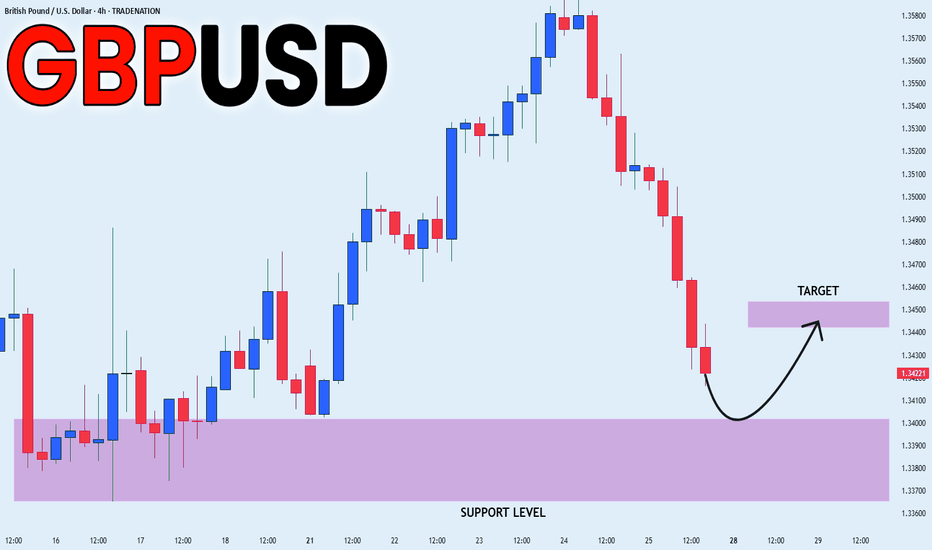

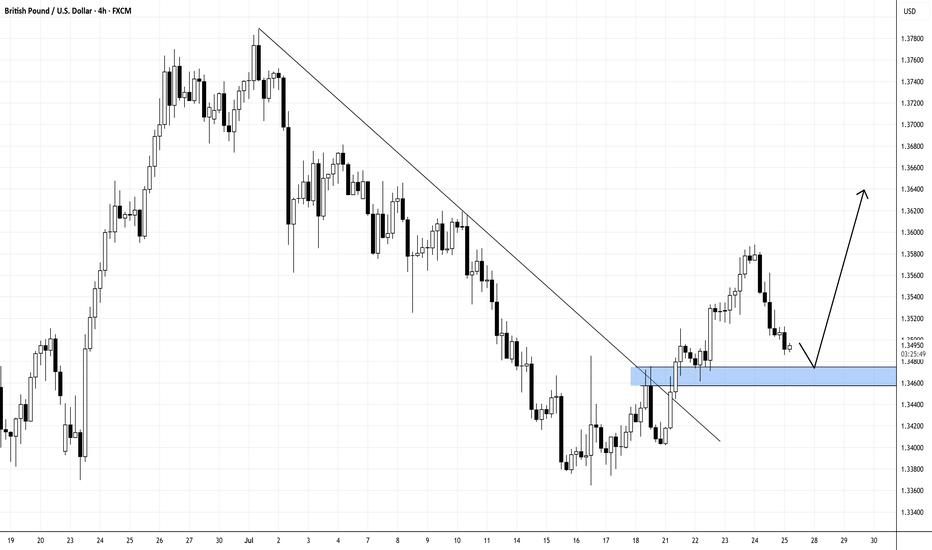

GBP_USD LONG FROM SUPPORT|

✅GBP_USD has been falling recently

And the pair seems locally oversold

So as the pair is approaching

A horizontal support of 1.3399

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trend Analysis

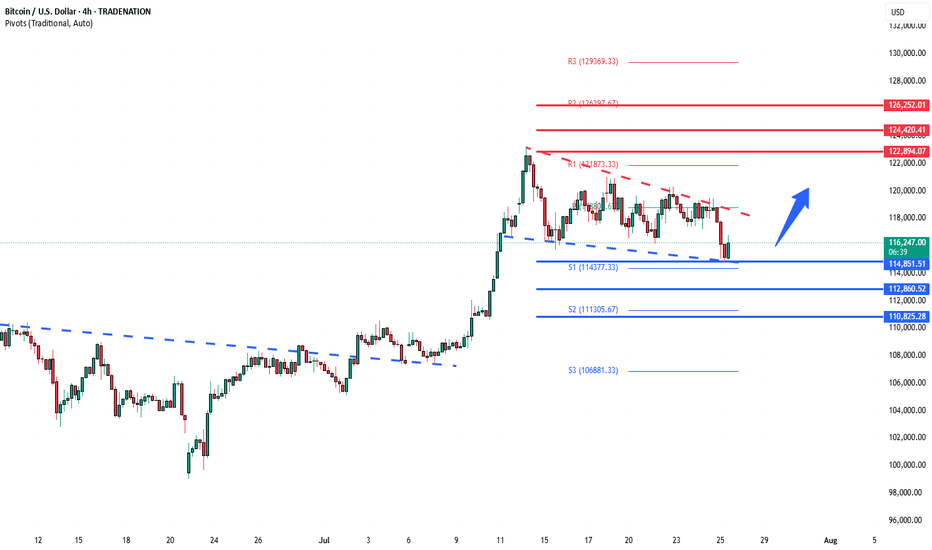

BTCUSD support retest at 114,850 The BTCUSD remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 114,850 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 114,850 would confirm ongoing upside momentum, with potential targets at:

122,900 – initial resistance

124,420 – psychological and structural level

126,250 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 114,850 would weaken the bullish outlook and suggest deeper downside risk toward:

112,860 – minor support

110,825 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the BTCUSD holds above 114,850. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

SAHARA/USDT - 2nd buy setup has already delivered a strong +100% move from the initial buy setup. Currently, the price is retesting the previous resistance level, which is now flipping into a strong base support — a classic bullish retest. This zone also acted as the breakout point for the recent parabolic leg, indicating strong interest from buyers. A green box has been marked for the next potential entry, anticipating the continuation of the bullish trend. If the support holds, the next leg could lead to another explosive move upward.

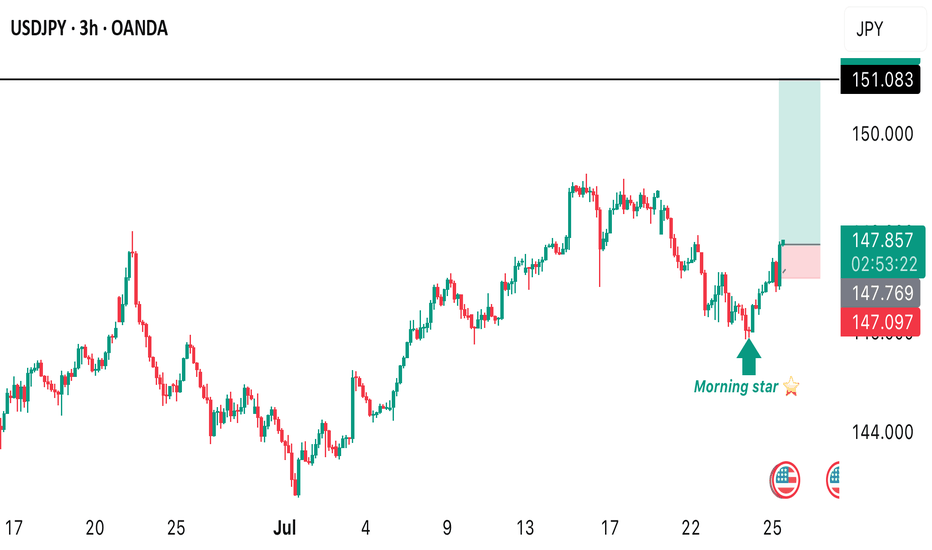

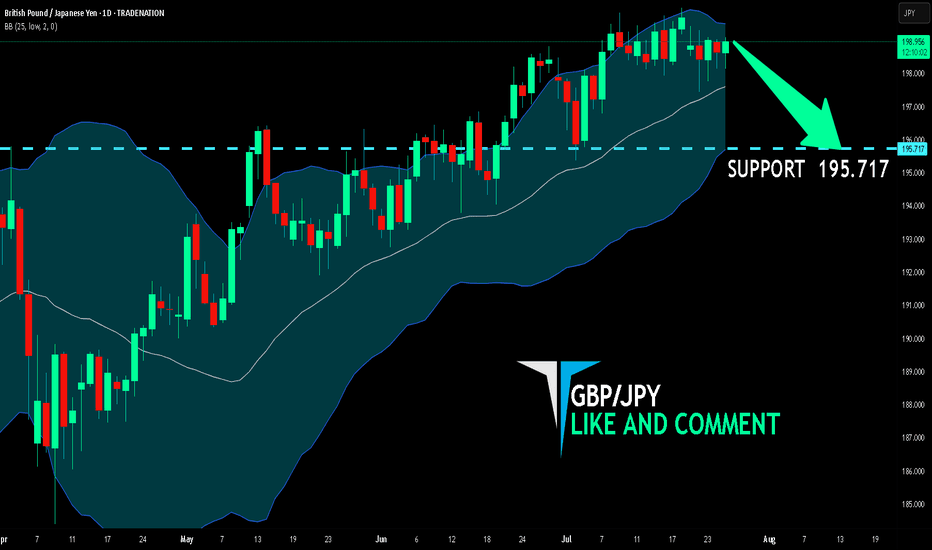

GBP/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

GBP/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 1D timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 195.717 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Cup & HANDLE + Mini Double Bottom: $TSLA to $610 ScenarioI maintain a bullish stance on Tesla ( NASDAQ:TSLA ), supported by a compelling combination of technical patterns and strong fundamental drivers. The current chart setup reveals a Cup and Handle formation complemented by a Mini Double Bottom, both of which are classic bullish continuation patterns. These suggest a potential breakout scenario that could drive NASDAQ:TSLA to $610 by year-end.

Technical Roadmap:

Gap Fill to $408: Anticipated earnings momentum, particularly from the Robotaxi segment, is likely to propel the stock to fill the previous gap at $408.

Consolidation at $450: Following the gap fill, I expect a consolidation phase forming a “box” around the $450 level.

Breakout to $610: A decisive breakout above $450 could trigger a strong rally toward the $610 target.

***Current Key Catalysts Supporting the Bullish Thesis:

Robotaxi Expansion: Tesla’s autonomous driving initiative is gaining traction, with Robotaxi developments expected to significantly boost revenue and margins.

India Market Entry: Tesla’s upcoming launch in India opens access to one of the world’s largest and fastest-growing EV markets.

In-House Chip Development & Dojo 2 Expansion: Continued investment in AI infrastructure and custom silicon enhances Tesla’s competitive edge in autonomy and robotics.

Tesla Diner Launch: The near-completion of Tesla’s themed diner adds to brand visibility and customer engagement.

Global EV Adoption: Tesla continues to benefit from rising EV demand across multiple international markets.

Optimus Robot Hype: Growing interest in Tesla’s humanoid robot project could unlock new revenue streams and investor enthusiasm.

Favorable Macro Trends: A declining interest rate environment supports higher valuations for growth stocks like Tesla.

Institutional Accumulation: Recent trading activity suggests that institutional investors are accumulating shares within the current range.

Grok AI Integration: The integration of Grok AI into Tesla vehicles could enhance user experience and differentiate Tesla’s infotainment ecosystem.

Investment Strategy:

I recommend initiating or increasing exposure to NASDAQ:TSLL (leveraged Tesla ETF) ahead of the upcoming earnings report. This could offer amplified returns if the bullish scenario plays out. Consider accumulating further on any dips, particularly during the consolidation phase around $450.

BUY NOW NASDAQ:TSLA NASDAQ:TSLL

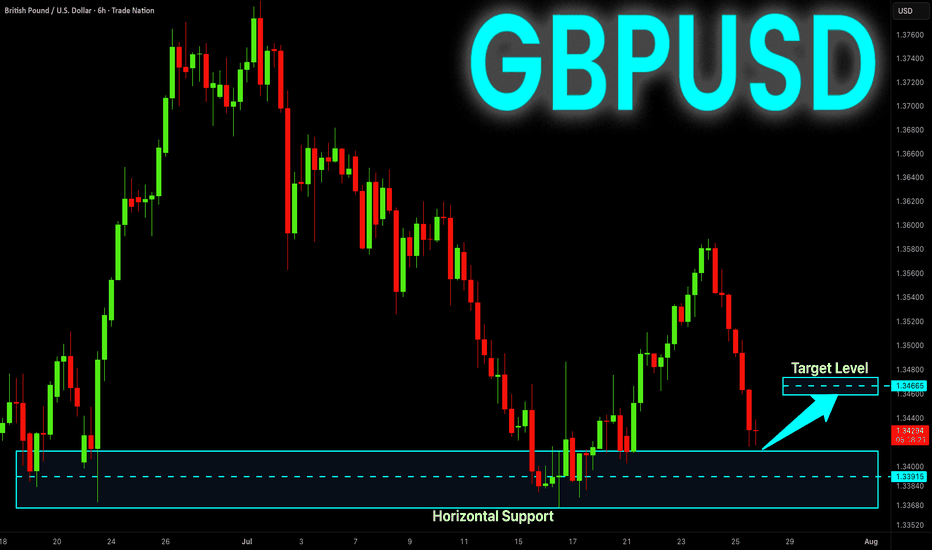

GBP-USD Support Ahead! Buy!

Hello,Traders!

GBP-USD went down but

The pair will soon hit a

Horizontal support level

Of 1.3400 from where we

Will be expecting a local

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

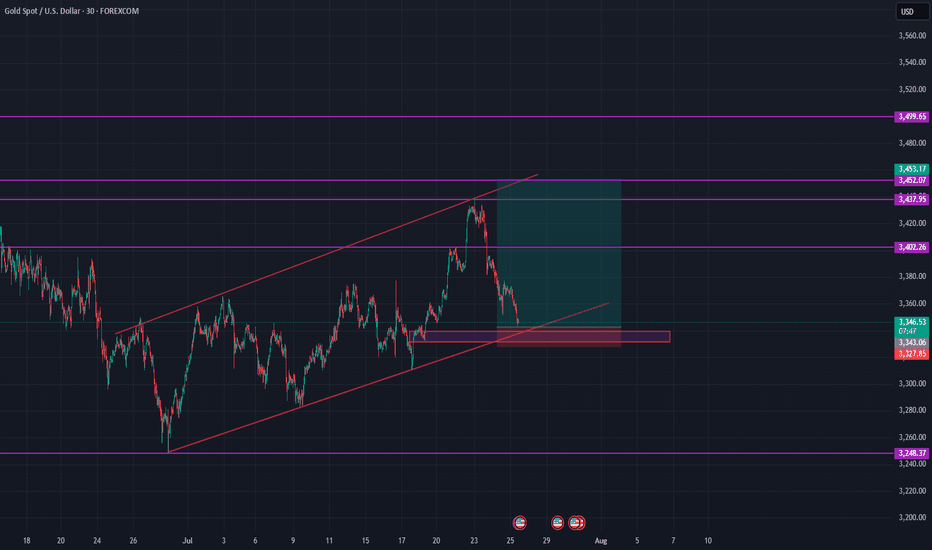

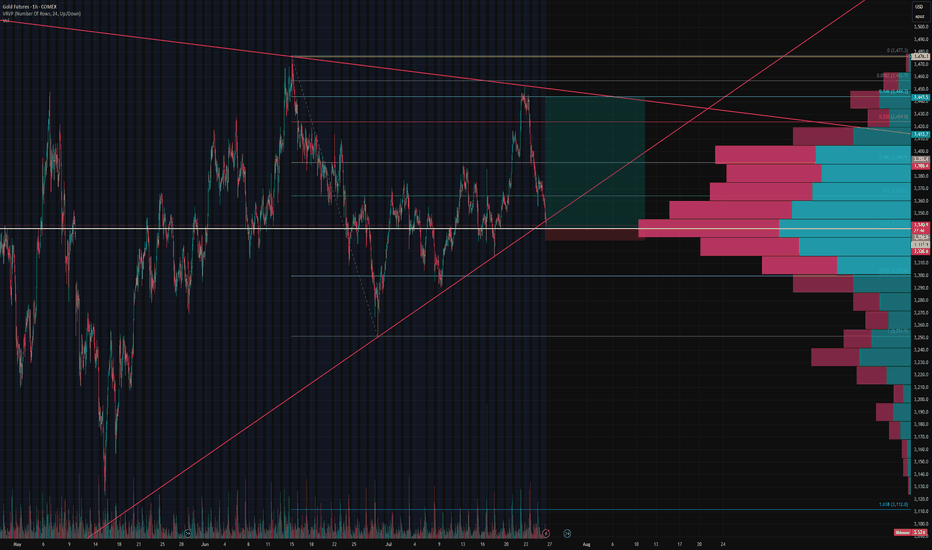

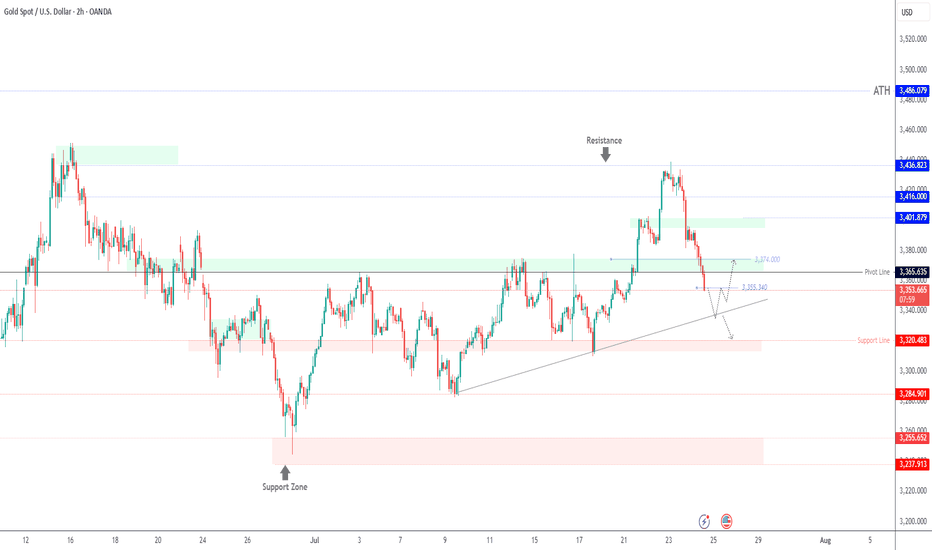

Gold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 ConfluenceGold Futures Update – 0.5 Fib Stop Hit, Eyes on 0.618 Confluence

Our initial long setup at the 0.5 Fibonacci retracement level has been stopped out, but the structure remains constructive.

Price is now approaching a key confluence zone at $3,336 , where:

The 0.618 fib retracement from the recent swing low to high aligns perfectly,

The ascending trendline support (respected multiple times since May) intersects, and

The oint of Control (POC) from the visible volume profile shows dominant volume transacted.

This area represents a high-probability support level where bulls may attempt to defend again. We’re monitoring for reaction and potential entry signals around this level. A break below would invalidate the rising wedge structure and shift bias toward lower fib extensions.

Pending Orders Are Not Set in Stone – Context Still MattersIn a previous educational article, I explained why I almost never trade breakouts on Gold.

Too many fakeouts. Too many emotional traps.

Instead, I stick to what works:

• ✅ Buying dips

• ✅ Selling rallies

But even these entries — placed with pending orders — are not automatic.

Because in real trading, price is not just a number — it’s a narrative.

And if the story changes, so should the trade.

________________________________________

🎯 The Setup – Buy the Dip Around 3400

Let’s take a real example from yesterday.

In my analysis, I mentioned I would look to buy dips near 3400, a former resistance now acting as support.

Price dropped to 3405, just a few points above my pending buy at 3402.

We saw a clean initial bounce — confirming that short-term support was real.

But I missed the entry by 30 pips.

So far, so good.

But here’s the important part — what happened next changed everything.

________________________________________

🧠 The Rejection Shifted the Entire Story

The bounce from 3405 was immediately sold into at 3420, a newly formed short-term resistance (clearly visible on the 15-minute posted chart).

After that, price started falling again — heading back toward my pending order.

📌 At that point, I cancelled the order. Why?

Because the context had changed:

• Bulls had tried once — and failed at 3420

• Sellers were clearly active and waiting above

• A second drop into my level wouldn’t be a clean dip — it would be retest under pressure.

The market was no longer giving me a “buy the dip” setup.

It was showing me a failed recovery. That’s a very different trade.

________________________________________

💡 What If It Had Triggered?

Let’s imagine that price had hit 3402 first, triggering my order.

Then rebounded, failed at 3420, and started dropping again.

Even then, I wouldn’t hold blindly.

Once I saw the rejection at 3420, I would have understood:

The structure had shifted.

The bullish case is weakening.

Exit early — breakeven or small controlled loss.

________________________________________

🔁 Sequence > Level

This is the most important principle:

• ✅ First down, then up = healthy dip → shows buyers are still in control

• ❌ First up, then down = failed breakout → shows selling pressure is stronger

Two scenarios. Same price. Opposite meaning.

That’s why you should look for:

Not just where price goes — but how it gets there.

________________________________________

🔒 Pending Orders Are Conditional

Many traders treat pending orders like traps:

“Just let price come to my level, and I’m in.”, but you should refine a little

✅ Pending orders should be based on a conditional expectation

❌ Not a fixed belief that the zone must hold

If the market tells a different story, remove the order.

No ego. No drama. Just process.

________________________________________

📌 Final Thought

Trading isn’t just about catching a price.

It’s about understanding price behavior.

First down, then up = strength.

First up, then down = weakness.

Let the market show its hand — then decide if you want to play.

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

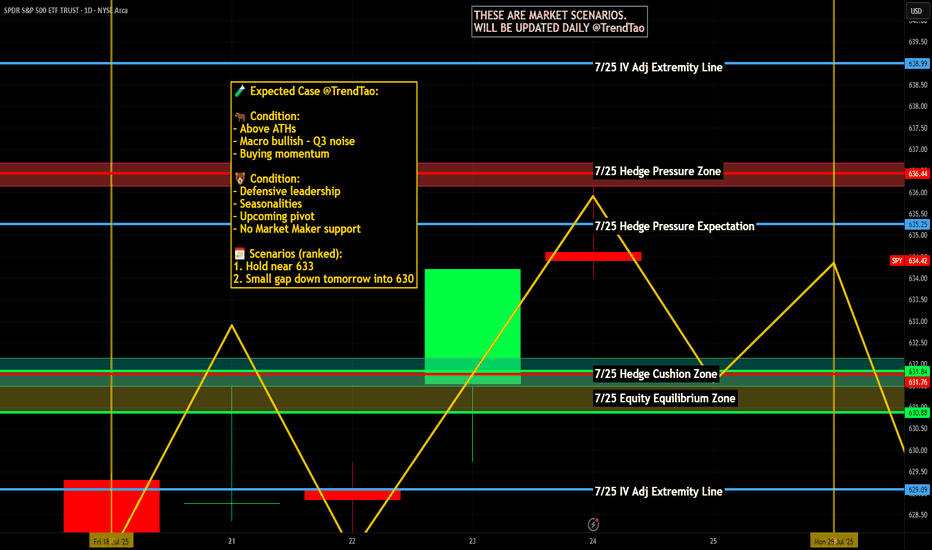

Nightly $SPY / $SPX Scenarios for July 25, 2025🔮 Nightly AMEX:SPY / CBOE:SPX Scenarios for July 25, 2025 🔮

🌍 Market‑Moving News 🌍

🏔️ Copper Market Flashpoint

Following President Trump’s announcement of steep copper tariffs (15–50% range), U.S. copper futures surged, then sharply reversed. Inventory arbitrage between CME and LME markets surged, distorting pricing dynamics and triggering concern over metal market stability.

🇪🇺 EU–China Summit Signals Trade Reset

EU leaders concluded their 25th summit with China, fostering deeper economic and strategic ties. Observers expect follow-up on mutual trade agreements, particularly regarding tech and sustainability sectors.

🌍 EM Equity Rally Consolidates Gains

Emerging markets continue to outperform global equities in 2025—with MSCI EM up ~18% vs. S&P 500. Analysts highlight strong opportunities in AI/fintech stocks in China and Latin America, suggesting further rotations out of U.S. markets.

📊 Key Data Releases & Events 📊

📅 Friday, July 25:

8:30 AM ET – Durable Goods Orders (June):

Forecast shows a sharp drop (~–10%), following a ~16% gain in May—signaling possible cooling in business-related equipment purchases.

10:00 AM ET – U.S. Imports of Steel Products (June):

Trade-data release monitoring steel flows amid evolving tariff frameworks.

All Day – Corporate Earnings Reports:

Companies such as First Financial Bancorp (FFBC), HCA, AON, Charter, and others report earnings. Outlooks may influence small- to mid-cap sentiment.

⚠️ Disclaimer:

This report is for educational and informational purposes only—not financial advice. Always consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #data #earnings #commodities #EM #technicalanalysis

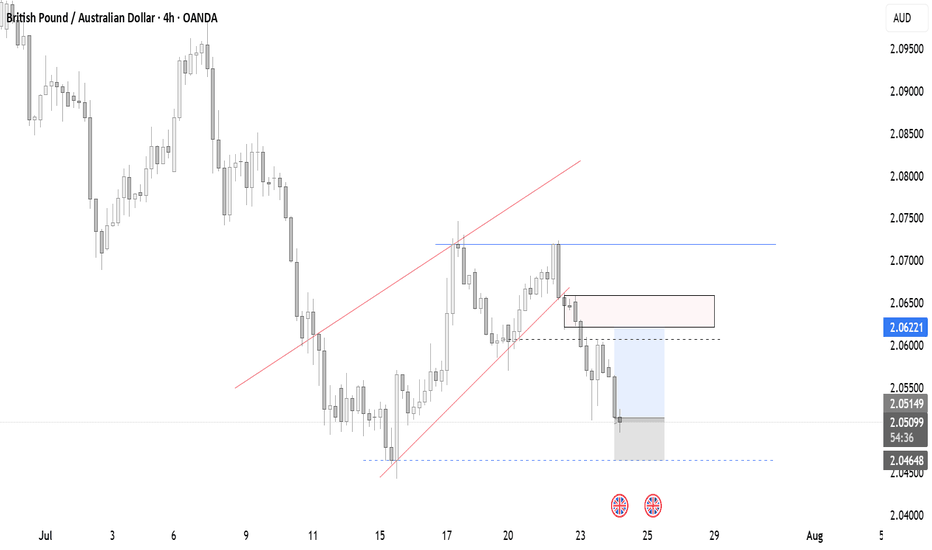

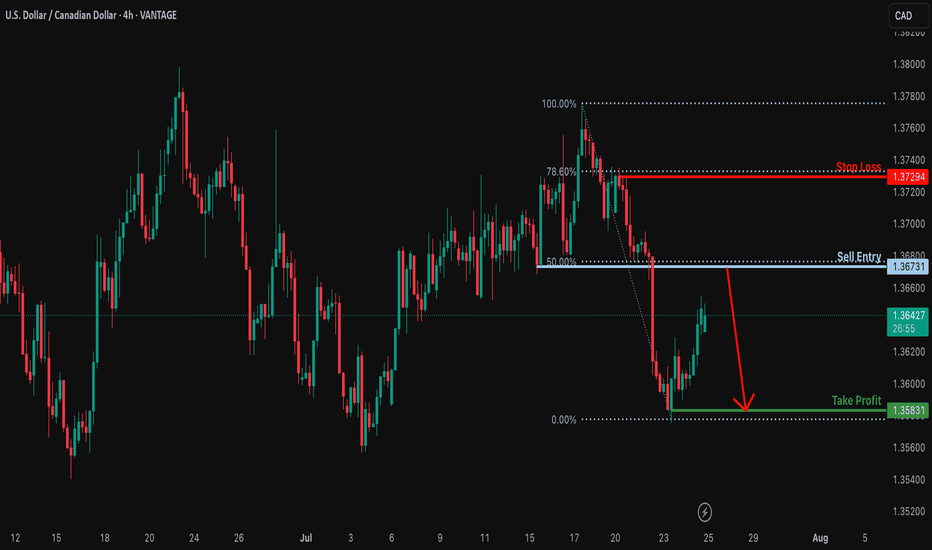

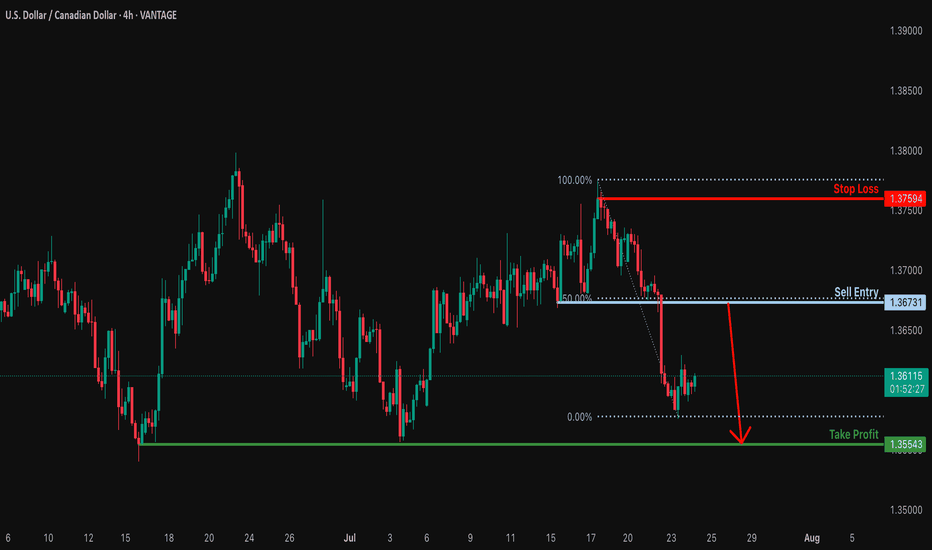

Heading into 50% Fibonacci resistance?USD/CAD is rising towards the resistance level, which serves as a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take-profit target.

Entry: 1.3673

Why we like it:

There is a pullback resistance that lines up with the 50% Fibonacci retracement.

Stop loss: 1.3729

Why we like it:

There is a pullback resistance that lines up with the 78.6% Fibonacci retracement.

Take profit: 1.3583

Why we like it:

There is a swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

GOLD Drops $60 – Bearish Bias Holds Below 3365GOLD | OVERVIEW

As expected, gold continued its bearish momentum, dropping from the 3430 level and delivering a move of approximately $60.

For today, the bearish bias remains valid as long as the price stays below 3365, with potential targets at 3337 and 3320.

However, if the price reverses and stabilizes above 3365, it could signal a shift to bullish momentum.

Key Levels:

Support: 3355 · 3337 · 3320

Resistance: 3374 · 3388

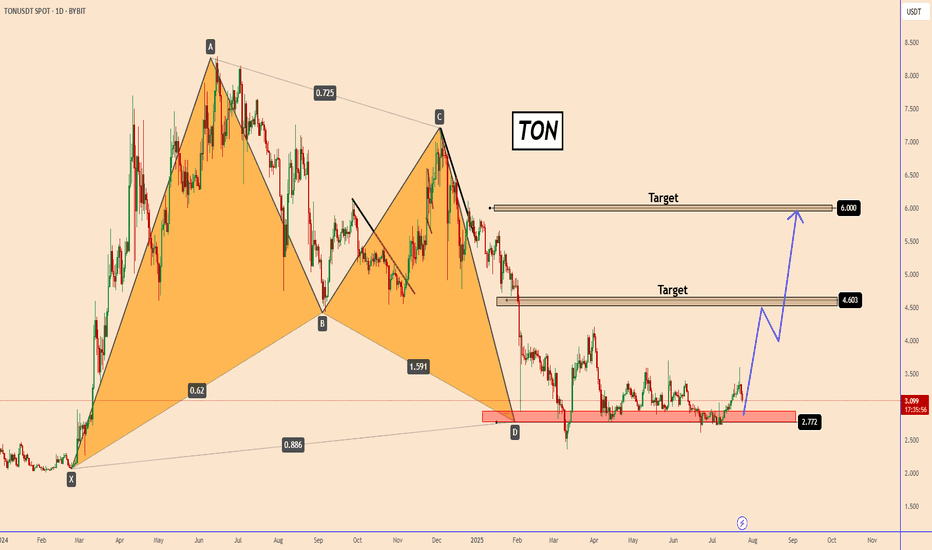

TON: The Bullish harmonic pattern could push TON back upTON: The Bullish harmonic pattern could push TON back up

On the Daily Chart, TON completed a strong harmonic upward move near 2.7500.

The price has been holding in this area since early February 2025.

It looks like this was the end and the price is rallying before making another upward move.

I am looking for two targets.

The first is near 4.60 which also corresponds to a strong structure area and the second is near 6 where the price spent a long time around this area.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

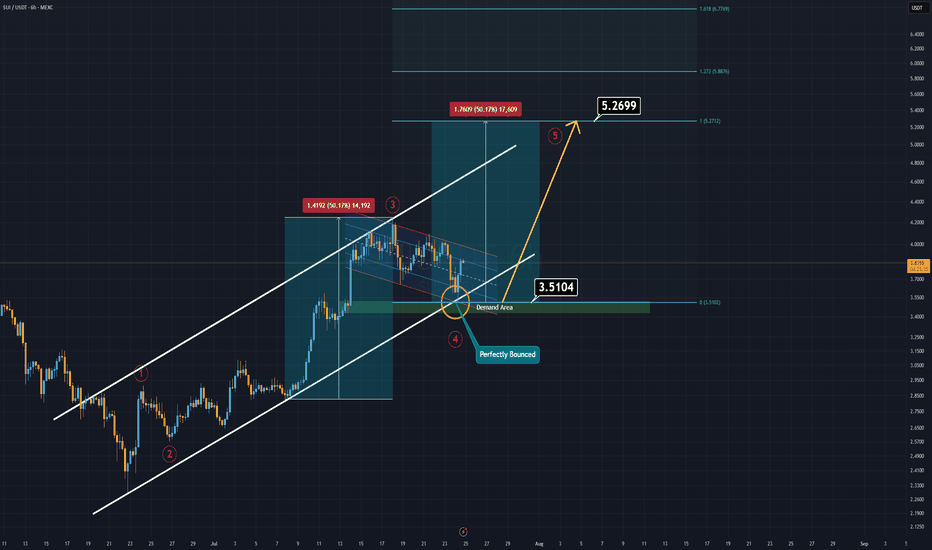

SUI Analysis (6H)If you're on the hunt for extreme risks and potentially high rewards — SUI might be calling your name.

Currently, SUI is trending within a well-respected ascending channel, and just today, it tapped both the demand zone and the lower boundary of this channel.

That’s what we call a double support, and it often signals a strong potential bounce.

SUI now appears to be forming a bullish flag pattern. If this formation breaks to the upside, it could trigger the fifth impulsive wave in line with Elliott Wave Theory.

In such a case, the main target is projected around $5.00–$5.20.

Extreme setups demand extreme conviction.

Good luck.

Heading into 50% Fibonacci resistance?USD/CAD is rising towards the resistance which is a pullback reistance that lines up with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.3673

Why we like it:

There is a pullback resistance that lines up with the 50% Fibonacci retracement.

Stop loss: 1.3759

Why we like it:

There is a swing high resistance.

Take profit: 1.3554

Why we like it:

There is a multi swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

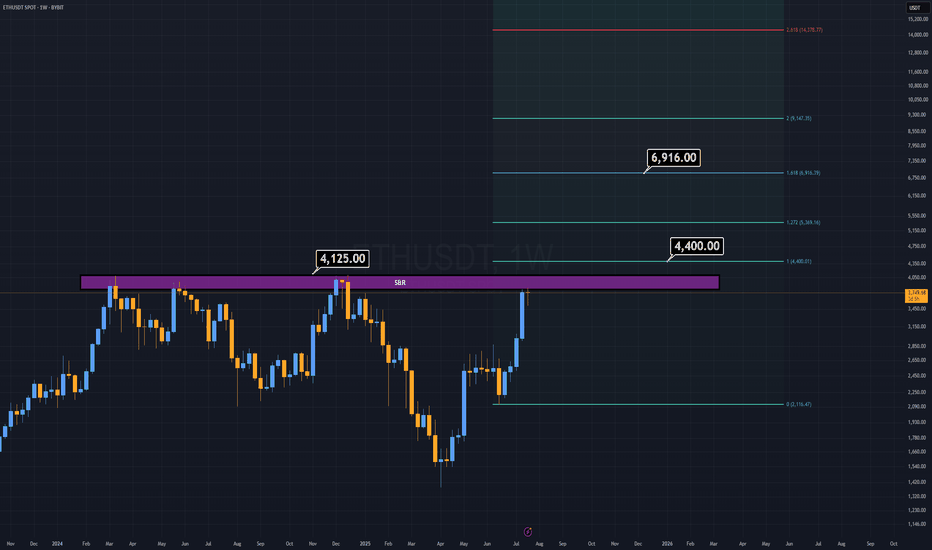

ETH Analysis (1W)Here I am, presenting the asset I personally dislike the most — ETH.

But the chart doesn’t care about feelings. ETH looks ultra bullish, but only if it breaks above the $4,125 level.

Why this level?

The $3,800–$4,100 range has historically acted as a major distribution zone — a place where market participants have consistently taken profit for years.

If this resistance is finally broken, we could see ETH rally toward $6,900 as a minimum target.

This level is based on the breakout projection of the long-standing macro structure.

Honestly, the target looks even better than the asset itself :)

Good Luck.

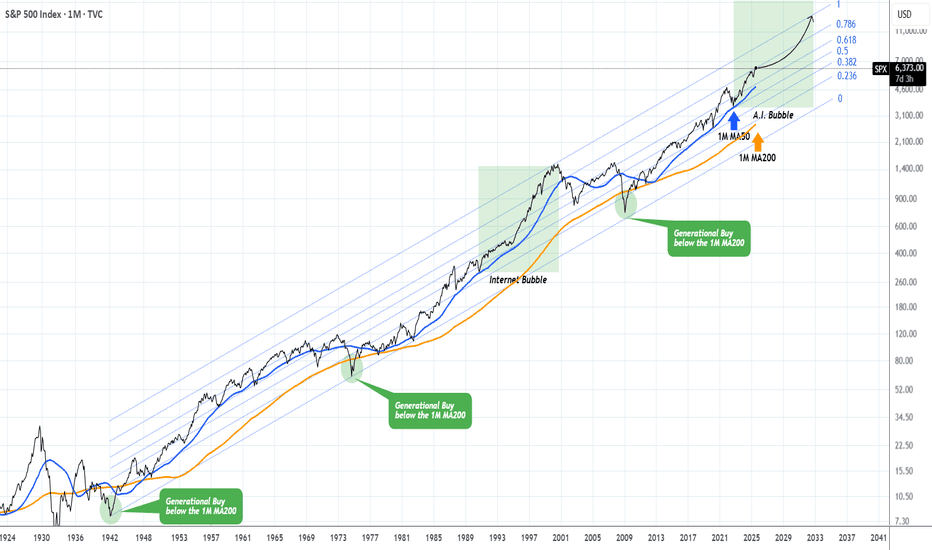

S&P500 This is why every CORRECTION is a GIFT.The S&P500 index (SPX) has been steadily rising since the April bottom to new All Time Highs (ATH). On the grand 100 year scale, the February - March tariff fueled correction, has been nothing significant. The last true technical correction has been the 2022 Inflation Crisis because it touched, and instantly rebounded on, the 1M MA50 (blue trend-line).

This is not the first time we bring forward our multi-decade perspective on stock and in particular this chart. But it serves well, keeping us into the meaningful long-term outlook of the market. This suggests that since the Great Depression and the first signs of recovery after the 1935 - 1941 Bear Cycle, the market has entered a multi-decade Channel Up, which is divided into long-term aggressive expansion periods (Bull Cycles) and shorter term depressions (Bear Cycles).

During a Bull Cycle, every test of the 1M MA50 is a instant cyclical buy opportunity and in fact that isn't presented very often. During a Bear Cycle, the market makes an initial aggressive correction below the 1M MA50, turns increasingly volatile for 5-7 years, trading sideways within the Channel Up with its second peak resulting into a 2nd correction that eventually breaks below the 1M MA200 (orange trend-line).

That is what we call a 'generational buy opportunity' as in the past 80 years, it has only been taken place 2 times.

Right now (again this is not something we mention for the first time), the market is at the start of the A.I. Bubble, with incredibly strong similarities with the Internet Bubble of the 1990s.

In fact, relative to the Internet Bubble, it appears that we are on a stage similar to 1993 - 1994, before the market turned parabolic to the eventual Dotcom Bust of 2000.

As a result, from a technical perspective, every 'small' correction such as the one we had this year, is a blessing in disguise (buy opportunity). As the index grew by 5 times during the Internet Bubble (300 to 1500), it is also very possible to see it approach this feat going from roughly 3500 (late 2022) to 14000 (by late 2032) and touch the top of the multi-decade Channel Up.

Are you willing to miss out on this generational wealth creation opportunity?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GOLD Melted , 2 Best Places To Sell Clear , Don`t Miss 200 Pips Here is My 30 Mins Gold Chart , and here is my opinion , we Again Below 3377.00 and we have a 30 Mins Candle closure below this strong res , so i`m waiting the price to go back and retest this res and new support and give me a good bearish price action to can enter a sell trade and we can targeting 200 pips , and we have a good res @ 3365.00 we can sell from it also if the price didn`t reach 3377.00 and targeting from 100:200 pips , and if we have a Daily Closure below This res this will increase the reasons for us , just wait the price to back a little to retest it and then we can sell it . if we have a daily closure aboveit this idea will not be valid anymore .

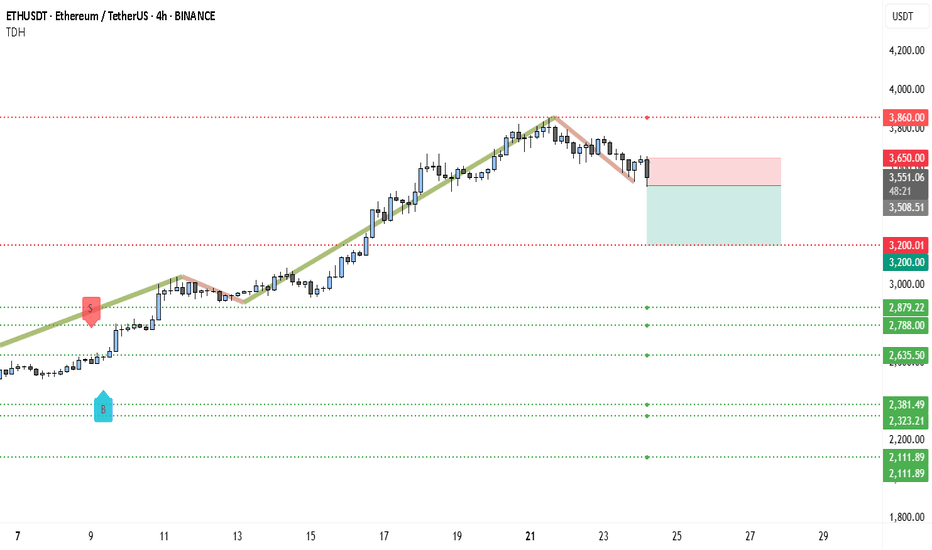

ETH Just Lost Key Support — Next Stop: $2,879?Ethereum (ETH) appears to be losing steam on the 4-hour chart as it fails to sustain above the critical $3,860 resistance level. After a strong rally, the price structure has started showing signs of exhaustion — the previous bullish momentum has clearly stalled, and ETH is now forming lower highs and lower lows. This breakdown marks a potential shift in trend, especially considering the clean rejection from $3,860 with several upper-wick rejections signaling aggressive selling pressure.

The green ascending trendline, which supported ETH throughout its recent rally, has been breached. Price has broken below the trendline and is now moving in a declining structure highlighted by the recent bearish wave. Sellers have stepped in, and the most recent candles indicate a bearish continuation setup forming just below a failed support-turned-resistance near $3,533.

There’s a visible trade setup taking shape:

• Entry: $3,530–$3,550 (post-retest of broken trend support)

• Stop-loss: $3,650 (above recent local highs)

• Target 1: $3,200 (key support level)

• Target 2: $2,879

• Target 3 (extended): $2,635 if downside pressure intensifies

This short setup offers a solid risk-reward ratio, especially if momentum accelerates below $3,500. The sell signal seen earlier aligns with this potential reversal zone, and unless ETH reclaims $3,650 with volume, the bears look likely to stay in control.

In summary, ETH on the 4H timeframe is now trading below major support, with a bearish structure, trendline breakdown, and rejection at resistance — all aligning for a short-biased move in the coming sessions. Any bullish invalidation would require ETH to push and close above $3,650 convincingly. Until then, the path of least resistance appears downward.