Nzdusdlong

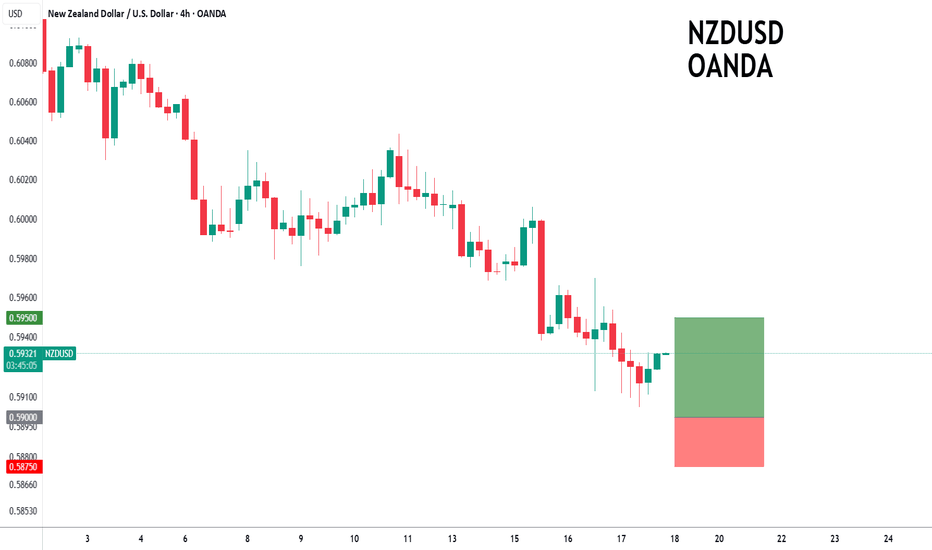

NZDUSD Forming Bearish ContinuationNZDUSD is carving out what appears to be a bearish continuation setup on the daily chart. The pair is forming lower highs and lower lows, guided by a clear corrective structure. As price breaks below the mini-leg retracement and edges lower, it suggests a potential slide toward the larger support zone around 0.5800–0.5820—an area that previously held as resistance and now flips to demand.

On the fundamentals front, the spotlight is on an increasingly dovish Reserve Bank of New Zealand. Inflation has remained within the RBNZ’s target band, with annual CPI rising just to 2.7%—slightly below forecasts—while labor data shows the unemployment rate creeping up to 5.2%, and labor force participation dipping to multi-year lows. Markets are now pricing in an 88% probability of another rate cut in August, Further weighting the scales against the kiwi.

Political and economic headwinds also cast a shadow over the NZD. The housing market is under pressure; prices are retracing sharply, rents are falling, and migration is declining. While the government is pushing fiscal stimulus via infrastructure spending, the momentum remains fragile—and it adds to bearish pressure on NZD.

Technically, this setup offers a defined structure and clean risk-to-reward. A violation below the last swing low around 0.5930 opens the path to 0.5800–0.5820. If that level gives way, the next logical target lies closer to 0.5700. For now, traders should be watching for confluence near 0.5950 for potential entry, aiming lower with stops tight above recent swing highs.

Ready to Rob the Kiwi? NZD/USD Bullish Breakout Plan🥝💚 NZD/USD Bullish Breakout Heist Plan 🟢💰 (Thief Trader Style)

🎭 Robbery Mission Activated – Code: Kiwi Uprising 💣📈

💥 Asset: NZD/USD

📍 Entry: 0.59400 (Breakout confirmed – the vault door’s open!)

🔐 Stop Loss: 0.58300 (Thief exit point – avoid the trap zone)

🎯 Target: 0.60500 (Cash-out point – grab the bags and vanish!)

🧠 Strategy: Layered Limit Orders a.k.a “Precision DCA Infiltration”

🧤 The Thief Trader is sneaking into the forex vaults once again — this time with eyes locked on Kiwi (NZD/USD). The bulls are loading up, and the breakout zone is showing green flags 🟢 — time to strike hard and clean 💰

🔥 Operation Details:

We’re stacking multiple limit orders like a pro thief would place decoys – distraction + precision = execution! Entry at 0.59400 is our main gate breach. Orders set in layers to trap liquidity zones below.

🚨 Stop Loss @ 0.58300 – tight enough to avoid getting caught, but wide enough to dodge fake traps.

🏆 Target: 0.60500 – that’s where the loot vault is sitting. Clean exit once we’re loaded with profits!

👀 Swingers & Scalpers Alert!

Only look LONG – no short robbing here!

🔁 Use trailing SL once in profit – protect your gold like a pro.

💡If cash is low – no panic, join the swing gang and glide in with patience & alerts. Smart robbers wait 🧠💼

📣 News Risk ⚠️

Avoid jumping during major news blast-offs.

Lock profits with trailing SL.

No panic entries — only sniper moves.🕵️♂️💥

❤️ Smash That BOOST Button 💥💪

Support the squad! More boosts = more heist plans, more clean money from the market streets 🚀📈

🎭 Stay sharp, rob smart — see you in the next plan, robbers 🤑🐱👤🎯

~ Thief Trader

NZDUSD – Breakout from Inverse Head & Shoulders + Trendline AreaNZDUSD is showing a bullish reversal setup on the 1-hour chart.

Price has broken above a long-standing descending trendline, indicating a potential shift in market structure.

A clear Inverse Head & Shoulders pattern has formed, suggesting a bullish reversal.

Price has broken above the neckline and the key resistance zone (highlighted in grey)

he 50 EMA has now been reclaimed, supporting the bullish bias

NZDUSD is in the Selling DirectionHello Traders

In This Chart NZDUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (NZDUSD market update)

🟢What is The Next Opportunity on NZDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

NZDUSD to form a higher low?NZDUSD - 24h expiry

Pivot support is at 0.5935.

We expect a reversal in this move.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5975 will confirm the bullish momentum.

The measured move target is 0.6000.

We look to Buy at 0.5935 (stop at 0.5910)

Our profit targets will be 0.5985 and 0.6000

Resistance: 0.5975 / 0.5985 / 0.6000

Support: 0.5935 / 0.5925 / 0.5910

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

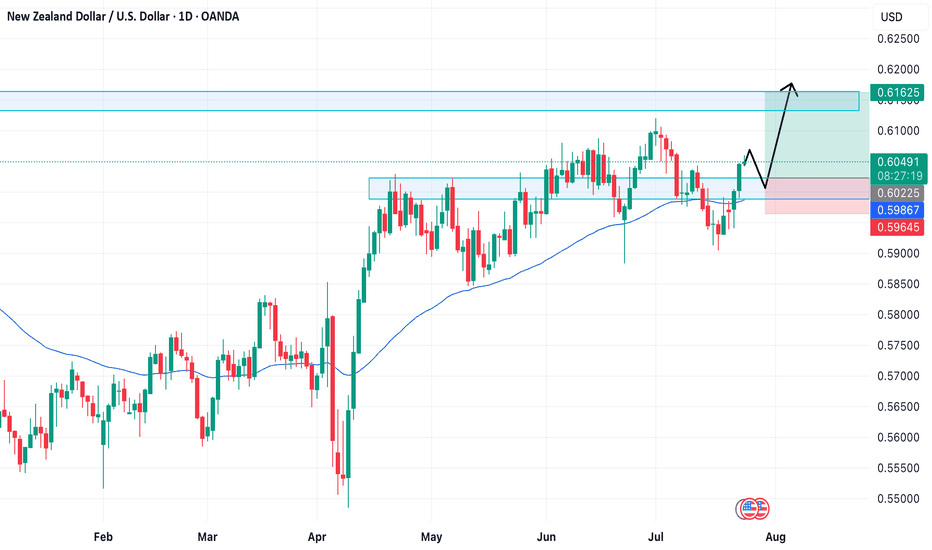

NZD/USD – A Bullish Opportunity You Shouldn't MissNZD/USD is showing a clear bullish structure across multiple timeframes:

Weekly: Overall trend remains bullish.

Daily: Structure flipped bullish on July 23, 2025, confirmed by a strong bullish engulfing candle.

4H: Also aligned bullish, adding further confluence.

We are now anticipating a retest near the previous Daily Higher Low (HL) — likely around a round psychological level. This zone may offer a textbook HL formation and a high-probability long setup.

📍 Potential Trade Plan

Entry: Around 0.6000

Take Profit: 0.6160

Stop Loss: 0.5960

⚠️ This is not financial advice. Please do your own research and analysis before entering any trade. I am not responsible for any potential losses.

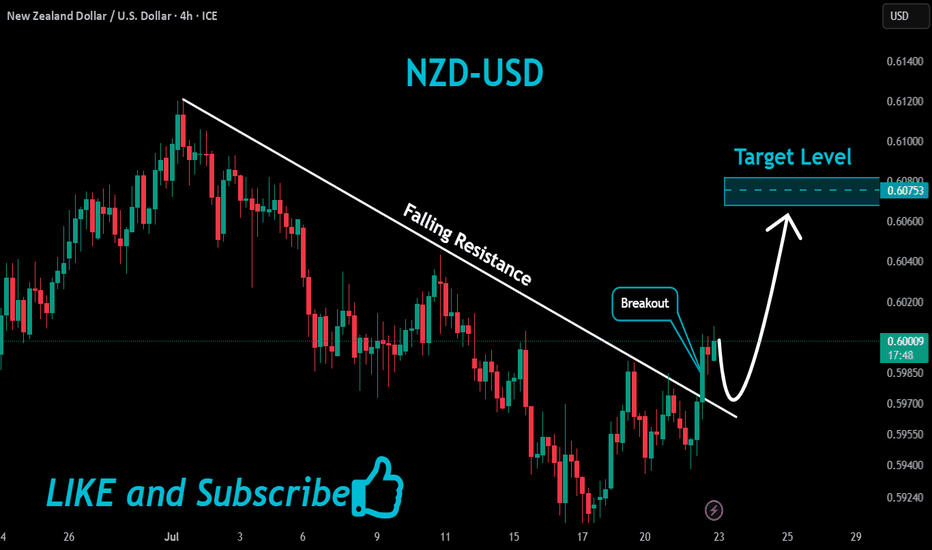

NZDUSD Massive Bullish Breakout!

HI,Traders !

#NZDUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

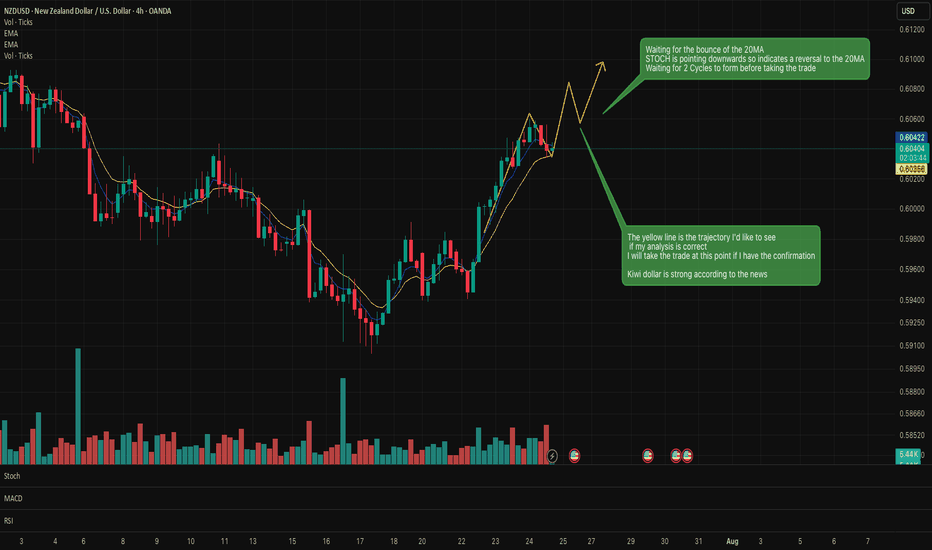

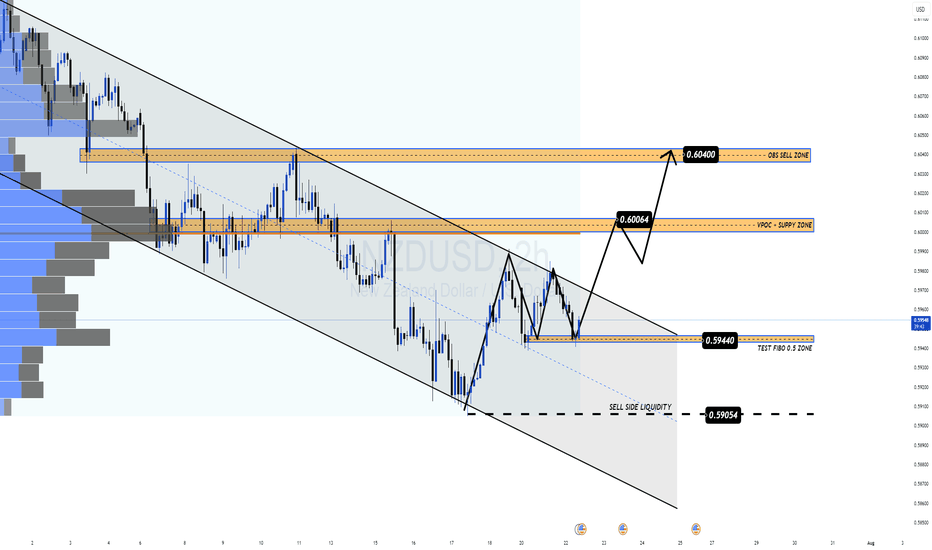

NZDUSD Is a Short-Term Rebound on the Table?NZD/USD is down nearly 0.4% in Tuesday’s European session, trading near the key support area of 0.5940 — a confluence of the 0.5 Fibonacci retracement and the midline of a descending channel. The pair is pressured by rising expectations that the RBNZ may cut rates in August, while the USD remains volatile amid uncertainty surrounding trade talks between the US and its key partners.

🔍 Technical Overview – Structure & Momentum

✅ Overall Trend: Bearish short-term (descending channel)

✅ Current Structure: Price is testing key technical support at 0.5940

✅ Volume Profile: VPOC and upper supply zones remain key targets on a bounce

NZD/USD continues to respect the bearish channel structure. However, the support zone at 0.5940 (Fibo 0.5 + recent demand) is showing signs of holding. If price sustains above this level, a bullish correction toward the 0.6006 and 0.6040 supply zones is a valid scenario.

🧭 Trade Scenarios

🔸 Bullish Short-Term Scenario (if 0.5940 holds):

Entry: Buy around 0.5940

TP1: 0.60064 (VPOC + supply zone)

TP2: 0.60400 (OBS sell zone)

SL: Below 0.5905 (sell-side liquidity break)

🔹 Bearish Continuation (if support breaks):

A clean break below 0.5905 confirms downside continuation

Look for retest and short entries targeting deeper channel lows (0.586x–0.583x)

⚠️ Macro Risk Drivers

Growing expectations of an RBNZ rate cut in August

Ongoing US trade negotiation uncertainty with key partners

Potential USD volatility around upcoming macroeconomic releases

📌 Key Price Levels to Watch

Technical Support 0.5940 Fibo 0.5 + mid-channel

Sell-Side Liquidity 0.5905 Bearish confirmation if broken

VPOC + Supply Zone 0.60064 First upside target

OBS Sell Zone 0.60400 Final bullish target / resistance

💬 The descending channel remains in control, but 0.5940 could be the key pivot. Wait for confirmation before entering, and watch volume closely.

NZDUSD to turnaround?NZDUSD - 24h expiry

The correction lower is assessed as being complete.

We expect a reversal in this move.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.5925 will confirm the bullish momentum.

The measured move target is 0.5975.

We look to Buy at 0.5900 (stop at 0.5875)

Our profit targets will be 0.5950 and 0.5975

Resistance: 0.5925 / 0.5950 / 0.5975

Support: 0.5900 / 0.5875 / 0.5850

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

"NZD/USD Bullish Heist! Steal Pips Before the Reversal Trap! 🏴☠️ NZD/USD Kiwi Heist Masterplan – Steal the Bull Run! 💰

🌟 Hola, Money Makers & Market Marauders! 🌟

Welcome to the Thief Trading Style raid on the NZD/USD "The Kiwi" Forex vault. Follow the blueprint sketched in the chart for a bold long takeover — escape the high‑risk Yellow MA Zone before guards tighten!

🎯 Heist Blueprint

1. Entry 🚀

"The vault swings wide—yank that Bull loot at any price!"

Drop your buy-limit orders within the next 15–30 min (or at the latest swing low/high). Don’t sleep—set chart alerts for the perfect breach.

2. Stop‑Loss 🛑

Thief-style SL lurks at the nearest 5h swing‑low wick (≈ 0.60400) for intra‑day.

Adjust your SL based on your risk appetite, position size, and combo of orders.

3. Target 🎯

Aim to escape by 0.62000, or bail early for safety.

4. Scalpers’ Edge 🔍

Only rob on the long side. Big bankroll? Go all‑in. Prefer safety? Slide into the swing crew with a trailing SL to lock in your spoils.

🔍 Market Intel

Why the Kiwi Loot is Ripe:

Bullish momentum marches on, fueled by macroeconomic clues, COT data, sentiment shifts, inter-market moves — all pointing upward.

📚 For Full Recon:

Dive into the fundamental, macro, COT, quant, sentiment & intermarket intel — plus trend targets and scorecards. Check the data here 👉🔗🔗

⚠️ Caution Zone

News Watch & Position Safety:

Major news = guarded vault. Don't open new trades during release windows.

If you're in already, use trailing stops to shield your haul and lock in gains.

💪 Support the Crew

Smash that “Boost” to fuel our team and keep the raid running smooth. With Thief Trading Style, every day’s a payday.

🗓️ Stay tuned for the next Kiwi Heist – we’re just getting started. Happy robbing, legends! 🐱👤💥

NZDUSD Hits Channel Top Bearish Momentum BuildingNZDUSD pair has touched a key resistance zone near the top of its rising channel and is showing early signs of rejection. This technical inflection point aligns with weakening New Zealand economic sentiment and renewed strength in the US dollar. The stage is set for a bearish rotation, with several support targets now in focus if momentum continues to build to the downside.

📉 Current Bias: Bearish

NZDUSD has failed to break above the 0.6085–0.6090 resistance area, marking repeated rejections at the channel’s upper boundary. Price action and structure suggest a potential move back toward 0.6000 and deeper levels such as 0.5960 and 0.5910 if support fails.

🔍 Key Fundamentals:

RBNZ on Hold and Dovish Leaning: The Reserve Bank of New Zealand has paused its tightening cycle, with Governor Orr signaling no urgency to hike further amid weakening domestic demand and subdued inflation momentum.

US Dollar Support: The USD is gaining traction amid Fed officials maintaining a hawkish hold tone, and with markets paring back bets on near-term rate cuts due to sticky inflation and resilient labor data.

NZ Economic Weakness: New Zealand’s growth has stagnated, with recent trade and retail data underwhelming. Business sentiment remains subdued, adding to downside Kiwi pressure.

⚠️ Risks to the Trend:

Soft US Data: Any major downside surprise in upcoming US labor market or inflation figures could reignite Fed rate cut bets and weigh on the dollar, lifting NZDUSD.

China Rebound: As China is a major trading partner for New Zealand, any strong recovery signs or stimulus headlines out of Beijing could buoy NZD on improved trade expectations.

Unexpected RBNZ Hawkishness: If the RBNZ pivots back to a more aggressive tone due to inflation persistence, NZD could find renewed strength.

📅 Key News/Events Ahead:

US PCE Inflation (June 28): Core metric closely watched by the Fed; any surprise will directly impact USD flows.

NZIER QSBO Survey (July 2): Offers insight into New Zealand business confidence.

US ISM Manufacturing & NFP (July 1–5): Major USD drivers with implications for broader market sentiment.

⚖️ Leader or Lagger?

NZDUSD is currently a lagger, often following directional shifts in USD majors like EURUSD and AUDUSD. However, due to its sensitivity to Chinese data and Fed rate expectations, it may accelerate moves once broader USD sentiment is established.

🎯 Conclusion:

NZDUSD looks poised for a bearish pullback from the channel top, with a confluence of macro and technical factors suggesting pressure toward 0.6000, 0.5960, and potentially 0.5910. While downside momentum builds, attention must remain on US data, China headlines, and RBNZ commentary for any sentiment shift. Bears hold the upper hand for now, but risk events ahead could challenge the momentum.

NZDUSD to find buyers at the current market price?NZDUSD - 24h expiry

The correction lower is assessed as being complete.

We expect a reversal in this move.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.6025 will confirm the bullish momentum.

The measured move target is 0.6075.

We look to Buy at 0.6000 (stop at 0.5975)

Our profit targets will be 0.6050 and 0.6075

Resistance: 0.6025 / 0.6050 / 0.6075

Support: 0.6010 / 0.6000 / 0.5975

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD Buy Setup✅ Key Levels:

Buy if Breakout: 0.60822

Invalidation (Stop Loss): 0.59983

Target 1 (TP1): 0.61495

Target 2 (TP2): 0.62160

---

🔍 Analysis Summary:

Breakout Setup: Price is approaching the resistance level at 0.60822. A confirmed breakout above this level signals a potential bullish move.

Trend: Uptrend continuation expected if price holds above the breakout level.

Invalidation Point: If price breaks below 0.59983, the setup becomes invalid, suggesting bearish pressure resumes.

Targets:

First take profit at 0.61495 (safe/partial profit-taking zone)

Second take profit at 0.62160 (full target if momentum sustains)

---

⚠️ Disclaimer:

This is a technical analysis and not financial advice. Always combine with your own research and risk management strategy.

NZDUSD to continue in the upward move?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.6100 will confirm the bullish momentum.

The measured move target is 0.6130.

We look to Buy at 0.6075 (stop at 0.6050)

Our profit targets will be 0.6125 and 0.6130

Resistance: 0.6100 / 0.6125 / 0.6130

Support: 0.6075 / 0.6060 / 0.6050

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Is This the Next Big Heist? Thief Trader Eyes NZD/USD Long SetupThief Trader’s NZD/USD Heist Plan – Long Setup in Play!

🌍 **Hello Global Wealth Warriors!**

Hello, Bonjour, Ciao, Salut, Guten Tag, Ola!

📢 **Fellow Profit Pirates & Market Mavericks**, it’s time to set sail again! Get ready to loot the forex seas with our latest **Thief Trader Strategy** targeting the **NZD/USD (The Kiwi)** pair.

---

🔎 **Trade Overview**

💥 Setup: Long Entry Plan – Executing our cunning blueprint with Thief Trading's sharp technical & fundamental intel**.

🎯 Target: 0.62300 (or exit just before for safety).

⚠️ Danger Zone: Watch for traps at the RED Zone Level – signs of overbought conditions, consolidation, trend flips & bearish setups.

---

🟢 **Entry Signal** – *The Heist Begins!*

📈 **Primary Entry**:

> Breakout above **MA Line (0.60300)** = Bullish move → *Place a Buy Stop above ATR Line*

📉 **Pullback Option**:

> *Buy Limit* at recent swing low/high on **15 or 30-min TF**.

📌 **Pro Tip**:

Set an **Alert** on your chart to catch the breakout live. Timing is everything!

---

🛑 **Stop Loss – The Getaway Plan**

📍 **SL Recommendation**:

> Recent swing low on the **4H chart (0.59400)** for day/swing trades.

> 🎯 Customize your SL based on risk, lot size, and total orders.

---

🔐 **Scalpers vs. Swingers**

👀 **Scalpers**: Focus ONLY on long-side plays.

💰 Got deep pockets? Dive in.

😎 Otherwise, swing traders – this is your golden moment. Trail your SL to protect profits.

🌐 **Market Pulse** – Momentum Watch

📊 Kiwi is navigating a **MA Resistance Zone**, but bullish bias remains due to:

* **Fundamentals**

* **Macro Insights**

* **COT Reports**

* **Sentiment & Intermarket Trends**

* **Quant Analysis + Overall Score**

📎 Check the linkks for detailed breakdown.

📰 **News Warning!**

⚠️ Major releases ahead?

* Pause entries.

* Protect trades with **trailing SLs**.

---

🚨 **Join the Next Heist with Thief Trading!**

💥 Smash that **Boost** or **Like** to join our profit squad.

With **Thief Trader Style**, we dominate the markets DAILY.

Your support fuels our mission. ❤️💼

---

💸 Stay ready for the next move, money-makers.

🎯 Eyes on the chart – timing is profit.

NZD/CHF Potential Bullish Reversal SetupNZD/CHF Potential Bullish Reversal Setup 🔄📈

📊 Chart Analysis:

The chart shows a potential bullish reversal for NZD/CHF, supported by technical patterns and key levels:

🧠 Key Technical Highlights:

🔹 Double Bottom Formation (🟠 Circles)

A clear double bottom pattern can be seen around the 0.48300 support zone, signaling potential reversal from the downtrend.

🔹 Strong Support Zone 📉

Price bounced from a historically respected support zone (~0.48200–0.48400), which held several times in the past (marked with green arrows).

🔹 Downtrend Breakout 🔺

A short-term bearish channel has been broken to the upside, indicating potential bullish pressure.

🔹 Target Zone 🎯

Immediate bullish target is around 0.49265, aligning with previous resistance.

🔹 Resistance Area (🔵 Boxes)

Next significant resistance lies at 0.49400–0.49800, which may act as the next hurdle if price breaks the 0.49265 level.

✅ Conclusion:

As long as price holds above 0.48400, bulls may aim for the 0.49265 🎯 target. A breakout above that level can open the path to higher resistances.

📌 Bullish Bias maintained above support zone — monitor for volume confirmation and retest strength.

NZDUSD to continue in the upward move?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.6085 will confirm the bullish momentum.

The measured move target is 0.6125.

We look to Buy at 0.6050 (stop at 0.6025)

Our profit targets will be 0.6100 and 0.6125

Resistance: 0.6085 / 0.6100 / 0.6125

Support: 0.6060 / 0.6050 / 0.6025

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZDUSD to continue in the upward move?NZDUSD - 24h expiry

There is no clear indication that the upward move is coming to an end.

Although we remain bullish overall, a correction is possible with plenty of room to move lower without impacting the trend higher.

Risk/Reward would be poor to call a buy from current levels.

A move through 0.6050 will confirm the bullish momentum.

The measured move target is 0.6075.

We look to Buy at 0.6020 (stop at 0.5995)

Our profit targets will be 0.6070 and 0.6075

Resistance: 0.6050 / 0.6070 / 0.6075

Support: 0.6025 / 0.6020 / 0.6000

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

Update idea

Add note