Bitcoin Analysis | Is 2026 the Crypto Bear Market Year? Hello traders, hope you’re all doing great!

Today I want to take a monthly look at Bitcoin and break down where we might be heading in the bigger picture.

🔹 The Halving & the Big Picture

First, let’s talk about Bitcoin Halving on higher timeframes.

In simple terms, halving cuts miners’ rewards in half. That means Bitcoin’s price needs to stay high enough for mining to remain profitable.

Based on research, the breakeven zone for miners is roughly $45,000–$50,000.

In crypto, moves are usually more aggressive, so personally I consider $40,000 as a maximum downside target in a worst-case scenario.

⚠️ Important note:

These numbers are not guaranteed. That’s exactly why risk management is critical—so a wrong scenario never kicks us out of the market.

In the worst case, I see around a 60% probability of a major bearish leg if certain levels break.

🚨 Bearish Warning Levels

These levels would act as serious danger signals:

82,000

60,000

If Bitcoin breaks and daily closes below these levels, we could realistically head toward the miners’ breakeven zone ($45k–$50k).

And honestly? If we ever reach that area, I’ll personally start accumulating Bitcoin step by step.

👉 For now though, as long as price is above $82,000, this bearish scenario remains low probability.

🔼 What Most Traders Are Waiting For

From what I see, many traders are expecting one more bullish leg in Bitcoin—ride it up, then exit the market.

For that bullish scenario, one level matters the most:

$93,000

A break and consolidation above $93k could trigger:

A move toward $100,000

Or even a retest of the previous ATH around $120,000

That’s a solid opportunity—especially if BTC moves up while dominance drops.

🌊 Bitcoin Dominance = Altcoin Opportunity

Before you go all-in on Bitcoin, make sure you understand BTC Dominance (BTC.D).

📈 BTC up + 📉 Dominance down → Altcoin Season

In that case, alts can outperform Bitcoin hard

If you’re newer to the market, stick with high-cap alts like ETH.

More experienced traders can look deeper into strong setups.

✅ Final Thoughts

Below $82k → caution, macro risk increases

Above $93k → potential final bullish leg

BTC.D matters more than ever

Risk management is non-negotiable

Don’t miss the daily analyses, where I share my real-time triggers and how I manage positions live.

Trade smart, stay patient, and stay profitable 🚀💙

Crypto market

SOL - Stuck in No Man's Land

Current Price: $124.93

AVWAP: ~$126-127

POC: $125-127

Price is at AVWAP. Price is at the POC.

Translation: This is going nowhere fast.

The Structure:

Look at the volume profile. The yellow bars (heaviest volume) are exactly where we're trading. That's the Point of Control - the battleground where neither side has won.

When price trades at both AVWAP AND the POC, you're in maximum uncertainty.

Bulls can't push above $128 with conviction.

Bears can't break $122 with volume.

So we grind sideways.

The Range:

Resistance: $128-130

Support: $122-120

Current: Dead center

This is crypto in January. Low volume. Holiday hangover. Waiting for catalysts.

What I'm Watching:

📈 Bull Case: Break above $130 with volume → Target $135-140

📉 Bear Case: Break below $120 → Target $115-110

Until one of those happens, this is noise.

The Trade:

In ranging markets, most traders lose money trying to pick direction.

The disciplined ones wait for the break.

I'm not interested in scalping $2 moves in a $125 coin.

I'm interested in positioning when the regime becomes clear.

Right now? The regime is "chop."

Sometimes the best trade is no trade.

---

Are you long, short, or sitting this out? 👇

#Solana #SOL #Crypto

BTC - Range-Bound Structure

Current Price: $87,498

AVWAP: ~$87,500

POC: $87,000-88,000

We're in chop mode.

Look at the volume profile (yellow bars). The heaviest volume is exactly where price is trading right now - $87k-$88k.

This is the Point of Control. The battleground. Neither bulls nor bears have control.

The Structure:

• Price AT AVWAP (not above, not below)

• Trading AT the POC

• Tight range: $87k-$90k

• No clear trend since mid-December

This is what consolidation looks like.

When price is at AVWAP and at the POC, you're in equilibrium. No regime. Just noise.

The Trade:

Range top: $90,000 (resistance)

Range bottom: $87,000 (support)

Breakout level: Above $90k = bullish continuation

Breakdown level: Below $87k = retest lower support

Until one of those breaks with conviction, this is a scalper's market, not a position trader's market.

What I'm NOT doing:

❌ Fighting for longs at resistance

❌ Catching knives at support

❌ Forcing trades in chop

What I AM doing:

✅ Waiting for a clear breakout/breakdown

✅ Letting the range define itself

✅ Preserving capital for the next trending move

The best traders know when to trade aggressively (trending regimes) and when to step aside (ranging regimes).

Right now? This is a step-aside environment unless you're scalping the range.

The next big move happens when one of these levels breaks. Not before.

Patience > Action.

---

Are you trading this range or waiting for the break? 👇

#Bitcoin #BTC #VolumeProfile

I believe $BTC will dump to $75K !The RSI structure suggests a bearish regime, as momentum has consistently failed to reclaim the 60 level since October 10th. This behavior typically signals that rallies are corrective rather than impulsive, with sellers maintaining control of the broader trend.

The 90K–91K zone has clearly developed into a major supply area. Despite spending nearly a month consolidating around this level, price has been unable to produce meaningful continuation. Prolonged consolidation at resistance, especially without momentum expansion, often reflects distribution rather than accumulation, indicating that upside energy is being absorbed.

The loss of momentum combined with repeated rejection near resistance increases the probability of a range breakdown. If that occurs, downside acceleration becomes likely, with 72K–76K standing out as a logical draw on liquidity—this zone aligns with prior demand, inefficiency, and potential mean-reversion levels.

From that region, a technical reaction is plausible. However, any bounce should initially be viewed as a relief or micro reversal, not a confirmed trend shift, unless momentum structure (RSI reclaiming 60+ and volume expansion) improves materially.

Overall, the market appears structurally weak below 91K, with risk skewed to the downside into January, and patience is warranted before labeling any lower-zone reaction as a sustainable reversal.

Invalidation occurs on a firm daily close above 91.5K with strong volume.

Thank you!

BTC | 4HCRYPTOCAP:BTC — 4H Zoom-In | Bottoming Structure

Respecting the broader BTC Monthly outlook, price has been supported by a highly validated convergent Q-Structure at the apex ➤ $80,619 . Given that this level remains unchallenged, the ongoing consolidation phase since November 21 can reasonably be interpreted as a bottoming formation.

All wave structures identified on this timeframe—including a Leading Diagonal as Minor Wave 1, a deep retracement ending in an Expanding Diagonal ⓒ, and the current consolidation in a Double Three (Flat | Zigzag | Triangle)—while respecting the interactive function of the illustrated Q-Structures—have collectively formed an integrated structure indicating the development of a significant bottom, marking the extreme point of Primary Wave ⓸ within the impulsive Wave III sequence of BTC’s second Cycle.

🔖 This potential reversal has been projected since Nov. 15 during the BTC decline.

🔖 This outlook is derived from insights within my Quantum Models framework.

RLC/USDT | Falling Wedge Breakout WatchThis analysis reflects my personal view on the RLC/USDT trading pair based on technical analysis. The idea is shared for educational and informational purposes only and should not be considered financial advice. Market conditions can change rapidly, so always do your own research and risk management before making any trading decisions.

bullish breakout above wedge resistance with strong volume confirmation is required. If confirmed, a fast upside move may follow.

This bullish scenario is invalidated if price breaks below wedge support.

Feedback and alternative views are welcome.* /Sanaz/

ETH — Price Slice. Capital Sector. 1872.78 BPC 22© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 01.01.2026

🏷 1872.78 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 22

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

Imagine price on a chart moving in a “zigzag”—up, then down, in an apparently chaotic sequence.

To this dynamic we introduce Magnitude 1.0 —a mathematical construct whose purpose is to trace a single, smooth, continuous line that best captures the overall direction of what initially appears to be disorderly motion.

This is analogous to the tire mark left on wet asphalt after a sharp maneuver: the track is jagged, yet you can still discern an “average” line indicating the vehicle’s general trajectory.

Magnitude 1.0 filters noise —minor fluctuations, emotional impulses, short-term liquidity spikes. It reveals not randomness, but structure .

Unlike linear models, Magnitude 1.0 permits this “average line” to be nonlinear , which is critical in markets where trends are rarely straight—especially in crypto assets.

Now we introduce Magnitude 1.1 —the logical forward extension of Magnitude 1.0.

If Magnitude 1.0 is a smooth curve fitted through historical data, then Magnitude 1.1 is its extrapolation beyond the observable time horizon .

This is not a forecast, but a hypothesis :

“If the market continues behaving as it has over the past N periods, price will most likely reside somewhere here.”

Magnitude 1.0 is a tool of anticipation, not action. It answers the question:

“What level could reasonably serve as a target, assuming the current market geometry holds?”

Yet the market is a living system. A new announcement, a liquidity shift, a macro impulse—any of these can instantly invalidate the hypothesis. Thus, the value of Magnitude 1.1 emerges only in context :

- current volume,

- position relative to key structural levels,

- the state of the external information environment.

Consider a river.

Magnitude 1.0 defines its general channel, despite waves, eddies, and local turbulence.

Magnitude 1.1 speculates where the river might flow next— if the terrain remains unchanged .

But if rain begins or a dam appears, the hypothesis collapses.

You do not build your house based on Magnitude 1.1. You merely prepare for one of several plausible scenarios.

Why does this matter?

Within the framework of Capital Geometry , where price is not merely a number but a projection of hidden structure:

- Magnitude 1.0 extracts implicit architecture from the chaos of price data,

- Magnitude 1.1 tests the temporal resilience of that structure— without conflating the model with reality .

This aligns with a foundational principle:

Analysis is not prediction—it is preparation for a sequence of events.

To whom is this addressed?

— Not to retail traders leveraging 100x.

— Not to those who “draw” arbitrarily on charts, then complain that price “goes the wrong way,” oblivious to timeframe hierarchy.

— Not to those who operate without defining price ranges or structural context.

This material is intended for institutional players, quantitative analysts, and those capable of decoding the embedded information .

It is a gesture of respect to those who think in terms of capital geometry , not short-term speculation.

The retail sector operates via mechanics : trading from levels within near-term ranges, only after confirmation and closure on timeframes of 1D and higher.

But if your analysis relies solely on indicators supplied by vested corporate entities for the purpose of disinformation—it is no surprise you fear the future.

Some are deceived by randomness, others lack patience, and a third group has merely been favored by capital—to make the crowd believe in illusion.

Volume. Time. Price.

These categories belong to a fading era.

Each is governed by deeper mathematical magnitudes.

Some participants provide liquidity, others are professional traders, and others still are analysts.

And then there are those who remain in the shadows—yet whose work forms the bedrock of market order.

I extend to you a sign of respect.

Because between the lines, you understand .

I assist those who think .

And I conceal pathways—not out of fear, but out of respect for the capital that engineered this system.

It is logical. Designed. And projected years ahead.

Thank you.

— The Architect

BPC — The Bolzen Price Covenant

How Overconfidence Destroys Profitable TradersHow Overconfidence Destroys Profitable Traders

Understanding Overconfidence in Trading

Welcome everyone to another article.

One of the most dangerous stages a trader can walk into is not fear… but overconfidence. (EGO)

Overconfidence in trading is essentially ego.

However, there is still an important difference:

- Confidence is a real belief built on proof, statistics, and discipline.

- Overconfidence is an inflated belief in your ability beyond the proof. This is driven by ego.

Many traders do not fail because they do not know enough.

They fail because at some point, they believe they know enough or know “everything.”

What Overconfidence appears as in Trading:

A trader builds a system. ( yay! )

They go on a clean winning streak maybe 10, 12, even 15 profitable trades in a row.

At this point, the trader begins to think and assume:

“ I’ve cracked the code. ”

- Risk gets increased .

- Position sizes get bigger .

- Rules start to bend .

Confidence continues grow until it crosses a dangerous path where belief is no longer supported by data, statistics and proof.

Reality eventually steps in.

You will never again feel as confident as you did during your first major winning streak when it looked like the market finally made sense and success was “ figured out. ”

That feeling is exactly what traps traders.

Overconfidence WILL break Risk Management

Overconfidence destroys a trader by slowly dismantling their risk management, their system, their discipline, their psychology and their consistency.

It rarely happens all at once.

First:

- “ I’ll just risk a little more this time. ”

- “ This setup looks perfect. ”

- “ I’m on a winning streak. ”

Over time, the trader begins to:

• Ignore position sizing rules ( Too many LOTS or contracts )

• Move stop losses (Increases risk)

• Add to losing trades ( Does not accept the original loss )

• Trade larger to “maximize opportunity” (Stick to what you can afford to lose )

The trader thinks and believes the system will continue to work, because it worked before.

But markets do not reward belief, they reward discipline. (I have mentioned this many times in my previous posts.)

Once risk management breaks, even a profitable system becomes dangerous and can lead to zero profits, or even down to negatives.

Overconfidence Blocks Positive criticism and continuous Learning

There is no such thing and there will never be a 100% perfecto trading system/strategy.

Losses are part of the game.

Overconfident traders struggle when reality does not meet their expectations.

Instead of adapting to the market by adjusting their strategy they:

- Resist feedback (Or consider any feedback as hate/negative criticism)

- Ignore changing market conditions (Consolidation, flat lining, barcoding etc)

- Refuse to admit the system is underperforming (Bad performance & results)

- Believe the problem can’t be them (“It’s not the system, it’s the computer!”)

But Why…?

Well because… their mind keeps rewinding the dopamine high from when everything worked perfectly and the win rate was 99%

They only remember the wins, and “ GREEN ” $$$ %%% not the probability.

The exact moment a trader believes they “can’t be wrong,” learning comes to a halt.

And in trading, when learning stops, losses accelerate, revenge trading increase, risk management collapses, and consistency becomes scrambled.

Overconfidence changes Traders into > Gamblers

Overconfidence does not just cause losses it can also change behavior.

Frustration from unexpected losses turns into:

- Anger

- Impatience

- Forced trades

- Revenge trading

Rules get ignored.

Emotions take control.

The trader may still look like a trader, but they are acting like a gambler.

The most dangerous part?

They still believe they are right…

Example: How Overconfidence Destroyed a Profitable Trader

Let’s look at Bobby.

Bobby was a profitable trader. A very successful one in his 4th year of trading.

He discovered what he believed was a 99% win-rate system.

The first month was incredible.

The second month was just as good. Cash flowing in, heaps of green.

By the third month, losses started to appear.

Instead of falling back, taking a breather and reassessing , Bobby doubled down.

Continuing to trade the same system despite clear signs of underperformance.

He was no longer focusing on perfect executions and setups, he was chasing the high.

Losses turned into frustration .

Frustration turned into anger .

Anger turned into impatience .

Soon Bobby was:

• Forcing trades

• Revenge trading

• Ignoring risk management

Bobby refused to take responsibility.

“It was my internet.”

“My computer lagged.”

“My family distraccted me.”

The excuses piled up, but the account kept shrinking.

Bobby did not fail because of the system.

Bobby failed because ego stopped him from adapting to the market and adjusting his system.

Markets Will Always Humble Ego

Markets will humble traders in ways they never expect.

No matter how experienced you are, there is always something else to learn.

Trading is not a destination, it is a constant process of adaptation towards the market. Traders who believe they “know everything” will always be reminded by the market that They. Do. Not.

Overconfidence doesn’t end trading careers immediately.

But it slowly erodes them trade by trade turning it into mental torture.

Final Thoughts

Confidence is necessary to trade.. But Ego is fatal!

The very moment a trader believes they have cracked the code is often the moment their decline begins.

Stay humble.

Respect risk.

Let statistics, not emotion, guide your decisions.

Because in trading, the market doesn’t punish ignorance it punishes ego.

XRP AND HAPPY NEW YEAR 🥂 Hope all is well, just wanted to take a minute to give my thanks. Here's to our last idea of 2025. Appreciate everybody so much and may we wrap up 2025 and bring in 2026 on a great note.

🥂 Technical keep an eye for that descending channel as we use it as a support while above it. Wishing al the best and keep watch for that pivot level. Especially since we've lost our 200 EMA on the 30 minute chart and those 20, 50 EMA's will play the greatest influence into the next few days as we seek to establish support and gain more ground or avoid forming a lower low.

🥂 To wrap things up, I'm so grateful for everybody that's joined me on this journey this year, words can't do justice for how much it means to be here and at almost 900 followers and counting. hanks for everything, wishing all the best, many blessings and have a happy new year!

Best regards.

~ Rock '

Two Rules for Crypto Traders in 2026: Less Hype, More DisciplineOver the past years, the crypto market has evolved from a curiosity-driven financial space into a highly competitive environment — where the difference between speculation and disciplined trading has become clearer than ever.

Most traders don’t lose money because they lack technical skills.

They lose because of:

- psychological biases

- unrealistic expectations

- bad information sources

For 2026, I would reduce things to just two essential principles.

🔹 1. Stop following bombastic influencers with a single narrative

If your feed looks like this…

- “Altcoin season is coming”

- “Next 100x coins”

- “How to become a millionaire in 2026”

- “This coin will change your life”

…you are not learning.

You are being emotionally conditioned.

These influencers/content creators are not traders — they are marketers.

Their incentives are:

➡ engagement

➡ clicks

➡ referrals

➡ product sales

Regardless of:

- trend direction

- market cycle

- volume and liquidity

- macro environment

their message remains the same:

“Bullish. Huge upside ahead. Don’t miss the opportunity.”

The real problem?

They never:

- consider alternative scenarios

- discuss risk or downside

- speak in probabilities

- build structured technical arguments

They don’t do analysis.

They sell optimism.

For a trader, exposure to this kind of content:

- increases FOMO

- reduces patience

- destroys discipline

- creates unrealistic expectations

If you see permanent hype — scroll past it .

A sustainable portfolio is not built on motivational narratives.

🔹 2. Use technical analysis and trade major, liquid coins

Most traders don’t blow up accounts because they:

- fail to understand patterns

- misread signals

They blow up because they allocate risk into:

- illiquid tokens

- low-cap projects

- structurally weak charts

- easily manipulated markets

Major, liquid coins:

- respect technical levels better

- have real trading volume

- react more cleanly to structure

- provide clearer probability models

Examples where TA makes sense:

- BTC

- ETH

- SOL

- high-liquidity L1 / L2

Here you can apply:

- trend-following

- support & resistance

- liquidity zones

- volume reactions

- structural break logic

You do NOT need to search for:

❌ “hidden gems”

❌ “next 100x coin”

❌ “unknown early opportunity”

You should be searching for:

👉 discipline

👉 structure

👉 probability

Trading improves when you stop:

- chasing hype

- hunting jackpots

- confusing hope with analysis

Closing Thought

If I had to summarize in one principle:

Less noise. Less spectacle.

More structure. More responsibility.

Success in trading rarely comes from:

❌ catching the miracle coin

❌ believing motivational promises

❌ chasing the next big narrative

It comes from:

✅ disciplined technical analysis

✅ rational risk management

✅ focusing on liquid assets

✅ staying emotionally grounded

Everything else is noise.

Happy New Year!

Mihai Iacob

ICPUSDTOn previous analysis, I was expecting price to react on POI but it got invalidated. Now I’m looking for price reaction on the Daily gap whether it would continue to go down and take the bottom wick. If invalidated again, I’d like to see price breakout on the swing high to confirm change of direction.

MINAUSDT.PAfter breaking out of the falling channel, a move

was observed that swept order block (OB)

liquidity. The N-shaped rising wave formed below the channel’s

upper support, with a high

probability of continuation to the upside,

supported by factors such as Tether dominance

(USDT.D) adjustment.

buyslooking to catch this second wave to the upside. possibly up to 90000.

. This analysis may change at any time without notice and is provided solely for educational purposes to help traders make independent investment decisions.

The information and publications are not intended to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView.

Movement comparisonBitcoin and Monero have approximately the same amount of coins in circulation. Bitcoin has an average of 500,000 transactions daily, while Monero has around 20,000. The Monero ownership centralization is obvious, but not provable.

The two assets have significantly opposite price movement.

The LTCBTC/XMRBTC pair is at the channel top.

The XMRUSD/LTCUSD is retesting long-term support.

The channel has been violated, which possibly means a strong corrective wave in the opposite direction is coming. LTCBTC pair isn't looking great for now, but LTCUSD has been in slow upside movement with quite high usage for payments. The upcoming LitVM hype might have impact on the price, and will be produced by Lunar Digital Assets company in deal with Bitcoin OS and Litecoin Foundation. The LDA is a marketing company and they have made a lot of damage through previous projects thus exercise extreme caution.

The BTCUSD is searching for support on 1W and appears to be completing Elliot five wave impulse, and forming a running flat.

The XMRBTC is at strong long-term resistance, the BTCUSD has more momentum for breakout while grinding at the channel top, and taking under consideration the BTCUSD and XMRBTC are inversed, the BTCUSD seems a better choice for investment at this moment.

However, XMRUSD does seem like it could get a correction, but in smaller magnitude than XMRBTC, thus the XMRUSD price might stay elevated for the period while BTCUSD is in bullish rally.

Furthermore, the BTCUSD versus GOLD is also finding significant support. Countries and private companies are holding the BTCUSD positions. It is possible that in this year people will realize it is easier to keep safe and spend Bitcoin rather than physical gold. Gold appears to be a fear hedge, around 50% of yearly mined gold being used for production of jewelry while around 10% used in electronics production. Silver appreciation is fair. The world will continue further into finance digitalization. Production of physical goods should also get more appreciation in the following years.

Opinion - Good time to move XMR to BTC, even though XMR might make another leg, but less likely.

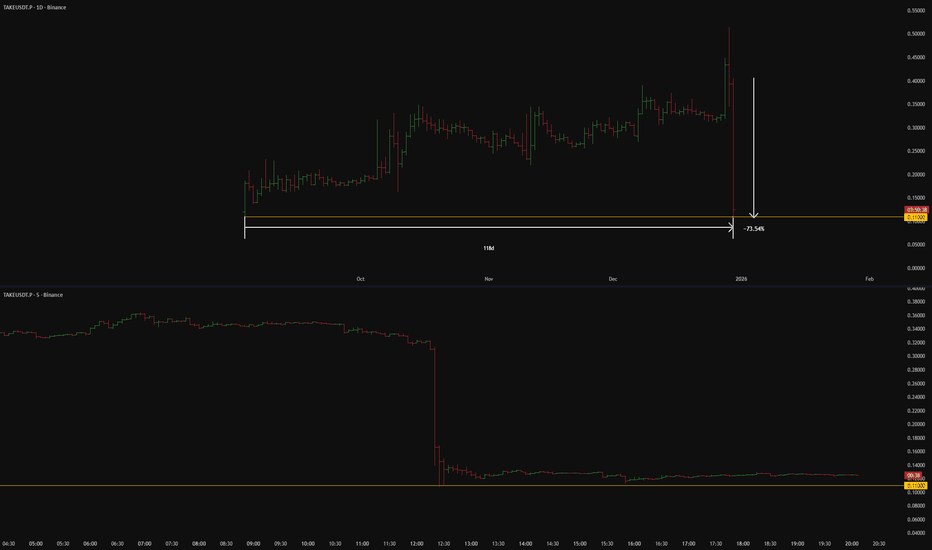

TAKEUSDT: short setup from daily support at 0.11000This case study highlights the critical significance of the asset's Listing Price level. At a minimum, it acts as a strong psychological barrier. At best, after 118 days of trading, we witnessed a pixel-perfect retest of this exact level — just look at how powerful the subsequent drop was.

I prioritize such setups because they heavily tilt the scales from a standard 50/50 toss-up to a solid statistical advantage in my favor. Several other confluence factors also strengthened this scenario, boosting the trade's profitability above the baseline. Clean charts like this are a rarity.

Relative to the 72% crash, the BINANCE:TAKEUSDT.P displays zero intent to correct, at least for now. The longer the accumulation continues above this support, the higher the likelihood of a breakdown. This market anomaly signals either a total vacuum of buyers or overwhelming selling pressure.

The scenario I expect:

Price void / low liquidity zone beyond level

Asset decoupled from the market (relative strength/weakness vs. BTC)

Momentum stall at the level

No reaction after a false break

Closing near the level

Closing near the bar's extreme

The chart displays negative factors:

Lack of consolidation

Was this analysis helpful? Leave your thoughts in the comments and follow to see more.