BT Group - Filled the gapBuy BT Group (BT.A.L)

BT Group plc is a communications services company. The Company is engaged in selling fixed-voice services, broadband, mobile and television products and services, as well as various communications services ranging from phone and broadband to managed networked information technology (IT) solutions and cyber security protection.

Market Cap: £18.96Billion

BT has broken out of a channel pattern on the daily chart. The shares recieved a boost following the Conservative win in the General Election and the shares gapped higher. We have now seen that gap get filled, which should attract fresh buying interest.

Stop: 181.6p

Target 1: 212p

Target 2: 230p

Target 3: 265p

UK

Ibstock - Building momentum brick by brick.Buy Ibstock (IBST.L)

Ibstock plc is a United Kingdom-based company, which is engaged in manufacturing of clay bricks and concrete products. The Company's segments are the UK and the US. The Company's principal products include clay bricks, brick components, concrete stone masonry substitutes, concrete fencing, pre-stressed concrete products and concrete rail products.

Market Cap: £1.01Billion

Ibstock shares are trading in a short-term uptrend, which topped out around 265p. The break of resistance at 239p was met with fresh buying interest before profit taking set in. The corrective move lower in recent days has seen the shares retest the breakout level at 239p. A bullish flag/pennant pattern has also formed, which suggests higher price will be seen in the short term. The first target is the resistance at 266p, with the ultimate target up at 305p.

Stop: 235p

Target 1: 266p

Target 2: 275p

Target 3: 305p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

FOOTSIE 100 POTENTIAL SELL!GOOD AFTERNOON TRADERS, ITS GOOD TO BE BACK! HERE WE HAVE A POTENTIAL SELLING OPPORTUNITY ON THE UK STOCKS. THE CURRENT DAILY PRICE ACTION IS A BEARISH ENGULFING AND IF FINISHES THIS WAY WILL CONFIRM ENTRY BUT I'D STILL LIKE MORE FROM CANDLES FOR A STRONGER CONFIRMATION. IT HAS MULTIPLE CONFLUENCES FROM A TECHNICAL STANDPOINT TO BACK UP THE SELL AND ACCOMPANIED WITH A GREAT RR. FROM A FUNDAMENTAL STANDPOINT UK STOCKS HAVE BEEN RALLYING AND HAS HAD A LOT OF BULLISH MOMENTUM PARTICULARLY IN THIS STOCK. SUCH AN IMPULSIVE MOVE UPWARDS IMPLIES A LOT OF VOLUME AND BULLISH STRENGTH SO TAKE IT EASY WITH THIS ONE AND USE UNDER 1% RISK AS COULD STILL CONTINUE TO RISE.

Europe is “disappointing”, we trade with oscillatorsMonday turned out to be a relatively calm day for the foreign exchange market. The euro and the pound could not reach Friday's peaks, due to the weak macroeconomic statistics.

For example, in Germany, the PMI in the manufacturing sector fell to its lowest level in the last couple of months and amounted to 43.4. This confirms that the largest eurozone economy is experiencing serious problems. Recall, any index value below 50 means that activity in the manufacturing sector is declining.

Germany is not an exception. Weak data came from both France and the UK. According to PMI, manufacturing activity in Britain is at its lowest level over the last 7 years. The PMI in the manufacturing sector in the UK came out at 47.4 pips (analysts expected 49.2).

In general, the lack of growth of the euro and the pound against the background of such data is quite logical.

On the other hand, this is not a reason to refuse to buy EURUSD and GBPUSD. All we need is statistics on industrial production in the United States come out weak. Well, for the pound it would be nice if the data on the labour market did not disappoint.

In general, today we are not expecting any revelations and strong directional movements. In our opinion, the best trading tactics for today is oscillatory trading. So we trade with RSI or Stochastic or you can choose another one.

Once again, we draw attention on extremely attractive positions for sales of the Russian ruble.

ridethepig | UK Elections [LIVE COVERAGE] UK Election Chartbook

With longs already getting nervous ahead of the exit polls, let's get started by digging deeper on the political side first...For all those tracking and trading the main event this evening we have only two realistic scenarios in play which makes capital flows easier to track:

=> A Tory majority which will deliver the Johnson/May deal with a hard brexit via Irish sea border and less activity with the EU (70% odds).

=> A Labour minority government with a helping hand from Lib Dems et al, here we can expect a second referendum in 2020 with a choice between a soft exit or remain (28% odds).

Any further gridlock in Parliament is currently sitting at <2% and does not remain in play. This would dramatically short-circuit GBP as markets will be caught out of position.

UK markets pricing a Conservative majority as a " positive resolution " to Brexit is complacent and allows us an opportunity to capture those out of position and mis-pricing UK market access beyond 2020. To date we have traded a tremendous amount of conjecture around the Brexit chapter, yet many are quickly to forget we are yet to trade the "fact" leg.

This next chart indicates the sense of division in Britain, a fragmented society which also highlights the stupidity to have such a referendum on a complex topic. The UK is not like Swiss for example having referendum after referendum, rather it is a representative democracy. Yet sadly we are seeing a corruption of democracy via media manipulation swerving public opinion.

For example, those who remember Cameron's premiership will remember the government was at the time asking for public to remain while they were pursuing policies of austerity (decreasing consumer confidence) and served to have more damage than good. The silent revolution or protest vote (all cleverly calculated) unlocked Pandoras box with a People vs Establishment narrative:

In any case, a ruthless Downing Street (with the help of Cambridge Analytica and co) have a free pass to do what they want and say what they want with scandal after scandal yet the masses remain on mute simply wanting to " get brexit done " ... bitterness in the public will last for a very long time and history will mark the collapse of the Crown, a fall that will stretch decades turning little England into a house of economic bondage.

A quick review of the UK Election Opinion Polls :

Survation: CON: 45% (+3) LAB: 31% (-2) LDEM: 11 (-) BREX: 4% (+1) GRN: 2% (-2), 05 - 07 Dec Chgs. w/ 30 Nov

BMG: CON: 41% (+2) LAB: 32% (-1) LDEM: 14% (+1) GRN: 4% (-1) BREX: 4% (-), 04 - 06 Dec Chgs. w/ 29 Nov

YouGov: CON: 43% (+1) LAB: 33% (-) LDEM: 13% (+1) BREX: 3% (1) GRN: 3% (-1), 05 - 06 Dec Chgs. w/ 03 Dec

Deltapoll: CON: 44% (-1) LAB: 33% (+1) LDEM: 11% (-4) BREX: 3% (-) Chgs. w/ 30 Nov

Panelbase (Scotland): SNP: 39% (-1) CON: 29% (+1) LAB: 21% (+1) LDEM: 10% (-1), 03 - 06 Dec Chgs. w/ 22 Nov

Exit polls will start at 10pm (GMT) via SKY/ITV/BBC. Usually the exit poll is very accurate so it is highly likely we will be able to clear the knee jerk flows quickly unless there is a major surprise. We can draw a tree below to showcase the forward walk with Brexit:

- UK Elections (we are here) => Conservative majority => No transition extension (most likely scenario)

or,

- UK Elections (we are here) => Hung parliament => Second referendum (least likely scenario)

On the macro side, I have widely covered segments on growth, inflation and policies in the Telegram and in previous ideas in the archives (see attached). A major round of fiscal easing is coming, this will artificially keep growth supported in the short-term however the output gap will not close. Inflation will once again tick above target, however not via a robust consumer as many predict but rather via supply side constraints and uncertainty. The BOE will remain sidelined till 2H20 and provide a decent profit taking opportunity for our macro short positions.

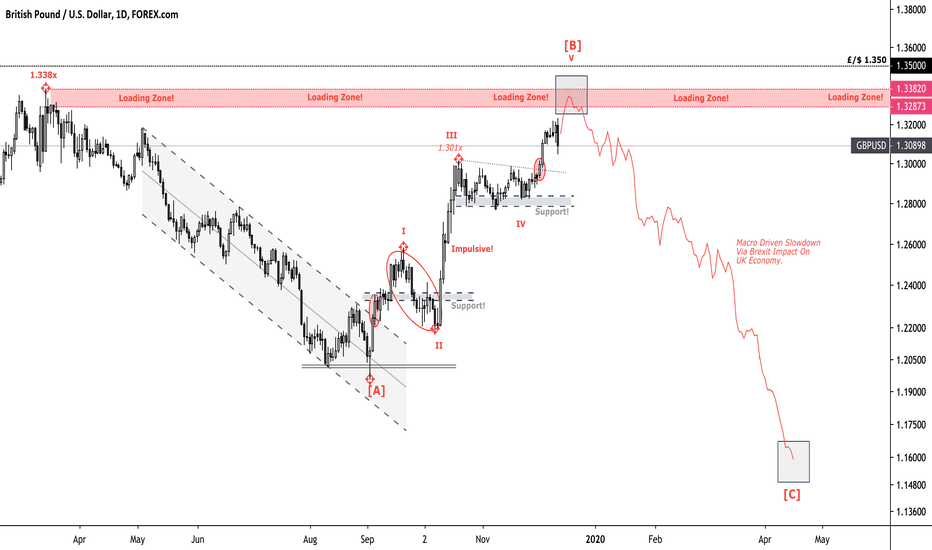

For the technical flows we are tracking the infamous 1.35xx psychological resistance. This is a great level to track for macro positions in 2020 on the sell side. Here I am tracking for a leg from 1.35xx => 1.15xx via Tory majority and the Brexit fact impact leg. A quick recap of the same levels we traded here live on tradingview earlier in the year. We are sitting at the same levels as before which we were loading into and traded a +/- 2000 tick swing !!!

Here I am becoming increasingly bearish on UK outlooks with either scenario. In my books Johnson will win by a country mile and we will immediately be able to trade the final flush in Pound (stage two of our rumour/fact impact legs). Populism is spelling danger across the global economy and shows no signs of abating.

...Best of luck to all those on the sell side and looking to increase exposure across portfolios. As usual thanks for keeping your support coming with likes and comments !!!

GBPAUD TRADING OPINION AND PLANPotential space for lower in my opinion and as the chart we can see price breaking lower the ascending trendline and support 1.93076 should indicate bearish in power. Boris Johnson and his friends are amending the Brexit bill to NOT allow further extensions. This means that, once the government has set a deadline, the U.K. must stick to it with or without a trade deal with the EU. On the other hand the so-called Phase One trade deal between Washington and Beijing has been “absolutely completed,” a top White House adviser said on Monday, adding that U.S. exports to China will double under the agreement which provided some positive vibe in comdolls sentiment which I think will help Aussie on this trade at the moment.

Brexit FUD is over. Labour party worse result since 1935!I am so proud of the UK. In the 1930s they rejected the growing populism in the world, and in 2019 they did the same.

All the propaganda, all the demonizing, and the forces of anti-freedom still lost, but a huge margin!

And if europe falls, we shall go on to the end. We shall fight in France, we shall fight on the seas and oceans, we shall fight with growing confidence and growing strength in the air, we shall defend our island, whatever the cost may be. We shall fight on the beaches, we shall fight on the landing grounds, we shall fight in the fields and in the streets, we shall fight in the hills; we shall never surrender.

The short sellers got scammed hard. "Oh no the GB economy will collapse if they leave". Those shorts have started to burn.

Their will be suckers rally, which I intend to join.

But I see the pound going up in general (different pairs may have different results at least the GBP against the EURO will I am nearly certain, continue to skyrocket).

Bears are getting their faces ripped off...

The perfect move would look like this:

We need a desperate attempt by GBP bears to get filled at a high RR in a high probability area.

What is good for us, on tradingview, Boris Johnson said he wanted the UK to be a world leader in tech innovations and finance.

They totally understand and support what we do, and want more of it.

I think the UK is going to be pretty safe from extremism as it has always been.

I wonder what deal they're going to get and how things will be for Ireland, and what will happen in Scotland, for some reason alot want to stay in the EU.

The experiment is about to fall apart, they should at least wait a few years before making emotional decisions...

There are so many medium sized and small countries in europe but a huge block like what it become is too much.

Different cultures languages etc... Did they think they could create something like the United States?

Germany Austria and Hungary could merge, maybe a little more, and being bigger like this would make them more relevant, Belgium the Netherlands and Luxembourg could merge to not be as small, Denmark Sweden Norway maybe Finland, Estonia Latvia Lithuania could merge.

I think it would be beneficial to them to make unions of 3 to 5 countries, rather than have all these tiny places, who knows or cares about Slovenia seriously?

Instead of 35 irrelevant countries in Europe, it could be a place with a few large federations or unions.

Right now to me Europe is: UK - Portugal - Spain - France - Italy - Germany - Poland - Ukraine - Romania - Greece - (Sweden) - (Turkey) - (Maghreb) - (Russia) - The Rest

In () the places that are peripherical to "main" europe.

Europe maybe made sense right after WW2, but this does not make as much sense anymore (also, we built a huge empire around germany to keep their conquest ambitions tamed?).

Europe is too ambitious and makes little sense. It's so big that it doesn't work and no one outside of it takes it really seriously. The place could have around a dozen merged states instead of 35+ and they would all have a certain importance, it would make european countries more relevant and recognizable, China would speak to the Polish Lithuanian commonwealth and take them seriously, but you think they care about Latvia and Belarus? Does anyone in the USA Or SEA have any clue Belarus even exists?

Poland + Lithuania + Latvia + Estonia + Belarus + Ukraine have a combined population of 100 million and a GDP of 900 billion, close to 1 trillion, which could bring them to the table with the big boys. They would actually be in the top 20 and a force to be reckoned with not some collection of "third world dumps".

But by themselves even the biggest ones - Poland and Ukraine - bring smile to people, no one takes them seriously.

Poland lmao, it's even a joke in west europe to call someone Polish.

Europe has to fall for european countries to grow together and bloom? Because why consider some alliances if you can just join europe.

Would also be nice to be able to trade some relevant (and uncorrelated) currencies because mini currencies like the Polish Zloty let me tell you they suck!

And low liquidity, high spreads... The currency doesn't even move by itself according to its own country economy...

We live in an open world, earth is much bigger than europe, so tiny countries do not make much sense anymore. This doesn't mean they should go for the complete extreme with an union of 25 countries that speak different languages...

As usual, people are only able to think in extremes, and it failed. AS IT ALWAYS DOES. Good riddance. Long live the queen.

Tesco - Pattern consolidation for long trajectory.Tesco:

-In the daily chart: Price action has consolidated into a rangebound symmetrical triangle, this usually symbolises continuation (to the upside) but I do not discount the possibility of a short if we fail to breakout long and in-turn breakout in the opposite direction.

Identifying a breakout: In this case price has had bullish candles deviate outside of the range, however, using both a price and time filters for confirmed entry, no bullish daily candle has so far managed to close outside. As we are right at the upper wall of the pattern, this could occur soon for a nice RRR ONLY IF we get a bullish daily candle close long.

Catalysts for the move: UK election - If the conservatives gain a majority on Thursday night then I expect this entry position to be triggered, if not then i expect the opposite for this and the FTSE100 in general if labour win or there is uncertainty with a hung parliament.

GBP/CAD Market Situation And Future Swing ProbabilitiesPositive expectations for the upcoming U.K. general elections could keep sterling supported throughout the session, especially if polls continue to confirm the Tories’ lead. A couple of medium-tier reports from the U.K weren't actually impressive. Monthly GDP was above the previous but QoQ and YoY were lower than previous no good changes. The construction site wasn't doing good. Industrial Production and manufacturing were only better than previous but trade balance ended up the deficit for the Oct. Economic release were mix but the prospect of more opinion polls confirming a lead by the Tories may have some weight reason to push the pound higher on this cross pair.

The UK General Election 2019. All you need to know.The UK General Election 2019. All you need to know.

Plus, a great betting opportunity guide as a bonus.

As we all know, The UK General Election is to take place on 15th of October, deciding the fate of the country not only for the next 5 years, but for the decades to come!

The need for the election was obvious, given the Brexit impasse in the parliament, that was unable to deliver Brexit for more than 3 years, sabotaging the will of the people. Having a Remainer prime minister without the real majority did not help the cause either.

Now, with new Brexiteer prime minister Boris Johnson at the helm, and the ERG-the European Research Group, the eurosceptic parliamentary fraction within the Conservative party, the country has got a chance to see some real action. Yet, we saw the parliament going to great lengths to sabotage the new government, ranging from using the powers of a scandalously biased speaker- John Bercow, to prevent voting from happening to using the newly created supreme court, who’s politically motivated decision undermined the government and the Brexit proceedings.

Getting to the election was a massive struggle in itself with the opposition blocking the motion to call for an election, which Implies the oppositions grim outlook on its electoral prospects.

Now, with less than 8 days to go, let's have a look at the election scene the way I see it.

So, the Tories are leading in the polls, entering this election as a ruling party, with some recent success in the Brexit talks, a charismatic energetic leader, and a clear Brexit position, which is now declared to be the hard Brexit, with a proper trade deal afterwards. The, who wins this election will decide not only the manner of leaving the EU but also the future relationship with the Block.

Brexit seems to be the key focus issue of the Tories in this election, and they are trying to steer all the debate into this channel. There is a grain of salt in there for Boris, however, as he promised to take the country out of the EU by 31st of October, and, as we can see, he did not. Not his fault though, but, a good aim for criticism for the competitors.

There are some spending promises from Tories too, for NHS In particular, which seems to have become the sacred cow of UK politics.

Boris Jonson himself is both an asset and a liability in the increasingly «presidential» in style UK elections. He is vocal and charismatic, bold and aggressive. Compared by many to Donald Trump in both the political style and in the way he looks. Some might remember him as a liberal mayor of London, for others, especially the young swing voters, his Brexit stance and his style might be a massive put off.

On the bright side, one of the highlights of the last debate was Boris’s clear position on Scottish independence. He said that the Union is more important than Brexit and than anything else, which is appealing to the part of the electorate that values the Union, which, let's be honest, is a majority, even in Scotland. Seats before current parliament dissolution: 298

Labor, in contrast, is entering the election mired In the antisemitism scandal, with Jeremy Corbyn as a leader and an unclear Brexit position. Corbyn, being a geriatric incoherent Marxist, who miraculously managed to become the Labor leader is a massive scarecrow for swing voters of all stripes.

The last election momentum surge, that deprived the Conservatives of their majority was largely due to the voter’s delusion of Labor being a Ramain party. That advantage is gone, with labor spending all 3 years of Brexit struggle sitting on a fence, calling it “constructive ambiguity” and now, becoming a second referendum party. Labor wants to renegotiate Boris Jonson's deal and then put the result to another public vote, with the Remain as a second option.

Unsurprisingly, Labor talks mainly about the “starved” public services, the river of cash for the NHS, the free broadband for everyone, in addition to their plans to nationalize Water, Rail, and Electricity.

More free stuff for everyone paid for by the money form the magic money tree, which is how Labor sees the government borrowing and taxation. Should labor get in power, having half their plan done is certain to put the country on the brink of insolvency. They call that ending the austerity, which turns out to be a maximum affordable level of spending when put under scrutiny. The fact that the public services used to get more funding in the pre-crisis Labor era simply means that the latter tend to spend beyond the means.

Another cornerstone of labor criticism of the Conservative opponents is the trade deal with the US which might be struck, should Brexit go as planned by the current government. Labor screams about the dreaded chlorinated chicken, lower labor protection and the sacred cow-the NHS being up for sale for the US health providers. For that, it is only fair to repeat Jonson’s joke, that the only chlorinated chicken here is Jeremy Corbyn himself. Seats before current parliament dissolution: 243

Lib Dems gamble on being a Remain party, with the policy to cancel Brexit seems to have backfired, with such pandering being perceived as unconstitutional and undemocratic by most of the people. Also, fake grotesque confidence exhibited by its newly elected leader, styling herself to the next Prime Minister which is almost impossible, has turned voters away.

The third mistake was remaining fiscally conservative, as it was expected for the Tories to go on a spending spree, so the Lib Dems wanted to appeal to the Tory voters, who are disappointed with the so-called current conservative's swing to the right, but who can’t vote labor. Having a female leader- a fresh face that is not mired in the “dirt” of the coalition years might help, yet, I don’t see the Lib Dems as a formidable contender. Seats before current parliament dissolution: 20

SNP- the Scottish independence party is interesting to watch with the independence talk being reinvigorated by Brexit, with not only the majority of Scotts voting Remain in the Brexit referendum, but also, previously, many voted to stay in the UK during the Scottish independence referendum, because of the UK’s membership in the EU. Now, with the UK set to leave the EU, SNP is making the case for another independence referendum, arguing that the post-Brexit UK would be such a different country, that another referendum is needed. Seats before current parliament dissolution: 35

The other parties are most likely to keep their insignificant number of seats and are largely irrelevant for this analysis. Independent MP’s: 24, DUP:10, Others:22. The total number of seats in the house of commons:650.

There is another interesting element in this election: the Brexit Party. A newly formed party starring in the latest EU parliamentary elections, which theoretically were not supposed to take place in the UK due to Brexit, humiliating Britain with its inability to get the job done.

The party is Nigel Farage’s child, who is arguably the most notorious and well-spoken Brexiteer, who advocated for the UK leaving the EU for the last 20 years.

The party was meant to be a boogieman for the Tories, pushing the latter further south on the scale of the Brexit hardness, threatening to steal the leave voters from the tories around the country.

The Brexit party's current position exposes the inadequacies of the UK’s current electoral system. The first-past-the-post (FPTP) system, where single MPs are picked per constituency on a non-proportional basis, means that smaller parties have virtually no chance of getting any representation in the parliament, ensuring the two main party’s lead position.

UKIP- the UK independence party, a former Nigel Farage’s project is a perfect example of the inflexibility of the FPTP system, with the UKIP polling in 7-12 percent at times, yet failing to get a single MP in the commons for years.

Voters might like your agenda, yet people vote for the party that has got chances of being in power at the end of the day. In other words, it is theoretically possible for the party to get 30% of the popular vote, but with it being distributed evenly among the constituencies, the party gets ZERO representatives in the parliament.

The recent study shows that nearly 14 million voters are living in constituencies that have been held by the same political party since at least the second world war, with some not having changed hands for more than a hundred years.

The Brexit party’s power, while having no chance of getting a single MP, is in that it could steal some voters from the Conservatives in each constituency, delivering victory to the Labor.

That is how it was supposed to work. This position might have shifted the Conservatives position, so the plan worked. Now, however, with the Tories being the only ones, who can deliver any Brexit at all, Nigel Farage said they are not targeting Conservative seats.

The same complication haunts the Lib Dems, with the Conservatives saying: vote Lib Dem-get Corbyn in power. And that is a reasonable claim.

It is clear, that this election is going to be about who you hate the least, not the who you like the most.

With no one having made a single major gaff yet, the campaigns have been quite dry and boring, the debates were toothless and uneventful. Taking this into account, with just a week left to go, the polls and the common sense suggest a high chance of the Conservative majority, with the bookmakers supporting this view with 2/5 odds on this scenario vs 6/1 on the Labor Minority being a second likeliest one.

Labor Minority, which Implies that Labor takes more seats than the Conservatives, yet less than needed for the majority, is wildly unlikely, due to the fact that Lib Dems are mostly targeting Labor seats. SNP might gain in Scotland, taking seats from both labor and Conservatives. So Torie seats are largely the only ones, that Labor can be targeting , which will prove to be a hard thing to do, given the current poor state of the labor party.

Tories minority government seems to be the second likeliest option to me with the odds around 10/1 making it an excellent betting opportunity. Here is why. If Tories don’t get the majority, labor might indeed try to form a coalition government by promising SNP a second independence referendum and offering Lib Dems a seat at the table and a second Brexit referendum with even softer Brexit option on the table. Labor will need both SNP and Lib Dems to form a coalition, which makes it an unlikely option, given the limited time given to form the government and the difficulty and instability of the Trilateral relationships. The prospects of the coalition are further undermined by the Lib Dem's bad memories from the coalition with Tories. Will they risk another one? Who knows. The unlikelihood of the coalition government is reflected in the 22/1 odds, making it a formidable betting option too, because, while being less likely than the Conservative Majority/Minority government it is still possible given how volatile politics has become.

Common sense suggests that the Tories majority is the best scenario for the UK now, as this option provides certainty with regards to Brexit, makes the US trade deal possible, and keeps the Union intact by denying the SNP their second referendum, which is an insane endeavor, to begin with. Not least because they had one already. And such votes are supposed to be a once in a generation thing at best. You can't just throw in an independence vote now and then for a laugh. Also, we can trust the Conservatives to be fiscally responsible, which will help the country prepare for both the possible global crisis and the headwinds of the first post-Brexit years.

On a side note, Brexit and all the other issues that the UK faced in the last 5 years exposed an outdated political system unfit for the 21st century. The need for the electoral reform, giving more power to smaller parties while also allowing for the new ideas to come onto the political scene, forcing major parties to adopt, is clear as day.

There is a need for a written constitution too, now that the UK has got a supreme court, which was able to overturn the decisions of the government recently while being unelected and unlimited in the scope and direction of its decisions by a written constitution. Finally, a radical decentralization is crucial to keep the Union, or one, and also to allow for the county to be run more efficiently, whereas now almost all the power rests in London.

The end.

Please, like, comment and subscribe.

UKX Price Action Analysis | Distribution SchematicThe Distribution Schematic #2, by Richard Wyckoff:

bit.ly

UK100 is currently in Phase D and has already done a Bearish SFP, which indicates a possible downtrend. This seems like a nice example of the Distribution Schematic #2 and also has a fundamental background due to #Brexit. Rest is Risk Management.

Entry: 7390

SL: 7810

TP-1: 6910

TP-2: 6610

TP-3: 6360

R/R: 2.44

Please let me know if you have any suggestions or any ideas to add. I can also give you more detailed explanation for this specific trade setup.

The ideas published here are not financial advices.

GBPUSD - Daily chartGBPUSD is fast approaching a very strong resistance level at 1.317, which is where I want to look to enter short on this pair.

This could also be the 3rd contact made on a forming trendline from the high in 2014.

My first target is 1.28 and I would wait to see a break below the ascending dotted line to confirm a further drop.

Fundamentals are playing a large role in all GBP pairs recently. So please be cautious and only take trades like this if you have already surpassed your weekly/monthly target gains.

FTSE 100 - Can it clear the cluster of resistance?We look to Sell at 7445

Bespoke resistance is located at 7445

Positive overnight flows lead to an expectation of a firm open this morning

We have a 61.8% Fibonacci pullback level of 7432 from 7729 to 7003

Although the anticipated move lower is corrective, it does offer ample risk/reward today

Expect trading to remain mixed and volatile

Stop: 7485

Target 1: 7275

Target 2: 7205

Ferguson - Turning up the heatBuy Ferguson (FERG.L)

Ferguson PLC is a distributor of plumbing and heating products. The Company operates through seven business units: Blended Branches, Waterworks standalone, HVAC standalone, Industrial standalone, Fire and Fabrication, Facilities Supply standalone and B2C e-commerce.

Market Cap: £15.35Billion

Ferguson is trading in a bullish long term channel. The shares are trading just below all time high and there is no sign of the momentum slowing. The small corrective move lower in recent days has attracted buying interest and a move to new highs is expected.

Stop: 6545p

Target 1: 7200p

Target 2: 7600p

Target 3: 8000p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Convatec - Chronically undervalued?Buy Convatec (CTEC.L)

ConvaTec Group PLC is a United Kingdom-based medical product and technology company. The Company focuses on therapies for the management of chronic conditions, including products used for advanced chronic and acute wound care, ostomy care, continence and critical care and infusion devices used in the treatment of diabetes and other conditions.

Market Cap: £3.79Billion

The recovery over the medium term continues as the shares trade in a sequence of higher highs and higher lows. The recent corrective move back to the trend line has attracted some buying interest. The formation and break of a small wedge is also an encouraging sign that we can expect a continuation. There is an unfilled gap at 223p to target on the upside.

Stop: 181.6p

Target 1: 211p

Target 2: 222p

Target 3: 240p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Barclays - Heading higherBuy Barclays (BARC.L)

Barclays PLC is a global financial service holding company. The Company is engaged in credit cards, wholesale banking, investment banking, wealth management and investment management services.

Market Cap: £29.60Billion

Barclays appears to have completed an inverse head and shoulders bottom pattern back on the 11th of October 2019. The shares continue to hold up well as a Conservative win at the upcoming election remains the most likely outcome. the medium-term target is up at 200p.

Stop: 163.65p

Target 1: 181p

Target 2: 193p

Target 3: 200p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

GBPJPY - Buying a gap fillWe look to Buy at 139.50

Trading within the Wedge formation.

The sideways consolidation continued although the market managed to post a significant high at 140.30.

We have a Gap open at 139.47 from 22/11/2019 to 24/11/2019.

Positive overnight flows lead to an expectation of a firm open this morning.

Further upside is expected and we look to set longs in early trade.

Stop: 139.10

Target 1: 141.20

Target 2: 141.60

FTSE 100 - Selling ralliesTrade Idea

Broken out of the channel formation to the downside.

Continued downward momentum from 7404 resulted in the pair posting net daily losses yesterday.

Negative overnight flows lead to an expectation of a weaker open this morning.

Further downside is expected although we prefer to set shorts at our bespoke resistance levels at 7310, resulting in improved risk/reward.

Expect trading to remain mixed and volatile.

We look to Sell at 7310

Stop: 7355

Target 1; 7095

Target 2: 7005