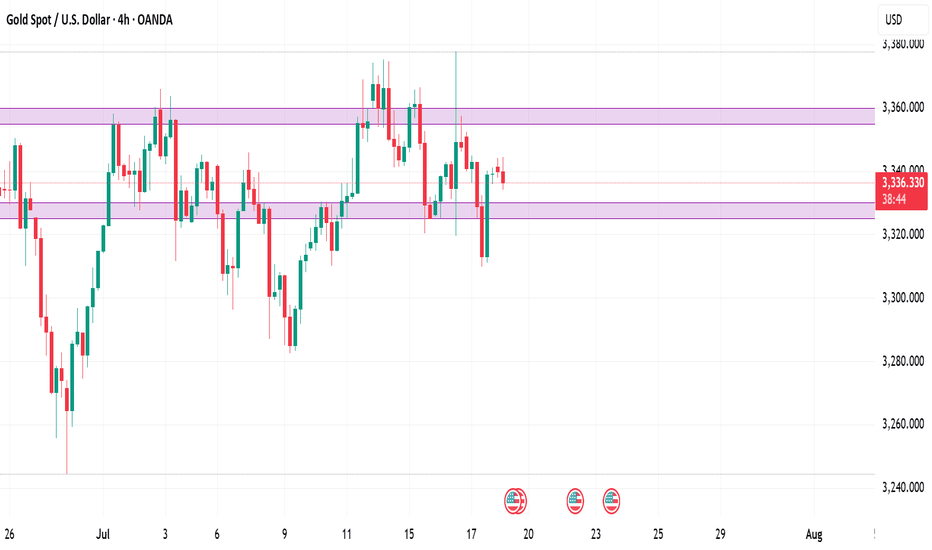

GOLD (XAUUSD): Support & Resistance Analysis For Next Week

Here is my latest structure analysis for Gold.

Support 1: 3306 - 3315 area

Support 2: 3245 - 3275 area

Support 3: 3121 - 3177 area

Resistance 1: 3371 - 3380 area

Resistance 2: 3403 - 3408 area

Resistance 3: 3431 - 3451 area

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Xauusdtrading

8/21: Sell High and Buy Low Within the 3358–3332 RangeGood morning, everyone!

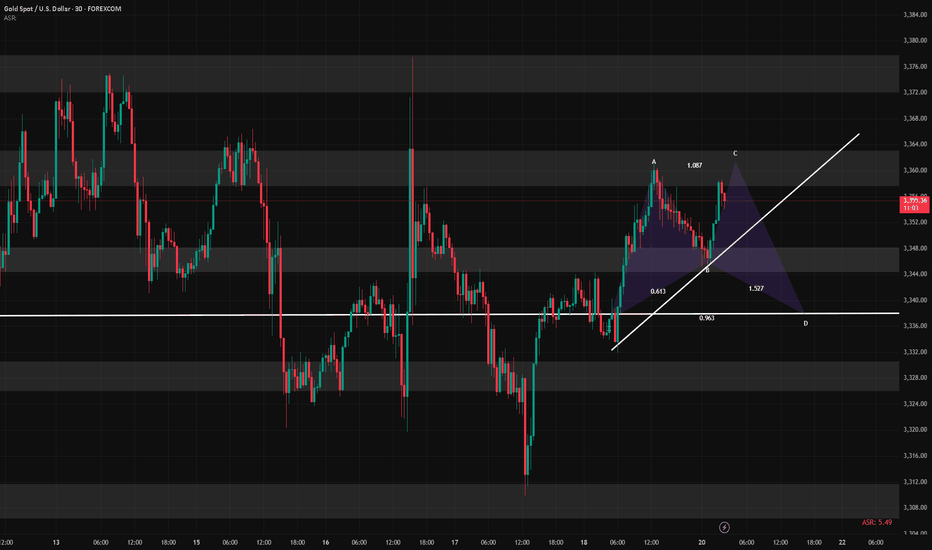

Gold rallied strongly yesterday. On the 4H chart, bulls still show upward momentum, but price has now entered the key 3352–3358 resistance zone. On the 30M chart, divergence signals are emerging, suggesting that the higher gold climbs, the greater the risk of a pullback.

During a retracement, watch support at 3343–3337–3332. In the short term, consider trading within the 3358–3332 range by selling near resistance and buying near support, while closely monitoring support/resistance flips. If bulls sustain momentum and break above 3358, the 3363–3378 zone offers a relatively safer area to look for short setups.

Gold (XAU/USD) 21st August 2025Gold continues to trade within a critical range, where institutional footprints are leaving clear supply and demand imbalances. Today’s outlook blends the Daily (macro bias), 4H (swing structure), and 1H (execution refinement) to deliver execution-ready trading zones.

🔵 Demand Side (Buy Zones)

Primary Buy Zone: $3325 – $3332

This zone represents the highest-probability demand for bulls. On the 4H chart, a fresh bullish order block was created after a clean break of structure, and the 1H confirms liquidity sweeps of prior lows alongside a fair value gap. Momentum indicators add confluence, with RSI resetting near 40 and OBV spiking during the last rally.

Execution Plan: Buy around $3330 with stops below $3320. Targets are $3362 and $3380.

Secondary Buy Zone: $3300 – $3308

If the first demand fails, deeper liquidity pools sit near $3300. This level coincides with discount pricing of the recent impulse leg and untapped demand on the Daily chart. Equal lows and a large liquidity cluster make this zone attractive for a potential accumulation before any further rally.

Execution Plan: Buy around $3305 with stops below $3292. Targets are $3340 and $3360.

🔴 Supply Side (Sell Zones)

Primary Sell Zone (Golden Zone): $3365 – $3372

This is today’s strongest supply area and the nominated Golden Zone. A fresh 4H bearish order block, aligned with a fair value gap and liquidity above recent highs, creates a high-probability rejection point. On lower timeframes, bearish divergence on MACD and expanding ATR volatility confirm the risk of a downside move.

Execution Plan: Sell around $3368 with stops above $3378. Targets are $3342 and $3328.

Secondary Sell Zone: $3388 – $3395

Should momentum overshoot the primary supply, $3390 offers another key resistance. This area represents extreme premium pricing of the current leg and overlaps with an untested supply block. Liquidity from prior double tops rests above this zone, while RSI shows signs of overbought conditions.

Execution Plan: Sell around $3392 with stops above $3402. Targets are $3360 and $3340.

🟡 Executive Summary – Golden Zone

The Primary Sell Zone ($3365 – $3372) stands out as the highest-probability setup of the day. With strong alignment across Daily, 4H, and 1H charts, this area combines:

Fresh institutional supply,

Liquidity resting above highs,

Fair value gap imbalance,

Bearish divergence on momentum indicators.

The structure favors a controlled short with a tight invalidation point at $3378.

Plan of the Day: Short from $3368 with targets at $3342 and $3328.

Final Note: Always manage risk with discipline. Zones highlight institutional footprints, but execution must adapt to live order flow and market conditions.

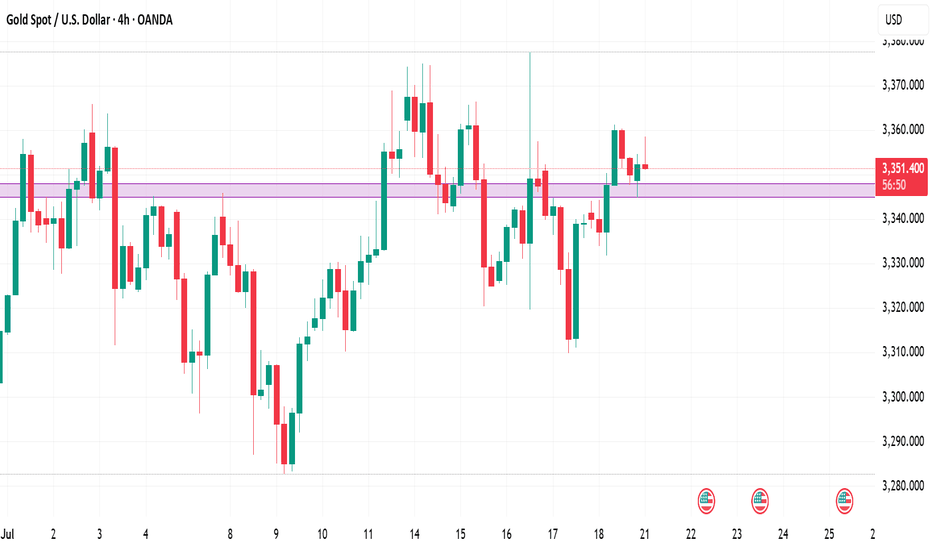

Gold (XAU/USD) 4H- 20th August 2025Gold continues to trade in a bearish transitional phase after extended bullish movement. Current structure shows price reacting from premium supply zones, with liquidity resting below prior lows. This suggests short setups remain favorable, while discount levels could still attract buyers if deeper pullbacks occur.

✅ Primary Trading Levels

Primary Buy Zone – $3280 to $3288

Gold has a fresh 4H demand block aligning with a discount zone and liquidity resting under recent equal lows. A rejection here could fuel a rebound back into $3338 and potentially $3350.

Stop Loss: Below $3270

Targets: $3338 → $3350

Primary Sell Zone – $3346 to $3354

This area sits in premium territory, overlapping with a refined supply block and an unfilled imbalance. Liquidity above equal highs at $3355 makes this the most attractive level for sellers.

Stop Loss: Above $3364

Targets: $3305 → $3288

⚠️ Fallback Levels

Fallback Buy Zone: $3252 – $3260 → Targeting $3305 / $3332

Fallback Sell Zone: $3372 – $3380 → Targeting $3330 / $3305

🏆 Golden Zone of the Day

Sell Zone $3346 – $3354 is the highest-probability, institution-grade level for today. This zone aligns with liquidity above equal highs and offers the best risk-reward for shorts into downside targets.

📌 Trading Plan

Focus on short setups near $3346 – $3354

Look for confirmation: wick rejection or displacement within the zone

Manage risk tightly around liquidity shelves

📢 Conclusion:

Gold is offering a clean sell-side opportunity from premium levels, with downside targets into $3305 and $3288. Buyers may only regain control if $3280 holds firmly. For now, sellers have the upper hand.

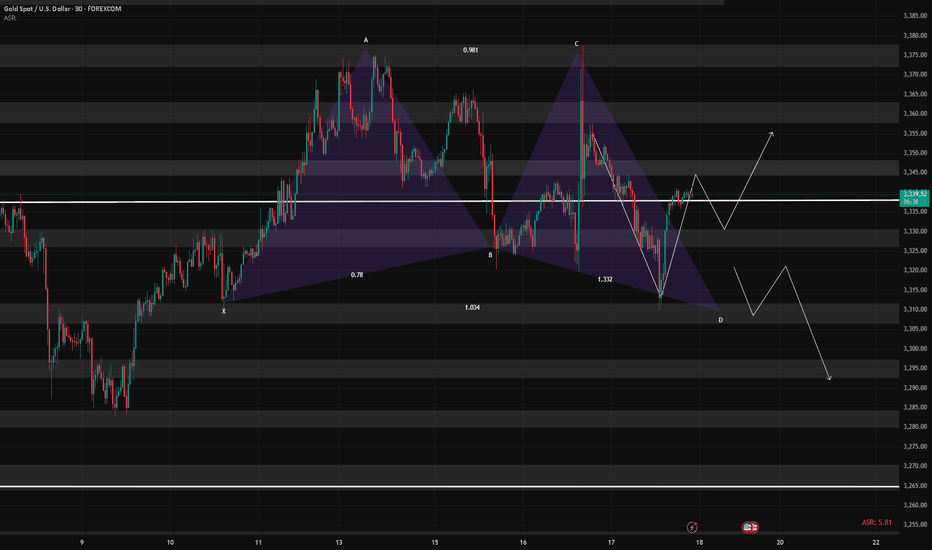

8/18: Gold May Fall Below 3300 This WeekGood evening, everyone!

After testing the 3332–3323 key zone today, gold saw its first bullish rebound, pushing price back to the 3352–3358 resistance area. While bulls claimed a small victory here, the broader trend still favors the bears. For a genuine trend reversal, price must hold above 3350 and break through the major daily resistance at 3363. Otherwise, bulls remain under pressure, and as resistance gradually shifts lower over time, a lack of confidence could give bears the chance to drive price below 3300.

In this setup, the 3323–3332 support zone is critical for bulls. Holding it keeps the door open for further upside; losing it would turn 3332-3337( 3343–3348 )into a strong resistance area during rebounds.

Based on this outlook, the short-term strategy leans bearish. If price drops to 3310–3298 tomorrow, it could be a good opportunity to consider long positions. On rebounds, watch resistance at 3323–3328, with 3316–3321 acting as an additional barrier if bulls remain weak.

8/15: Watch Resistance at 3348–3358, Support at 3328–3323Good afternoon, everyone!

Yesterday, gold’s rebound was capped at 3352–3358, failing to turn resistance into support. As anticipated, price then moved into the 3332–3323 battleground.

On the 2H chart, bulls still hold a slight edge, with signs of a potential double bottom. However, if price continues to face resistance at 3348–3352 without breaking out, or loses the key 3328 support on a pullback, bullish momentum will weaken, and a bearish setup may re-emerge, increasing the likelihood of a retest near 3300.

With important US session data ahead, my strategy today differs from yesterday — focusing on buying dips as the main approach, with shorting near highs as a secondary option. Manage risk carefully and feel free to reach out if you need assistance.

XAU/USD – Institutional Outlook 15 August 2025Gold continues to grind through a tight mid-$3,300 range after Thursday’s hot U.S. PPI print boosted the dollar and dented large Fed rate-cut bets. Despite the short-term pullback, the broader 4H structure remains intact — giving traders both an upside and downside opportunity today.

This is not a scattergun approach. We work with only ONE Buy Zone and ONE Sell Zone with full institutional confluence. Every level here is refined using Price Action, Smart Money Concepts, ICT core principles, Order Blocks, Fair Value Gaps, Premium/Discount arrays, and liquidity mapping.

Primary Buy Zone ($3,325–$3,330) – The Golden Zone

This is today’s highest-probability trade location. Price sits in structural discount, right on top of a fresh 4H Rally-Base-Rally demand zone with a refined bullish Order Block. An unmitigated Fair Value Gap overlaps perfectly with the Optimal Trade Entry (0.705–0.79 retracement) of the last bullish leg.

Liquidity is positioned just below at equal lows near $3,322, inviting a possible stop-run before reversal. Volume imbalance on the prior up-leg confirms smart-money participation.

Entry: $3,325–$3,330

Stop-Loss: Below $3,318 (liquidity + swing low)

Take-Profit Targets:

TP1: $3,357 (local structure)

TP2: $3,380 (Fib 1.272 projection)

Kill Zone: London open into New York overlap

Primary Sell Zone ($3,355–$3,360)

Gold’s upside is capped by a 4H Drop-Base-Drop supply zone nested in premium pricing. A refined bearish Order Block aligns with a Fair Value Gap from the last impulsive sell-off. Equal highs around $3,360 offer liquidity for a potential sweep before distribution.

Entry: $3,355–$3,360

Stop-Loss: Above $3,370 (EQH cluster)

Take-Profit Targets:

TP1: $3,330

TP2: $3,305 (Fib 1.272 extension)

Fallback Zones – In Case of Manipulative Displacement

Fallback Buy: $3,315–$3,320 → Demand zone + OTE + minor FVG; SL below $3,308; same TPs as Primary Buy.

Fallback Sell: $3,365–$3,370 → Secondary supply + OTE + OB; SL above $3,375; same TPs as Primary Sell.

Why the Golden Zone Matters Today

Among all four levels, the Primary Buy Zone at $3,325–$3,330 stands out. It sits at the crossroads of structural discount, smart-money footprints, and liquidity positioning. If price sweeps the equal lows at $3,322 during the London or early NY session, the probability of a sharp, institution-led reversal increases dramatically.

Institutional Consensus

Market commentary from FXStreet, FXEmpire, and DailyForex all acknowledge mid-$3,320s as a key support zone, with resistance forming near $3,355–$3,400. This alignment reinforces our bias: sellers control the premium zone, but buyers are poised to defend structural discounts.

Execution Reminder

Trade only the defined zones with precise risk control. These are institution-level liquidity plays, not mid-range chases. If price fails to respect the primary zone, step aside or switch to the fallback. Patience is part of the edge.

💬 If you find this level-by-level breakdown useful, drop a comment below. Let’s see how the Golden Zone plays out in real time.

8/12: Key Support at 3343–3337, Resistance at 3366–3372Good morning, everyone!

Yesterday, the market saw a one-sided drop, with selling pressure on the 4H chart largely released. However, the daily bullish structure has been damaged. Given the size of yesterday’s decline, there’s a decent chance of an intraday rebound today.

Key support levels to watch are 3343–3337 and 3328–3323, while resistance sits at 3352–3358 and 3366–3372–3378. Trading should focus on these zones.

With today’s news-driven volatility likely to exceed yesterday’s, if the downtrend continues, I see 3312–3298 as an attractive buying opportunity. My overall bias for the day remains buying on dips, with potential short opportunities near resistance.

8/8: Continue to Focus on Selling, Watch Support at 3372–3366Good evening, everyone!

Today, after breaking above the 3400 level, gold experienced a pullback. The current structure shows dense support below, with previous resistance levels at 3378, 3372, and 3366 now turning into support.

On the daily chart (1D), price remains above the MA20, and the MA5 (~3382) serves as key short-term support. The candlestick formation still reflects a bullish structure for now.

However, the 4-hour chart (4H) reveals significant upward resistance, and unless the 4H structure is repaired, the market may favor a corrective or consolidation phase in the near term.

🔍 Trading Outlook:

For the remainder of today’s session and early next week, the strategy should primarily focus on selling into strength.

If the 4H chart corrects via a direct price retracement, gold could potentially test the 3348–3337 support zone.

Prior to that, closely monitor the 3372–3366 area as the primary short-term support and pivot zone.

8/7: Continue to Focus on SellingGood afternoon, everyone!

During today’s session, gold successfully moved into the anticipated resistance zone of 3386–3398, and encountered significant selling pressure near 3398, resulting in a retracement to around 3372. While the price action aligned with prior expectations, the delayed timing has led to a bearish shift in the technical structure, which may hinder further upside momentum for the bulls.

That said, important economic data will be released during the US session later today. We’ll need to observe whether bulls can leverage the potential catalyst to break through the current resistance levels.

⚠️ Trading Strategy Recommendation:

Regardless of the data outcome, it is advisable to maintain a bearish bias in subsequent trades.

From a technical standpoint, the higher the price climbs, the greater the probability of a pullback, making short positions relatively less risky.

📌 Reference Range:

Continue to monitor and trade within the key zones outlined yesterday, adjusting entries and exits as per intraday developments.

Institutional Gold Strategy Note – August 7, 2025🔍 Executive Summary

Gold (XAU/USD) continues to hold firm above the $3,370 handle, supported by a bullish macro narrative and confirmed technical structure on the 4-hour chart. Amid dovish expectations from the Fed and soft labor market data out of the U.S., bullion maintains its premium as a hedge, attracting institutional flow in line with the rate-cut narrative for Q3–Q4.

Today’s market profile suggests a high-probability long setup, anchored in a fresh demand structure just below current price, supported by unmitigated institutional order flow, premium discount levels, and clear liquidity sweeps.

🎯 Directional Bias: Bullish–Transitional

While price is consolidating around $3,378, the underlying structure favors a bullish continuation. A Change of Character (CHoCH) has been confirmed on the 4H chart, suggesting a shift from corrective to impulsive intent. Liquidity remains stacked below recent equal lows, and the premium-to-discount array strongly favors buy-side execution.

🟩 Primary Buy Zone (GOLDEN ZONE)

Entry: $3,350–$3,355 | Stop-Loss: < $3,340 | Targets: $3,400 / $3,430

This zone represents the highest institutional quality setup of the day. It aligns with:

A fresh unmitigated Rally-Base-Rally Demand Zone

A refined Bullish Order Block within optimal trade entry (OTE) discount range

A Fair Value Gap (FVG) aligned with internal BOS leg

Equal Lows (EQL) sweep below $3,355, targeting liquidity

Overlap with volume imbalance, suggesting a clean institutional leg

Clear CHoCH confirming bullish structure

Kill Zone Alignment: Asia–London overlap, pre-London accumulation

This zone is statistically favored for execution by both Smart Money and legacy institutions, given its confluence density and asymmetrical risk profile.

🟥 Primary Sell Zone

Entry: $3,385–$3,390 | Stop-Loss: > $3,400 | Targets: $3,350 / $3,320

A valid counter-trend liquidity sweep opportunity, located above short-term equal highs near the psychological $3,400 level. Key confluences include:

Drop-Base-Drop Supply Zone

Overlapping FVG + OB in premium zone

Alignment with OTE premium retracement

Liquidity cluster near recent EQH

Structural resistance + round-number magnetism

Execution window during London–NY overlap

This zone is valid only for short-duration scalps or short-term reversal positioning.

🟢 Fallback Buy Zone (If Primary is invalidated)

Entry: $3,320–$3,325 | SL: < $3,310 | TPs: $3,400 / $3,430

A deeper mitigation zone with reduced confluence but adequate historical support. This zone captures:

A mitigated OB inside Demand

0.618 Fib retracement from internal BOS

Liquidity sweep potential of a broader EQL stack

Minor structure support

Use only if the market sweeps the primary zone and rebalances deeper.

🔻 Fallback Sell Zone (If Primary Sell fails)

Entry: $3,410–$3,415 | SL: > $3,420 | TP: $3,350

Set well above prior resistance, this extended zone aligns with:

Extended Supply + Unmitigated OB

FVG inside premium OTE zone

Recent accumulation liquidity trap (potential fakeout zone)

Session mispricing during NY–Asia rollover

Use only if price impulsively breaches the $3,400 psychological barrier and stalls near the top of an exhaustion leg.

🌐 Institutional Cross-Validation

Citi Group has upgraded its 3-month Gold forecast to $3,500, citing weakening U.S. macro data and elevated inflation expectations as bullish catalysts.

Reuters and FXStreet confirm Gold's hold near 1-week highs with sentiment strongly skewed toward continued demand amid Fed rate-cut odds exceeding 90%.

TradingView pro charts show confluence with OB/FVG zones at both $3,355 and $3,390, validating both primary zones technically.

📌 Final Notes

Action Bias:

Aggressively long from $3,350–$3,355 with tight structure-defined invalidation.

Hold shorts only from $3,385–$3,390 under strict reversal logic.

Risk Reminder:

All zones are built from 4H structural flow only. Intraday volatility outside kill zones may distort price behavior — wait for displacements and internal breaks before entering. Manage partials at 1.272 extension and hold runners toward 1.618 only if structure confirms.

Gold (XAU/USD) 4H Institutional Analysis — August 6, 2025As of August 6, 2025 (12:23 UTC), Gold (XAU/USD) is trading around 3,367.60, according to Kitco’s live spot price feed. After a sustained bullish recovery from the 3,320–3,330 demand zone, gold finds itself at a structural inflection point. Institutional footprints across the board — from order blocks to liquidity maps — are signaling one dominant message: the bulls are setting the stage.

In today’s breakdown, we deliver a high-conviction execution plan using a fusion of Smart Money Concepts (SMC), ICT methodology, and 4H structural dynamics — isolating only the strongest Primary Buy and Sell zones, along with their fallback counterparts. At the center of this framework is our Golden Zone, the most institutionally-aligned, high-probability area of the day.

🔍 Market Structure & Directional Bias

The 4-hour chart has shown a clear Change of Character (CHoCH) to the upside after a bullish Break of Structure (BOS) above the 3,355 level. This signals a phase shift from consolidation into accumulation and potential expansion, likely aiming toward the 3,400 psychological magnet and beyond.

The presence of volume imbalances, fair value gaps, and unmitigated order blocks across multiple structural layers further supports a bullish directional bias. Liquidity has been swept below previous equal lows (EQL), creating an environment ripe for institutional accumulation.

Directional Bias: Transitional → Bullish

🎯 Primary Execution Zones

✅ Primary Buy Zone (Golden Zone) — 3,355 to 3,360

This zone represents the highest-quality long opportunity on the chart today. Sitting in the discount array (below 50% of recent swing), the zone is built on a fresh Rally-Base-Rally (RBR) demand structure formed after a decisive CHoCH.

The 3,355–3,360 range aligns with a valid unmitigated Order Block, an embedded Fair Value Gap, and an OTE retracement between 0.705–0.79 Fib levels. Beneath this zone lies a sweepable liquidity pocket just under 3,350, further increasing the magnetism of the area.

Entry: 3,355–3,360

Stop Loss: Below 3,350 (liquidity invalidation)

Take Profits:

TP1: 3,395–3,400 (1.272 extension)

TP2: 3,420 (1.618 extension)

Confluences: RBR Demand, OB, FVG, OTE, Volume Imbalance, EQL Sweep, Discount Array, Structural Support

Kill Zone Timing: London-NY Overlap

✅ Golden Zone of the Day

✅ Primary Sell Zone — 3,395 to 3,400

While the broader bias is bullish, gold remains capped by a strong Drop-Base-Drop (DBD) supply zone around 3,400 — also the 1.272 fib extension from prior bullish legs. A pocket of equal highs (EQH) just above 3,405 serves as a liquidity magnet and stop-loss hunting zone — making this supply level extremely attractive for short-term reversion plays.

Entry: 3,395–3,400

Stop Loss: Above 3,405

Take Profits:

TP1: 3,360

TP2: 3,350

Confluences: DBD Supply, OB, FVG, OTE Retrace, EQH Sweep, Premium Array, Structural Resistance

⚠️ Secondary Execution Zones (If Primary Fails)

🟢 Fallback Buy Zone — 3,325 to 3,330

If the market manipulates lower and invalidates the primary buy zone with a deep liquidity sweep, this deeper zone offers a second chance. It contains a secondary demand block, a valid FVG, and lies cleanly within a deep discount retracement.

SL: Below 3,320

TPs: 3,360 and 3,380

🔴 Fallback Sell Zone — 3,445 to 3,450

If gold breaks cleanly above 3,405, likely invalidating the primary sell idea, the next institutional level of interest is 3,445–3,450 — sitting on a higher timeframe premium OB and major liquidity shelf.

SL: Above 3,455

TPs: 3,395 and 3,370

🌐 Institutional Consensus: Bullish Convergence

Institutional analysts across major platforms confirm a bullish bias, with targets hovering around the 3,400–3,420 area:

Reuters reports that gold is near a one-week high, supported by weaker U.S. data and increased rate-cut bets.

MarketPulse highlights the “return of the bulls” amid sustained momentum and light CPI expectations.

Citi has raised its medium-term gold target to $3,500, citing negative U.S. macro headwinds.

TradersUnion confirms support at 3,320 and resistance at 3,400 — mirroring our execution levels.

There is no significant divergence in sentiment or structure, validating today's trade zones with confidence.

📌 Final Thoughts

In a liquidity-driven market, price is engineered — not discovered. Today, that engineering points to one thing: 3,355–3,360 is the Golden Zone — the strongest execution area, supported by eight institutional confluences, favorable structure, and widespread sentiment confirmation.

Gold has re-entered its institutional kill-box. The next move? Likely engineered to deliver smart money profits while trapping the uninformed. Don’t chase price. Let it come to your zone. Execute with discipline.

8/4: Watch Support at 3343–3337 and Resistance at 3372–3378Good morning, everyone!

Last Friday, gold rallied strongly, driven by a combination of favorable economic data and bullish technical signals, decisively breaking above the 3337–3343 resistance zone. During the subsequent pullback, price action remained firm above 3337, followed by a secondary upward move.

From a technical standpoint, the structure suggests the potential for continued upward consolidation, with the possibility of filling the gap near 3396. However, significant resistance remains between 3372 and 3378 — failure to break through this zone decisively may result in a short-term pullback before further gains.

Key levels to watch:

Initial support: 3348 and 3337–3343 zone

Major support: 3312–3300 zone (a break below could signal deeper downside risk)

Trading Strategy:

Focus on intraday setups around these critical areas. Look for buy opportunities on dips as long as support holds, while remaining cautious of sharp pullbacks near strong resistance.

GOLD (XAUUSD): Detailed Support & Resistance Analysis

Here is my fresh support & resistance analysis for Gold.

Vertical Structures

Vertical Resistance 1: Rising trend line

Horizontal Structures

Support 1: 3327 - 3344 area

Support 2: 3246 - 3275 area

Resistance 1: 3431 - 3451 area

The price is currently coiling on a trend line.

Your next bullish confirmation will be its breakout.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Market Analysis: Gold Prices Ease – Market Awaits Fresh CatalystMarket Analysis: Gold Prices Ease – Market Awaits Fresh Catalyst

Gold price started a fresh decline below $3,380.

Important Takeaways for Gold Price Analysis Today

- Gold price climbed higher toward the $3,430 zone before there was a sharp decline against the US Dollar.

- A key bearish trend line is forming with resistance near $3,350 on the hourly chart of gold at FXOpen.

Gold Price Technical Analysis

On the hourly chart of gold at FXOpen, the price climbed above the $3,380 resistance. The price even spiked above $3,400 before the bears appeared.

A high was formed near $3,432 before there was a fresh decline. There was a move below the $3,380 support level. The bears even pushed the price below the $3,350 support and the 50-hour simple moving average.

It tested the $3,325 zone. A low was formed near $3,325 and the price is now showing bearish signs. There was a minor recovery wave towards the 23.6% Fib retracement level of the downward move from the $3,433 swing high to the $3,325 low.

However, the bears are active below $3,342. Immediate resistance is near $3,350. There is also a key bearish trend line forming with resistance near $3,350.

The next major resistance is near the $3,380 zone. It is close to the 50% Fib retracement level of the downward move from the $3,433 swing high to the $3,325 low. The main resistance could be $3,410, above which the price could test $3,432. The next major resistance is $3,450.

An upside break above $3,450 could send the gold price towards $3,465. Any more gains may perhaps set the pace for an increase toward the $3,480 level.

Initial support on the downside is near the $3,325 level. The first major support is near the $3,310 level. If there is a downside break below it, the price might decline further. In the stated case, the price might drop towards the $3,265 support.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Gold (XAU/USD) 4-Hour Technical Analysis Report - 25 July 2025 📌 Market Context & Sentiment Overview

The gold market is currently trading in a state of technical compression, with the price hovering just beneath the mid-3360s. After a significant rally earlier in the month, the recent sessions have seen price action coiling within a tight ascending triangle—a classic pattern known to precede breakouts.

According to recent publications by FXEmpire, FXStreet, and Investing.com, sentiment remains moderately bullish. Analysts point to strong institutional demand near the 3320–3330 zone, while also warning of resistance pressures near the 3380–3390 zone. These insights align with our technical findings, which suggest a developing structure with increasing breakout potential.

📊 Technical Structure Analysis (4-Hour Timeframe)

🔹 Price Action & Structural Patterns

The prevailing structure is a rising triangle anchored between support at 3320 and resistance near 3380–3390. Price has been forming higher lows, indicative of underlying buying pressure, while simultaneously facing resistance at increasingly frequent tests of the upper band. The contraction of candlestick bodies and volume confirms the presence of a coiling market—hinting at an imminent directional move.

The presence of upper-wick rejections near 3380 signals seller interest, while long-tailed candles at 3330 underscore buyer defense of the rising trendline. This dynamic equilibrium is the hallmark of a triangle formation nearing completion.

🔹 Support & Resistance Levels

Our analysis identifies the following zones as technically significant:

Key Support (Buy Zones):

3320–3330: This zone hosts a major bullish order block, 8/21 EMAs, and the lower trendline of the rising triangle. It is further supported by the 61.8% Fibonacci retracement drawn from the 3300 low to the 3390 swing high.

3300–3310: A psychological level and previous 4-hour swing low. Acts as a secondary defense level.

Key Resistance (Sell Zones):

3380–3390: Triangle resistance, aligned with the 50 EMA and a bearish order block.

3440–3450: An upper extension zone if breakout materializes, noted in external institutional outlooks.

🔹 Volume, VWAP & Institutional Concepts

Volume has notably contracted, a classical feature of triangle formations, with most trading volume aggregating at the mid-point (~3345–3355). VWAP sits just below the current price, reflecting mean reversion tendencies. Furthermore, liquidity pockets are observed just beneath 3320, suggesting potential for liquidity grabs before a bullish reversal.

From a Smart Money lens:

A bullish order block has formed near 3320–3330.

A bearish OB and resistance cap prices around 3380.

A small Fair Value Gap (FVG) lies around 3340–3350, acting as a potential price magnet.

🔹 Indicators & Oscillators

Moving Averages: The 8/21 EMA cluster lies just below current price, offering dynamic support.

MACD: Negative but converging—suggesting bearish momentum may be waning.

ADX: Reading ~40, indicating a trending market, though momentum has slightly slowed.

RSI: Hovering near 35–40, close to oversold; signals potential bounce.

Stochastics & CCI: Both deeply negative—supporting the case for a mean-reverting move.

🎯 Strategic Buying & Selling Zones

✅ High-Probability Buy Zones

3320–3330:

Rationale: Confluence of bullish OB, rising trendline, EMAs, and Fib 61.8%.

Confidence: High (★ ★ ★)

3300–3310 (buffer zone):

Rationale: Psychological and historical swing low support.

Confidence: Moderate

❌ High-Probability Sell Zones

3380–3390:

Rationale: Triangle resistance, prior highs, and bearish OB presence.

Confidence: High

3440–3450:

Rationale: Post-breakout measured move target and potential take-profit zone.

Confidence: Moderate

🏆 The Golden Setup: High-Conviction Trade Idea

Direction: Long

Entry: 3325

Stop Loss: 3300

Take Profit: 3390

Confidence Level: ★ ★ ★ (High)

🔍 Justification

This setup takes advantage of the strongest structural support within the triangle—centered around 3325. This level is reinforced by the 61.8% Fibonacci retracement, bullish order block activity, and EMA compression, all coalescing with the triangle’s rising support line.

Indicators are turning from oversold, and the volume profile suggests that institutional players may look to engineer a liquidity sweep under 3330 before a continuation push to test the 3380 resistance. The reward-to-risk ratio is favorable, and the setup offers clear invalidation with a tight stop at 3300.

Should momentum continue post-breakout, a secondary TP could be explored at 3440. However, for the purpose of tactical execution, 3390 is a strategically sound exit point.

🧠 Sentiment Cross-Check & Market Alignment

External sentiment and professional forecasts support the underlying thesis of a bullish breakout, pending confirmation. TradingView’s top technical authors emphasize the breakout of this ascending triangle toward 3440+, while Investing.com’s shorter-term signals reflect bearish pressure that aligns with our buy-the-dip strategy.

This synthesis of internal and external analysis increases our conviction in a long-biased tactical approach from the current support zone.

✅ Summary Table

Buy Zones Sell Zones Golden Setup

3320–3330 (primary) 3380–3390 (primary) Direction: Long

3300–3310 (buffer) 3440–3450 (extension) Entry: 3325

Stop Loss: 3300

Take Profit: 3390

Confidence Level: ★ ★ ★ (High)

🔚 Final Thoughts

Gold’s current price structure presents a rare opportunity—one defined by tight consolidation, structural clarity, and institutional footprints. As the market coils within a classic triangle, the 3320–3330 zone emerges as a high-probability springboard for long positions. With precise risk management and a disciplined approach, this setup offers traders a compelling entry with defined technical boundaries.

The golden rule now: Respect structure. React to confluence. Trade with conviction.

XAU/USD Chart Analysis: Bulls Break Important ResistanceXAU/USD Chart Analysis: Bulls Break Important Resistance

When analysing the XAU/USD chart last week, we:

→ noted that the ADX indicator had reached its lowest level since the beginning of 2025 – a clear sign of declining gold price volatility;

→ highlighted the formation of a large-scale triangle with its axis around the $3,333 level, bounded by a resistance line (marked in red) and the lower boundary of the ascending channel.

Since then, the price has climbed above $3,400 – reaching its highest level since mid-June. According to media reports, the uptick in demand may be driven by escalating geopolitical risks, renewed optimism regarding potential monetary policy easing in the US, and consistent gold buying from central banks.

This suggests that the balance has shifted in favour of the bulls, who have made an attempt to break through the resistance line – an attempt that, so far, appears promising and points towards a potential resumption of the upward trend.

However, today's XAU/USD chart shows that the bulls are now facing a key resistance level at $3,440 – a level that has reversed gold prices downward both in May and June. What will happen in July?

It is possible that, following a prolonged consolidation near the lower boundary of the channel, the bulls have built up sufficient momentum to finally break through this critical level and push gold prices towards line Q, which divides the lower half of the long-term channel into two quarters.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

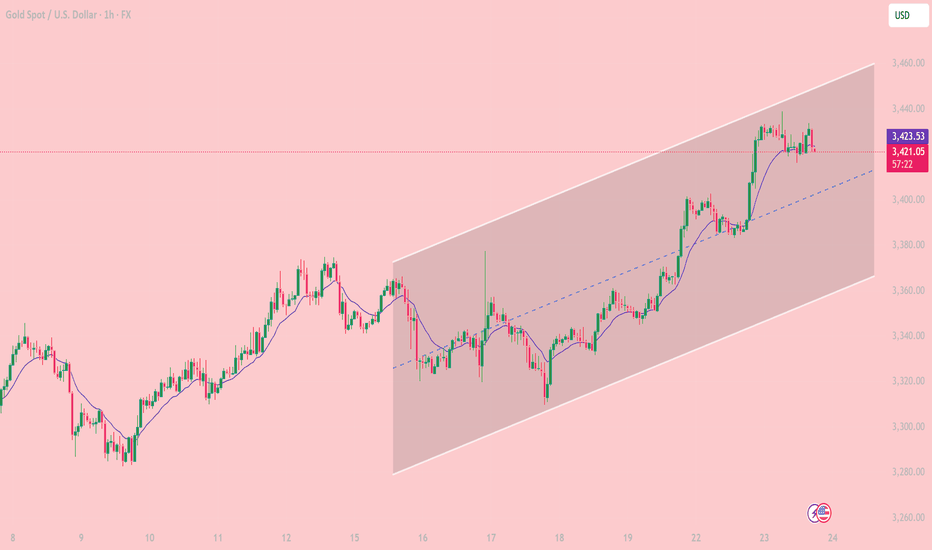

Bullish Channel in Play Key Trading Zones and Strategy for JulyOn the 1-hour chart, XAUUSD is clearly moving inside a well-defined ascending price channel, with price respecting both the channel boundaries and the midline as dynamic support/resistance. The pair continues to print higher highs and higher lows, confirming short-term bullish structure.

Trend Channel: Since July 18, gold has been steadily climbing within an ascending channel, bouncing off the lower boundary and riding above the midline.

EMA Support: The 10-period EMA (purple) has been acting as a dynamic support. Price has yet to close below it during this bullish swing.

Candle Behavior: Recent bullish candles with strong bodies show that buyers still have control, although price is stalling near the upper boundary of the channel.

Technical Level

3,459 USD. Major Resistance. Top of the channel – potential reversal or take-profit zone

3,423 USD.Immediate Support. EMA10 and current consolidation area

3,400 USD. Mid-Channel Support. Key pullback zone if price rejects near highs

3,360 – 3,365 USD. Major Support. Bottom of the ascending channel – break may invalidate bullish setup

Scenario 1 – Buy the Dip (trend continuation):

Wait for price to retest the 3,400 – 3,410 USD area or EMA10.

Look for bullish confirmation (e.g., pin bar, bullish engulfing).

Target: 3,445 – 3,459 USD

Stop loss: below 3,395 USD

Scenario 2 – Short at Channel Top (mean-reversion setup):

Monitor price behavior near 3,455 – 3,459 USD resistance.

If bearish reversal candles appear (e.g., shooting star, bearish engulfing), consider shorting.

Target: 3,420 – 3,410 USD

Stop loss: above 3,465 USD

As long as price remains inside the rising channel, buying pullbacks is the preferred strategy.

Stay alert to macroeconomic catalysts (Fed comments, PMI data, labor market releases) that could increase volatility.

Gold remains in a strong short-term uptrend on the 1H chart. Trading in the direction of the trend with proper risk management continues to offer the best opportunities for intraday traders.

If you found this analysis useful, don’t forget to follow for more trading strategies and ideas!

July 21: Key Resistance at 3358–3366, Breakout Targets 3378–3388Good morning, everyone!

Last Friday, gold tested the support around 3332 but did not break below it. The price then rebounded to the 3358 zone, where it encountered selling pressure and pulled back. At today's open, the price retraced to the 3343 level, where support held well, prompting another rally back toward 3358.

It’s important to note that since the 3358 resistance was already tested on Friday, some of the selling pressure has likely been absorbed. As a result, there is a higher probability of a breakout today. If a breakout occurs, the next key resistance lies at 3366/3372–3378. In the case of strong bullish momentum, the price may extend further toward the 3386–3392 resistance zone.

However, if the price continues to be capped below 3358–3366, we may see a consolidation or short-term pullback. In this case, watch support at 3348–3343. Should the price successfully break above 3378, then support on pullbacks will shift higher to 3363 and 3358–3352.

🔺 Key Warning: The 3358 resistance zone is technically crucial. If the price repeatedly fails to break through, watch out for a potential double-top pattern on the 30-minute chart, which could signal a near-term bearish reversal.

Gold (XAU/USD) Technical Outlook — 21 July 20251. Market Overview & Live Price Confirmation

Gold is currently trading around $3,354, with a daily range of approximately $3,345–$3,359. This places it firmly within its broader uptrend, showing resilience amid recent macro uncertainties and consolidating its position above key support zones.

2. Four-Hour Technical Breakdown

Trend & Structure

The 4-hour chart reveals a strong bullish structure, marked by consistent higher highs and lows. A recent Break of Structure occurred near $3,324, reinforcing the upward bias. A minor Change of Character around $3,360–$3,358 reflects a healthy retracement, but the bigger picture remains strong.

Key SMC & ICT Zones

Supply Zone: $3,360–$3,362 — recent peak area likely to attract sellers and sweep above liquidity.

Demand Zone: $3,340–$3,344 — aligns perfectly with the 38.2% Fib from the $3,308–$3,362 swing, forming a prime area to buy from.

Order Block / FVG Zone: $3,336–$3,342 — open imbalance suggesting price may revisit for efficient entry.

Liquidity Context: Order flow patterns indicate stop hunts around established zones — part of classic Smart Money Concepts.

Fibonacci Levels

38.2% retrace at $3,340, offering medium-term confluence support.

Upside projections via Fibonacci:

1.272 extension: $3,378

1.618 extension: $3,389

3. One-Hour Intraday Trading Setups

Aligned with the 4-hour bullish bias, these setups offer scalable, structured entry opportunities.

Strategy Entry Zone Stop-Loss Take-Profit Risk:Reward

Aggressive Long $3,344 $3,338 $3,358 → $3,362 ~2:1

Conservative Long $3,340 $3,330 $3,362 → $3,378 ~2.5:1

Short Opportunity Rejection @ $3,362 $3,368 $3,344 ~2:1

🌟 The Golden Setup

Buy within $3,340–$3,344 (4H demand + Fib zone + FVG)

Stop-Loss: $3,330

Take-Profit 1: $3,362 (range high)

Take-Profit 2: $3,378 (Fib 1.272)

Why It Works: A confluence of structural support, liquidity zones, and retracement levels gives this setup high predictive quality.

4. Analyst Consensus Snapshot

Market commentary from professional analysts shows alignment with dip-buy strategies. Most recognize the $3,340 region as key support and express caution entering $3,360–$3,375 resistance. Weekly forecasts describe tight trading with potential for breakouts or retracements depending on economic data and Fed commentary, but the medium-term trend remains bullish.

5. Summary & Trading Blueprint

Price Range: $3,345–$3,359 (daily); $3,338–$3,378 (targets)

4-Hour Bias: Bullish, with defined demand and supply zones

Golden Trade: Buy $3,340–3,344 → SL $3,330 → TP1 $3,362 / TP2 $3,378

Catalysts to Watch: Federal Reserve speech, tariff developments, USD movements.

6. Final Thoughts

Gold continues to demonstrate bullish resilience, supported by both technical structure and macro tailwinds. The $3,340–3,344 zone offers a clear, high-probability entry confluence, while stop placement and profit targets are well-defined. Profit management around $3,360 ensures disciplined scaling or early exits if risk factors emerge.

By blending price action, Smart Money frameworks, ICT concepts, and Fibonacci confluence—all structured into actionable trade setups—you have a professional-grade playbook ready for deployment.

7/18: Watch 3343 Resistance, Guard Against Break Below 3323Good morning, everyone!

Yesterday, gold broke below the 3337 support after consolidating there, driven lower by bearish data, and eventually reached the 3323–3312 support zone. A rebound followed, and price has now returned above 3323, which also aligns with the daily MA60.

📌 Key Levels to Watch Today:

Resistance: 3343 / 3352–3358

→ A sustained break above 3343 opens the door for a potential move toward 3366 / 3372–3378;

Support: 3323 / 3312

→ If price remains capped below resistance and weekly close is under 3323, it will signal bearish structural pressure for the medium term.

📌 Trading Strategy:

Trade flexibly within the range of 3358–3343–3332–3323–3312

📌 Important Reminder:

If today’s closing price is below 3323, and you're planning to hold positions over the weekend, it’s safer to lean short. While we can’t predict weekend news, technically, bears have the upper hand, so risk control is essential.

Step-By-Step Guide to Building a Winning Gold Trading Strategy

In the today's article, I will teach you how to create your first profitable gold trading strategy from scratch.

Step 1: Choose the type of analysis

The type of analysis defines your view on the market.

With technical analysis you rely on patterns, statistical data, technical indicators, etc. for making trading decisions.

Fundamental analysis focuses on factors that drive the prices of gold such as micro and macroeconomics, news and geopolitics.

A combination of technical and fundamental analysis implies the application of both methods.

For the sake of the example, we will choose pure technical approach.

Step 2: Specify the area of analysis

Technical and fundamental analysis are complex and multilayered subjects. That is why it is crucially important to choose the exact concepts and techniques that you will apply in gold trading.

For example, with a technical analysis, you can trade harmonic patterns, or apply a combination of key levels and technical indicators.

With fundamental analysis, you can build your trading strategy around trading the economic calendar or important news releases.

Here we will choose support & resistance levels and smart money concepts.

Step 3: Select a trading time frame

Your trading time frame will define your trading style. Focusing on hourly time frame, for example, you will primarily catch the intraday moves, while a daily time frame analysis will help you to spot the swing moves.

You can also apply the combination of several time frames.

We will choose the combination of a daily and an hourly time frames.

Step 4: Define your trading zones

By a trading zone, I mean an area or a level on a price chart from where you will look for trading opportunities.

For example, a technical indicator trader may apply moving average as the trading point.

For the sake of the example, we will choose support and resistance levels on a daily time frame as our trading areas.

Step 5: Choose confirmations

Confirmation is your entry reason . It is the set of conditions that indicates a highly probable projected outcome.

For an economic calendar traders, the increasing CPI (inflation) figures can be a solid reason to open a long position on Gold.

Our confirmation will be a local change of character on an hourly time frame.

Step 6: Define your stop loss placement, entry and target selection and desired reward to risk ratio

You should know exactly where should be your entry point, where will be your stop loss and where should be the target.

We will open a trading position immediately after a confirmed change of character, stop loss will lie below the lows if we buy or above the highs if we sell.

Target will be the next daily structure.

Minimal reward to risk ration should be 1.5.

Step 7: Define Your Lot Size and Risk Per Trade

You should have precise rules for the calculation of a lot size for each trade.

For our example, we will strictly risk 1% of our trading deposit per trade.

Step 8: Set trade management rules

When the trade is active, trade management rules define your action:

for example, whether you strictly wait for tp or sl, or you apply a trailing stop loss.

In our strategy, we will move stop loss to entry 10 minutes ahead of the release of the US news in the economic calendar.

Step 9: Back test your strategy

Study the historical data and back test at least 50 trading setups that meet your strategy criteria.

Make sure that the strategy has a positive win rate.

Step 10: Try a trading strategy on a demo account

Spend at least a month on demo account and make sure that you obtain positive overall results.

If you see consistent profits on a demo account, it is the signal for you that your strategy is ready , and it's time to start trading on a real account.

In case of negative results, modify your trading conditions and back test them again, or build a new strategy from scratch.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Gold (XAU/USD) Premium Technical Outlook - 18 July 2024As gold continues to trade near record highs, the market’s current price action around $3,336–3,340 demands a sharp, disciplined technical view. This premium analysis combines price action, Fibonacci techniques, institutional concepts (ICT and Smart Money Concepts), and advanced supply–demand dynamics to identify actionable trade opportunities.

We anchor on the 4-hour timeframe for directional bias and zoom into the 1-hour chart for precision intraday setups.

📊 4‑Hour Timeframe: Structure and Directional Bias

Gold remains in a clear bullish structure on the 4-hour chart, as evidenced by sustained higher highs and higher lows. The most recent bullish Break of Structure (BOS) occurred above the $3,320–3,325 level, confirming buyers’ control for now.

Currently, price hovers near equilibrium at the 61.8% Fibonacci retracement, testing prior resistance as potential support. This zone aligns with a small fair value gap (FVG), reinforcing it as an area of interest for smart money participants.

Key 4H Levels to Watch

Level Significance

$3,360–3,365 Major supply zone & bearish OB

$3,350–3,355 Minor resistance

$3,337–3,340 61.8% Fib / equilibrium

$3,330–3,333 BOS retest & key support

$3,300–3,310 Strong demand zone & bullish OB

$3,285–3,295 Secondary demand zone below BOS

The directional bias on 4H remains neutral-to-bullish, contingent on price holding above $3,300. A clean break and close above $3,360 could open a path to $3,400–3,420, while a sustained drop below $3,300 would mark a change of character (CHOCH) and shift bias to bearish.

🪙 Institutional Concepts in Play

Order Blocks (OB): Strong bullish OB sits at $3,300–3,310, while a bearish OB dominates at $3,355–3,365.

Fair Value Gaps (FVG): On the bullish side, $3,300–3,315 remains unfilled; on the bearish side, $3,330–3,345 caps rallies.

Liquidity Grabs: Dips toward $3,295–3,300 appear to sweep sell-side liquidity, while spikes above $3,360 tap into resting buy stops.

The area around $3,330 remains a key battleground where smart money likely accumulates positions before the next impulsive move.

⏳ 1‑Hour Timeframe: Intraday Trade Setups

On the 1-hour chart, the market is compressing between a bullish order block and bearish supply. Price action shows evidence of short-term liquidity sweeps and reactions to imbalances, offering two clear scenarios for intraday traders.

📈 Setup A – Bullish Zone Bounce

Entry: Buy limit at $3,332–3,333

Stop-loss: Below $3,328

Take-Profit 1: $3,345

Take-Profit 2: $3,355

Rationale: Confluence of 4H demand, Fib retracement, BOS retest, and 1H bullish order block.

📉 Setup B – Supply Rejection Short

Entry: Sell limit at $3,355–3,360

Stop-loss: Above $3,365

Take-Profit 1: $3,337

Take-Profit 2: $3,330

Rationale: Price into 4H bearish OB, aligning with supply and stop runs above recent highs.

🌟 The Golden Setup

Among these, the Bullish Zone Bounce at $3,332–3,333 stands out as the highest-probability trade. This level represents maximum confluence:

Retest of 4H BOS.

Bullish OB on 1H.

61.8% Fibonacci support.

Unmitigated fair value gap.

This setup offers a favorable risk–reward profile with clear invalidation and multiple upside targets.

🔎 Summary Table

Bias Key Support Zones Key Resistance Zones

Neutral-to-bullish $3,300–3,310, $3,330–3,333 $3,350–3,355, $3,360–3,365

Intraday Setups Entry Zone Stop-Loss Take-Profit Targets

Bullish Zone Bounce 🌟 $3,332–3,333 < $3,328 $3,345 / $3,355

Supply Rejection Short $3,355–3,360 > $3,365 $3,337 / $3,330

📣 Final Word

Gold maintains a structurally bullish outlook above $3,300, with strong institutional footprints evident in the $3,300–3,333 demand zones. Traders should remain vigilant around $3,360, where sell-side liquidity and supply are concentrated.

The Golden Setup — a bullish bounce from $3,332 — offers the best confluence and statistical edge intraday.