BTC - Short Trade Plan Updated details for this BTC short below, with a lower entry than first plan.

DISCLAIMER - This is my personal trade only and I’m not advising you what to do with your money. Trading is risky and please use your own discretion and risk practices.

Fundamental analysis of this trade can be found on my prior posts.

Entry Range - 116,700 to 117,000

Stop Loss - 120,000

Target 1 - 88,000

Target 2 - 61,500

Target 3 - 35,000

Target 4 - 8,000

God speed. Let the dump begin.

Shorts

ATOM Short

Short entry positioned at $5.16, aligning with a strong supply zone and major resistance based on the 2.618 Fibonacci extension.

Stop loss set at $5.48, above recent highs and upper resistance to mitigate risk from volatility spikes and potential wicks.

Take profit targeted between $4.23 and $4.03, within a solid historical demand zone on high volume.

Setup offers favourable risk/reward ratio (approx. 1:3).

4H ADX currently at 23, indicating a modest trend but favouring range-bound trading strategies.

Main risk includes the possibility of false breakouts above resistance, leading to stop-outs before a reversal.

Price may find strong support around the take profit zone, causing potential bounce or stalling.

Broader market structure neutral to slightly bullish; range may eventually break after repeated tests.

Setup validity is reinforced if BTC and overall crypto market continue consolidating in established ranges.

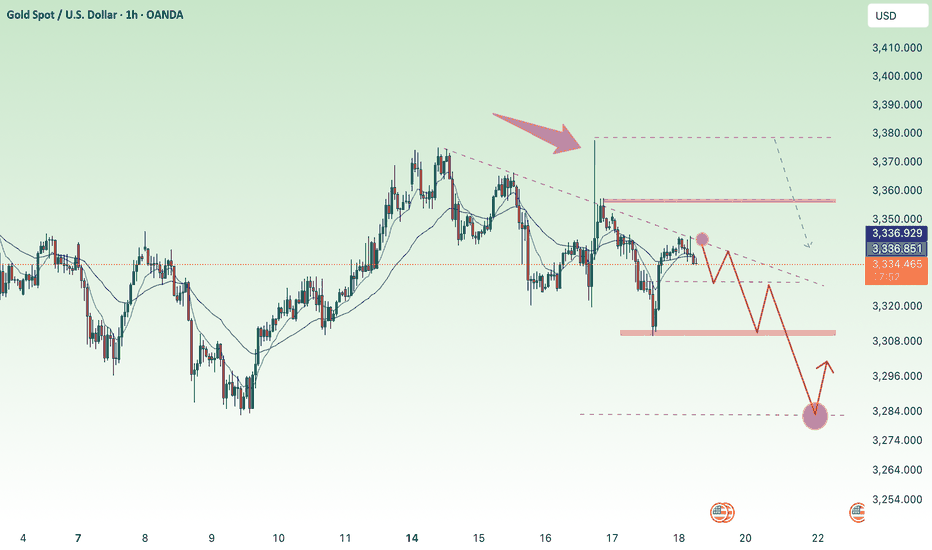

Xauusd downtrendXAUUSD is currently trading around 3328. The market structure shows bearish momentum with sellers still in control. If this pressure continues, I expect price to push further down toward the 3288 level, which may act as the next support zone. Traders should watch for confirmation signals before entering, as volatility around key levels is likely.

Recovered and traded below 3374 , XAU today⭐️GOLDEN INFORMATION:

Gold (XAU/USD) came under renewed selling pressure in Thursday’s Asian session, stalling Wednesday’s solid rebound from the $3,311–3,312 zone, its lowest level in nearly three weeks. The release of the late-July FOMC minutes revealed a hawkish tilt, with policymakers voicing greater concern over inflation than labor market conditions. This has tempered expectations for a jumbo Fed rate cut in September, bolstered the U.S. Dollar, and diverted flows away from the non-yielding metal.

Further weighing on gold, optimism surrounding a potential resolution to the Russia–Ukraine conflict has dampened safe-haven demand. At the same time, political noise added uncertainty after President Donald Trump called for Fed Governor Lisa Cook to resign amid mortgage fraud allegations, raising questions over the central bank’s independence. This could limit aggressive USD buying and lend some support to bullion. Looking ahead, traders will eye global flash PMI readings for fresh cues before Fed Chair Jerome Powell’s highly anticipated remarks at the Jackson Hole Symposium.

⭐️Personal comments NOVA:

Short-term downtrend line, gold price maintains accumulation at 3300 - 3374, use fibo to find support reaction points

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3373- 3375 SL 3380

TP1: $3366

TP2: $3354

TP3: $3344

🔥BUY GOLD zone: $3302-$3300 SL $3295

TP1: $3313

TP2: $3325

TP3: $3337

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

EURUSD UPDATEAs you can see, EUR/USD has finally reached the upside target — the supply zone around 1.17000, where I identified an opportunity and entered short positions. This analysis was originally shared on August 3rd, and it has played out very well.

Currently, I have set three downside targets (marked with the red lines). At each level, I will closely monitor price action to decide whether to take partial profits. Depending on how the market reacts, I may also look for potential long entries in case of a reversal. If the market continues in my favor, I am satisfied with securing profits from the short trade.

BTCUSDT 4H🔎 Chart Context

• Pair: BTC/USDT

• Exchange: Binance

• Timeframe: 4H (240M)

• Date: 16 August 2025

The chart applies price action, liquidity sweep, demand/supply zones, and FVG (Fair Value Gaps) to forecast market behavior.

📊 Key Observations

1. Major Highs & Lows

• Recent Highs: 124,474 and 123,218

• Key Resistance: 122,335.16 zone

• Significant Lows: 112,650.00 and 111,920.00 (highlighted as potential liquidity target)

These represent liquidity pools where institutional activity often occurs.

2. Current Price

• Trading around 117,621 – 118,235 zone at the time of charting.

• Price is consolidating after rejection from 124,474 top.

3. Liquidity Structure

• Market swept liquidity above 124,474 and quickly rejected, signaling a potential distribution phase.

• Below, untested liquidity exists near 111,920, which is marked as a probable downside target.

4. FVG & Demand Zones

• A Fair Value Gap (FVG) remains open around 115,200–116,500, which price could retest before further downside.

• Stronger demand lies around 111,920–112,650, likely to act as a magnet if the retracement deepens.

5. Resistance Zones

• 122,335–124,474 is a strong supply block / distribution zone, which caused the sharp rejection.

• Any bullish recovery will need to reclaim 120,247 and 119,800 to sustain upside momentum.

📈 Bullish Case (Less Likely, Countertrend Scenario)

• If BTC holds above 115,200–116,500 FVG zone and forms higher lows:

• First target: 119,800 (minor supply).

• Second target: 122,335 (major resistance).

• Reclaiming this zone could trigger a retest of 124,474.

• However, this requires strong demand and volume, which currently looks weak.

📉 Bearish Case (Higher Probability Scenario)

• After liquidity grab at 124,474, rejection suggests continuation lower.

• Likely retracement path:

• Retest 116,500–115,200 (FVG zone)

• Break below to sweep 112,650

• Final downside liquidity target: 111,920

This scenario aligns with the chart projection arrow pointing toward 111,920.88.

⚡ Trading Plan

• Short Entries (Preferred Play):

• At 119,800–120,247 (supply retest)

• At 122,335 zone (distribution block)

• Target 1: 116,500–115,200 (partial close).

• Target 2: 112,650.

• Target 3: 111,920 (main liquidity sweep).

• Stop-loss: Above 124,474 high.

• Long Setup (Countertrend, Risky):

• Entry at 115,200–116,500 (FVG)

• TP1: 119,800

• TP2: 122,335

• Stop: Below 114,700

JTO USDT UpdateHELLO 😍

JTO Update

💁♂️ -25% 🔥

I shared this analysis when it was in the entry section. It would be nice to have an update of this analysis.

The JTO cryptocurrency has corrected 25% since the entry zone.

We saw a very good analysis together. What do you think? 😊💖

You can save some profit from the position in this area. 🐱

Please don't forget to like, share, and boost so that I can analyze it for you with more enthusiasm. Thank you. 💖😍

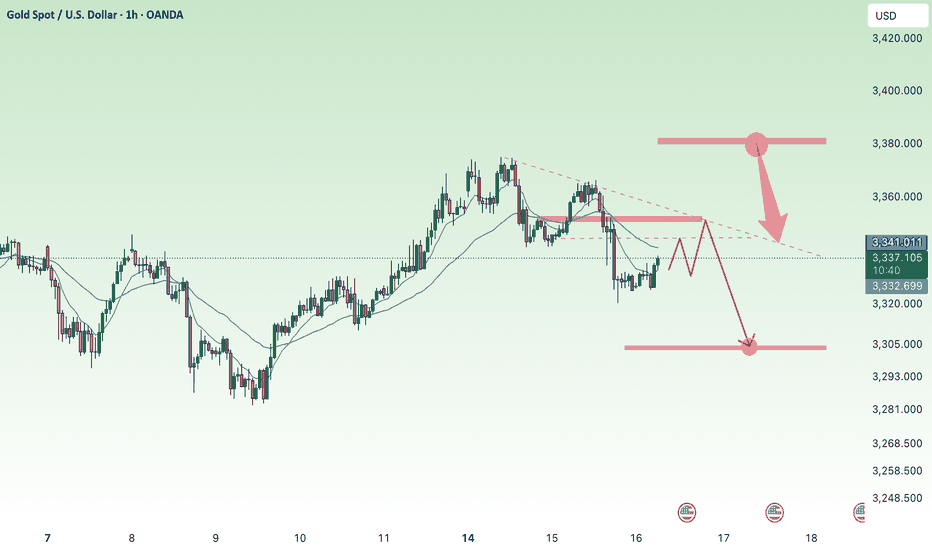

downtrend below 3300 , after ADP-NF⭐️GOLDEN INFORMATION:

The Federal Reserve’s policy statement noted that economic activity has slowed in the first half of the year, although the unemployment rate remains low and inflation is still “somewhat elevated.” The Fed reaffirmed its commitment to achieving maximum employment and returning inflation to its 2% target, while also acknowledging that “uncertainty around the economic outlook remains elevated.”

Earlier data showed that U.S. GDP grew in the second quarter, but underlying details painted a softer picture. Consumer spending cooled, and business investment declined significantly. According to Reuters, most economists now forecast full-year GDP growth at 1.5%, below the Fed’s 1.8% projection.

⭐️Personal comments NOVA:

Gold prices reacted negatively as the FED kept interest rates unchanged and Chairman POWELL's hawkish stance. Selling pressure below 3300 is being maintained.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3360- 3362 SL 3367

TP1: $3350

TP2: $3340

TP3: $3330

🔥BUY GOLD zone: $3249-$3247 SL $3242

TP1: $3258

TP2: $3270

TP3: $3285

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Get liquidity at the beginning of the week, continue to decrease⭐️GOLDEN INFORMATION:

Gold (XAU/USD) continues to lose ground, slipping to around $3,335 in early Asian trading on Monday. The metal is on its fourth straight day of declines as easing geopolitical tensions and trade progress weaken safe-haven demand. Investors are now turning their focus to the upcoming FOMC policy decision on Wednesday.

Market sentiment has improved following a breakthrough in US–EU trade talks, with both sides agreeing to a uniform 15% tariff on traded goods, effectively ending months of stalemate. The new tariffs will come into effect on August 1. Meanwhile, the US and China are reportedly planning to extend their tariff truce for another three months, according to the South China Morning Post. The renewed risk appetite continues to pressure gold, traditionally favored in times of uncertainty.

⭐️Personal comments NOVA:

Short-term recovery in Asian session, gold price takes liquidity and continues to accumulate below 3369

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3369- 3371 SL 3376

TP1: $3360

TP2: $3350

TP3: $3340

🔥BUY GOLD zone: $3305-$3303 SL $3298

TP1: $3314

TP2: $3330

TP3: $3342

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

sideways in weekend downtrend⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) struggle to extend Thursday’s recovery from the $3,309 region—a one-week low—consolidating within a tight range during Friday’s Asian session. The US Dollar (USD) continues to retreat from its peak since June 23, pressured by dovish signals from Federal Reserve (Fed) Governor Christopher Waller.

Additionally, growing concerns over US President Donald Trump’s unpredictable trade policies and their potential consequences for global growth are keeping investors cautious, supporting demand for the safe-haven metal. These factors collectively help limit deeper losses in Gold, though the metal lacks clear bullish momentum for now.

⭐️Personal comments NOVA:

Gold price is moving sideways, accumulating in the downtrend line, not much fluctuation in weekend news

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3379 SL 3386

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3293-$3295 SL $3288

TP1: $3308

TP2: $3318

TP3: $3330

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

downtrend, back to 3300 gold price⭐️GOLDEN INFORMATION:

Gold prices (XAU/USD) inch higher in early Asian trading on Wednesday, recovering part of Tuesday’s sharp decline to multi-day lows, though follow-through buying remains limited. Lingering uncertainty surrounding US President Donald Trump’s trade tariffs, combined with expectations that the Federal Reserve (Fed) will maintain elevated interest rates, continues to dampen risk appetite. This weaker market mood is providing modest support to the safe-haven metal.

Meanwhile, the US Dollar (USD) eases slightly after Tuesday’s surge to its highest level since late June, which is helping gold stabilize. However, persistent speculation that the Fed may delay rate cuts, following a slight uptick in US inflation, continues to bolster the greenback and could cap further gains in gold. Traders remain cautious and await today’s US Producer Price Index (PPI) release for clearer direction.

⭐️Personal comments NOVA:

Selling pressure, break 3340 downtrend line continues. Economic news is helping DXY recover

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3381- 3383 SL 3388

TP1: $3370

TP2: $3360

TP3: $3350

🔥BUY GOLD zone: $3306-$3304 SL $3299

TP1: $3318

TP2: $3330

TP3: $3343

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Bitcoin Eyes $200K: Why a Correction Could Come FirstAs Bitcoin continues its remarkable run, optimism is high that we could see BTC break the $200,000 mark this year. The momentum is there, with bullish sentiment across the crypto and traditional finance spaces. Yet, it’s important to acknowledge a potential short-term correction ahead before new highs are reached.

Why a Correction May Happen Soon

Several factors point to a volatile period in the weeks ahead:

Upcoming Tariffs: On August 1st, the new round of tariffs announced by President Trump is set to take effect. Trade disputes historically introduce uncertainty into global markets and can sap risk appetite, even in alternative assets like crypto.

Federal Reserve Policy: The Federal Reserve has not yet begun lowering interest rates. High rates continue to pressure both equity and crypto markets by making cash relatively more attractive and increasing the cost of leverage.

Geopolitical Tensions: Ongoing instability in the Middle East adds another layer of unpredictability. Geopolitical flare-ups often lead to market volatility as investors act defensively.

The Takeaway

While Bitcoin is on track to reach unprecedented levels this year, investors should remain mindful of the broader market context. Short-term corrections are part of any healthy bull run and can be driven by macroeconomic and geopolitical events. Staying informed and maintaining a disciplined approach will be crucial for navigating what promises to be an exciting—and eventful—rest of the year.

Not Investment Advice!

#crypto #bitcoin #short #correction #dump #uncertainty #volatility #war #news #bearish

GBPAUD Weekly Trade Setup–Parallel Channel Breakdown Opportunity1. Overview of GBPAUD Technical Setup

As of 15th July 2025, the GBPAUD 4-hour chart reflects a price currently positioned at a critical support level around 2.0470–2.0480, which has held multiple times since early April. The price action leading to this point has formed a classic descending parallel channel, with price making lower highs and testing horizontal support with increased frequency.

Key observations:

Price is well below the 200 EMA (currently around 2.0794), confirming a bearish long-term bias.

The resistance zone at 2.1070–2.1120 has proven strong over time, pushing back multiple rallies.

Price is compressing — getting squeezed into the lower boundary of the channel with shorter pullbacks, often a precursor to breakout.

The setup is aligning for a high-probability short trade, with a potential move toward the next major demand zone around 2.0100.

The Breakdown Thesis – What We See on the Chart

The current structure of GBPAUD tells a very clear story:

After a rally in early April, price has been trading within a consolidation range, failing to make higher highs.

The support around 2.0470 has now been tested repeatedly with lower bounces each time.

Price recently made a lower high and returned to support with momentum, increasing the probability of a breakdown.

We are expecting a bearish breakout of this support level, followed by a re-test of the broken zone, and then a strong downside continuation.

Risk Management Strategy

Every trade setup — no matter how technically perfect — must begin with a strong risk management plan.

For this GBPAUD setup:

Entry Trigger: Breakdown below 2.0470 and successful re-test rejection with bearish candle confirmation

Stop Loss: Above re-test high; ideally, just above 2.0530 (~66 pips risk)

Target 1: 2.0300 (170+ pips)

Target 2: 2.0200

Target 3 / Final: 2.0100 (potential 370+ pip move)

This gives us an excellent Risk:Reward ratio of ~1:5 or more, allowing traders to be wrong several times and still remain profitable over time.

Opportunities in the market don’t come from guessing — they come from waiting. The GBPAUD parallel channel setup is a brilliant example of structure-based trading that combines logic with discipline. Whether you're a full-time FX trader or a part-time swing participant, setups like these are where consistency is built.

Watch the breakdown. Wait for the re-test. Execute only when the market confirms your plan.

Happy Trading!

=================================================================

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

=================================================================

Accumulated above 3300, market is sideways⭐️GOLDEN INFORMATION:

Gold prices posted modest gains on Wednesday, supported by a pullback in US Treasury yields, even as the US Dollar remained firm against major currencies. Market sentiment continued to be driven by trade developments, while the Federal Reserve’s latest meeting minutes revealed that policymakers are still leaning toward a rate cut in 2025. At the time of writing, XAU/USD is trading at $3,312, up 0.31%.

The FOMC minutes indicated that the majority of Fed officials believe a rate cut this year would be appropriate, with a few members open to the possibility of initiating a reduction as early as July—provided the economic data continues to align with expectations.

⭐️Personal comments NOVA:

Gold price recovered to 3320, mainly still accumulating, waiting psychology on current tariff situation of countries

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 3358- 3360 SL 3365

TP1: $3345

TP2: $3332

TP3: $3320

🔥BUY GOLD zone: $3245-$3247 SL $3240

TP1: $3256

TP2: $3269

TP3: $3280

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account