NVO

NVO Novo Nordisk Options Ahead of EarningsAnalyzing the options chain and the chart patterns of NVO Novo Nordisk prior to the earnings report this week,

I would consider purchasing the $162.5 strike price Calls with

an expiration date of 2023-8-18,

for a premium of approximately $6.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

End of the Road for Novo Nordisk. NVOAnother impulse done and dusted. Divergent, now looking out of steam.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

$NVO Trade ideaToday NVO got over resistance and did not look back. I noticed some bullish sweep call flow today that caught my attention. The 2022 dated calls had a low OI. It gapped up today at open with strong conviction. I am planning on entering a trade at a dip near today's gap placing the 2.618 as a target. I'll be looking at the 78-80 area as a possible stop loss in case it is not able to get over the highs. IV on options are close to the lowest historically so it leads me to believe that we'll continue this bullish trend. As long as this week's low holds, I'll keep swinging my position.

Novo Resources Corp - New Bullish CycleNo retracement yet of the first up-leg, this is just starting!

NVO showing weakness in short termPrice action near $57.5 will determine where it will go next.

- it has shown strength when breaking through $57.5 on larger timeframes

- NVO is a buy

- A pullback to $57.5 would be a good long entry point, provided that there are no heavy sell off during this pullback.

- new ATH likely, given some time.

NVO Breakout to All-Time HighIn this chart we're looking at NVO on the 1W chart as price has consolidated into an ascending triangle . Price has broken through the horizontal boundary around $58. After price prints a 1W candle (1 day left) through $59.77 breakout will be confirmed.

This ascending triangle has a price target of around $85 for about a ~46% gain.

Price has good momentum as it has found support on the 200EMA and is breaking out of its chart pattern boundary well above the 200EMA.

If you would like to see more of these ideas on a regular basis, follow me as I will be posting many more exciting chances to earn on chart pattern breakouts this upcoming year!

Drop a like or comment if you found this idea informational or helpful in any way!

Cheers!

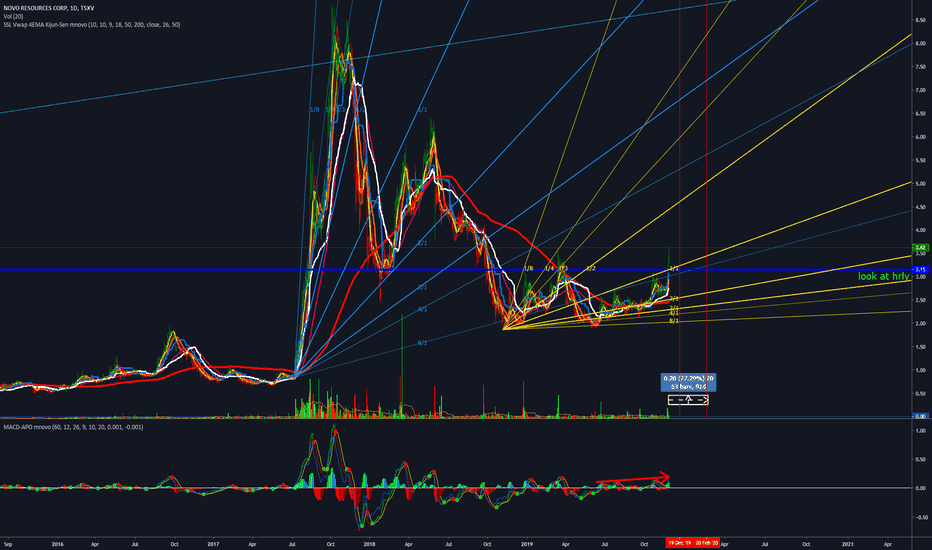

Novo Resources will choose direction before end of August '19Novo Resources ( TSXV:NVO ) is about to end a massive triangle, completion to be expected before the end of August 2019. My bet, with gold back in bullmarket, is that Novo will move strongly upward.

Background: this junior is active in the Western Australian Pilbara region and has found massive gold resources, being researched now for inclusion in the M&I resources. This could be one of the largest gold discoveries ever. Do your own Due Dilligence please.

Set up NVO.ca (TSX)Nice set up here in this resource stock. Watching for confirmation of bounce on fresh uptrend start.. 4.65 good buy taget, with an add over 6.

LABU, long trade ideaI've been in an out of LABU over the years. I rode it up recently to the upper trend line. I now see a pullback complete and a chance we are breaking out of a bull flag higher. Stop anywhere below the flag (dotted red lines) should break above the upper trend line and move higher. IMHO

IBB Biotechnology sectorIBB, the tracking stock for the Bio sector looks ready to regain its upward trajectory. With the RSI and %R at very oversold positions it may be ready. We recently had a bounce off the 200ma, There appears to be consolidation in the blue box currently. Look for a move above the 8ema to enter long.