Silver Breakout, Tech Resistance & TRY Rotation 📊🔥 Silver Breakout, Tech Resistance & TRY Rotation – Structure Meets Reality 🌍📉

Hey traders, FXPROFESSOR here 👨🏫

Today’s charts show how technical structure and real-world capital behavior can tell one powerful story. We’re watching Silver surge, Tech stall, and the Turkish Lira react to local capital flows — all aligning with clean market levels.

Let’s break it down:

🔍 Silver (XAG/USD)

Price exploded into $39.30, reaching the top of a well-defined ascending channel.

Now stalling — pullbacks toward $35.38 or even $32.17 would be natural.

🧠 Structurally strong, fundamentally backed by industrial demand, inflation hedging, and tight supply dynamics. Just not a good timing to 'ape it' today.

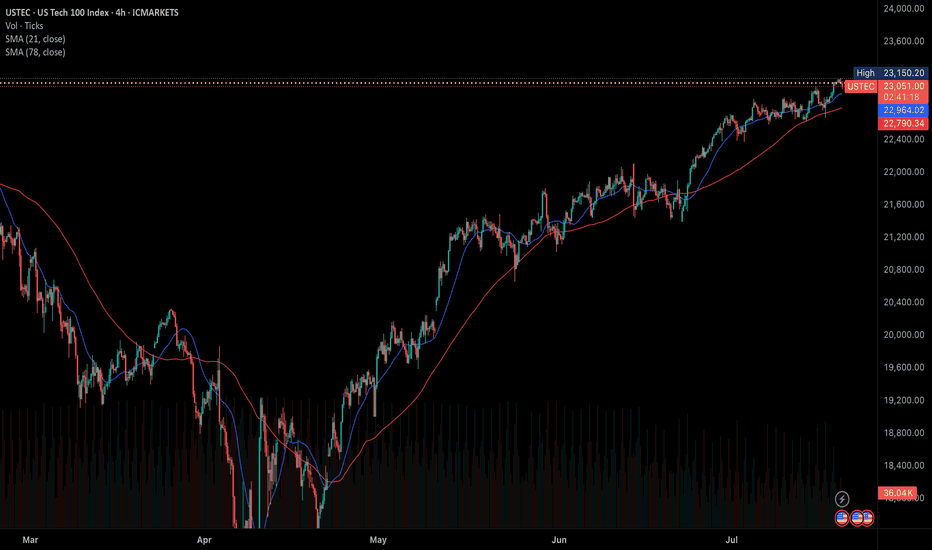

📉 US Tech 100 (USTEC)

Testing resistance around 23,434.

RSI and OBV show signs of exhaustion, suggesting potential pause or pullback.

In a stretched macro environment, tech is vulnerable to rotation — especially if yields shift or inflation expectations change.

💱 EUR/TRY – Turkish Lira Rotation

We just saw a sharp rejection at 47.78, a key round-number resistance.

On the ground, there’s a notable shift — My Turkish brother says 'FX profits being converted into real estate and hard assets, especially by locals and returning expats'. And I trust a good Turk as much as i trust my Greek family! (yes, we can be friends when there is respect and no hatred! common interests work best in this troubled world)

The chart reflects this move: potential drop toward 46.00 → 45.45 → 43.79 if momentum fades.

🧩 What These Charts Teach Us

This is a perfect storm where technical resistance, macro rotation, and local capital behavior all align:

🔹 Silver rising = hard assets in favor

🔹 Tech pausing = overextension risk

🔹 TRY dropping = profit-taking & capital redeployment

Trade what you see — but understand why it’s happening.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

Ustech100

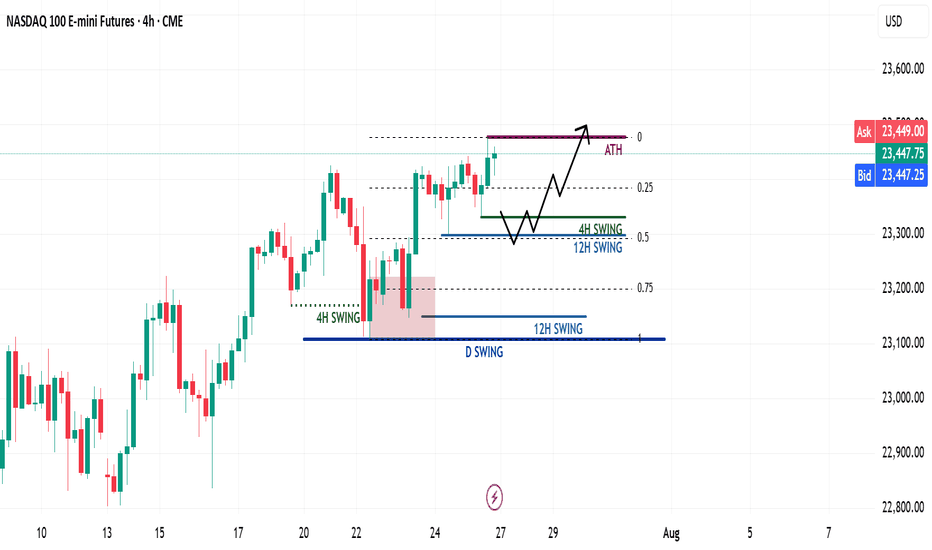

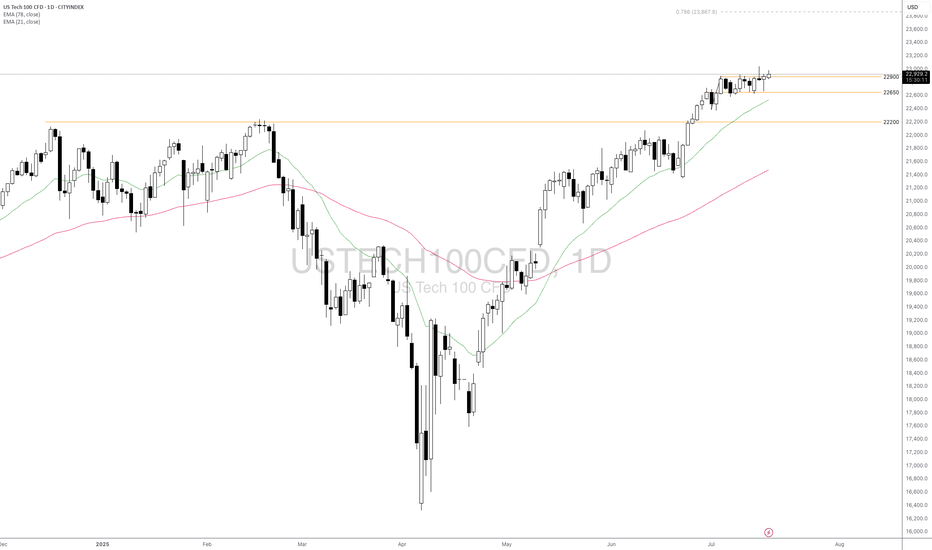

NQ Weekly Recap & Gameplan – 27.07.2025🧭 Market Sentiment

The overall sentiment remains bullish, supported by:

• Lower inflation data

• Trump’s policy shift toward aggressive rate cuts

This creates a strong risk-on environment across U.S. indices.

🔙 Previous Week Recap

• NQ continued its price discovery phase

• Price swept 4H swing liquidity and triggered a market structure shift

• A new 1H demand zone was formed after MSS

• Price revisited the 1H demand and launched toward new all-time highs (ATH)

• While I anticipated a deeper retracement, ES provided the cleaner pullback

• I executed longs on both ES and NQ using SMT divergence (ICT SMT concept)

📊 Technical Analysis

My bias remains bullish as long as the higher timeframe structure holds.

For the upcoming week:

• Watching for either the 4H or 12H swing high to get swept

• Ideally, a retracement toward the 0.5 Fib level, which aligns with my bullish discount zone

• A clean liquidity sweep into this zone could act as a launchpad for the next leg higher

⚙️ Trade Setup & Execution Plan

Entry Strategy:

• Wait for a new 1H–4H Market Structure Shift

• Identify the new demand zone post-MSS

• Look for price to return to the zone for a long opportunity with LTF confirmation

Trade Management:

🎯 Target: New ATH

⛔ Stoploss: Swing low of the 1H–4H demand zone

📌 Chart will include Fib levels, MSS zones, and execution trigger areas.

Let me know your thoughts or share your plan below.

Happy trading!

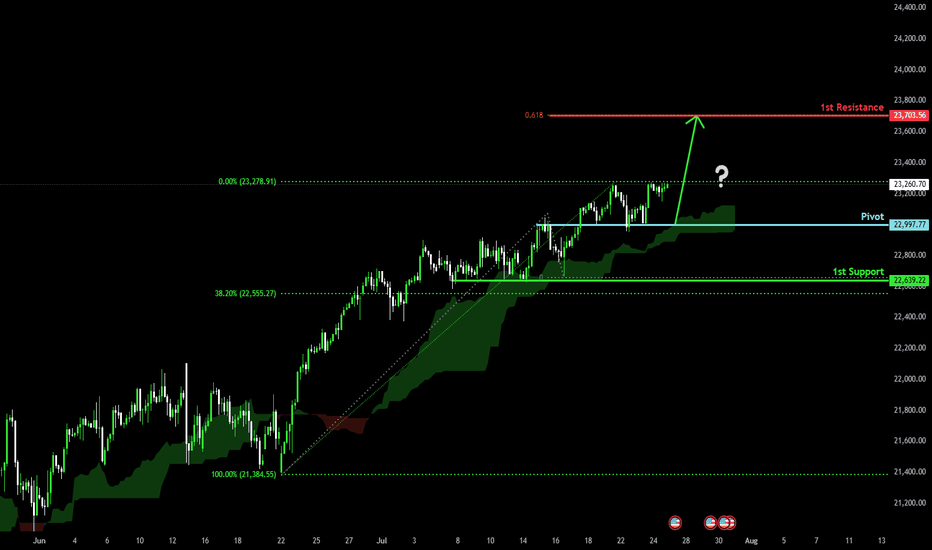

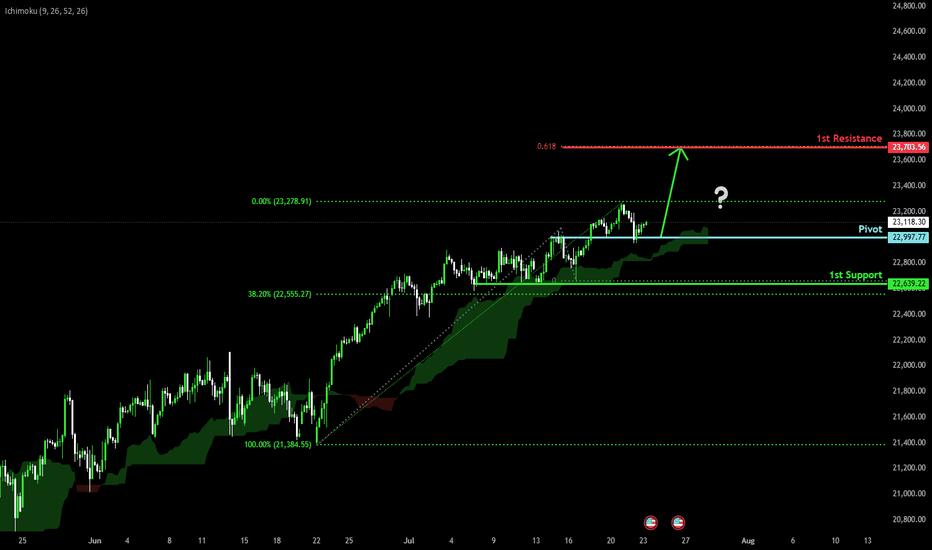

NSDQ100 pushing to new ATH?Thursday was a slightly positive session for equities, with the NASDAQ 100 rising +0.18% to close at a fresh record high, driven by strong economic data. However, overall market action was subdued, with the S&P 500’s trading range the narrowest since February (0.35%).

Notably, the equal-weighted S&P 500 fell -0.33%, highlighting underlying weakness outside mega-cap tech.

A key drag on the NASDAQ came from Tesla (-8.20%), which slumped after disappointing earnings. This weighed on the Magnificent 7, which declined -0.21% despite gains in the other six members.

On the macro front, the US dollar strengthened as Donald Trump downplayed his dispute with Fed Chair Jerome Powell, though continued to pressure the Fed on interest rates. Meanwhile, the FCC approved Paramount’s merger with Skydance, signaling a green light for M&A activity in media despite political tensions.

Conclusion – NASDAQ 100 Trading View:

The NASDAQ 100 remains technically bullish, setting new highs amid resilient economic data. However, breadth is weakening, and headline risk—especially around earnings (e.g., Tesla)—could trigger short-term volatility. Traders should stay long with caution, watching for sector rotation or profit-taking near highs, and monitor Fed-related rhetoric for macro-driven moves.

Key Support and Resistance Levels

Resistance Level 1: 23480

Resistance Level 2: 23600

Resistance Level 3: 23790

Support Level 1: 23070

Support Level 2: 22950

Support Level 3: 22750

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bullish continuation?USTEC has bounced off the pivot and could potentially rise to the 1st resistancewhihc lines up with the 61.8% Fibonacci projection.

Pivot: 22,997.77

1st Support: 22,639.22

1st Resistance: 23,703.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish continuation?USTEC has bounced off the pivot, which has been identified as an overlap support, and could rise to the 1st resistance.

Pivot: 22,997.77

1st Support: 22,639.22

1st Resistance: 23,703.56

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

US100 (NASDAQ 100) 24-Hour Technical Analysis ForecastCurrent Price: 23,076.60 (Close: Friday, July 18th, 2025)

Analysis Period: Next 24 Hours (July 19-20, 2025)

Market Status: Weekend - Preparing for Monday Open

---------------------------------------------------------------------------------------------

EXECUTIVE SUMMARY - 24H OUTLOOK

Primary Bias: Neutral to Bullish (Short-term consolidation expected)

Key Resistance: 23,150 - 23,250

Critical Support: 22,850 - 22,950

Expected Range: 22,900 - 23,200

Volatility Level: Moderate (Tech earnings season approach)

---------------------------------------------------------------------------------------------

1. CANDLESTICK PATTERN ANALYSIS

Friday's Close Formation

---------------------------------------------------------------------------------------------

Pattern: Small-bodied candle with upper shadow at 23,076

Significance: Indecision after testing resistance near 23,150

Volume: Above-average volume suggesting institutional activity

Context: Failed to break cleanly above psychological 23,100 level

---------------------------------------------------------------------------------------------

Expected 24H Patterns

---------------------------------------------------------------------------------------------

Monday Gap: Potential small gap up to 23,100-23,120 area

Continuation Pattern: Bullish flag/pennant formation developing

Key Reversal: Watch for hammer formation at 22,950 support if decline occurs

---------------------------------------------------------------------------------------------

Pattern Probability Assessment

---------------------------------------------------------------------------------------------

Doji/Spinning Top: 40% probability (continued indecision)

Bullish Engulfing: 35% probability (if gap up occurs)

Bearish Reversal: 25% probability (if resistance holds)

---------------------------------------------------------------------------------------------

2. HARMONIC PATTERN ANALYSIS

Current Harmonic Setup

---------------------------------------------------------------------------------------------

Primary Pattern: Bullish Cypher Pattern in Development

---------------------------------------------------------------------------------------------

X: 22,400 (previous major low)

A: 23,250 (recent swing high)

B: 22,800 (61.8% retracement)

C: 23,150 (127.2% extension - current test area)

D (Completion): 22,650-22,750 (78.6% retracement zone)

---------------------------------------------------------------------------------------------

Alternative Pattern: Bull Flag

---------------------------------------------------------------------------------------------

Pole: 22,400 → 23,250 (850-point move)

Flag: Current consolidation 22,950-23,150

Target: 23,250 + 850 = 24,100 (extended projection)

---------------------------------------------------------------------------------------------

Fibonacci Levels (24H Focus)

---------------------------------------------------------------------------------------------

Golden Ratio Support: 22,950 (61.8% of recent swing)

38.2% Retracement: 23,025

23.6% Retracement: 23,050

Extension Target: 23,375 (161.8% projection)

---------------------------------------------------------------------------------------------

3. ELLIOTT WAVE THEORY - 24H COUNT

Primary Wave Count (Bullish Scenario)

---------------------------------------------------------------------------------------------

Macro Structure: Wave 5 of larger degree impulse in progress

Current Position: Wave 4 correction completing

Mini-wave Count: Flat correction pattern (A-B-C structure)

---------------------------------------------------------------------------------------------

24-Hour Wave Projection

---------------------------------------------------------------------------------------------

Wave A: 23,250 → 22,800 (Completed)

Wave B: 22,800 → 23,150 (Completed - 70% retrace)

Wave C: 23,150 → 22,950 (In Progress - Equal to A)

Wave 5 Target: 24,000-24,200 (1.618 extension)

---------------------------------------------------------------------------------------------

Alternative Count (Corrective Scenario)

---------------------------------------------------------------------------------------------

Structure: Double zigzag correction

Current Phase: Second zigzag development

Target: 22,750-22,850 (Wave Y completion)

---------------------------------------------------------------------------------------------

Critical Elliott Levels

---------------------------------------------------------------------------------------------

Wave 4 Low: 22,750 (must hold for bullish count)

Invalidation: Below 22,400 (Wave 1 high)

Confirmation: Break above 23,250 (Wave 3 high)

---------------------------------------------------------------------------------------------

4. WYCKOFF THEORY - 24H PHASE

Current Market Phase Assessment

---------------------------------------------------------------------------------------------

Primary Phase: Reaccumulation (Phase B-C transition)

Composite Operator Action: Testing supply at 23,150 area

Volume Analysis: Absorption of selling pressure evident

Smart Money Activity: Institutional buying on dips below 23,000

---------------------------------------------------------------------------------------------

Expected 24H Wyckoff Dynamics

---------------------------------------------------------------------------------------------

Phase Progression: Moving toward Phase D (Sign of Strength)

Testing Action: Final test of support at 22,950-23,000

Volume Expectation: Declining volume on any weakness

Breakout Setup: Spring action possible below 22,950

---------------------------------------------------------------------------------------------

Key Wyckoff Signals (24H Watch List)

---------------------------------------------------------------------------------------------

Sign of Strength (SOS): Break above 23,150 with volume

Last Point of Support (LPS): 22,950 area test

No Supply: Expected on rallies to 23,100-23,150

Backup to Edge of Creek: Potential dip to 22,850

---------------------------------------------------------------------------------------------

5. W.D. GANN THEORY - 24H ANALYSIS

Square of Nine Analysis

---------------------------------------------------------------------------------------------

Current Position: 23,076° on Gann wheel

Next Cardinal Point: 23,100° (significant psychological resistance)

Natural Support: 23,000° (perfect square - strong magnetic level)

Critical Angle: 22,900° (45-degree angle support from recent low)

---------------------------------------------------------------------------------------------

Time Theory - 24H Cycle

---------------------------------------------------------------------------------------------

Natural Time Cycle: 24-hour cycle from Friday's close

Critical Time Windows:

---------------------------------------------------------------------------------------------

6 hours: 02:00 UTC Monday (potential turn time)

18 hours: 14:00 UTC Monday (major turn potential)

24 hours: 20:00 UTC Monday (cycle completion)

---------------------------------------------------------------------------------------------

Angle Theory Application

---------------------------------------------------------------------------------------------

Rising 45° Line: Currently at 22,950 (critical support)

Rising 63.75° Line: 23,100 (steep resistance angle)

Declining 26.25° Line: 23,150 (gentle resistance)

---------------------------------------------------------------------------------------------

Gann Price Forecasting

---------------------------------------------------------------------------------------------

Square Root Method:

---------------------------------------------------------------------------------------------

Current: √23,076 ≈ 151.9

Next resistance: 152² = 23,104

Major resistance: 153² = 23,409

---------------------------------------------------------------------------------------------

Primary Target: 23,104 (natural Gann resistance)

Extended Target: 23,409 (next perfect square)

---------------------------------------------------------------------------------------------

Time-Price Harmony

---------------------------------------------------------------------------------------------

Harmonic Time: 144 hours from last major low

Price Harmony: 23,076 in harmony with 22,500 base

Next Harmony Level: 23,400 (Fibonacci price relationship)

---------------------------------------------------------------------------------------------

6. MULTI-TIMEFRAME INTRADAY ANALYSIS

5-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Micro Trend: Consolidating triangle pattern

Support: 23,050-23,060 (recent lows)

Resistance: 23,090-23,100 (intraday highs)

Volume Profile: Balanced - no clear direction

RSI (5M): 48-52 range (neutral)

Pattern: Symmetrical triangle (breakout pending)

---------------------------------------------------------------------------------------------

15-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Structure: Bull flag formation

Flag Boundaries: 23,040-23,120

Breakout Level: Above 23,120 (bullish)

Breakdown Level: Below 23,040 (bearish)

Moving Averages: EMA20 at 23,065 (support)

MACD: Consolidating above zero line

---------------------------------------------------------------------------------------------

30-Minute Chart Analysis

---------------------------------------------------------------------------------------------

Primary Pattern: Ascending triangle

Horizontal Resistance: 23,150 (multiple tests)

Rising Support Line: From 22,950 to current levels

Breakout Target: 23,350 (triangle height projection)

Volume: Decreasing (typical triangle behavior)

Bollinger Bands: Contracting (low volatility)

---------------------------------------------------------------------------------------------

1-Hour Chart Analysis

---------------------------------------------------------------------------------------------

Major Structure: Bullish continuation pattern

Cup and Handle: Handle formation in progress

Handle Depth: 7% correction (healthy)

Breakout Level: 23,175 (handle resistance)

Target: 24,000 (cup depth projection)

RSI (1H): 55 (bullish but not overbought)

---------------------------------------------------------------------------------------------

4-Hour Chart Analysis

---------------------------------------------------------------------------------------------

Macro Trend: Strong uptrend intact

Correction Type: Shallow pullback (wave 4 character)

Support Cluster: 22,900-23,000 (multiple confluences)

Resistance Zone: 23,150-23,250

Ichimoku Cloud: Price above cloud (bullish)

Volume Trend: Higher lows pattern (accumulation)

---------------------------------------------------------------------------------------------

7. TECHNICAL INDICATORS MATRIX

Momentum Indicators

---------------------------------------------------------------------------------------------

RSI (4H): 58 (Bullish momentum, room for upside)

RSI (1H): 55 (Neutral-bullish)

Stochastic %K: 62 (Above %D line - bullish)

Williams %R: -35 (Not oversold, upside potential)

---------------------------------------------------------------------------------------------

Trend Indicators

---------------------------------------------------------------------------------------------

MACD (4H): Above signal line, histogram positive

ADX: 35 (Strong trend strength)

Parabolic SAR: 22,950 (supportive)

Supertrend: 22,850 (strong support)

---------------------------------------------------------------------------------------------

Volume Indicators

---------------------------------------------------------------------------------------------

OBV: Rising trend (accumulation pattern)

Volume Rate of Change: Positive

Chaikin Money Flow: +0.15 (buying pressure)

Accumulation/Distribution: Uptrend

---------------------------------------------------------------------------------------------

8. KEY SUPPORT & RESISTANCE LEVELS (24H)

Critical Resistance Levels

---------------------------------------------------------------------------------------------

R1: 23,100 (Psychological + Gann)

R2: 23,150 (Technical resistance + harmonic)

R3: 23,200 (Minor resistance)

R4: 23,250 (Major swing high)

R5: 23,350 (Extended target)

---------------------------------------------------------------------------------------------

Vital Support Levels

---------------------------------------------------------------------------------------------

S1: 23,040 (Immediate support)

S2: 23,000 (Psychological + Gann)

S3: 22,950 (Critical support cluster)

S4: 22,900 (Strong technical support)

S5: 22,850 (Major support zone)

---------------------------------------------------------------------------------------------

9. 24-HOUR TRADING SCENARIOS

Scenario 1: Bullish Breakout (50% Probability)

---------------------------------------------------------------------------------------------

Trigger: Break above 23,120 with volume expansion

Initial Target: 23,180-23,200

Extended Target: 23,300-23,350

Stop Loss (Longs): Below 22,990

Expected Timeline: 12-18 hours from breakout

---------------------------------------------------------------------------------------------

Scenario 2: Continued Consolidation (35% Probability)

---------------------------------------------------------------------------------------------

Range: 23,000-23,150

Trading Strategy: Range-bound scalping

Buy Zone: 23,020-23,040

Sell Zone: 23,120-23,140

Duration: Full 24-hour period

---------------------------------------------------------------------------------------------

Scenario 3: Bearish Breakdown (15% Probability)

---------------------------------------------------------------------------------------------

Trigger: Break below 22,990 on volume

Target 1: 22,900-22,950

Target 2: 22,850-22,900

Bounce Level: 22,800-22,850

Recovery Above: 23,050 negates bearish scenario

---------------------------------------------------------------------------------------------

10. RISK FACTORS & CATALYSTS (24H)

Bullish Catalysts

---------------------------------------------------------------------------------------------

Tech earnings optimism building

AI sector momentum continuation

Institutional portfolio rebalancing (month-end flows)

Strong economic data expectations

Risk-on sentiment from Asia markets

---------------------------------------------------------------------------------------------

Bearish Risk Factors

---------------------------------------------------------------------------------------------

Profit-taking ahead of earnings

Rising bond yields concern

Geopolitical tensions impact

Overbought technical condition worries

Sector rotation out of tech

---------------------------------------------------------------------------------------------

High-Impact Events (Next 24H)

---------------------------------------------------------------------------------------------

Asian market opening (risk sentiment gauge)

Weekend news flow analysis

Pre-earnings positioning

Options expiry effects

Futures gap analysis

---------------------------------------------------------------------------------------------

11. TRADING RECOMMENDATIONS (24H)

For Scalpers (5M-15M Timeframes)

---------------------------------------------------------------------------------------------

Primary Setup: Triangle breakout trade

Entry Long: Above 23,120

Target: 23,160-23,180

Stop Loss: 23,080

Risk/Reward: 1:2 ratio

---------------------------------------------------------------------------------------------

For Intraday Traders (30M-1H)

---------------------------------------------------------------------------------------------

Strategy: Bull flag continuation

Entry Zone: 23,050-23,070 (on dips)

Target 1: 23,150

Target 2: 23,200

Stop Loss: 23,000

---------------------------------------------------------------------------------------------

For Swing Setup (4H basis)

---------------------------------------------------------------------------------------------

Approach: Pullback buying opportunity

Optimal Entry: 22,950-23,000

Primary Target: 23,350-23,400

Extended Target: 23,600

Stop Loss: 22,850

---------------------------------------------------------------------------------------------

12. CONFLUENCE ANALYSIS

Bullish Confluence at 22,950-23,000

---------------------------------------------------------------------------------------------

Gann Theory: 23,000° perfect square support

Elliott Wave: Wave 4 completion zone

Wyckoff: Last Point of Support (LPS)

Fibonacci: 61.8% retracement level

Moving Averages: EMA 50 confluence

Volume Profile: High volume node support

---------------------------------------------------------------------------------------------

Resistance Confluence at 23,150-23,200

---------------------------------------------------------------------------------------------

Harmonic: Cypher pattern C-point resistance

Previous Structure: Multiple test area

Psychological: Round number resistance

Gann Angles: 63.75° resistance line

Elliott Wave: Wave B completion area

Technical: Flag pattern upper boundary

---------------------------------------------------------------------------------------------

FINAL 24H FORECAST SUMMARY

Most Likely Scenario: Continued consolidation with upward bias, testing 23,150 resistance with potential breakout to 23,200+ levels.

Trading Range Expectation: 22,980 - 23,180 (primary range)

Breakout Levels:

---------------------------------------------------------------------------------------------

Bullish: Above 23,120 → targets 23,200-23,350

Bearish: Below 22,980 → targets 22,900-22,950

---------------------------------------------------------------------------------------------

Key Time Windows:

---------------------------------------------------------------------------------------------

Asian Open: 00:00-02:00 UTC (gap direction)

US Pre-market: 08:00-13:30 UTC (institutional flows)

US Cash Open: 13:30 UTC (volume confirmation)

---------------------------------------------------------------------------------------------

Risk Management Notes:

---------------------------------------------------------------------------------------------

Position sizing should account for tech sector volatility

Weekend gap risk considerations

Earnings season positioning effects

---------------------------------------------------------------------------------------------

Probability Assessment:

---------------------------------------------------------------------------------------------

50% - Bullish breakout scenario

35% - Range-bound consolidation

15% - Bearish breakdown

---------------------------------------------------------------------------------------------

Disclaimer: This analysis is for educational purposes only. Trading involves substantial risk of loss. Always use appropriate risk management and never risk more than you can afford to lose. Past performance does not guarantee future results.

---------------------------------------------------------------------------------------------

---------------------------------------------------------------------------------------------

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

US consumer sentiment improved in Jun could boost US indices The US July Michigan Consumer Sentiment Index increased to 61.8 from 60.7, while the 12-month inflation expectation decreased to 3.6% from 4% in the previous month. This suggests an easing of inflation concerns and improved consumption optimism.

This data, coupled with recent stronger Retail Sales figures, continues to support expectations for robust US economic growth amidst trade tariff uncertainties. Inflation is anticipated to have a limited short-term impact. Concurrently, the approval for AMD and Nvidia (NVDA) to export AI chips to China further bolsters the US tech sector.

The USTEC is currently in an upward trend, having reached a new high before a slight retreat. It is trading above both the EMA21 and EMA78, indicating higher highs and higher lows, suggesting the rally could persist.

Should the USTEC continue its surge, the index may test the resistance level at 23,200. Conversely, a failure to maintain above the trendline could trigger a decline towards the next support at 22,600.

By Van Ha Trinh - Financial Market Strategist from Exness

Will USTEC Continue to Climb Amid Key Catalysts Ahead?Fundamental approach:

- USTEC climbed to fresh record highs this week, supported by positive investor sentiment amid consolidation ahead of key catalysts.

- Sentiment was buoyed by expectations of continued AI and semiconductor strength, with Nvidia (NVDA) and Amazon (AMZN) registering gains, while Tesla (TSLA) rebounded on optimism despite recent volatility. However, persistent tariff threats and uncertainty around US trade policy generated caution, with markets jittery as investors eyed incoming earnings reports and inflation data releases for further direction. The term structure in tech remains constructive, with buyers stepping in on minor pullbacks, showing little sign of trend exhaustion.

- USTEC may face heightened volatility as the next round of corporate results and updates on US tariffs could shift sentiment. Upcoming earnings from major tech firms and macroeconomic releases, including key inflation and consumer confidence data, could set the tone for the index's next move.

Technical approach:

- USTEC closed above the range of 22650-22900, and also above both EMAs, indicating a strong upward momentum.

- If USTEC maintains above 22900, it may continue to rise to 78.6% Fibonacci Extension at around 23870.

- On the contrary, closing below 22900 may push the price to retest the previous support at 22650.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

NAS100 Forecast 24HAs of Tuesday, July 15, 2025, 2:03:11 AM UTC+4 the forecast for US100 (Nasdaq 100) in the next 24 hours presents a mixed outlook, with underlying bullish sentiment but caution due to ongoing market dynamics and potential for short-term pullbacks.

Factors Contributing to a Bullish Bias:

Underlying Strength and Breakout Behavior: Despite some short-term bearish technical signals, the Nasdaq is described as being in "breakout mode," decisively overriding key levels. This suggests underlying bullish momentum.

AI as a Growth Driver: Artificial intelligence (AI) remains a primary growth driver for the US economy and the technology sector, which heavily influences the Nasdaq 100. Confidence in secular tailwinds like cloud computing and semiconductor demand also persists .

Temporary US Dollar Weakness: The US Dollar Index (DXY) is currently in a retracement phase, pulling back after strength. A weaker dollar can provide a relief rally for risk assets like the Nasdaq, making US tech stocks more attractive to international investors.

Potential for Federal Reserve Rate Cuts: While no rate cuts are expected over the summer, a rate cut is considered likely in September. Historically, phases of moderate interest rate cuts in the absence of a recession have been positive for the US stock market.

"Buy on Dip" Mentality: Some analyses suggest that any short-term declines could be viewed as buying opportunities, indicating an underlying positive sentiment among investors.

Strong Earnings Expectations (for some tech): Despite general market concerns, some technology companies associated with AI innovation are expected to perform well, contributing positively to the index.

Factors Suggesting Caution and Potential for Bearish Movement/Volatility:

Escalating Trade Tensions (Trump's Tariffs): President Trump's continued aggressive protectionist stance and new tariff threats (e.g., against Canada) are a significant risk. These can create uncertainty, weigh on corporate profits, and lead to market volatility. This is frequently cited as the main risk for US indices.

Short-Term Technical Bearishness: Some technical analyses indicate a high chance of bearish candle closures across various timeframes (1H, 4H, Daily, Weekly, Monthly) , and some traders are eyeing selling opportunities from specific resistance zones (e.g., around 22,800-22,869).

Overvalued Growth Stocks: Following a recent rally, US stocks, particularly growth stocks, are trading at a premium to fair value. This can limit upside potential and make the market more susceptible to corrections if tariff negotiations falter or earnings guidance disappoints.

Market Seasonality: As we move into the latter half of July, market seasonality can shift from bullish to a more bearish stance.

Earnings Season and "Sell on the News" : While major financial institutions are kicking off Q2 earnings season, there's a potential for a "sell on the news" response, even if earnings aren't particularly bad, given the strong rally stocks have already staged.

Mixed Global Signals: European markets showing mixed performance and pressure from US futures suggest cautious global risk sentiment, which could cap upside for the Nasdaq.

Unfilled Stock Imbalances: Some technical analysis points to an unfilled stock imbalance around 22,300, which could act as a reaction point if the price pulls back.

Key Levels to Watch (Approximate):

Support: 22,600, 22,300 (unfilled imbalance), 21,611 (resistance-turned-support), 20,673 (Fibonacci extension and prior high).

Resistance: 22,800, 22,869, 23,000-23,100 (potential re-entry targets for rally continuation), 25,000-25,100 (approximate imbalance level to be filled).

In conclusion, for the next 24 hours, the US100 is likely to face a battle between underlying bullish momentum driven by AI and potential Fed policy, and the immediate headwinds of escalating trade tensions and some short-term technical bearishness. Traders should be prepared for volatility and quick shifts in sentiment based on news flow, particularly regarding trade and upcoming earnings reports.

For those interested in further developing their trading skills based on these types of analyses, consider exploring the mentoring program offered by Shunya Trade.

I welcome your feedback on this analysis, as it will inform and enhance my future work.

Regards,

Shunya Trade

⚠️ Disclaimer: This post is educational content and does not constitute investment advice, financial advice, or trading recommendations. The views expressed here are based on technical analysis and are shared solely for informational purposes. The stock market is subject to risks, including capital loss, and readers should exercise due diligence before investing. We do not take responsibility for decisions made based on this content. Consult a certified financial advisor for personalized guidance.

NAS100 Setup Locked In — Ride the Drop from the Order Block!Hey Guys,

I'm planning a sell trade on the NAS100 index from a designated order block. Once price reaches the sell zone, the position will be activated.

📍 Trade Details:

- 🟢 Entry Level: 22,869

- 🔴 Stop Loss: 22,930

- 🎯 TP1 – First Target: 22,839

- 🎯 TP2 – Second Target: 22,794

- 🎯 TP3 – Final Target: 22,671

📐 Risk-to-Reward Ratio: 3.24

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏

NSDQ100 Bullish breakout retest?Donald Trump escalated trade tensions again, threatening a 35% tariff on Canadian goods shortly after reopening trade talks, and floated doubling global tariffs to 20%. This reinforces his aggressive protectionist stance and puts renewed pressure on allies like Canada and Vietnam, the latter blindsided by a 20% levy. Meanwhile, US-China relations may be entering a critical phase, with a possible Trump-Xi summit hinted at by Marco Rubio during talks in Malaysia.

On the geopolitical front, Trump is signaling a harder line on Russia, previewing a “major statement” and backing expanded sanctions as the US sends more weapons to Ukraine. This raises global uncertainty, especially for energy and defense sectors.

Conclusion for NSDQ100 trading:

Rising trade tensions and geopolitical risks may dampen market sentiment and lead to volatility in tech-heavy Nasdaq stocks, particularly those reliant on global supply chains. While traders have grown numb to tariff talk, the cumulative pressure suggests a downside risk is building. In the short term, maintain a cautious stance—watch for potential pullbacks and heightened intraday volatility as policy clarity remains elusive.

Key Support and Resistance Levels

Resistance Level 1: 22940

Resistance Level 2: 23060

Resistance Level 3: 23180

Support Level 1: 22410

Support Level 2: 22300

Support Level 3: 22130

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

One last squeeze and NAS100 could explode into the next rallyThe NAS100 is currently coiling within a tight consolidation range, showing signs of tension building up. After a strong push upward, price has been moving sideways in a narrowing structure. This build-up around the high, a compression of buyers and sellers in a low-volatility squeeze could be an indication that we could use. This kind of price action typically signals that buyers are gaining control, squeezing out sellers with each dip.

The lack of deep pullbacks combined with increasingly shallow sell-offs shows fading bearish momentum. Which is often typical during a buildup phase before a breakout. If buyers can push price above with a strong close, it could trigger breakout momentum and lead to a continuation of the larger bullish trend.

Ideally, if price reacts positively and forms bullish confirmation, it would set up a solid continuation entry, with upside potential toward the next target of 23.400.

Until then, bulls are watching closely for signs of commitment. The breakout is yet to be confirmed, but the squeeze is on, and the pressure is building.

What will happen next?

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NASDAQ – Decision Point is Now: Breakout or Breakdown?📈🔍 NASDAQ at Key Inflection – Momentum or Meltdown? ⚠️💥

Hey Traders,

The NASDAQ 100 is now standing right at the make-or-break zone: 22,655. This level marks a critical retest of the recent breakout, and what happens here could define the next major move.

🔵 The Setup:

After a strong bounce and sharp rally from below 18K, we've climbed back into the tight ascending structure. But momentum is slowing…

This zone could produce either a bullish continuation to new highs — or a brutal rejection that unwinds the entire move.

📍 Structure Speaks:

Holding above 22,655 = likely continuation

Breakdown = deeper pullback toward 20,000 and lower channel support

Momentum names like NVIDIA are doing the heavy lifting again — but can they sustain the market alone?

📊 What I'm Watching:

Bullish path = measured target ~25,000+

Bearish path = test of the broader trendline near 20,000 or even the 18,200 region

Macro signals still mixed — stay nimble, not married to one bias

⚠️ Stay Sharp:

Just like in crypto, the Nasdaq can punish both bulls and bears when it enters chop mode. Structure and discipline remain your best defense.

I’ve updated the chart — fresh out the oven 🍞 — and more market ideas are following, including BTC, ETH, and BTC Dominance.

One Love,

The FXPROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

NSDQ100 Bullish Flag continuation pattern developing Metals Market Volatility

Trump’s proposed 50% tariff on copper imports triggered a sharp drop in London copper prices (~2%), with risks of falling below $9,000/ton. While U.S. prices spiked on supply concerns, the global move reflects industrial demand fears—potentially weighing on manufacturing and cyclical stocks.

Trade Negotiations Intensify

Asian trade delegates have logged over 350,000 air miles traveling to Washington as tariff timelines remain unclear. Ongoing uncertainty is capping broader risk appetite, though delayed duties and active talks are offering short-term relief to markets.

Fed Under Pressure

Trump ramped up criticism of Fed Chair Jerome Powell, calling him “terrible,” and may consider replacing him with top adviser Kevin Hassett. This raises questions about central bank independence and future rate policy, a potential headwind for investor confidence.

Market Snapshot

U.S. stock futures: Slightly higher

Oil: Up, on Red Sea conflict

Gold: Down, as risk appetite stabilizes

Conclusion – Nasdaq 100 Trading Outlook

Near-term view: Mildly bullish, supported by easing trade tension and tech sector strength.

Caution warranted: Watch for headline risks from new tariff announcements or Fed-related developments.

Key Support and Resistance Levels

Resistance Level 1: 22940

Resistance Level 2: 23060

Resistance Level 3: 23180

Support Level 1: 22410

Support Level 2: 22300

Support Level 3: 22130

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Nasdaq 100: Bearish Signals Near the All-Time HighNasdaq 100: Bearish Signals Near the All-Time High

As the 4-hour chart of the Nasdaq 100 (US Tech 100 mini on FXOpen) shows, the index reached a new all-time high last week. However, the price action suggests that the current pace of growth may not last.

Last week’s strong labour market data triggered a significant bullish impulse. However, the upward momentum has been entirely retraced (as indicated by the arrows).

The tax cut bill signed on Friday, 4 July, by Trump — which is expected to lead to a significant increase in US government debt — contributed to a modest bullish gap at today’s market open. Yet, as trading progressed during the Asian session, the index declined.

This suggests that fundamental news, which could have served as bullish catalysts, are failing to generate sustainable upward movement — a bearish sign.

Further grounds for doubt regarding the index's continued growth are provided by technical analysis of the Nasdaq 100 (US Tech 100 mini on FXOpen) chart, specifically:

→ a bearish divergence on the RSI indicator;

→ price proximity to the upper boundary of the ascending channel, which is considered resistance.

It is reasonable to suggest that the market may be overheated and that bullish momentum is waning. Consequently, a correction may be forming — potentially involving a test of the 22,100 level. This level acted as resistance from late 2024 until it was broken by strong bullish momentum in late June.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NSDQ100 lower after ADP Employment shrank to 33K in JuneTrump Trade Tensions:

Donald Trump reaffirmed his July 9 deadline for higher tariffs, intensifying criticism of Japan, particularly over auto sector issues. While Japan insists talks are in good faith, market fears of a breakdown are rising.

US Tax Policy in Focus:

Trump’s “Big Beautiful” tax and spending bill faces potential resistance in the House despite narrowly passing the Senate. The proposal’s scale and political friction are drawing investor attention.

Apple Supply Chain Worry:

Foxconn has pulled hundreds of Chinese staff from its Indian iPhone factories, sparking fresh concerns about Apple’s supply chain and Wall Street’s potentially overheated tech optimism.

Paramount Settlement:

Paramount resolved a lawsuit with Trump over alleged election interference via CBS’s coverage. Meanwhile, the company awaits FCC approval for its Skydance merger.

Auto Sector Weakness:

Stellantis reported a 10% drop in U.S. Q2 deliveries despite some brand gains. Tesla is expected to post a 12% annual decline in vehicle deliveries, reinforcing signs of cooling demand in the sector.

Conclusion:

Markets remain cautious but resilient amid political tensions, supply chain disruptions, and weaker auto sales. Attention is now turning to upcoming trade deadlines, policy decisions, and Q2 corporate results.

Key Support and Resistance Levels

Resistance Level 1: 22710

Resistance Level 2: 22820

Resistance Level 3: 22930

Support Level 1: 22190

Support Level 2: 22040

Support Level 3: 21900

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

"NASDAQ 100: THE TECH ROBBERY! – Quick Profits Before Reversal?"🔥 "The NDX NASDAQ 100 INDEX Heist: Bullish Loot & Escape Before the Trap!" 🔥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥 (technical + fundamental analysis), here’s our master plan to heist the NDX - NASDAQ 100 INDEX. Follow the strategy on the chart—long entry is the play! Aim to escape near the high-risk RED Zone (overbought, consolidation, potential reversal). The bears are lurking, so take profits and treat yourself—you’ve earned it! 💪🏆🎉

🚀Entry (The Vault is Open!)

"Swipe the bullish loot at any price!"

For precision, place buy limit orders within 15-30min timeframe (recent swing lows/highs).

Set alerts! Don’t miss the heist.

🛑 Stop Loss (Safety Net)

Thief-style SL at nearest swing low (4H timeframe) → 21,000.00 (adjust based on risk/lot size).

🏴☠️ Target 🎯: 22,800.00

Bullish momentum is fueling this heist—ride the wave but exit before the trap!

📰 Fundamental Backing (Why This Heist Works)

Macroeconomic trends, COT data, geopolitics, and sentiment align for bullish moves.

Full analysis? Check our bio0 linkk! 👉🔗🌎

⚠️ Trading Alerts (News & Risk Mgmt)

Avoid new trades during high-impact news (volatility = danger).

Use trailing stops to lock profits and dodge sudden reversals.

💥 Boost This Heist!

Hit 👍 (Boost Button) to strengthen our robbery squad!

More heists = More profits—stay tuned for the next steal! 🚀🤑

See you soon, fellow thieves! 🤝🎉

NASDAQ 100 TECH HEIST: Bullish Loot Before the Bear Trap!🚨 E-MINI NASDAQ 100 HEIST: Tech Rally or Bear Trap? (Thief Trading Blueprint) 🚨

🌟 Hola! Oi! Bonjour! Hallo! Salam! 🌟

Attention all Market Bandits & Tech Raiders! 🏴☠️💻💰

🔥 Thief Trading Intel: We're targeting the E-MINI NASDAQ 100 for a bullish loot grab! Long entry only—high-risk Red Zone ahead: overbought, consolidating, and primed for a reversal. Don’t let the bears ambush your profits!

"Claim your tech treasure and run—you’ve earned this steal!" 💰🚀

🚪 ENTRY: The Tech Vault is Open!

📈 "Swipe bullish loot at any price—the heist is LIVE!"

Buy Limit orders at recent swing lows/highs (15-30 min TF).

📌 Pro Thief Move: SET ALERTS! Don’t miss the breakout.

🛑 STOP LOSS: Escape Plan

📍 Thief SL (Smart Crew): Recent swing low (20,700.00, 4H TF).

📍 Adjust based on your risk, lot size, and orders.

🎯 TARGET: Loot & Exit!

🎯 22,600.00 (or bail early if the market flips!)

⚡ SCALPERS’ QUICK HIT

👀 Long scalps ONLY!

Deep pockets? Raid now.

Light wallet? Join swing traders.

Trailing SL = Your Profit Shield! 🛡️

📢 WHY THIS HEIST? (NASDAQ Bullish Momentum)

Tech rally brewing! Key drivers:

Fundamentals (COT, Macro, Geopolitics)

Sentiment & Intermarket Trends

Index-Specific Analysis & Positioning

🔗 Full intel? Bio linkss checkk! 👉🏻👉🏻👉🏻

⚠️ WARNING: News = Danger Zone! 📡🚨

Tech news moves FAST! Protect your loot:

❌ Avoid new trades during news.

🔒 Trailing SL = Lock profits.

💖 SUPPORT THE TECH HEIST CREW!

💥 SMASH THAT BOOST BUTTON! 💥

More boosts = bigger future heists!

Stronger crew = more $$$ for all!

Profit daily with Thief Trading Style! 📈🏆

Next tech raid coming soon—stay tuned! 🖥️🤑

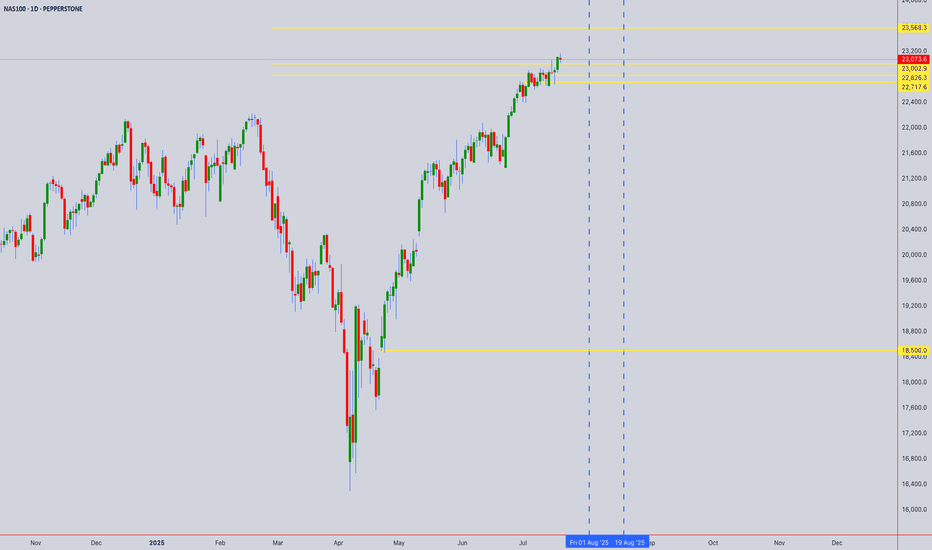

Nasdaq 100: A New All-Time HighNasdaq 100: A New All-Time High

As shown on the Nasdaq 100 chart (US Tech 100 mini on FXOpen), the value of the technology stock index has risen above its February peak, setting a new historical high.

Bullish sentiment may be supported by:

→ Easing concerns over potential US involvement in a Middle East war, as the ceasefire between Israel and Iran remains in effect.

→ Media reports suggesting that Donald Trump is considering replacing Federal Reserve Chair Jerome Powell by September or October, in an effort to influence a rate cut that could accelerate economic growth (though this also raises the risk of a new inflationary wave).

Technical Analysis of the Nasdaq 100 Chart

Price fluctuations in May and June have formed an ascending channel (highlighted in blue), with the following observations:

→ The decline (marked by red lines) appears to be an interim correction forming a bullish flag pattern;

→ The 22K level, which acted as resistance mid-month, was breached by a strong bullish impulse (indicated by the arrow) from the week's low.

This leaves the market vulnerable to a potential correction, which seems possible given:

→ Proximity to the upper boundary of the ascending channel;

→ Overbought conditions indicated by the RSI.

If the market corrects, a retest of the 22K level may happen.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

NSDQ100 Bullish breakout supported at 21950President Trump rejected a Pentagon intelligence report suggesting his airstrikes on Iran had limited effect, claiming they caused “total obliteration,” despite inconclusive satellite imagery. In a surprising move that weakens longstanding US sanctions, Trump also allowed China to resume purchases of Iranian oil.

Federal Reserve Chair Jerome Powell reiterated that the current inflation outlook supports holding interest rates steady. He is expected to provide further detail in testimony before the Senate Banking Committee today.

Markets responded calmly: stock futures were steady as the Israel-Iran truce held, and oil prices rose slightly after their sharpest two-day drop since 2022.

Separately, the UK announced plans to purchase 12 US-made F-35A fighter jets capable of carrying nuclear weapons, in a bid to strengthen ties with Trump. NATO allies are working diplomatically to reassure the US of their unity, ahead of a summit in The Hague.

Key Support and Resistance Levels

Resistance Level 1: 22380

Resistance Level 2: 22500

Resistance Level 3: 22690

Support Level 1: 21950

Support Level 2: 21810

Support Level 3: 21680

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USTECH H4 AnalysisUSTECH Showing a bullish Flag. If it breaks this zone above, Most probably can fly up to 22,106.35 and higher TO 23,200. If no, Can rally between 20,800, 20,400 or even lower. Trading Analysis from 23-06-25 to 27-06-25. Take your risk under control and wait for market to break support or resistance on smaller time frame. Best of luck everyone and happy trading.🤗

NSDQ100 bullish continuation supported at 21300Markets & Geopolitics:

Investors are holding back as Trump may try diplomacy before acting against Iran. Oil prices dropped, European stocks rose, and the dollar slipped.

Tensions remain high: Israel hit Iranian missile and nuclear sites, and Iran’s president demanded Israel stop unconditionally. Iran’s foreign minister is in Geneva for talks, and the country is speeding up oil exports.

Technology:

SoftBank’s founder Masayoshi Son wants to partner with TSMC to build a huge AI and robotics hub in Arizona. It’s unclear if TSMC will join, as it’s already investing $165 billion in the US.

US Politics & Immigration:

A court backed Trump’s use of the National Guard during LA protests, despite pushback from California’s governor. A deeper report looks at how immigration raids affect workers.

Trade & Business:

Canada may raise tariffs on US steel and aluminum if trade talks stall. Meanwhile, Temu’s US sales are falling as it cuts back on ads. A Fidelity manager says markets have likely priced in Trump’s tariff threats and sees opportunity in mid-sized companies.

Key Trading Levels:

Resistance Level 1: 22070

Resistance Level 2: 22370

Resistance Level 3: 22780

Support Level 1: 21300

Support Level 2: 21060

Support Level 3: 20820

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.