a Risky QuickScalp on #EURUSD📌 Market Insight: {#EURUSD }

⚠️ Risk Assessment: {High}

🚀 Approach:

Not a Quality setup and market seems need time be sorted out .

We can have it as a Quickscalp by a nice valid momentum Structure .

#Ash_TheTrader #Forex #GBPJPY #MarketAnalysis #TradingSetup #RiskManagement #GOLD #Scalper #NQ #EURUSD

Scalp

QuickScalp at #EURUSD 📌 Market Insight: {#EURUSD }

⚠️ Risk Assessment: {High}

🚀 Approach:

Not a Good time to Trade but lets have it at watchlist ... just need a valid Momentum Structure at LTF . ... QuickScalp

will wait for the setup ... just for next 30-45 mins ... if nothing happen will back tomorrow .

#Ash_TheTrader #Forex #GBPJPY #MarketAnalysis #TradingSetup #RiskManagement #GOLD #Scalper #NQ #EURUSD

#BTC – Isn’t it time to buy?#BTC – Isn’t it time to buy? 🚀

By analyzing market structure and outside news, BTC is approaching the zone where I’d seriously consider entering .

📍 88k–76k is the key range I’m watching for potential buys, aiming for 15–40%+ profit with a 15% stop los s.

⚡️ Important: Wait for LTF entry sign – don’t jump in blindly . Always do your own research before making a move.

#CryptoTrading #Bitcoin #BTC #ScalpTrading #CryptoAnalysis #BTCScalp #CryptoStrategy #TradeSmart #HODL #BitcoinAnalysis

BTCUSDT.P - November 13, 2025BTCUSDT.P has formed a consolidation base above $101,600, indicating accumulation and potential for further upside toward the $103,685 partial profit zone and the $105,297 profit level.

A decisive close above $103,700 would confirm bullish momentum continuation, while failure to hold above $100,700 could expose the pair to renewed selling pressure toward $99,200.

Risk Assessment: Moderate — The price structure suggests potential bullish recovery from oversold levels, but the setup remains vulnerable to downside continuation if support near $100,700–$100,000 fails to hold. Traders should consider moving stops to breakeven once the $103,685 level is reached to manage risk effectively.

20% long play UAMYI have noticed that healthy companies with bull runs tend to have major pullbacks of ~50-60% before short term reversal. I believe UAMY is probably topped out after the recent blow off bull run, but here we are at 56% down after the recent ATH, RSI at a local extreme low. I am buying here and TP around $11.4, unless there are indications for a greater upward move. SL at $8.7. If this fails $8.14 is next support.

xauusd 1min scalpobserve this trade on 1min and 15min also. All the levels are on 15min and the blue level is on 4H. i observed that 15 minutes has volume, but is not able to break the range. observed on 1 minute how the market is reacting on 1 minute on levels then decided to short on 1min. here my strategy was the same as i use on 15min.

ENA possible Ascending triangle breakout playLook for confirmation above the Resistance line in Pink... maybe wait for a breakout, then a pullback touching the Prior Resistance line before entering... and then note the size of the triangle as a possible TP zone.

It is however, Entirely possible that the structure falls apart as a candle deviates from this pattern and falls to the bottom... just be careful on your entry.

Not Financial Advise... duh..

#ENA #scalptrade #leveragetrading #leveragetrade #eth BINANCE:ENAUSDT.P

BTC Bleeding, Scalpel Please💣 Price just nuked back to our OG S1 zone and buyers are throwing hands at $113k 🥊

This is a quick scalp play while the dust settles

🎯 Entry: 113,159

🛡 Stop: 113,111 (just below S2's base. you can tighten this up, to the base if desired.)

📈 Scalp Target 1: 114,444

🚀 (Swing Trade) Target 2: 116,588

🧠 Setup: Reclaim after wick trap

📐 Structure: Bullish continuation off demand

📍 Zone: Micro-range base + sweep low trap

Scalpel sharp ✂️

Clean. Tight. Ruthless.

⚠️ Heads up — 30m still trending down

So lock those stops and stay nimble 🔪

⚠️If $113k fails, watch for a flush to S2 or even S3.

This bounce is a scalp — not a trend shift (yet) 🚨

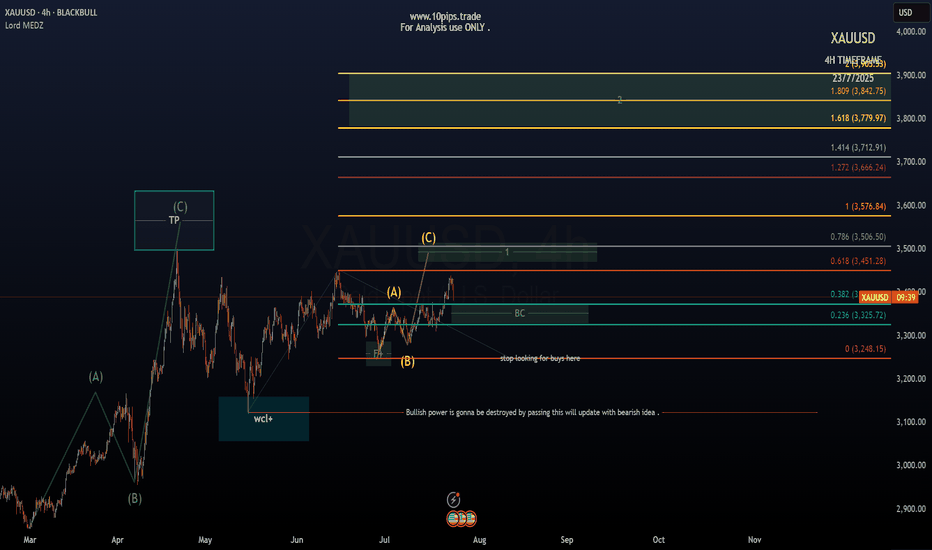

GOLD – Bullish Flag Breakout After Demand Zone Test

Price pulled back into the major demand zone (blue area), rejected with a strong wick, and formed a bullish flag structure. The breakout above the flag channel suggests continuation toward recent highs.

Trade Plan:

✅ Entry:

Above 3344 (breakout confirmation)

✅ Stop Loss:

Below 3332 (last swing low)

✅ Target:

3357–3360 (previous resistance zone)

Context:

• Demand zone respected

• EMA support aligning

• Clear breakout candle with volume

Risk Management:

Max risk per trade: 1%

Zoom in M5:

#Gold #XAUUSD #PriceAction #BreakoutTrading #MJTrading #ForexSignals #CommodityTrading

PRIME TIMEIt’s prime time for PRIME. Very low entry cost good risk to reward ratio, I believe with Bitcoin if it holds we could see PRIME do a very strong and fast push upwards. Not financial advice it’s just what I see. I was told I can’t post links in my ideas,

Long scalp if BTC breaks it’s downtrend, otherwise retrace downward until we get support as we are overbought on the daily but if this peaks we will see some price movement. If you follow me you have gained some scalp trades over 15-25% these past days on PRIME.

Good luck and have fun with it.

NC HAMMER CRYPTO will be my new name.