Structuretrading

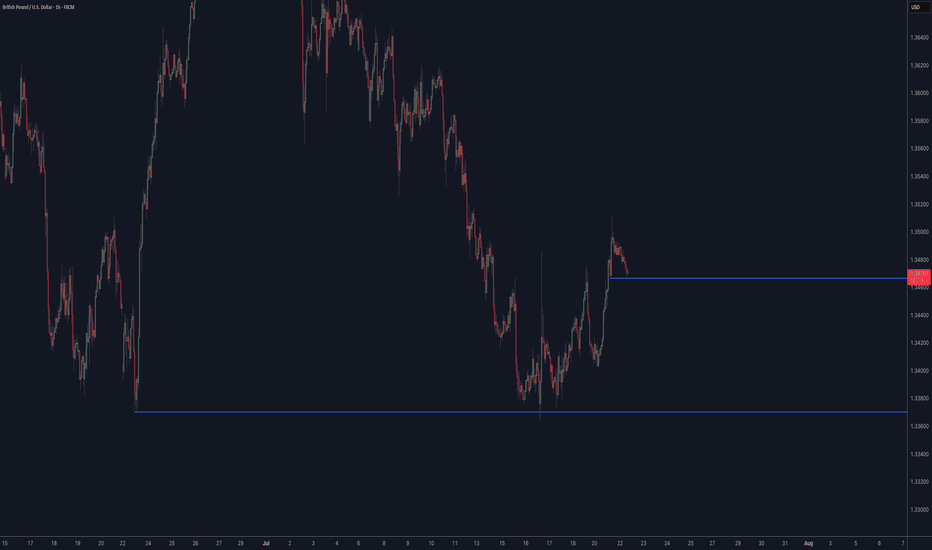

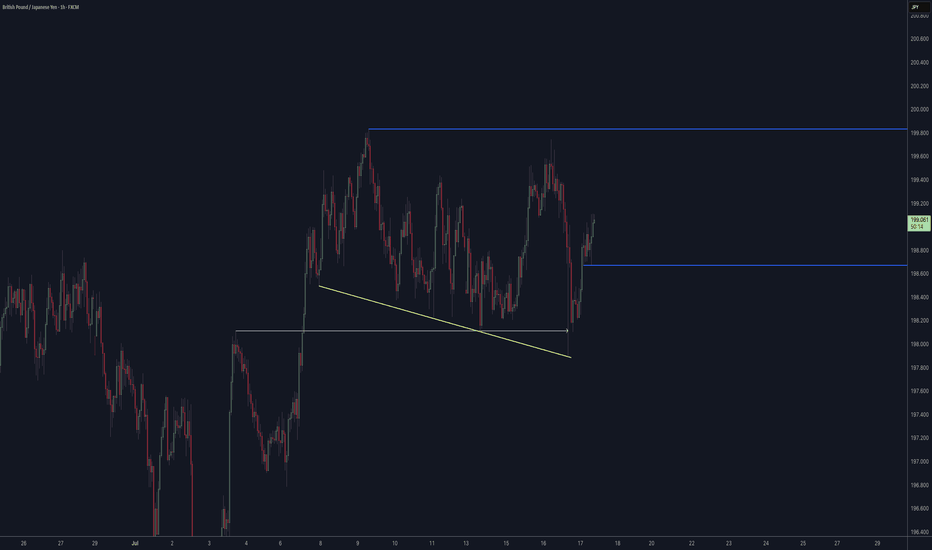

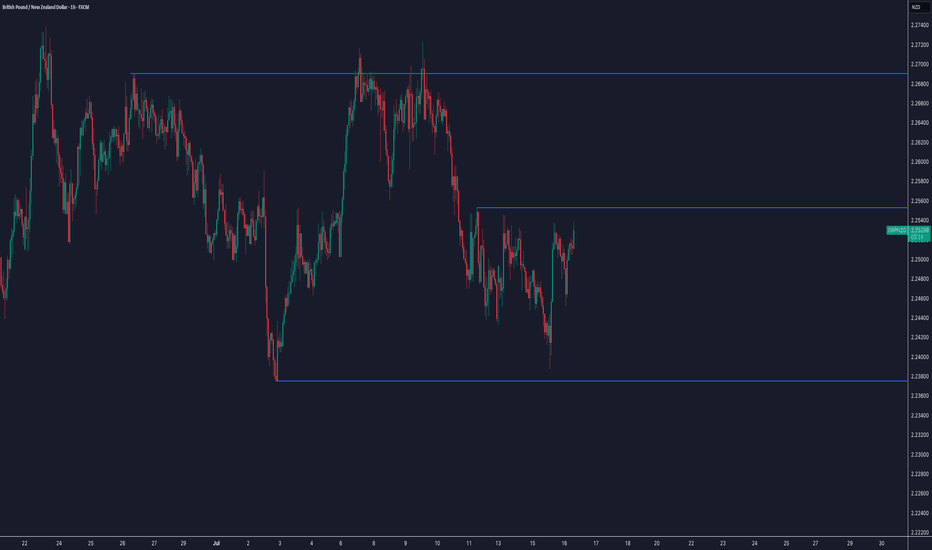

GBPUSD - GBPJPY - USDJPY Trade Recaps 28.07.25Three positions taken last week. Some vital findings within my self-review process which showed a stop loss error with GBJPY causing me to miss a solid 4% trade, and a manual close on GBPUSD to bank a little extra profit.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

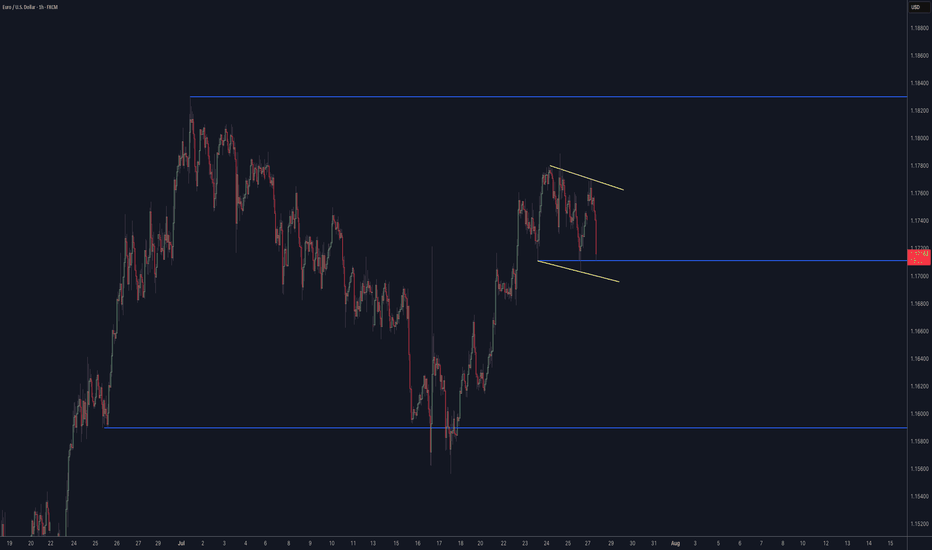

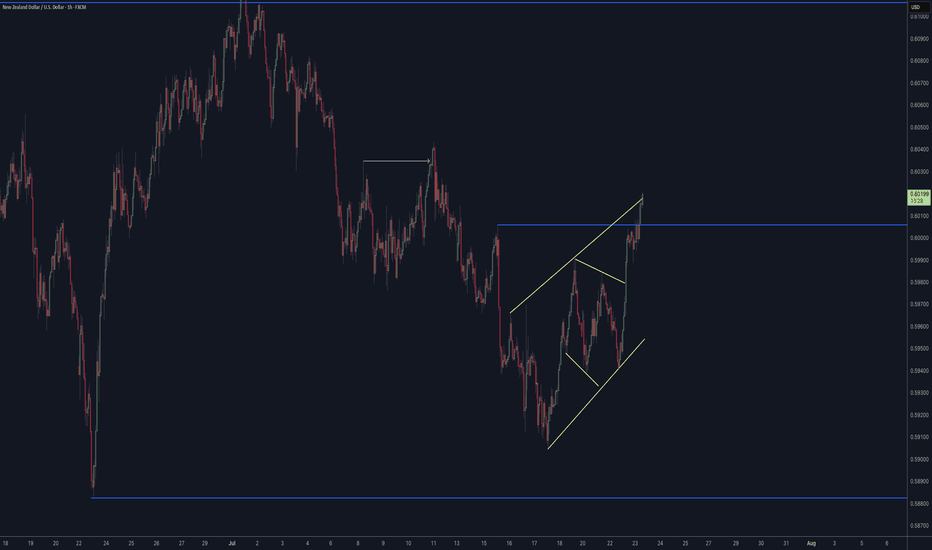

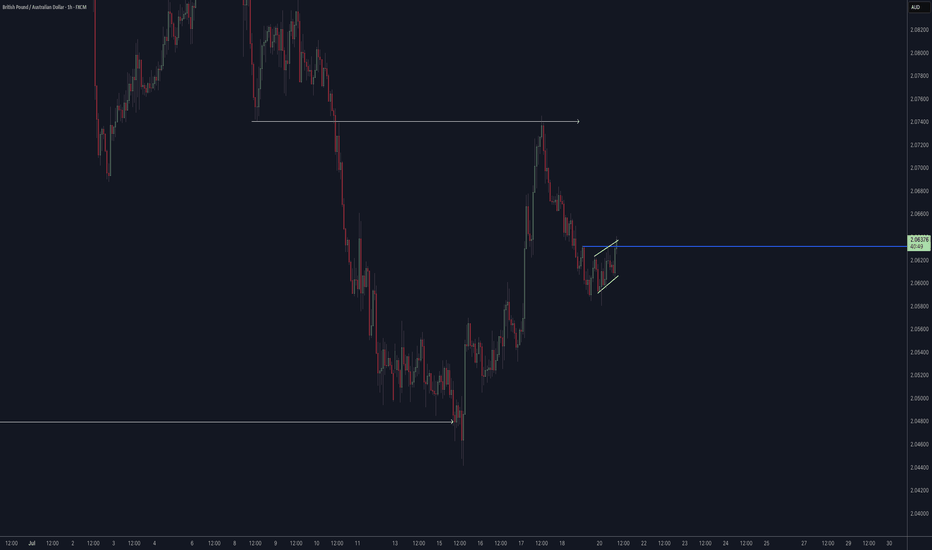

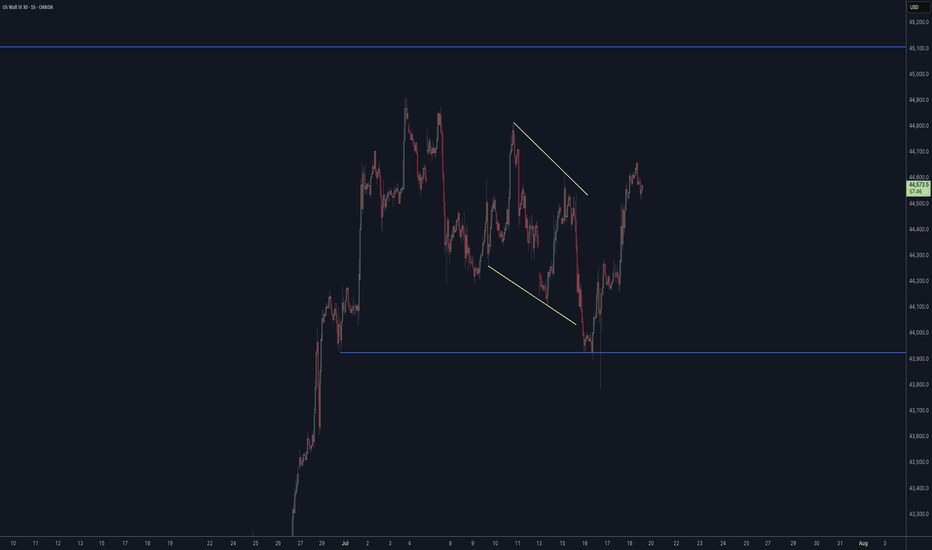

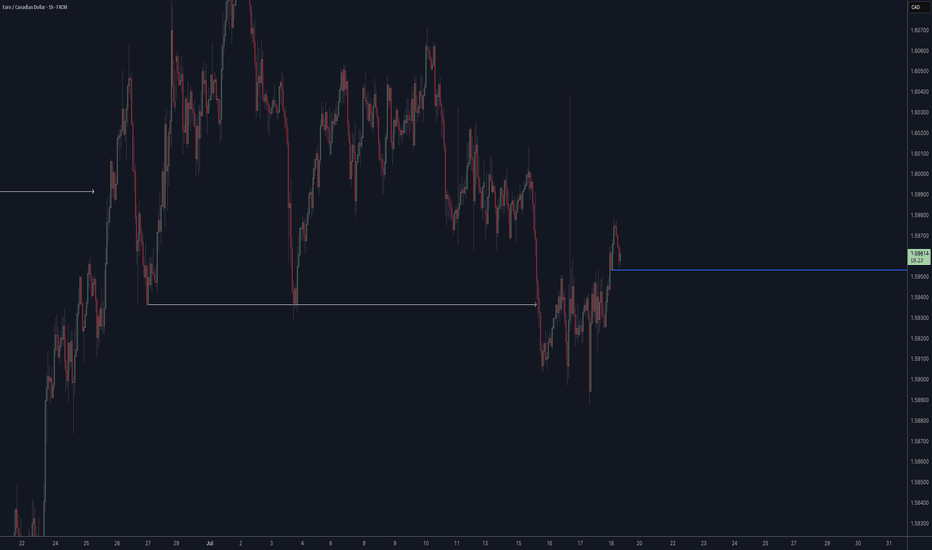

EURUSD & US30 Trade Recaps 18.07.25A long position taken on FX:EURUSD for a breakeven, slightly higher in risk due to the reasons explained in the breakdown. Followed by a long on OANDA:US30USD that resulted in a loss due to the volatility spike that came in from Trump.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

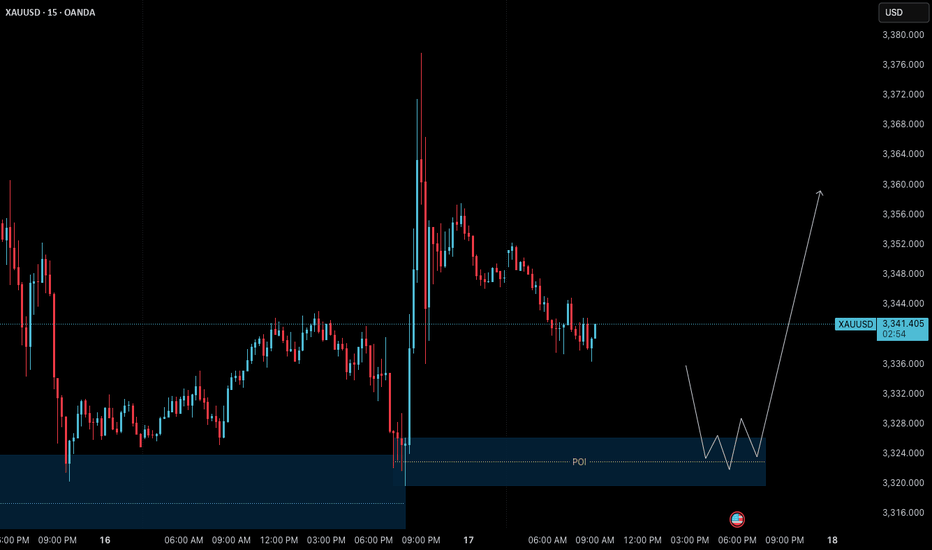

Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play🟢 Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play

Gold continues to follow the bullish structure we’ve been tracking in our recent posts. Yesterday's news-driven price action pushed the market to a new swing high near 3377.600 , confirming strength in higher timeframes. Now, price is currently in a retracement/pullback phase , pulling back toward a key intraday demand zone at 3326–3320 — offering potential opportunity for the next leg upward.

🔍 Where Are We Now?

The market is currently pulling back toward a key M15 demand zone: 3326–3320 . This level also aligns with a higher timeframe order block on the H4, making it a critical confluence area for structure-based traders.

This 3326–3320 zone is crucial because:

→ It’s a fresh M15 demand zone inside a higher timeframe bullish structure

→ It aligns with the H4 OB that previously acted as a launchpad

→ The overall trend remains bullish unless this zone is decisively broken

If the zone holds and we get LTF confirmation (such as M1 internal structure shift + micro-BoS), it may present a high-probability long setup.

⚙️ Structure Summary:

✅ H4: Bullish continuation structure with recent higher high

✅ M15: Pullback within bullish order flow

✅ M1 (for entry): Awaiting ChoCH + BoS as entry trigger inside POI

📌 Trade Setup Plan (upon confirmation):

→ Entry: From 3326–3320 demand zone

→ Stop Loss: 40 pips below entry

→ Take Profit: 120 pips (targeting new HH based on H4 projection)

→ Risk-to-Reward Ratio: 1:3

🧠 Key Trading Insight:

We never predict — we prepare .

We don’t chase price — we position with confirmation .

Discipline means waiting for price to invite us in , not entering just because a level looks attractive.

📈 Summary & Expectations:

➡️ Price is retracing into a structurally significant demand zone

➡️ Market bias remains bullish unless this zone fails

➡️ If the zone holds with valid M1 confirmation, we’ll consider a long setup targeting a new high

➡️ No confirmation = no trade. Patience > prediction.

📘 Shared by @ChartIsMirror

This analysis is part of our ongoing structure-based approach to trading Gold. All entries are derived from pure price action, multi-timeframe structure alignment, and trader discipline — as taught in our book:

“The Chart Is the Mirror: Mastering Gold with Structure, Stillness, and Price Action”

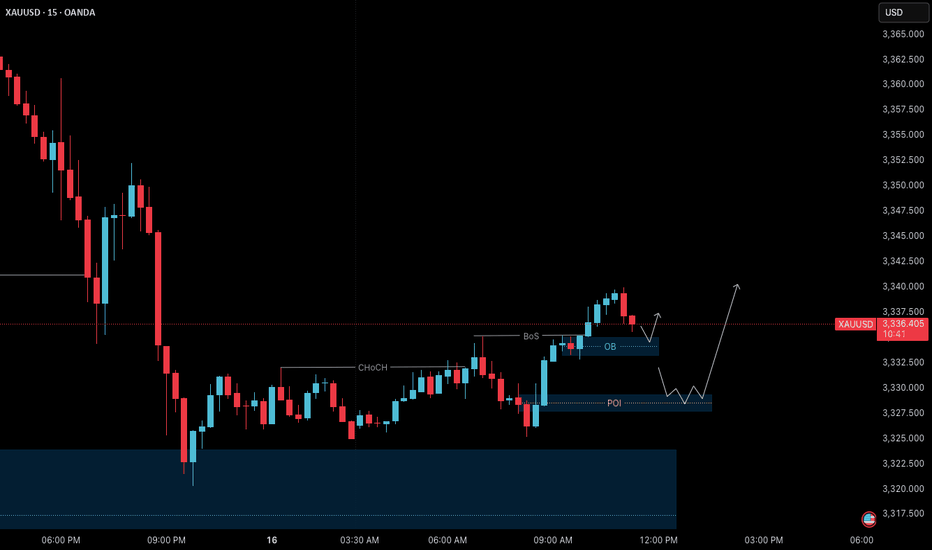

Gold – Bullish Structure Confirmed | July 16 Outlook🟢 Gold (XAUUSD) – July 16 Analysis | Uptrend Resumed After H4 OB Test

As outlined in our previous post — Gold – H4 Structure at Key Decision Point | July 14 Outlook , price has now tested the H4 order block near 3320, which we marked as a high-probability reversal zone.

Following this, the market has shown clear signs of strength — with both internal structure shift and a Break of Structure (BoS) on M15, confirming that the uptrend has resumed.

🔍 Structure Alignment:

✅ H4: Bullish continuation after OB test

✅ M15: ChoCH + BoS → confirms trend alignment with H4

📌 Key Intraday Levels to Watch:

🟩 3335–3333 (M15 Order Block & Breaker Level):

→ A short-term OB just before our main POI

→ If price respects this zone with LTF confirmation (M1 Micro-ChoCH + BoS), we may plan an early long entry

🟩 3327.7–3329.4 (Main M15 POI Zone):

→ High-probability continuation zone

→ On retest + LTF confirmation → plan for long setup

📈 Trade Plan:

→ Watch 3335–3333 OB first

→ If respected with M1 confirmation, early entry is valid

→ If that zone fails, wait for price to revisit 3327–3329 POI

→ Same confirmation rules apply

In both cases, target new HH, in line with current trend momentum

📖 When price respects structure and confirms behavior, don’t second-guess — follow the process.

📘 Shared by @ChartIsMirror

Gold – M15 Downtrend in Play | July 15 Analysis🔻 Gold (XAUUSD) – July 15 Analysis | Bearish Bias Until Proven Otherwise

The market has entered a pullback phase on H4, and we’re expecting a potential retest of the 3320 Order Block before any continuation of the broader uptrend resumes.

🔍 M15 Market Structure:

✅ ChoCH followed by BoS confirms a downtrend on M15

🎯 Current short-term objective: Retest of H4 OB (3320)

📍 Price Action Context:

Price is now revisiting the same M15 POI where yesterday’s short setup originated.

Last session, this POI was respected, but instead of creating a new Lower Low, price is trading inside the same zone again.

This signals indecision — so we let price reveal its intent

🧭 Trade Planning Scenarios:

Scenario 1 – Bearish Continuation:

→ If the POI is respected again with clear M1 confirmation ( Micro-ChoCH + BoS ), we will plan for a short setup toward 3320

Scenario 2 – POI Breaks:

→ If price breaks above this POI zone, the next key level to observe is the 3355–3359 supply zone

→ We’ll reassess from there based on new confirmation

📌 Bias for Today:

🔻 Bearish bias remains intact as long as M15 structure does not shift back to bullish.

All setups must align with structure — we are short-biased only until the market proves otherwise

📖 Structure before emotion. Let the market invite you — not the other way around.

📘 Shared by @ChartIsMirror

Gold – H4 Structure at Key Decision Point | July 14 Outlook🟡 Gold (XAUUSD) – July 14 Outlook | Key Reaction Ahead at 3366

Gold closed Friday at 3355.665 , after facing resistance from the H4 swing high (3366) .

While price failed to break that level during the session, the last H4 candle closed as a bullish spinning top , signaling indecision — but with slight bullish pressure.

As we head into Monday’s open, the next move could be pivotal in determining the direction of the upcoming H4 trend leg.

🔮 Key Scenarios to Watch

1️⃣ Bullish Scenario (Preferred Bias):

If the market opens above 3366 , creating a clean Break of Structure (BoS) , it would confirm the continuation of the H4 uptrend.

→ In this case, we will watch for a retest of the 3320 Order Block (OB) — a potential long setup zone.

→ If price gives another BoS after the first, it may also present a continuation entry opportunity, depending on structure.

2️⃣ Rejection / Bearish Case:

If the market fails to break 3366 , we’ll step back and observe how M15 reacts.

→ Consolidation could follow before any significant BoS.

→ In this scenario, patience is key — we’ll wait for either confirmation of a deeper pullback or a structure shift on lower timeframes.

3️⃣ Consolidation Possibility:

There’s also a strong possibility that price consolidates between the H4 swing high (3366) and the 3320 OB before making a structural decision.

→ A tight range can trap both buyers and sellers — so it’s crucial not to act prematurely.

🧭 Trade Bias Summary

✅ If BoS (above 3366):

→ Bullish bias confirmed

→ Look for long on OB retest (e.g., 3320 zone) or next M15 structure break

⚠️ If No BoS:

→ Step back, observe M15

→ Wait for structure clarity before forming bias

🔁 If Range Forms (3366–3320):

→ Stay out until market resolves direction

→ Let breakout + retest guide the next setup

🧠 Final Thoughts

This analysis is shared for educational and structural observation purposes only — not as trade advice or recommendation.

The goal is to track price behavior around key zones and adapt based on how structure confirms or invalidates bias.

📖 Let the market reveal its intention — not with emotion, but through structure.

We don’t predict the breakout — we prepare for both outcomes.

📘 Shared by @ChartIsMirror

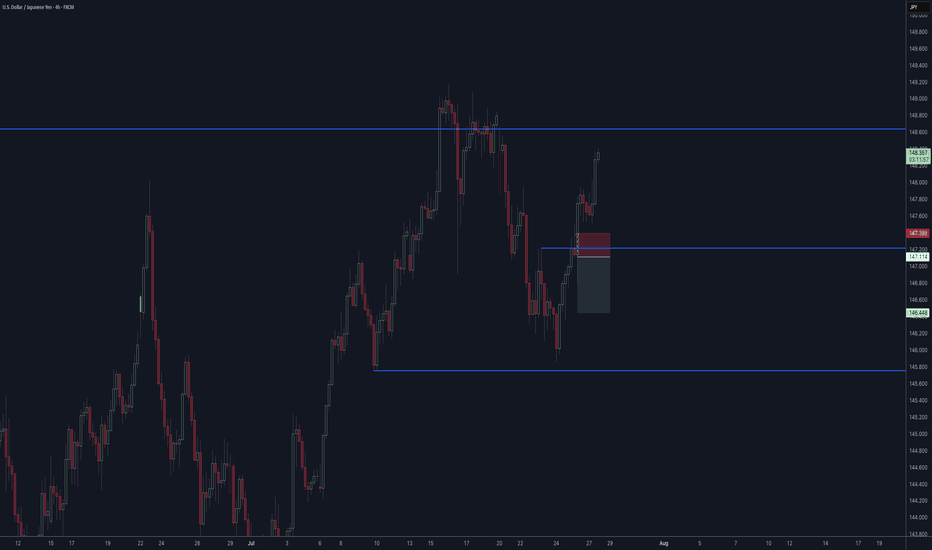

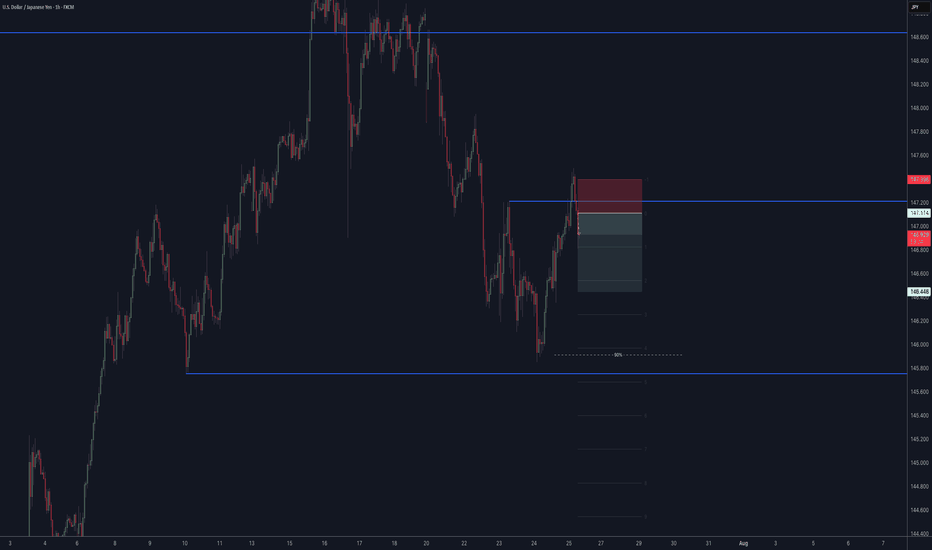

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇

Gold – July 11 | H4 & M15 Aligned, Higher Highs in Sight🟡 Gold – Higher Highs in Sight | July 11 Analysis

As outlined in our July 10 analysis

( Gold – H4 OB Held, BoS Confirmed ),

price retested the 3313–3310.5 POI and continued upward in alignment with the broader bullish structure.

Gold is now trading around 3330–3335 , and both H4 and M15 remain in clear uptrends — forming a consistent sequence of higher highs and higher lows .

This post is intended purely for educational and structural observation —

not as trading advice or encouragement to enter trades.

Please use your own strategy, confirmation methods, and risk assessment before taking any action.

🔄 Structure Alignment

✅ H4: Bullish continuation

✅ M15: Trend aligned, forming HH–HL structure

🟢 Bias: Long-only setups (based on structure)

🔍 Key Supply & POI Zones

📌 3345–3346:

→ Strong supply zone

→ If price breaks above, we expect a new higher high

📍 If retracement occurs before breaking 3346:

→ Watch 3319.5–3321.5 (M15 POI)

→ Valid only if respected with M1 confirmation (ChoCh + BoS)

🎯 Trade Plan (Educational Observation)

🛑 No shorts — structure does not support counter-trading

🕒 Monitor: For price to revisit the 3319.5–3321.5 zone

✅ If respected + M1 confirms → structure favors long

🎯 Target: Move above 3346 , continuing the bullish sequence

🧠 Final Thoughts

Price structure remains in strong alignment — but the key is confirmation, not prediction.

Wait, observe, and only act within your own defined process.

📖 Trade the structure, not the emotion.

When the trend aligns, hesitation costs more than waiting.

📘 Shared by @ChartIsMirror

Gold – July 10 | H4 OB Held, BoS Confirmed, Watching 3310🟡 Gold (XAUUSD) – July 10 Analysis | H4 Pullback Over, M15 Aligned for Bullish Continuation

The H4 order block around 3280 (3288–3275) was tested, and the market responded strongly — just as anticipated .

Following that, M15 structure gave a clear ChoCh + BoS , signaling that the H4 pullback is now complete .

The market has likely resumed its bullish continuation trend.

🔁 Current Market Structure

✅ H4 Trend: Resumed upward after OB reaction

✅ M15 Trend: Now aligned with H4 (ChoCh + BoS confirmed)

Bias: Bullish

→ We are only looking for long setups , in sync with both timeframes

📍 Key Levels to Watch

1️⃣ 3322–3326 → M15 OB zone

→ Currently acting as rejection zone

→ Already reacted — price is pulling back

2️⃣ 3313–3310.5 → Next potential M15 POI

→ If respected with M1 confirmation (ChoCh + BoS), long setups become valid

🎯 Target: 3345

→ Based on structure projection and intraday range

📌 If 3313–3310.5 fails:

→ Watch next zone at 3296–3298 for fresh demand/support

🧭 Execution Plan

• Wait for price to enter 3313–3310.5 zone

• Look for M1 confirmation (ChoCh + BoS)

• If confirmed:

→ Enter long

→ Target = +120 pips (as per fixed RR model)

→ SL based on M1 structure

• If zone breaks:

→ Reassess near 3296–3298

🧠 Final Thoughts

The H4 pullback is over — structure confirms bullish continuation

M15 is aligned — we now prepare , not predict

Wait for the chart to call you in — not your bias.

📖 We don’t predict reversal — we confirm structure.

We don’t chase price — we prepare for it.

📘 Shared by @ChartIsMirror