Gold Setting the Trap: Fake Rally Before the Fall?Gold (GC) Futures are showing signs of a potential reversal after a surprise bullish NY session, likely sparked by headline sentiment (Trump-related news). While the impulse looked strong, we remain below the previous daily high, and structure may still favor a deeper move south.

🔍 Key Notes:

Price is stalling near a high-volume node (~3436–3445).

Possible liquidity sweep above NY highs before reversal.

Watching for confirmation during Asian or London killzone.

Bearish continuation becomes more likely if we break below NY session lows and hold.

Bias: Bearish, targeting rebalancing of the H4 FVG if structure confirms.

Sharing this to track how the algo reacts inside upcoming killzones. Open to thoughts, breakdowns, and alternate reads 👇

SELL

Dow Jones Potential DownsidesHey Traders, in today's trading session we are monitoring US30 for a selling opportunity around 44,300 zone, Dow Jones is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 44,300 support and resistance area.

Trade safe, Joe.

RIVN Rivian Automotive Options Ahead of EarningsIf you haven`t bought RIVN before the previous earnings:

Now analyzing the options chain and the chart patterns of RIVN Rivian Automotive prior to the earnings report this week,

I would consider purchasing the 10usd strike price Puts with

an expiration date of 2025-10-17,

for a premium of approximately $0.39.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

PTON Peloton Interactive Options Ahead of EarningsIf you haven`t bought the dip on PTON:

Now analyzing the options chain and the chart patterns of PTON Peloton Interactive prior to the earnings report this week,

I would consider purchasing the 7.50usd strike price Calls with

an expiration date of 2025-8-8,

for a premium of approximately $0.46.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

PINS Pinterest Options Ahead of EarningsIf you haven`t bought PINS before the previous earnings:

Now analyzing the options chain and the chart patterns of PINS Pinterest prior to the earnings report this week,

I would consider purchasing the 39usd strike price Calls with

an expiration date of 2025-8-8,

for a premium of approximately $2.22.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

XAUUSD Gold Trading Strategy August 5, 2025

Yesterday's trading session, gold prices continued to increase sharply due to previous influences. However, the possibility of a short-term correction in gold prices at the end of the week will be very high.

Basic news: According to CME FEDWatch, the probability of the Fed cutting interest rates at its September meeting has now increased to about 84%, reflecting increasing concerns about economic weakness. The market is currently pricing in at least two 25 basis point cuts between now and the end of the year, showing a clear shift in investor sentiment after disappointing employment data.

Technical analysis: Gold's bullish momentum is currently showing signs of weakening. The peak area of 3383 - 3385 may create a double peak pattern on H1, but the possibility of gold prices correcting today is very low. Currently, gold prices are filling liquidity at support areas. The correction of gold prices may take place at the end of the week when buyers take profits.

Important price zones today: 3350 - 3355 and 3330 - 3335.

Today's trading trend: BUY.

Recommended orders:

Plan 1: BUY XAUUSD zone 3350 - 3352

SL 3347

TP 3355 - 3365 - 3375 - 3400.

Plan 2: BUY XAUUSD zone 3330 - 3332

SL 3327

TP 3335 - 3345 - 3365 - 3400.

Plan 3: SELL XAUUSD zone 3420 - 3422

SL 3425

TP 3417 - 3407 - 3387 - 3357 - OPEN (small volume).

Wish you a safe, successful and profitable trading day.🌟🌟🌟🌟🌟

EURUSD Will Move Lower! Sell!

Please, check our technical outlook for EURUSD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 1.156.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 1.140 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF Is Very Bearish! Short!

Take a look at our analysis for USDCHF.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.808.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.804 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Gold Surges on Weak NFP Hello everyone, what’s your take on XAUUSD?

Gold prices soared at the end of the last session and are now trading around $3,380. This sharp rise followed a weaker-than-expected U.S. Non-Farm Payrolls (NFP) report, which shifted market sentiment toward expectations that the Fed may delay interest rate cuts. As a result, the U.S. dollar weakened and demand for gold as a safe haven surged.

Technically, gold appears to be forming a cup and handle pattern, with the first resistance target at $3,400, followed by $3,435.

What do you think? Could this rally continue? Let us know in the comments!

EURUSD – Bearish pullback in play ? EURUSD has broken the ascending trendline and dropped below the EMA confluence, confirming a bearish structure. The current rebound is testing the 0.5–0.618 Fibonacci zone, but weak buying pressure and rejection candles suggest it’s likely just a technical pullback.

If momentum holds, the pair may resume its downtrend toward 1.1400 and potentially 1.1296. The bears remain in control unless strong fundamentals shift the balance.

XAUUSD breaks out – bullish bias returnsGold has bounced from the bottom of the descending channel, initiating a clear upward move with a series of strong bullish candles. On the H2 chart, price has broken above the upper boundary of the medium-term downtrend channel and filled the nearest fair value gap, signaling a resurgence in buying pressure.

Current price action is approaching a previous resistance zone, aligned with recent swing highs. The chart suggests a potential consolidation before further upside, provided that the current bullish structure remains intact.

From a macro perspective, while the stronger-than-expected U.S. PMI data supports the USD in the short term, weak labor market figures and ongoing global geopolitical tensions continue to fuel demand for gold as a safe-haven asset. This environment is helping sustain XAUUSD’s current recovery structure.

USDCHF – Bullish comeback in progress?Hey everyone! What’s your take on the current trend of USDCHF?

While the pair experienced a recent dip, take a step back and look at the bigger picture — doesn’t it still seem to be moving within an ascending channel?

Right now, USDCHF is hovering around 0.8092 and starting to bounce back. The recovery appears to be supported by a newly formed support zone and the confluence of the EMA 34 and 89. The pair seems to be eyeing the recent high, with potential to climb further toward the upper boundary of the channel.

My current bias? Bullish.

What about you — do you see the same opportunity?

Drop a comment and hit like if you’re on the same page!

XAUUSD (Next 24 Hours) Technical Analysis Forecast1. Japanese Candlestick Analysis

4H/1H: Price opened at 3374.13 near critical resistance (3375–3380). Recent candles show bearish harami and dark cloud cover, signaling rejection.

30M/15M: Gravestone doji at 3374.13 indicates bearish pressure. Failure to close above 3375 confirms weakness.

5M: Three black crows pattern emerging, suggesting strong short-term momentum.

Outlook: Bearish reversal likely if 3370 breaks.

2. Harmonic Patterns

4H/1H: Bearish Butterfly Pattern completing at 3374.13 (D-point).

PRZ: 3370–3375 (confluence of 127.2% XA and 161.8% BC).

Fibonacci Ratios: AB=CD symmetry (3370–3375).

30M: Bullish Crab forming at 3355, but secondary to larger bearish setup.

Outlook: High-probability short entry at 3374–3375 with target 3340.

3. Elliott Wave Theory

4H: Wave 5 of impulse cycle peaked at 3374.13.

Structure: Completed 5-wave sequence from 3320 → 3374.13.

Corrective Phase: ABC pullback targeting 3320–3340 (Wave A: 3340).

1H: Sub-wave (v) of 5 ending at 3374.13. RSI divergence confirms exhaustion.

Outlook: Bearish correction to 3320–3340 within 24 hours.

4. Wyckoff Theory

Phase: Distribution (after markup from 3320 → 3374.13).

Signs: High volume at 3374.13 (supply), upthrust above 3380 failed.

Schematic: Phase C (markdown) initiating.

1H/30M: Spring at 3365 failed to hold, indicating weak demand.

Outlook: Break below 3365 triggers markdown to 3320.

5. W.D. Gann Theory

Time Theory

24H Cycle: Key reversal windows:

UTC+4: 10:00–12:00 (resistance test), 16:00–18:00 (trend reversal).

Square of 9: 3374.13 aligns with 0° angle (resistance).

Square of 9

3374.13 → Resistance Angles:

0° (3375), 90° (3385), 180° (3400).

Support: 45° (3350), 315° (3330).

Price Forecast: Reversal at 3375 (0° angle).

Angle Theory

4H Chart: 1x1 Gann Angle (45°) from 3320 low at 3350. Price above angle = bullish, but overextended.

1H Chart: 2x1 Angle (63.75°) at 3374.13 acting as resistance.

Squaring of Price & Time

Price Range: 3320 → 3374.13 (54.13 points).

Time Squaring: 54 hours from 3320 low → 3375 resistance (54 points = 54 hours).

Harmony: 3374.13 = Time Cycle Peak (24H from open).

Ranges in Harmony

Primary Range: 3320–3400 (80 points).

50% Retracement: 3360 (support).

61.8% Retracement: 3340 (critical support).

Secondary Range: 3340–3380 (40 points).

Key Levels: 3360 (50%), 3340 (61.8%).

Price & Time Forecasting

Price Targets:

Short-Term: 3340 (61.8% Fib, Gann 45° angle).

Extension: 3320 (100% of prior correction).

Time Targets:

First Reversal: 10–14 hours from open (UTC+4 14:00–18:00).

Second Reversal: 22–24 hours (UTC+4 22:00–00:00 next day).

Synthesized 24H Forecast

Bearish Scenario (High Probability)

Trigger: Break below 3370 (confirmed by 1H/30M close).

Targets:

T1: 3340 (61.8% Fib, Gann 45° angle).

T2: 3320 (Wyckoff markdown, Elliott Wave A).

Timeline:

10–14H: Drop to 3340 (UTC+4 14:00–18:00).

22–24H: Test 3320 (UTC+4 22:00–00:00 next day).

Confirmation: RSI <50 on 1H, volume spike >25% average.

Bullish Scenario (Low Probability)

Trigger: Sustained close above 3380 (Gann 0° angle).

Targets: 3385 (90° angle), 3400 (180° angle).

Timeline: 14–18 hours (if 3380 breaks).

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.(world wide web shunya trade)

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya.Trade

world wide web shunya trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

eth sell midterm "🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

SILVER Is Going Down! Sell!

Please, check our technical outlook for SILVER.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 3,722.4.

The above observations make me that the market will inevitably achieve 3,685.7 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EURJPY Will Go Down From Resistance! Short!

Please, check our technical outlook for EURJPY.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 170.468.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 168.585 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

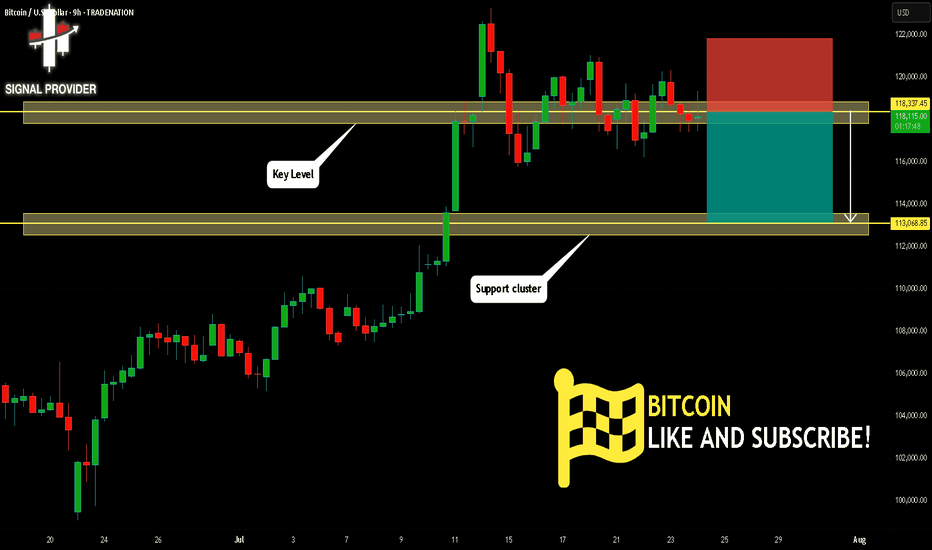

BITCOIN Will Fall! Short!

Take a look at our analysis for BITCOIN.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 118,337.45.

Considering the today's price action, probabilities will be high to see a movement to 113,068.85.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

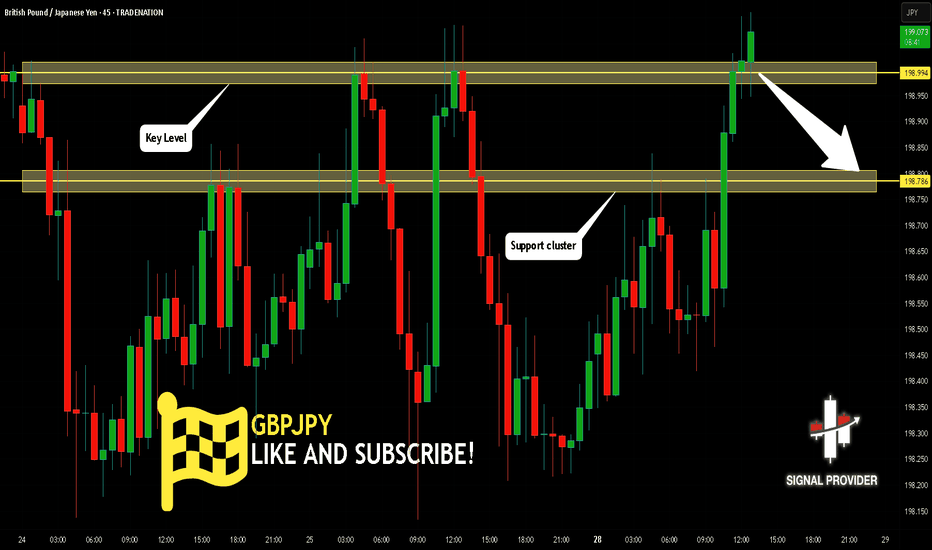

GBPJPY Is Very Bearish! Sell!

Please, check our technical outlook for GBPJPY.

Time Frame: 45m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 198.994.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 198.786 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUDJPY Will Go Lower! Sell!

Take a look at our analysis for AUDJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 96.734.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 96.102 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCHF Will Go Down From Resistance! Short!

Take a look at our analysis for USDCHF.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.813.

Considering the today's price action, probabilities will be high to see a movement to 0.806.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USOIL Is Bearish! Short!

Please, check our technical outlook for USOIL.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 69.178.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 66.684 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

GOLD BEARS WILL DOMINATE THE MARKET|SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 3,366.62

Target Level: 3,261.15

Stop Loss: 3,436.93

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/CAD SENDS CLEAR BEARISH SIGNALS|SHORT

GBP/CAD SIGNAL

Trade Direction: short

Entry Level: 1.833

Target Level: 1.821

Stop Loss: 1.840

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 3h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅