SUI - Just one step away from the explosion!The last candle on the daily chart just confirmed a BOS (Break of Structure) — a clear and strong sign of bullish continuation for the asset.

✅ This is a textbook entry for a long position.

🎯 Next target: $5 — and so far, no bearish signs in sight.

Best regards,

Ceciliones 🎯

Smctrading

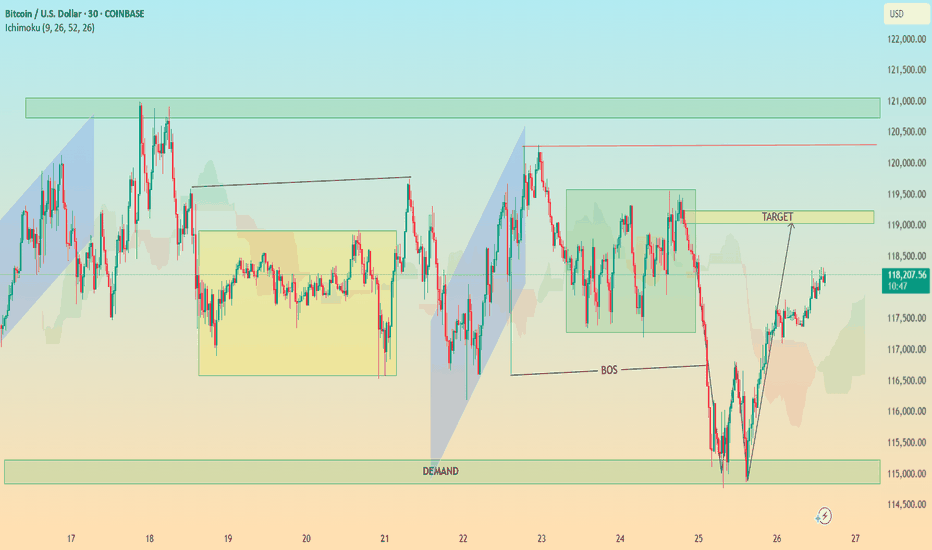

BTC In-Depth Technical Analysis: BTC/USD (30-Min Chart)🔍 In-Depth Technical Analysis: BTC/USD (30-Min Chart)

🟩 1. Demand Zone Reaction

Location: ~$114,500 – $115,500

Significance:

Price sharply reversed after a strong move into this demand zone.

This zone coincides with a liquidity grab below previous lows — textbook Smart Money trap.

Volume (if checked) would likely spike here, indicating institutional interest.

✅ Interpretation: Institutional demand stepped in, absorbing sell orders and triggering a reversal.

📉 2. Break of Structure (BOS)

Zone: Around July 24–25

Price broke below a key higher low, signaling temporary bearish structure.

However, this was quickly reclaimed after demand zone reaction — suggesting a fakeout BOS or a liquidity sweep.

✅ Interpretation: BOS caused shorts to enter, but reversal suggests a bear trap and continuation higher. The BOS served to fuel a more aggressive bullish rally.

🎯 3. Target Zone

Marked Target: ~$118,900–$119,200

Why This Area?

It aligns with a previous consolidation zone / supply before the sharp drop.

Also overlaps with Ichimoku cloud resistance and previous highs — strong confluence.

✅ Interpretation: Price is likely to face resistance here. If broken with strong momentum, bullish continuation to the next supply zone (~$121K) is possible.

⛓️ 4. Market Structure Analysis

Higher Lows Forming after demand reaction.

Price is forming a bullish market structure with an ascending wave pattern.

A break and retest of the $119K zone could lead to a mid-term rally.

Failure to break could result in:

A pullback to the $117,000 area

Or a deeper retest of the demand zone

✅ Trading Plan Options:

Bullish Bias: Buy pullbacks above $117,000 with $119,000 as target

Bearish Bias: Wait for strong rejection at $119,000 to short back to $115K

☁️ 5. Ichimoku Cloud Insight

Price has moved above the cloud, suggesting momentum shift to the upside.

The cloud is twisting bullish, supporting short-term bullish trend.

However, flat Kumo tops around $119K = likely rejection zone.

✅ Interpretation: Ichimoku confirms bullish potential, but price must close above the cloud + $119K zone to sustain trend.

📌 Key Takeaways for Publishing

Chart Idea Title:

“BTC/USD Demand Zone Reversal | Break of Structure & $119K Target in Sight”

Summary Description:

Bitcoin has reclaimed bullish momentum after a sweep into the $115K demand zone. A break of structure triggered shorts, but demand absorption led to a sharp reversal. Now, price is approaching the key $119K supply zone — a critical level that could determine if this is a short-term rally or the beginning of a new trend. Watch for either a clean breakout or a rejection for a possible retest of $117K or lower. Confluence from Ichimoku, BOS, and market structure support the analysis.

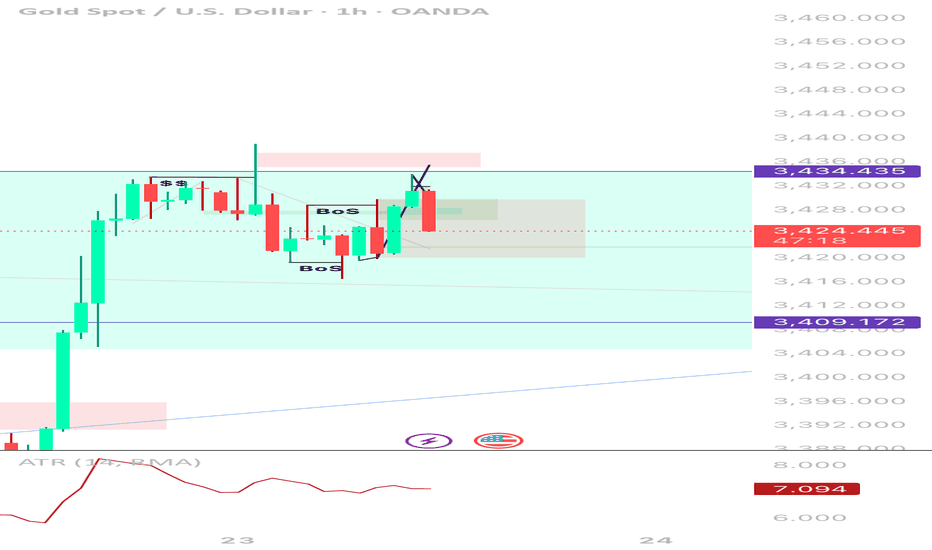

Call me bluff 🧾 TradingView Journal Entry – XAUUSD

Date: July 23, 2025

Pair: XAUUSD

Timeframe: 1H (Entry), HTF Alignment: 4H / 1W

Position: Sell

Execution Style: SMC (Smart Money Concept)

⸻

🧠 Trade Reasoning

• HTF Context (4H/1W):

Price recently broke out of a falling wedge on the weekly and created a strong impulsive leg on the 4H. However, price had reached a key supply zone near 3,434, showing signs of exhaustion. No continuation above key structure → likely retracement phase incoming.

• LTF Setup (1H):

• ✅ Equal Highs Liquidity (”$$”) above 3,434 swept

• ✅ Bearish engulfing candle immediately after sweep

• ✅ Two internal BOS (Breaks of Structure) showed clear bearish intent

• ✅ Price returned to mitigate inside a small OB/FVG zone

• ✅ Entry confirmed on rejection wick + strong bearish follow-through

⸻

💼 Trade Management

• Entry: 3,433.5

• Stop Loss: 3,436.5 (above liquidity wick)

• Take Profit Targets:

• TP1: 3,420 (mitigation zone fill) ✅

• TP2: 3,409.172 (clean imbalance + EQ) ⏳

• TP3: 3,388.985 (4H POI / demand) 🔜

• Risk: ~3 points

• Reward: ~15–45 points (1:5–1:15 depending on TP)

⸻

📈 Reflection

This was a high-confidence SMC setup:

• Liquidity sweep ✅

• Structure shift ✅

• Entry confirmation ✅

Only improvement: I could have refined entry on 15m or 5m for even better RR. ATR was dropping, signaling a compression → made sense for a clean move post-sweep.

⸻

📌 Tag Notes

• #SMC #LiquiditySweep #BreakOfStructure #1HEntry #HTFRejection #Gold #XAUUSD #RiskReward

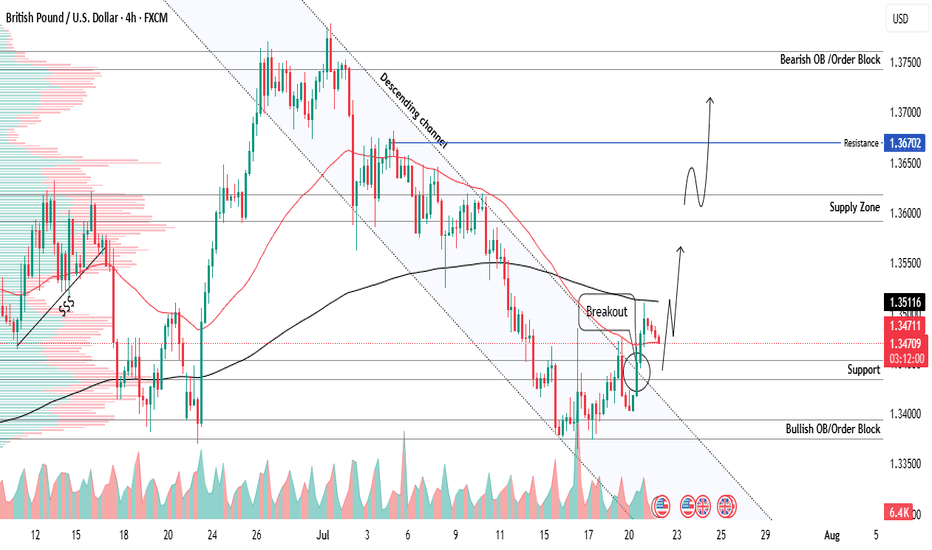

GBPUSD new breakout from descending channel bullish strong 📊GBPUSD Analysis – 4H Timeframe

GBPUSD has broken out of the descending channel with a strong bullish candle, signaling a potential shift in structure and bullish momentum

📍 Key Support Zone:

✅ Buy activated from 1.34400 – now acting as a solid demand area after breakout

🛑 Stop Loss:

Set below at 1.33800, aligned with the bullish order block for added protection

🎯 Next Resistance Levels / Profit Zones:

🔹 1.36000 – first supply zone

🔹 1.36700 – short-term resistance

🔹 1.37500 – major bullish OB target zone

🧠Trade with structure, manage risk, and follow your plan – no emotions, just execution

Share your view on GBPUSD below

#gbpusd

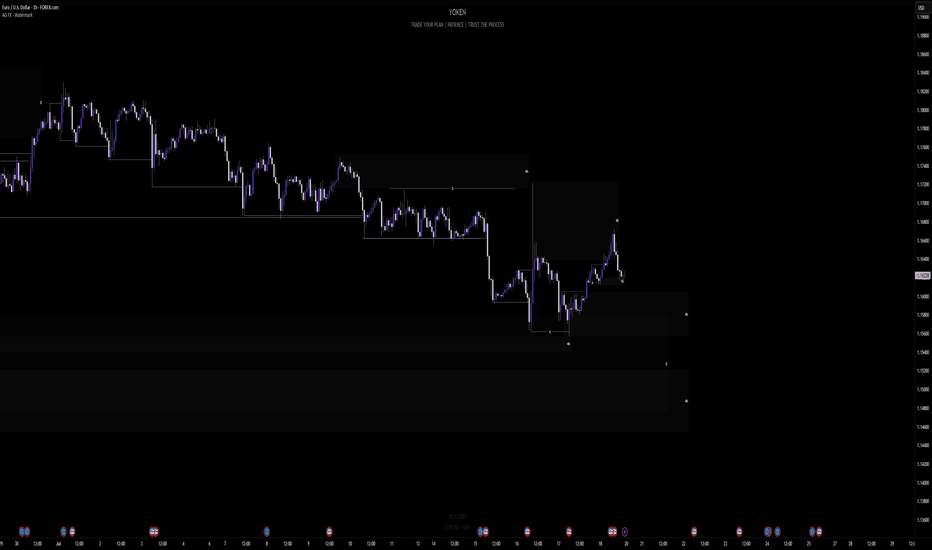

Week of 7/20/25: EURUSD AnalysisLast week's price action was bearish and has finally reached the extreme daily demand level and provided some reaction. Price has swept bulls and bears, so now we follow internal structure and wait to see where price actually wants to go. If internal 1h structure breaks bearish, we have confirmation to trade bearish until price goes deeper into the daily extreme zone.

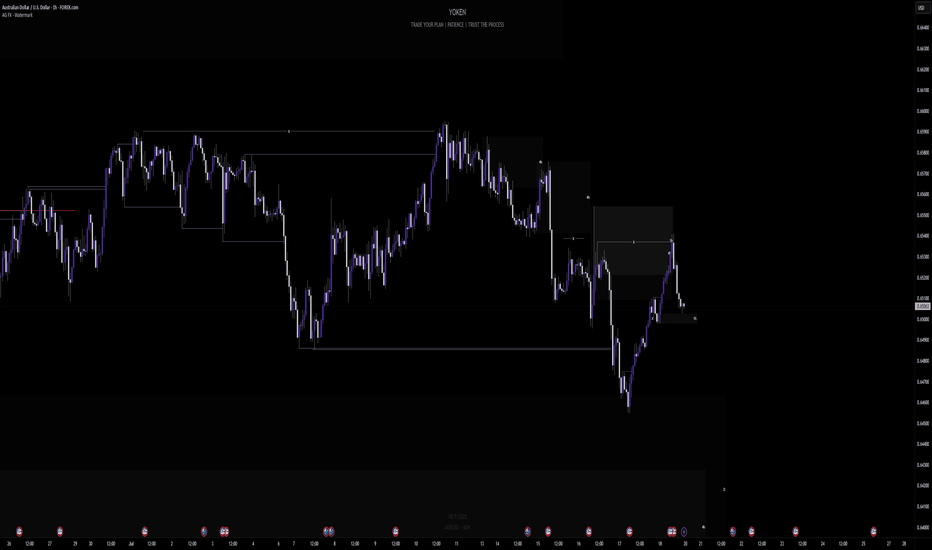

Week of 7/20/25: AUDUSD AnalysisLast week's price action was bearish and this week I will follow bearish order flow unless internal 1h structure continues to be bullish. I'm going to look for shorts after 1h internal structure is broken as confirmation, then take trades down to the daily demand zone and then look for bullish signals.

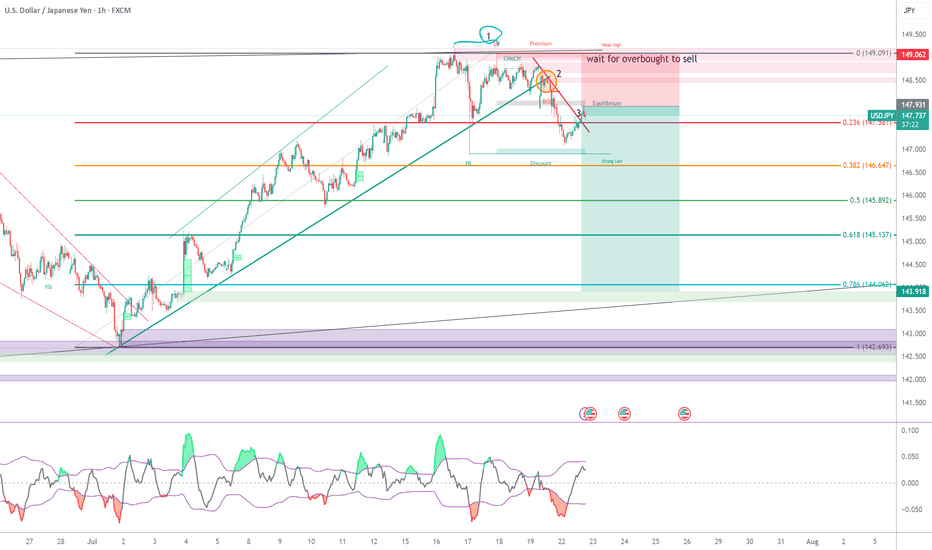

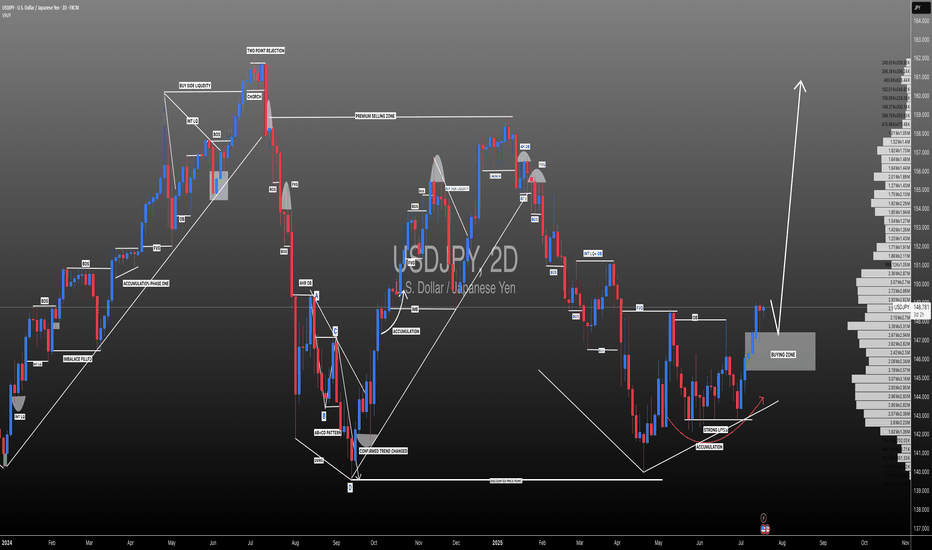

#USDJPY: Swing Buy Almost +2000 Pips! Dear Traders,

The USDJPY currency pair appears to be in an accumulation phase at the moment, as evidenced by the lack of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments will have substantial implications for the future trajectory of the USDJPY pair. Consequently, there’s a possibility that the price may experience a decline before initiating a bullish trend. We’ve recently seen a strong bullish candle, which suggests a strong bullish move in the coming weeks. Additionally, the strong USD could continue rising, while the JPY is dropping.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will indicate potential reversal zones.

It’s crucial to conduct your own analysis before making any financial decisions. This chart should be used solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it’s advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Please share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, don’t hesitate to comment below. We’re here to provide support.

Team Setupsfx_

❤️🚀

BTC wave structure analysis on 4 hour and daily timeframe- Daily time frame, after price gave stop hunting signal, price increased again.

- On the 4-hour time frame, the price broke through the strong peak and gave a bullish reversal signal.

- So there is a high possibility that BTC will continue to rise and break the previous top.

Week of 7/13/25: AUDUSD AnalysisLast week pushed bullish and demand is still in control on all time frames, so we are going to follow bullish order flow.

Looking for bottom liquidity to be taken in the local range before getting in on a long.

Major News:

Tuesday - CPI

Wednesday - PPI

Thursday - Unemployment

Bitcoin - Power of 3 in play!The chart illustrates a classic application of the ICT concept known as the "Power of 3," a theory that outlines a common market behavior pattern consisting of three phases: consolidation, manipulation, and distribution. This model is often used by smart money traders to identify points where institutional players may be accumulating or offloading positions, typically by targeting retail liquidity.

Consolidation

In this scenario, Bitcoin has exhibited a prolonged period of consolidation, where price fluctuated within a defined range throughout most of June and into early July. This range-bound movement, highlighted in blue, represents the market gathering orders from both buyers and sellers, creating a liquidity pool on either side of the range. During this phase, market participants become uncertain about the next direction, while smart money positions itself for the next move.

Manipulation/sweeping liquidity

Recently, Bitcoin has broken out of this consolidation range in an upward move, which is now being interpreted as the manipulation phase. This move served to sweep the liquidity resting just above the established highs of the range. These highs were prime areas for stop-losses of short sellers and breakout entries of longs, making them attractive targets for institutional manipulation. The price push above this level, marked in green, appears to be a false breakout designed to trap breakout traders and trigger stops before a likely reversal.

Possible distribution phase

Following this manipulation phase, the chart suggests we are entering or have just begun the distribution phase, marked in red. Distribution in the context of the Power of 3 refers to the process where smart money offloads their positions onto unsuspecting buyers who entered during the manipulation. The anticipated outcome is a sustained move to the downside, aligning with the forecasted bearish structure shown on the right side of the chart.

Conclusion

In conclusion, the chart reflects a textbook ICT Power of 3 pattern in play on Bitcoin. After a lengthy period of sideways consolidation that built liquidity on both sides, Bitcoin executed an upward manipulation to capture liquidity above the range. Now, with the highs swept and buy-side liquidity taken, the market looks poised for distribution, signaling a probable downward move in the near term. Traders familiar with smart money concepts would view this as a high-probability reversal zone.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Bitcoin - Last move down, ready for ATH?Bitcoin is showing clear signs of a corrective move within a broader bullish structure. After forming a second consecutive lower high, price is now pressing downward, creating space for a potential liquidity grab and discount entry. Despite this short-term weakness, the macro narrative remains intact. The all-time high remains untapped above, holding a thick layer of liquidity that the market has yet to collect.

Liquidity and Fib Confluence

There is a visible equal low structure around the 107.8k area. This is a prime zone for a sweep, where smart money is likely to trigger sell stops before reversing. Below that lies a Fair Value Gap (FVG) extending into the 106.5k range. Within this same zone, we also have strong Fibonacci confluence, especially at the 0.786 level near 106.2k. This makes it a high-probability entry area if price delivers a clean displacement after the sweep.

Short-Term Bearish, Long-Term Bullish

The market is respecting a trendline drawn across the lower highs, giving the impression of sustained bearish control. However, this is likely a trap. Once the sell-side liquidity below the 107.8k low is taken and the imbalance around 106.5k is filled, price will be primed for a reversal. The true target lies much higher, with the all-time high around 110.5k as the main magnet.

FVG Fill and Reversal Mechanics

This entire drop is likely engineered to fill inefficiencies left behind earlier in the move up. The FVG acts not only as a magnet, but also a springboard for the next leg. Expecting price to show a reaction at the 0.786 level, where the order flow could shift and confirm a bullish reversal, is key here. Ideally, we see a clean sweep, a displacement, and a reclaim of previous structure before targeting higher levels.

Projection and Trade Setup

The anticipated sequence is a sweep of 107.8k, fill of the gap and fib zone down to 106.2k, then a potential reversal structure forming. If that structure confirms, the next major move should aim for the untouched all-time highs, where significant liquidity remains resting. Traders should remain patient and let the sweep and confirmation unfold before entering.

Conclusion

We are watching a classic setup where engineered downside movement is likely to create the conditions for a powerful reversal. As long as price respects the 106k zone and gives a strong reaction, the path toward the ATH remains wide open.

___________________________________

Thanks for your support!

If you found this idea helpful or learned something new, drop a like 👍 and leave a comment, I’d love to hear your thoughts! 🚀

EURJPY LONG IDEAI have been waiting for this EURJPY long setup to form for the past 2 trading sessions.

This morning I saw this beautiful bullish swing low formed and that is my entry signal for to take a long trade on EURJPY.

REASONS:

EURJPY is super bullish right now.

The Daily and 4Hour time frame trend is extremely bullish. So, am only looking to take a long buy to follow the trend direction.

How to Trade Liquidity Sweep in Forex Market (SMC Trading)

I will show you a real example of trading liquidity sweep with Smart Money Concepts.

You will learn the essential SMC liquidity basics, a simple and profitable strategy to identify and trade liquidity sweep.

I will share with you an accurate entry confirmation signal that works perfectly on any Forex pair.

Liquidity Basics

In order to trade liquidity sweeps profitably, you should learn to identify significant liquidity zones.

To spot them, analyze a historic price action and find clusters of important historic key levels.

Examine a price action on EURUSD on an hourly time frame.

I underlined multiple horizontal key levels.

The price respected each level, found support on them, and rebounded.

What is so specific about these levels is that they are lying close to each other, composing a liquidity cluster.

That fact that EURUSD strongly bounced from these levels suggests that buying interest and high buying volumes were concentrated around them.

We can unite these levels and treat them as a single demand zone that has just been broken and turned into a supply zone.

After we found a valid liquidity zone, we can look for a liquidity sweep.

First, we should let the price approach that area and look for a specific price behavior then.

That is a perfect example of a liquidity sweep.

You can see that the price formed a wide range candle with a long tail.

Its high went way beyond the underlined area, but its body closed within.

In order to understand, why a liquidity sweep occurred, let's zoom in our chart and try to understand a behavior of the market participants.

Our supply zone concentrated selling orders , we assume that sellers were placing their orders across its entire length.

Their stop losses were presumably lying above that area.

Smart Money know that and with a liquidity sweep they manipulate the market, making sellers close their positions in a loss (buying back their positions from the market) and providing a liquidity for big players.

After a formation of a such a candlestick, a reliable confirmation of a saturation of the Smart Money is a formation of a strong bearish candle - a clear sign of strength of the sellers.

A bearish engulfing candle above confirmed a completion of a liquidity sweep and indicates a highly probable bearish continuation.

Your perfect sell entry is immediately after a close of such a candlestick.

Stop loss should strictly lie above the high of a liquidity sweep.

Take profit is based on a local low.

Look, how quickly the price reached the goal.

Your strategy of trading liquidity sweeps of demand zones is absolutely the same.

Let the price test a demand zone, wait for a formation of wide range bearish candle with a tail going below its lows.

Wait for a bullish imbalance candle and buy immediately then.

Stop loss will be below the low of a liquidity sweep, take profit - a local high.

This SMC strategy works on any time frame and can be applied for trading any Forex pair, Gold, Silver, Crypto and commodities.

Try it by your own and let me know your results.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.