Bearish trend dominates, gold awaits direction decisionGold's 1-hour moving average has begun to turn around from a high point. For gold bulls, this may mean that if they want to reverse their decline in the short term, they may need major news to stimulate the market. Otherwise, in the short term, gold bulls may find it difficult to make any significant progress. Gold's 1-hour moving average has fallen at this rate, and there has been basically no major rebound. This rebound also provides a second opportunity for shorting. The key level of gold is still in the 3365-3380 area. If the US market is under pressure at the 3365-3380 area, then gold will continue to be shorted on highs. The market is changing rapidly. We never become rigid longs or shorts. Trading is about following the wind. We go where the wind blows, otherwise we will eventually fail against the wind. Gold bears are now clearly becoming stronger, so we should continue to ride on the tailwind of the gold bears.

Xauusdshort

GOLD Touches the Order blocks and does a little retracement.Gold is stuck in some range bond and is still not able to break 3500. Watch the DXY and be very careful when it breaks the supports or resistances. Can be fake-outs. Check your support and resistances and open positions accordingly. Wait for Price Again and strong solid breakouts to enter the market.

Disclaimer:

The content presented in this IMAGE is intended solely for educational and informational purposes. It does not constitute financial, investment, or trading advice.

Trading foreign exchange (Forex) on margin involves a high level of risk and may not be suitable for all investors. The use of leverage can work both for and against you. Before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience, and risk tolerance.

There is a possibility that you may incur a loss of some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be fully aware of all the risks associated with foreign exchange trading, and seek advice from a licensed and independent financial advisor if you have any doubts.

Past performance is not indicative of future results. Always trade responsibly.

Gold's decline does not mean a bearish trendGold opened high and closed low today, gradually declining from 3405 and then widening its losses, hitting a low of 3354 in the European session. The intraday short-term trend was clearly weak, with the price still unable to break through 3400 and stabilize. In last week's analysis, I emphasized that if this uptrend fails to stabilize above 3400, a downward turn is possible at any time.

However, in the medium and long term, the bullish outlook remains unchanged. Although 3400 hasn't been broken, after a deep correction, it will likely break again; it's just a matter of time.

It also requires the right opportunity, namely, news stimulus to drive the market. Focus on CPI data. Don't turn bearish based on today's decline; it could potentially rebound tomorrow. Therefore, we recommend avoiding short positions. Even if you do go short, wait for a rebound and use a stop-loss to maintain risk management.

Gold is currently trading sideways around 3360. If it rebounds before the US market opens and reaches the 3378-3380 level, short it with a stop-loss at 3390, targeting 3360-3350.

If there's no rebound before the US market opens and the decline continues, then consider a bullish trend around 3345. This was last week's starting point and coincides with the 50% retracement support level. A rebound could be expected if it reaches the watershed level of 3334, with a target around 3380. OANDA:XAUUSD VELOCITY:GOLD VANTAGE:XAUUSD CMCMARKETS:GOLD PYTH:XAUUSD FOREXCOM:GOLD EIGHTCAP:XAUUSD

Gold weakness confirmed, short selling may accelerateAfter short-term sideways consolidation, gold continued its downward trend in the European session. It is expected to break the previous wide sweeping pattern today. In the 4H cycle, the price effectively fell below the middle Bollinger band under the pressure of continuous negative lines, showing the momentum of continued decline; after the short-term support of 3360 was lost, the lower Bollinger band space was further opened, and the weak pattern was confirmed. Strategically, the European and American sessions were adjusted to maintain a downward trend. The upper pressure focused on the 3365-3380 area. The operation was mainly rebound shorting. If 3350 was further broken below, the target could be extended to the 3340-3330 area.

Gold operation suggestion: short gold when it rebounds around 3365-3380, target 3350-3340-3330.

Financial markets are set to receive a slew of important newDomestic gold prices fell due to the impact of world gold prices. In the international market, after closing the week at a high level, today's gold price suddenly reversed and plummeted when opening the new trading week.

Gold prices fell contrary to the forecast of analysts and investors when they expected the precious metal to continue to increase this week.

This week, the market is waiting for a lot of economic information such as the meeting to announce Australia's interest rate decision; the US consumer price index (CPI) report for July; the US producer price index... The data of this information is expected to affect the gold price.

This morning, the USD index (DXY) in the international market recovered to 98.1 points, also creating pressure to reduce gold prices.

How to correctly grasp the gold trading opportunities?At present, the suppression of 3410 is still quite strong. After testing the resistance, a short-term long-short reversal was formed, and it retreated and broke the 3380 low support. It is expected to test the 3360 and 3345 moving average supports below today. After falling below the 3380 bullish starting point, the short-term trend will temporarily be mainly downward. Only when it is close to the low support can a new layout be made. Therefore, wait patiently for the low point to be retreated and stabilized before considering going long on gold.

Gold Technical Analysis - Bearish Bias Below $3,384Gold is currently trading near $3,373 within an ascending channel but showing signs of weakness. A rejection near the $3,384–$3,390 resistance zone could trigger a downside move toward key supports at $3,350, $3,338, and $3,326. If price breaks below the channel midline, bearish momentum may strengthen. However, a bounce from support could push gold back toward the upper range. Keep an eye on breakout zones for the next move.

🔑 Key Levels to Watch

- Resistance: $3,384 → $3,390: Strong resistance zone

- Support: $3,350 → $3,338 → $3,326

- Breakout Zones: Below $3,338: Opens room to $3,310 and below. Above $3,390: May lead to fresh highs toward $3,410+

🧭 Trend Outlook

- Short-Term: Bearish bias within the ascending channel, especially if price breaks below mid-channel.

- Medium-Term: Neutral to bullish as long as the lower channel trendline holds.

- Momentum: Losing bullish momentum; potential for downside correction.

Price is at a decision point within the ascending channel. A clean break below the mid-channel and $3,365 area can accelerate downside correction. Stay alert to key support zones and any reversal signals.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

XAUUSD Buying Opportunity from Key Support ZoneXAUUSD – Gold Price Analysis for August 11, 2025: Buying Opportunity from Key Support Zone

In today’s session, gold (XAUUSD) on the H1 timeframe is pulling back after breaking the short-term support zone at 3,376 – 3,378 and moving down towards 3,356 – 3,358 – which aligns with the 0.618 Fibonacci retracement of the previous bullish swing. This is a key support area where buyers may step in if the market reacts positively.

1. Technical Analysis

EMA: Price is trading below the short-term EMA, showing sellers in control, but the gap is small, leaving room for a potential rebound.

Fibonacci: The 0.618 level around 3,356 acts as a technical pivot and strong support.

RSI: Approaching oversold territory, signaling a possible technical bounce.

Trendline: Price is testing the medium-term ascending trendline from late July. Holding this level would strengthen the bullish outlook.

2. Key Price Levels

Near-term Resistance: 3,376 – 3,378

Major Resistance: 3,383 – 3,384 and 3,393 – 3,395

Near-term Support: 3,356 – 3,358

Major Support: 3,340

3. Trading Strategies

Primary Scenario: Buy around 3,356 – 3,358, stop loss below 3,348, take profit at 3,376 – 3,378, extended targets at 3,383 – 3,393.

Alternative Scenario: If price breaks below 3,348 with strong volume, consider selling towards 3,340 – 3,328.

Today’s bias remains buying at support – taking profit at resistance. Traders should closely monitor price action at these levels to optimize entries.

Follow for more actionable gold trading strategies in the upcoming sessions.

XAUUSD Gold Intraday Analysis 11.08.2025Price has recently broken below the ascending trendline and is currently trading beneath a key supply zone between 3375–3380. After the trendline break, the market has shown a strong bearish impulse followed by consolidation, suggesting potential continuation to the downside.

If price retraces back into the 3375–3380 area and shows clear signs of rejection (such as bearish engulfing, rejection wicks, or lower time frame structure shift), I will be looking for short entries with a target towards the next demand zone around 3345.

Trade Setup:

Sell Limit: 3375–3380 (upon rejection confirmations)

Stop Loss: Above 3385

Take Profit: 3365/3355/3345

This setup provides a favorable risk-to-reward opportunity, aligning with the current bearish structure after the break of trendline support.

Always follow proper risk management and wait for confirmation before entering.

Price broke below lower trendline. Price finally broke below lower trendline thus signaling more downsides for this week . It should be notedworthy that 3340s is our next target then 3280s support zones . A break below 3280s - 3270s brings us down to 3180s . Signal service available . Its free , PM for more details .

8/11: Sell High and Buy Low in the 3416–3372 RangeGood morning, everyone!

This week’s major data releases and news events are concentrated between Tuesday and Friday. Monday is relatively calm, so today’s strategy will mainly rely on technical analysis.

Technically, after a pullback to the MA20, last week’s weekly candle closed as a small bullish candle, and price has re-entered the strong resistance zone at 3400–3450. On the daily chart, bullish momentum hasn’t been fully released yet, but the 4H chart is showing early signs of bearish pressure. For today, keep an eye on the 3400–3420 resistance area, with primary support at 3386–3378 and secondary support at 3372–3366. Unless the bulls completely give up, a break below secondary support seems unlikely.

The main trading range for today is 3372–3416. If the market turns into a one-way move, consider a “contrarian” approach — just avoid buying high and selling low. If you find yourself in a trapped position, don’t panic. As long as risks are controlled, you can use scale-in entries or hedging to recover. If your trade rhythm is off, even holding onto positions (“sitting it out”) can reduce losses or turn a profit. Of course, if risk gets out of control, cut losses decisively — better to retreat than to blow up the account.

Account safety always comes first. Keep your capital intact, and you’ll find plenty of profitable opportunities this week — so many, you might start wondering if someone added extra days to the calendar.

If you need assistance, feel free to leave me a message.

GOLD (XAU/USD) Weekly Open Analysis – H2 Structure# 🟡 GOLD (XAU/USD) Weekly Open Analysis – H2 Structure

**Date:** 2025/08/11

**Timeframe:** 2H (Heikin Ashi)

**Style:** Smart Money Concept (SMC) + Supply/Demand + Price Action

---

## 📊 Market Context

At the weekly open, gold price has started trading above the **upper parallel channel** where last week's close was printed. This level acts as a short-term **bullish bias zone**.

Simultaneously, the **Dollar Index (DXY)** opened at lower levels, showing signs of weakness. Historically, a falling DXY often supports upward movement in gold, and we may see a reaction as mapped in the chart.

---

## 🔍 Key Technical Levels

- **Upper CHOCH Breakout Zone:** ~**3,399 – 3,400**

- **Major Supply Zone:** ~**3,440 – 3,445**

- **Demand Zone #1:** **3,345 – 3,350** (POI)

- **Demand Zone #2:** **3,320 – 3,330** (FVG completion)

- **Final Demand Floor:** **3,260 – 3,265**

---

## 📈 Bullish Scenario (Primary)

1. **Condition:** CHOCH breakout above **3,400** with a bullish BOS confirmation.

2. **Entry Zone:** Retest near **3,399 – 3,402** after breakout.

3. **Targets:**

- 🎯 TP1: **3,420**

- 🎯 TP2: **3,432**

- 🎯 TP3: **3,445** (Major Supply)

4. **Invalidation:** Close back below **3,395** after breakout attempt.

---

## 📉 Bearish Scenario (Alternative)

1. **Condition:** Price fails to break the upper CHOCH and rejects from **3,399 – 3,400**.

2. **Expected Move:** Drop towards **Demand Zone #1** (**3,345 – 3,350**).

3. **If Demand #1 Fails:** Continuation towards **Demand Zone #2** (**3,320 – 3,330**).

4. **Final Target in Deep Drop:** **3,260 – 3,265** (lowest demand line in chart).

---

## ⚠️ Analysis Validity

> This analysis remains valid **as long as the upper CHOCH is not broken to the upside**.

> If the CHOCH breaks and a bullish BOS forms, the bearish path will be invalidated, shifting the focus to the upside targets.

---

📌 **Note:** Always combine with DXY monitoring – a significant DXY rally could limit gold’s bullish potential.

#XAUUSD #GoldAnalysis #SMC #SupplyDemand #CHOCH #BOS #TradingView

Shorting at highs is steadier to avoid risksAlthough gold kept breaking through its daily highs last week, rising all the way to around 3410 before starting to pull back, and the daily lows were also gradually climbing – making it easy to profit whether going long or short – I still recommend prioritizing shorting at high levels. This way, we can avoid losses if gold drops sharply. 📉

Go short at highs during the Asian session 📉

Go long at lows during the European session 📈

Go short at highs again during the U.S. session 📉

⚡️⚡️⚡️ XAUUSD ⚡️⚡️⚡️

🚀 Sell@ 3410 - 3400

🚀 TP 3390 - 3380 - 3370

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

XAUUSD Analysis todayHello traders, this is a complete multiple timeframe analysis of this pair. We see could find significant trading opportunities as per analysis upon price action confirmation we may take this trade. Smash the like button if you find value in this analysis and drop a comment if you have any questions or let me know which pair to cover in my next analysis.

2024 vs 2025 gold will shine to 4k or collapse to 3klast year gold start flying before fed fomc did rate cut in september 2024

everyone is expecting repeat of 2024

gold already begin flying after NFP revision

if cpi comes very weak and fed do big cut same like last year then good chance gold will fly to 4k

but if thing changed after cpi or jackson hole gold may not repeat like last year

gold collapse back to 3k will be shocking because nobody expecting total opposite by fed in 2024 vs 2025 september fomc

EURUSD Analysis week 33🌐Fundamental Analysis

The US Dollar (USD) struggled to find buying momentum on Thursday, but the EUR/USD pair struggled to build upside momentum. The US economic calendar will not release any macroeconomic data that could boost USD valuations over the weekend. Therefore, investors may pay attention to comments from Federal Reserve officials and risk sentiment.

A bullish move on Wall Street after the opening bell could limit the USD’s upside momentum and help the EUR/USD pair find support. Conversely, the pair could continue to decline if the market turns cautious in the second half of the day.

🕯Technical Analysis

EURUSD is still trading in an uptrend and is facing resistance at 1.170. A break above 1.160 forms a lower boundary support zone that should prevent further downside. Pay attention to the resistance and support zones noted on the chart to have a strategy when there is a price reaction in that area.

📈📉KEY LEVEL

Support: 1.160-1.145

Resistance: 1.170-1.181

MY ANALYSIS ON XAUUSDLet's go through a top-down analysis for XAUUSD using the charts you've provided, starting from the 4-hour timeframe down to the 15-minute timeframe. I'll highlight key levels and POIs (order blocks, breaker blocks, and FVG) for possible trade setups.

1. 4-Hour Timeframe (Overall Market Structure)

* Market Structure: From the 4-hour chart, the market is in a bullish structure as it is making higher highs and higher lows.

* Key POI (Order Block / Breaker Block): There is a recent order block formed around 3,360.000, where the market pushed strongly upwards after a consolidation phase. This could be an area of interest if price revisits this level.

* Liquidity Sweep / Inducement: A potential inducement occurred when price broke the 3,375.000 level earlier, sweeping liquidity before pushing higher. This move suggests price could look to continue its upward momentum after a retrace.

* FVG: There's a gap between 3,375.000 and 3,380.000, which might get filled on a retrace. If the market revisits this level, we could expect a continuation.

2. 1-Hour Timeframe (Refining POIs)

* Market Structure: The price action continues to reflect a bullish trend , with higher highs and higher lows. The structure on this timeframe aligns with the 4-hour view.

* Key POI (Order Block / Breaker Block): There's another order block formed near 3,385.000 – 3,390.000. This is where the market saw a sharp upward movement, indicating a potential support zone for a retracement.

* Liquidity Sweep / Inducement: On this timeframe, we observe a small sweep of liquidity around 3,375.000, where price broke a minor support before rallying. This suggests further potential upside if the market returns to this level.

* FVG: There’s a noticeable gap around 3,400.000 – 3,405.000. If price comes back down into this zone, it could fill the gap before continuing the upward trend.

3. 15-Minute Timeframe (Entry Setup)

* Market Structure: The price continues to be bullish with a series of higher highs and higher lows in recent price action. Price is currently consolidating near the recent highs.

* Key POI (Order Block / Breaker Block): There is an order block near 3,395.000 where a sharp move upwards occurred. This could act as a potential entry point if price revisits it.

* Liquidity Sweep / Inducement: There's a liquidity sweep around 3,380.000, where price broke below before pushing upwards. If price returns to this area, we could expect a potential bounce to the upside.

* FVG: A small FVG is visible near 3,395.000. If price fills this gap and finds support, a long position could be considered.

---

TRADE SETUP

Bias: Bullish (uptrend).

* Buy Setup:

* Entry: Look for a price retracement to the order block near 3,395.000 – 3,380.000 (15-minute timeframe).

* Stop Loss: Place a stop below the recent swing low (around 3,375.000) to minimize risk.

* Target: The next target is around 3,400.000 – 3,410.000 , with a secondary target at the recent high near 3,420.000 on the 4-hour timeframe.

This setup aligns with the overall bullish structure and key points of interest. If price comes back into these zones, watch for confirmation signals like rejection or reversal candlestick patterns to enter.

Ready to BUY Gold to target 3445✏️ OANDA:XAUUSD confirms a continued uptrend as it breaks out of the triangle. The price is heading towards 3430 today and even higher at 3445. Today is Friday, the weekly candle close, and according to the range of the candle, it is possible to reach those highs. The BUY strategy can be activated at the moment and hold the position until the US session with the continuous US session buying pressure in recent days.

📉 Key Levels

Support: 3385-3365-3333

Resistance: 3419-3431-3445

Buy trigger: Confirmation of the h4 candle buying pressure above 3385

Buy trigger: Rejection of the support zone at 3365

Target 3445

Leave your comments on the idea. I am happy to read your views.

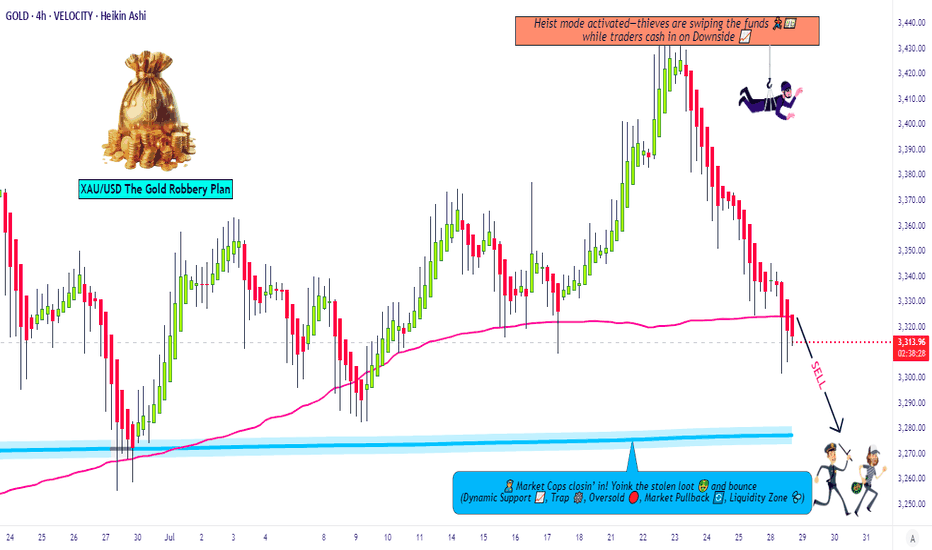

Gold Robbery Blueprint: Smart Bears on the Move Now!💣 XAU/USD GOLD HEIST PLAN: Robbery Begins at Resistance Zone! 🔐💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Market Robbers, 🕵️♂️💸🚀

Welcome to another strategic strike by Thief Trading Style™—where smart analysis meets bold execution. We're targeting XAU/USD (Gold) in this scalping/day-trade opportunity, primed with fundamentals, technicals, and pure robbery logic.

🔍 THE GAME PLAN

We're looking at a neutral zone turning bearish, and here’s how the robbery unfolds:

🔑 ENTRY POINTS

🎯 “Vault wide open” signal!

Initiate short orders at current price zones or set layered SELL LIMITS near swing highs on 15M/30M charts. We're running a DCA-style pullback entry for max loot.

🕵️♀️ Entry isn't about one shot—it's about precision raids.

🛑 STOP LOSS: THE ALARM SYSTEM

Set SL just above the nearest swing high (4H timeframe preferred).

Use candle wick tips as your defense line (Example: 3350.00).

Adjust SL based on risk appetite and number of orders stacked.

🎯 TARGET: THE GETAWAY PLAN

💸 First Vault: 3280.00

💨 Or escape earlier if price action signals reversal. Protect your gains. Professional thieves don't get greedy.

📊 WHY WE’RE ROBBING HERE

This level is a high-risk barricade zone—police aka "market makers" are strong here.

We spotted consolidation, oversold signals, trend reversal setups, and a bullish trap disguised as support. A perfect time to strike. 🧠🔍

📰 FUNDAMENTAL & SENTIMENTAL CHECKPOINTS

🔎 Stay updated with:

Global news drivers

Macro & Intermarket analysis

COT reports & future trend targets

👉 Check the 🔗🔗🔗

⚠️ TRADING ALERT - STAY SAFE DURING NEWS BOMBS!

Avoid entries during major economic data releases.

Use trailing SL to protect running profits.

Monitor volatility spikes & price anomalies.

💖 JOIN THE CREW, BOOST THE HEIST!

If this plan adds value to your trades, hit that Boost Button 💥

Support the Robberhood and help grow the gang of smart money snipers 🕶️💼💣

Every boost = more ammo for next mission. Let's rob the market—not each other. 🚀🤑

📌 Remember: Market is fluid. Stay sharp, adapt quick, and trade like a shadow.

Catch you soon in the next grand heist 🎭💼

#XAUUSD #GoldTrade #ScalpingStrategy #DayTrading #ThiefTrader #RobTheMarket #BoostForMore #NoChaseNoCase