$USUR - Unmployment Rate (November/2025)ECONOMICS:USUR 4.6%

November/2025

source: U.S. Bureau of Labor Statistics

- The US unemployment rate increased to 4.6% in November 2025 from 4.3% in August, exceeding market expectations of 4.4% and marking the highest level since September 2021.

The number of unemployed stood at 7.8 million, little changed from September, while employment levels were also broadly stable.

The labor force participation rate was little changed at 62.5%, reflecting a largely steady labor force.

The broader U-6 unemployment rate in the United States, which includes discouraged workers and those working part-time for economic reasons, rose in November, reflecting a sharp increase in involuntary part-time employment.

Nonfarmpayrolls

$USNFP - Non-Farm Payrolls (November/2025)ECONOMICS:USNFP

November/2025

source: U.S. Bureau of Labor Statistics

- U.S job growth totaled 64K in November, compared with a 105K loss in October and market expectations of a 50K increase.

Employment rose in health care and construction, while federal government continued to lose jobs.

Meanwhile, the unemployment rate rose to 4.6%, more than expected.

$USNFP -U.S Economy Adds More Jobs Than ExpectedECONOMICS:USNFP +119K

September/2025

source: U.S. Bureau of Labor Statistics

- U.S nonfarm payrolls rose by 119K in September, compared to a revised 4K decline in August and beating market forecasts of 50K.

Jobs continued to rise in health care, food services, and social assistance, while transportation, warehousing, and the federal government saw losses.

Meanwhile, the jobless rate inched higher to 4.4%, the highest since October 2021.

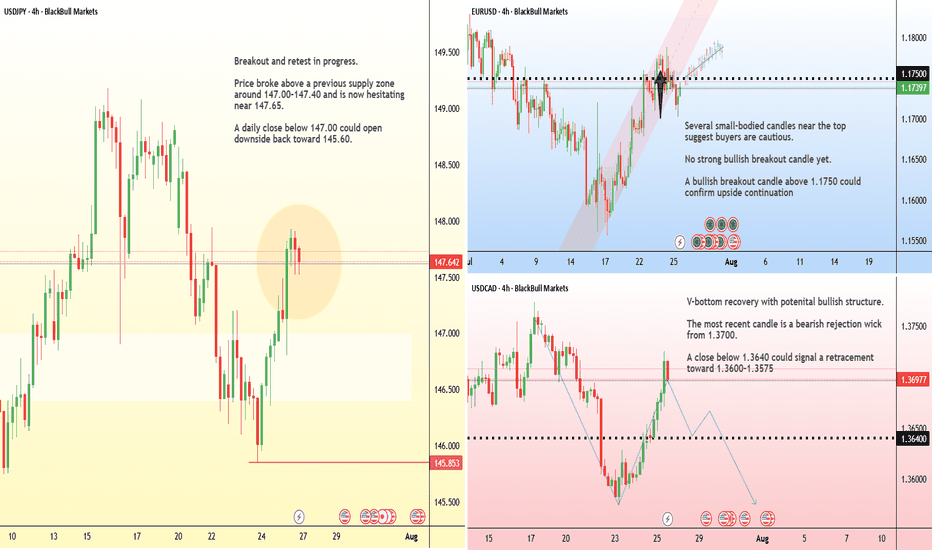

Correction in EURUSDEURUSD remains in a corrective structure.

Despite the brief recovery, another decline toward the area below 1,1600 is possible.

We continue to focus only on long opportunities, while monitoring the reaction around key support levels.

Friday’s upcoming NFP release could be the catalyst for the next major move.

Critical jobs data you need to watch this week Fresh labor market data will likely be the focus this week, with payrolls, unemployment, and wage growth all carrying weight for the Federal Reserve’s policy path. Stronger-than-expected job reports could revive dollar demand, while weaker figures may keep pressure on the greenback as markets price in further Fed easing.

Nonfarm payrolls for September are projected at 39K, a modest improvement from August’s 22K, but still far below the levels seen through most of 2023 and earlier years (chart, top left).

The unemployment rate is expected to hold at 4.3% (chart, top right).

Average hourly earnings are seen rising 0.3% month-on-month, matching August’s gain. That would keep annual wage growth steady, reflecting sticky wage pressures even as job creation softens.

The JOLTS job openings series remains elevated at 7.3 million (chart, bottom left), but still well below the peaks of 2022. This suggests firms are slower to post new jobs, but demand has not collapsed entirely.

Fed cut odds hit 97% ahead of Friday’s jobs report Markets are waiting for Friday’s U.S. NFP jobs report, which could heavily influence the Federal Reserve’s next move on interest rates.

Traders want a result that supports the case for rate cuts but doesn’t raise fears of a weakening economy. The ADP private payrolls report showed 54,000 new jobs in August. Stocks moved higher on the news, as wall street saw the number as weak enough for the Fed to cut rates in September, but not so weak that it signals a recession.

According to CME Group’s FedWatch tool, there is now a 97% chance the Fed will lower rates when it meets in two weeks.

What to trade if you can't trust jobs data? U.S. President Donald Trump has dismissed the head of the Bureau of Labor Statistics (BLS), reportedly in response to jobs figures he disagreed with.

This raises concerns about the integrity of government-reported economic data, especially ahead of the next key Non-Farm Payrolls (NFP) release on September 5.

This upcoming report also includes the BLS’s annual revision, adjusting past job growth figures from April 2024 through March 2025. Goldman Sachs “estimate a downward revision on the order of 550,000 to 950,000 jobs—or a reduction of 45,000 to 80,000 jobs per month over the April 2024 to March 2025 period.”

Given macro uncertainty and signs of distrust in U.S. economic data, the bid for gold may persist.

Gold has rebounded sharply in recent sessions, breaking a short-term downtrend and climbing back above the 3,360 level. Price has now retraced more than 50.0% of the July 24–31 selloff. The pair may be Short-term bullish, if price holds above 3,310.

EURUSD after the FedEURUSD continues to trade within the reversal zone highlighted in our previous analyses.

Following yesterday’s Fed decision, we’re seeing additional downside movement, though price hasn’t yet reached the support level at 1,1346.

Our outlook remains unchanged – we’re watching for the end of the pullback and will look for buying opportunities afterwards.

The H1 candle formed during the news release can serve as a reference. A break and close above it would signal a potential reversal to the upside.

Conversely, if price breaks and closes below that candle, it would suggest the correction is likely to continue toward lower levels.

Markets face a PACKED schedule this weekThe tariff truce between the U.S. and several major trading partners is set to expire on August 1 . A deal with Japan has already been reached, but talks with the EU, Canada, and Mexico remain active.

In monetary policy, the Federal Reserve is widely expected to hold rates steady at 4.5% during its midweek meeting .

Across the border, the Bank of Canada is also expected to leave its interest rate unchanged at 2.75% . After cutting rates twice earlier this year, the BoC is seen as entering a wait-and-see phase.

In Asia, the Bank of Japan will announce its decision on Wednesday . While the BoJ isn’t expected to hike this month, recent U.S.–Japan trade progress has opened the door for policy tightening later this year.

Finally, the week concludes with the U.S. Non-Farm Payrolls report on Friday. Economists expect job gains of around 110,000 in July, down from 147,000 in June.

EURUSD before the NFPEURUSD remains in an uptrend, holding steady around the 1,1800 level.

Today, the U.S. Non-Farm Payroll (NFP) data will be released.

The news is scheduled for 1:30 PM London time and tends to have a significant market impact.

It's advisable to reduce risk on all open positions and avoid rushing into new trades.

Keep an eye on how the price reacts around key levels and whether it has the strength to continue the trend.

US Nonfarm Payroll Report: Market InsightsUS Nonfarm Payroll Report: Market Insights

Navigating the complex waves of the financial markets requires an astute understanding of various economic indicators. Among them, the nonfarm payroll report stands out as a pivotal monthly metric that can significantly sway financial markets. This article demystifies the intricacies of this influential report, walking through what to know before trading it.

Nonfarm Payroll Definition

The nonfarm payroll (NFP) is a key economic barometer that tallies the number of employed individuals in the US, excluding the agricultural sector. Besides the farm workers, government, private household, and nonprofit organisation workers are not included.

This nonfarm payroll, meaning the workforce in industries like manufacturing, services, construction, and goods, reflects the health of corporate America and, by extension, the US economy. It’s one of the components of the Employment Situation report released on the first Friday of every month by the US Bureau of Labor Statistics. Nonfarm employment change data is released along with unemployment rate and average hourly earnings data.

Given its encompassing nature, the NFP and its importance to economic vitality makes it a beacon for investors and traders, who see the data as a projection of economic trends and an influencer of the Federal Reserve's monetary policy. Fluctuations in NFP numbers can cause significant movements in currency, bond, and stock markets.

The Nonfarm Payroll Report and Market Volatility

The release of NFP figures is a major event on the economic calendar, often triggering heightened market volatility. As nonfarm payroll news hits the wires, traders and investors brace for potential rapid swings in asset prices, particularly in the forex market. The immediate aftermath can see significant fluctuations in currency pairs with the US dollar. The anticipation and reaction to the nonfarm payroll in forex markets exemplify the weight this report carries.

Impact of NFP on USD Pairs

The nonfarm payroll report has a profound influence on USD pairs. When the NFP data is released, traders immediately compare the figures to market expectations, leading to price adjustments based on how well the actual data aligns with analyst forecasts. The broader trend of NFP data is also important, but it generally takes a backseat compared to actual vs expected figures.

For example, if the report indicates stronger-than-expected job growth, the US dollar typically strengthens, especially against currencies like the euro, yen, and pound. A robust employment outlook suggests economic health, potentially raising expectations for tighter monetary policy from the Federal Reserve.

On the flip side, if the NFP numbers fall short of expectations, the US dollar may weaken, particularly if the data points to economic slowdown or stagnation. In such cases, currencies like the euro or Japanese yen might rise against the dollar, as traders speculate that the Federal Reserve could delay interest rate hikes or even consider easing measures to boost the economy.

The NFP report also reverberates through other major currency markets. For instance, currencies in economies closely tied to US trade and investment—such as the Canadian dollar or Mexican peso—may experience volatility as changes in US employment data often reflect shifts in economic demand for their goods and services.

The Role of Employment Rates and Wages in Market Sentiment

Within the US nonfarm payroll release, two key indicators—unemployment rates and average hourly earnings (month-on-month)—are pivotal in influencing market sentiment.

Unemployment Rates

The unemployment rate measures the percentage of the labour force actively seeking employment but currently without a job. A falling unemployment rate generally signals that more people are finding work, a positive indicator for economic growth.

As a result, equities may rally, and the US dollar often strengthens, particularly if the data beats expectations. Traders interpret lower unemployment as a sign of economic resilience, which could influence the Federal Reserve to maintain or tighten monetary policy, further boosting the dollar.

Conversely, a rising unemployment rate may signal economic weakness, spurring concerns over reduced consumer spending and slowing economic activity. This could lead investors to shift towards so-called safer assets like bonds or gold.

In the forex market, a rising unemployment rate tends to weaken the US dollar as it lowers expectations for interest rate hikes and prompts speculation about potential stimulus or rate cuts by the Federal Reserve, further pressuring the dollar and encouraging risk-off sentiment.

Average Hourly Earnings

Alongside unemployment, average hourly earnings (m/m) is another key metric that traders closely monitor. This indicator tracks changes in wages from one month to the next and offers insight into inflationary trends.

When average hourly earnings rise, it can indicate that workers have more disposable income, which can increase consumer spending. Higher wages often fuel concerns about inflation, prompting markets to anticipate interest rate hikes to combat potential overheating in the economy. This expectation typically strengthens the US dollar.

However, if average hourly earnings come in below expectations or show signs of stagnation, markets may interpret this as a sign of weaker inflationary pressures. In such cases, traders may anticipate a more dovish stance from the Federal Reserve, potentially delaying or even reversing interest rate hikes. This can weigh on the US dollar and boost equities.

Execution Tactics for the Nonfarm Payroll Report Release

On the day the NFP data is released, specific execution tactics tailored to the NFP's unique market footprint can add substantial value. Due to the potential for rapid price movements, traders narrow their focus to liquid markets, like EUR/USD, USD/JPY, and GBP/USD, to facilitate quick entries and exits. They’ll typically trade on the 1m, 2m, 5m, or 15m charts and often require platforms built with speed in mind.

Nonfarm payroll trading involves comparing the actual data against market expectations. The outcomes can typically be categorised as follows, with each scenario influencing forex markets differently:

- As Expected: Currency values may experience minimal immediate impact if the report aligns with analyst forecasts, as the anticipated news is already priced into the market.

- Better than Expected: A robust report can boost the US dollar, as higher employment rates suggest economic strength, potentially leading to rising interest rates.

- Worse than Expected: Conversely, weak employment figures can devalue the US dollar, reflecting economic concerns and pressuring policymakers towards accommodative measures.

Given the volatility, many traders prefer limit orders to manage slippage, potentially ensuring they enter the market at predetermined points. Lastly, spreads can widen substantially, inadvertently triggering a stop loss. Some traders choose to set a wider stop loss than normal for this reason.

Traders usually monitor not just the headline number but also revisions of previous reports and associated metrics, such as unemployment rate and wage growth, which can influence market sentiment. High-speed news feeds and an economic calendar containing nonfarm payroll dates are employed to access the numbers in real-time, enabling immediate analysis.

Analysing Unemployment and Wage Growth Numbers Together with NFP

When trading around the nonfarm payroll release, it's essential to look beyond the headline number and integrate unemployment and wage growth data into your analysis. The NFP number alone can drive initial market reactions, but combining it with unemployment and wage growth figures provides a more nuanced view of the economy’s direction.

Traders start by comparing the trends across these three metrics. For example, if the NFP report shows strong job creation but unemployment remains stubbornly high, this could indicate that the economy is absorbing a larger labour force, potentially due to discouraged workers returning to job-seeking. This dynamic might lead to a more muted market response, as the overall labour market picture is mixed.

On the other hand, rising average hourly earnings alongside strong US nonfarm payrolls often signals not just employment growth but increasing inflationary pressure. If wages grow faster than expected, especially when paired with a low unemployment rate, it could indicate that labour shortages are driving up pay, raising inflation risks and making Federal Reserve action more likely. In this scenario, traders might anticipate a stronger US dollar, as higher interest rates become more probable.

To streamline your analysis during nonfarm payrolls, consider the following approach:

- Aligning Expectations: Traders compare actual numbers for NFP, unemployment, and wage growth with analyst forecasts. If NFP and wages grow but the unemployment rate falls, the market is likely to favour USD strength, while mixed results can trigger choppier price action as traders digest the implications.

- Gauging Momentum: Looking at the broader trend can provide further insight. If unemployment has been trending down and wages are steadily increasing (i.e. an expanding economy), the overall market sentiment may remain bullish even if NFP slightly underperforms. Conversely, if there’s a rising unemployment rate despite decent NFP growth, it could signal that the economy is slowing down.

- Assessing Policy Impact: It’s good to know how the Federal Reserve might interpret the combined data. For instance, moderate NFP growth with stagnant wage numbers may not trigger immediate policy shifts, allowing for more accommodative conditions in the near term. However, strong wage growth and low unemployment alongside robust NFP numbers are more likely to prompt a hawkish response.

Trading the NFP: A Strategy

Traders often consider analytical nonfarm payroll predictions to calibrate their strategies. However, an approach to take advantage of whichever direction the market takes uses an OCO (One Cancels the Other) order. This order straddles the current price range just before the report is released. Such a strategy prepares the trader for movement in either direction, as the NFP release can generate a significant breakout from the prevailing range.

According to theory, the strategy unfolds:

- An OCO order is placed with one order above the current price range and another below it. This setup positions the trader to catch the initial surge regardless of its direction.

- Stop losses might be set on the opposite side of the pre-report range to potentially manage risk.

- Profit targets might be established within a four-hour window post-release, aiming for a favourable risk/reward ratio, such as 1:3.

- Alternatively, a trailing stop may be utilised, adjusting above or below newly formed swing points to protect potential returns as a trend develops.

Such strategies allow traders to potentially capitalise on the new trend direction ushered in by the NFP data.

Risk Management When Trading NFP

Trading the NFP report often brings heightened volatility, making risk management crucial for protecting capital during these market swings. Below are some key risk management practices often employed when trading the NFP:

- Awareness of Spreads: Spreads can widen substantially during NFP releases. This can trigger even wide stop losses; tight stop losses can suffer extreme slippage, where the stop loss execution price differs substantially from the desired price.

- Conservative Position Sizing: Some traders take smaller positions when entering pre- and post-NFP release. The increased volatility when the report is released can lead to slippage and greater-than-anticipated losses as a consequence. Likewise, post-release conditions can also be unpredictable if data is mixed.

- Avoiding Overtrading: Aim to be selective with trades to avoid chasing price swings in a highly reactive market. It might be preferable to wait for a clear direction to emerge before entering a trade.

Comparative Analysis with Other Economic Indicators

The NFP report serves as a primary mover in the forex market, but its full value is best understood in concert with other economic indicators. Investors compare its findings with the Consumer Confidence Index for insights into spending trends, as employment health can influence consumer optimism and spending behaviours.

Likewise, juxtaposing NFP data against the Gross Domestic Product (GDP) figures provides a more complete narrative of the economic cycle since higher employment typically signals increased production and economic growth. Additionally, assessing the Consumer Price Index (CPI) and Producer Price Index (PPI) alongside NFP numbers can offer insight into inflationary pressures; strong employment data may point to higher inflation, a significant factor in central bank policy decisions.

The Bottom Line

In closing, learning how to trade nonfarm payroll data today may sharpen your market acumen and create exciting trading opportunities in the future. For those ready to apply these insights when NFP data is released, opening an FXOpen account provides access to over 700 markets, high-speed trade execution, tight spreads from 0.0 pips, and low commissions from $1.50. Happy trading!

FAQ

What Is NFP and How Does It Work?

The NFP meaning refers to the nonfarm payroll report, data that measures the number of jobs added in the US economy, excluding the agricultural sector. Released on the first Friday of every month by the US Bureau of Labor Statistics, the NFP is a key indicator of economic health, affecting currency, bond, and stock markets.

How Does Nonfarm Payroll Affect the Stock Market?

NFP data can drive stock market volatility. Strong job growth signals economic strength, often boosting equities. Conversely, weak NFP figures may indicate a slowing economy, leading to stock market declines as investors anticipate weaker corporate earnings.

What Happens When NFP Increases?

An NFP increase suggests robust job growth, typically strengthening the US dollar and stock markets, as investors expect economic expansion and potentially tighter monetary policy from the Federal Reserve.

Why Is Nonfarm Payroll So Important?

An NFP report is crucial because it reflects the overall health of the US labour market and economy. Traders and investors use the data to gauge economic trends, determine Federal Reserve actions, and understand where markets are headed.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NFP Data: Can it Sway Election? Just days before the U.S. heads to the polls, the last employment report before Election Day will offer a snapshot of hiring and unemployment, key factors in a race where the economy remains top of mind for voters.

Ordinarily, monthly jobs data provides a clearer gauge of economic conditions. However, analysts project that last month’s hiring figures could be skewed by multiple disruptions. Hurricanes Helene and Milton, alongside a prolonged strike by Boeing machinists, are expected to have temporarily trimmed employment by up to 100,000 jobs.

Gold could emerge as one of the most responsive assets. Following a surge to record highs, bullion slipped as some investors opted to lock in gains and pushed the RSI into oversold levels. Technically, XAU/USD is potentially still bullish.

$USNFP -U.S Non-Farm Payrolls (MoM)$YSNFP (AUGUST/2024)

US Economy Adds Fewer Jobs Than Expected

source: U.S. Bureau of Labor Statistics

- The US economy created 142K jobs in August, more than downwardly revised 89K in July but below market expectations of 160K.

Most job gains occurred in construction and health care while manufacturing employment declined.

Meanwhile, the jobless rate edged lower to 4.2% from 4.3% in July.

the number #1 indicator In Forex TradingWhen I began trading, the non-farm payrolls were the number #1 indicator I looked for

I remember countless of nights trying to understand

why this Economic News was so important

in Forex trading...today you get to witness just how powerful this

indicator is.

Yesterday the Federal Reserve Chairman of the United States Bank decided to pause interest rates this

This has given more fuel to investors to sell their euros and buy more dollars on this currency pair

because they will make more money on their savings in US Dollars until September

when the next FOMC meeting will be held.

This trend change is something you really need to watch out for

every time you are approaching the Non-farm payrolls.

This is your opportunity to go short on this currency pair

Disclaimer: Trading is risky you will lose money whether you like it or not, please learn risk management and profit-taking strategies.Trade safe.l

Strifor || GBPUSD-NFPPreferred direction: BUY

Comment: The fact of recovery is also visible on the pound chart. Here we also have both scenarios activated that we published at the beginning of the week. Before the NFP , the bullish mood remains, and an approach to the level of 1.26000 is expected. You can also consider level 1.26500 as an additional target.

In the short term, the pound is most likely to strengthen, but in the medium term, we will have to look at the facts. Growth towards the level of 1.28000 depends on many factors, the formation of which must take time.

Additional comments on this trade will be provided as situation changes. Follow us!

Thank you for like and share your views!

AUD/USD eyes confidence reportsThe Australian dollar has pushed higher on Monday. In the North American session, AUD/USD is trading at 0.6600, up 0.35%.

Australia’s Westpac consumer confidence is expected to rebound in April after a 1.8% decline in March. The market estimate stands at 0.5%. We’ll also get a look at the mood of the business sector, with NAB business confidence expected to fall to -3 in March, down from 0 in February.

Consumers and businesses are in a surly mood about the economy and last month’s pause from the Reserve Bank of Australia increased skepticism about a rate cut. The RBA has maintained the cash rate three straight times and hasn’t signaled when it will end its “higher for lower stance”.

The March RBA minutes didn’t mention the possibility of a rate hike, the first time that’s happened in the current tightening cycle, but the hot US nonfarm payrolls release may have pushed back the timing of an RBA cut. A rate cut from the RBA would have more impact if the Federal Reserve lowered rates first but the nonfarm payrolls data has pushed the likely timing of a first rate cut in the US from July to September.

US nonfarm payrolls jumped to 303,000 in March, up from a revised 270,000 in February and blowing past the market estimate of 200,000. The unemployment rate dipped lower to 3.8%, down from 3.9% and below the market estimate of 3.9%. Wage growth matched expectations at 4.1%, down from 4.3%.

The strong release points to a robust labour market, and investors have doubts if the Fed will cut more than twice this year. This mark a huge turnaround in market expectations – in January, an exuberant market had priced in six rate cuts in 2024, but the US economy is performing much better than expected despite high interest rates.

AUD/USD tested resistance at 0.6606 earlier. Above, there is resistance at 0.6632

0.6577 and 0.6551 are providing support

Japanese yen jumpy ahead of US payrollsThe Japanese yen showed a bit of strength earlier but has pared these gains. In the European session, USD/JPY is trading at 15141, up 0.04%

The markets are bracing for a sharp drop in US nonfarm payrolls for March. Job growth hit 353,000 in January but then fell to 275,000 in February and the market estimate for March stands at 200,000. The labour market has stood up well in the face of elevated interest rates but another decline in the March data would indicate a clear downtrend in job growth, which would support the Federal Reserve deciding to lower interest rates sooner rather than later.

When can we expect the Fed to take the plunge and start lowering interest rates? That is a tough one to answer, especially because not all Fed members are on the same page, as evidenced by comments this week. Fed Chair Jerome Powell said that although inflation has been bumpy, he expected the Fed to lower rates “at some point this year”. Cleveland Fed President Loretta Mester echoed this position, saying that the Fed was becoming more confident that it could lower rates in the next few months.

Minneapolis Fed President Neel Kashkari sounded more hawkish, as he questioned if rate cuts were needed this year “if we continue to see inflation moving sideways”. Kashkari does not have a vote on monetary policy but his comments indicate that a rate cut is not a given and will depend on the data, in particular inflation.

In Japan, household spending rebounded in February with a gain of 1.4% y/y, compared to -2.1% in January. This beat the market estimate of 0.5%. On an annualized basis, household spending dropped 0.5%, following a 6.3% decline in January and beating the market estimate of -3%. The 0.5% decline marks a 12th straight drop in household spending but the rebound leaves room for optimism.

USD/JPY is testing resistance at 151.41. Above, there is resistance at 151.71

There is support at 151.06 and 150.76

Strifor || GBPUSD-NFPPreferred direction: BUY

Comment: The British pound also remains on the buy list. Here, the expected movement for the current NFP is the same as for the euro . Growth is expected towards the level of 1.27000 , where local resistance will occur. The target is not set above this area (quite an aggressive option). But one can consider potential sales when generating a signal. We do not exclude the possibility that a potential downward reversal will already occur at the beginning of next week.

Additional comments on this trade will be provided as situation changes. Follow us!

Thank you for like and share your views!

Strifor || EURUSD-NFPPreferred direction: BUY

Comment: The setup for today's NFP remains in favor of the buyer. Most likely, the euro will update yesterday's high around the level of 1.09000 . At this level, there is an area of resistance, and most likely it is from here that we can expect a deeper correction than the one we are currently observing.

Additional comments on this trade will be provided as situation changes. Follow us!

Thank you for like and share your views!

Euro extends gains as Services PMIs improveThe euro is on a bit of a roll and has pushed slightly higher on Thursday. In the European session, EUR/USD is trading at 1.0857, up 0.19%. The euro is up for a third straight day and has climbed 0.8% since Monday.

Business activity improved across the eurozone in March. The eurozone services PMI rose to 51.5, up from 50.2 in February. The German reading improved to a revised 50.1, up from 48.3 in February. This marks the first expansion in Germany’s services sector in six months. Spain, France and Italy all showed stronger expansion in March. The 50.0 line separates contraction from expansion.

The services sector has carried the eurozone economy as manufacturing continues to decline. The eurozone has managed to avoid a recession, but the economy remains fragile. At the same time, inflation has been falling faster than expected, and European Central Bank policy makers have the tough task of determining the appropriate time to start cutting the deposit rate, which is currently at a record high 4%.

The markets are anticipating a rate cut in June and some ECB members have publicly stated that they support such a move. ECB member Robert Holzmann, considered a hawk on rate policy, said on Wednesday that he isn’t against a June cut but would want to see more data before making a decision. Holzmann added that if the ECB lowers rates in June and the Federal Reserve stays on the sidelines, this would reduce the effectiveness of the ECB lowering its deposit rate.

In the US, employment numbers are in focus, with nonfarm payrolls on Friday. The markets are expecting a drop to 200,000 in March, compared to 275,000 a month earlier. Unemployment claims will be released later today and are not expected to show much change. The market estimate stands at 214,000, compared to the previous reading of 210,000.

NFP preview: Trading S&P or GBPUSD? NFP preview: Trading S&P or GBPUSD?

US Fed Chairman Jerome Powell has reiterated on multiple occasions that a tight labor market acts as a deterrent to lowering interest rates. Which is why this month's NFP data release should be interesting.

This Friday's Non-Farm Payrolls (NFP) data is expected to show an addition of 200,000 new jobs. Since Feb 2023, data has consistently hovered between 300K and 150K. Many of these initial readings were subsequently revised downwards. Nevertheless, at the time, they significantly reduced the likelihood of Federal Reserve rate cuts and, most recently, bolstered the dollar.

Traders anticipated ~6 rate cuts at the beginning of the year, but now will be content if the Fed reduces rates three times. However, even three rate cuts are dubious, given that most recent US data has exceeded expectations. This Monday, the ISM manufacturing index turned positive for the first time since October 2022.

If the NFP data surpasses expectations, GBP/USD could become an attractive trade. In the event of a soft NFP reading, attention could shift to the S&P, which would have a window to rebound before major banks commence reporting their latest earnings.

GBP/USD has remained trapped within a rectangular pattern for almost 100 days now, potentially indicating some strong boundaries to take note of for a range trade. The pair currently sits in the lower half of the range.

The jobs data on Friday could heavily influence Wall Street's sentiment, potentially determining whether the market remains overall bullish or requires even more of a corrective move. The 5200 level could be pivotal. It has previously acted as resistance and now functions as support. Even if a breakdown occurs below this level, support could be anticipated at the 5100 level or the 50-day SMA.

Strifor || GOLD-NFP SetupPreferred direction: SELL

Comment: By the end of the week, all long trades on metals have been fixed, and on the eve of the NFP , we expect a fall in gold . It should be noted that a slight increase is still possible even without the NFP data, where, against the background of volatility, the price may rise above the current new historical maximum. However, this growth is nothing. Therefore, we're coming to NFP with two scenarios that differ in the range of potential false upward movement. Most likely, we won’t see the price above $2200 .

Both scenarios are on the chart, where the overall target for the fall is located at the level of $2120.

It should also be said that there is no point in delaying sales, since the medium-term buyer is strong.

Additional comments on this trade will be provided as situation changes. Follow us!

Thank you for like and share your views!