SILVER Free Signal! Sell!

Hello,Traders!

SILVER Triple-top rejection at premium levels confirms distribution phase. SMC shows liquidity sweep above highs before sharp drop through neckline, shifting order flow bearish.

-------------------

Stop Loss: 4,721$

Take Profit: 4,537$

Entry: 4,632$

Time Frame: 3H

-------------------

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Silver

Silver Bullish breakout support at 4595The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 4595 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 4595 would confirm ongoing upside momentum, with potential targets at:

4745 – initial resistance

4822 – psychological and structural level

4886 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 4595 would weaken the bullish outlook and suggest deeper downside risk toward:

4555 – minor support

4525 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the silver holds above 4595. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Silver bullish breakout supported at 4440The Silver remains in a bullish trend, with recent price action showing signs of a continuation breakout within the broader uptrend.

Support Zone: 4440 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 4440 would confirm ongoing upside momentum, with potential targets at:

4570 – initial resistance

4615 – psychological and structural level

4650 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 4440 would weaken the bullish outlook and suggest deeper downside risk toward:

4406 – minor support

4380 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the silver holds above 4440. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

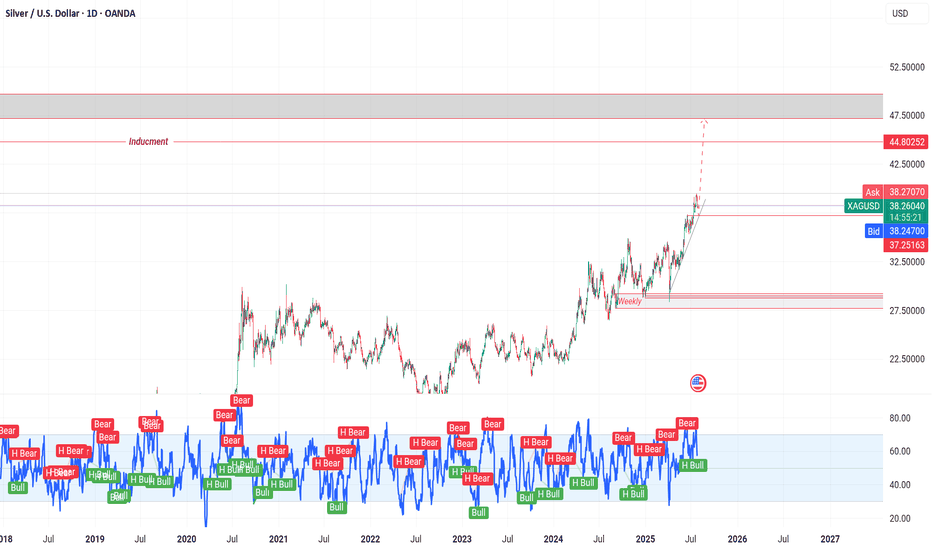

XAG/USD on high time frame

"Hello, for investors in XAG/USD, the $37 zone appears to be a low-risk area for buying. Both technical and fundamental analyses suggest that the price is likely to move higher towards $48."

If you require further insights or have additional information to discuss, feel free to share!

Silver will Make a New All Time HighHello Traders

In This Chart XAGUSD HOURLY Forex Forecast By FOREX PLANET

today XAGUSD analysis 👆

🟢This Chart includes_ (XAGUSD market update)

🟢What is The Next Opportunity on XAGUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Trader Tilki | XAGUSD (Silver) 1H Analysis: Strategic Buy ZonesHello Guys,

Here’s my XAGUSD-SILVER analysis. I’ve received many requests for this, and every follower matters to me — I can’t ignore your demands.

As you know, SILVER usually moves in positive correlation with GOLD and often reacts the same way to news events.

The buy levels I’ll be watching:

🔵 BUY level: 44.66118

🔵 BUY level: 44.02180

🟢 Target level: 46.64801

🔴 Set your stop level according to your own margin.

If price reaches these zones, I’ll definitely open a buy position and take my shot.

Let’s see together how this analysis plays out.

Every like is my biggest motivation to keep sharing these analyses.

Thanks to everyone supporting and following me!

SILVER: Expecting Bearish Movement! Here is Why:

Looking at the chart of SILVER right now we are seeing some interesting price action on the lower timeframes. Thus a local move down seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

Gold next week: Key S/R Levels and Outlook for Traders🏆 Friday’s Close & Recent ATH: Gold closed the week near $3,769, not far from its latest all-time high ($3,734) as bullish momentum continues to dominate. Every dip is being met with strong buying interest, reinforcing the uptrend.

📈 Trend Structure: The market remains firmly inside an ascending channel on both 1H and 4H charts. The broader structure is bullish, with corrections appearing as healthy consolidations rather than reversals.

🔑 Key Resistance Levels: T he most critical resistance sits at $3,800, a psychological and technical barrier. Beyond that, $3,810–3,820 represents potential breakout extension targets if bulls push through.

🛡️ Support Zones: Immediate support rests at $3,753–3,755, aligned with a rising trendline. Deeper supports lie at $3,690–3,675, with stronger downside protection at $3,660–3,650. A sustained break below $3,650 would signal deeper correction risk.

⚖️ Likely Scenarios:

o Scenario 1 (Base Case) – A short-term pullback toward support before continuation higher.

o Scenario 2 – A shallow correction, followed by a direct breakout above $3,800.

Probabilities currently favor Scenario 1 due to overbought conditions.

📊 Short-Term Targets: On continuation, upside levels to monitor are $3,740 → $3,780 → $3,800, with a possible push toward $3,810 ATH+ extension.

💡 Market Sentiment Drivers: Geopolitical tensions, central bank accumulation, and persistent currency debasement concerns remain key macro tailwinds. These factors underpin the long-term bullish bias, despite near-term choppiness.

🔄 Retracement Outlook: Analysts suggest a retracement is due after the strong run-up. A controlled dip into the $3,660–3,640 zone could offer buying opportunities for swing traders targeting another leg higher.

🧭 Risk Levels to Watch: Holding above the ascending trendline (around $3,630–3,640) keeps the bullish structure intact. A decisive break below this area could trigger a deeper correction toward channel midpoints.

🚀 Overall Weekly Outlook: Gold remains in a strong bullish trajectory with $3,800 as the major battleground. Expect short-term pullbacks, but the path of least resistance is still higher, with long-term prospects pointing toward $4,000.

SILVER Hitting ALL-TIME-HIGH 50$! EPIC!

Guys!

While everyone was obsessed with Gold for obvious reasons, Silver quietly made 300%!!! since 2020, and more than 65% in 2025 alone. Bitcoin? How about Silver baby?! And I am not surprised. I've been telling everyone who'd listen that Silver is epically Undervalued and here we are at an all-time-high again. From where we are bound to see a good correction.

But make no mistake! Silver will keep growing, along with Gold in the coming years and the coming I will treat the coming correction as a way to buy MORE Silver!

Precious metals are out past, present and future with no real replacement, and I oh boy will I be buying the dip!

SILVER What Next? SELL!

My dear followers,

I analysed this chart on SILVER and concluded the following:

The market is trading on 4606.0 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 4537.7

Safe Stop Loss - 4644.6

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BRIEFING Week #39 : The Turning Point is HereHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Silver buy above 137520 tgt 139621 intrday stop loss ??Silver buy above 137520 tgt 139621 intrday stop loss 137330

Silver buy above 137520 tgt 139621 intrday stop loss 137330

Silver buy above 137520 tgt 139621 intrday stop loss 137330

Silver buy above 137520 tgt 139621 intrday stop loss 137330

Silver buy above 137520 tgt 139621 intrday stop loss 137330

Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330Silver buy above 137520 tgt 139621 intrday stop loss 137330

XAG/USD | Silver Rally Continues – Bulls Eye $44.60 & $44.80! By analyzing the Silver chart on the 2-hour timeframe, we can see that after correcting down to $43.34, the price gained demand again and rallied more than 2.5%, reaching $44.47.

Currently, silver is trading around $44.16. If the price breaks above $44.49, we could see another push higher, first retesting $44.47, and then aiming for $44.60 and $44.80 as the next targets.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Gold (XAUUSD) – Technical Outlook

🔴Bearish Scenario (Downtrend)

*Pivot Level: 3759

* If price trades below 3759, downside momentum may develop.

* 🎯 First target: 3736 (key support)

* If 3736 breaks strongly → continuation lower.

* 🎯 Second target: 3700

🟢Bullish Scenario (Uptrend)

* If price holds above 3759, upside momentum is likely.

* 🎯 First target: 3791 (previous major high)

* If 3791 breaks with strength → full bullish continuation.

* 🎯 Next upside targets: 3810 → 3830

Silver - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

XAGUSD SILVER📈 Silver (XAGUSD) – Long Setup (4H)

Technical View

Price has broken out of a rectangle consolidation on the 4H chart.

Breakout is supported by bullish momentum candles.

Market structure showing higher highs (HHs) and higher lows

Trading Plan

Entry: On successful breakout retest / bullish confirmation candle.

Targets:

🎯 TP1:

🎯 TP2:

🎯 TP3:

Risk Management Rule

Once TP1 is hit, immediately move SL to entry (break-even).

Partial profits can be booked at TP1; let the rest run toward TP2 and TP3.

SILVER XAGUSD30 min TF Short Scalp

Silver is very bulish Just a pull back is what we can capture , very risky trade but Head & shoulder pattern is making it look good

Trade will be active once complete Bearish candle close below the neckline

Must book partial profit, Once achieve 50 % towards TP put your SL to tp , and partial profits

SILVER TO $750 IN THE NEXT DECADE ?This has to be the biggest Cup & Handle Formation in Human History. Holy Smokes.

Ok, let's dive into the Fundamentals:

1) Industrial Demand: Silver is essential in various high-growth industries such as electronics, solar energy, and medical devices. As technological advancements continue, the demand for silver is expected to increase significantly.

2) Investment Demand: Economic uncertainty, inflation, or financial crises often lead investors to seek precious metals like silver as a safe haven.

3) Supply Constraints: Silver mining production may face challenges due to factors like depleted mines, increased extraction costs, or regulatory changes. Supply shortages can occur if production cannot keep up with demand, which will ultimately lead to a short squeeze.

4) Monetary Policy and Inflation: Central banks' monetary policies, such as maintaining low interest rates or implementing quantitative easing, can weaken currencies.

5) Green Energy Initiatives: The push for renewable energy sources, particularly solar power, relies heavily on silver for photovoltaic cells. As global efforts to combat climate change intensify, the demand for silver in green technologies is likely to rise, boosting its price.

(aka Agenda 2030 - The Great Reset)

What scares me about this chart is that it suggests terrible events are imminent.

The impact of these events cannot yet be measured, but they will be catastrophic for humanity.

Stay Safe and keep stacking as fast as possible, NFA!

CYANE

SILVER SELLERS WILL DOMINATE THE MARKET|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 4,409.7

Target Level: 4,246.7

Stop Loss: 4,517.2

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅