Xauusdanalysis

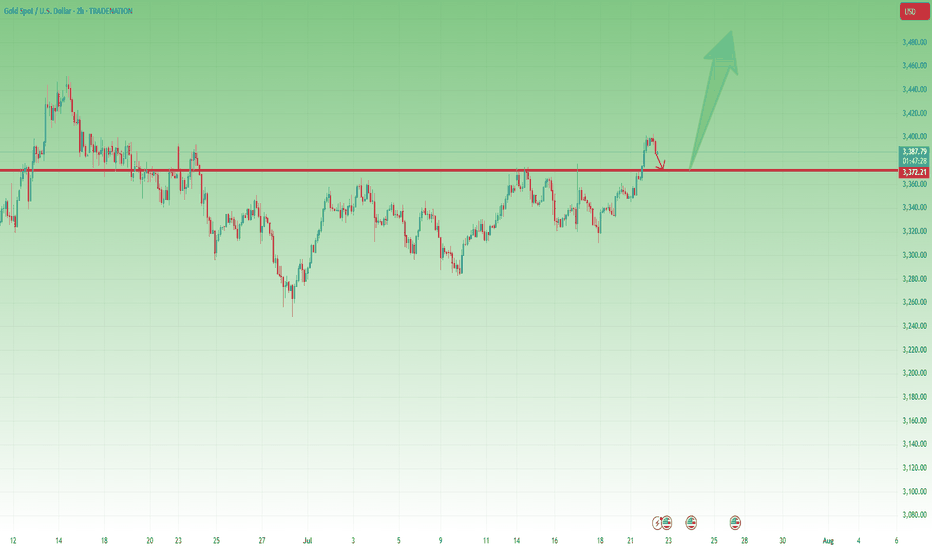

Gold - Above 3370 Is Bullish Territory – But 3360 Must Hold📆 What happened yesterday?

After more than a week of frustrating, sideways price action, Gold finally broke out above the key 3370 resistance zone.

The breakout was clean and impulsive, with TRADENATION:XAUUSD pushing to an intraday high around 3400.

Following that move, price printed a small double top near the high and began a modest correction — perfectly normal after such a breakout. At the time of writing, Gold trades at 3385, still holding above former resistance.

📈 Why this breakout matters:

The daily close at 3396 came in strong and near the top, leaving behind a clear Marubozu candle

This kind of price action signals conviction and momentum

The breakout confirms what I’ve been anticipating for days — the range is resolved, and the market is choosing the bullish path

🎯 What to expect next:

If price stabilizes above 3400, the road to 3450 opens — which is the target mentioned in my previous analyses

That area represents the next major resistance and likely magnet for price if bulls stay in control

🧭 Trading Plan:

For me, the plan is now simple:

✅ Buy the dips — especially on a potential retest of the 3370–3375 broken resistance, which now turns into support

❌ Negation comes only with a daily close below 3360, which would invalidate this breakout and raise questions

📌 Conclusion:

The breakout has finally come. After days of coiling, Gold chose the upside.

Momentum is building, structure is clean, and bulls are back in control — unless 3360 fails.

Until then, I remain bullish, looking to buy dips into strength. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

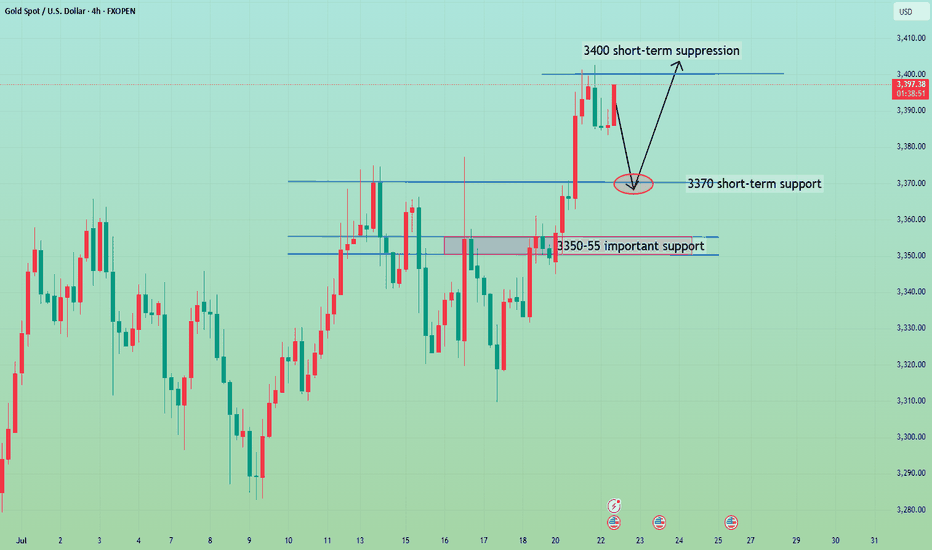

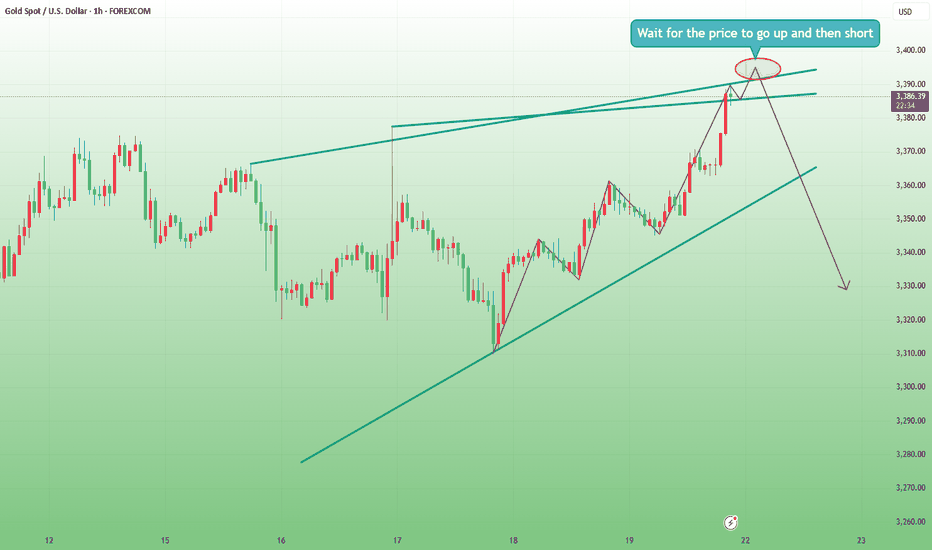

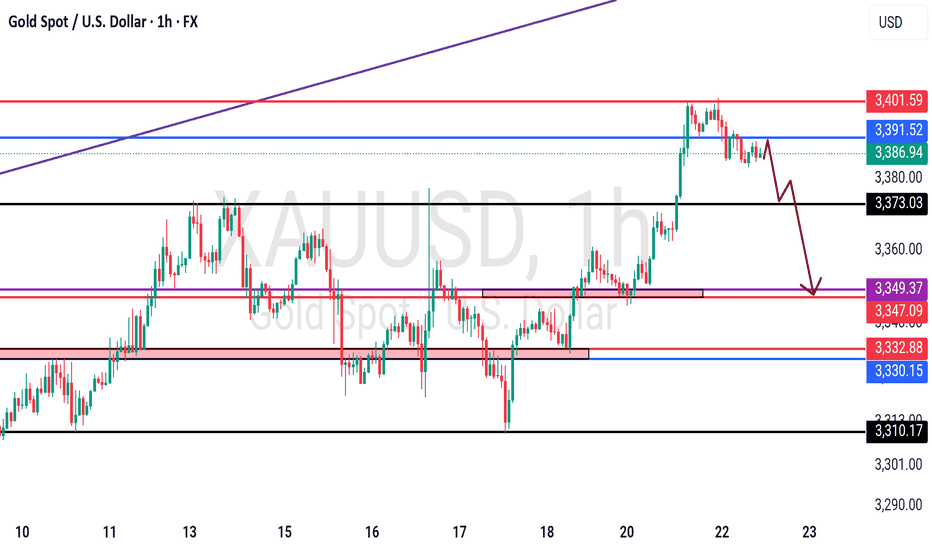

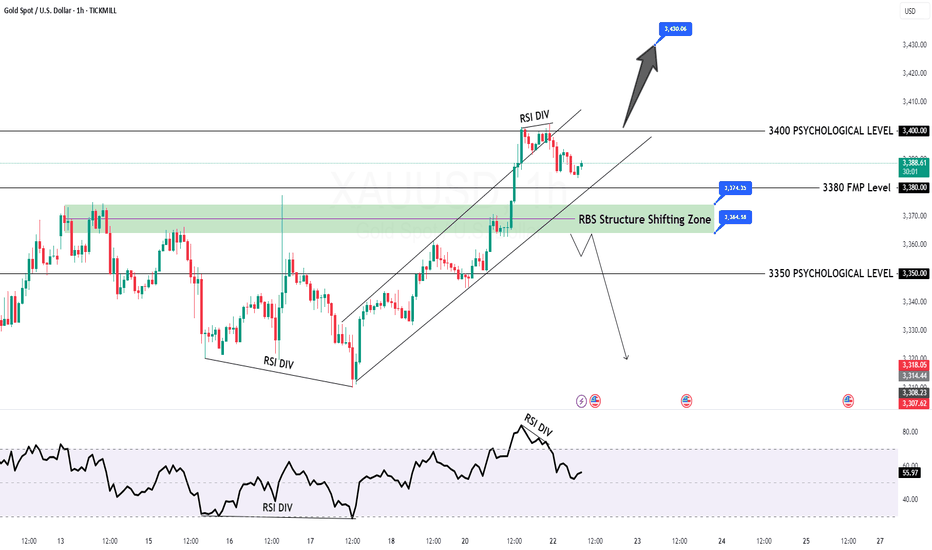

More Pain for Gold? The Charts Say It’s PossibleSince the start of the London market, gold has almost maintained a narrow range of fluctuations in the 3390-3385 area. Compared with yesterday, the market is much weaker today, and gold has failed to stabilize at 3400 several times, indicating that the sentiment of cashing out near this area is also very high. From the current gold structure, gold is obviously biased towards a long structure. Since gold broke through 3400, 3375-3365 has become the key support area after the top and bottom conversion in the short term.

However, gold rose strongly yesterday but did not stabilize at 3400. The bullish sentiment may no longer be strong. Moreover, after the accelerated rise in gold, the sustainability was not strong, so gold still needs to retreat in the short term. This is why I insisted on shorting gold again near 3400 yesterday. Therefore, I think gold has not yet retreated to the right level. I will pay attention to the opportunity to go long on gold after it pulls back to the 3375-3365 area.

Gold fell after touching 3400 twice. Whether a short-term effective "M" double top structure has been formed, I think more signals are needed to verify. However, in the short term, it is still under pressure in the 3405-3410 range, so if there is no major positive news, I think gold may maintain a wide range of fluctuations in the 3410-3360 range. Therefore, if gold rises to the 3400-3410 range again, I will continue to try to short gold!

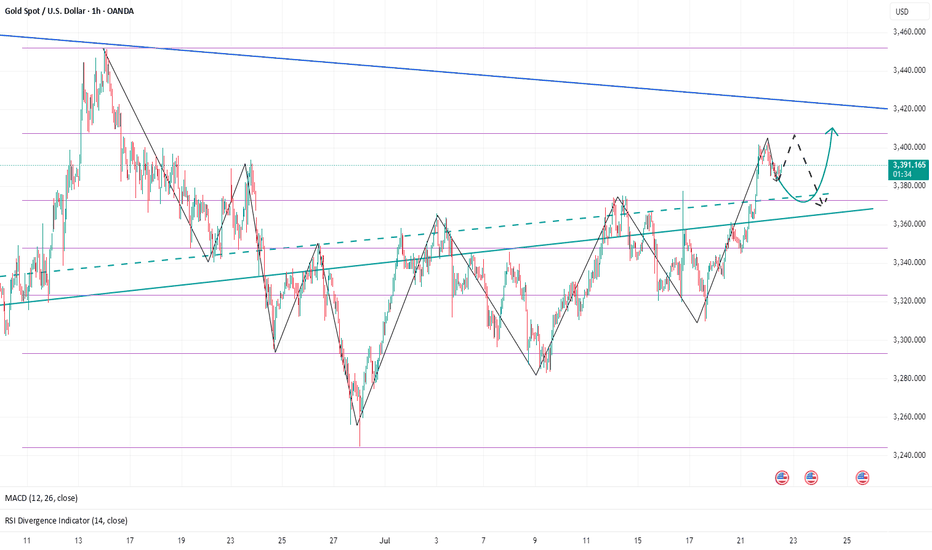

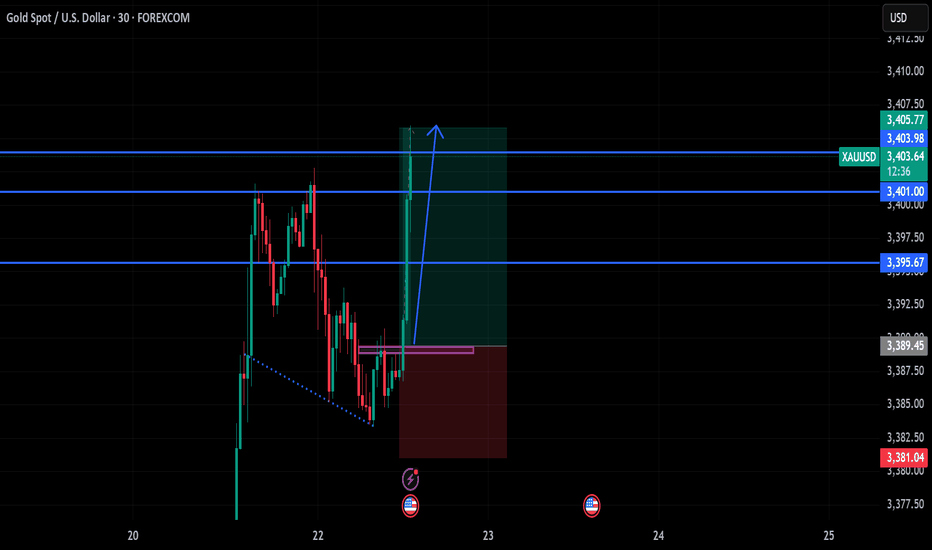

XAUUSD Technical Analysis – Triangle Breakout Ahead?Gold is currently consolidating in a symmetrical triangle pattern around $3,389. If it breaks above $3,402, we can expect a bullish continuation toward $3,420 and beyond. Key support lies at $3,367; a breakdown below this level would turn the trend bearish. The overall trend is still bullish, but a breakout is needed for confirmation.

📈 Potential Scenarios:

✅ Bullish Breakout Scenario:

- Break above $3,392–$3,402 zone.

- Targets: $3,420 > $3,450 > $3,480

- Supported by strong upward BOS (Break of Structure) and higher lows.

❌ Bearish Breakdown Scenario:

- Breakdown below $3,373–$3,367 zone.

- Targets: $3,355 > $3,345

- Would invalidate current bullish structure and form a lower low.

🔮 Trend Bias:

Bullish Bias remains intact as long as price stays above $3,367 and maintains higher lows. However, consolidation suggests waiting for breakout confirmation from the triangle before entering new trades.

🧭 Trend Outlook:

Gold is currently consolidating in a symmetrical triangle pattern, which typically precedes a breakout — either upward or downward. The price is holding above the key Fibonacci support levels and the overall market structure is bullish, suggesting an upward continuation is more likely if buyers maintain momentum.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

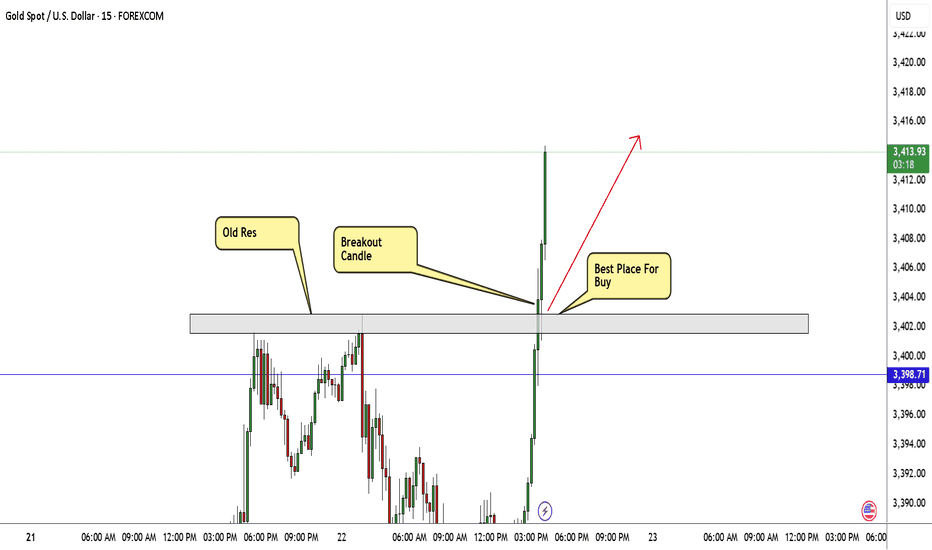

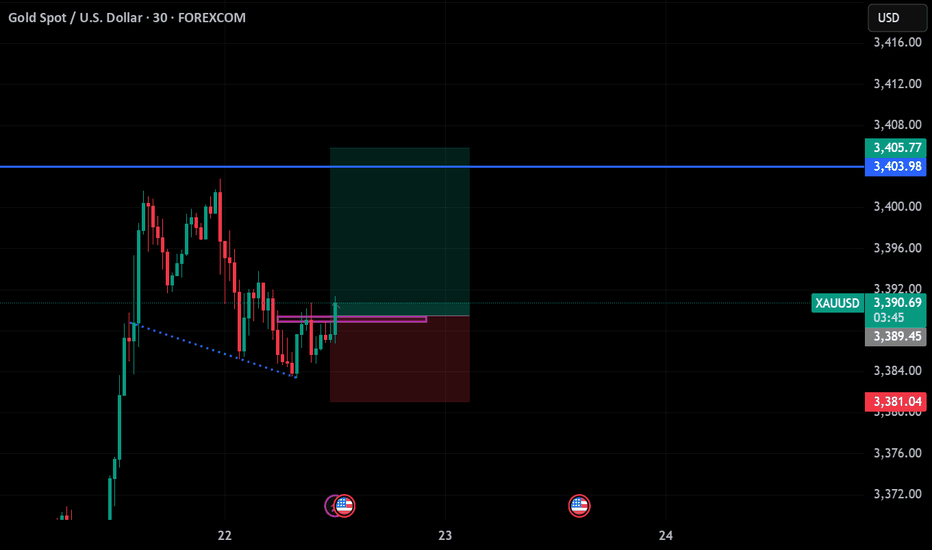

GOLD Still Bullish , Are You Ready For New Wave ? 200 Pips ValidHere is My 15Mins Gold Chart , and here is my opinion , we finally above 3400.00 and we have a 30 Mins Candle closure above this strong res , so i`m waiting the price to go back and retest this res and new support and give me a good bullish price action to can enter a buy trade and we can targeting 200 pips , and if we have a 4H Closure Above This res this will increase the reasons for buyers , just wait the price to back a little to retest it and then we can buy it . if we have a daily closure below it this idea will not be valid anymore .

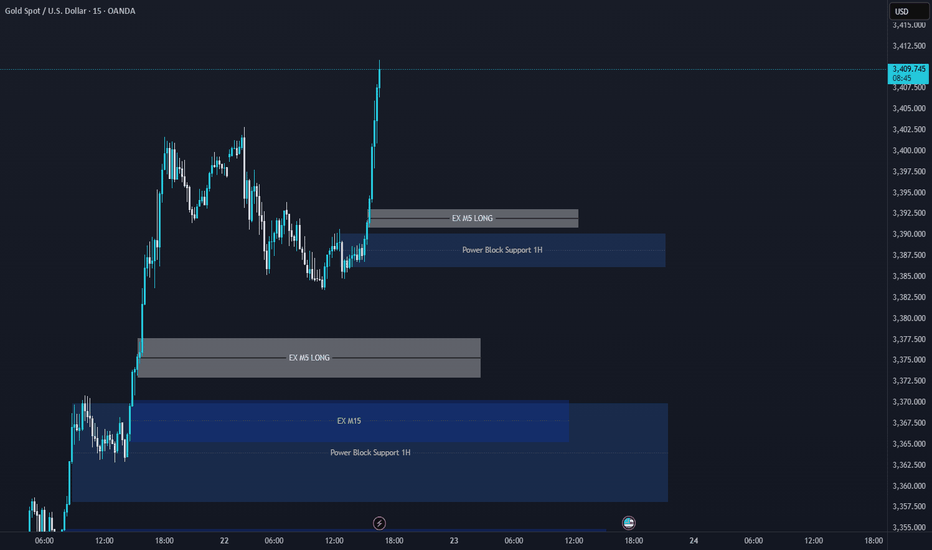

XAUUSD Support & Resistance Levels🚀 Here are some key zones I've identified on the H1/M15/M5 timeframe.

These zones are based on real-time data analysis performed by a custom software I personally developed.

The tool is designed to scan the market continuously and highlight potential areas of interest based on price action behavior and volume dynamics.

Your feedback is welcome!

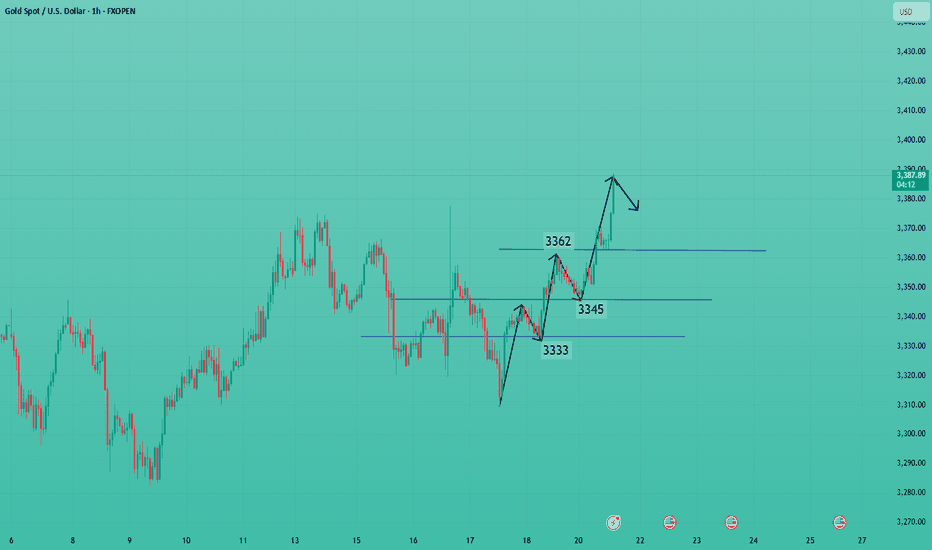

XAUUSD Trade Idea: Golden Cross Signals Bullish MomentumGold (#XAUUSD) is surging after breaking above the 61.8% Fibonacci level, confirming strong bullish momentum!

📊 Key Observations:

Price has bounced off the upper trendline, with an imbalance below, suggesting a possible small correction.

The MA50 has crossed above the MA200, forming a Golden Cross – a highly bullish signal!

🎯 Trade Strategy:

🔼 Consider buying ONLY if price consolidates above 3400 & the nearest fractal.

✅ Target: 3435 (next resistance zone)

⚠️ Watch for pullbacks – the Golden Cross supports upside, but a retest of support could offer a better entry.

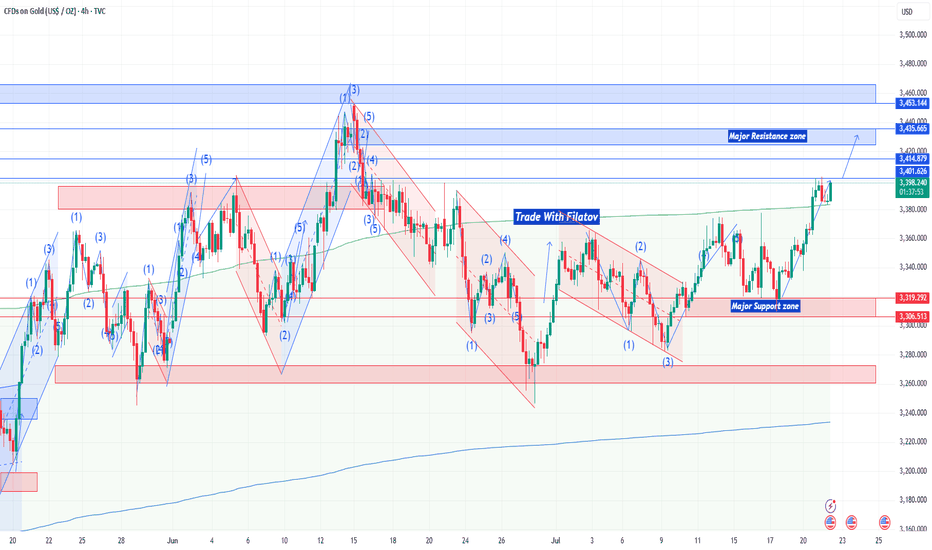

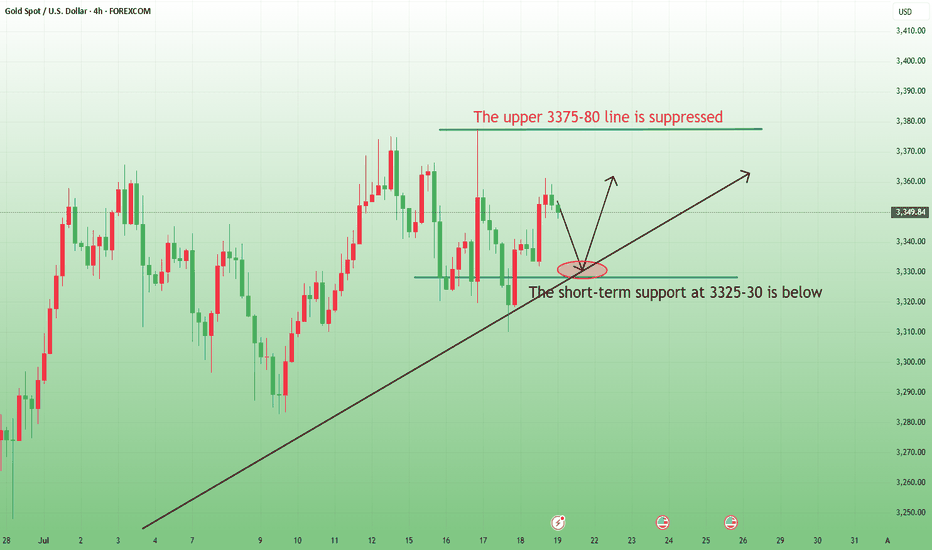

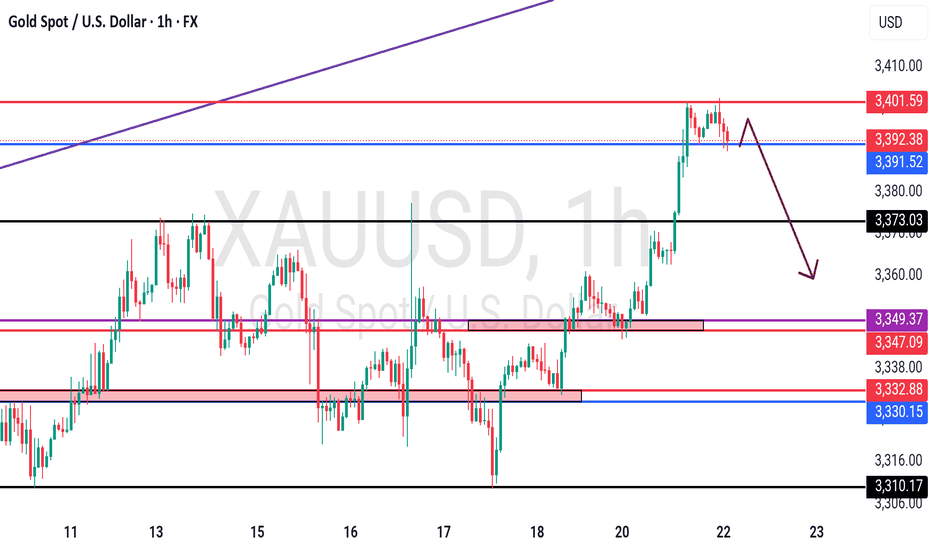

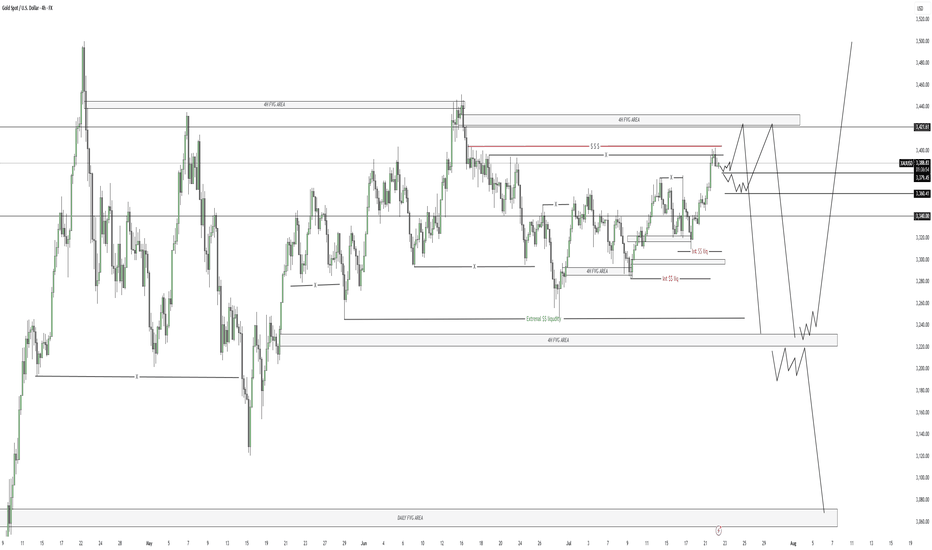

The bulls rise and fall back to continue.Yesterday, gold technically held high and rose strongly in the Asian session relying on the 3350 mark. Both the European and American sessions formed a strong bullish rise and accelerated to break through the 3370 mark before the US session and continued to rise to the vicinity of the 3400 mark and fell back slightly to close strongly. The daily K-line closed with a shock break of the high-middle positive. The overall gold price broke through the recent rebound high of 3377 to form a bullish strong attack pattern. In the short term, 3377-80 became a new key support area.

From the 4-hour analysis, today's retracement relies on this position to continue to follow the trend of the main bullish bullish trend. The short-term bullish strong dividing line focuses on the 3350 mark. The daily level stabilizes above this position and continues to maintain the rhythm of retracement and bullish bullish trend. Short selling can only enter the market at key points, and enter and exit quickly without fighting.

Gold trend analysis: bullish but not chasing the rise.Gold, last Thursday's daily line closed with a long lower shadow, bottomed out and stabilized, and once again stabilized at the lower track support point of the large convergence triangle. Combined with the cyclical movement after the two stabilizations at 3247 and 3282, it was three consecutive positive rises; therefore, last Friday, and at least these two days on Monday this week, there will be consecutive positive rises; today gold rose as expected, the Asian and European sessions continued to be strong, and there was a second rise in the U.S. session. Since the U.S. session went directly higher before and after, the current support below has moved up to the 3377-75 area, where a top and bottom conversion position will be formed. Therefore, if it falls back to 3375-77 in the evening, you can continue to go long and look to above 3400. If it falls below 3370, it will fluctuate. The upper short-term resistance level is 3387-3393, the previous high. If the market touches here for the first time, you can try to see a double top decline.

Gold opening operation strategy.Gold's trend on Friday was mainly volatile upward. It can be said that gold was in a volatile market on Friday night, closing at 3350. If there is no stimulation from international news over the weekend, we will continue to be bullish next week. If your current gold operation is not ideal, I hope Tian Haoyang can help you avoid detours in your investment. You are welcome to communicate with us!

From the 4-hour analysis, the short-term support below continues to focus on around 3340-45, and the strong support is at the 3310 level. The key pressure above is the 3380 line. We will rely on this range to maintain the main tone of high-altitude and low-multiple cycles. For the middle position, we will watch more and do less, and be cautious in chasing orders, and wait patiently for key points to enter the market.

Investment is not a matter of one day or one night. Losses in the early stage do not mean losses in the later stage; profits in the early stage do not mean profits in the later stage. Therefore, friends who lose money should not be discouraged, and friends who make profits should not be complacent. Let yourself invest rationally with a peaceful mind. In this ever-changing market, the rise and fall of the market is not determined by personal subjective will, but is full of more than empty fights. Victory and failure are always around, but one thing is that the trend of the market will determine the future direction. The three steps of setting the trend, selecting the position, and controlling the position are success. Therefore, choice is far greater than hard work. Choosing a good teacher will benefit a lot, and I have always been there.

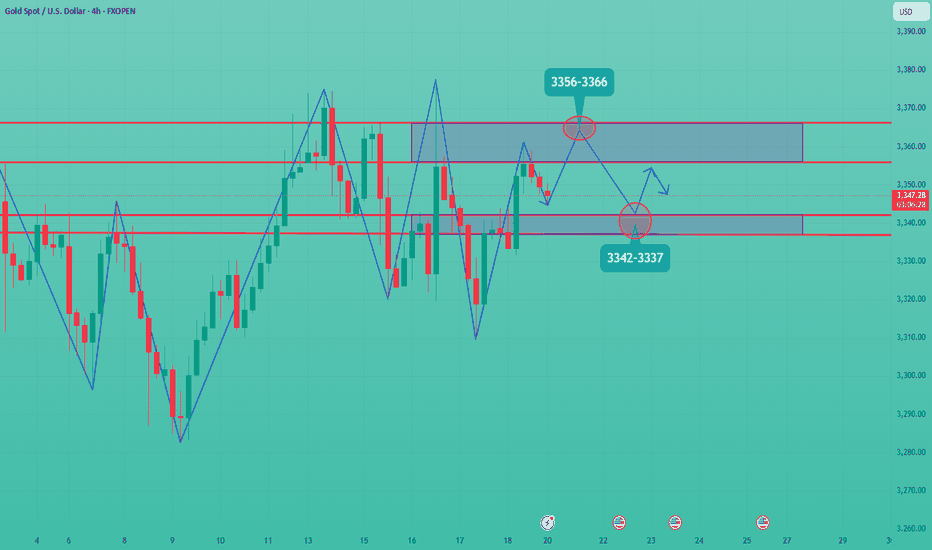

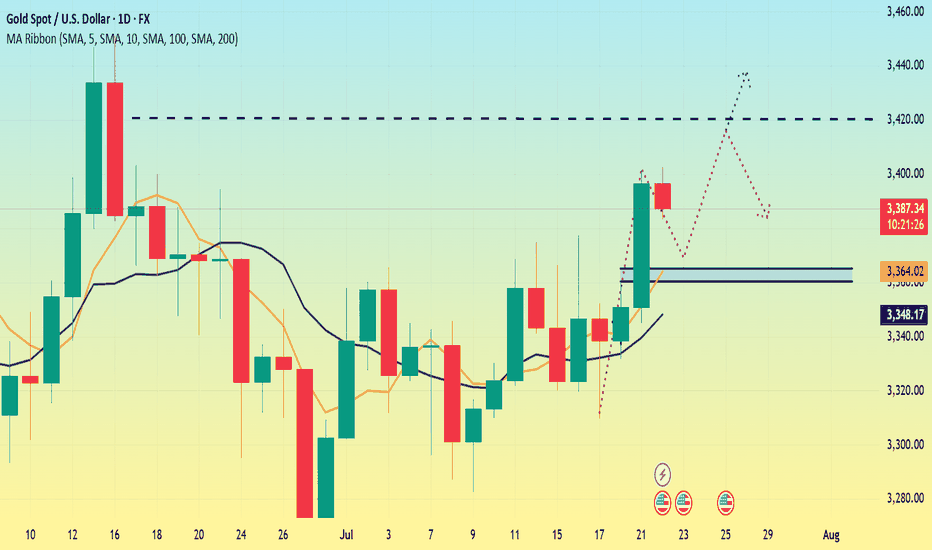

Gold opening market trend analysis.Last week, the gold price rebounded after hitting the low of 3310. The 4-hour chart shows that the Bollinger Bands failed to open downward, and the current market still maintains a volatile trend. Although the short-term price is easy to rise and difficult to fall, it should be noted that the three-month adjustment cycle is coming to an end when the fundamentals of the bull market remain unchanged, and the daily level change window is approaching. It is recommended to focus on preventing risks (especially short-term operation risks) at the opening today and wait patiently for the unilateral market start signal. In terms of short-term operations, the hourly chart price broke through the key level of 3344 after stepping back to the support of 3332. Today's overall trend is volatile and bullish. It is recommended to wait for the price to fall back to the 3337-3342 range to arrange long orders in batches at the opening today. Focus on the 3356-3366 resistance band above. If you encounter resistance, you can try short-term operations. Be sure to strictly stop losses to prevent the risk of false breakthroughs.

Gold continues to rise.The gold hourly line fell slightly to 3346 this morning and stabilized. It bottomed out and pulled up again to stand on the middle track of the hourly line, which means that the short-term stabilized and the overnight 3361 suppression adjustment ended. Looking at the second pull-up, this should have happened in the US market last Friday, but it was delayed until today. Finally, it successfully reached the 3366 target and hit the 3370 line;So today's Asian market rose, the European market continued to break high, and the US market still had a second pull-up; but because it is in a period of shock, wait patiently for a wave of stabilization before taking action. The reference point to choose is to pay attention to the 3382 split support, that is, 3361-60, which happens to be the top and bottom conversion support point, followed by 3358-56, 50 split support and the middle track, the limit is here, and then the starting point of 3350 cannot and should not break, otherwise it will encounter shocks and washes back and forth; the upper resistance level is concentrated at 3390-3395. It is expected that 3390 will not be able to break through in one breath for the time being. You can try to see a decline when you approach it for the first time;

GOLD - at cit n reverse area? What's next??#GOLD... market perfectly moved as per our video analysis and now market just reached at his current ultimate swing area

That is around 3402

So if market holds 3402 in that case selling expected otherwise not.

NOTE: we will go for cut n reverse above 3402 on confirmation.

Good luck

Trade wisely

Gold is under pressure. There is hope for another rise.Today's important news:

At 8:30, Fed Chairman Powell delivered a welcome speech at a regulatory meeting; at 13:00, Fed Governor Bowman hosted a fireside chat session at the large bank capital framework meeting hosted by the Fed.

Market conditions:

The current daily trend is mainly "strong rise" (Monday closed positive and broke through the shock, and the moving average turned upward). The core logic is that short-term bullish momentum is dominant, and it is necessary to focus on the effectiveness of support and the rhythm of breaking through resistance.

Today, we need to focus on the support belt 3365-3360 area (this position is the 5-day moving average position and the low point of yesterday's European session). As a short-term moving average support, this area is the first line of defense for bulls today. If it can stabilize here, it can be regarded as a signal of short-term strong continuation.

The key pressure level is still around 3420. As a trend line resistance that has been under pressure many times in the early stage, if it can break through, it means that the bulls will break the shock suppression and open up more room for growth.

In terms of operation, it is still mainly low-long. The current gold is still strong. Operation strategy:

Short around 3420, stop loss 3430, profit range 3400-3380

Long around 3360, stop loss 3350, profit range 3380-3400

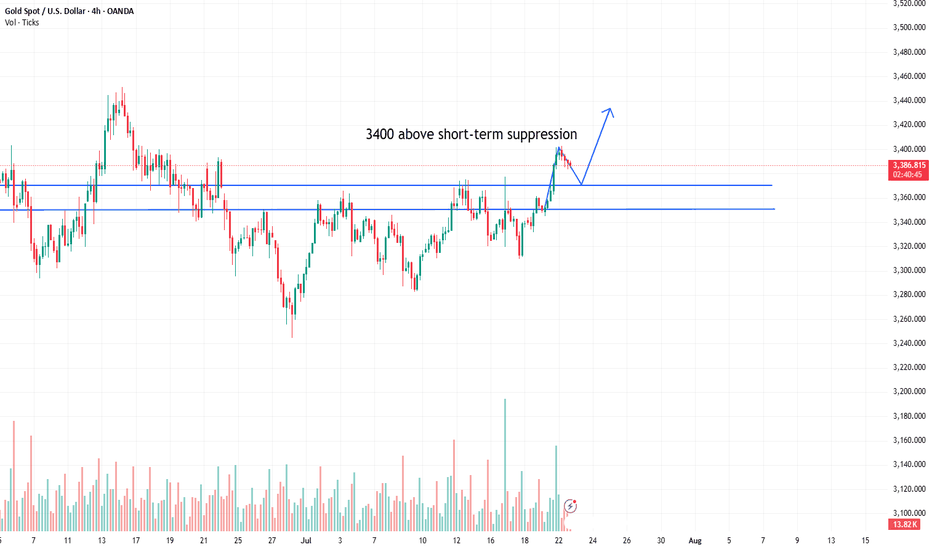

The general trend is to go long after the retracementFrom the 4-hour analysis, the short-term support below is 3370, the important support is 3350-55, and the upper resistance is 3400-05. The overall support range is maintained in this period to maintain the main tone of high-altitude low-multiple cycle participation. In the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market. I will provide specific operation strategies in the link prompts, please pay attention in time.

Gold operation strategy:

1. Go long on gold when it falls back to 3370, and add more positions when it falls back to 3350-55, stop loss 3344, target 3395-3400, and continue to hold if it breaks;

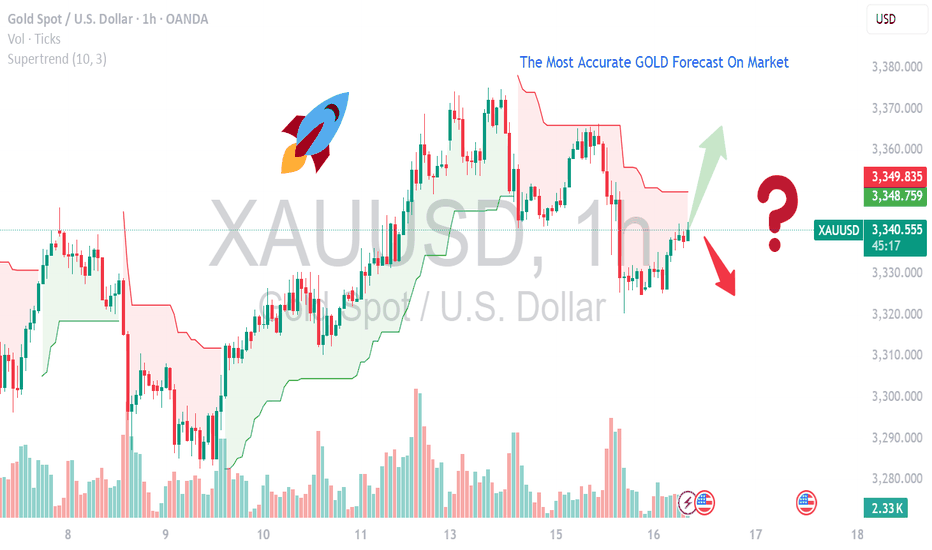

MOST ACCURATE XAUUSD GOLD FORECAST ANALYSIS MARKETCurrent Setup & Technical Outlook

Consolidation & Pennant Formation: Gold is building a bullish pennant and trading above its 50‑day MA — a classic continuation pattern suggesting a breakout toward new highs if momentum resumes .

Key Levels:

Support: $3,330–3,340 — confirmed by multiple technical sources .

Resistance/Breakout Zone: $3,360–3,375 — clearing this could trigger a rally toward $3,400+ .

Upside Targets: $3,390, then possibly $3,500–$3,535 per weekly forecast .

Alternate Bearish Scenario: A failure around the 0.618 Fibonacci resistance (~$3,374) and overbought RSI could spark a pullback to $3,356 or lower .

---

🧠 Fundamental Drivers

Inflation & U.S. Macro Data: Market awaits June CPI/PPI and Fed commentary — cooler inflation could boost gold via dovish expectations, while hotter data may strengthen the USD and weigh on bullion .

Geopolitical & Safe-Haven Demand: Trade tensions (e.g., tariffs) are keeping gold elevated near $3,350–$3,360 .

Central Bank & Real Yields Watch: Continued gold purchases and lower real rates are supportive, although mid-term easing in risks (like global trade) could curb momentum .

Gold Xauusd Analysis **Market Analysis: Pivot at 3381**

- **Bullish Scenario**: Establish long positions above the 3380–3382 range, targeting resistance levels at 3414 and 3424.

- **Bearish Scenario**: Below 3380, anticipate further downside momentum with support levels at 3362 and 3347.

- **Key Resistance Zone**: Initial resistance at 3414, followed by a secondary resistance at 3424.

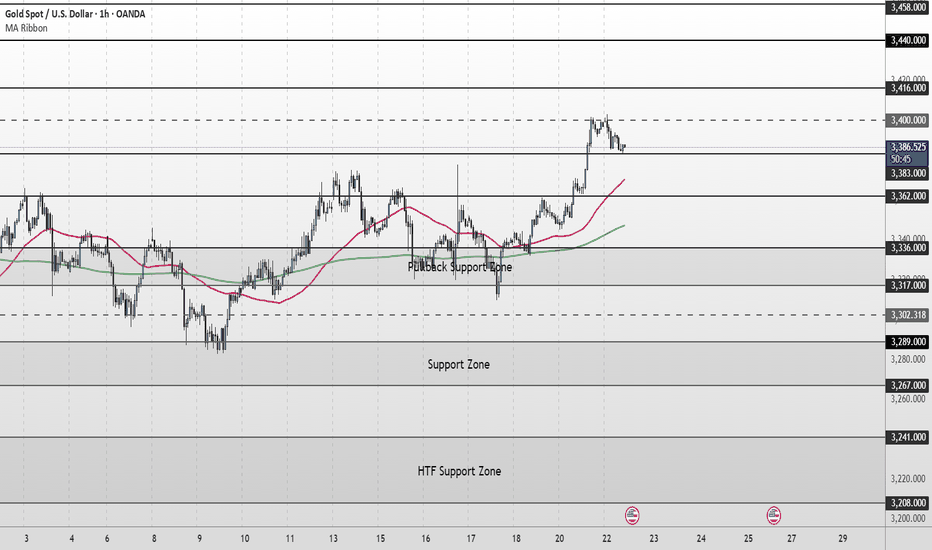

XAU/USD Intraday Plan | Support & Resistance to WatchGold broke above the 3,362 resistance and extended its rally into the 3,400 resistance zone, currently trading around 3,386. Price remains comfortably above both the 50MA and 200MA, which are sloping upward and acting as dynamic support—keeping short‑term structure bullish.

A confirmed break and hold above 3,400 would open the path toward the next upside targets at 3,416 and 3,440, with 3,458 as a higher‑timeframe extension if momentum continues.

If price fails to sustain above 3,383–3,400 and begins to fade, watch the initial pullback toward 3,362.

A deeper move below that would shift focus to the Pullback Support Zone.

Failure to hold there could expose price to the Support Zone and potentially the HTF Support Zone if bearish pressure builds.

📌 Key Levels to Watch

Resistance:

3,383 ‣ 3,400 ‣ 3,416 ‣ 3,440

Support:

3,362 ‣ 3,336 ‣ 3,317 ‣ 3,302 ‣ 3,289

🔎 Fundamental Focus –

📌 Fed Chair Powell Speaks – key event that can move USD and gold sharply.

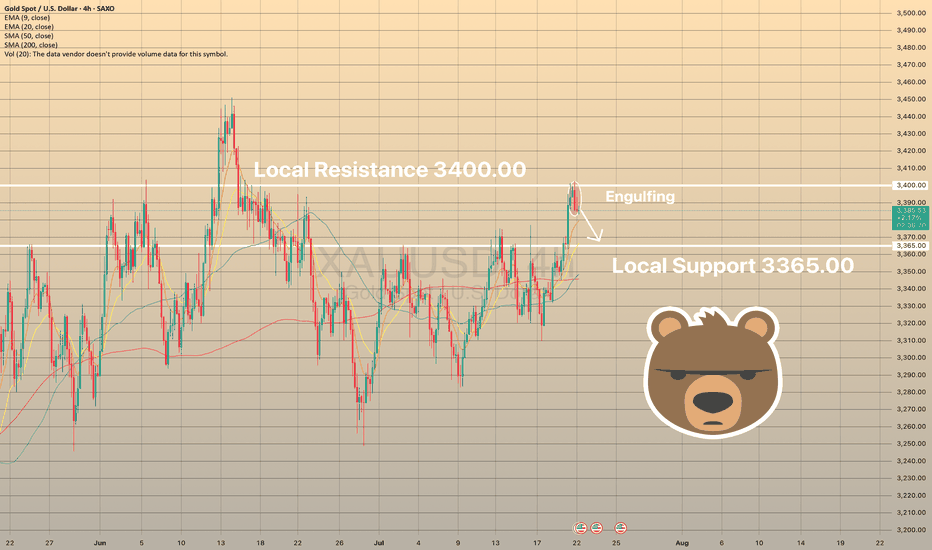

XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?XAUUSD HAS FORMED BEARISH ENGULFING PATTERN. WHAT'S NEXT?

XAUUSD has been trading bullish within the last day. The price touched the resistance level of 3,400.00. As a result, the bearish engulfing pattern has formed on 4-h chart.

An engulfing pattern is a two-candle reversal pattern where a smaller candle is followed by a larger one that completely covers it, indicating a potential shift in the trend. A bullish engulfing pattern, which signals a buy signal, occurs in a downtrend when a small red candle is followed by a larger green candle. A bearish engulfing pattern, which signals a sell signal, occurs in an uptrend when a small green candle is followed by a larger red candle. To trade, identify the pattern in a clear trend with high trading volume on the engulfing candle. Enter a buy position (for a bullish engulfing pattern) or a sell/short position (for a bearish engulfing pattern) after the engulfing candle closes, confirming a rebound from support or resistance. Set a stop-loss below the low of the bullish engulfing candle or above the high of the bearish engulfing candle. Aim for the next support or resistance level or aim for a 1:2 risk-reward ratio.

So, here I expect the price to move down towards local support of 3,365.00, where supposedly, the price will start to consolidate.