SOL/USD: Bullish Swing Plan w/ Layered Buy Limits & Target🏴☠️ ATTENTION ALL THIEVES & ROBBERS! 🏴☠️

Asset: SOL/USD "Solana vs U.S Dollar" Crypto Market Heist Plan (Swing / Day Trade)

Plan: Bullish Heist ✅

🎯 THE MASTER PLAN: OPERATION SOLANA BULL RUN

Ladies & Gentlemen of the thieving community! 👔🦹♂️🦹♀️ Based on the Thief Trader's secret technical analysis, the vault door to Solana profits is creaking open! Time to execute the heist!

🚪 ENTRY: LAYER UP & SLIP IN SILENTLY

The Thief is using a multi-layer limit order strategy for this entry! We don't knock down the door, we pick the locks one by one! 🔓

Place your buy limit orders at these levels:

Layer 1: 190.00000

Layer 2: 195.00000

Layer 3: 200.00000

🛠 PRO TIP: You can increase your limit layers based on your own capital! More layers = bigger haul! 💰💰

🛑 STOP LOSS: THE GETAWAY DRIVER'S LOCATION

This is the Thief's SL: @180.00000

Listen up, OG's! 👉 Adjust your final SL based on your own strategy and risk appetite! Don't get caught because you got greedy on the entry! Know your exit route! 🚗💨

🎯 TARGET: ESCAPE BEFORE THE COPS ARRIVE!

The police barricade is forming at @240.00000! 🚨👮♂️

Do NOT get greedy! Grab the stolen money, exit the vehicle, and ESCAPE WITH THE PROFITS before the target! A true thief knows when the job is done! 🏁💰

⚠️ THIEF'S FINAL WARNING & DISCLAIMER

📰 News is an Undercover Cop: It will wreck our plan! Avoid new trades during high-impact news!

🔄 Use Trailing SL: Once in profit, trail your stop to lock it in! Protect the loot!

📉 This is not financial advice. This is a heist plan. You are the thief. Your capital, your risk. I'm just the mastermind.

💖 Enjoyed the plan? SMASH THAT LIKE & BOOST BUTTON! ✅ It helps our crew grow and plan the next big score! 🚀🤝

Stay sharp, thieves! I'll see you on the next heist. 🤑👋

Solusdsignal

DeGRAM | SOLUSD above the $200 level📊 Technical Analysis

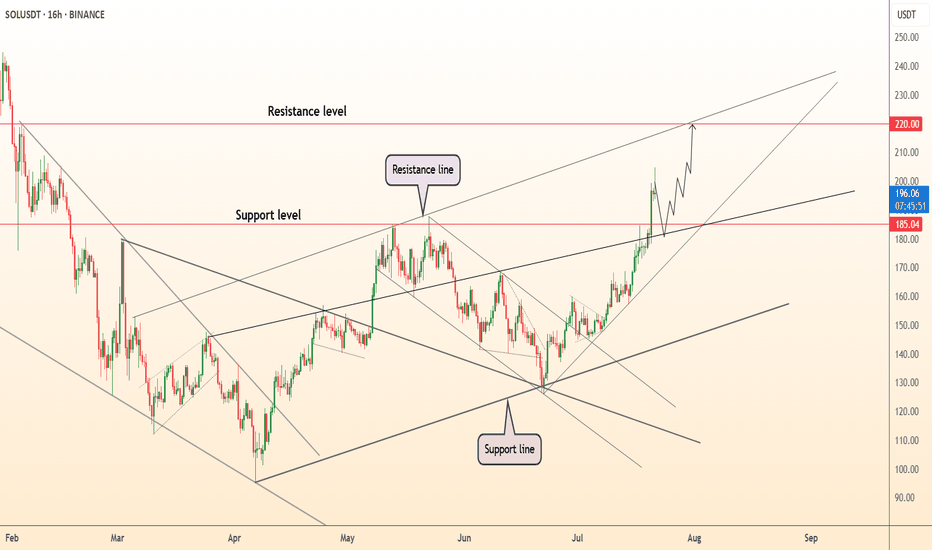

● SOL/USD is trading within a well-defined ascending channel, holding above the 189–190 support zone and building higher lows that reinforce bullish structure.

● The current move targets the 226–230 resistance, with the rising parallel channel supporting further gains as long as price remains above 189.

💡 Fundamental Analysis

● Solana’s DeFi TVL has grown over 20% in August, driven by fresh institutional inflows, while its ecosystem expansion (notably in gaming and payments) strengthens adoption.

✨ Summary

Bullish above 189; breakout continuation eyes 226 → 230. Invalidation below 189.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD repeated pullback from $205📊 Technical Analysis

● SOLUSD is consolidating near the rising support zone of 170–172 within a broad ascending channel, preparing for another attempt toward the 206 resistance level.

● A breakout above 206 would confirm bullish continuation, opening the path to challenge the channel top around 220–230, supported by higher lows and strong structural momentum.

💡 Fundamental Analysis

● Analysts now assign a 95% probability to spot Solana ETF approvals, boosting institutional interest, while Solana’s mainnet reached 100,000 TPS in stress tests, reinforcing scalability.

● Corporates like BIT Mining and Upexi are making direct multi-million-dollar allocations into Solana, underscoring growing confidence in its long-term adoption.

✨ Summary

Bullish above 170; breakout trigger at 206. Targets 220 → 230. Invalidation on a close below 170.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD updated the rising low📊 Technical Analysis

● SOLUSD is advancing within a steepening channel, holding above 186.5 after reclaiming mid-channel support and setting sights on the 216.2 resistance zone.

● The structure shows higher lows and accelerated momentum, with potential to challenge the upper boundary near 225 if current trendlines hold.

💡 Fundamental Analysis

● Solana’s recent integration with Fireblocks’ institutional staking service is driving positive sentiment, while on-chain activity in DeFi TVL has surged over 15% this month.

✨ Summary

Bullish above 186.5; targets 216.2 → 225. Invalidation on a close below 186.5.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD will test the support level📊 Technical Analysis

● SOLUSD is pulling back after testing the upper resistance channel near 205 and is now approaching key support at 162.5, aligning with the breakout zone.

● Structure remains bullish as price respects the midline of the ascending channel, and upside continuation toward 205 remains likely if 162 holds.

💡 Fundamental Analysis

● Solana remains a top performer in weekly ETP inflows, per CoinShares, and continues to dominate in NFT volume and developer activity.

● Funding remains positive across major derivatives platforms, signaling sustained bullish sentiment despite short-term volatility.

✨ Summary

Long bias above 162. Breakout target remains 205 ▶ 220. Setup remains valid while above key structure support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD is holding the $177 level📊 Technical Analysis

● SOLUSD is bouncing from the rising trendline support at 177 after a retracement, maintaining structure within a bullish ascending wedge.

● Price holds above the prior resistance-turned-support near 176.9, with a clear path to retest the 205.8 and 219–222 confluence zone.

💡 Fundamental Analysis

● Solana's 30-day DApp volume ranks top 3 among L1s, signaling increased utility. Institutional SOL inflows also continued for a fifth week, per CoinShares.

● Strong user metrics and positive funding rates suggest bullish momentum remains supported on-chain and through derivatives markets.

✨ Summary

Buy dips above 177. Targets at 205 ▶ 220. Long setup holds while price stays above 175.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD seeks to the $220 level📊 Technical Analysis

● After reclaiming the mid-June swing cap 185 (now support) price accelerated along a steep parabolic fan; the move completed a 1:1 extension of the early-July flag yet leaves room to the channel crest near 220.

● Structure shows successive closes above the March–July internal resistance line; momentum pull-backs are respecting the fan base at 190, indicating healthy trend continuation toward the next fib / rail confluence at 219-222.

💡 Fundamental Analysis

● FXStreet notes Solana’s daily active addresses just hit a 12-month high, while CoinShares reports a fourth straight week of SOL-focused ETP inflows—evidence of strengthening network use and institutional demand.

✨ Summary

Buy 190-195; hold above 185 eyes 205 ▶ 220. Long thesis void on a 16 h close below 175.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD seeks to confirm the breakout📊 Technical Analysis

● Bulls pushed back inside the broad rising channel and pierced the five-week gray trend-cap; the breakout has been retested at the 147-150 pivot (green strip), now acting as support.

● Price is carving a tight bull-flag on diminishing volume; its 1.618 swing and the channel median intersect with the May swing high near 173, while the upper rail aligns with 187-190.

💡 Fundamental Analysis

● VanEck’s late-June 19b-4 filing for a US spot Solana ETF trimmed perceived regulatory risk, and Firedancer’s public test-net timeline lifted developer sentiment, both fuelling fresh inflows.

✨ Summary

Long 147-150; flag break above 155 targets 173 → 187. Invalidate on a 16 h close below 140.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD retest of the 136 level📊 Technical Analysis

● Price bounced at 136 where the rising-channel base meets a long-held internal trend-line, locking in a higher-low and printing bullish RSI divergence.

● A micro falling-wedge is fading; clearance of the wedge roof/150 round turns bias up toward the 158.8 horizontal pivot and the channel mid-band near 187.4.

💡 Fundamental Analysis

● Solana’s daily active wallets and DEX volume have risen ~20 % since 20 Jun as new DeFi incentive programs (Jupiter, Pyth, Kamino) go live, hinting at returning user demand despite broader crypto lethargy.

Summary

Buy 137-145; confirmed break above 150 targets 158.8 → 187.4. Long thesis voided on a 16 h close below 130.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD channel floor launch toward 170+Solana continues to respect the broad rising channel that has guided price since early April. Recent corrective action tagged the channel median and then the intersecting 137-140 horizontal support, forming a classic confluence floor. The reaction: a sharp bullish rejection that restored price above the magenta internal trendline, indicating buyers remain in firm control. The corrective structure itself resembles a descending wedge losing bearish momentum, while RSI prints a positive reversal at 40 – conditions that often precede explosive upside resolution. A decisive close over 150 triggers an upside breakout aiming first at 160 (wedge objective) and subsequently at the 172-175 resistance block where prior distribution occurred. Should momentum spill over, the upper channel trajectory extrapolates 185-190 in coming weeks. Bullish bias is intact while candles close above 137; deeper dips into that zone likely represent opportunity rather than weakness.

DeGRAM | SOLUSD Held the $145 level📊 Technical Analysis

● SOL broke above the long-term descending resistance near $130 and held it on a retest, confirming a bullish reversal.

● A consolidative range between $145 support and $154 supply has formed; a decisive break above $154 targets the rising-channel top near $160.

💡 Fundamental Analysis

● SOL staking volume recently surpassed Ethereum’s, underlining robust on-chain yield demand.

● DeFi Development Corp filed to offer $1 billion in securities to boost SOL holdings, signaling institutional accumulation.

✨ Summary

Resistance-turned-support at $145, strong staking growth, and corporate demand support a short-term long bias: targets $154 → $160; invalidation below $140.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | SOLUSD Testing the Demand Zone📊 Technical Analysis

Support and Uptrend

SOL/USDT has formed higher lows along the uptrend line and is now testing the $120-125 support area.

Resistance area

Key resistance is at $135; a breakout could trigger an acceleration of the upside.

Outlook Scenario

Price may retest the $135 level in the near term, with bullish momentum strengthening.

💡 Fundamental Analysis

Solana is gaining momentum thanks to growing DeFi volume and high developer activity, which boosts investor confidence.

✨ Summary

Technical and fundamental signals coincide - watch $135 for breakout confirmation.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Solana/USD About to Moon?Solana has held the Fibonacci golden pocket as support, and has now broken the corrective trendline, confirming the bull market. We’re looking for price to have a continued upside, targeting the 27% fibonacci extension at the price of USD 235. Our idea would be no longer valid if price breaks below the fibo golden pocket and trades through the $165 mark.