EURUSD is Nearing an Important Support!Hey Traders, in tomorrow's trading session we are monitoring EURUSD for a buying opportunity around 1.17000 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.17000 support and resistance area.

Trade safe, Joe.

USD (US Dollar)

EURUSD Long: Demand at 1.1720 Sets Up a Push Toward 1.1770Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. After forming a solid pivot low, EURUSD transitioned into a bullish trend, supported by a rising trend line that guided price action higher. Following this move, the market entered a consolidation range, signaling temporary balance before the next expansion phase. Price later broke out of the range to the upside, confirming renewed buyer strength. However, upon reaching the upper Supply Zone near 1.1770–1.1780, EURUSD experienced a fake breakout, followed by rejection and increased selling pressure. This rejection highlighted active sellers defending supply. Despite this, buyers managed to push price higher again, leading to another breakout attempt above supply, though momentum remained limited.

Currently, EURUSD is pulling back from the supply area and is trading near the Demand Zone around 1.1720, which aligns with the rising demand line and prior breakout structure. This zone represents a key decision area, where buyers may attempt to defend the bullish structure.

My scenario: as long as EURUSD holds above the 1.1720 Demand Zone, the broader bullish structure remains intact, and the pullback can be considered corrective. A strong reaction from demand could lead to another test of the 1.1770 Supply Zone. However, a decisive breakdown below demand would signal a loss of bullish control and open the door for a deeper corrective move. For now, price is at a critical level, with demand acting as the key area to watch. Manage your risk!

GBPUSD is Nearing a Decent Support Area!Hey Traders, in today's trading session we are monitoring GBPUSD for a buying opportunity around 1.33600 zone, GBPUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.33600 support and resistance area.

Trade safe, Joe.

AUDUSD (Short)The pair is still on a Uptrend its currently looking like its in the process of making a Higher Low, There is a good risk to reward trade presenting itself but it is Friday the last day of the trading week I don't like holding trades over the weekend but in this pair it is common for a weekly low or high to be set on Friday... Spreads suck especially on a sell order during market close or open the spread alone can hit your stop loss, so unless this trade is in profit by a big margin I don't recommend holding on Friday just my opinion from experience.

USDJPY consolidation may soon break upwards.The USDJPY pair has been ranging since the November 20 High within the 154.350 Support and 157.900 Resistance. With the 1D MA50 (red trend-line) offering long-term Support however, we may finally see this consolidation pattern break upwards.

On top of that, the 4H RSI has been rising on Higher Lows for the past 30 days. As a result, if the Resistance breaks, we see a quick window of opportunity for a short-term buy, targeting the top of an emerging Channel Up at 159.000 (+2.20% Bullish Leg like the previous one).

On a longer term note, we can see the pair hit the 2.0 Fibonacci extension at 161.400, located just under the July 03 2024 High.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDT Dominance USDT Dominance

Still trading inside a long-term descending channel

Price is at the upper trendline resistance (~6.3%)

Key support: 4.8–5.0%

Rejection from here → Liquidity rotates into BTC & Alts (Bullish)

Break & hold above resistance → Risk-off, alt pressure

👉 Watch rejection vs acceptance at this level

Patience over prediction 📊

DYOR | NFA

Bearish reversal off pullback resistance?Swissie (USD/CHF) is rising towards the pivot, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement and could reverse to the 1st support.

Pivot: 0.7945

1st Support: 0.7891

1st Resistance: 0.7979

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Could we see a reversal from here?KIWI (NZD/USD) is reacting off the pivot, which has been identified as an overlap support that aligns with the 38.2% Fibonacci retracement and could bounce to the 1st resistance, which is also an overlap resistance.

Pivot: 0.5744

1st Support: 0.5713

1st Resistance: 0.5792

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish drop?Aussie (AUD/USD) has reacted off the pivot and could drop to the 1st support, which aligns with the 100% Fibonacci projection.

Pivot: 0.6685

1st Support: 0.6633

1st Resistance: 0.6721

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

USDHKD monthly demand level is playing out. New leg expectedUSDHKD monthly demand level mentioned a few weeks ago is playing out as expected. New leg expected. New bullish price action and strong daily and H4 bullish impulses are happening as a reaction to this strongly monthly demand level at $7.77.

Expecting a new bullish leg in the following weeks.

Potential bearish reversal?Fiber (EUR/USD) is reacting off the pivot and could reverse to the 1st support, which is a pullback support.

Pivot: 1.1749

1st Support: 1.1680

1st Resistance: 1.1806

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

AUDUSD: Bullish Pullback Within Uptrend!!Hey Traders,

In today’s trading session, we are monitoring AUDUSD for a potential buying opportunity around the 0.66500 zone.

Technically, AUDUSD continues to trade within a well-defined uptrend and is currently in a healthy correction phase. Price is approaching the 0.66500 support zone, which coincides with trend support and a key structure level — an area where buyers have previously stepped in.

As long as this level holds, the broader bullish bias remains valid, with pullbacks seen as potential continuation setups rather than reversals.

Trade safe,

Joe

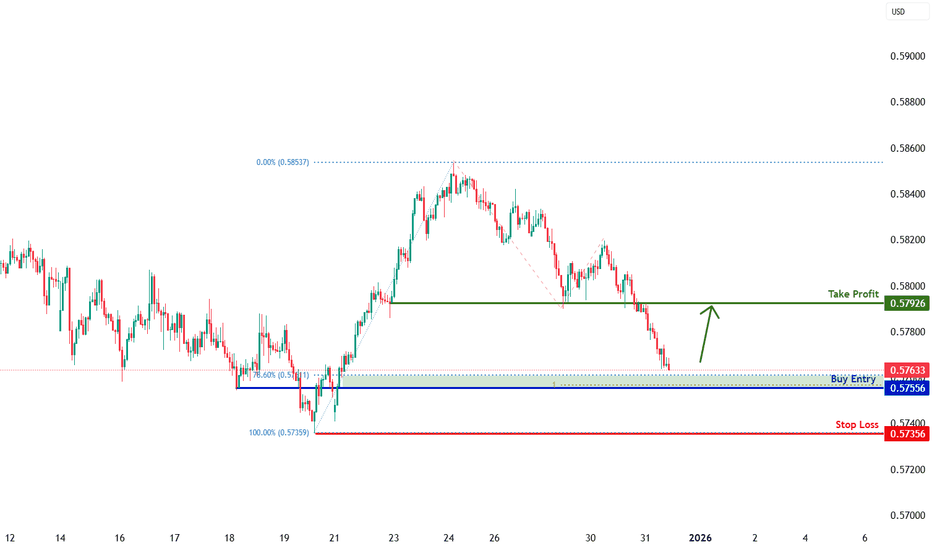

KIWI H1 | Could We See A Bullish Reversal?Based on the H1 chart analysis, we can see that the price is reacting off our buy entry level at 0.5755, which is a pullback support that is slightly below the 78.6% Fibonacci retracement and also aligns with the 100% Fibonacci projection.

Our stop loss is set at 0.5735, which is a swing low support.

Our take profit is set at 0.5792, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

AUDUSD H1 | Bearish DropBased on the H1 chart analysis, we could see the price rise to the sell entry level at 0.6697, which is a pullback resistance.

Our stop loss is set at 0.6716, which is a pullback resistance.

Our take profit is set at 0.6656, which is a pullback support that aligns with the 50% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (

USDCAD H1 | Bullish Bounce Off Pullback SupportBased on the h1 chart analysis, we could see the price fall to our by entry level at 1.3680, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 1.3659, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Our take profit is set at 1.3736, which is a pullback resistance that is slightly below the 61.8% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

USDCHF H1 | Potential Bullish RiseBased on the H1 chart analysis, we can see that the price has bounced off our buy entry level at 156.31, which is a pullback support.

Our stop loss is set at 155.76, which is a pullback support.

Our take profit is set at 157.27, which is a pullback resistance that is slightly below the 161.8% Fibonacci extension.

High Risk Investment Warning

Stratos Markets Limited (

USDCHF H1 | Bearish Reversal Off Pullback ResistanceThe price is rising towards our sell entry level at 0.7937, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Our stop loss is set at 0.7958, which is a pullback resistance.

Our take profit is at 0.7906, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited (

GBPUSD H1 | Falling Towards 50% Fib SupportThe price is falling towards our buy entry level at 1.3442, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 1.3422, which aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 1.3500, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off for Bitcoin?The price has bounced off the pivot and could rise to the 1st resistance, which acts as a multi-swing high resistance.

Pivot: 87,847.82

1st Support: 86,753.29

1st Resistance: 90,258.97

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

EURUSD H1 | Bearish Drop OffThe rice has reacted off our sell entry level at 1.1756, which is a pullback resistance.

Our stop loss is set at 1.1777, which is a pullback resistance.

Our take profit is set at 1.1736, which is a pullback support that aligns with the 78.6% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

Could we see a bounce from here?The USD/CHF could fall towards the support level, which serves as a pullback support that aligns with the 50% Fibonacci retracement, and then bounce from this level to our take-profit.

Entry: 0.7895

Why we like it:

There is a pullback support level that aligns with ht e 50% Fibonacci retracement

Stop loss: 0.7871

Why we like it:

There is a pullback support level.

Take profit: 0.7933

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bullish bounce off?GBP/USD is falling towards the support level, which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3443

Why we like it:

There is a pullback support level that aligns with the 50% Fibonacci retracement.

Stop loss: 1.3414

Why we like it:

There is a support level at the 61.8% Fibonacci retracement.

Take profit: 1.3501

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish breakout?EUR/USD has rejected off the resistance level, which his a pullback resistance, and could drop from this level to our take profit.

Entry: 1.1777

Why we like it:

There is a pullback resistance level.

Stop loss: 1.1807

Why we like it:

There is a swing high resistance level

Take profit: 1.1708

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.