RAY/USDT – Major Decision Zone at $0.85–$1.10RAY has returned to the same demand zone that triggered every major rally over the past 2 years.

Hold this zone = potential multi-month reversal.

Lose this zone = structural breakdown.”

---

Pattern & Market Structure Explanation

The weekly chart of RAY/USDT is showing one of the clearest macro setups:

1. Multi-Month Descending Triangle (Strong Bearish Pressure)

A clean series of lower highs forming a dominant descending trendline.

This trendline has rejected every bullish attempt since mid-2024 — clear seller dominance.

2. Titanium Demand Zone: $0.85–$1.10

This zone has been the launchpad of every major RAY rally in 2022, 2023, and 2024.

Every touch of this area resulted in strong upside acceleration.

Price is now retesting it again…

This is the most important test for RAY’s macro trend heading into 2025–2026.

3. Liquidity Sweeps Are Appearing

Sharp wicks below the zone followed by rapid rejections upward.

This behavior is typical before a major direction shift — markets clean liquidity first.

Suggests big positions are being prepared beneath the surface.

---

Bullish Scenario – If This Zone Holds, a Major Reversal Can Begin

Bullish Confirmation Triggers:

Weekly close back above $1.15–$1.20.

Breakout above the descending trendline (major signal).

Increasing buying volume during the breakout.

Upside Targets:

1. $1.50 – Early resistance & first momentum checkpoint.

2. $1.85 – Trend structure recovery.

3. $2.65 – Mid-range target if momentum sustains.

4. $3.40 – Strong resistance where larger moves often stall.

5. $7.20–$8.70 – Long-term targets if a macro breakout unfolds.

Bullish Narrative:

If this demand zone holds, we might not be looking at a minor bounce —

this could be the beginning of a fresh multi-month bullish impulse.

---

Bearish Scenario – If Support Breaks, the Structure Shifts Completely

Bearish Confirmation Triggers:

Weekly close below $0.85.

No quick reclaim on the following weekly candle.

Strong selling volume on the breakdown.

Downside Targets:

$0.55 – First structural support.

$0.35 – High liquidity area.

$0.133 – Historical low (capitulation zone).

Bearish Narrative:

If this long-term support finally breaks, RAY enters a new phase of macro weakness.

Demand is absorbed, and price enters an extended redistribution cycle.

---

Core Insight: “The Last Support”

The $0.85–$1.10 zone is not just a level — it is the foundation of RAY’s macro structure.

At this zone:

Smart money typically positions

Liquidity concentrates

Market sentiment is tested

Breakdown = major shift in long-term trend.

Hold + trendline breakout = potential start of a new bullish cycle.

This is why this zone is the single most important area on RAY’s chart in the past 2 years.

---

#RAY #RAYUSDT #CryptoAnalysis #CryptoOutlook #TechnicalAnalysis #DescendingTriangle #DemandZone #Altcoins #PriceAction #CryptoTrading

Rayusdt

RAYUSDT Forming Falling WedgeRAY/USDT looks like it’s entering a pivotal phase right now. Technically, the price has been consolidating after a corrective pull-back, and what I’m watching is whether RAY can break above its recent consolidation high with volume supporting the move. The project sits within a high-visibility niche—decentralized exchange infrastructure on the Solana chain—where AMM + order book, deep liquidity, and protocol buy-backs are high-search keywords. On the fundamentals, RAY is benefiting from renewed interest thanks to increased token staking, reduced circulating supply via buy-backs, and a strong ecosystem growth posture.

From a strategic viewpoint, a clean breakout above resistance and confirmation with volume would be the trigger for me. If RAY closes above resistance and holds it, the next move could carry upside momentum. The reward potential looks favorable given the combination of structural base plus thematic strength in the Solana-DeFi space. Risk control is essential, so placing a stop just below the recent consolidation low or major support would allow a defined risk-to-reward.

Fundamentally, the token maps into current crypto market themes that are heavily trafficked: DEX dominance, Solana ecosystem expansion, tokenomics with buy-back, and staking rewards. Investors appear to be increasingly interested again, as on-chain metrics and trading volume suggest increased engagement. That alignment between narrative and structure adds weight to the bullish thesis.

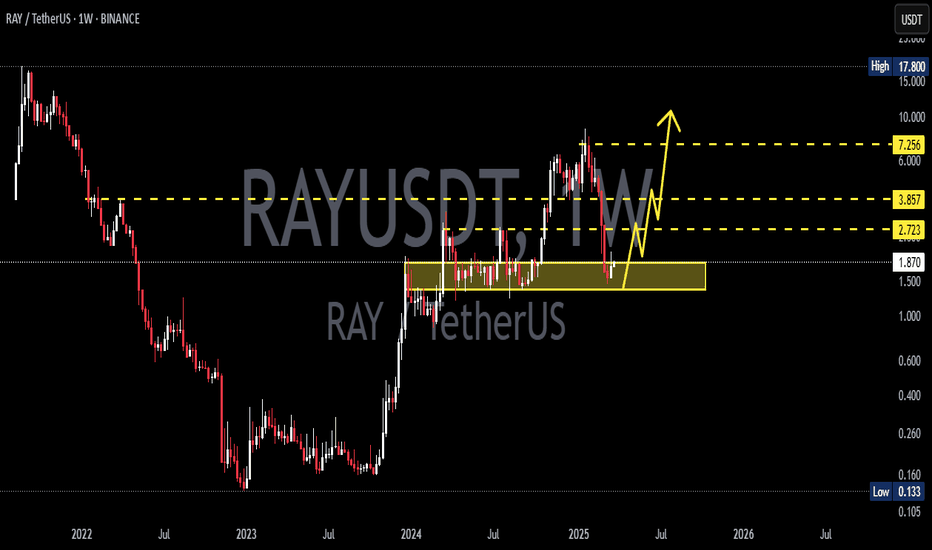

RAY/USDT — Critical Point: Accumulation or Breakdown New Lows?RAY is currently sitting at one of the most crucial structural zones, around the major support area of $1.50 – $1.96 (yellow box).

This area has acted as a key price pivot since mid-2024, where buyers and sellers have continuously battled for control.

After a sharp correction from the 2025 peak, price managed to hold above the main demand zone, with a long downside wick signaling liquidation or stop-hunt followed by immediate buying pressure.

This kind of reaction often represents a potential spring phase before a major trend reversal — if confirmed by a strong weekly close above support.

---

Structure & Pattern Analysis

Range Base / Accumulation Zone: The yellow block ($1.5 – $1.96) acts as a potential accumulation base, resembling a Wyckoff Accumulation pattern, where the spring phase (wick below support) might have just occurred.

Lower High Structure: The current structure still shows lower highs, but a confirmed higher low above $1.9 could signal a major trend reversal.

Key Resistance Levels: 2.72 – 3.67 – 7.25 – 12.68 – 16.66 – 17.80

→ These are progressive resistance targets for any mid-term bullish move.

---

Bullish Scenario

If RAY manages to close the weekly candle above $1.96 and hold, it would confirm:

A reclaim of the major demand zone.

Validation of the Wyckoff spring phase (accumulation completed).

The beginning of a mid-term trend reversal toward higher targets.

Bullish Targets:

1️⃣ $2.72 → First resistance / breakout trigger.

2️⃣ $3.67 → Range breakout confirmation.

3️⃣ $7.25 → Mid-term target zone (previous supply level).

A breakout with strong volume above $3.67 would likely trigger a larger markup phase, indicating the start of a new bullish cycle.

---

Bearish Scenario

If price fails to hold and closes weekly below $1.50, it would mean:

The main structural support has broken down.

Selling pressure could intensify toward $1.00 – $0.60.

In an extreme case, price might revisit its historical liquidity zone around $0.13.

Bearish Confirmation Signs:

Weekly close < $1.50.

Consecutive lower closes without recovery.

High-volume red candle (true capitulation, not just a sweep).

---

Technical Summary

RAY is standing at a macro decision zone — every upcoming weekly close will define whether:

The market is building a new base for the next bullish cycle,

or

Entering a continued bearish leg toward historical lows.

The area between $1.5–$1.9 is the “make or break zone.”

As long as the price doesn’t close below it, the mid-term bullish structure remains valid.

---

Trading Notes

Strong rejection candles within support = potential swing-buy opportunities (tight SL below wick).

Breakout above 2.72 with strong volume = confirmation for mid-term re-entry.

Be cautious of fakeouts — always wait for weekly candle closes before confirming bias.

---

#RAYUSDT #Raydium #CryptoAnalysis #WeeklyChart #MarketStructure #CryptoTechnical #SwingTrade #Wyckoff #DeFi #SupportZone #PriceAction #TrendReversal #AltcoinSetup #TradingViewAnalysis

Raydium lifting away form horizontal support RAY is in a nice uptrend that appears to be a retracement. With that said, an impulsive move attempt from the bears should be considered. Keep in mind, it could lead to a swing failure. Regardless, any dips are for accumulating as long as horizontal support is respected.

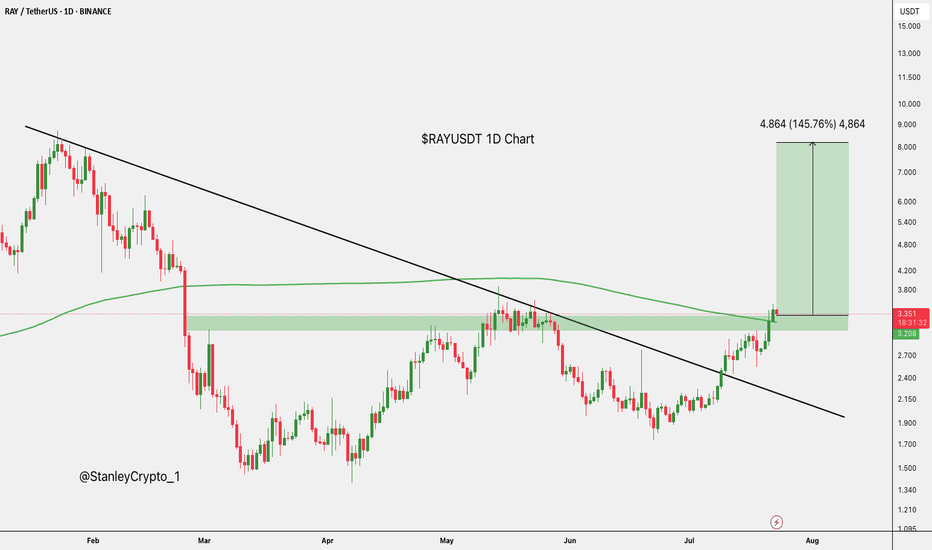

RAYUSDT UPDATE#RAY

UPDATE

RAY Technical Setup

Pattern : Bullish Falling Wedge Breakout

Current Price: $3.68

Target Price: $4.59

Target % Gain: 30.04%

Technical Analysis: RAY has broken its falling wedge resistance on the 4H chart, showing bullish momentum and continuation potential. The breakout is backed by higher lows, rising volume, and a strong push above the trendline, with upside projection toward $4.59.

Time Frame: 4H

Risk Management Tip: Always use proper risk management.

Record Breaking Solana Highs & The Rise of Dark DexsDark DEXs routed through aggregators are eating Solana spot flow- leaving BINANCE:SOLUSDT & BINANCE:JUPUSDT as the cleanest upside while order-book DEXs fight for share.

TVL on Solana just hit all-time highs, with the biggest lift coming via Jupiter (JUP) routing.

Over the last 30 days, the largest spot volume was on a private “dark DEX” (Humidifi) - not Meteora, BINANCE:RAYUSDT , or BYBIT:PUMPUSDT .

These private venues plug into Jupiter’s aggregator, filling at better prices; efficiency accrues to the dark DEXs + the aggregator + the chain.

Net result: Raydium/Orca can rise with the tide short-term, but market share pressure is real if dark routing keeps compounding.

Trade view: The most direct upside is SOL + JUP. SOL’s pivotal level ≈ $175 - sustained breakout targets $250, then thin resistance up to ~$300.

Watching JUP share of routed volume, SOL TVL/fees, and spot depth for confirmation.

Not financial advice. Do your own research.

RAY : razor edgeHello friends

Given the price growth we had, the price is now in a triangle, which is now in an important area in the triangle. If the price is supported and our triangle is broken, it can move to the identified resistance areas, which are price pivots.

But if the support breaks and the price falls, the identified important supports can be the next price targets.

*Trade safely with us*

RAY (Raydium) – Long Swing Trade Setup from Major SupportRAY is trading at a major support zone between $2.85 – $3.25, which historically has acted as a base for significant upward moves. With strong support beneath and favorable upside targets, this presents a solid long swing opportunity with clear invalidation.

🔹 Entry Zone:

$2.85 – $3.25 (key support and previous accumulation range)

🎯 Take Profit Targets:

🥇 $4.23 (previous resistance and psychological level)

🥈 $5.00 (key breakout level and round number target)

🛑 Stop Loss:

$2.84 (tight invalidation just below support zone)

Breaks Out of Red Resistance Zone 🚨 NASDAQ:RAY

Breaks Out of Red Resistance Zone 🚨

NASDAQ:RAY

has successfully broken out of the red resistance zone, which was part of a symmetrical pattern. This breakout could signal a strong bullish move.

📈 Technical Overview:

Pattern: Symmetrical

Breakout Level: Red resistance zone.

🎯 Potential Targets: To be determined upon further price action.

RAYSOL/USDT – READY TO BLAST OFF? PRIME LONG SETUPThis is where smart money is likely to reaccumulate before pushing price higher.

We're targeting internal liquidity levels and prior highs with a clean risk-reward structure.

Confirmation can come from a bullish reaction or engulfing candle within the zone.

Entry Zone: 2.25 – 2.28

Targets:

TP1: 2.365

TP2: 2.485

TP3: 2.660

Stop Loss: 2.151

DYOR:

This idea is for educational purposes and reflects a personal trading plan.

Always do your own research, use strict risk management, and wait for confirmation before executing.

#RAYDIUM #RAY #RAYSOL #RAYUSDT

Raydium Medium Sized +545% Wave Mapped (Trading Strategy)This is one of those pairs that grew in astonishing ways since late 2023. Raydium managed to grow by 5,372% from October 2023 through January 2025. Simply amazing. I was very surprised when I found this pair as it moved beyond all expectations.

The last advance was preceded by a six months long consolidation phase. The whales used this period to accumulate. When one phase is long, the next one is short. This means that RAYUSDT can start to grow soon. This is based on the law of alternation.

Needless to say, the chart is full of higher lows and the action continues to be strong. I am tempted to open some LONGs.

This is a solid trade setup. It has low risk vs a high potential for reward.

This one can turnout into something good but please keep in mind that we have a little over two weeks before the market becomes full time bullish. Right now it is still early for the upcoming bullish wave. The reason I am all in now is because my group likes to enter early. Some other people prefer waiting and confirmation. We like early because it allows for maximum profits potential. The risk is higher but also the reward.

If you are uncertain or have doubts, you can always wait. The thing about Crypto is that when it moves it does so strongly, by the time we have confirmation the market is always several levels up. It can make a huge difference.

How you approach the market depends on your trading style, your risk tolerance, your capital, your goals. If you want to get in and get out, it is wise to wait until the action is hot. If you want relaxation, peace of mind and easy profits, it is better to buy and hold. If you have lots of time and energy to invest in this game, you can use all the different methods at the same time; a stack for long-term, a stack for passive hold, a stack for short-term and another portion of your capital for leveraged trades. It is also smart to leave some funds behind because good opportunities come out of nowhere. If we have funds available just because, we might end up with something that does better than our best choice.

It is a big game. It can be entertaining and profitable. There is lots to learn as well. You cannot hide here, if your ego is too strong, you will see the results in your funds. If you cheat yourself, if you lie to yourself, you will know it because your money will be gone. If you are honest with yourself and accept your mistakes, the market will give you as much as you can take.

Namaste.

Breaking: Raydium ($RAY) Reclaims $2 PivotRaydium's ( NASDAQ:RAY ) which is an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX)'s native token has reclaimed the $2 pivot albeit the crypto market is in a general market correction.

The asset surge 6%, and is gearing up for a breakout to the $3 resistant as a breakout above the $2.3 region would cement the grounds for a bullish continuation move to the $3 point.

Unlike any other AMMs, Raydium provides on-chain liquidity to a central limit orderbook meaning that funds deposited into Raydium are converted into limit orders which sit on Serum’s orderbooks.

With the RSI at 60, Raydium is poised for the breakout move as momentum builds up.

However, should NASDAQ:RAY fail to pull up the stunt, a consolidation move to the $1.8 support point will be vehemently tested.

Raydium Price Live Data

The live Raydium price today is $1.99 USD with a 24-hour trading volume of $98,068,751 USD. Raydium is up 1.71% in the last 24 hours, with a live market cap of $578,910,409 USD. It has a circulating supply of 290,814,662 RAY coins and a max. supply of 555,000,000 RAY coins.

Raydium RAY price analysisNot so long ago, we published an idea on #OM and wrote that MM holds the price well

And here's what happens when MM lets the price go "free floating" and stops pushing it up on the example of #RAY

If OKX:RAYUSDT fails to consolidate above $4 in the near future, there may be another wave down, and the price of #Raydium may drop to around $1.5

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

Key Support Test – Will RAY Hold & Rally?$RAY/USDT chart shows a key retest of the breakout zone, which previously acted as resistance and is now a crucial support level. A successful bounce could confirm bullish continuation, while a breakdown may lead to further downside.

Additionally, the Stochastic RSI is signaling a bullish crossover at oversold levels, indicating potential upward momentum. If buyers hold this zone, RAY could see a strong rally.

DYOR, NFA

Is RAYUSDT About to Break Out? Key Levels to Watch Now!Yello, Paradisers! Is RAYUSDT gearing up for a massive breakout? The chart is showing a proper triple zigzag within a descending channel, which significantly increases the probability of an upcoming bullish move.

💎If RAYUSDT bounces from the current level, it could form a W-pattern, but for a high-probability setup, we need to see a breakout and a confirmed candle close above the key resistance. This move would also break the descending channel, signaling a stronger bullish push.

💎On the other hand, if the price retraces further or consolidates, a bounce may still occur, but the setup would be lower probability, making it less favorable to trade in this zone.

💎However, if RAYUSDT breaks down and closes below the support zone, the entire bullish setup will be invalidated. In that case, it would be wiser to wait for better price action before looking for new opportunities.

🎖 Patience and discipline are key, Paradisers. If this breakout happens, it will be a strong opportunity—but if invalidated, we wait for the market to present a better setup. Trade smart!

MyCryptoParadise

iFeel the success🌴