Parallel Channel

EURJPY still bullish for expect

OANDA:EURJPY strong bullish push we are have on start of month, thoughts are strong bullish volume is gathered and the we can see still here bullish trend.

Currently price is in ASCENDING CHANNEL, expecting to see break of same and new bullish push.

SUP zone: 158.500

RES zone: 164.500

XAUUSD need some rest and fallWe are looking for dump asap here for gold price already broke resistance channel but i am expecting it will get back in channel and after that with high volume the dump expected to the targets like 2900$.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚

Bitcoin Dominance Ascending Channel and Altseason (1W Log)CRYPTOCAP:BTC.D has been in a clean uptrend inside an ascending channel for over 2 years.

• The midline has consistently acted as a magnet, but BTC.D has recently detached from it and might be headed for another retest of the upper boundary.

• Unless major macro catalysts intervene, I expect no notable changes until the 72-73% key area, the same zone that triggered 2021's altseason.

Regarding altseason, this cycle isn't like previous ones. With millions of tokens today, dilution is real, and a full-blown altseason where everything pumps seems unlikely.

Instead, I expect selective rotation into quality projects, and that might actually make it easier to find real outperformance.

Dell Technologies (NYSE: $DELL) Stock Gains on Tariff ReliefDell Technologies Inc. (NYSE: NYSE:DELL ) rose sharply on Monday following the Trump administration’s temporary suspension of tariffs on smartphones, computers, and other electronics. The updated guidance from U.S. Customs and Border Protection late Friday excluded these items from the latest round of reciprocal tariffs, which had raised concerns among tech manufacturers.

Dell shares gained 4%, closing at $85.19, up $3.26 on the day, with a trading volume of 12.35 million shares. The stock had opened at $89.29 and reached a low of $84.01 during the session. The tariff pause, though potentially temporary, has eased pressure on companies that heavily rely on global supply chains. Dell, which produces most of its hardware outside the United States, stands to benefit significantly from the exemption.

JPMorgan analysts commented that the exemption highlights the strategic importance of electronics to American consumers and the economic weight of companies like Dell and Apple. While Apple is accelerating its manufacturing diversification into countries like India and Vietnam, Dell continues to leverage international production capacity to maintain its competitiveness.

Technical Analysis

From a technical perspective, DELL is currently trading within a descending channel that started from its all-time high of $179.70. The recent bounce from a support zone indicates potential short-term support. The price action suggests two likely scenarios: a continued climb toward the upper boundary of the channel near $110, or a pullback to test lower levels around $42, aligned with the bottom of the channel.

The 200-day moving average (86.18) and 100-day (116.72)currently sit above the price, indicating a bearish medium-term trend. However, if DELL holds support around $85.11 and gains momentum, it could challenge the mid-channel resistance and eventually attempt a breakout.

Potential Downtrend in JPMorgan JPMorgan Chase has rallied sharply in recent sessions, but some traders may see downside risk.

The first pattern on today’s chart is the series of lower highs and lower lows since mid-February. JPM is returning near the top of that descending channel. Could another lower high result?

Second, JPM is potentially stalling at the March 31 low of $237.36. Old support may have become new resistance.

Third, prices are stalling around the 21-day exponential moving average.

Next, economic sentiment has recently deteriorated. Mortgage rates are higher, consumer credit growth has slowed, business surveys have missed estimates and confidence measures have weakened. JPM responded by hiking loan-loss reserves in its latest quarterly report. Continuation of those trends may drag on the megabank’s fundamentals.

Finally, JPM is a highly active underlier in the options market, trading about 125,000 contracts per session in the last month. (It ranks 18th in the S&P 500, according to TradeStation data.) That could help traders take positions with calls and puts.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

XLM/USD Main trend. Timeframe 1 week. Channel. Radiant Star of 2218) One of the most “silent” cryptocurrencies. Unlike its fellow clone, pumped up by the community on the ears of pseudo-esoterics (although 589 is not going anywhere, which is, that is, it is not price))))....

Note that past secondary trend reversals are shrinking after significant dips. We are now in the lower zone of the channel, but not at the lowest potential values. Never “catch” the lows and highs, but work most of your position near those values, and you will be happy and relaxed.

I advise you to combine pyramiding (up) + martingale (down), and you won't care where the price goes, because you'll be happy with either direction. It is also rational to protect your profits with stops, but not near intraday volatility.

It is also natural for your peace of mind to forget about two things if you have a mind:

1) Forget margin trading. Work only on spot.

2) Forget the 1 “world's most reliable exchange” (diversification of trading and storage).

Coinmarket: XLM

About the enlightenment: .

1) Instant (less than 3 sec) transactions,

2) Conditionally free transactions $0.000001 (0.00001 XLM micro payments),

3) No network congestion (30 sec refund in case of failed transaction (not to be confused with exchange),

4) Smart contacts and NFT (2022),

5) "Transaction rollback" (this is an advantage, not a disadvantage for real use, not speculation),

6) Support for multi-currency transactions.

7) Interest in XLM blockchain by states.

And much more...

Roughly speaking, all the best worked out solutions from thousands of temporary “faith cryptocurrencies” over the last 10+ years.

Incidentally, many states will be making “transitional” fiat currencies on this blockchain. For example, the long-suffering Ukraine. But then when there will be “total sadness”. Creating a problem—presenting a ready-made solution.

Here's what this important zone looks like on the 1-day timeframe. Key reversal or trend continuation zone.

Breakout of the local symmetrical triangle +10% to the mirror resistance level of 0.2022.

GOLD → Countertrend correction. What to do in this case?FX:XAUUSD , after a bull run, bumps into strong limit resistance at 3244 and enters a correction phase, which is generally a logical maneuver amid strong gains.

Gold corrects from Friday's record $3,245 and moves back to $3,200 amid improving market sentiment and progress in trade talks. The price pared gains after a strong weekly rally, reacting to U.S. concessions on tariffs on Chinese electronics and China's pledges to boost economic stimulus. Additional influences come from the dialog between the US and Iran, as well as the anticipation of China's GDP and trade data for March. Despite the pullback, downside may be limited due to ongoing uncertainty.

Technically, it is worth looking at the 3187 - 3167 conglomerate of support, which can stop (temporarily or even turn the price upward) a strong and sharp decline, as the fundamental backdrop within the tariff war is still tense.

Resistance levels: 3244, 3270

Support levels: 3187, 3174, 3167

The rally is temporarily halted, but there is no talk of a trend reversal, as the tariff war fire is still burning, Trump or Xi Jinping may add to the fire....

Within the framework of counter-trend correction, the emphasis is on the support of 3187, 3174, 3167 from which we can trade a false breakdown and catch the price rebound.

Regards R. Linda!

NZDJPY → Back in range, there's a chance to strengthenFX:NZDJPY is forming a false break of the range support and within the reversal pattern confirms the break of the bearish structure

The fundamental background has been extremely unstable lately and depends on any harsh statements of politicians, mainly related to the trade war.

But, technically, the pair is returning to the range on the background of local market recovery. A false breakdown of the range support is formed.

The break of the bearish structure, the formation of the reversal pattern and the return to the trading range give chances for strengthening of the price. If the bulls hold the defense above 83.7 - 84.2, the currency pair may strengthen to 85.15 - 87.4

Resistance levels: 84.196, 86.15

Support levels: 83.79, 83.31, 82.21

Consolidation above the key support zone may allow the bulls to strengthen the price to the local zone of interest. Global trend is neutral, local trend is upward.

Regards R. Linda!

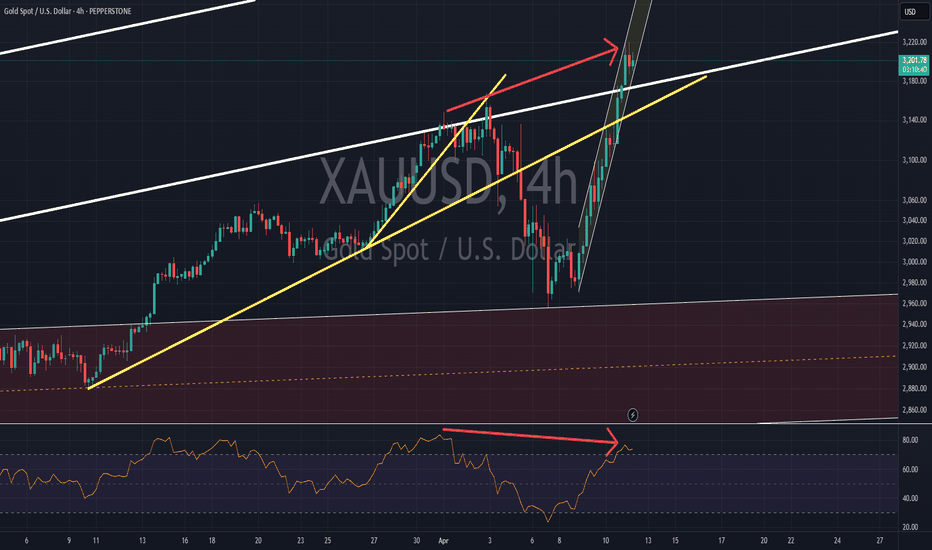

Buy limit order plan for Gold on 4HGold is performing in assenting parallel channel on daily time frame as will as on 4H time frame. However there is a bearish divergence that indicates the price will go down and will continue the up trend after the correction.

A buy limit order can be setup on 4H time frame.

Entry : 3072.166

Stop Loss : 2954.231

TP1 : 3190.101

TP2 : 3308.036

Bulls Score : 2

Bears Score : 1

gold (update)Hello friends

Due to the price growth, we have given you the analysis that the price will fall and the same thing happened. Now, due to the sharp decline, the price has entered the channel and the 3 specified areas are important support areas for us, where we can buy with risk and capital management and move towards the specified goals.

*Trade safely with us*

GOLD → Price is consolidating, but to what end? Growth?FX:XAUUSD continues on its way as part of a strong rally. Price is testing strong resistance and there is a good chance of a new high as the trade war escalation intensifies. Against the backdrop of the bull run, there is no need to think about selling!

Gold is trading near all-time highs above $3,200 on Friday, posting a weekly gain of about 5.5%. Rising prices are fueled by concerns over U.S. financial stability and the possible resignation of the Fed chief, adding to pressure on the dollar. Expectations of recession and Fed rate cuts are increasing amid escalating trade war with China, after the US imposed tariffs of 145% and Beijing retaliated - China raised tariffs to 125%. Inflation in March came in below expectations, reinforcing forecasts for a rate cut. Focus is on further trade talks and China's response

Resistance levels: 3219.5

Support levels: 3197, 3187, 3167

Emphasis on the local range: 3219 - 3187. Breakdown and price consolidation above the resistance will provoke rally continuation. But I do not rule out a correction to accumulate energy before the continuation of growth. In this case gold may test 3197 (0.7f), or support of 3187 range.

But we should be aware of the fact of unpredictability: If the US and China sit down for negotiations, the situation may change dramatically.

Regards R. Linda!

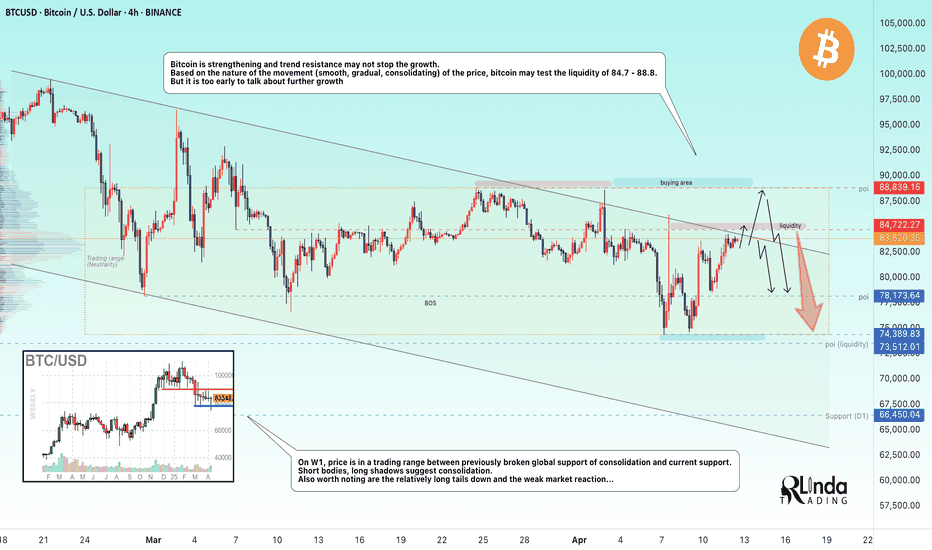

BITCOIN → Testing trend resistance. Will there be a breakout?BINANCE:BTCUSDT is approaching trend resistance and most likely it may test the liquidity zone and risk zone for sellers (liquidity hunt ?), but does the market have the potential to support the upside?

Bitcoin is strengthening and channel resistance may not stop this growth. Based on the nature of price movement (smooth, gradual, consolidating), bitcoin may test liquidity 84.7K - 88.8K. But it is too early to talk about further growth

On W1, the price is in a trading range (consolidation) between the previously broken global consolidation support and the current support. Short bodies, long shadows speak about consolidation. Also worth noting are the relatively long tails to the downside and the weak market reaction...

Fundamentally, the cryptocurrency market (community as a whole) for the past week did not get anything positive as from the very beginning of this year, the growth can be attributed to the 90-day technical break by Trump, but there are a number of nuances:

- the fire has not yet been put out

- just because they gave a 90-day break doesn't mean everything is fine. It's just a head start for the U.S. to prepare for the situation more thoroughly

- The escalating conflict between the U.S. and China has investors looking for less risky assets like gold. Cryptocurrencies are definitely not on that list.

- Rumors of a US interest rate cut are likely to provide support as well.

Resistance levels: 84700, 88800

Support levels: 78200, 73-74К, 66500

I would not hurry with conclusions about further growth. Growth could be considered if bitcoin overcomes 88800 and consolidates above this zone. But a sharp approach or a false breakout of one of the mentioned liquidity zones may provoke a reversal and fall.

Regards R. Linda!

USDJPY Wave Analysis – 11 April 2025

- USDJPY broke the support zone

- Likely to fall to support level 141.65

USDJPY currency pair recently broke the support zone between the support level 144.60 (which stopped wave 1 at the start of April, as can be seen below) and the support trendline of the daily down channel from January.

The breakout of this support zone accelerated the active short-term impulse wave 3 – which belongs to wave (3) from the end of March.

Given the strongly bearish US dollar sentiment, USDJPY currency pair can be expected to fall to the next support level 141.65, former strong support from August and September.

Long Bullish Idea — Reddit $RDDT (4H Chart)Alright, here’s the play.

Reddit’s been bleeding inside this falling channel for months. But here’s where it gets interesting.

→ IF price holds this buy zone around $100 - $95...

→ THEN I’m expecting a breakout towards $135 as first target. That’s about +34%.

Strong bounce here, plus a clean break of this descending channel = confirmation for me.

Volume is kicking in — I wanna see continuation.

→ IF price breaks $135 with momentum...

→ THEN next stop is $165 — the 2nd target. That’s another +20%.

This isn’t a scalp. It’s a swing idea. 2-5 months range.

Earnings 1st May could be a catalyst — but I want to be in early, not chasing after.

→ IF price loses $70 support with volume...

→ THEN idea invalidated. No ego, I’m out.

Simple plan. Clear levels. No hope, just execution.

Gold Wave Analysis – 10 April 2025- Gold broke key resistance level 3150.00

- Likely to rise to resistance level 3200.00

Gold today broke above the key resistance level 3150.00 (which stopped the previous impulse wave I at the start of April, as can be seen below).

The breakout of the resistance level 3150.00 accelerated the active intermediate impulse wave (3) from last November.

Given the overriding daily uptrend, Gold can be expected to rise to the next resistance level 3200.00, which is the forecast price for the completion of the active impulse wave (3).

USDCHF Wave Analysis – 10 April 2025

- USDCHF broke support zone

- Likely to fall to support level 0.8200

USDCHF currency pair recently broke the support zone between the key support level 0.8400 (which reversed the price multiple times in August and September) and the support trendline of the daily down channel from February.

The breakout of this support zone accelerated the active intermediate impulse wave (3).

USDCHF currency pair can be expected to fall to the next support level 0.8200, which is the target price for the completion of the active impulse wave (3).

Total 3 targeting 1.5TWelcome back dearest reader,

This is going to be a short one, all information is in the chart above.

Total 3 has been in a Massive Cup and handle formation.

Measured from the base of the cup till the top of the handle gives us a ''total 3'' price target of 1.5T$ which is 100x from here. If you were to do a different analysis and like flags more then we come to the same price target of 1.5T$ (Blue bars).

Price action is now retesting resistance from march 2024 as support. When this is done i expect blast-off mode.

~Rustle

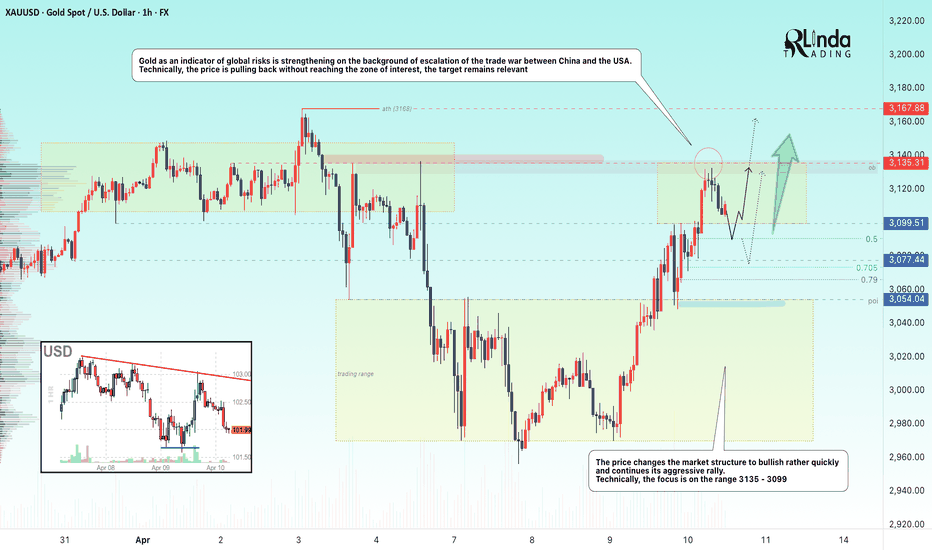

GOLD → Global economic risk indicator consolidates ahead of CPIFX:XAUUSD , rather quickly changes the market structure to bullish and continues its aggressive rally. The economic risk indicator is working perfectly. Technically, the focus is on the range 3135 - 3099

Gold is consolidating around $3,100 in anticipation of US inflation data. The escalating trade war between the US and China keeps demand for defensive assets alive despite the pause in price gains. Trump imposed 125% tariffs on Chinese goods and China retaliated with duties of 84% on U.S. imports. Increased tariff tensions are raising recession expectations and encouraging bets on a Fed interest rate cut, which supports gold. However, a rise in March CPI inflation (expected 2.6% y/y) could trigger a downward correction, although the impact could be short-lived - tariff news remains the main driver

Technically, the price failed to reach the 3135 liquidity zone and reversed, which attracted the crowd willing to sell (deceptive maneuver). But, after correction the price may return to the target quite quickly

Resistance levels: 3135, 3167

Support levels: 3100, 3090, 3077

Emphasis on the range boundaries, possible retest of 3100-3090- 3075 before continuation of growth. On the news or before the opening of the American session there may be a long squeeze before the continuation of growth.

Regards R. Linda!