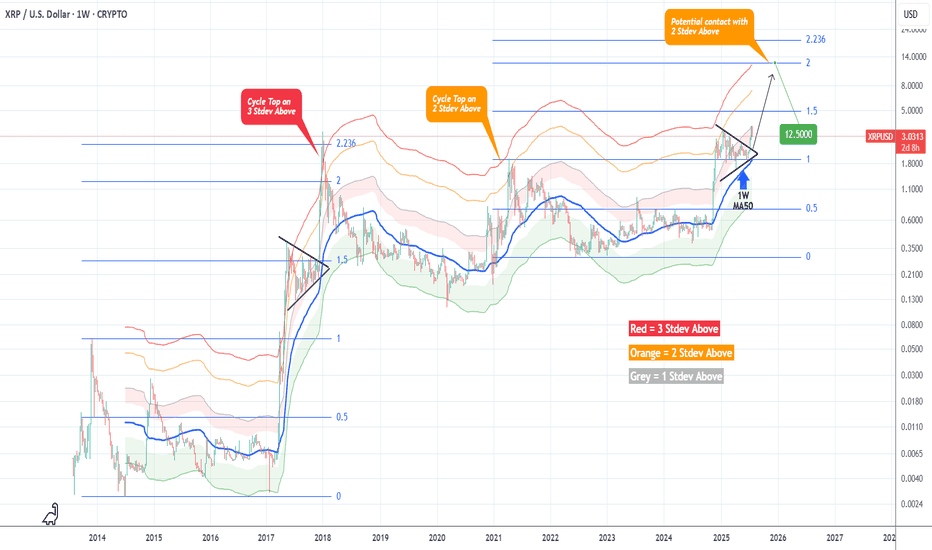

XRPUSD Massive break-out that can Top at $12.500XRP (XRPUSD) got out of its Accumulation Triangle (December 2024 - June 2025) making an aggressive break-out similar to the December 2017 one, which was after an identical Triangle pattern.

The fractals are so comparable that both mostly traded within the 1W MA50 (blue trend-line) and the Mayer Multiple (MM) 2 Stdev Above (orang trend-line).

As you can see, that MM trend-line was where the Top of the previous Cycle (April 2021) was priced and the one before was above the 3 Stdev Above (red trend-line).

Assuming that this Cycle will also go for the 'minimum' 2 Stdev Above test, it can make that contact by the end of the year on the 2.0 Fibonacci extension (Cycle Top-to-bottom) at $12.500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trend Analysis

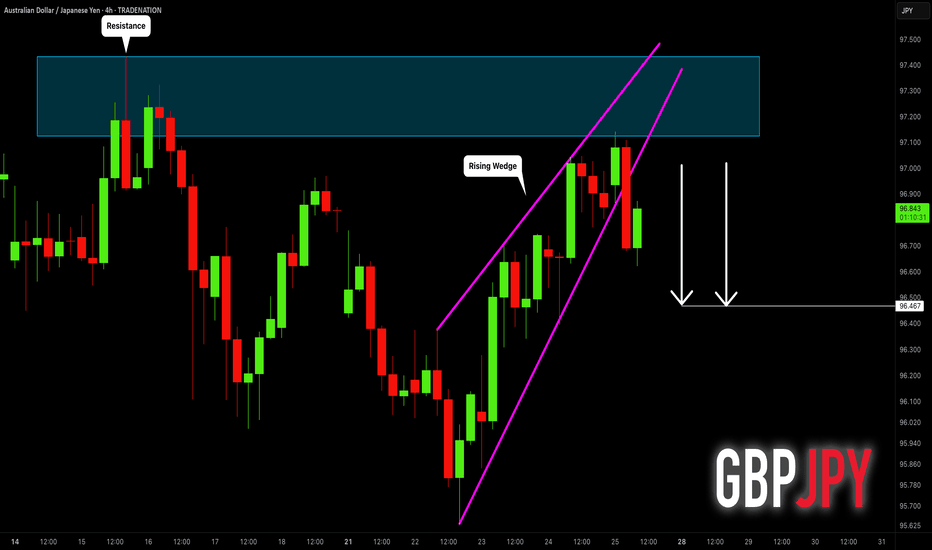

AUDJPY: Strong Bearish Signal?! 🇦🇺🇯🇵

AUDJPY may retrace from a key daily resistance.

As a confirmation, I see a bearish breakout of a support line of a rising

wedge pattern with a high momentum bearish candle.

Goal - 96.47

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

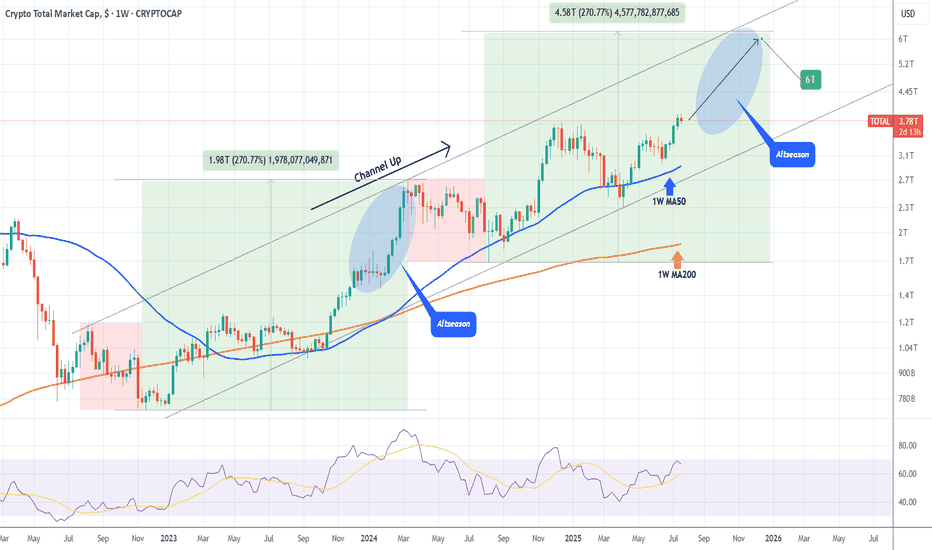

TOTAL CRYPTO MARKET CAP expected to hit $6 Trillion!The Crypto Total Market Cap (TOTAL) has been on a Channel Up since the 2022 market bottom and since the April 07 2025 Low (Higher Low for the pattern), it's initiated the new Bullish Leg, already turning the 1W MA50 (blue trend-line) into Support.

As long as this holds, we expect it to complete a +270% rise from the August 05 2024 Low, similar to the Bull Cycle's first Green Phase, and reach at least a $6 Trillion Market Cap!

More importantly, we expect this final part (blue ellipse) to be what is commonly known as an Altseason, where the lower cap coins show much higher returns and disproportionate gains to e.g. Bitcoin.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

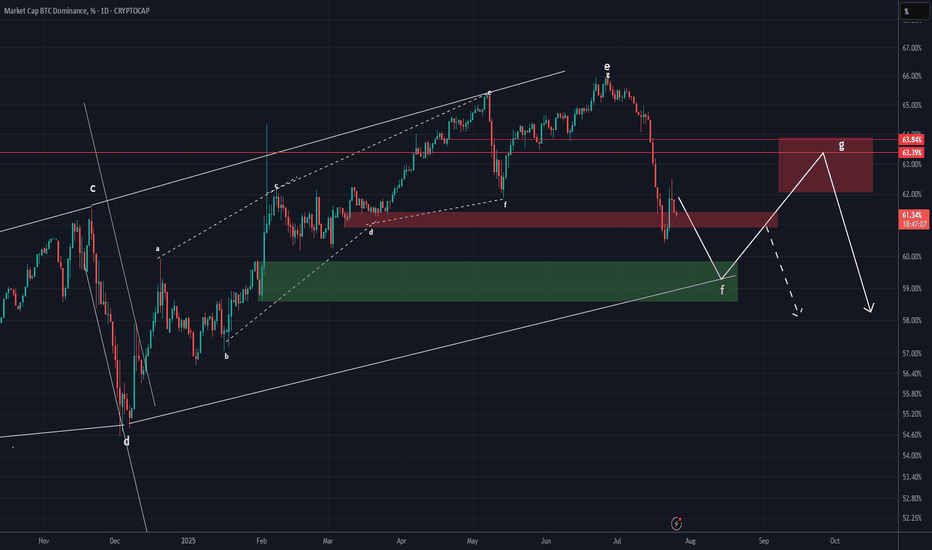

BTC DOMINANCE Update (1D)It seems that Bitcoin dominance may soon experience upward corrections, as it has broken through several support zones to the downside without any reaction and is now close to another support area. Usually, when the market maker pushes the price through multiple supports without a reaction, the price can retrace from a nearby support.

The price may soon move to complete wave G.

We have considered two different scenarios for the fluctuations of this index. However, note that this chart is a derivative chart, and the fluctuations may not follow the schematic exactly, but this analysis gives us a good view of the support and resistance zones and the probable path.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

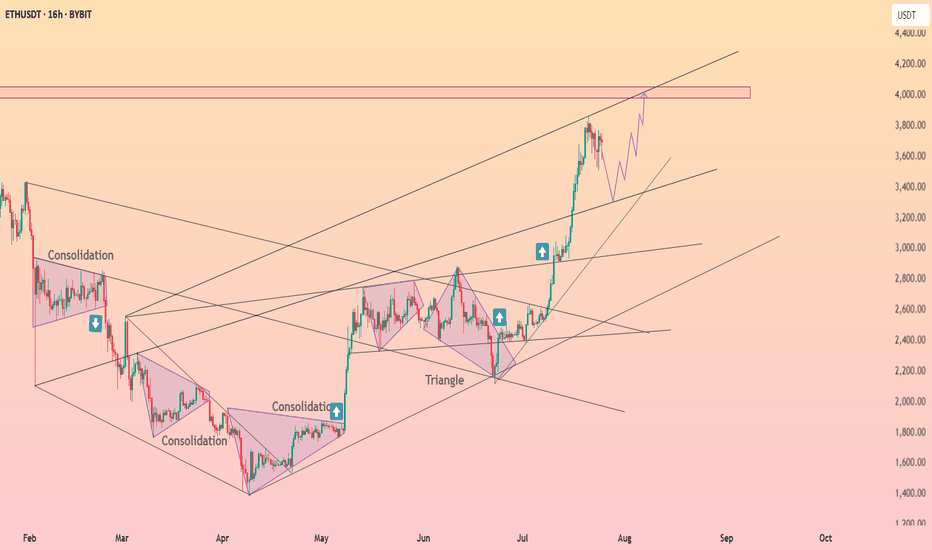

Ethereum Charts Aligning for a Major BreakoutI analyzed Ethereum on both the monthly and 2-week timeframes, and the structure looks strong.

On the right side, we have the monthly chart, where ETH has printed a bullish Morning Star pattern right off the key support trendline.

This is a classic reversal signal, and price is now approaching the upper resistance zone. A breakout from here could trigger a major rally, similar to what we saw in 2020.

On the left side, the 2-week chart shows CRYPTOCAP:ETH pressing into a critical resistance zone after a strong bounce. If price breaks and holds above this zone, it could open the doors to $6K–$8K targets in the coming months.

ETH is showing strength, now we wait for confirmation from the breakout.

Thanks for reading!

ZORA/USDT -40% has delivered an explosive move since July 2025, rallying nearly +700% from its listing price. This kind of parabolic price action typically marks the climax of a strong impulse wave, especially for newly listed tokens on perpetual markets.

Currently, ZORA is showing early signs of exhaustion, with price stalling near recent highs. Momentum indicators are flattening out, and volume is starting to decline classic signs of distribution. Given the magnitude of the recent move, a healthy correction is likely before any potential continuation.

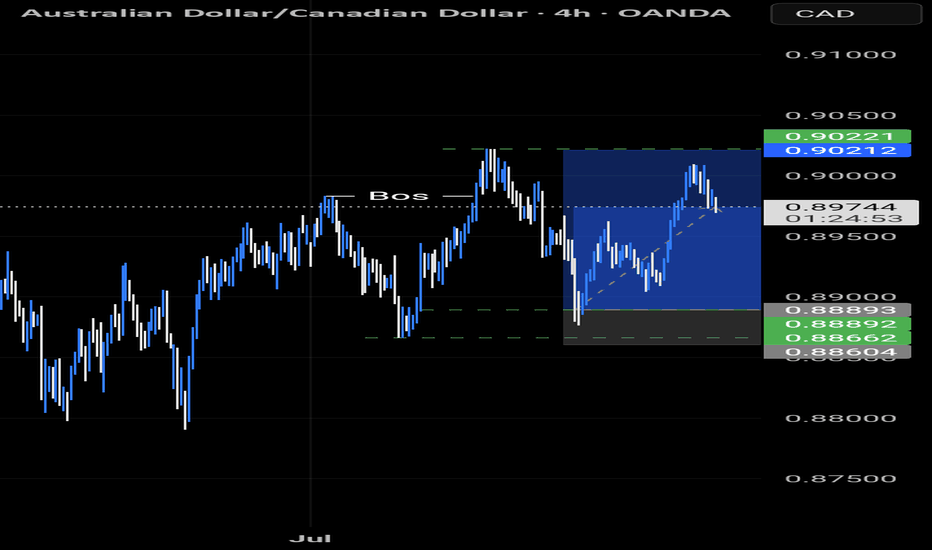

SUI - Just one step away from the explosion!The last candle on the daily chart just confirmed a BOS (Break of Structure) — a clear and strong sign of bullish continuation for the asset.

✅ This is a textbook entry for a long position.

🎯 Next target: $5 — and so far, no bearish signs in sight.

Best regards,

Ceciliones 🎯

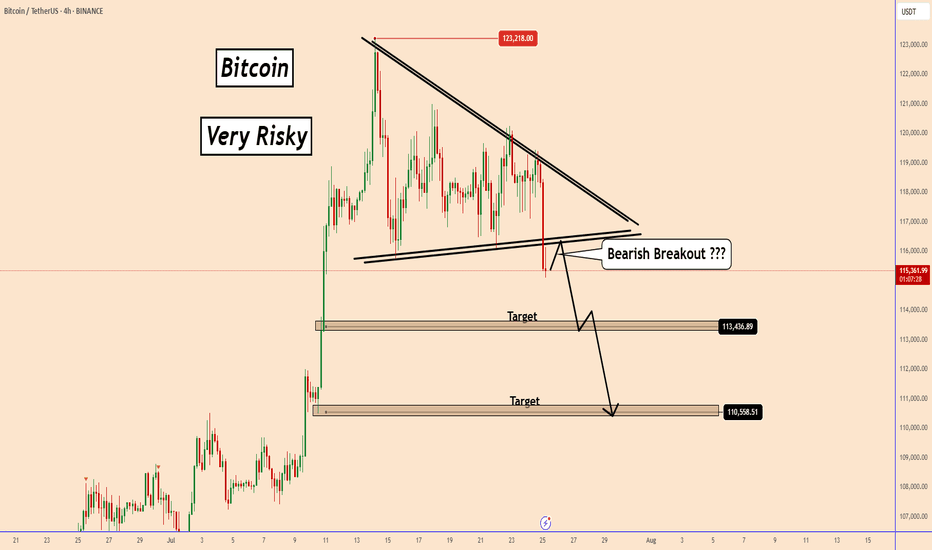

BTC Unfolds in Complex Way After Hitting 123KBTC Unfolds in Complex Way After Hitting 123K

Bitcoin recently reached a historic all-time high near 123,200, marking a strong bullish run. Over the past two weeks, BTC has been consolidating, showing signs of a potential upward movement.

However, today's price action disrupted that bullish setup and introduced bearish momentum.

At this moment, two scenarios are possible:

1️⃣ Continued Bullish Momentum: The prevailing trend remains strongly bullish. Selling BTC now is risky, as there's a high chance it could resume its aggressive rise again.

False Bearish Breakout: The recent bearish signal may be misleading. BTC may be forming a broader accumulation structure, paving the way for another upward move.

2️⃣ Profit-Taking Phase: This bearish shift might be valid, suggesting that Bitcoin is entering a profit-taking cycle after an extended rally. If this scenario unfolds, a deeper correction may follow, aligning with the current technical pattern.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Spy.. 650 topLooking for a top this week

The top of this monthly trendline dating from 2009 should be tagged this week around 643-645.00. As you can see price can grind up here for weeks until the BIG drop.

That grind would possibly be distribution with

A range trade of 620-640 for the month of august. historically Sept is very bearish and could see a drop back below 600 then.

Summer price action looks like so

Smaller price action (Tradeable technicals)

Bull flag early July has us squeezing up this last leg here..

If we gap up Sunday night then i like the short around 638ish

If we gap down and flush i like the dip buy around 634 gap close with the next target being 640+

Daily candle closed outside Bbands so I would not long this on any gap up... on a big earnings week like this, there will be a shake out day or a flush to try and stop out all of those who bought long last week for this weeks earnings.

TVC:NYA or NYSE

Has also reached the top of its weekly channel here. 21,000 will be tough. Price could grind up here but I'd be careful trading anything non tech.

As far as tech goes

Here's NASDAQ:QQQ

monthly chart (Logarithmic)

We have room for 575-580

This should compliment Spy 550

Zoomed in on the daily chart and it's climbing back up to the resistance shown on the monthly

Hourly chart shows price action from early july... tight channel illustrates how frustrating the swings have been

562-563 is support heading into next week. If we have a major gap up Sunday night I would look to open short near 570 for a pullback before ER... if we gap down, I would buy the dip around 563 and average down if need be down to 561..

We should tag 575 this week

The sector that I think lags the most this week is the banking sector... AMEX:XLF

Banks outperform the entire market last week and are overheated at resistance I think they lag this week

I will update this more throughout the week if necessary..

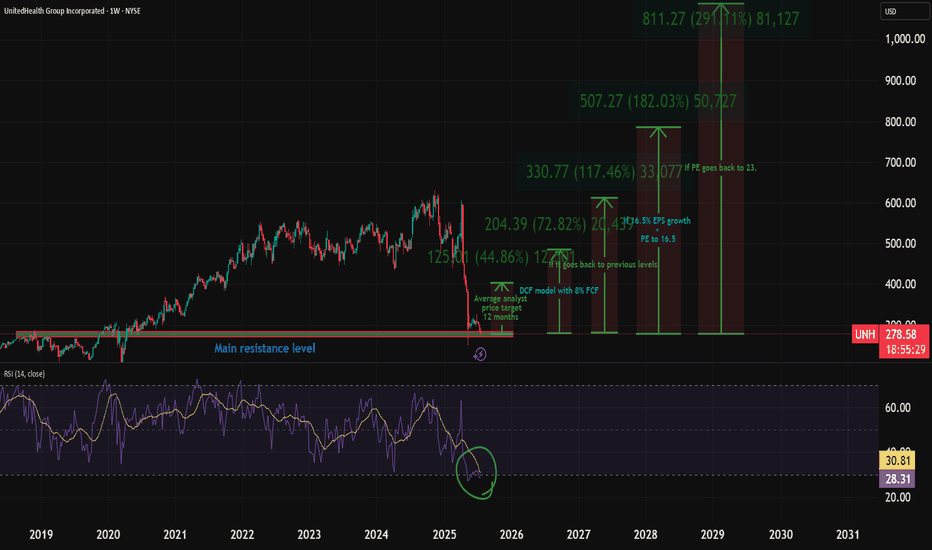

My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) earnings could flip the script. As a historically dominant player, UNH is now undervalued amid sector weakness, offering massive upside if regulatory fears ease.

Here's my full bull case. 👇 FUNDAMENTAL ANALYSIS

Why the Sell-Off? A Perfect Storm of Bad News

UNH crushed the market for 15 straight years (2009-2023) with positive returns, predictable EPS growth, and 134% gains over the last decade.

But 2024 brought chaos:

Feb: Massive cyber attack caused a one-time EPS hit (non-recurring).

Ongoing: DOJ antitrust probe, criminal fraud investigation, rising Medicare costs, and Optum losses.

April: Disastrous Q1 earnings miss + lowered guidance.

Leadership drama: CEO death.

This erased gains (down 7% over 5 years), amplified by healthcare sector outflows—the biggest since 2020. But is this overblown? Signs point to yes. The markets almost always overreact to bad news.

Bullish Signals: Insiders Betting Big

The tide is turning:

Insider Buying Boom: $32M+ in 2024 (vs. $6.6M in 2019), including new CEO/CFO—highest in 15 years.

Congress Buying: Q2 2024 saw net purchases for the first time in 5 years (vs. historical selling).

DOJ Shift: Probe refocusing on pharmacy benefits (PBM) unit, dropping acquisition/monopoly scrutiny—implies no major findings. Great news!

Sector Tailwinds: Healthcare is one of 3 S&P sectors below historical valuations. Super investors (usually tech-obsessed) are piling in, despite the sector's -10% YTD vs. S&P's +13%.

Plus, UNH's dividend yield is at a record ~3% (vs. 1.5% avg), with 16%+ historical growth and 100%+ free cash flow conversion. Rare combo of yield + growth!

Valuation: Screaming Buy?

UNH trades at PE ~11.9 (vs. 10-year avg 23)—a steal.

Analysts project 16.7% EPS CAGR through 2029.

Conservative Scenario: 16.5% EPS growth + PE to 16.5 = $780/share by 2030 (173% total return, 18% CAGR ex-dividends).

Optimistic: PE back to 23 = $1,084/share (280% return).

Models confirm:

DCF (8% FCF growth): ~$484/share (70% upside).

DDM (7% div growth): ~$607/share (112% upside).

Blended Fair Value: ~$545/share (75-90% upside from ~$300). Buy below $436 for 20% safety margin.

Still, there is fear of DOJ uncertainty—investors hate unpredictability and that's why the stock is so low.

Key Catalyst: July 29 Earnings

This could be UNH's "most important report ever." Watch for:

Regulatory/legal updates (DOJ progress).

Full-year guidance revisions.

Metrics like medical loss ratio and PBM performance.

Positive news = potential rocket 🚀. Expectations are low (20 bearish EPS revisions vs. 0 bullish), so a beat could spark volatility... upward.

Risks: Not Without Bumps

Regulatory escalation (e.g., PBM issues) could tank it further.

Short-term headwinds: Medicare costs, sector selling.

Mitigants: DOJ de-risking, strong FCF buffer, insider confidence. Enter cautiously—size positions small.

TECHNICAL ANALYSIS

I also did a little technical analysis:

UNH price is at a resistance level

My EVaR indicator tells me we are in a low-risk area

RSI says the stock is oversold

I added the different price targets for better visualization

THE PLAN

My plan:

Later today, I will allocate 1% to 1.5% of my portfolio to the stock. If it drops, I will continue to DCA. The stock is already really beaten down, and I think a company this large cannot drop much more.

Quick note: I'm just sharing my journey - not financial advice! 😊

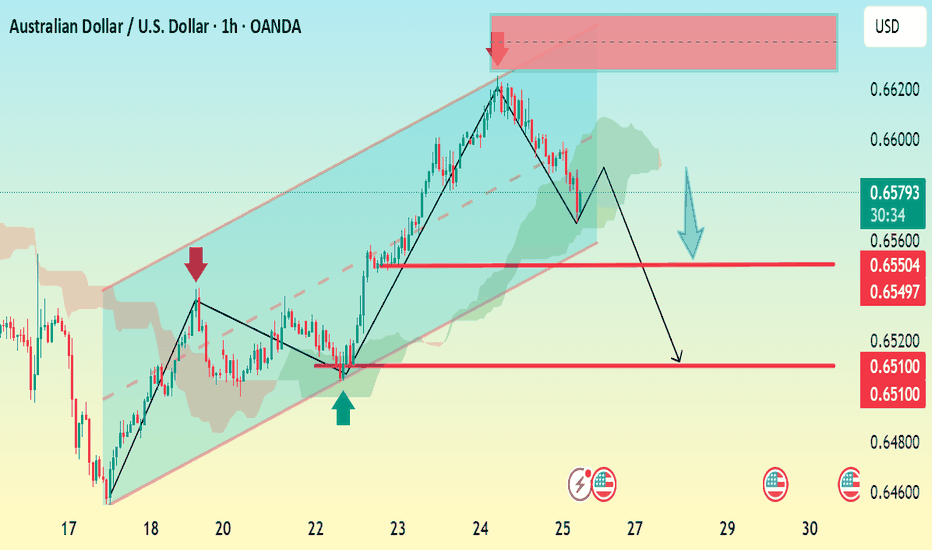

AUD/USD Bearish Reversal Setup (1H Chart) Analysis:The pair has recently broken down from the ascending channel (highlighted in blue), indicating a potential trend reversal.

A lower high has formed after the peak near 0.66200, followed by a sharp drop, confirming bearish momentum.

Current price is hovering around 0.6573, and the structure shows a bearish flag/pullback, hinting at another drop.

Bearish Target Zones:

1. First Support/TP1: 0.6550 – 0.6549 (short-term support zone)

2. Second Support/TP2: 0.6510 – 0.6515 (major support level and key target)

Confirmation:

Watch for price to reject any bullish pullbacks below the broken channel and drop past 0.6550 for stronger confirmation of the move toward 0.6510.

Bias: Bearish

Timeframe: 1H

Invalidation Level: Break back above 0.6620 resistance zone.

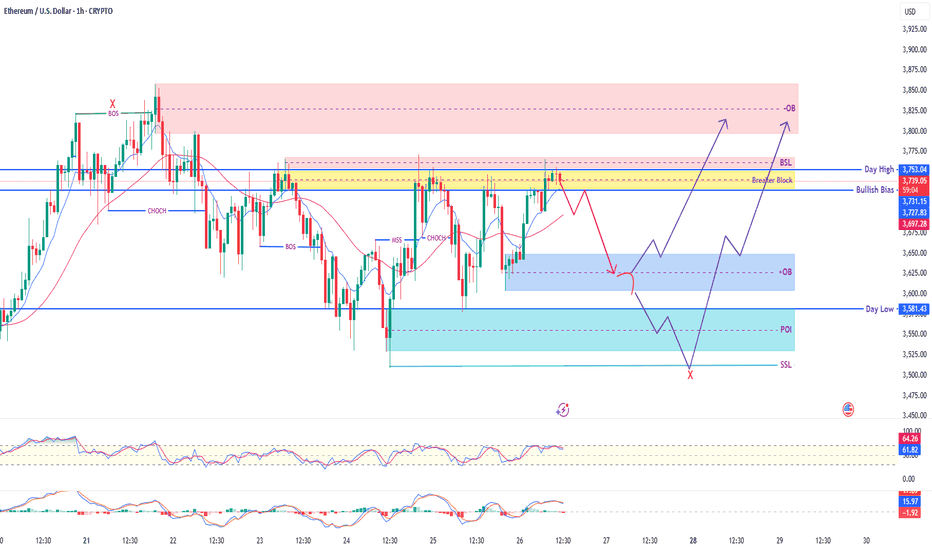

ETH/USD - Ethereum's Next Move? Decoding Price Action! Hey TradingView Family! 👋 Get ready to dive deep into our latest 1-hour Ethereum (ETH/USD) chart analysis. We're tracking some fascinating price action and key Smart Money Concepts that could dictate ETH's next big move!

What We're Seeing Right Now:

Current Price Zone: ETH is currently consolidating around the $3,730 - $3,750 area, right within a critical zone.

Breaker Block in Play: Notice the yellow 'Breaker Block' zone (around $3,700 - $3,750). This was previously support and is now being retested, acting as potential resistance. A break above could signal strength, while rejection confirms weakness.

Liquidity Magnets:

BSL (Buy Side Liquidity) 🎯: Just above us, around $3,750 - $3,770, lies a pool of buy-side liquidity. Price often targets these zones to fuel its next move.

SSL (Sell Side Liquidity) 📉: Down below, near $3,510 - $3,520, we have sell-side liquidity. This is a potential magnet if bearish momentum takes over.

Key Zones to Watch:

Upper Order Block (Red OB) 🔴: Our primary supply zone overhead, from $3,800 to $3,850. This is where we might see strong selling pressure if price reaches it. Also marked with a 'New High' for extra context.

Lower Order Block (Blue OB) 🔵: A potential demand zone below, roughly $3,600 - $3,650. This could act as strong support for a bounce.

Point of Interest (POI - Light Blue) ✨: An even deeper demand zone around $3,540 - $3,590. This area could provide robust support if price continues to drop.

Potential Scenarios (Follow the Purple Arrows! 🔮):

Bullish Path (Uptrend Continuation) 🚀: If ETH can definitively break and hold above the 'Breaker Block' and clear the BSL, we could see a strong push towards the Upper Order Block ($3,800 - $3,850). This would align with a continuation of the bullish bias we've seen.

Bearish Path (Pullback & Reversal) ⬇️: If the 'Breaker Block' holds as resistance, we might see a pullback. Price could find support at the Lower Order Block ($3,600 - $3,650) for a bounce. However, a break below this could lead to a test of our POI ($3,540 - $3,590), and potentially a sweep of the SSL ($3,510) before finding a true bottom.

Indicators Check:

RSI: Currently around 67, indicating strong momentum but approaching overbought conditions.

Stochastic: Showing an upward trend, confirming current bullish sentiment but also nearing the top.

Our 'Day High' ($3,757) and 'Day Low' ($3,581) are crucial pivot points to monitor!

Always remember to trade smart, manage your risk, and wait for confirmation. This is not financial advice. Do your own research! 🛡️📊

Don't forget to Like 👍, Comment 💬, and Follow for more detailed analyses!

#ETH #Ethereum #Crypto #Trading #TechnicalAnalysis #SmartMoneyConcepts #PriceAction #ETHUSD #TradingSetup #MarketAnalysis"

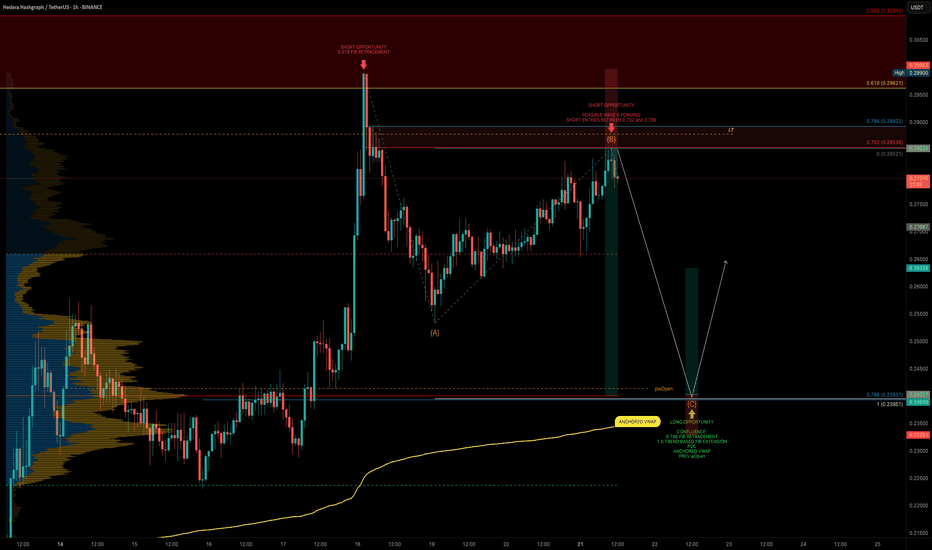

HBAR Game Plan: Short the Bounce, Long the Liquidity GrabHBAR has been moving strongly and is currently offering both short and long trade opportunities based on a clean potential ABC corrective pattern, key fib levels, volume profile, and anchored VWAP. Let’s break down the setup.

🧩 Technical Breakdown

Higher Timeframe Confluence:

0.618 fib retracement from the macro move

1.618 trend-based fib extension

1.272 VWAP band resistance

Point of Control (POC) from the visible range profile

This is marked as a major take profit/short opportunity zone.

For extra confluence, the negative fib extension golden pocket (-0.618 to -0.666) also aligns right at this resistance zone

Current Structure:

We’re potentially completing wave B of an ABC corrective move

Price has retraced into a high-probability short zone

🔴 Short Setup

Entry Zone:

Between the 0.702 and 0.786 fib retracement levels

Why Here?

0.702–0.786 fib retracement → short zone for reversals

Potential wave B top → setting up for a C leg down

Target (TP):

Around $0.25–$0.24, near the expected wave C completion

🟢 Long Setup

Entry Zone:

~$0.25–$0.24 area.

Why Here?

This zone is a strong confluence area:

➡️ 0.786 fib retracement

➡️ 1.0 trend-based fib extension of ABC

➡️ Anchored VWAP from the entire trend, offering dynamic support

➡️ Liquidity pool

➡️ Previous weekly Open

Plan:

Wait for price to complete wave C into this zone, then look for bullish reaction signs to enter long.

💡 Educational Insight

Why the 0.702–0.786 short zone?

These fib levels are often overlooked but are key “hidden” zones where wave B tops out before C waves.

Why anchored VWAP?

Anchored VWAP gives you dynamic institutional support/resistance, especially when aligned with fibs and liquidity.

Why wait for confirmation?

Blindly longing or shorting levels can trap you. Wait for SFPs, wick rejections, or lower timeframe structure flips to boost trade probability.

Final Thoughts

HBAR is in a highly interesting zone, offering both:

A short setup into the C wave,

And a long setup at the C wave completion, backed by multiple confluence factors.

Let the levels come to you and wait for confirmation!

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

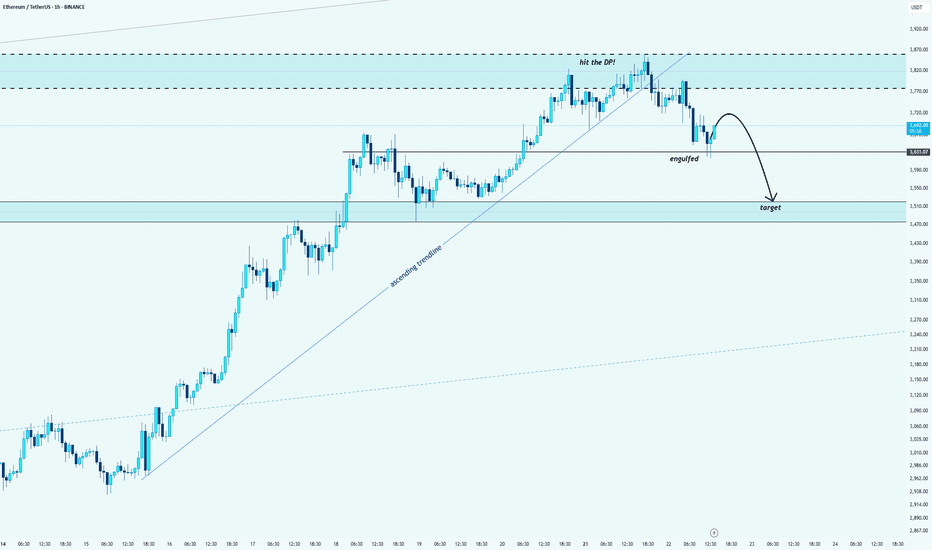

ETH/USDT: Bearish Reversal After Hitting the Decision PointHello guys!

After a strong rally, ETH finally hit the Decision Point (DP) zone marked above. Like what I said:

And we’ve already seen signs of rejection from that level.

🔹 The ascending trendline is broken

🔹 A key support got engulfed

🔹 Price is now forming a bearish structure

The target zone is mapped out around $3,500 – $3,470, where previous demand sits.

We might see a small pullback before continuation, but overall momentum is shifting downward.

Wait for confirmations and protect your capital

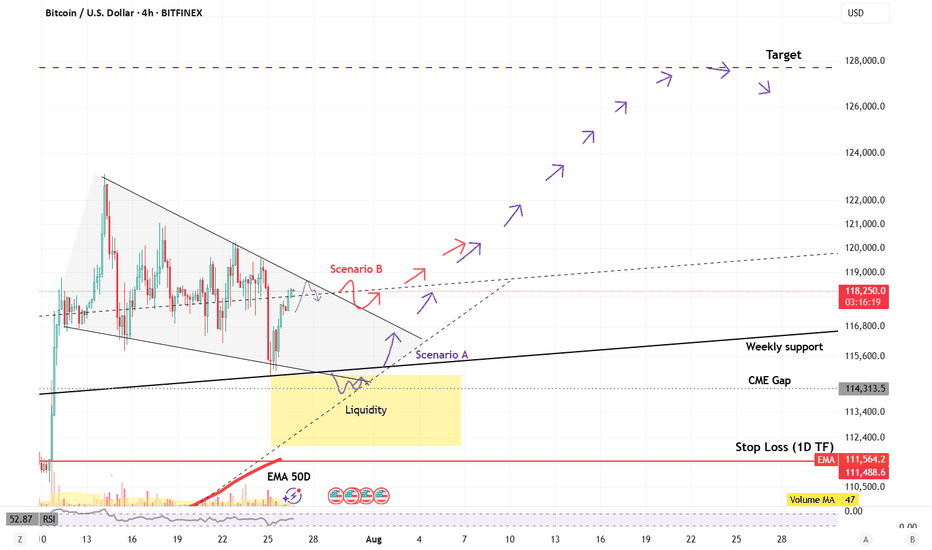

BTC wait for entryBTC has broken above the long-term weekly resistance (dating back to 2021) and is now consolidating above that key level.

On the 4H timeframe, price action is forming a descending wedge, a structure often associated with potential bullish breakouts. Two primary scenarios are unfolding:

Scenario A: Price continues to decline within the wedge, potentially reaching the high-liquidity demand zone (highlighted in yellow). A strong bounce is expected from this area.

Scenario B: A breakout occurs before liquidity is swept—suggesting stronger buyer momentum and early bullish confirmation.

Trade entries will be aligned with whichever scenario plays out, with confirmation signals provided in the accompanying chart.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

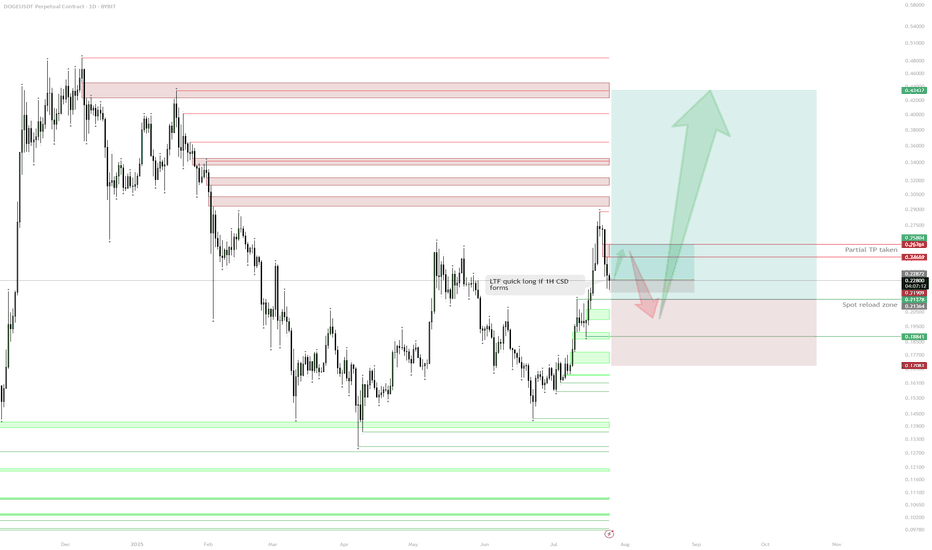

DOGE – HTF Plan & Spot Reload ZoneSpot Position & Realized Profit:

Spot position held from the $0.19 sweep.

Previous long from demand taken and partially realized at $0.26, de-risking the core position.

Current Structure:

After reaching resistance ($0.26–$0.27 zone), price is retracing.

Daily demand/support sits around $0.20–$0.21, with multiple confluences for spot re-accumulation.

Immediate Plan:

Waiting for price to revisit daily demand ($0.20–$0.21) to reload spot and/or open fresh longs.

Watching for a possible lower timeframe (1H) bullish confirmation (e.g., 1H change of structure/1H CSD) as a trigger for a tactical long before daily demand is tagged.

LTF Play:

If price prints a 1H CSD, a quick long up to daily imbalance ($0.24–$0.25) can be considered.

Invalidation:

Loss of daily demand ($0.188) would invalidate the bullish scenario and require re-evaluation.

Upside Target:

If demand holds, looking for moves back into daily supply/imbalance, with ultimate HTF targets at $0.26, $0.32, and higher.

Reasoning:

The core plan is to build spot exposure at strong demand after de-risking on the first move up. The context is that DOGE has shown willingness to bounce at major demand, and with realized profits in the pocket, risk can be managed comfortably on new entries. Short-term, LTF confirmation (such as a 1H CSD) can offer a tactical long back into daily imbalance before the main reloading zone is tagged. Patience and precise triggers are key—no need to rush until price action confirms.

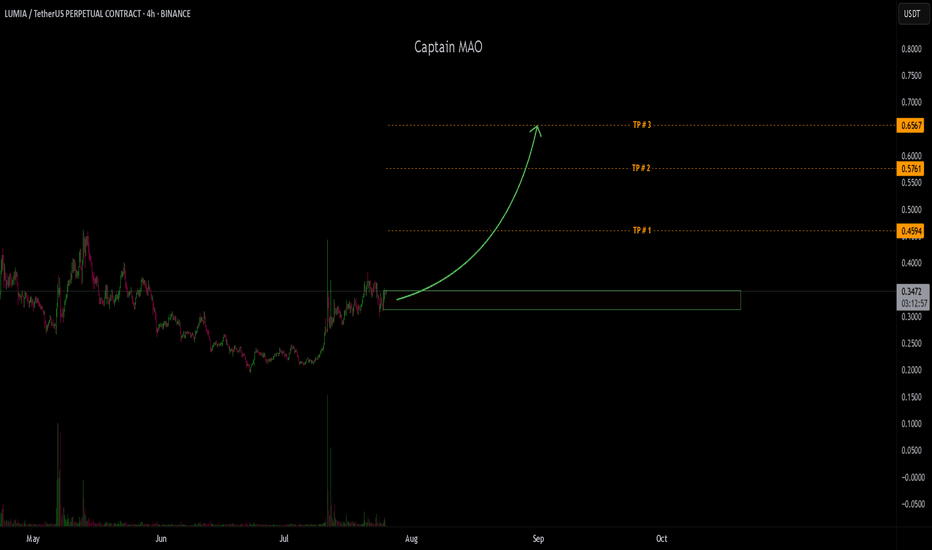

LUMIA/USDTLUMIA/USDT has shown strong bullish momentum, with the first leg printing over +100% gain—signaling early strength and buyer dominance. Over the past two weeks, price action has been consolidating in a tight re-accumulation phase, forming a healthy base just above previous resistance . This phase appears to be nearly complete, and the chart structure suggests it's gearing up for the next impulsive leg upward.

A break above the short-term range high with strong volume will likely confirm the continuation. We’ve marked the green box as the ideal entry zone, aligning with recent demand and structural support.

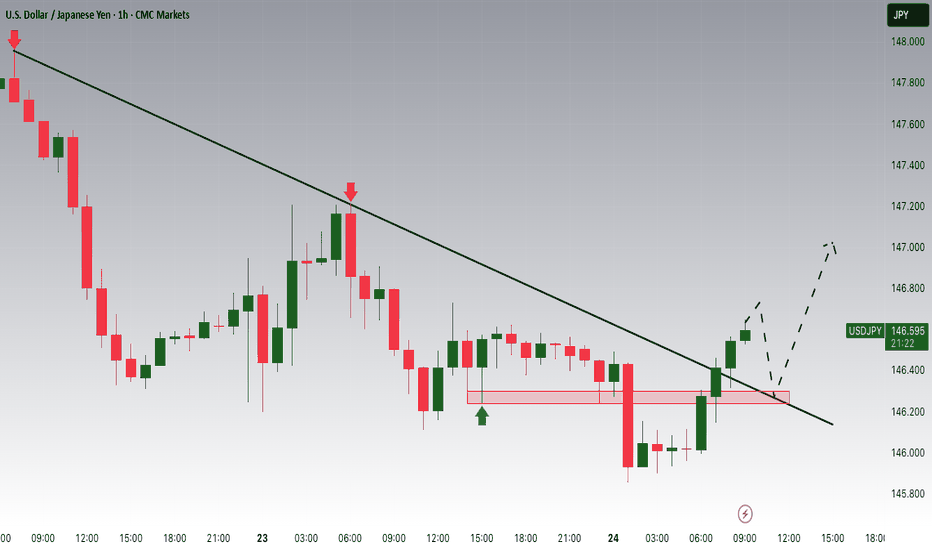

USDJPY Breakout and Potential RetraceHey Traders, in today's trading session we are monitoring USDJPY for a buying opportunity around 146.300 zone, USDJPY was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 146.300 support and resistance area.

Trade safe, Joe.