XRP TESTING SUPPORT QUICK POST🌊 Hey hey, here with a quick post, nothing crazy, just wanted to get a quick post out with everything going on and our price action this week.

🌊 The broad crypto market has seen a dip in general with price action as more liquidations and some retail panic pushes things further. Our technical also gives further insight for us with that our indicator's showing us that we've lost some momentum here and we're still getting dragged by this current down.

🌊 The descending channel is still hitting hard as ever, when above and within, it'll play that support but from below it's a hard resistance to break. As I write this we've come up on that support and are retesting $1.87-1.90 after having fallen down and out of our horizontal channel and our descending channel.

🌊 It's been a bit tough the last couple of days for the market and XRP but here we'll see if our support can keep us above $1.85 else we risk losing a lot more ground if we can't keep above that. Whales continue to slowly accumulate and a lot of what we're seeing right now is retail panic and price action that's been drive by some technical factors.

🌊 I'll be watching to see whether or not we regain our footing and can climb back into our descending channel or if we'll continue this 'tug of war'. I've attached a 15 minute chart below for reference showing how we've slipped once we lost the channel so it's simply a matter of regaining that and establishing support with this retest here above $1.85.

🌊 Next couple of hours, days should give us a lot more and we're almost upon January, the market may be more optimistic with the new year so we've got a lot more in store but for now let's keep our eyes peeled and focus on what lies ahead. Thanks for tuning in as always, wishing well and appreciate everyone as always.

🌊 Many thanks and best regards till next!

~ Rock'

Xrparmy

XRP NEWS AND HIGHLIGHTS FOR THE WEEK TO KNOW!🔥 Hey, hope everyone's been well, here with a quick follow up on things and some highlights and insights for the week to consider and give a quick read. As always, thanks for tuning in.

🔥 ETF Inflows: U.S. spot XRP ETFs have seen significant inflows. Total assets under management across funds like Canary's XRPC and REX-Osprey's XRPR are approaching $1 billion. This shows strong institutional demand following regulatory clarity.

🔥 Price and Market Activity: XRP is consolidating within the $2.00-$2.30 range, with a current price around $2.11. Whales have been accumulating tokens while retail investors sell, a pattern seen in previous recovery phases.

🔥 Regulatory Clarity: Regulatory support in Europe, particularly under the MiCA framework, has boosted confidence in XRP. This has accelerated adoption among financial firms. The August 2025 U.S. SEC settlement provides a clear legal foundation for institutional participation.

🔥 Ripple's Strategy: Ripple continues to expand its global infrastructure. The focus is on real-world asset tokenization, CBDC collaborations, and expanding its On-Demand Liquidity (ODL) corridors using its RLUSD stablecoin.

🔥With this and XRP consolidating at a monthly support above that $2.00 we can see whales accumulating while retail has been panicking a bit the last few months of which price action has been pretty influenced, driven by sharp price drops followed by aggressive liquidations and our technical which still has us within this descending channel as marked by the blue.

🔥 Main thing I'm keeping watch for is when we break out of the current horizontal channel 'in yellow' and if we can break that $2.20 which would help us regain our 200 EMA and could ultimately lead to a breakout if we exit the main descending channel. Basically we want to get out of the blue channel dragging us down. Think of it as a river, once we get out of the river we can climb up.

🔥 As I said, quick and short highlights there with some important things to consider as we face the next couple of days. Market sentiment may be mixed but whales know more than we do and if their stockpiling I doubt it's for no reason, we already understand the market as a whole is recovering, consolidating, or testing support. At the end of the day the next few months look optimistic as ever.

🔥 Thanks for joining as always, happy to share some quick highlights for the week and let's keep posted, excited to see what the next few months hold for us, especially as XRP continues to grow it's presence and support by the day continuing to build towards the vision we believe in. Everything works out.

🔥 Best regards as usual, stay rocking,

~ Rock'

XRP MONTH OF ETF'S! 🔥 Hey hey, if your reading this I hope this finds you well. Been a while and figured it'd be good to catch up with things and make a quick analysis on what we're dealing with and looking at on our technical and beyond analysis'.

🔥 The last month or so has seen much of the digital space take on a rather big slump being led by Bitcoin's 14% decline from that $115,000 mark down to the $94-95,000 range. That being said XRP has managed to hold and keep it's gains much better than most others in the space, especially as it holds above that $2.1 mark, even after the flash sale that hit October 10th the asset has held strong.

🔥 It's great to see that price action has been pretty steady, even as we've been dragged down thanks to a descending channel so that's been positive to see the market's resilience through everything. I've set a price alert at $1.95 should we break below that but with tomorrow's XRP ETF launch we may just see things bounce from where we are with bullish optimism, hype.

🔥 Main thing I'll be watching for is the descending channel, mainly looking for bullish confirmation if we reenter the channel and another confirmation would be if we could break out of the channel for a breakout which could help sustain that momentum and help us retest $2.5 and even $3 depending on just how much investors and institutions are willing to buy into the ETF on the opening.

🔥 Definitely won't be easy though, it has also been reported that a whale has transferred roughly $95 Million worth of XRP to Binance within the last few days. Might not mean much but historically speaking more often then not we're use to seeing whales move large quantities off cold storage to the exchanges prior to large events whether it's an ETF or some hype for a project or asset in anticipation of selling some or buying more using leverage depending on which way things lean. So least to say, it'll be a fight this week for bulls and bears.

🔥 Main driver we've got right now for XRP is it's ETF debut's this month with it's first being Canary's Capital funds XRP ETF which saw a record $58 million in volume for the first day setting 2025's ETF debut record. That's been a good boost and with Franklin Templeton's XRP ETF launch today expectations are high for the new investment vehicle so hoping we get some positive price action today.

🔥 Last but not least, much as we love doing our beyond analysis, for our technical we're watching this falling wedge to see if XRP can breakout of that channel and possibly give us the breakout we've been waiting on. If there's ever a day we'd want it, it's today and at the very least this week so keeping track with that and my alert for $2.19 should we reverse and fall further. Either way keep posted and keep your spirits up.

🔥 End of the day, everything works out, just have to trust in the process. Thanks for joining me today and wishing all the best.

🔥 Best regards as always till next time,

~ Rock'

Number 3 is reminding the party he’s still on the guest list.Number 3 is reminding the party he’s still on the guest list. 🥂

CRYPTOCAP:XRP breaking clean from its $2.80–$2.95 consolidation base.

Push into $3.00+ signals bullish continuation if volume holds. Next test sits at $3.10–3.20.

📈 Momentum: creeping into overbought, but room for one more leg higher.

🔊 Volume: breakout backed by real buy-side conviction.

The Alpha View 👇

🎯 Setup is long, but execution requires patience:

— Ideal entry on a retest of $2.95–$2.99 (flipped resistance → support).

— Bonus confluence: a 1H bullish tail.

🎯 Targets:

TP1: $3.20–3.25

TP2: $3.40+ (runner if momentum extends)

⚠️ Don’t FOMO green candles. Precision beats emotion.

⚖️ Watch BTCЗif they stall, XRP’s move could fade.

🔑 Self-Regulate. Risk is the only guest you can control.

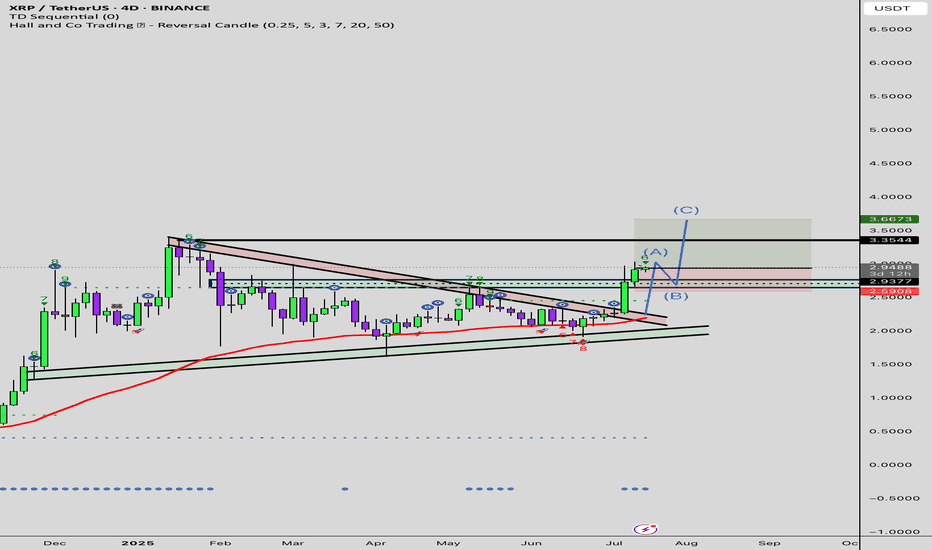

XRP – Next Upside Target🎯 CRYPTO:XRPUSD is poised to resume its impulsive cycle from the April 2025 low, with the minimum extension for wave 5 targeting the $3.89–$4.26 zone.

Structure remains constructive as long as price holds above the recent low, with potential for continuation in the coming sessions.

XRP - MacD selling divergenceCan you see it?

Don't forget the backtest out of the flag.

I don't think it'll be too big yet, they still want the daily pivot squeeze into Oct for the ETF's.

It also looks like coinbase isn't selling off XRP, big money are moving their XRP off coinbase itself into more secure places. Prepare yourself.

WHEN NOTHING FEELS RIGHT XRP⚡ Hey hey, hope things have been well. Here with a quick and short idea for you guys, been juggling a lot lately but wanted to take the opportunity to get a quick idea out while I had the chance so thanks for stopping by.

⚡ We sit here at a time where nothing seems to feel right in a few ways, at a time when we'd expect things to be pushing with all the hype we had going for us from the crypto legislation and the break above that $3 resistance showing the strength behind the market and XRP.

⚡ That being said we've still got our rules and channels which will continue to apply regardless of sentiments and news. Can see how the last month or so we've been pulled down thanks to these two major descending channels with our second one forming after we broke out and broke away from $2.7 before we again slowly descending back to the $2.7 range where we currently stand.

⚡ Technically speaking we're at a support point, we've bounced back up from here before so it'll be a good reference point for active traders on whether or not we'll be headed for another possible breakout or if we'll continue to trend further down within the descending channel until we regain that 200 EMA.

⚡ Next few days should be pretty eventful, especially once memorial day weekend wraps up I'm sure traders will want to get active and make a move but that brings us to my next highlight.

⚡ Historically speaking September is the weakest performing month for the market, it's the month we see stocks and indexes usually stumble a bit before they recover as the new year then approaches so that should be kept in mind. I'd love to see a breakout but if not this would also be a great time to accumulate given that within the next year or two we'll more than likely be trading above that $5 and $6 range.

⚡ Have to go for now but wanted to get a quick idea out and give some reference points with these descending channels. They will either help us get a breakout or push us further if we can't break out of them so keep that in mind along with Septembers historical performance. Much as we love the present looking on the past helps identify and note many key and potential plays.

⚡ As always, thank you so much for the support and all the best till next.

Best regards,

~ Rock'

XRP Is Ready For Blast Off!I foresee a big pump coming for XRP. When support is found, the big picture accumulation pattern should take us soaring to new all-time highs in a mass adoption phase. I am very excited about this coin and firmly believe we will see a strong run. Based on fractal analysis, it looks very similar to its first accumulation fractal.

As always, stay profitable.

- Dalin Anderson

XRP - a note about pivotsShe's gonna bounce around in this area until the end of the month. Squeeze them new daily pivots and then rip.

Pivots are a marker for the average price of open orders, both to buy (S1-5) and sell (R1-5). The pivot itself is the most common price of the two right smack in the middle, a very powerful pull. They change based on the time frame you're in. The larger the time frame the stronger the pull.

Once a new time cycle starts, new pivots are issued. They will expand and contract as orders push the price quick or slow. If they become closer together the move out will be explosive, and you'll have to use other indicators to tell which way she'll break.

You'll often see pivots line up within supply and demand zones. (Again areas of open orders). Give them a watch for a while and see how it plays.

Follow for more

Scalping $XRP – Road to $3.4222Scalping CRYPTOCAP:XRP – Road to $3.4222 🚀

XRP is knocking on the $3.31 gate — a breakout here unlocks clean air to $3.38–$3.42.

🎯 Target: $3.4222 (next liquidity cluster from last impulse high).

For the move:

✅ 1H close > $3.31 w/ vol

✅ Clean body closes (no long rejection wicks)

Risk:

⚠️ Fail to hold $3.31 = trap & fade to $3.22–$3.18

⚠️ Weak vol = fake out zone

Smart Play:

🎯 Entry: 1H close > $3.31

🛑 Invalidation: < $3.25

📌 Bonus: Strong $3.4222 hit could fuel $3.45–$3.48

Patience > FOMO. The breakout candle will tell the story. 🗝️

THERE CAN ONLY BE ONE – THE STANDARDXRP is ready for takeoff.

On the 6W chart, a low was created at $1.61. Price broke above $3.39 and is moving back toward the 2025 high at $3.66.

I don’t think people are ready for what’s about to happen. XRP has always been the token that outperformed Bitcoin — yet it’s still nowhere near Bitcoin’s price… for now.

I remember years ago, Jimmy Vallee from Valhil Capital said XRP could reach $35K–$50K. With Ripple’s massive global banking partnerships, their invitation to the White House, and their victory over the SEC lawsuit — XRP is the most battle-tested and credible token out there. It’s been through the fire and came out shining.

The days of buying XRP at $0.20 or $0.50 are gone.

I still think we’re at a comfortable price right now, but once it gets past $100 — congratulations to those who held through the storms.

I don’t need courses. I don’t need mentors. I don’t need paid signals or groups. I’ve reached a point in my trading career where I just know. Now, I’m on a mission to execute everything I’ve worked hard for over the last 11 years — to silence every doubter and naysayer. This is a mission for myself, my self-worth. Just me and the markets, closing out the noise, locked in on the goal.

The #XRParmy is here to stay. 🚀

XRP breaking wedge2 for 2 on here now. IH&S went according to plan. Rested on the daily pivot and now its off on good news for their appeal drop.

Now were breaking out of the falling wedge. Next target is 3.56 supply then 3.74, daily r1 pivot.

Watch inflow for support. Could see some shake downs. Remember, this bad boy, and others like it are ONLY MOVED by institutions. Market Makers. You and me, we don't have the capital to drive them one red cent. So, any real quick move was for a reason. And its not for the sake of retail.

Follow for more bangerz

XRP/BTC – Channel Midline in Play The XRP/BTC pair trade inside a multi-year channel, with price currently testing the midline of this structure — a pivotal level that could define the next macro leg.

If bulls manage to break the midline to the upside and successfully retest it as support, the upper boundary of the channel becomes the next major target.

🔼 Upside Scenario:

A confirmed breakout above the midline would signal structural strength and likely lead to a rally toward the upper channel resistance.

If this move aligns with BTC dominance dropping below the 60% threshold, we could see a full-blown altseason emerge.

Under such conditions, historical XRP/BTC behavior suggests that XRP/USD could reach $12–$24.

🔽 Downside Risk:

Losing the mid-channel from here would weaken the structure and invalidate the breakout thesis.

In that case, XRP/BTC would likely rotate back toward range lows, and a defensive strategy is warranted.

Macro Implication:

The 60% BTC Dominance level remains critical. A clean breakdown below it historically marks the beginning of altseason, where high-beta plays like XRP against BTC have outperformed. XRP’s current posture within the channel reflects this high-stakes moment.

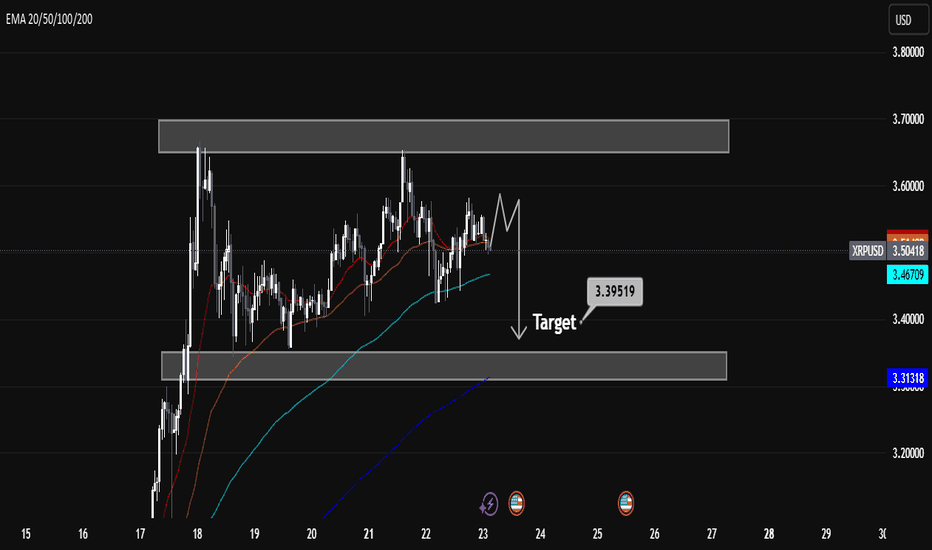

XRPUSD Technical Analysis — Bearish Retracement in PlayXRPUSD Technical Analysis — Bearish Retracement in Play

Overview:

XRPUSD is currently exhibiting signs of bearish momentum after failing to break through a key resistance zone. Price action suggests a potential retracement towards the marked target level of 3.39519, supported by multiple technical indicators and price structure.

Key Technical Levels:

Immediate Resistance: 3.70 – 3.75 (strong supply zone; price rejected here multiple times).

Support Zone: 3.30 – 3.39 (prior demand zone and EMA confluence).

Target: 3.39519 (short-term bearish target as marked on chart).

Current Price: 3.50 (as of chart time).

Indicators & Price Action:

EMA Analysis:

EMA 20/50 (red/orange) are flattening out, indicating weakening short-term momentum.

EMA 100 (cyan) acts as current dynamic support.

EMA 200 (blue) is far below, suggesting room for deeper retracement if sentiment weakens.

Price Structure:

XRPUSD formed a double top near resistance, followed by lower highs.

Recent candle patterns show indecision and possible distribution.

Projected bearish leg toward 3.39519 suggests sellers are in short-term control.

Conclusion:

XRPUSD is likely to retest the 3.395 support level after rejecting the upper resistance zone. The bearish structure is supported by EMA alignment, price action, and repeated failure to break resistance. A break below 3.395 could open further downside towards 3.31. However, a strong bounce from support could invalidate this setup.

Trade Bias: Short-term bearish toward 3.395, watching for reaction at support.

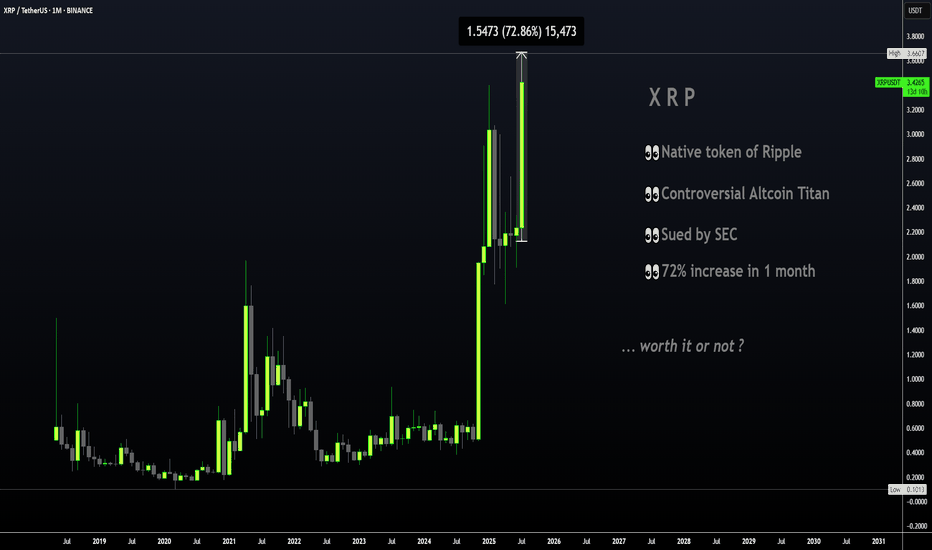

XRP | Great TP Zone is HERE for HODLERSXRP has seen a 62% increase since breaking out above the moving averages in the daily timeframe.

The previous time XRP broke out above the moving averages in the daily, the price increased around 440%:

However, with XRP being the ultimate pumper and dumper, I'll take my chances at 62%! Because this bull run has been anything but ordinary and it's best to avoid being too greedy. The price of XRP falls extremely quick, just as quick as it rises.. ( Maybe not overnight but you know, it has happened before ).

If you're one of few who bought around $1, or heck even later at $2, this is a solid increase and it should not be taken for granted. XRP has gone LONG periods without increases and often stayed behind making new ATH's when other cycles have come and gone (twice), as other alts make new ATH's. Over the years, I've made extensive posts on XRP; documented its use case, followed the SEC case closely and yet, XRP still remains one of the strangest and most unpredictable alts I have ever tried to analyze. Long term followers will remember that a I was bullish in 2018/2019 and then slowly became uninterested up until the point of negative towards XRP for probably the past 3-4 years.

This is not only because of the lagging price compared to other older alts that soared like ETH and even Litecoin. Sure we did not see the growth and the taco stand ( who remembers ) just kept dumping on the market... But the entire "scandal" of the actors marketing/pimping, the dumping behind the scenes by executives to fund Ripple in early days, the lawsuit etc. was just such a colossal mess that I even wonder how XRP is still alive and kicking today.

All I'm saying is that this is truly a spectacular moment - it's hard to even imagine cripple crossed $3 after years and years of waiting on XRP when other alts x1000% and beyond. Point being - Don't miss it! Trading only works when you take profits.

________________________

BINANCE:XRPUSDT

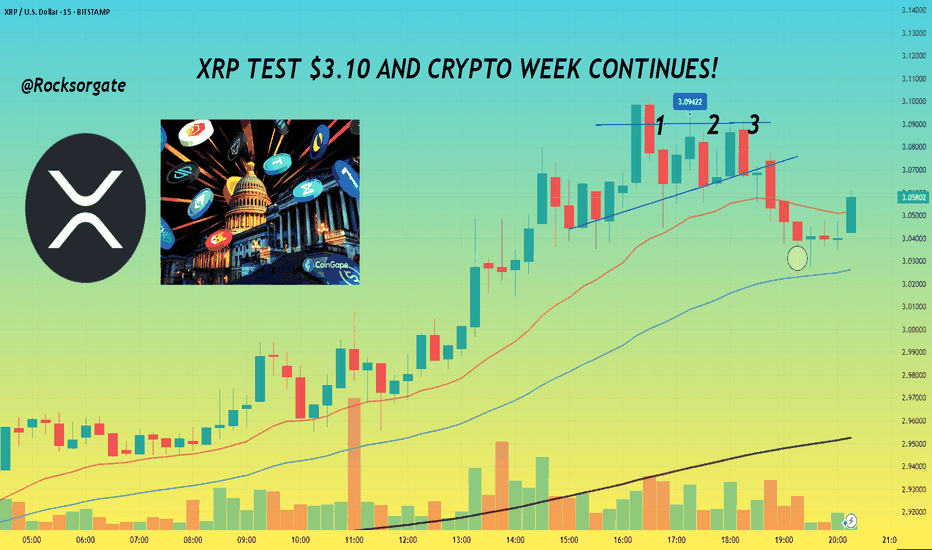

XRP TEST $3.10 AND CRYPTO WEEK CONTINUES!📊 Hey hey, hope all is well, gonna keep this idea pretty short and concise for the day, have a lot to do but thanks for joining as always.

📊 With Crypto week ongoing and the House of Representatives considering the Guiding and Establishing National Innovation for U.S Stable coins or GENIUS for short. Alongside that there's the Digital Asset Market Clarity Act or Clarity for short which is being considered as well. The last bill being considered is one which would be directed towards blocking the Federal Reserve from issuing a central bank digital currency directly to individuals.

📊 For summary CBDC is fiat money, just in digital form and that fiat money is issued and regulated by a central bank of a country.

📊 GENIUS has already made the rounds and passed through senate but is facing a snag, in limbo as House lawmakers as some lawmakers like Marjorie Taylor Greene and Chip Roy who themselves we're looking to get anti-CBDC language in with 12 republicans voting no on Tuesday's vote. Least to say things are still in flux, so we'll have to see if lawmakers can come to an agreement and sort things out simply put.

📊 If passed GENIUS would require stable coins to be fully backed by U.S dollars or similar liquid assets. Along with this you'd have annual audits for issuers with a market cap of more than $50 billion and guidelines would be established for foreign issuance.

📊 the Clarity Act takes a full on approach to crypto and would create a clear regulatory framework for crypto, this would function through the U.S Securities and Exchange Comission and Commodity Futures Trading Commission will regulate the crypto space. Digital asset firms would also have to provide retail financial disclosures and separate corporate from customer funds. More than likely in a nod to the collapse that FTX brought about for money when the company took advantage and started using customer funds.

📊 Overall these bills and acts alongside the CBDC bill would be a significant change for the digital asset space and give much more clarity for Institutions further allowing more money to enter the space basically.

Reference:

www.coindesk.com

www.theblock.co

📊 XRP itself will be impact by these changes just like the rest of the space with some digital assets making significant jumps or declines based on what bills and changes are ultimately decided so it's a crazy week to say in the least. For Technical I've added a chart below for reference:

📊 Can see how we're facing that horizontal level of resistance at $3.10 now, gonna set an alert for that but more than anything, right now what's gonna make or break things will be the news, we've already seen how much that's done us the last few weeks, grateful and blessed for it as always.

📊 Main thing now is to keep an eye on the news and watch that $3.10 level for resistance or a further breakout. We've also converged with our 200 EMA on the 3 minute chart so no doubt we'll see bulls and bears fight to break or keep that point. Should be an interesting next few days.

📊 Have to go study but as always, grateful for the continued support and those that take the time to read through these and continue with me on this journey, it's taken a few years but things are coming together finally, grateful we've perservered.

Best regards,

~ Rock '

XRP/USD (RIPPLE) BUYtitle: XRP/USD (RIPPLE) BUY

Asset: Crypto

Symbol: XRP/USD

Market Entry Price 1: $2.9450

Limit Entry Price 2: $2.7450

Stop Loss: $2.6450

Take Profit 1: $3.145 (close 10%)

Take Profit 2: $3.345 (close 25%)

Take Profit 3: $3.645(close 50%)

Take profit 4: $3.845 (close 75%)

Let any remaining Xrp run risk free

Why XRP Holders Are About to Get Super Rich!I believe XRP is heading into a mass adoption cycle—something even bigger than what Bitcoin saw in 2021. We’re looking at a truly sustainable growth pattern fueled by a longer accumulation phase and crypto being adopted and invested in by major institutions.

This means we could see XRP skyrocket to $22 as my lowest target— and potentially even well over $100 per coin . This coin is truly ready for massive things. Be prepared!

Let me know what you think: Will XRP crash? Or is it heading for mass adoption? Share your thoughts in the comments below.

As always, stay profitable,

– Dalin Anderson

XRP SHOOTS UP TO $3! 🌠 Wow, we'll, we've done it. We've hit $3 once again. Before I start this idea just want to give my thanks for tuning in, appreciate it.

🌠 This month has been pretty incredible for Ripple to say in the least from the BNY-Mellon Custodian Deal to Trump's Media company filing for a crypto Blue Chip ETF of which included the likes of XRP. With all the news and positive sentiment around XRP and Bitcoin which itself has hit a new All-Time-High hitting $123,000! Below I'll add a Bitcoin chart for reference:

🌠 To say in the least it's been a golden month for Crypto and Digital Assets. And one important thing to note is that as of today the Fedwire Funds Service is set to go live with the ISO 20022 standard starting July 14, 2025. The implementation will replace Fedwire's dated (FAIM) format with the ISO 20022 message format with the change happening over a single day.

🌠 For those that don't know ISO 20022 is a global messaging standard for financial transactions meant to reduce cost and fraud alongside automate transactions and reduce transactional costs. What this means for XRP is that it could become a much bigger player in cross-border payments now through RippleNet as XRP is one of the selected assets for the ISO 20022 standard.

🌠 ISO 20022 and global institutions will start utilizing XRP and it's ability to process transactions seemingly instantly and efficiently while significantly cutting down on cross border and transaction costs making it a considerably solution for banks and financial institutions. After all, if your objective is to make money, and you can make more money while cutting down on costs and making transactions, record keeping much simpler, then why not? Especially in an age where everyday things are continuously advancing and improving nobody want's to be left behind. Especially the big financial players.

🌠 Curious to see if prices can hold and keep pushing but just going off technical, we already know $3 is a tough point. At $3 just over 95% of XRP holders are in profit which makes a good reason for many to sell and take profit but with all the news and ISO now really kicking in we may not see as much selling, especially as holders are more confident and less likely to be swayed in letting go of their XRP. So it'll definitely be interesting to see how things play out.

🌠 Main thing will be Bitcoin, even if XRP holders hold I can't guarantee the same for Bitcoin, especially should it start to reverse, we know how financial institutions play taking advantage of the news. Just be cautious and set some price level alerts whether your trading XRP or Bitcoin.

🌠 In the long run things look very good regardless of what happens in the next week or two so keep that in mind. I'll be watching XRP to see if we can continue and break $3 but in my experience, with these impulse waves we usually see a big move up followed by some retracement as traders look to test support and liquidity so the waters may turn choppy but again like I said, we're here focused on the long term, whatever happens happens. We'll still be here for that but nonetheless the main objective is the longterm. $3 may seem like a lot but it's nothing compared to what XRP has in store.

🌠 This week is also 'Crypto Week' for lawmakers in DC as U.S lawmakers get ready to potentially pass changes in the regulatory setting when could push even more institutional demand further adding to the hype and optimism the crypto space has been running with as of lately.

🌠 Have to run but thanks as always for tuning in, really appreciate it and hope everyone is doing well! thanks as always and all the best till next. Feel free to keep posted and follow for more as always.

Best regards,

~ Rock '