Market Analysis: USD/JPY Aims Fresh SurgeMarket Analysis: USD/JPY Aims Fresh Surge

USD/JPY is rising and might gain pace above 148.20.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 147.00 and 147.40 levels.

- There is a major bearish trend line forming with resistance at 147.70 on the hourly chart.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from 146.20. The US Dollar gained bullish momentum above 146.50 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 147.50. The pair climbed above 148.00 and traded as high as 148.10. It’s now consolidating gains above the 50% Fib retracement level of the upward move from the 146.73 swing low to the 148.10 high.

The current price action above 147.40 is positive. Immediate resistance on the USD/JPY chart is near a bearish trend line at 147.70 and the 50-hour simple moving average.

The first key hurdle is near 147.95. If there is a close above 147.95 and the RSI moves above 50, the pair could rise toward 148.10. The next major stop for the bulls could be 148.50, above which the pair could test 150.00 in the coming days.

On the downside, the first major support is 147.40. The next area of interest for buyers could be near the 76.4% Fib retracement at 147.05.

If there is a close below 147.05, the pair could decline steadily. In the stated case, the pair might drop toward 146.20. Any more losses might open the doors for a drop to 145.00.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Usdjpysetup

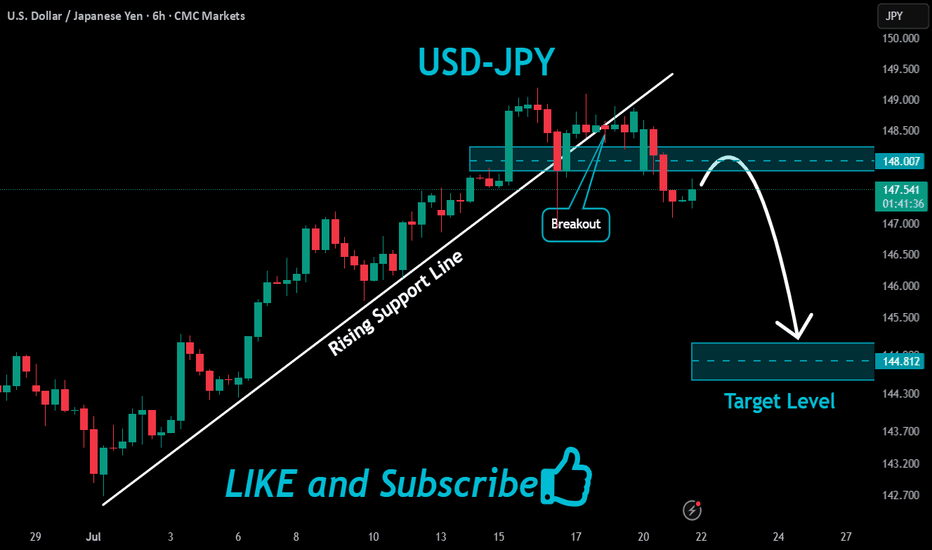

USDJPY Next Week | Short From 147.56 Targeting Liquidity SweepHere’s my outlook for USDJPY in the coming week.

If price rises to around 147.56 in the early part of next week (Aug 18–22), I believe it’s a good area to consider going short. This level has acted as resistance several times recently, and I expect it could hold once again.

If price fails to reach 147.56, I won’t take the trade — in that case, the risk-to-reward profile would likely deteriorate, and I prefer to avoid setups where my predefined advantage is weakened.

The stop loss should be placed above the white line. From experience, once price breaks above that line, it often continues to take out the highs above it. That’s why I believe placing a stop here is both reasonable and sufficient.

The purple line below marks a level where I expect price could extend to if it sweeps the liquidity (stop losses) resting around recent lows. This purple line is located roughly halfway between the previous low and the nearby high beneath it. Based on my years of trading experience, when price breaks a low, it rarely reverses immediately; more often, it continues a bit further before turning around.

For that reason, I allow a small buffer and set my take profit around the 0.382 Fibonacci level between those two price points.

My plan is to hold the short position until that level, then take profit and start looking for a potential long setup from there.

In my view, 147.56 is likely to be reached sometime next week, so I will post an update once we see how the market reacts.

This trade setup gives a risk-to-reward ratio of 6.5. Without including fees, the breakeven win rate for this trade would be approximately 13.33%. Knowing these figures in advance helps me avoid emotional trading.

If you often find yourself trading based on emotions, I recommend doing this type of pre-planning and quantifying your setups before execution — it can be a simple yet highly effective improvement.

I’ll be sharing updates on how this idea plays out, so if you want to follow along and see the outcome, consider following me here on TradingView.

---

*This post is for general informational and educational purposes only. It does not constitute financial advice, investment recommendation, or a service targeting specific investors, and should not be considered illegal or restricted information in any jurisdiction.*

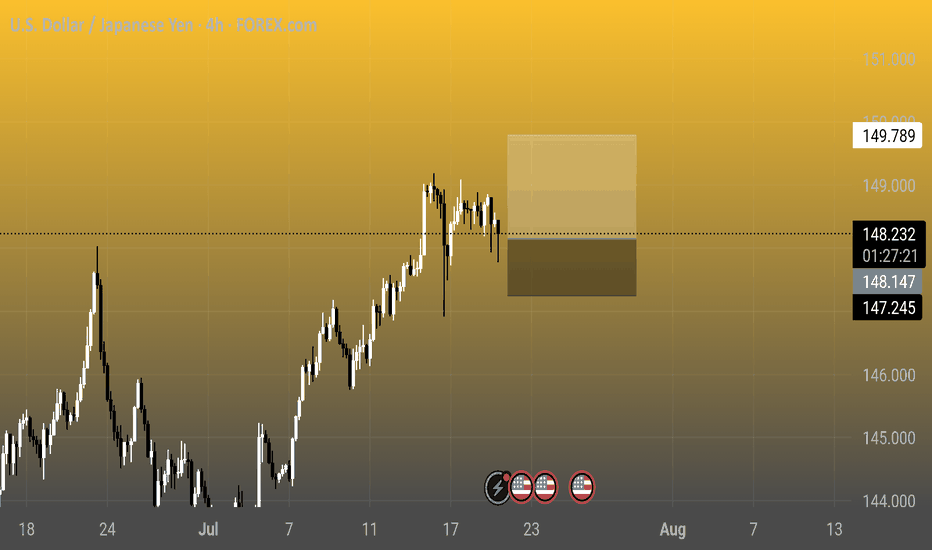

USDJPY - ShortUSDJPY Analysis - SELL 👆

In this Chart USDJPY H4 Timeframe: By Nii_Billions.

❤️This Chart is for USDJPY market analysis.

❤️Entry, SL, and Target is based off our Strategy.

This chart analysis uses multiple timeframes to analyze the market and to help see the bigger picture on the charts.

The strategy uses technical and fundamental factors, and market sentiment to predict a BEARISH trend in USDJPY, with well-defined entry, stop loss, and take profit levels for risk management.

🟢This idea is purely for educational purposes.🟢

❤️Please, support our work with like & comment!❤️

USD/JPY 1D Forex Chart - August 12, 2025daily performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) as of August 12, 2025. The current exchange rate is 148.277, reflecting a 0.09% increase (+0.136). The chart includes a trendline indicating a potential upward movement, with a buy signal at 148.277 and a sell signal at the same level. Key support and resistance levels are marked, with a notable range between 146.786 and 151.234. The chart spans from early 2025 to mid-2026, showing historical price action and future projections.

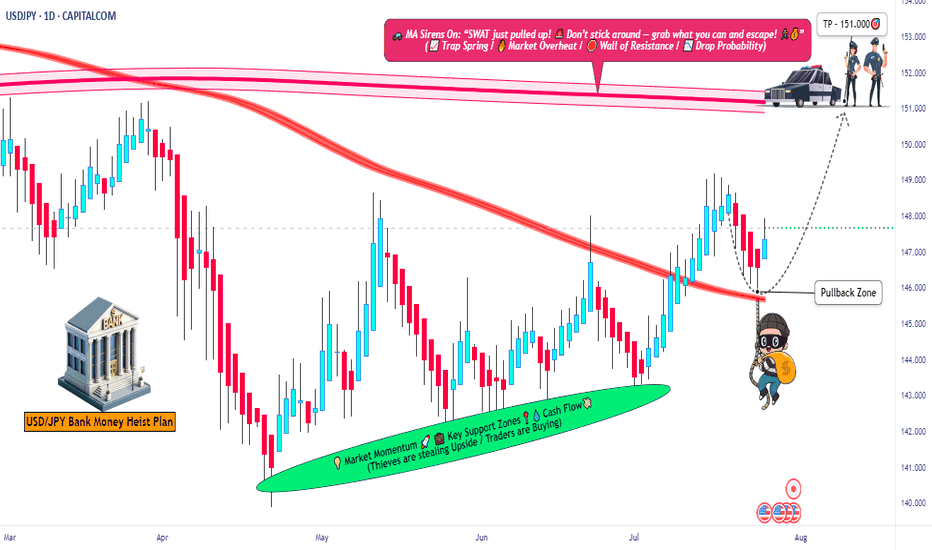

USD/JPY Robbery Route | Enter at Dip, Exit Before Police💥USD/JPY Forex Money Heist Plan 🎯 — Ninja Robbery at 146.000💥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Bandits, Money Makers & Risky Robbers 🤑💰💸✈️

Welcome to another Thief Trader-style operation. We've cracked open the USD/JPY vault (aka "The Gopher" 💹), and here's the blueprint to pull off this forex heist like true professionals. 💼🎭💵

🚨 Strategy Overview

This isn't just a trade – it’s a well-researched, precision-timed robbery mission based on technicals, macro analysis, sentiment, and the bigger global picture.

Expect action near critical zones – especially the moving average barricade, where police (aka risk) is waiting. Stay sharp.

🔓 Entry Point – Unlock the Vault

📈 Watch for bullish pullbacks near 146.000.

Whether it's a dip, zone test, or wick bounce — you’re looking to layer buy limit orders like a seasoned thief using DCA tactics.

Enter on swings or any bullish confirmation.

Heist Window is Open.

🛑 Stop Loss – Escape Route

📍 SL near 143.000 (1D swing low) — adjust based on your capital and position size.

💡 Don’t go blind — SL is your backup plan, not an optional accessory.

Custom-fit it based on how many entries you’re stacking.

🎯 Target – Vault Exit Point

🏁 151.000 or exit before resistance heat catches on.

No greedy thieves here — precision exit is key.

Lock profits, vanish in style. 🕶️💼💸

🧲 Scalpers Take Note

Only long side raids are valid. Scalping against the trend? That's walking into a trap.

Use trailing SLs and protect your loot.

Small bag or big vault — play your game smart. 🎯💰

📢 Fundamental Boosters

USD/JPY’s bullish run isn’t random — it’s backed by:

📊 Macro shifts,

📈 COT reports,

🧠 Sentiment drivers,

📉 Intermarket trends,

And a whole mix of thief-level intel 🔍

🧭 Dive deeper before acting. The map’s been provided. 🔗🌍

🗞 News Traps Ahead – Move Cautiously

🚫 Avoid new trades during major releases

🔁 Use trailing SLs on open positions

💡 Position management is a thief’s best defense. Risk management keeps you in the game. 🎯🧠

🔥💖 Support the Heist Crew

Smash that ❤️🔥 Boost Button to keep our robbery engine running.

Each boost = strength for our crew.

💬 Share the love, spread the intel, and trade like a rogue with brains. 🤝💵

👀 Stay tuned for more high-profile FX heists from Thief Trader.

Until next time — loot wisely, vanish clean. 🐱👤💨

USDJPY Weakening or a Correction to the Uptrend✏️ OANDA:USDJPY is approaching the old Break out support zone. The convergence zone of the 2 EMA lines. If there is a sweep to the support zone at the beginning of the week, it will be an opportunity to buy to continue the bullish wave structure. When this 146.200 zone is broken, the uptrend will be broken and we have to wait for new momentum to determine the next trend.

📉 Key Levels

Support: 146.200-143.200

Resistance: 150.800-154.500

Buy zone 146.300 (Support & Trendline)

Buy zone 143.200 Strong support zone

Target 154.500

Leave your comments on the idea. I am happy to read your views.

U.S. Dollar / Japanese Yen - 4h Chart (FOREX.com)4-hour chart from FOREX.com shows the exchange rate between the U.S. Dollar (USD) and the Japanese Yen (JPY). The current rate is 148.184, reflecting a decrease of 0.623 (-0.42%) as of 01:29:16. The chart highlights recent price movements over the past few hours, with a shaded area indicating a consolidation phase around the current level.

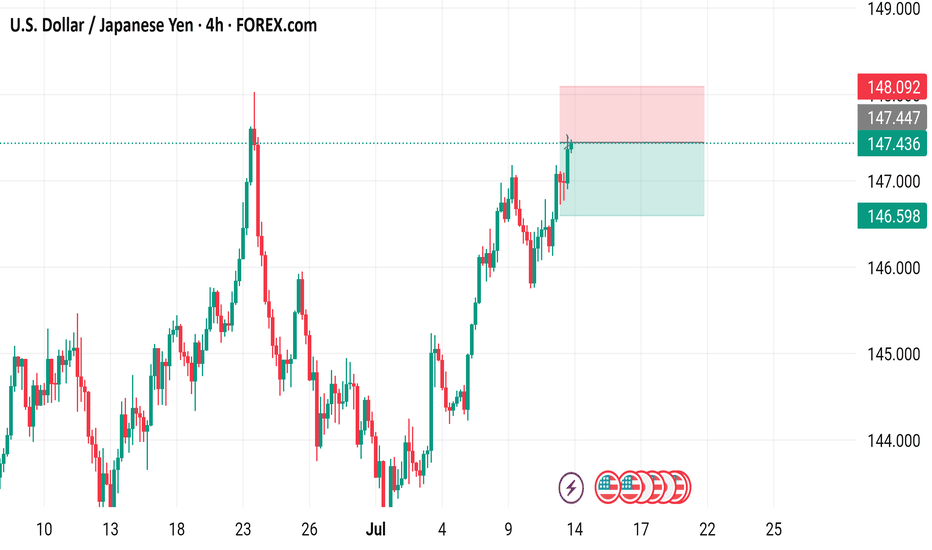

#USDJPY: Price is currently accumulating ! Wait For DistributionAt present, the USDJPY currency pair appears to be in an accumulation phase, as evidenced by the absence of significant price movement throughout the current week. Several factors contribute to this trend.

Firstly, several significant economic events are scheduled for this week, particularly tomorrow and Friday. These developments hold substantial implications for the future trajectory of the USDJPY pair. Consequently, there exists a possibility that the price may experience a decline prior to initiating a bullish trend.

Secondly, there are two primary areas where the price could reverse its course. The extent to which the USD reacts to the economic data will serve as an indicator of the potential reversal zones.

It is imperative that you conduct your own analysis before making any financial decisions. This chart should be utilised solely for educational purposes and does not guarantee any specific outcome.

Regarding the stop loss, as this is a swing trade, it is advisable to employ a larger stop loss if the price reaches entry zones. The take profit level can be determined based on your entry type and analysis.

We wish you the best of luck in your trading endeavours and emphasise the importance of trading safely.

Kindly share this analysis with others through likes, comments, and social media platforms. If you have any questions or require further assistance, please do not hesitate to comment below. We are here to provide support.

Team Setupsfx_

❤️🚀

Market Analysis: USD/JPY RisesMarket Analysis: USD/JPY Rises

USD/JPY is rising and might gain pace above the 149.20 resistance.

Important Takeaways for USD/JPY Analysis Today

- USD/JPY climbed higher above the 147.50 and 148.40 levels.

- There is a key bullish trend line forming with support at 148.40 on the hourly chart at FXOpen.

USD/JPY Technical Analysis

On the hourly chart of USD/JPY at FXOpen, the pair started a fresh upward move from the 145.75 zone. The US Dollar gained bullish momentum above 146.55 against the Japanese Yen.

It even cleared the 50-hour simple moving average and 148.00. The pair climbed above 149.00 and traded as high as 149.18. The pair is now consolidating gains above the 23.6% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high.

The current price action above the 148.50 level is positive. There is also a key bullish trend line forming with support at 148.40. Immediate resistance on the USD/JPY chart is near 149.20.

The first major resistance is near 149.50. If there is a close above the 149.50 level and the RSI moves above 70, the pair could rise toward 150.50. The next major resistance is near 152.00, above which the pair could test 155.00 in the coming days.

On the downside, the first major support is 148.40 and the trend line. The next major support is visible near the 147.90 level. If there is a close below 147.90, the pair could decline steadily.

In the stated case, the pair might drop toward the 147.50 support zone and the 50% Fib retracement level of the upward move from the 145.74 swing low to the 149.18 high. The next stop for the bears may perhaps be near the 146.55 region.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY 4-Hour Forex Chart4-hour performance of the U.S. Dollar (USD) against the Japanese Yen (JPY) from late June to mid-July 2025, sourced from FOREX.com. The current exchange rate is 147.436, with a 1.178 (+0.81%) increase. Key levels include a sell price of 147.393 and a buy price of 147.479. The chart shows a recent upward trend with a resistance zone highlighted between 147.436 and 148.092, and support around 146.598. Candlestick patterns indicate volatility, with notable price movements around early July.

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

147.500 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY Profit Heist – Are You In or Missing Out?"🔥💰 "USD/JPY NINJA HEIST: Bullish Loot Before the Trap! (Thief Trading Style)" 💰🔥

🌟 Attention Market Robbers & Profit Takers! 🌟

🚨 Thief Trading Alert: USD/JPY "The Ninja" is primed for a BULLISH HEIST!

Based on our stealthy technical & fundamental analysis, we’re locking in a long entry strategy. The plan? Loot profits before the RED ZONE danger hits! Overbought? Maybe. Risky? Sure. But the real robbery happens before the bears wake up! 🏴☠️💸

🎯 ENTRY: The Vault is OPEN!

Buy Limit Orders: Swipe the dip on pullbacks or jump in at key swing lows.

Aggressive? Enter now & ride the wave!

🛑 STOP LOSS (Thief-Style Escape Plan):

Swing Low (5H TF): 143.600 (Adjust based on your risk & lot size!)

Multiple orders? Scale SL wisely—don’t get caught!

🎯 TARGETS:

Main Take-Profit: 151.000 (Or escape earlier if the trap triggers!)

Scalpers: Only play LONG—trail your SL & lock in quick loot!

📢 SCALPERS & SWING TRADERS:

Got deep pockets? Ride the wave now!

Small account? Join the swing heist & rob the trend slowly!

📈 WHY USD/JPY?

Bullish momentum + Macro/Fundamental tailwinds!

COT Report, Sentiment, & Intermarket Analysis all hint at more upside! go ahead to check 👉🔗🌏

⚠️ WARNING: NEWS = VOLATILITY!

Avoid new trades during high-impact news!

Trailing SL = Your best friend! Protect profits & avoid jail (stop-out)!

💥 BOOST THIS IDEA TO SUPPORT THE HEIST!

More boosts = More robberies = More profits for YOU!

Stay tuned—next heist coming soon! 🚀💰

🔥 Like, Share, & Follow for Daily Steals! 🔥

USD/JPY Made H&S Reversal Pattern , Short Setup Valid !Here is my 15 Mins Chart on USD/JPY , We have a very clear reversal pattern , head & shoulders pattern and we have a confirmation by closure below our neckline so we can enter direct now or waiting the price to go back and retest the neckline and this is my fav scenario .

USDJPY h4 strongly downBearish Expectation Disruption / Bullish Counterpoint

Resistance (147.5) Rejection and drop Breakout and continuation toward 148.5+

Breakout FVG Fakeout and reversal True breakout — bullish trend continues

Bullish Zone (~144) Clean break below Accumulation zone, strong buying interest may emerge

Target (~143) Next leg down May not be reached if price stabilizes above 145

Support (~142.5) Final drop destination Could become irrelevant if trend flips decisively bullish Original Assumption: Market is behaving in isolation from fundamentals.

Disruption: If U.S. data (e.g., strong NFP, CPI, or Fed commentary) supports rate hikes, USD/JPY may remain bid and breakout to 148+ instead of reversing.

Watch For: Strong dollar narrative or dovish BOJ language.

USDJPY Price Accumulated|Time For Bullish Distribution|Setupsfx|The price has accumulated nicely and is now distributing. We have three targets in mind, but set your own based on your analysis. Our approach is purely technical, but also includes a basic fundamental approach. This analysis concludes over 1500 pips and is a swing move. Please use this analysis as educational purposes only, as it does not guarantee that price will move exactly as predicted.

If you like our idea, please consider liking and commenting on it.

Good luck and trade safely!

Team Setupsfx_

Unlocking the Bull Vault: USD/CAD Heist Setup🕵️♂️💼 The Loonie Vault Raid: USD/CAD Buy Blueprint 💰🔐

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

To All Currency Conquerors, Market Raiders & Profit Seekers 💸🚁🕶️

Welcome to another Thief Trading Style playbook, crafted for bold traders ready to infiltrate the Forex vaults with precision.

📜 Mission Brief – The Loonie USD/CAD Buy Op:

Using a blend of 🔥strategic market intel🔥 (technical + fundamental), we’re gearing up for a targeted buy operation. The goal? Extract max profits and vanish before the guards show up. 🏃♂️💨

🎯 ENTRY POINT – Authorized Access Only!

🎯 Buy Zone #1: Around 1.37000+

🎯 Buy Zone #2: Around 1.36400 (Caution: This is Market Maker Trap turf – approach wisely)

⏳ Wait for pullback signs & reversal confirmation before execution – The real pros enter when the crowd hesitates.

🛑 STOP LOSS – Backup Plan if Things Go South

🧠 Wise raiders always have an exit route!

🔹 SL Strategy 1: Nearest Swing Low on 2H timeframe (e.g., 1.36000)

🔹 SL Strategy 2: Institutional Buy Zone SL (1.34000 or deeper)

💡 Position sizing and risk tolerance are your call, but don’t skip this shield.

🏴☠️ TARGET – Where the Loot Lies

🎯 Aim for 1.39500 or exit early if the heat rises (volatility spike/consolidation stalls)

💼 Remember, the best thieves know when to grab the bag and bounce.

💹 Scalpers Advisory – Shortcuts to Riches

👀 Only ride the bullish tide.

💰 If you’ve got capital muscle, dive in. If not, roll with the swing crew.

📌 Trail that SL like a pro – don’t get caught slippin’.

📊 Why We Strike Now – The Big Picture

USD/CAD is showing bullish signs backed by:

✔️ Macro shifts

✔️ COT reports

✔️ Sentiment shift

✔️ Intermarket synergy

✔️ Smart money positioning

🔗 Full intel available – KlicK & explore!

⚠️ High Alert: News & Chaos Protocol

🚨 News drops = alarm bells.

To survive:

📌 Avoid fresh trades during major releases

📌 Use trailing SL to protect your gains

📌 Don’t overexpose – one vault at a time

💖 Support the Crew – Hit BOOST

Your boost helps fund the next mission. Show love, share strength, and become part of the Forex Heist Syndicate 🕵️♂️💵💼

One chart at a time, we rewrite the game.

🎯 Stay locked in – next mission drops soon... 🤑💻🚀

USD/JPY "The Ninja Heist" – Bullish Loot Grab!🌟 Hey, Thieves & Market Bandits! 🌟

💰 Ready to raid the USD/JPY "The Gopher" vault? 💰

Based on 🔥Thief Trading Style🔥 (technical + fundamental heist analysis), here’s the master plan to swipe bullish profits before the market turns against us! Escape near the high-risk Yellow MA Zone—overbought, consolidation, and bear traps ahead! 💸 "Take the money and run—you’ve earned it!" 🏆🚀

🕵️♂️ Heist Strategy:

📈 Entry (Bullish Raid):

The vault’s unlocked! Buy any price—this heist is LIVE!

Pullback lovers: Set buy limits at recent/swing lows for extra loot.

🛑 Stop Loss (Escape Route):

Thief SL at recent/swing low (4H/Day trade basis).

Adjust based on your risk, lot size, and multiple orders.

🎯 Target (Profit Escape):

148.700 (or flee earlier if bears ambush!)

⚔️ Scalpers’ Quick Strike:

LONG ONLY! If rich, attack now. If not, join swing traders & rob slowly.

Trailing SL = Your bodyguard! 💰🔒

💥 Why This Heist?

USD/JPY "The Ninja" is bullish due to key factors—check:

📌 Fundamental + Macro + COT Report

📌 Quantitative + Sentiment + Intermarket Analysis

📌 Future Targets & Overall Score (Linkks In the profile!) 🔗🌍

🚨 Trading Alert (News = Danger!):

Avoid new trades during news—volatility kills!

Trailing SL saves profits on running positions.

💖 Support the Heist Team!

💥 Smash the Boost Button! 💥

Help us steal more money daily with Thief Trading Style! 🏆🚀

Stay tuned—another heist is coming soon! 🤑🎯

USD/JPY Bullish Reversal AnalysisUSD/JPY Bullish Reversal Analysis 📈💹

🔍 Technical Overview:

The chart illustrates a strong bullish reversal pattern forming on USD/JPY after price reacted from a key support zone at 144.600. This level has held firm multiple times, marked by green arrows, signaling strong buying interest.

📐 Chart Patterns & Structure:

✅ A bullish harmonic pattern (possibly a bullish Bat or Gartley) is completing near the 144.600 zone.

🔄 Multiple rejection wicks and bullish engulfing patterns indicate a potential upside reversal.

🔵 Descending trendlines have been broken, confirming momentum shift.

🔁 Previous resistance turned support (near 145.000) is acting as a possible launchpad for the next move.

🎯 Upside Target:

The projected move targets the resistance zone at 147.698, aligning with previous highs and a significant supply area.

If price breaks above 145.900 convincingly, continuation toward this resistance is expected.

🔻 Downside Risk:

A break below 144.600 would invalidate the bullish setup and expose price to the lower support range near 142.000–143.000.

📊 Conclusion:

USD/JPY is showing signs of bullish reversal from a strong demand zone. If price sustains above 145.000 and breaks the minor consolidation, the pair could rally toward 147.698 🎯.

Bias: Bullish ✅

Support: 144.600

Resistance: 147.698

USD/JPY Breaks Higher – Bullish Momentum Targets 148.40FX:USDJPY CMCMARKETS:USDJPY USD/JPY continues to climb, extending gains above the key 146.00 breakout level, supported by Fed–BoJ policy divergence and rising geopolitical tensions. Despite Japan’s strong CPI and PMI prints, the BoJ maintains a dovish tone, while tariff concerns continue to cap yen sentiment. The Middle East conflict further fuels demand for the USD as a safe haven.

Technically, the pair confirmed a bullish breakout, with price hugging the upper Bollinger Band – a sign of sustained upside pressure. As long as 146.00 holds, bulls may aim for the 148.40 monthly resistance.

Key Levels :

Resistance : 146.75 / 148.40

Support : 146.00 / 145.25

⚠️ Momentum favours the upside while above 146.00. Break below may trigger short-term pullback toward 145.25.