PLTR Weekly Options Setup | $165C Eyeing 75% Upside!

## 🚀 PLTR Weekly Options Play (Aug 25–29): Tactical Call Setup 🎯🔥

**Summary of Model Signals**

* **Mixed Views:** 2 bullish/neutral vs. 2 bearish/neutral → no full consensus.

* **Claude:** ✅ Bullish, calls at \$165 (OI cluster, daily RSI rebound).

* **Grok:** ❌ Bearish, puts at \$142 (institutional selling, weak RSI).

* **Gemini + Llama:** ⚖️ Neutral, no clear trade.

**Key Market Notes**

* 📊 2.2x weekly volume = high institutional activity.

* ⚡ Options flow neutral (C/P 1.04).

* 🌀 Daily RSI rebounding from oversold.

* 💎 Heavy call OI stacked \$160–\$170 (pinning/squeeze zone).

* 🛑 Risks: theta decay (4 DTE), gamma whipsaws, low VIX → possible chop.

---

### 📈 Trade Plan (Speculative, Small Size)

* 🎯 **Direction:** CALL (LONG)

* 🔑 **Strike:** \$165.00

* 💵 **Entry:** \$0.98 (ask)

* 🎯 **Target:** \$1.70 (+75%)

* 🛑 **Stop:** \$0.53 (–45%)

* 📅 **Expiry:** Aug 29, 2025

* 📏 **Size:** 1 contract (small/speculative)

* ⏰ **Timing:** Entry at open, exit by Thursday if no momentum.

* 📊 **Confidence:** 60% (moderate conviction, mixed models).

---

### 📊 TRADE DETAILS (JSON for coders/quant backtesters)

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 165.0,

"expiry": "2025-08-29",

"confidence": 0.60,

"profit_target": 1.70,

"stop_loss": 0.53,

"size": 1,

"entry_price": 0.98,

"entry_timing": "open",

"signal_publish_time": "2025-08-25 13:14:21 UTC-04:00"

}

```

---

### 🔖 Tags:

\ NASDAQ:PLTR #OptionsTrading #WeeklyOptions #CallOptions #TechStocks #MomentumTrading #StockMarket #TradingSetup 🚀📈🔥💎

Pltrlong

Palantir - The unstoppable company!💣Palantir ( NASDAQ:PLTR ) is just too strong:

🔎Analysis summary:

Since mid 2022, Palantir managed to rally more than 2.500%, creating new all time highs every single month. Eventually this rally will slow down, but before this happens, Palantir could rally another +100%. This is a classic example of stock market behaviour and you should take advantage.

📝Levels to watch:

$200

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

PLTR CALL 170C —Don't Miss it

🚀 **PLTR Weekly CALL Alert!** 🚀

Momentum building 📈 | RSI rising | Favorable volatility ⚡

🎯 **Strike:** \$170 CALL

💵 **Entry:** 0.70 | 🎯 **Target:** 1.40 | 🛑 **Stop:** 0.35

📅 **Expiry:** Aug 19 | ⏰ **Entry:** Open

⚡ **Confidence:** 70%

Bulls in control + rising RSI = upside potential 💥📊

\#PLTR #OptionsTrading #WeeklyCalls #BullishMomentum #SwingTrade #TradeSetup #VIX #TechStocks

Palantir: Cooling Off After a Strong Bull Run & ATHPalantir: Cooling Off After a Strong Bull Run & ATH.

Palantir has recently taken a breather following an impressive upward rally. The stock surged from the $66 level on April 7th this year to reach a new all-time high of $190.

As expected, no asset moves parabolically upward forever without a retracement.

Over the past week, Palantir has been experiencing a pullback, with today’s session showing a decline of over 6%. The stock is currently trading around $161.

From a technical perspective, I am eyeing two potential entry zones — $160 and $150. Both levels align closely with the Fibonacci 50% and 61.8% retracement areas, making them significant points of interest for a possible rebound.

As always, I take a medium- to long-term approach to my trades, as patience is often the key to capturing real value in strong stocks.

If you found this analysis helpful, please like, comment, share, and connect with me. Let’s continue building a strong TradingView community together.

PLTR Weekly Options Outlook – Overbought & Losing🚨 PLTR Weekly Options Outlook (Aug 12, 2025) – Overbought & Losing Steam? 🚨

### **Market Sentiment**

* **Call/Put Ratio:** 0.81 → Neutral bias

* **Days to Expiration:** 3 → Gamma risk & fast time decay kicking in

* **VIX:** 15.3 → Low volatility = easier directional plays

### **RSI Check**

* **Daily RSI:** 75.3 → Overbought, trending **down**

* **Weekly RSI:** 81.5 → Overbought, trending **down**

* Momentum exhaustion likely → risk of **pullback/consolidation**

### **Volume & Options Flow**

* Weekly volume **+150%** → Institutional participation confirmed

* Options flow balanced (calls ≈ puts) → Hedging, not aggressive bets

### **Consensus Across Models**

✅ Agreement: Strong institutional flow, but RSI decline = caution

⚠ Disagreement:

* Some models → **No trade** (momentum exhaustion risk)

* Others → **Moderate bullish** (volume support)

### **Conclusion**

📉 Short-term bias: **Neutral → Slight Bearish** despite bullish volume

📊 **Confidence Level:** 65%

🚫 No naked calls recommended here — wait for better entry after a pullback

---

**💡 Key Risks:**

1. RSI exhaustion → bigger pullback possible

2. Volatility shift before expiration → premium decay risk

---

📌 **Tags:**

\#PLTR #OptionsTrading #WeeklyOutlook #StockAnalysis #GammaRisk #Overbought #RSI #VolumeAnalysis #InstitutionalFlow #TradingView

PLTR Bulls Unstoppable? Key Levels You Can’t Ignore! 🚀 PLTR Swing Trade Setup (2025-08-09) 🚀

**Bias:** 📈 **Cautious Bullish** — momentum strong, RSI hot, but volume light = high risk at highs.

**🎯 Trade Plan**

* **Ticker:** \ NASDAQ:PLTR

* **Type:** CALL (LONG)

* **Strike:** \$212.50 (slightly OTM)

* **Entry:** \$0.85 (open)

* **Profit Target:** \$1.27 (+49%)

* **Stop Loss:** \$0.59 (-30%)

* **Expiry:** 2025-08-22 (2W)

* **Size:** 1 contract

* **Confidence:** 70%

**📊 Key Notes**

* RSI 84.2 → extreme overbought 🚨

* Multi-timeframe momentum ✅

* Weak volume = low institutional conviction ❌

* Resistance ahead — watch \$175-\$180 pullback zone for safer reload

* Mixed analyst models: some say “wait,” others say “small bullish”

PLTR Next Move? **PLTR — Weekly Trade Idea (Aug 8, 2025)**

🚀 **Strong Bullish Momentum** — Daily RSI: 81.2 / Weekly RSI: 79.0

📈 **Volume Surge** — +70% vs last week, strong institutional backing

📉 **Low Volatility** — VIX at 15.8 supports bullish setups

⚠️ **High Gamma Risk** — 0DTE options, rapid time decay today

**Trade Plan:**

* **Type:** Buy Call (190 Strike)

* **Expiry:** Aug 8 (0DTE)

* **Entry:** \$0.39 at open

* **Target:** \$0.78 (100% gain)

* **Stop:** \$0.16 (-40%)

* **Confidence:** 75%

* **Tip:** Manage size carefully; close before EOD to avoid decay crush

PLTR Earnings About To Print

## 🚨 PLTR Earnings Incoming: +80% Confidence Call Setup into AI Boom 🚀

**🧠 Palantir Technologies (PLTR) Earnings Analysis – August 8, 2025 (AMC)**

**📈 Position:** \$165 Call | 🎯 Entry: \$6.45 | 💰 Target: \$22.58 | 🛑 Stop: \$3.23

**🕒 Entry Timing:** Pre-Earnings Close | Expiry: Aug 8, 2025

---

### 🔍 Quick Breakdown:

* 📊 **Revenue Growth:** +39.3% TTM – AI sector leadership

* 💰 **Margins:** 80% Gross | 19.9% Operating | 18.3% Net

* 🧾 **EPS Beat Rate:** 88% | Avg Surprise: +10.7%

* 📉 **Debt-to-Equity:** 4.43 – watch rates & debt risk

* 📈 **RSI:** 66.88 – strong momentum, near breakout

* 📊 **Volume:** Above average – institutional accumulation

* 🧠 **Options Flow:** Heavy \$165/\$170 call OI = bullish gamma exposure

* 🛡️ **Support:** \$151.94 | 📌 Resistance: \$161.24

* 🔭 **Macro Tailwinds:** AI + defense demand + sector rotation into tech

---

### 🧠 Trade Thesis:

Strong fundamentals + bullish options flow + tech sector tailwinds = **High-probability breakout**

🧨 **IV Rank: 0.75** – Big move priced in

💡 Likely to squeeze if results exceed expectations

---

### 💼 Trade Setup (Recap):

```

💎 Ticker: NASDAQ:PLTR

🔔 Direction: Long Call

🎯 Strike: $165

💵 Entry: $6.45

🎯 Profit Target: $22.58 (250%+)

🛑 Stop Loss: $3.23

📅 Expiry: 2025-08-08

📆 Earnings: August 8 (AMC)

🧠 Confidence: 80%

```

---

### 📌 Hashtags for TradingView:

```

#PLTR #EarningsPlay #AIStocks #TechMomentum

#OptionsTrading #GammaSqueeze #CallOptions

#UnusualOptionsActivity #Palantir #EarningsSetup

#TradingViewIdeas #VolatilityPlay #RiskReward

#AI #DefenseStocks #SwingTrade

```

---

💬 **TL;DR:** PLTR earnings are set to rip. Revenue surging, margins healthy, call options stacked, and momentum rising. Are you in before the AI-driven explosion?

PLTR WEEKLY TRADE IDEA – AUG 2, 2025

📈 **\ NASDAQ:PLTR WEEKLY TRADE IDEA – AUG 2, 2025** 📈

⚡️ *Earnings Week Setup – Mixed Signals, But Bullish Flow*

---

🧠 **SENTIMENT SNAPSHOT**

• Call/Put Ratio: **2.29** = Bullish

• Volume Ratio: **1.1x** = Weak breakout support

• VIX: **20.38** = Normal vol, clean setups possible

📉 **RSI DIVERGENCE WARNING**

• Daily RSI: **56.3 (falling)** – losing steam

• Weekly RSI: **71.2 (overbought + falling)** – 🔻Bearish divergence

➡️ *Momentum fading, caution advised*

📊 **INSTITUTIONAL FLOW**

• Strong call buying ahead of earnings

• But... price not confirming = possible **profit-taking**

⚠️ **EARNINGS RISK ALERT**

• Earnings = this week

• Could inject volatility or invalidate setup – size small & use stop

---

🔥 **TRADE IDEA** 🔥

🟢 Direction: **CALL (LONG)**

🎯 Strike: **\$160**

💰 Entry: **\$6.80**

🏁 Target: **\$12.25** (80%+ gain)

🛑 Stop Loss: **\$3.40** (50% risk)

📆 Expiry: **08/08/2025**

⚖️ Confidence: **65%** (moderate risk, macro-backed)

⏰ Timing: **Buy Monday Open**

---

🔎 **STRATEGY TAGS**:

\#PLTR #WeeklyOptions #EarningsPlay #MomentumTrade #SmartMoneyFlow

---

📌 Final Thoughts:

Mixed momentum + strong call volume = **potential breakout**, but **momentum cracks** say **don’t chase blindly**. Small size, tight stop, defined risk = smart approach here.

🚀 *Save + Follow for more option setups each week!*

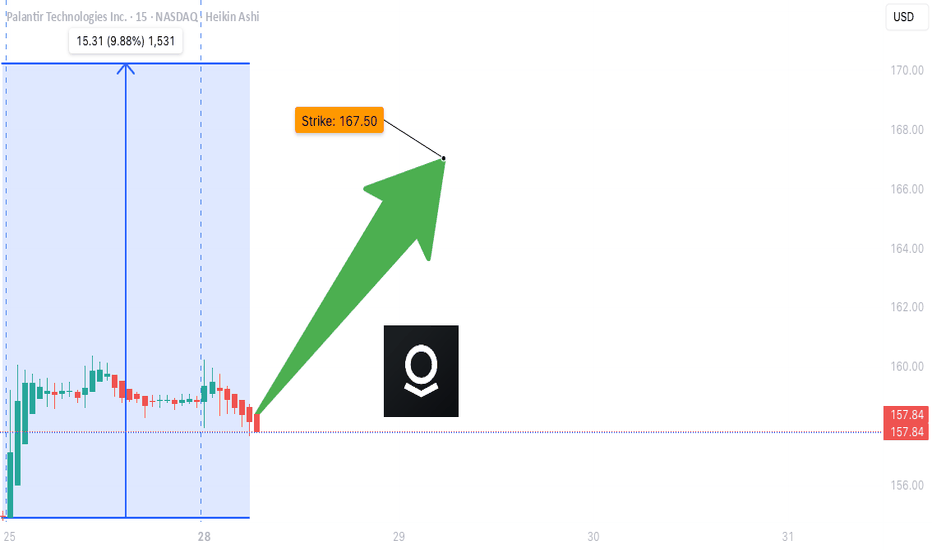

PLTR WEEKLY TRADE IDEA (07/28/2025)

**🚀 PLTR WEEKLY TRADE IDEA (07/28/2025) 🚀**

**Momentum is 🔥 but Volume is the Missing Ingredient**

---

📈 **Momentum Snapshot:**

* **Daily RSI:** 71.9 ⬆️ (🚨 Overbought but still rising)

* **Weekly RSI:** 76.7 ⬆️ (📢 Clear Bullish Strength)

➡️ *Strong upside pressure, but entering the overbought zone*

📉 **Volume Insight:**

* Weekly Volume = **0.8x last week**

⚠️ *Weak institutional conviction during the breakout = yellow flag*

🔍 **Options Flow Check:**

* **Call/Put Ratio:** 1.09 = *Neutral*

➡️ Balanced flow = *no aggressive buying yet*

🌪️ **Volatility Environment:**

* **VIX = 15.4**

✅ Favorable for directional trades — low IV supports premium growth

---

📊 **Model Consensus Recap:**

✅ Bullish RSI momentum (unanimous)

✅ Volatility ideal for long calls

⚠️ Volume flagged as a concern by some models

📌 Final stance: **MODERATE BULLISH**

---

💥 **RECOMMENDED TRADE SETUP (Confidence: 65%)**

🎯 **Play:** Buy CALL Option

* **Strike:** \$167.50

* **Expiry:** Aug 1, 2025

* **Entry Price:** \~\$0.74

* **Profit Target:** \$1.48 (🟢 2x return)

* **Stop Loss:** \$0.37 (🔻-50%)

📆 **Entry Timing:** Market Open Monday

📦 **Size:** 1 Contract

---

⚠️ **Key Risks to Watch:**

* 📉 Weak volume = possible consolidation before next leg up

* ⏳ Premium decay risk into expiry

* 📊 No strong institutional footprint = stay nimble

---

📌 **JSON FORMAT TRADE DETAILS (Automation Ready):**

```json

{

"instrument": "PLTR",

"direction": "call",

"strike": 167.50,

"expiry": "2025-08-01",

"confidence": 0.65,

"profit_target": 1.48,

"stop_loss": 0.37,

"size": 1,

"entry_price": 0.74,

"entry_timing": "open",

"signal_publish_time": "2025-07-28 10:13:40 EDT"

}

```

---

🔥 TL;DR:

* Momentum is undeniable ✅

* Volume = suspect 🟡

* VIX = Green light for directional play ✅

💬 **\ NASDAQ:PLTR Bulls, are you ready or waiting for volume confirmation?**

\#PLTR #OptionsTrading #BullishSetup #UnusualOptions #MomentumPlay #TradingView #StockMarket

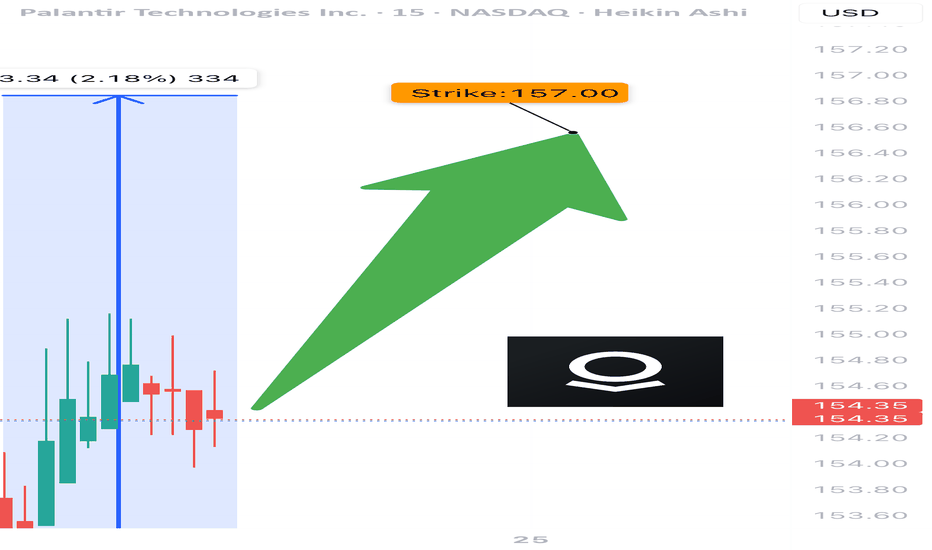

PLTR TRADE SIGNAL (07/24)

🚨 PLTR TRADE SIGNAL (07/24) 🚨

💥 Expiry in 1 day = HIGH GAMMA risk = BIG MOVES coming

🧠 Key Highlights:

• Call/Put Ratio: 1.40 → bullish options flow

• Strong institutional positioning 📈

• RSI cooling off = ⚠️ watch momentum

• Volume concerns → cautiously bullish

💥 TRADE SETUP

🟢 Buy PLTR $157.50 Call exp 7/25

💰 Entry: $0.59

🎯 Target: $0.89 (50%+)

🛑 Stop: $0.24

📈 Confidence: 65%

⚠️ Gamma + Time Decay = explosive but risky. Tight execution needed.

#PLTR #OptionsAlert #OptionsFlow #UnusualOptionsActivity #TechStocks #DayTrading #GammaSqueeze #TradingView #BullishSetup #CallOption

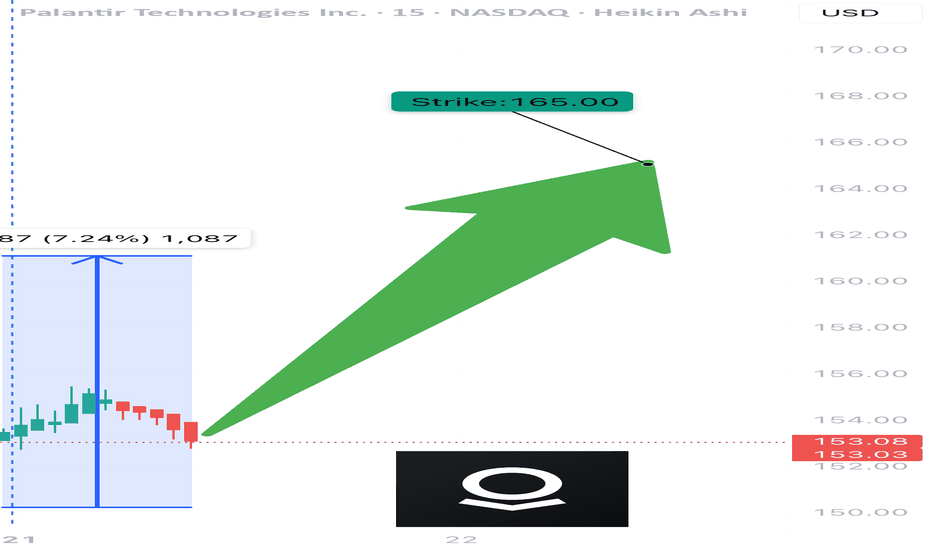

PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025

🔥 NASDAQ:PLTR WEEKLY OPTIONS TRADE IDEA – JULY 21, 2025 🔥

Bullish Momentum + Strong Options Flow = Prime Setup 📈

⸻

📊 TRADE SETUP

🎯 Instrument: NASDAQ:PLTR

📈 Direction: CALL (LONG)

💵 Strike Price: $165.00

🟢 Entry Price: $0.59

🛑 Stop Loss: $0.30 (50% risk cap)

🎯 Profit Target: $1.18 (2x reward)

📅 Expiry: July 25, 2025 (Weekly)

📏 Size: 1 contract

💪 Confidence: 75%

⏰ Entry Timing: Market Open

⸻

📌 Why This Trade?

✅ RSI Strength: Daily RSI = 71.0 | Weekly RSI = 75.3 → Bullish continuation

✅ Weekly Range Positioning: Trading at 96.6% of weekly high

✅ Options Flow: Call/Put ratio = 1.47 — institutional bullish bias

✅ Strike Interest: Heavy OI @ $162.50 & $165.00 = strong magnet zones

🟡 VIX = 16.6 → Favorable volatility for short-term premium plays

⚠️ Volume is flat (1.0x) — no surge confirmation, so keep stops tight

⸻

🧠 Execution Plan

• Open position at the bell

• Mental stop at -50%, or ~$0.30

• Target 100% return = ~$1.18

• Exit ahead of Friday’s expiration unless the trade hits target early

⸻

💡 Key Levels to Watch

🔹 Resistance Zone: $155.68 – $156.59

🔹 Support Watch: Below $152 could break structure

🔹 Earnings Risk: Check calendar — volatility can spike unexpectedly

⸻

🏁 Verdict

• Momentum = 🔥

• Flow = 🚀

• Volume = 😐

➡️ Net Bias: MODERATE BULLISH — Risk-managed call with solid R:R

⸻

NASDAQ:PLTR Call @ $165 — Entry $0.59 → Risk $0.30 → Target $1.18 💥

Clean setup for disciplined bulls. Don’t overstay. Ride momentum. 🎯

⸻

#PLTR #OptionsTrading #WeeklyOptions #MomentumPlay #CallOptions #FlowTrade #TradingView #StockSignals #TradeSetup #RiskReward #SwingTrade #SmartMoneyFlow

PLTR Weekly Options Outlook — June 1, 2025🚨 AI Consensus: Bullish Momentum with Caution on Short-Term Overbought Levels

🧠 AI Model Highlights

🔹 Grok (xAI)

Technicals: Strong uptrend, riding upper EMAs & Bollinger; RSI = 87.

Sentiment: VIX stable, bullish AI headlines; max pain at $122.

Trade: Buy $145C @ $0.88 → Target $1.06 (+20%), Stop $0.62 (−25%)

Confidence: 70%

🔹 Claude (Anthropic)

Technicals: Overbought on all frames; volume spike on red bars.

Sentiment: Positive news, but gravity toward $122.

Trade: Buy $120P @ $0.88 → Target $1.76 (+100%), Stop $0.44

Confidence: 75%

🔹 Gemini (Google)

Technicals: Bullish breakout; 5-min RSI hot, but daily trend intact.

Sentiment: Strong $145 call flow.

Trade: Buy $145C @ $0.88 → Target $1.54 (+75%), Stop $0.44

Confidence: 70%

🔹 Llama (Meta)

Technicals: Bullish daily, short-term overbought.

Sentiment: Bullish, but recommends waiting for pullback to $130–131.

Trade: No immediate entry; consider $132–133C later.

🔹 DeepSeek

Technicals: Bearish MACD cross; overbought RSI; resistance at $133.5.

Sentiment: Mixed flow; expects pullback.

Trade: Buy $125P @ $1.80 → Target double, Stop 50%, Size: 3

Confidence: 65%

✅ What They Agree On

📈 Strong rally across the board

⚠️ 5-min RSI > 85 = overbought condition

🧲 Max Pain at $122 = potential late-week gravity

📰 Bullish AI sentiment continues

🔄 Where They Disagree

🔺 Bulls (Grok, Gemini, Llama) favor calls, especially $145

🔻 Bears (Claude, DeepSeek) expect reversion to mean via puts

📆 Llama urges patience, others suggest open entry

🎯 Target gains range from 20% to 100%

🎯 Recommended Trade Setup

💡 Strategy: Bullish Naked Call

🔘 Ticker: PLTR

🔀 Direction: CALL (LONG)

🎯 Strike: $145

💵 Entry Price: $0.88

🎯 Profit Target: $1.54 (+75%)

🛑 Stop Loss: $0.44 (−50%)

📏 Size: 1 Contract

📆 Expiry: 2025-06-06 (Weekly)

⏰ Entry: At Market Open

📈 Confidence: 70%

⚠️ Risk Factors to Monitor

RSI overheated — watch for early week pullbacks

Max pain at $122 could drag later in week

Time decay (theta) rises sharply after Wednesday

Negative macro or AI-related headlines could reverse flow

📊 TRADE DETAILS (JSON)

json

Copy

Edit

{

"instrument": "PLTR",

"direction": "call",

"strike": 145.0,

"expiry": "2025-06-06",

"confidence": 0.70,

"profit_target": 1.54,

"stop_loss": 0.44,

"size": 1,

"entry_price": 0.88,

"entry_timing": "open",

"signal_publish_time": "2025-06-01 15:47:31 UTC-04:00"

}

Bullish Opportunity: Palantir Technologies (PLTR) Current Price: $83.00

TP1: $90 (Analyst target)

TP2: $100 (Psychological resistance)

TP3: $120 (Upper channel target)

🚀 Why Palantir is a Bullish Opportunity

1️⃣ Strong Q4 Earnings Outlook 📊

Earnings Report Due: February 3, 2025 – Analysts expect another strong quarter.

405% Growth Over the Past Year – Palantir was the best-performing S&P 500 stock in 2024.

Wedbush Analyst Dan Ives Calls Palantir’s Q3 a "Masterpiece" – Revenue surged 30% YoY to $726M, driven by AI demand.

2️⃣ AI Leadership & Competitive Edge 🤖

AIP Named Best AI Platform by Forrester Research – Ranked ahead of Google Cloud, AWS, and Microsoft Azure.

AIP Growth Driving Revenue – U.S. commercial revenue is expanding rapidly, with unprecedented demand for AIP solutions.

Dan Ives Sees Palantir as the Next Oracle – If true, this would mean 185% upside from current valuation.

3️⃣ Institutional Confidence & Price Upgrades 💡

Wedbush Raised Price Target to $90 – Signaling continued AI-driven momentum.

Strong Hedge Fund Interest – Institutional investors remain bullish on Palantir’s AI expansion.

Market Cap Nears $185B – With 81.1% gross margins, Palantir is positioned as a high-growth AI leader.

4️⃣ Government & Commercial Expansion 📈

$400M+ Partnership with U.S. Army – Reinforcing Palantir’s role in defense & AI applications.

Strong Commercial Growth – Demand for AIP is driving both new customer conversions and existing client expansions.

The Biden Administration’s AI Push – Government spending on AI infrastructure directly benefits Palantir.

🔎 Conclusion

Palantir is positioned as a leading AI company, with institutional backing, strong earnings momentum, and government contracts fueling growth. With analyst upgrades and AI adoption surging, PLTR could see a breakout toward $100+ in the coming months.

Palantir (PLTR) – What’s the Play?Hi all,

I've received a lot of questions about PLTR, so here’s my take:

Initially, if it were to approach $100 for the first time, I’d have nothing to say—it would be extremely risky, especially after the strong rally we've seen in recent months. The first approach to $100 can make strong retracements.

However, after analyzing the chart about a few weeks later, we got a solid weekly close above $100, which started forming a more structured setup. Now, there's at least a decent technical case for making a decision.

The highlighted box could be a reasonable buying zone—but keep in mind, this is still risky. Technically, it's shaping up, but your fundamental conviction should be strong.

Fun fact: In my home country, a well-known investor, Investor Toomas, has added PLTR to his portfolio. While that’s an interesting signal, we don’t know his holding strategy or reaction to current market moves but still, we can take it as a small confirmation from fundamental analysis.

Final Thought: Do your own research - buy it, skip it, the choice is yours! I can confirm that technically there is at least something to consider.

Cheers,

Vaido

🚀 Stay Ahead of the Markets - Get high-quality technical analysis, real investment ideas, and key price levels—without the noise.

📩 Subscribe to my Substack for expert insights that help you trade smarter!

📱 On mobile: Just scroll down and select your preferred language.

💻 On desktop: Find the links in my BIO —copy & paste or click the Website icon to go directly to Substack ENG.

Market Close Update: PLTR Continuation Outlook to New 52-Wk HighPLTR bounced on the Jan 3th, 2025, after finishing 2024 as the top stock in the S&P 500, rising 340% as it leaned heavily into artificial intelligence. It has since retraced and retested support, showing potential to continue pushing higher. We're looking for a current entry of around the $75 Price Levels to be positioned before tomorrow's Pre-Market Session, with a $74.60 Stop Loss and $79.98 Price Target going into the end of January. Even with it's recent bounce back, it's only $4.14 off it'sl 52-Week High meaning we could potentially see some heavy pushes higher above those $84 to at best, set new 52-Week Highs.

Follow us to connect and stay tuned for more at MyMI Wallet.

@MyMIWallet #MyMIWallet