Trend Analysis

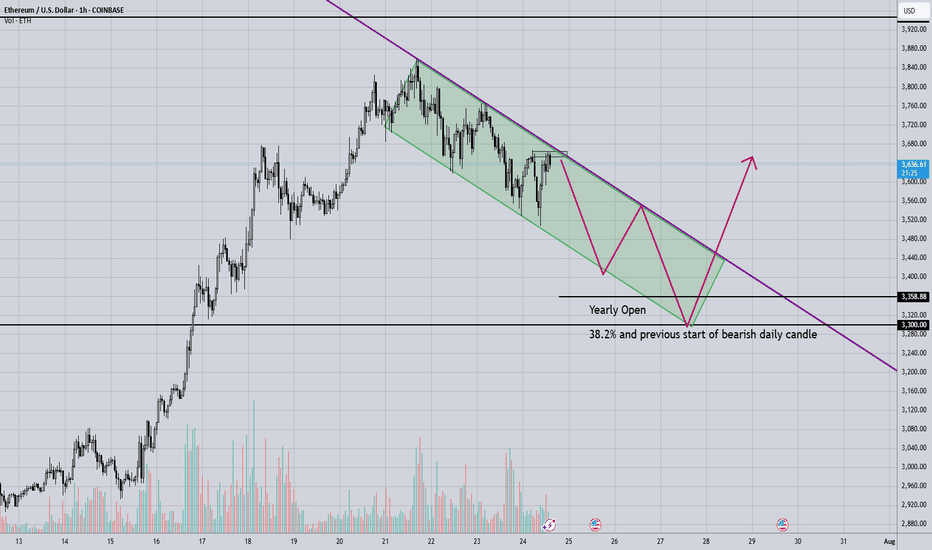

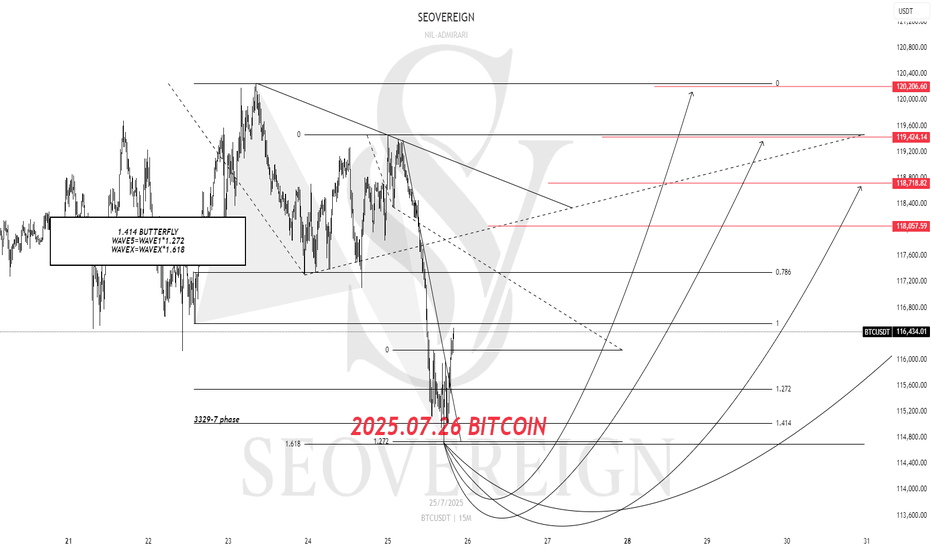

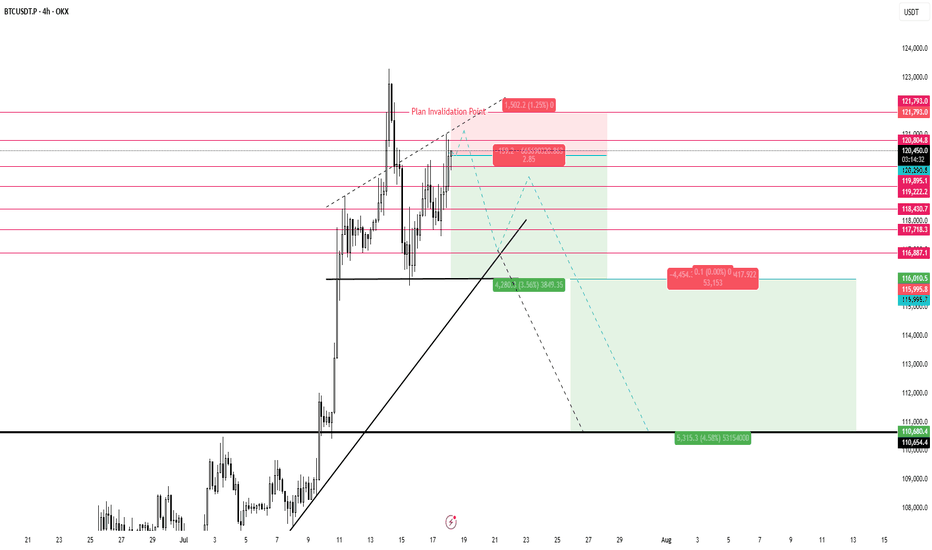

[SeoVereign] BITCOIN BULLISH Outlook – July 26, 2025The previous idea did touch the average TP price, but showed a rather disappointing rebound, so I will once again attempt to capture the starting point of the rebound. It is still considered that one more upward wave remains.

Accordingly, the TP is suggested at 118,057 USDT.

As always, I will carefully observe how the chart develops over time and update this idea with further explanations by organically integrating its specific interpretations and underlying rationale.

Thank you.

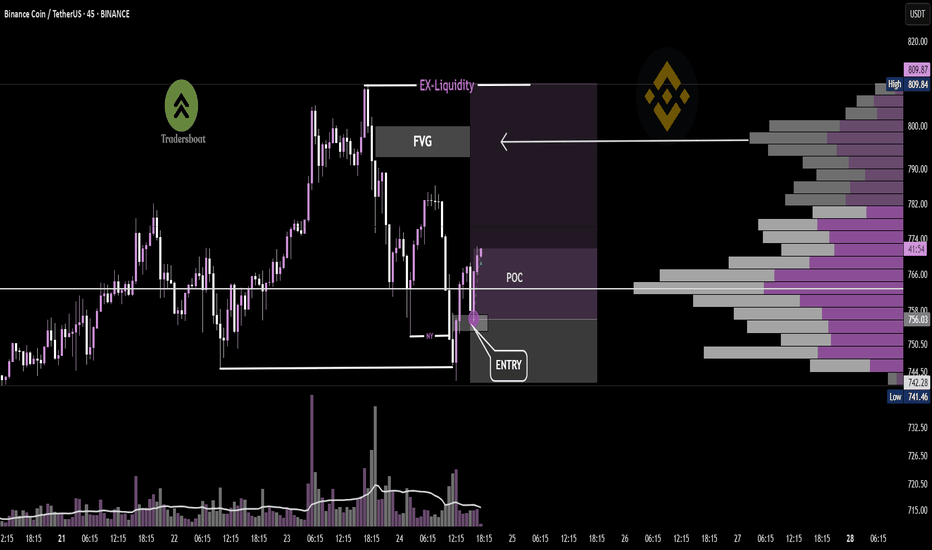

BNB/USDT - 45MIN Reversal in PlayPrice swept the New York session low, tapping into a key POC zone. A strong bullish engulfing candle followed, signaling potential reversal from demand. With momentum building, the setup targets the recent external liquidity above near FVG highs — a classic SMC bounce play.🔁

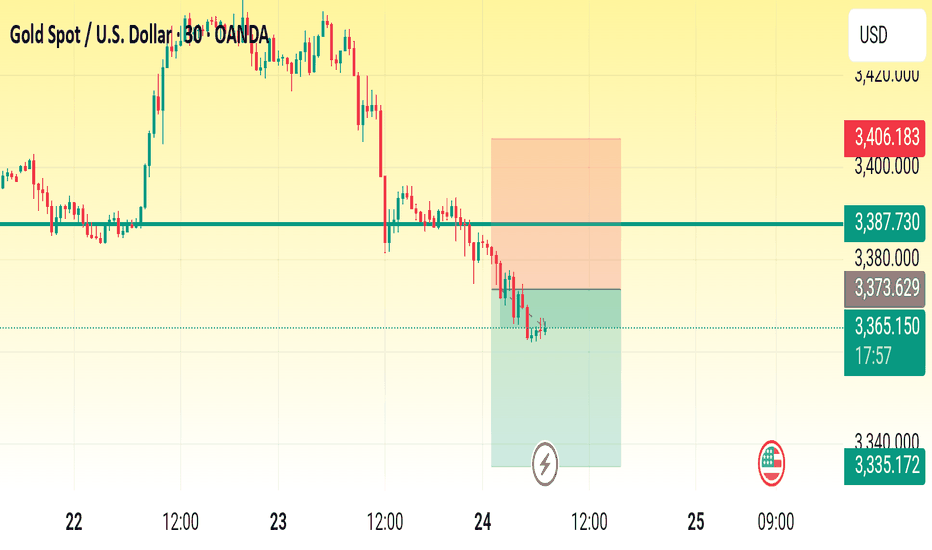

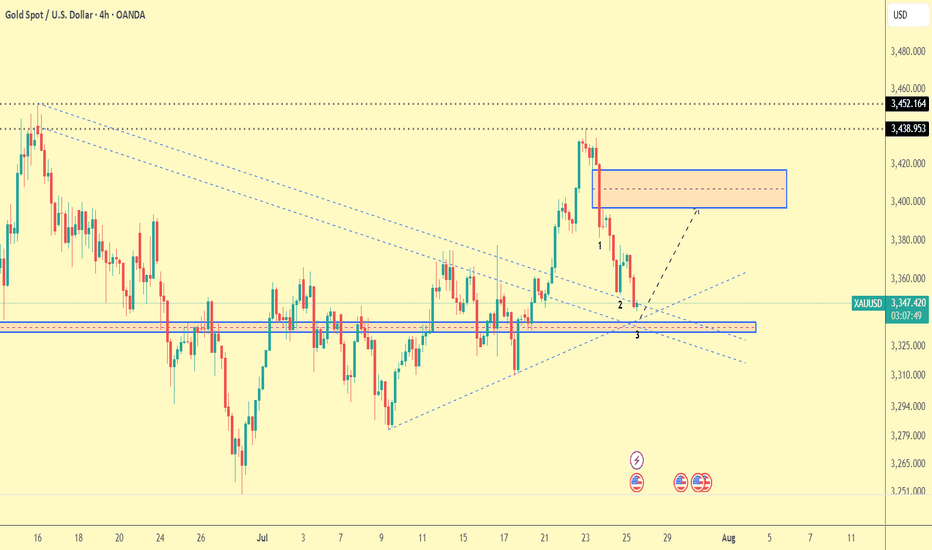

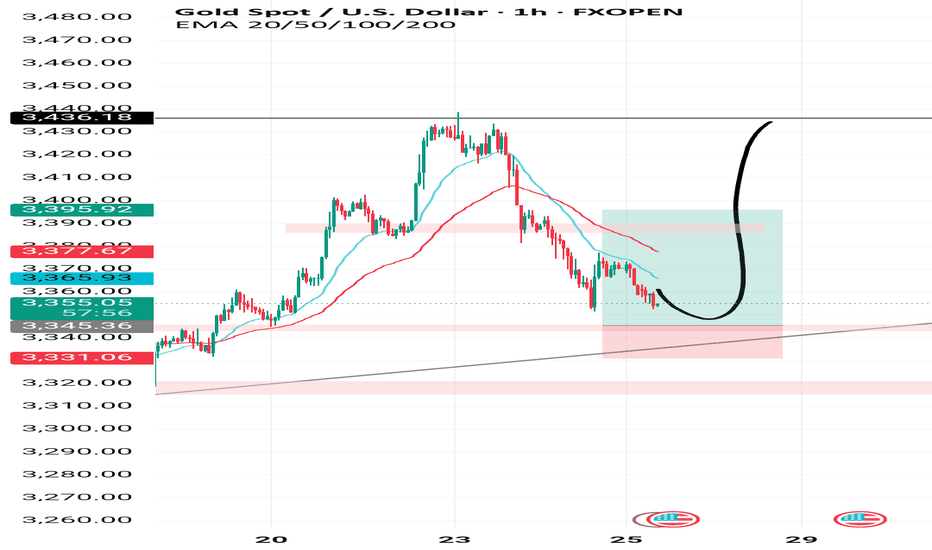

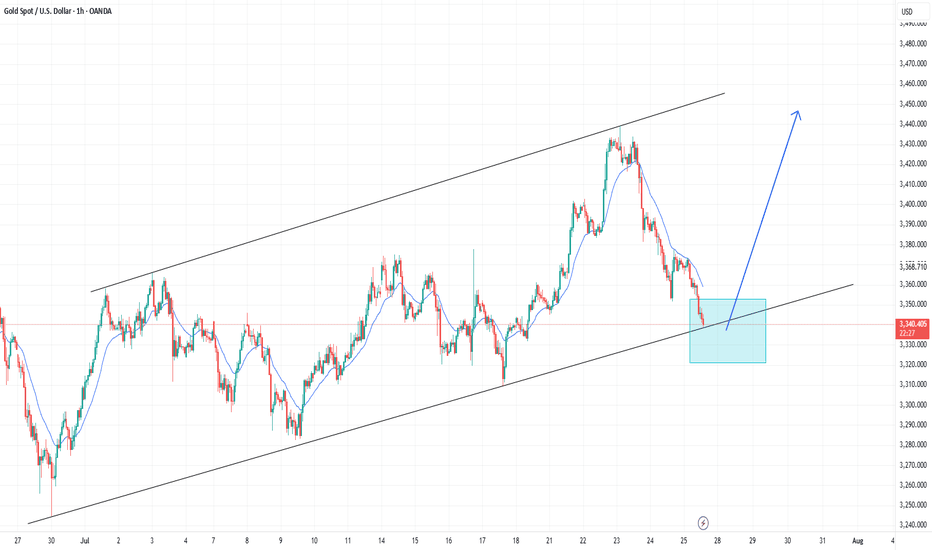

Gold Trade Plan 25/07/2025Dear Trader,

Gold (XAU/USD) is currently in a corrective phase, reaching near the support zone at around 3,340. The price is testing the trendline, and we may see a potential bounce towards the resistance level at 3,400-3,420. If the price breaks below this support, we could expect a further drop towards the next support levels near 3,325-3,310. The market will likely consolidate in this range until we see a breakout in either direction. The key levels to watch are 3,340 (support) and 3,400-3,420 (resistance). Monitor the price action closely as a reversal or continuation can occur here.

Regards,

Alireza!

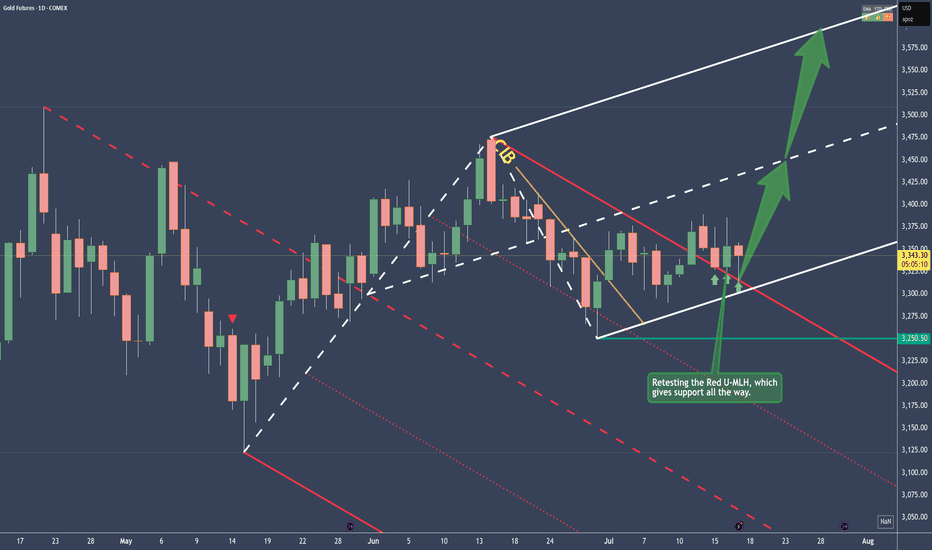

Gold - Bullish and here's whyPrice traveled within the Red Fork, until it broke the CIB Line, which is indicating a Change In Behavior.

From there on, sideways action, until the break of the Red U-MLH happened.

After the close above the Red U-MLH, price has tested it the 3rd time now. At the time of writing, the Bar looks like a PinBar. So it has good sepparation from the bottom, or a long Down-Wick. That's indicates good strenght.

To me this looks like a good long trade, but as everytime, play it save and don't let greed eat your brain ;-)

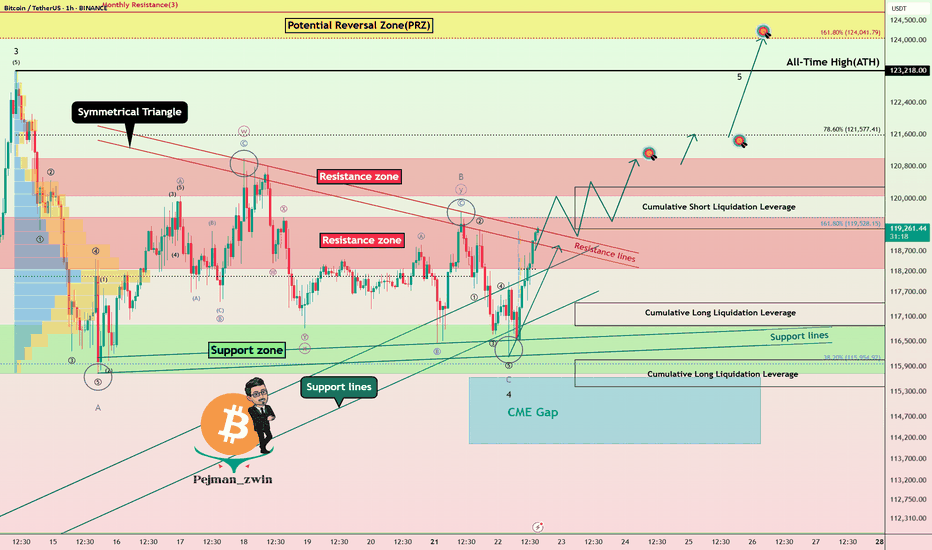

Powell’s Comments Could Decide BTC’s Fate: New ATH or Rejection!Bitcoin ( BINANCE:BTCUSDT ) has attacked the Support zone($116,900-$115,730) several times over the past week but failed to break through, meaning that buyers are still hoping for a BTC increase or even a new All-Time High(ATH) .

Bitcoin has reached a Resistance zone($119,530-$118,270) again and is trying to break the upper lines of the Symmetrical Triangle Pattern . The Cumulative Short Liquidation Leverage($117,255-$116,675) is important and includes high sell orders , so if Bitcoin can break the Resistance zone($119,530-$118,270) and the Resistance lines with high momentum , we can hope for a continuation of the upward trend.

Whether or not the Resistance zone($119,530-$118,270) and the Resistance lines break could depend on the tone of Jerome Powell’s speech today .

Jerome Powell will speak at the opening of the “ Integrated Review of the Capital Framework for Large Banks ” — the final major appearance before the Federal Reserve enters its pre-meeting blackout period.

Market Expectations:

The speech is officially about regulatory frameworks (like Basel III), but traders are watching closely for any hints regarding interest rate policy. Even indirect comments could move risk assets like BTC.

Rate Cut Signals?

With political pressure mounting (including criticism from Trump ) and markets pricing in a potential cut later this year, Powell may adopt a cautious, data-dependent tone emphasizing flexibility in decision-making.

--------------------

In terms of Elliott Wave theory , it seems that the wave structure of the main wave 4 correction is over. The main wave 4 has a Zigzag Correction(ABC/5-3-5) , so that the microwave B of the main wave 4 has a Double Three Correction(WXY) . Of course, the breakdown of the Resistance zone($119,530-$118,270) and Resistance lines can confirm the end of the main wave 4 .

Also, there is a possibility that the 5th wave will be a truncated wave because the momentum of the main wave 3 is high , and Bitcoin may NOT create a new ATH and the main wave 5 will complete below the main wave 3.

I expect Bitcoin to rise to at least the Resistance zone($121,000-$120,070) AFTER breaking the Resistance zone($119,530-$118,270) and Resistance lines .

Second Target: $121,620

Third Target: $123,820

Note: Stop Loss(SL)= $117,450

CME Gap: $115,060-$114,947

Cumulative Long Liquidation Leverage: $117,429-$116,878

Cumulative Long Liquidation Leverage: $116,053-$115,411

Please respect each other's ideas and express them politely if you agree or disagree.

Bitcoin Analyze (BTCUSDT), 1-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

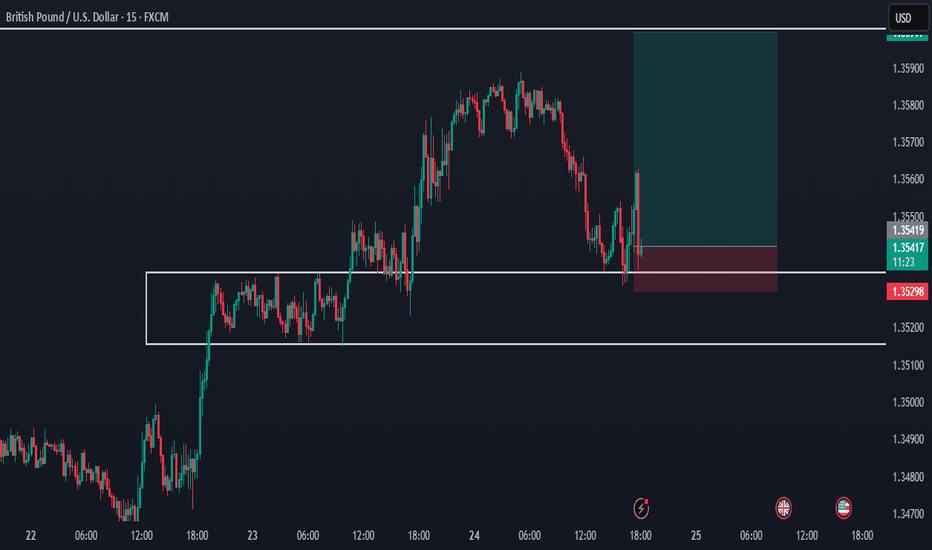

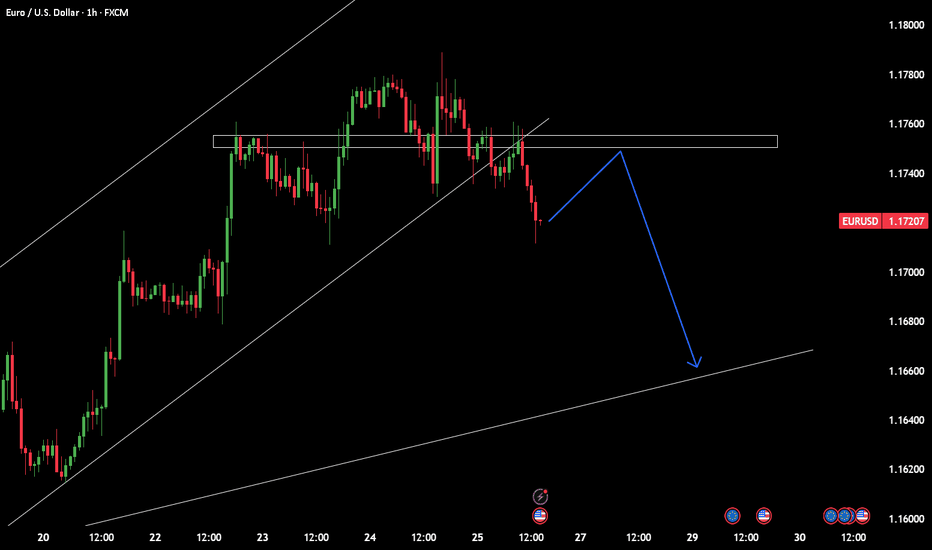

EURUSD: Long Signal with Entry/SL/TP

EURUSD

- Classic bullish pattern

- Our team expects retracement

SUGGESTED TRADE:

Swing Trade

Buy EURUSD

Entry - 1.1724

Stop - 1.1714

Take - 1.1743

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

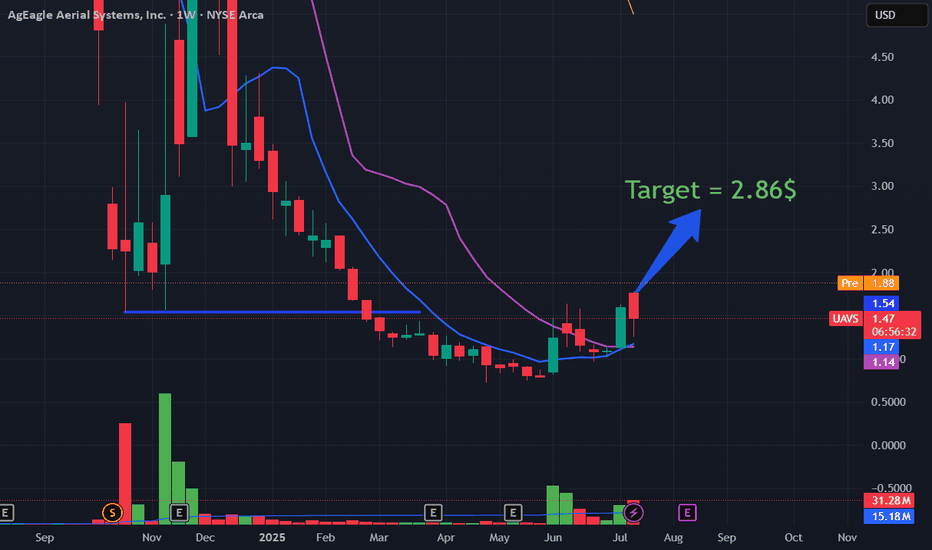

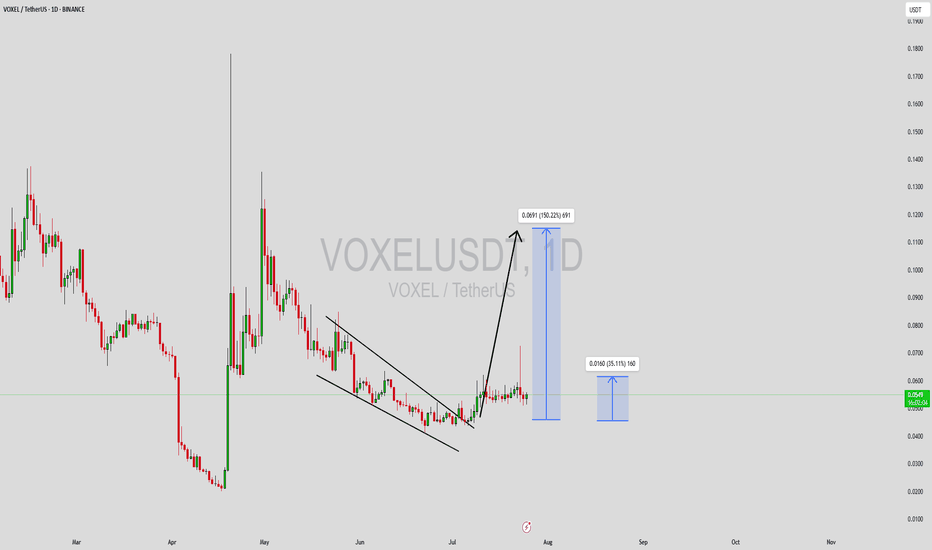

VOXELUSDT Forming Strong Bullish PotentialVOXELUSDT is currently exhibiting a highly promising setup with strong bullish potential, as shown in the latest price structure. The chart clearly displays a falling wedge formation, a pattern known for its bullish implications when confirmed with a breakout. VOXEL has recently broken out of this wedge with increased volume, suggesting a significant shift in momentum. Based on this breakout structure, an expected gain of 140% to 150%+ seems technically plausible in the upcoming sessions.

The token has demonstrated consistent accumulation in the lower price range, which often precedes sharp upward moves, especially in low-cap or mid-tier gaming/metaverse coins like VOXEL. With market participants increasingly shifting their attention toward undervalued gaming and metaverse projects, VOXEL is positioned to benefit from both technical and narrative-driven catalysts. The current market sentiment favors assets with solid technical foundations and growing community interest—both of which VOXEL currently exhibits.

Furthermore, the recent increase in trading volume reinforces the bullish scenario. Volume expansion post-breakout is typically a strong indicator of institutional or whale accumulation. Traders looking to capitalize on high-risk, high-reward setups should closely monitor VOXELUSDT for further confirmation candles and volume surges, which could signal the beginning of a parabolic run.

Given its current structure and historical price behavior, VOXEL may offer a rare opportunity for outsized returns if momentum continues. It is crucial, however, to manage risk and set realistic take-profit zones based on key resistance levels highlighted on the chart.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

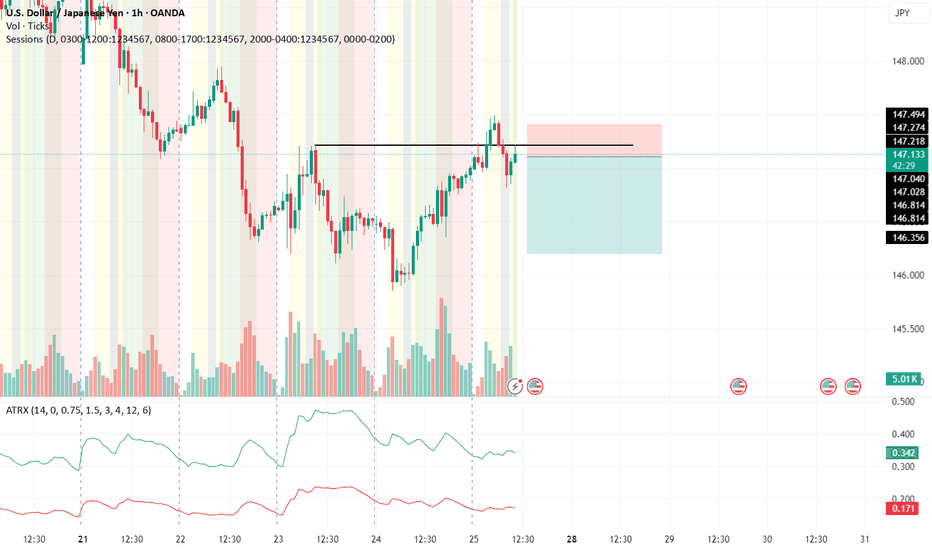

USD JPY shortthe sl is a bit short and narrow but yet lets see the rr is very good 1 to 3 lets see

Please note: This is for educational purposes only and not a trading signal. These ideas are shared purely for back testing and to exchange views. The goal is to inspire ideas and encourage discussion. If you notice anything wrong, feel free to share your thoughts. In the end, to learn is to share !

Report - 25 jully, 2025U.S.–EU Tariff Negotiations Stabilizing Markets

Reports confirm the U.S. and EU are nearing a deal for 15% reciprocal tariffs—lower than the initially threatened 30% by President Trump. This easing of tensions led to moderate equity gains in both blocs, with the Stoxx 600 reaching a 6-week high before closing +0.2%. Pharmaceutical and auto stocks outperformed (Volkswagen +2.3%, Bayer +2.3%).

Forecast: If the 15% deal is finalized by the August 1 deadline, it would remove a key overhang on equities and boost cyclical sectors reliant on transatlantic trade. A failure, however, risks escalation, triggering retaliatory tariffs by the EU on $93bn of U.S. goods, dragging risk assets sharply lower.

DXY Outlook: Tariff de-escalation boosts safe-haven flows and investor optimism, supporting USD strength.

S&P 500: Short-term relief rally expected if the 15% tariff framework is signed. However, margin compression risks remain from lingering supply chain disruptions.

Tesla vs Trump: Policy Shock Rattles EV Sector

Elon Musk warned that Trump's anti-EV stance and trade war posture will sharply erode Tesla’s regulatory credit revenue and remove the $7,500 EV tax credit. Tesla's stock has cratered 37% since December, with a sharp 8% drop yesterday. Adjusted Q2 net income was down 22%, revenue -12%.

Risk Forecast: Loss of EV subsidies + political fallout between Musk and Trump could drag Tesla further and dampen broader EV sector growth.

XAUUSD: Rising political uncertainty and risks to the U.S. tech sector may drive safe-haven flows into gold.

Dow Jones: Tesla's underperformance and anti-EV policies could limit industrial sector gains.

ECB Holds Rates Amid Trade Risk Fog

The European Central Bank paused its easing cycle, holding the benchmark rate at 2%. Lagarde emphasized a "wait-and-watch" stance, signaling uncertainty due to unresolved trade talks and tariff volatility.

Market Implication: Eurozone government bond yields rose (10Y Bund at 2.70%), paring rate-cut bets. The euro softened to $1.1760.

EURUSD: Lack of further ECB accommodation and weaker consumer confidence amid trade frictions.

Fed Independence in Jeopardy? Market Confidence Wobbles

Pimco warned that White House pressure on Fed Chair Powell—including potential firing and scrutiny over $2.5bn HQ renovations—could destabilize markets. Trump continues pushing for aggressive 1% rates, diverging from current 4.25–4.5% levels.

Fiscal/Political Implication: Undermining Fed autonomy risks flight from U.S. bonds, undermining monetary policy credibility and capital inflows.

USDJPY: Yen may gain if markets lose faith in U.S. institutional integrity, despite rate differentials.

DXY: Temporary support from yields, but structural downside if Fed credibility erodes.

Deutsche Bank and BNP: Diverging Strengths in Volatile Landscape

Deutsche Bank posted its strongest Q2 in 18 years, driven by litigation charge reversals and stable investment banking performance. BNP Paribas also reported solid FICC trading (+27%), though equity trading lagged due to weak derivatives demand.

Equity Implication: Strong capital returns and stable European banking profitability support DAX resilience amid trade noise.

DAX: Boosted by banking and auto outperformance.

China–EU Trade Strains Escalate

Von der Leyen directly confronted Xi Jinping over trade imbalances and support for Russia. EU exports to China are down 6% YoY while Chinese imports to the EU are up 7%. Xi defended Beijing’s stance, warning against "decoupling" rhetoric.

Geostrategic Implication: EU may escalate anti-dumping and export control measures. Markets may see renewed volatility in European industrials and luxury sectors reliant on China.

XAUUSD: Rebalancing of power and heightened East–West tensions favor gold.

Oil Oversupply Warning from TotalEnergies

Total warned of an oil glut due to OPEC+ production increases and weakening global demand. Q2 profits fell 30% YoY. Brent now likely to stay within $60–70 range barring major geopolitical flare-ups.

Crude Oil: Short- to medium-term downside risk with soft demand and oversupply fears.

Energy Stocks: Dividend maintenance remains but debt levels and margin pressures may weigh.

AI Spending Surges – Alphabet and SK Hynix

Alphabet posted a 19% Q2 profit jump as AI integration boosts search volumes. Google’s cloud revenues rose 32%. Capex raised to $85bn. SK Hynix also posted record revenues from high-bandwidth memory chip sales, extending its lead over Samsung.

S&P 500: AI-driven earnings upside bolsters tech sector. Expect multiple expansion in mega-cap AI-exposed names.

XAUUSD : Robust AI investment supports risk appetite but inflationary fears could lift gold marginally.

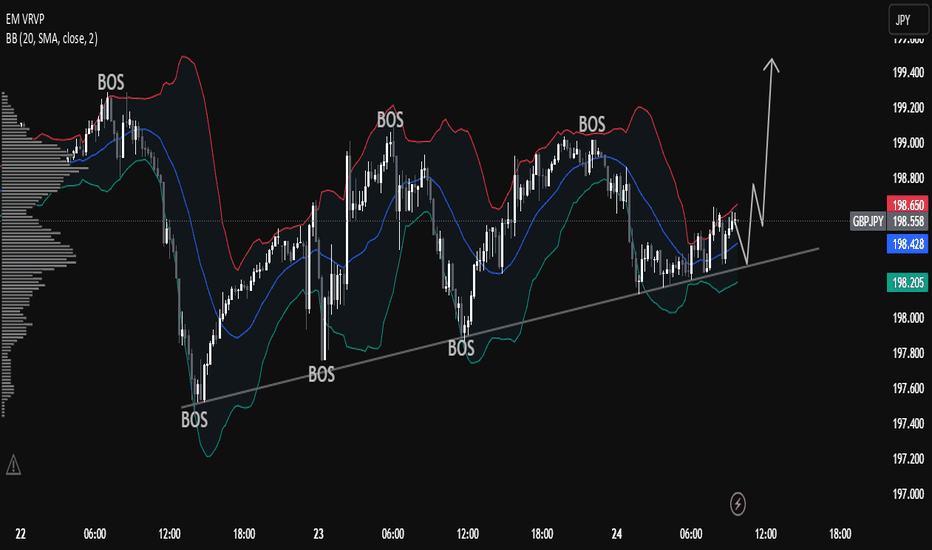

Understanding Market Structure: GBPJPY Trendline Support 📊 GBPJPY Technical Analysis — 15-Min Chart (As of July 24, 2025)

Trend Structure & Price Action

The chart shows a clear ascending trendline, connecting higher lows across the last sessions.

Multiple Break of Structure (BOS) points confirm bullish market behavior, with price consistently forming higher highs and higher lows.

The most recent BOS and price rejection from the lower boundary of the cloud band indicate bullish intent is still active.

Indicators Used

Custom Cloud Band (EMA Based 20, 1.5 settings):

Price is oscillating within and around the cloud band.

Recent candles are attempting to reclaim the upper band, suggesting building bullish momentum.

Volume Profile (VRVP) shows strong volume support around the 198.200–198.500 range, aligning with the trendline.

Support & Resistance

Support Zone: 198.200 (trendline confluence + volume shelf)

Immediate Resistance: 198.800–199.000

Major Resistance: 199.400 (next psychological level and prior high)

Forecast & Trade Idea (Educational Purpose)

If price continues to respect the ascending trendline and breaks above the recent local high (~198.750), we could see a bullish breakout toward 199.200+.

A bullish flag or small consolidation above the trendline before breakout is likely, as illustrated by the arrow.

Invalidation occurs if price breaks and closes below the trendline and 198.200, which may trigger a short-term correction.

✅ Conclusion

GBPJPY is currently in a bullish market structure with support from both trendline and volume profile. A clean breakout above 198.800 with volume confirmation could fuel continuation toward 199.200 and beyond. Risk management is crucial — watch for false breakouts or a shift in structure below the rising trendline.

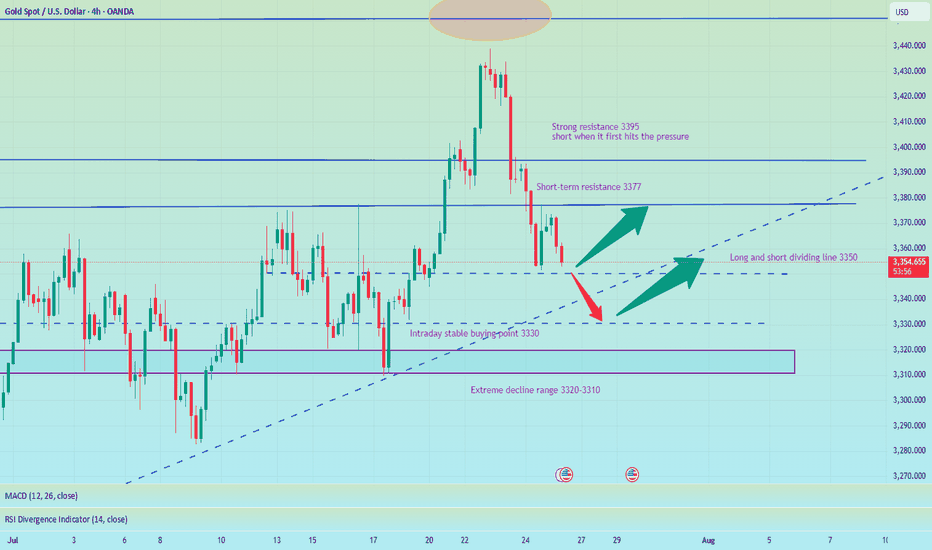

Be alert to new lows, pay attention to 3350 and go long at 3330📰 News information:

1. Tariff issues

2. Next week's NFP data

📈 Technical Analysis:

Last night, gold rebounded to only around 3377 before starting to fall back. Our judgment that the current rebound is weak is completely correct. 3350 is the support point of the bottoming out and rebounding to nearly $20 last night. Whether the European session can go down to 3350 will determine the trend of gold.

From the daily chart, the daily line has fallen for two consecutive days, suggesting that the price may continue to fall today. At present, we need to pay attention to this week's starting point of 3344-3345, and then the 3330 line below. The extreme decline is 3320-3310. At the same time, the narrowing of the daily Bollinger Bands is also paving the way for next week's NFP data.

From the 4H chart, the current MACD indicator crosses and increases in volume, and the middle track of the Bollinger Bands and SMA30 basically overlap near 3388. As for the hourly chart, the upper pressure is mainly concentrated near 3375-3377, which is also the high point of the rebound last night. If gold rebounds directly upward and encounters pressure and resistance at 3375-3385 for the first time, you can consider shorting and strictly implement stop loss.

Overall, if the current market falls to 3350-3345 for the first time and gets effective support, you can consider going long with a light position, defend 3340, and look to 3356-3362; if the decline is strong and continues to fall below 3350, the best stable long point for the day is 3330-3320, defend 3310, and earn $10-20 to leave the market.

🎯 Trading Points:

BUY 3350-3345

TP 3356-3362

BUY 3330-3320

TP 3345-3360

In addition to investment, life also includes poetry, distant places, and Allen. Facing the market is actually facing yourself, correcting your shortcomings, facing your mistakes, and exercising strict self-discipline. I share free trading strategies and analysis ideas every day for reference by brothers. I hope my analysis can help you.

TVC:GOLD PEPPERSTONE:XAUUSD FOREXCOM:XAUUSD FX:XAUUSD OANDA:XAUUSD FXOPEN:XAUUSD