USDCAD → Short squeeze for further declineFX:USDCAD is forming another short squeeze relative to the global price range ahead of a possible decline within the global downtrend.

After breaking through the resistance of the global trading range, USDCAD was unable to continue its upward momentum. The price returned to the range, under strong resistance, and is forming a pre-breakdown base for a possible decline. The trigger in our case is support at 1.3762. The dollar is stagnating, trading below strong resistance. A decline in the dollar could trigger a fall in USDCAD

Support levels: 1.376, 1.3695, 1.3629

Resistance levels: 1.3774, 1.3809

The market structure is quite weak, both globally and locally. In addition, against the backdrop of an expected rate cut, the dollar may continue its downward global trend, which may also affect the price of the currency pair, which has formed a false breakout of resistance...

Best regards, R. Linda!

Triangle

XRPUSD formed the Triangle pattern. The price may increase.XRPUSD formed the Triangle pattern. The price may increase.

XRPUSD has been declining since July 23, reaching the lowest mark at 2.72000 on August 3. Since then the price started to form the triangle pattern. It is not a reversal chart pattern, however, RSI indicator started to show some strength of the bullish momentum. In this case, if the price breaks through the SMA200 on hourly chart and holds above it and the level of 3.00000, the following rise towards 3.20000 is expected.

Accurate Price Model for Trading Smart Money Concepts SMC (=

If you trade Smart Money Concepts SMC, there is one single pattern that you should learn to identify.

In this article, you will learn an accurate price model that you can use to predict a strong bullish or bearish movement way before it happens.

Read carefully and discover how to track the silent actions of smart money on any market.

The only thing that you need to learn to easily find this pattern is basic Structure Mapping . After you map significant highs and lows, you will quickly recognize it.

This SMC pattern has 2 models: bullish and bearish ones.

Let's start with a bearish setup first.

Examine a structure of this pattern

it should be based on 2 important elements.

The price should set a sequence of equal lows.

These equal lows will compose a demand zone.

The area where a buying interest will concentrate.

The minimum number of equal lows and lowers highs should be 2 to make a model valid.

Exhausting of bullish moves will signify a loss of confidence in a demand zone . Less and less market participants will open buy positions from that.

At some moment, a demand zone will stop holding. Its bearish breakout will provide a strong bearish signal , and a bearish continuation will most likely follow.

This price model will signify a market manipulation by Smart Money.

They will not intentionally let the price fall, not letting it break a demand zone. A buying interest that will arise consequently will be used as a source of liquidity.

Smart money will grab liquidity of the buyers, silently accumulating huge volumes of selling orders.

Once they get enough of that, a bearish rally will start, with a demand zone breakout as a trigger.

Though, the chart model that I shared above has a strong bullish impulse, preceding its formation, remember that it is not mandatory.

The price may also form a bearish impulse first and for a pattern then.

Each bullish movement that initiates after a formation of an equal low should be weaker than a previous one.

So that the price should set a lower high every time after a formation of an equal low.

Look at a price action on USDCHF forex pair. Way before the price dropped, you could easily identify a market manipulation of Smart Money and selling orders accumulation.

A breakout of a horizontal demand zone was a final bearish confirmation signal.

Let's study its bullish model.

It has a similar structure.

The price should set a sequence of equal highs, respecting a horizontal supply zone.

Each bearish move that follows after its test should have a shorter length, forming a higher low with its completion.

This model will be also valid if it forms after a completion of a bearish impulse.

Weakening bearish movements will signify a loss of confidence in a supply zone, with fewer and fewer market participants selling that.

Its bullish breakout will be an important even that will confirm a highly probable strong bullish continuation.

Smart Money will use this price model to manipulate the market and accumulate buying orders, not letting the price go through a supply zone. They will grab a liquidity of the sellers each time a bearish move follows from a supply zone.

When they finally get enough of a liquidity, a bullish rally will initiate and a supply zone will be broken , providing a strong confirmation signal.

That price model was spotted on GBPJPY forex pair.

Smart Money were manipulating the market, not letting it continue rallying by creating a significant horizontal supply zone.

Selling orders that were executed after its tests provided a liquidity for them.

A bullish breakout of the underlined zone provides a strong bullish confirmation signal.

A breakout and a future rise could be easily predicted once this price model appeared.

Why they do it?

But why do Smart Money manipulate the markets that way?

The answer is simple: in comparison to retail traders, they trade with huge trading orders . To hide their presence and to not impact market prices much, they split their positions into a set of tiny orders that they execute, grabbing the liquidity.

The price model that we discussed today is the example how they do it.

The important thing to note about this pattern is that it efficiently works on any market and any time frame. You can use that for scalping, day trading, swing trading. And it can help you find great investing opportunities.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Solana looking bullish for a long trade.Solana has been trading in an ascending triangle since the top of the 2021 bull market. Ascending triangle is a bullish pattern. If Solana can close a few weekly candle and hold support at $250, it would be really bullish for Solana possibly head towards the $500-700 range.

Watch the stochastic RSI on the monthly closely, once it closes above the 20 level it will be bullish as momentum picks up, the last time it did this was in Jan 2023 than solan went from $8 to $295.

Happy Trading

SUI Bullish Breakout Confirmed- $8 Target In sight! Hey everyone,

Today marks an important moment for SUI. We’ve just witnessed a clean breakout from a long-term symmetrical triangle on the weekly timeframe, supported by a confirmed Break of Structure (BoS) and a weekly Fair Value Gap (FVG) acting as strong support.

Price respected the FVG zone and bounced, showing clear bullish intent. With strong structure forming and momentum building, I’m targeting the $8 region as the next major level of interest. Market structure is bullish, and the confluence of trendline support, FVG, and the breakout gives me confidence in this move.

Key Highlights:

• Weekly CHoCH followed by BoS 🚀

• Price broke out of triangle and retested FVG🚀

• Bullish continuation structure (W formation)🚀

• Targeting $5.5 → $8 range if momentum holds🚀

A descending triangle Commonly known as bearish pattern. Price has been increasing for the past few weeks forming a descending triangle. It has attempted to two weeks in a row and price got rejected. As it got close the volume decreased in this particular patten, will this be the invalidation and is it in an accumulation period before the price breaks higher, or will it validate, trap bulls to reverse the price. Another opportunity developing itself for both players. What are your thoughts ?

SPK : Does history repeat itself?Hello friends🙌

✅You see that once a pattern was formed and after the resistance was broken, we had a good growth.

✅Now the same pattern has formed again and the price is in the accumulation phase.

✅We have to see if history repeats itself and if the buyers support the price again or not.

✅We have obtained important support areas for you, so that if it falls, you can buy in steps and if the pattern breaks, you can buy in steps right here, of course with capital and risk management.

🔥Follow us for more signals🔥

*Trade safely with us*

MarketBreakdown | EURCHF, WTI CRUDE OIL, GBPNZD, DXY

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURCHF daily time frame 🇪🇺🇨🇭

The market is testing a strong supply area

based on a solid falling trend line and a horizontal resistance.

Probabilities will be high that the price will retrace from that.

2️⃣ CRUDE OIL #WTI daily time frame 🛢️

The price is very close to a significant demand zone

based on a horizontal support cluster and a rising trend line.

I will expect a bullish reaction to that.

3️⃣ #GBPJPY daily time frame 🇬🇧🇳🇿

The market is trading within a contracting triangle.

The price nicely respected its support line and goes up steadily.

I think that bullish momentum will remain strong and the market

will go up to the resistance line of a triangle.

4️⃣ DOLLAR INDEX #DXY daily time frame 💵

The market is consolidating on a key daily support cluster.

Probabilities will be high that the price will bounce from that.

Today's fundamental news can be a trigger.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AFRM Pre Earnings Triangle BreakAFRM has broken the symmetrical triangle to the upside. If this holds we could see a strong rally into earnings. I would want to see strong volume added to this equation for the move up to be confirmed.

My STOP on this position would be a daily candle close back under the trendline with confirming volume. A retest of the triangle would be my spot to add to the position.

MAGIC / USDT – Symmetrical Triangle Breakout | Pullback OpportunMAGIC has recently broken out of a symmetrical triangle pattern that had been forming for several months. The breakout occurred with strong bullish volume and was accompanied by an RSI breakout above its MA, suggesting solid momentum behind the move.

📏 Technical Notes:

A descending dynamic resistance has been finally broken.

The price has clearly exited the symmetrical triangle, which often leads to explosive moves.

According to the height of the triangle’s base (~0.22), a technical target of around 0.45–0.47 can be projected.

📉 Possible Pullback:

A retest of the breakout zone around 0.20–0.21 is likely before continuation. This area also aligns with the upper triangle boundary, now turned into support.

---

🎯 Bullish Targets (Based on Triangle Breakout):

TP1: 0.30

TP2: 0.42

TP3: 0.47 (Full triangle target)

---

🛑 Stop Loss Suggestion:

Below 0.19, if the breakout fails and the price falls back into the triangle.

---

📊 Indicators:

RSI above 70 with bullish crossover.

Volume spike during breakout confirms institutional or whale interest.

Oil short: breakdown from triangle againThis idea is backed by my general view that the stock market is going to crash in August. what this means is that we are going into a risk-off environment and there will be reduced consumption and demand for oil too.

Technically, I pointed out 4 things in this chart:

1. Descending triangles

2. Lower highs

3. 3rd breakdown (after a false break to the upside)

4. A corrective wave structure

Good luck!

Energy printing fresh highs within weeksHere's a better chart than the one shared in October, showing that energy has been consolidating above an upward sloping triangle formation, over 900 days in the making .

With just under 4% remaining to reach prior highs set in April, fresh highs could be just weeks away. Looking at the height of the triangle to project potential gains, there could be a whopping 30% upside ahead.

Lately I've stepped back to ponder the fundamental underpinnings of this move. During the same period, the price of oil has cratered by 40%.

Charting XLE/BRENT shows an astonishing double during the bullish XLE triangle formation

Could it be something to do with the hot war in Ukraine? Anecdotally we know OPEC+ (Saudio Aramco et al) has continued to hold on output increases, while their western peers (XLE) are pushing more product than ever. One theory is XLE companies have taken market share to account for the decline in prices.

Two questions remain:

would oil prices in the $40's be enough to tank XLE shares?

if XLE can hold historic value during a deeper oil price decline, where could its valuation be headed during the next bull cycle in oil?

Energy stocks poised for fresh ATHEnergy stocks (XLE) have been in a clear ascending triangle for some months now on the weekly chart. There was a false breakout not too long back, but the pattern held up after breaking down and price is again pushing up against resistance at the top of the triangle.

Having recently posted a massive green candle with the angst in the Middle East, coming weeks and months could bear witness to fresh all time highs.

ETHUSDT Breakout ImminentETH sitting on $3500 support after reclaim

Price action is tight and indecisive.. lots of dojis and back-and-forth engulfing candles. Buyers and sellers clearly fighting it out.

We’re coiled in a symmetrical triangle, right on a key level that used to be strong support. It got broken but now reclaimed, im leaning bullish.

S&P and Nasdaq opened strong. If we break out of this triangle to the upside with volume, we could see a quick move toward $3650-3700.

USDJPY → False breakdown of upward trend supportFX:USDJPY is testing trend support as part of a correction triggered by news. The dollar has been recovering since the start of the session, giving the pair a chance to rise.

As part of a correction against the backdrop of sharp and unexpected Friday NFP data, the currency pair is forming a false breakdown of trend support and testing the 0.7f buy zone. The market is reacting to the retest of support. Momentum is forming. Focus on the local range of 147.6 - 147.9. If the bulls keep the price above this consolidation, the price may continue to rise

Resistance levels: 147.95, 149.02

Support levels: 157.55, 147.0

Focus on the trend and the indicated consolidation, which may move into the realization phase. If the bulls take the initiative, the pair will have a chance to rise to 149 - 150.8.

Best regards, R. Linda!

EURSEK 1W: triangle breakdown - bearish retest in playOn the weekly chart, EURSEK completed a symmetrical triangle pattern followed by a clean breakdown. The recent bullish move is now testing the 0.705–0.79 Fibo zone ($11.29–11.20), which aligns with the lower boundary of the former consolidation and 200 EMA resistance. So far, the price fails to break and hold above — suggesting a bearish continuation is likely.

Technical outlook:

Symmetrical triangle broke downward

Price is retesting Fibo zone 0.705–0.79

Strong resistance near 11.29

EMA200 adds overhead pressure

Next downside target: 1.618 Fibo at 10.38

From a macro perspective, the Swedish krona is holding better due to domestic rate expectations, while the euro may weaken further if the ECB pauses tightening. If the trend holds, EURSEK could break 11.00 and head toward 10.38 in the coming weeks.

When structure and fundamentals align - markets tend to follow.

GOLD → The rally following weak NFP data may continueFX:XAUUSD is moving into distribution (rally) on the back of unexpected NFP data released on Friday. The dollar is plummeting...

Fundamentally, the gold market is getting support from an influx of funds after the unexpectedly weak NFP report. Against this backdrop, Trump said that the employment data had been “rigged” to make him look bad...

I believe that the situation is somewhat different: the president's administration failed to control this moment, hoping to see positive dynamics. Powell now has a small trump card to control his actions. The reduction in interest rates will most likely be postponed until the fall.

Technically, on D1, gold is rebounding from the support of the global trading range, forming a local bullish trend that coincides with the global one.

Resistance levels: 3362.8, 3383, 3433

Support levels: 3345, 3334

Gold is exiting the local downward channel, breaking through resistance at 3334 and 3345. Consolidation is forming, and by the end of the session, the price will break through resistance at 3354.75. The market is quite strong. Focus on two levels: 3362.8 and 3354.7. At the opening of the session, the price may attempt to break through the resistance level of 3362.8. If gold consolidates above this level, growth may continue. If not, then before further growth, the market may test the support level...

Best regards, R. Linda!

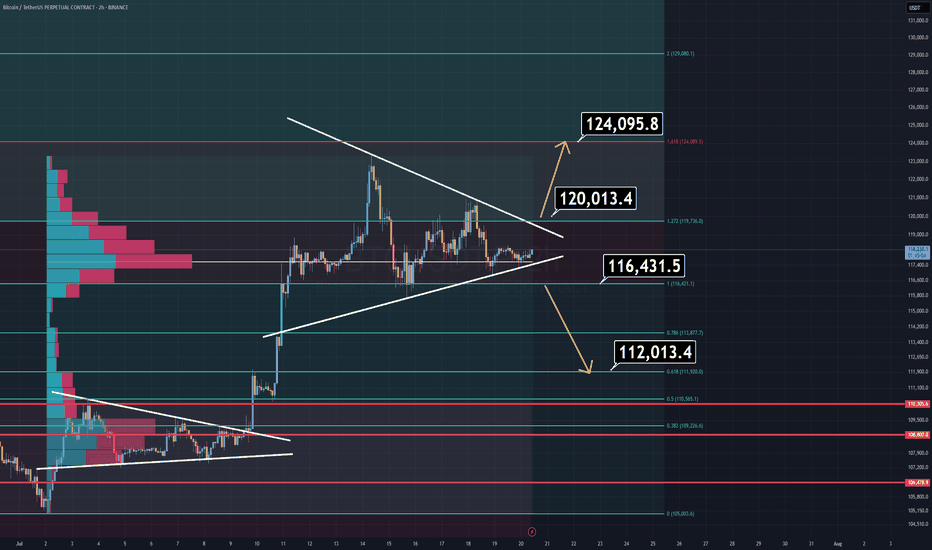

BTC Analysis (2H)Bitcoin is currently consolidating within a symmetrical triangle, suggesting indecision in the market. However, a breakout is imminent — and when it comes, it will likely be sharp.

🔹 Bullish Scenario:

A breakout above $120K would likely lead to a new All-Time High near $124K.

🔹 Bearish Scenario:

A breakdown below $116,400 opens the door for a quick drop toward the $112K–$110K zone, which should be considered a buy opportunity.

⚠️ Pro Tip:

There’s a volume imbalance just below the $116.4K level. If price breaks below it, the move down may be faster and more aggressive than expected — so plan accordingly.

Regardless of short-term volatility, the macro trend remains bullish, and Bitcoin will rise again.

Thanks for reading.