closes back under, shift to PE (safe)

↓ 25,083 : PE in the “risky” reversal zone

↓ 24,930 : Bias flips negative; keep/add PE

↓ 24,780 : Opening‑R1 break; hold PE

↓ 24,672 : Continue PE below this level

↓ 24,535 : Unwinding zone – watch for fast drops

↓ 24,437 : Final downside support; trail PEs here

Nifty Analysis EOD – June 17, 2025 – Tuesday🟢 Nifty Analysis EOD – June 17, 2025 – Tuesday 🔴

⚠️ Resistance Rejection at 25K – Pause or Warning Sign?

Yesterday’s note rightly anticipated today’s challenge near 25K — and that’s exactly how the session unfolded.

Nifty opened at 24,977.85, right inside the critical resistance zone of 24,972–25,000, and formed a near O=H (Open = High) structure. The index quickly lost ground, dropping 135 points within the first hour to mark a day low of 24,813.70, forming a medium-sized Initial Balance (IB) within a wide CPR — conditions known for range-bound or tricky days.

Throughout the session, Nifty hovered largely inside the CPR and IB, with a false breakdown attempt around 12:50 PM. Such setups (wide CPR + higher value + medium IB) often result in false moves or low-conviction sessions, and today was no exception.

By day’s end, Nifty closed at 24,853.40, logging a modest −93.10 point dip, forming what can be termed as a healthy pullback — but the real test remains.

If bulls want to take charge again, they must breach and close above 25,025. On the flip side, if 24,800–24,820 gives way, it could trigger a slide toward 24,725 and 24,660 in the coming sessions.

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,977.85

High: 24,982.05

Low: 24,813.70

Close: 24,853.40

Change: −93.10 (−0.37%)

📊 Candle Structure Breakdown

Real Body: 124.45 pts → 🔻 Red Candle

Upper Wick: 4.20 pts

Lower Wick: 39.70 pts

🔍 Interpretation

Opened near the day’s high but selling dominated soon after.

Small upper wick shows minimal buyer strength; recovery attempts were mild.

Lower wick indicates some support emerged at day’s low, but overall tone remained bearish.

🕯 Candle Type

🟥 Bearish Candle – strong real body, minor lower wick — reflects steady intraday selling, though not overly aggressive.

📌 Key Insight

Nifty has now rejected the 25K zone two days in a row, turning it into short-term resistance.

If 24,800 breaks, expect pressure to mount — next watch: 24,725 → 24,660.

Bulls need a close above 25,025 to regain command.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 258.48

IB Range: 131.60 → Medium IB

Market Structure: ⚖️ Balanced

Trades:🚫 No Trade Triggered by System

📌 Support & Resistance Zones

Resistance Levels

24,894 ~ 24,882

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,825 ~ 24,847

24,725 ~ 24,735

24,660

24,590

💭 Final Thoughts

Today’s session didn’t break anything major — but it also didn’t conquer anything new.Stuck between major support and resistance, the index is coiling for a move. Bulls have the burden of proof now.

🧠 “Markets don’t pause forever — compression leads to expansion. Be ready when it chooses its direction.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Analysis EOD – June 16, 2025 – Monday🟢 Nifty Analysis EOD – June 16, 2025 – Monday 🔴

📈 Expected Follow-Through Plays Out – Bulls Eye 25K Hurdle Next

Nifty opened flat-to-positive at 24,737, briefly dipped to the day’s low of 24,703.60, and then reversed smartly to touch an intraday high of 24,967.10 by 13:40. After that, the index spent the rest of the day consolidating in a narrow 40-point band and closed at 24,940.95 intraday (adjusted close: 24,946.50), delivering a solid +227.90 point gain.

As anticipated, the 24,768–24,800 support zone provided the launchpad for further upside, confirming the bullish follow-up from Friday's recovery. The rally tested 24,967, just shy of the crucial resistance at 24,972, which remains a key watch for the next session.

🔍 However, going forward, the bulls face major challenges around 25,000–25,080. This zone has acted as a hurdle in the past and could either stall the rally or serve as a breakout trigger. Watch price behavior carefully around these levels to assess conviction.

🛡 5 Min Chart with Levels

🕯 Daily Time Frame Chart

🕯 Daily Candle Breakdown

Open: 24,732.35

High: 24,967.10

Low: 24,703.60

Close: 24,946.50

Change: +227.90 (+0.92%)

📊 Candle Structure Breakdown

Real Body: 214.15 pts → 🟢 Strong Green Candle

Upper Wick: 20.60 pts

Lower Wick: 28.75 pts

🔍 Interpretation

Opened near day’s low, closed near day’s high — classic bullish sentiment.

Small wicks show controlled buying with minimal resistance and shakeouts.

Reinforces the bulls’ momentum after Friday’s OL recovery candle.

🔦 Candle Type

💚 Bullish Marubozu–type / Bullish Continuation Candle– Often found during the middle leg of a bullish swing, signaling strong trend momentum.

📌 Key Insight

Today's price action confirmed continuation of the recovery.

Close above 24,950–25,000 in the next session could ignite fresh upside.

Rejection around 25,060–25,080 would indicate caution — stay nimble.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 268.49

IB Range: 114.05 → Medium IB

Market Structure: ⚖️ Unbalanced

Trades:

✅ 10:20 AM – Long Triggered → Target Achieved, Trailing SL Hit (RR: 1:3.28)

📌 Support & Resistance Zones

Resistance Levels

24,972 ~ 25,000

25,060 ~ 25,080

25,102 ~ 25,125

Support Levels

24,894 ~ 24,882

24,825 ~ 24,847

24,725 ~ 24,735

24,660

💭 Final Thoughts

The market played exactly as mapped — now it’s about decision time near 25K. Will the bulls charge ahead or pause? Either way, the structure favors short-term bullishness — but profit booking pressure near resistance must be expected.

🧠 “Momentum is a gift – but without volume and conviction, it fades at resistance.”

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

3 june Nifty prediction #Nifty50 #option trading

99% working trading plan

✅ Gap-Up Opening Strategy

🔹 If Nifty opens above 24,860 and hold for 15 mins:

📈 Bullish Trade

🎯 Targets: 24,970

🔹 If Nifty opens at 24,860 but fails to break above after 15 mins:

📉 Bearish Trade

🎯 Targets: 24,670 → 24,560

✅ Gap-Down Opening Strategy

🔹 If Nifty opens above 24,670 and hold for 15 mins:

📈 Bullish Trade

🎯 Targets: 24,860 → 24,970

🔹 If Nifty opens below 24,670 and fails to break above after 15 mins:

📉 Bearish Trade

🎯 Target: 24,560

🎓 For more educational content, follow & support me!

📈 TradingView ID: @mayuraj_820

Nifty Analysis EOD – June 2, 2025 – Monday🟢 Nifty Analysis EOD – June 2, 2025 – Monday 🔴

“Relaxed day... if you forget the first and last 20 minutes!”

Nifty opened flat with a slightly negative tone and, within the first 20 minutes, collapsed over 200 points, hitting an intraday low of 24,526. However, the day had other plans. A slow and steady recovery followed, with Nifty reclaiming almost all its losses by mid-session. But just when things looked stable, the index shed 88 points in the final 20 minutes, eventually closing at 24,716.60, just 34 points lower than the previous close.

If you ignore the volatility of the first and last few minutes, the day felt calm—almost deceptive. Small and mid-cap stocks, along with Bank Nifty, saw a positive day, showcasing broad market strength despite Nifty’s indecisiveness.

🛡 5 Min Chart with Levels

📌 Diamond Pattern BreakoutAs discussed in yesterday’s note, the diamond pattern on the daily and 5-min chart finally saw a breakout today—and yes, the target was achieved. But let’s be real: with all the action packed into the opening move, most traders (including me) missed the train. A frustratingly textbook pattern—but a tricky execution.

🕯 Daily Time Frame Chart

📊 Daily Candle Breakdown

Open: 24,669.70

High: 24,754.40

Low: 24,526.15

Close: 24,716.60

Change: −34.10 (−0.14%)

Candle Structure:

🟩 Green Candle: Close > Open (46.90 pts body)

🔻 Lower Wick: 143.55 pts – Strong buying at the dip

🔺 Upper Wick: 37.80 pts – Limited rejection from top

Interpretation:Despite closing slightly lower, the candle reflects strong intraday buying after a deep dip. The long lower shadow shows support around 24,520–24,550 is active. Close near the top half signals buyers held their ground after early weakness.

Candle Type:🔨 Hammer-like: Bullish sentiment hidden in the chaos.

Key Insight:

Holding above 24,755 can trigger a fresh bullish leg.

Breach of 24,520 may invite more selling pressure.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 272.03

IB Range: 191.40 → 🔴 Wide IB

Market Structure: ImBalanced

Total Trades: 0

12:35 – Long signal came, but entry didn’t trigger. No trades taken.

🧭 Support & Resistance Levels

📈 Resistance Zones:

24,727 ~ 24,737

24,768 ~ 24,800

24,820

24,882

24,894

24,920

24,972 ~ 25,000

25,062 ~ 25,070 (5th rejection!)

25,116 ~ 25,128

25,180 ~ 25,212

25,285 ~ 25,399

📉 Support Zones:

24,700

24,660

24,640 ~ 24,625

24,590

24,530 ~ 24,480

24,460

🧠 Final Thoughts

"Structure se hi samjho... market bhale chhup jaye, lekin footprint chhod deta hai."Diamond breakout ho gaya, lekin execution ne dhoka diya. Lesson? Stay ready—patterns repeat, but you only profit if you’re prepared.

✏️ DisclaimerThis is just my personal viewpoint. Always consult your financial advisor before taking any action.

NIFTY : Trading levels and plan for 26-May-2025📊 Nifty Trading Plan – 26-May-2025

Timeframe: 15 Min | Reference Spot Price: 24,845

Gap Opening Threshold: 100+ Points

🚀 Gap-Up Opening (Above 24,974) – 100+ Points

If Nifty opens above the Opening Resistance level of 24,974, it enters a critical resistance zone that may trigger two-sided moves. The area between 25,195 – 25,294 is marked as the Profit Booking Zone / Last Intraday Resistance .

🟥 This zone has historically seen supply, and sharp up-moves may get trapped without strength in broader participation.

✅ Plan of Action:

– Avoid initiating long trades immediately post gap-up unless price shows strong bullish candles above 25,195.

– For intraday buying, wait for a clean 15-min candle close above 25,294 with strength in heavyweights.

– Ideal entry would be on a retest of the 25,195–25,294 zone if price holds.

– Reversal patterns (like Shooting Star / Bearish Engulfing) near 25,195 – 25,294 can offer sell-on-rise opportunities toward 24,974, then 24,845.

– Watch for volume confirmation – avoid shorting just because price is high.

🎓 Educational Note: Gap-ups into strong resistance zones require caution. Momentum without volume and market-wide confirmation often leads to failed breakouts. Let structure confirm before jumping in.

📈 Flat Opening (Between 24,790 – 24,974)

This places Nifty inside the No Trade Zone defined between 24,790 – 24,974.

🟧 This range is uncertain – the index may move sideways with choppy price action and lack of conviction from buyers or sellers.

✅ Plan of Action:

– Stay on the sidelines in the first 15–30 mins.

– Only consider long trades if price breaks and sustains above 24,974, then aim for 25,195 – 25,294.

– For short trades, wait for a clean breakdown below 24,790 with a bearish candle close to ride down to 24,684 and then 24,558.

– Risk reward is best outside this zone, not inside. Patience is key.

🎓 Educational Note: Flat openings in mid-range zones often cause emotional trades. Use this time to assess volume trends, sectoral strength, and structure. Most clean entries happen post-10:15 AM.

📉 Gap-Down Opening (Below 24,684) – 100+ Points

A gap-down below 24,684 pushes Nifty near its immediate supports at 24,558 (Last Intraday Support) and 24,250 – 24,190 (Buyer’s Zone).

🟩 This is a sensitive area where smart money may attempt reversals, especially near 24,250 – 24,190.

✅ Plan of Action:

– Watch for reversal signs (Hammer, Bullish Engulfing) around 24,558 and especially in the Buyer’s Support Zone: 24,250 – 24,190.

– If price finds footing and sustains above 24,558, reversal trades can be initiated with a target back to 24,684 – 24,790.

– A strong breakdown below 24,190 would confirm bearishness – in that case, avoid catching falling knives.

– Only go short below 24,190 on breakdown candle with next target open toward swing lows.

🎓 Educational Note: Gap-downs into major demand areas offer some of the best R:R setups—but only if there's evidence of absorption and reversal structure. Never go long just because price is “low”.

🛡️ Options Trading – Risk Management Tips

✅ Use slightly In-the-Money (ITM) options for better delta movement and less time decay.

✅ Avoid trading in No Trade Zones; theta will eat up your premiums.

✅ Follow the 1–2% capital risk rule – don’t over-leverage in anticipation of a breakout.

✅ Always define your stop loss using the underlying spot level, not just option premium.

✅ Book partial profits once price moves in favor and trail SL for the rest.

✅ If you hit 2 stop-losses in a row, take a break and re-assess the trend.

✅ Monitor OI data and sectoral strength—don’t blindly follow index candles.

📌 Summary & Conclusion

🔹 No Trade Zone: 24,790 – 24,974

🔹 Profit Booking / Resistance Zone: 25,195 – 25,294

🔹 Opening Supports: 24,684 & 24,558

🔹 Strong Buyer’s Support: 24,250 – 24,190

📈 For Gap-Ups, avoid early longs into resistance zones unless breakout is confirmed.

📉 For Gap-Downs, prepare for potential reversal from Buyer’s Support Zone.

🕒 In Flat Openings, wait 15–30 mins to avoid whipsaws inside No Trade Zone.

⚖️ Best trades occur outside the No Trade Zone with price + structure + volume alignment.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This trading plan is purely for educational purposes. Please conduct your own analysis or consult a SEBI-registered advisor before taking trades.

NIFTY : Intraday Trading levels and Plan for 07-Mar-2025

📌 Key Levels to Watch:

🔴 Resistance Levels: 22,635 | 22,819

🟢 Support Levels: 22,467-22,496 | 22,378 | 22,258

📝 Market Context:

Nifty has shown strong momentum in recent sessions, currently trading near 22,529. The profit booking zone lies around 22,635, while a breakout above this could lead to 22,819. On the downside, key support exists at 22,467-22,496, and a further breakdown may drag prices toward 22,378-22,258.

📈 Scenario 1: Gap-Up Opening (100+ Points Above 22,630) 🚀

If Nifty opens above 22,630, it enters the profit booking zone, making further upside dependent on momentum. A clean breakout above 22,819 will signal strength.

Buy above 22,635 🔼

🎯 Target: 22,750 – 22,819

🛑 Stop Loss: 22,550

📝 Plan: If Nifty sustains above 22,635, it can attempt 22,819. Wait for a proper 15-minute candle close above 22,635 before entering. Profit booking is advised near resistance levels.

Rejection at 22,635 ❌

🔽 Sell below 22,630

🎯 Target: 22,500 – 22,467

🛑 Stop Loss: 22,680

📝 Plan: If Nifty struggles at 22,635 and reverses, a short trade can be considered toward 22,467. Volume confirmation is necessary before entering shorts.

📉 Scenario 2: Flat Opening (22,450 – 22,550) 📊

A flat opening near 22,450 – 22,550 suggests indecision. The 22,467-22,496 range is a crucial support area.

Buy above 22,550 🔼

🎯 Target: 22,635 – 22,700

🛑 Stop Loss: 22,500

📝 Plan: If Nifty holds above 22,550 and shows strength, an upside move toward 22,635 is likely. Look for bullish price action confirmation before entering.

Sell below 22,467 🔽

🎯 Target: 22,378 – 22,350

🛑 Stop Loss: 22,525

📝 Plan: If Nifty breaks below 22,467 and struggles to reclaim it, selling pressure may drag it toward 22,378. Wait for a sustained breakdown before taking short positions.

📉 Scenario 3: Gap-Down Opening (Below 22,429) ⚠️

A gap-down below 22,429 signals weakness, with support at 22,378 and 22,258.

Buy near 22,258 – 22,300 🟢

🎯 Target: 22,440

🛑 Stop Loss: 22,220

📝 Plan: If Nifty stabilizes at 22,258-22,300, a bounce toward 22,440 is possible. Ideal for risk-managed long trades.

Sell below 22,258 🔽

🎯 Target: 22,150 – 22,100

🛑 Stop Loss: 22,320

📝 Plan: If selling pressure persists below 22,258, a further slide is likely. Avoid panic selling; wait for confirmation.

💡 Risk Management Tips for Options Traders 🎯

✅ Theta Decay Awareness: Avoid buying OTM options late in the day.

✅ Stop-Loss Discipline: Always use SL based on technical structure.

✅ Position Sizing: Risk only 2% of capital per trade.

✅ Avoid Overtrading: Trade only high-probability setups.

📌 Summary & Conclusion 📌

🔹 Bullish above 22,635 for 22,819.

🔹 Bearish below 22,258 for 22,150.

🔹 Flat open needs confirmation for direction.

🔹 Key support: 22,467-22,496 | 22,258.

🔹 Key resistance: 22,635 | 22,819.

📢 Trade with discipline, follow the plan, and manage risk effectively!

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This analysis is for educational purposes only. Do your own research or consult a financial advisor before trading. 📊📉📈

#NIFTY Intraday Support and Resistance Levels - 21/02/2025Gap down opening possible in nifty near the 22800 level. After opening important support for nifty is 22750-22800 range. Major downside expected in nifty in case it gives breakdown of this level and starts trading below 22700. This downside can goes upto 22500 level in today's session. Any bullish rally only expected above 23050 level.

Nifty Intraday Trade Setup | 30th January 2025Nifty opened flat around 23030 and after forming a low at 22976 it went up and made high above 23180.

Tomorrow, buy Nifty if sustains above 23180 for the targets of 23240 and above marked level. On the other side, sell if Nifty sustains above 23080 for the targets of 23030 and above marked level on the chart.

Expectations: Volatile Day

Intraday Levels:

Buy Above - 23180

Sell Below - 23080

To motivate us, Please like the idea If you agree with the analysis.

Happy Trading!

InvestPro India

NIFTY : Trading Levels and Plan for 29-Jan-2025Here's your detailed trading plan for NIFTY on 29-Jan-2025, covering all possible opening scenarios with actionable insights.

📈 Scenario 1: Gap-Up Opening (200+ points above 23,088)

If Nifty opens with a gap-up, watch for resistance levels around 23,231-23,288:

🔹 Resistance Zone: 23,231-23,288 – Wait for confirmation before initiating a put option trade, targeting 23,088-23,024 if the level holds.

🔹 If 23,288 breaks with volume, expect a rally towards 23,350+. Look for call option trades with a strict stop-loss below 23,231.

🔹 Avoid overtrading near 23,088-23,231 without clear signals.

💡 Pro Tip: Wait for a 15-minute candle close above/below key levels for confirmation.

📉 Scenario 2: Flat Opening (Near 22,976-23,024)

A flat opening brings the market closer to the No Trade Zone (22,963-23,024). Breakout confirmation is crucial:

🔹 If Nifty sustains above 23,024, it may test 23,088 and later 23,231 – Ideal for call option trades.

🔹 If Nifty breaks 22,963, expect weakness towards 22,862-22,829. Look for put option trades with a stop-loss above 23,024.

💡 Pro Tip: A breakout from the No Trade Zone often leads to strong directional moves. Let the market decide the trend.

⬇️ Scenario 3: Gap-Down Opening (200+ points below 22,963)

A bearish gap-down will test buyer strength at crucial support zones:

🔹 Support Zone: 22,862-22,829 – Look for reversal signs. If the price holds, call options targeting 22,963-23,024 can be considered.

🔹 If 22,829 breaks decisively, expect further downside towards 22,637. Plan for put option trades, keeping SL above 22,862.

🔹 Be cautious near 22,637 as it might act as a reversal zone.

💡 Pro Tip: After a gap-down, monitor institutional activity before taking a trade. Avoid bottom fishing too early.

🛡️ Risk Management Tips for Options Trading

🔹 Use a fixed percentage of capital per trade (1-2%) to manage risk effectively.

🔹 Avoid chasing trades—let the market confirm levels.

🔹 Always use stop-loss and avoid averaging losing positions.

🔹 Prefer at-the-money (ATM) or slightly out-of-the-money (OTM) options for liquidity.

📊 Summary and Conclusion

🔹 Key Resistance Zones: 23,088, 23,231, 23,288

🔹 Key Support Zones: 22,963, 22,862, 22,829, 22,637

📌 Follow the plan, avoid emotional trading, and stick to defined levels. The market rewards discipline and patience!

⚠️ Disclaimer: I am not a SEBI-registered analyst. This plan is for educational purposes only. Trade responsibly. 😊

#NIFTY Intraday Support and Resistance Levels - 28/01/2025Gap up opening expected in nifty near the 22950 level. After opening it will face resistance at this level and chances of reversal in index. If reversal occurs at this level then expected downside movement upto 22700- in today's session. Any bullish rally now only expected if nifty starts trading and sustain above 23050 level.

NIFTY : Trading levels and Plan for 28-Jan-2025📊 NIFTY Trading Plan for 28-Jan-2025 📊

📈 Key Levels to Watch:

Opening Support/Resistance Zone: 22,816-22,829

Intraday Resistance Zone: 22,909-22,930

Last Intraday Resistance Zone: 22,995

No Trade Zone: 22,816-22,829

Do or Die Intraday Zone: 22,594-22,638

Final Support Zone: 22,309

🌟 Scenario 1: Gap-Up Opening (100+ points above 22,909) 🌟

If NIFTY opens significantly above 22,909:

✅ Wait for Retest: Do not jump into trades immediately. Allow the index to retest the 22,909-22,930 zone for confirmation of strength.

📈 Action Plan: If the price holds above 22,930, initiate long trades targeting 22,995 (last resistance) and further extending to 23,220. Keep a stop-loss below 22,900.

🚫 Caution Zone: If resistance is observed near 22,995, consider profit booking or tightening stop-loss. Avoid fresh longs unless a breakout above 22,995 is confirmed.

💡 Pro Tip: Use bull call spreads to manage risk while capturing potential upside gains.

📉 Counter Strategy: If a bearish rejection candle forms near 22,995, short trades targeting 22,909 can be considered with a tight stop-loss.

🔄 Scenario 2: Flat Opening (Near 22,816) 🔄

If NIFTY opens flat or within the No Trade Zone: 22,816-22,829:

⚪ Avoid Immediate Trades: This range is indecisive. Wait for a breakout above 22,829 or a breakdown below 22,816.

🔼 Breakout Strategy: If the price breaks and sustains above 22,829, go long targeting 22,909-22,930. Use a stop-loss below 22,800.

🔽 Breakdown Strategy: If the price breaks below 22,816, initiate short trades targeting 22,689. Maintain a stop-loss above 22,850.

💡 Pro Tip: In a flat market, time decay in options can work against you. Use directional trades or hedged strategies.

🚦 Options Strategy: Consider a straddle or strangle strategy around the no-trade zone to capitalize on a potential breakout or breakdown.

🌧️ Scenario 3: Gap-Down Opening (100+ points below 22,816) 🌧️

If NIFTY opens below 22,816:

📉 Key Zone to Watch: The Do or Die Zone: 22,594-22,638 is critical. Look for bullish price action (e.g., hammer or bullish engulfing candles) for a potential reversal.

✅ Action Plan: If the price holds above 22,594, initiate long trades targeting 22,816. Use a stop-loss below 22,580.

🔥 Aggressive Selling Levels: If the price sustains below 22,594, further downside towards 22,309 is possible. Short trades can be initiated with strict risk management.

💡 Pro Tip: During gap-down scenarios, volatility spikes. Use hedging strategies (e.g., protective puts) to limit losses.

🚫 Avoid Overtrading: Gap-downs can lead to whipsaws. Wait for confirmation before entering trades.

🛡️ Risk Management Tips 💡:

🎯 Always follow your stop-loss and avoid emotional decisions.

🔥 Never risk more than 2% of your trading capital on a single trade.

🧘 Stay patient and disciplined. Avoid trading in the No Trade Zone .

📊 Utilize options strategies to hedge risk and protect your capital.

📝 Summary & Conclusion:

Key Zones to Monitor:

Resistance: 22,909-22,930 , 22,995 , and 23,220 .

Support: 22,816 , 22,689 , and 22,594-22,309 .

Gap-ups favor long trades above 22,909 , while gap-downs focus on supports like 22,594 .

Stick to your plan and avoid trades in the No Trade Zone unless a breakout or breakdown occurs.

⚠️ Disclaimer:

I am not a SEBI-registered analyst . All information shared is for educational purposes only. Please consult with a financial advisor before making any trading decisions.