XRPUSD – The December Accumulation Play | Smart Money Blueprint Market Context – The Perfect Storm for XRP |

XRP is sitting at one of the most compelling risk/reward setups in crypto right now. After a historic 430% rally from early November that took XRP from $0.50 to a local peak of $2.87 on December 2, 2024, the asset has entered a healthy consolidation phase inside a rising channel between $1.95-$2.00 support and $2.62-$2.80 resistance.

But here's what makes this different from your typical alt pump: the fundamentals are actually there.

The surge followed Donald Trump's election victory in November 2024, which triggered expectations of more favorable US crypto policies. The SEC, under new pro crypto leadership, is nearing a final resolution with Ripple, with the SEC keeping $50 million from the previous $125 million fine and returning the rest. This removes years of regulatory overhang.

Then came the game changer: Ripple launched its RLUSD stable coin globally on December 17, 2024 Business Wire, which is fully backed by U.S. dollar deposits, U.S. government bonds, and cash equivalents Business Wire. This isn't just another stable coin it's enterprise grade infrastructure designed for cross border payments for Ripple's customers starting early next year FXStreet.

Translation? XRP isn't speculation anymore. It's becoming institutional grade infrastructure.

🔎 Technical Framework – Smart Money Channeling Higher

Current State:

Rising channel accumulation phase with whale conviction

Key Liquidity Zones:

🔴 Premium Liquidity Zone (Sell Opportunity):

$2.62 - $2.80 (upper channel resistance + FVG cluster)

This is where retail gets greedy and smart money distributes

Historically, significant spikes in whale to exchange transactions align closely with XRP price peaks.

🟢 Discount Liquidity Zone (BUY ORIGIN):

$1.90 - $2.00 (lower channel support + whale accumulation cluster)

This support zone has consistently triggered rebounds since December 2024

In the last 24 hours alone, large holders accumulated an additional 110 million XRP.

⚖️ Equilibrium / Chop Zone:

$2.20 - $2.40 (mid channel consolidation)

Avoid blind entries here—wait for structural confirmation

🐋 WHALE ACTIVITY – The Real Story

This is where it gets JUICY . While retail panicked during the recent pullback, whales went on an absolute buying spree:

Ripple whales accumulated 160 million XRP worth around $380 million as of December 10, 2024

Large XRP investors added 590 million XRP worth $1.29 billion over a seven day period

Between December 25 and December 28, XRP whales accumulated tokens worth $2.17 billion

Let me repeat that: $2.17 BILLION in THREE DAYS .

CryptoQuant data indicates whale activity over the past month reached unprecedented levels, multiples higher than any other period. This isn't retail FOMO—this is institutional positioning.

Now here's the kicker: Whale order clusters near $1.80-$2.00 USD during 2025 show persistent large holder activity. Every time XRP dips to this zone, whales defend it aggressively. That's your signal.

🚨 Recent Developments – Catalyst Stack

SEC Settlement (MASSIVE)

Ripple will retain $75 million from the SEC settlement, and most importantly, be able to offer XRP tokens to institutional investors. This was the missing piece preventing institutional adoption. Now? Game on.

RLUSD Stablecoin Launch

Ripple announced the launch of RLUSD on December 17, 2024, calling it an "enterprise grade stablecoin built on trust, utility, and compliance". Ripple plans to use both RLUSD and XRP in its cross border payments solution, creating direct utility demand for XRP in institutional payment flows.

Regulatory Tailwinds

With Trump's pro crypto administration and Gary Gensler stepping down, the regulatory environment has flipped 180 degrees. Former CFTC Chair Christopher Giancarlo stated the SEC should drop the Ripple case.

ETF Momentum Building

Franklin Templeton and Canary Capital have filed for XRP ETFs. If approved, we're talking about billions in potential institutional inflows.

🎯 Trade Plans – Precision Entry & Exits

🟢 BUY XRPUSD: $1.90 - $2.00 | SL $1.82

Thesis: Discount origin tap at proven whale accumulation zone + rising channel support = institutional buy zone

Entry Rules (WAIT FOR CONFIRMATION):

Price dips into $1.90-$2.00 zone

Bullish CHoCH (Change of Character) + BOS (Break of Structure) on M15-H1

Strong bullish wick rejection + volume spike

Ideally on FVG fill or after Order Block retest

Targets:

$2.40 - $2.50 (mid-channel retest, quick 20-25% gain)

$2.70 - $2.85 (upper channel resistance, 35-42% gain)

$3.50 - $3.75 (1:1 Fibonacci extension + previous ATH retest, 75-87% gain)

Moonshot: $4.75+ (if RLUSD adoption + ETF approval coincide)

🔴 SELL XRPUSD: $2.65 - $2.80 | SL $2.92

Thesis: Premium liquidity grab at channel top followed by engineered bearish displacement—smart money distribution before reaccumulation

Entry Rules (WAIT FOR CONFIRMATION) :

Price touches $2.65-$2.80 zone

Bearish CHoCH + MSS (Market Structure Shift) + BOS down on M15-H1

Heavy volume spike on exchange inflows (use CryptoQuant whale inflow data)

Entry after FVG fill or Order Block retest post BOS

Targets:

$2.35 - $2.40 (first reaction, mid channel)

$2.10 - $2.15 (deeper retracement)

$1.90 - $2.00 (full channel retest—BUY zone reactivates)

⚠️ Risk Management & Critical Notes

Do NOT trade inside the mid channel chop zone ($2.20-$2.40) without structural confirmation—this is where retail gets chopped to pieces

Sweeps ≠ Trend Entries: If XRP wicks to $2.80 or down to $1.85, that's likely a liquidity grab, NOT a breakout/breakdown

Use tight SL based on structure invalidation—never average down in consolidation

Monitor whale to exchange inflow data (CryptoQuant): Rising whale to exchange flow indicates selling pressure

Given macro volatility (Fed policy, crypto regulation news), consider scaling position size down by 30-50%

📊 The Bottom Line – December's Hidden Gem

XRP is trading at a critical juncture. On one hand, you have:

✅ Record whale accumulation ($3.8B+ since November)

✅ SEC settlement removing regulatory overhang

✅ RLUSD launch creating institutional utility demand

✅ Pro Crypto political environment

✅ Rising channel structure with clear support/resistance

On the other hand:

⚠️ Consolidation phase means volatility is coiling

⚠️ Whales could distribute at channel top ($2.65-$2.80)

⚠️ Bitcoin weakness could drag XRP lower short-term

My Take? This is classic Smart Money accumulation. The $1.75-$2.16 support zone has been defended relentlessly by whales. Every dip gets bought. That's institutional positioning for a leg higher.

Strategy:

If you're not in yet wait for $1.90-$2.00 pullback (high probability long setup)

If you're already in take partial profits at $2.65-$2.80, let the rest ride with a trailing stop

If we break $2.80 with volume add to position, target $3.50-$4.75

This isn't financial advice this is technical + fundamental confluence at its finest.

🔥 Final Word – Why This Time Is Different

XRP has had false starts before. But this time, the stars are actually aligning:

Regulatory clarity ✅

Institutional utility (RLUSD) ✅

Whale conviction ✅

Political tailwinds ✅

Technical setup ✅

The question isn't if XRP moves it's when and how violently.

Position accordingly. Trade the structure. Follow the whales.

Drop a 🚀 if you're accumulating XRP at these levels. Let's ride this wave together.

Xrplong

XRPUSDT Bullish Scenario Updated🔎 Technical Outlook

XRP is currently trading around 3.03 – 3.04 USDT, after bouncing from a key support zone near 2.95 USDT. The chart shows a sequence of higher lows with multiple buy signals clustering near the base, suggesting strong accumulation.

The resistance zone sits around 3.18 USDT, which is also marked as your target area. A clean breakout above minor intraday resistance at 3.05 USDT would open the way for bullish continuation. The structure favors buyers as long as price holds above 2.95 support.

________________________________________

📈 Trade Setup (Bullish Bias)

• Entry: 3.03 – 3.05 USDT (current market zone)

• Stop-Loss: 2.95 USDT (below recent support & invalidation level)

• Take Profit 1: 3.12 USDT (intermediate resistance)

• Take Profit 2: 3.18 USDT (major resistance target)

• Risk/Reward: ~1:2

________________________________________

🛡 Risk & Trade Management

• 🔒 Partial Profit Booking: Secure some profits at 3.12 USDT to reduce risk exposure.

• 📈 Trailing Stop: Once TP1 is hit, move stop-loss to breakeven (3.03) and trail along higher lows to ride momentum.

• 🚫 Invalidation: If XRP breaks below 2.95, the bullish setup is invalid, and exiting quickly protects capital.

________________________________________

✅ Summary

XRP is showing bullish intent after defending the 2.95 support zone and looks set to retest 3.12 – 3.18 USDT. A layered profit-taking approach with a trailing stop allows you to capture the move while managing downside risk effectively.

________________________________________

XRP New Higher Low and Break of Structure, LONG PlayThe 45min chart is powerful for Crypto, and is showing a new Higher Low.

Break of structure to the upside. (See "bos" horizontal lines).

An upward channel is present on 45min chart and 1h chart.

Bull Pennant Pattern is showing on my candle times, including 4h and daily. These usually break bullish.

On the 45min chart the 200ma has just crossed above the 314ma. In my methodology that's a bullish MA cross.

ADX/DI and Squeeze and Wadda indicators are favorable on the lower time frames including 4h's.

This is slightly high octane speculation, but mostly TA with a slight bit of front running and TIGHT stop loss.

Overall looks like the ALT market is green today for many pairs against USD and USDC on Coinbase. If nothing else today should offer a stop loss in the green while XRP makes a move.

Long!! I opened a leverage long position over the weekend. I am planning to take profit at $4, $4.50 and $5. Stop loss is at $2.7

Reasons for a long position:

1) The price has pulled back and found a clear support at Fib .5 and EMA55.

2)The current chart set up is very similar to that in Jan 2025 (see green vertical line in the chart).

3) RSI is consolidating in the bull zone.

4) MACD lines are bunched up together and moving horizontally. However, the lines are in the bull zone and MACD histogram shows bear momentum is waning. It might be safer to wait for MACD lines to cross to the upside, but there are enough confluences for bullish bias.

5) The daily candle is now moving above Fib 0.236. Fib 0.236 often works as the last line of defence for the bear and if it is breached, it is very likely to move to the upside.

Scalping $XRP – Road to $3.4222Scalping CRYPTOCAP:XRP – Road to $3.4222 🚀

XRP is knocking on the $3.31 gate — a breakout here unlocks clean air to $3.38–$3.42.

🎯 Target: $3.4222 (next liquidity cluster from last impulse high).

For the move:

✅ 1H close > $3.31 w/ vol

✅ Clean body closes (no long rejection wicks)

Risk:

⚠️ Fail to hold $3.31 = trap & fade to $3.22–$3.18

⚠️ Weak vol = fake out zone

Smart Play:

🎯 Entry: 1H close > $3.31

🛑 Invalidation: < $3.25

📌 Bonus: Strong $3.4222 hit could fuel $3.45–$3.48

Patience > FOMO. The breakout candle will tell the story. 🗝️

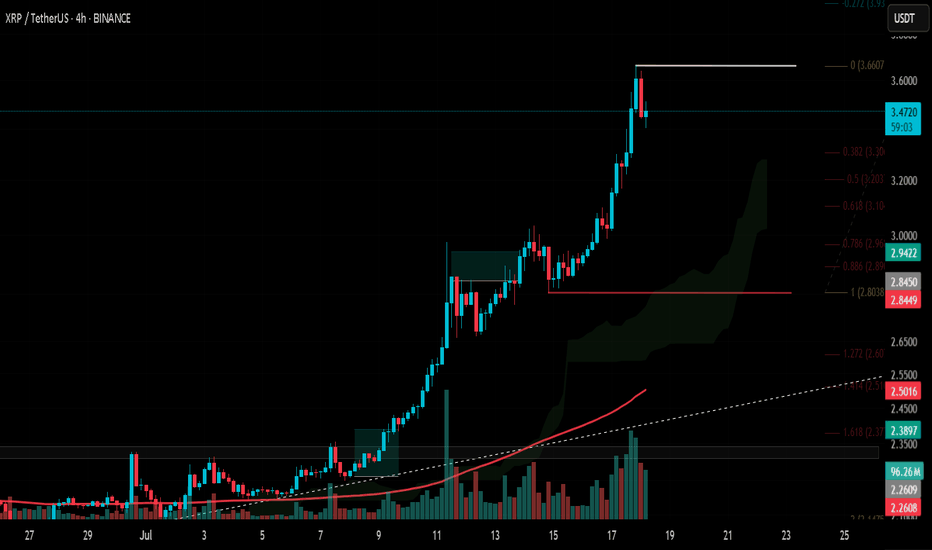

#XRP Update #3 – July 18, 2025#XRP Update #3 – July 18, 2025

XRP has surged roughly 28% in its latest impulsive move. Naturally, we now expect a correction phase. Potential retracement levels are:

Level 1: $3.30

Level 2: $3.20

Level 3: $3.10

Pullbacks to any of these levels should not be alarming — they are typical and healthy corrections.

I plan to go Long if XRP bounces from the first correction zone. However, at the moment, I’m just observing, as the current signals are not strong enough to justify entry.

It’s also important to note that there are heavy whale sell orders between XRP’s current price and the $4.00 zone. Breaking through this resistance will likely require strong buy-side volume from large players. Caution is advised.

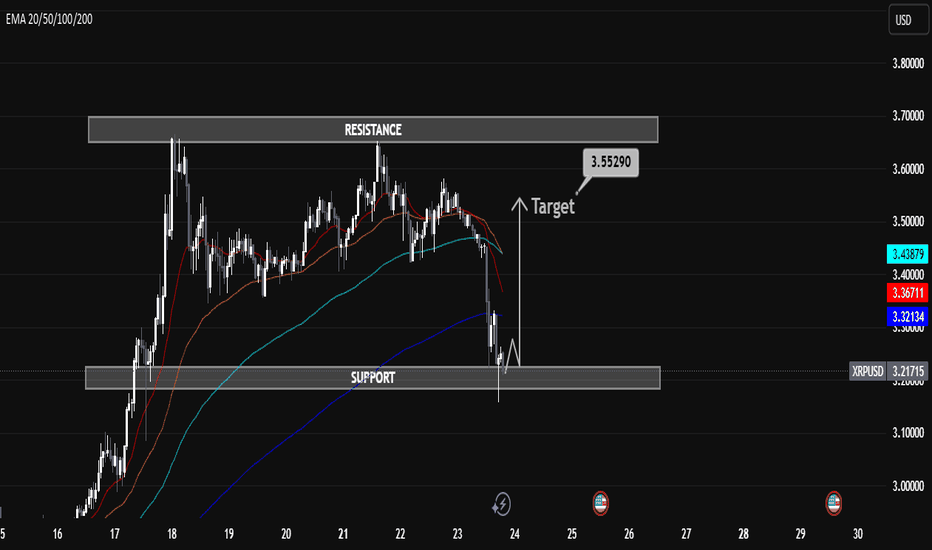

XRP/USD H1 Educational Market Analysis – Support-Based XRP/USD H1 Educational Market Analysis – Support-Based Long Opportunity

🔍 Structure Overview:

• Support Zone: $3.21 – $3.23

This level has acted as a strong liquidity pool and base for past bullish moves. Price has tapped into it, showing signs of potential demand returning.

• Resistance Zone: $3.65 – $3.70

Acts as a key supply zone, where previous bullish attempts failed. Targeting this area after a rebound is technically sound if structure confirms.

⸻

🔄 Price Action Insights (H1):

• Price broke down through EMAs (20/50/100/200), confirming short-term bearish pressure.

• A rejection wick from support hints at possible absorption of selling pressure.

• If price forms a higher low structure above $3.25 and reclaims EMAs, a potential bullish reversal may unfold.

⸻

🧠 Educational Note:

• H1 charts are ideal for intraday strategies, and this structure provides a clear example of:

• Support-resistance dynamics

• The use of EMAs as trend confirmation tools

• Reversal vs. continuation setups

⸻

🎯 Intraday Bullish Scenario:

• If price holds above $3.21 and breaks above the $3.40 (EMA cluster), bulls may push toward the $3.55290 target.

• This level aligns with the mid-range of the resistance zone, offering scalp-to-swing potential.

⸻

🚫 Bearish Risk:

• Failure to hold $3.21 could lead to a deeper correction toward $3.10 or even $3.00.

• Confirmation of bearish continuation would be a lower high rejection from EMAs without reclaiming them.

⸻

📌 Summary:

On the H1 chart, XRP is at a critical support. Watch for a clean bounce and break above EMAs for a move toward $3.55. However, losing $3.21 could attract further downside. Use price action confirmation before entries.

XRPCRYPTOCAP:XRP is at a major turning point at the $2.65 level as we look to push through the 200 EMA. If we get news of the SEC case dropping, Federal Reserves or more positive ETF news we may be on our way towards $3 heading into the weekend.

If we fail this level we may retest the $2.45 support before we head back up.

We are looking more bullish everyday, the time is coming for the switch to be flipped.

2x for xrpusdt or 1/2 ? that's the questionyou can see that xrp has broken the old all time high and did a pullback and it seems that we are waiting for a 150% rally but another scenario is that it may be a fake breakout and it would go back into the wide wide trading range that it has been inside 60% probabilty is in favor of an 150% rally but let's see what would happen

XRP/USDT 1H: Bulls Eye $3.35 After Key Liquidity Sweep !XRP/USDT 1H Chart Analysis

🚀 Follow me on TradingView if you respect our charts 📈Daily new charts!

Current Market Structure:

Bullish trend confirmed after a liquidity sweep at 2.65.

Smart Money Activity: Accumulation phase evident with clear order blocks around 3.12.

Risk Score: 7/10 (favorable setup).

Trade Setup:

Entry Zone: 3.17 - 3.18 (current price).

Targets:

T1: 3.25 (premium zone).

T2: 3.35 (previous high).

Stop Loss: Below 3.11 (recent order block).

Key Observations:

RSI: Bullish divergence forming at 57, supporting upside potential.

Premium Zone: Identified at 3.20 - 3.25.

Market Maker Intent: Targeting liquidity above 3.35.

No bearish divergences present, further supporting bullish bias.

Recommendation:

Long positions favorable within the 3.17 - 3.18 range.

Maintain tight stops below 3.11 to limit downside risk.

Watch for volume confirmation to strengthen confidence in the breakout.

Confidence Level: 8/10 for bullish continuation.

🚀 Follow me on TradingView if you respect our charts 📈Daily new charts!

False breakout to the downside..It seems we had a false breakout to the downside, and now we've recovered back into the forming bullflag pattern which can still take us right back into a major breakout run to the upside!

It makes it way more bullish because bears getting desperate for profits, only to be rekt once again cos we going UP! 🚀

XRP is holding its own in the equilibrium zone.XRP has been holding its own in the wedge pattern that it is currently trading in. Although it has the potential to form a bearish divergence on the weekly RSI, it appears that XRP is getting ready for another leg to the upside.

Good luck, and always use a stop loss!

XRP Big Picture Grinding HIGHER? XRPUSDT Buy Long only for Us! XSeeking Pips likes XRP HIGHER STILL!

Yes price has stalled somewhat but ✅️HIGHER TIMEFRAMES still call for $4 xrp MINIMUM TARGET in our opinion.

As Stated on our shared analysis last week on 15/01/25 🟢SeekingPips🟢 thinks below $5 XRPUSD REMAINS A BARGAIN as a LONG TERM HOLD.👌

Daily Chart BULL FLAG remains in play and SeekingPips continues to see BULLISH REACTIONS on our LOWER timeframe CHARTS and PRICE LEVELS we have identified and shared until now.

🔴 SUBSCRIBE NOW🔴 & Receive Our Latest Chart Analysis...

XRP Long to 6.66Observing the fractal pattern on XRP, we see a potential setup similar to AVAX's previous price action.

The price seems ready to expand soon and is likely to dip into the orange demand zone, creating a buying opportunity. The demand zone is crucial, much like it was on AVAX's chart before its massive move upward.

Entry Zone : Look for a dip into the orange demand zone around $2.21 - $2.41.

Target: $6.66 – A potential long-term target based on the fractal comparison with AVAX.

Key points:

The price structure shows a similar pattern of consolidation before a major price breakout.

Timing will be critical as we expect the price to dip into the demand zone before moving up.

Stay vigilant for entry confirmation within the demand zone.

If this fractal plays out as expected, XRP could see significant upside potential, following a path similar to AVAX's recent price action.

Xrp usdt"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"