CADJPYCADJPY shows strong signs of a potential downward move based on technical analysis:

Market Structure: Price has formed a lower high, indicating a bearish shift in structure.

Resistance Zone: Price has reacted from a key resistance / supply area, showing rejection with long upper wicks.

Trend: The pair remains below key moving averages, confirming bearish momentum.

RSI: RSI is below 50 and turning downward, suggesting weakening bullish strength.

Liquidity Sweep: Price appears to have swept buy-side liquidity above recent highs and is now reversing.

Break of Structure (BOS): A bearish BOS has occurred, increasing probability of continuation to the downside.

📉 Bias: Bearish

🎯 Expectation: Price likely to continue dropping toward previous support levels unless resistance is broken and held above.

Forex market

bank of England and the Federal Reserve remain key risk drivers.* Forward market pricing sees GBP/USD finishing December around current levels, which suggests limited volatility but still a bullish tone.

GBP/USD buy bias remains intact as long as price respects the 1.3300–1.3400 support and the broader uptrend continues above key moving averages.

(NB:) Monetary policy differences between the Bank of England and the Federal Reserve remain key risk drivers. Market expectations of slower BoE easing vs. Fed cuts could shift quickly with inflation and growth data changes.

USDJPY LONGMarket structure bullish on HTFs 3

Entry At Daily AOi

Weekly Rejection at AOi

Daily Rejection at AOi

Previous Structure point Daily

Around Psychological Level 156.000

H4 Candlestick rejection

Rejection from Previous structure

TP: WHO KNOWS!

Entry 95%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

USDCHF SHORTMarket structure bearish on HTFs DW

Entry at Both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Structure point Weekly

Daily Rejection At AOi

Around Psychological Level 0.79500

Touching EMA H4

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

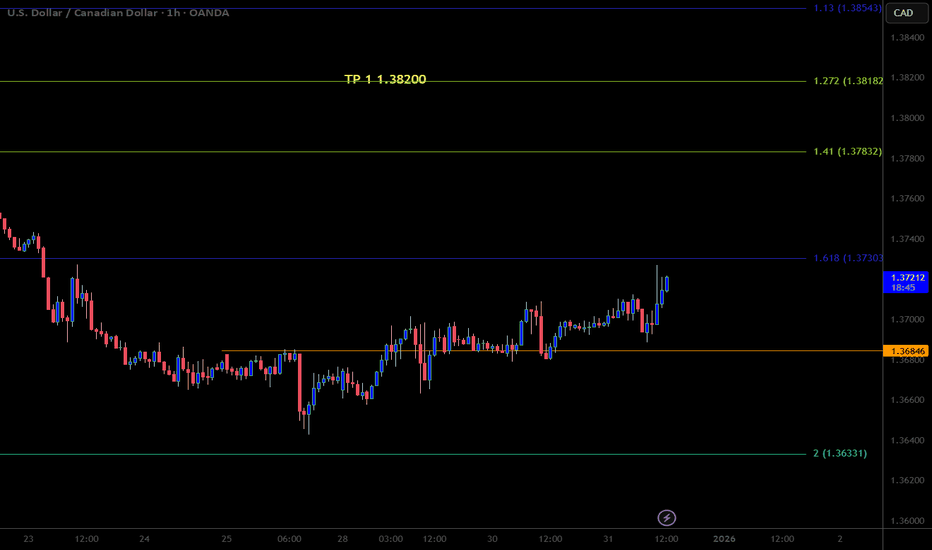

USDCAD SHORTMarket structure bearish on HTFs DW

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Structure Point on the Weekly

Daily Rejection at AOi

Previous Structure point Daily

Round Psych Level 1.37500

Touching EMA H4

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

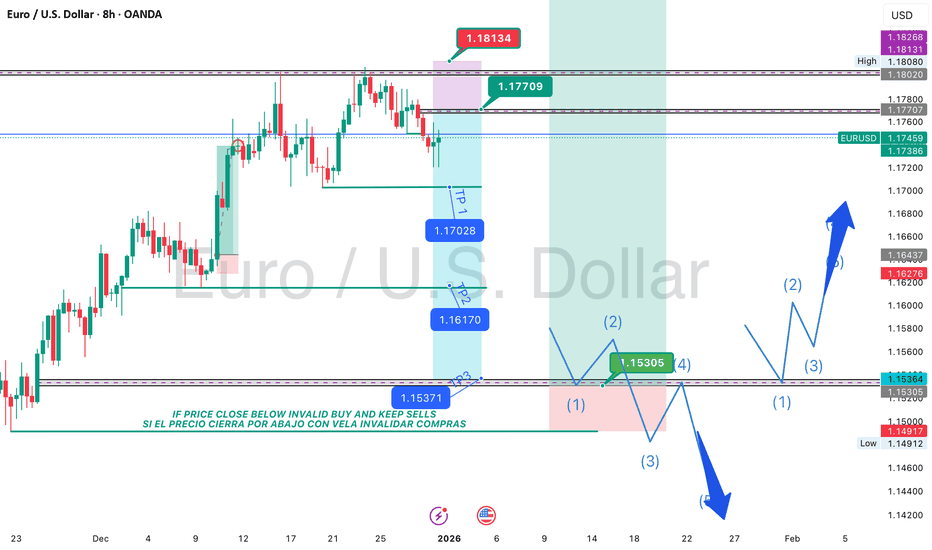

EURUSD LONGMarket structure bullish on HTFs DW

Entry on both Weekly and Daily AOi

Weekly Rejection on AOi

Previous Structure point on Weekly

Daily Rejection at AOi

Previous Structure point Daily

Round Psych Level 1.17500

Touching EMA H4

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

GBPJPYGBPJPY — Institutional Structure & Liquidity Commentary

(Educational Analysis | Intraday Framework)

Welcome to my TradingView journal.

All content shared here is provided strictly for educational and informational purposes only. The purpose of this analysis is to document market structure, liquidity behavior, and price delivery through an institutional lens. Nothing presented constitutes financial advice, trade signals, or investment recommendations.

🔍 Market Structure Context

GBPJPY has recently delivered a clear bullish break of structure (BOS), confirming a shift in short-term directional intent. The impulsive expansion suggests strong participation rather than corrective price movement, indicating that prior sell-side liquidity has been absorbed.

Following the expansion, price has begun to stabilize above the broken structure, reflecting acceptance at higher levels rather than immediate rejection.

🧠 Demand Zone Perspective

The highlighted demand zone marks the origin of the bullish displacement. From an institutional perspective, this zone is treated as a contextual reference, not a signal. Such areas often represent locations where imbalance entered the market with conviction.

If price revisits this zone, the nature of the reaction will provide insight into whether bullish order-flow remains present or whether deeper rebalancing is required.

⚖️ Probabilistic Framework

Markets operate on probabilities, not certainty.

From current conditions:

Continuation remains valid while demand holds

•Corrective pullbacks may occur to rebalance inefficiencies

•Consolidation is possible as liquidity redistributes

•All scenarios remain valid until price confirms or invalidates them.

📌 Channel Philosophy

This channel is built around:

•Structure over indicators

•Liquidity logic over emotion

•Process over prediction

•Education over hype

There will be no signals, no guarantees, and no performance claims — only clean charts, disciplined reasoning, and transparent analysis.

If you value institutional logic, objective market commentary, and a rule-based analytical approach, you’re welcome to follow and engage.

Let price tell the story.

NZD-USD Local Long! Buy!

Hello,Traders!

NZDUSD has completed a sell-side liquidity sweep into a well-defined horizontal demand zone. Strong rejection signals smart money absorption, with price likely to rotate higher toward internal buy-side liquidity above recent structure. Time Frame 2H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Potential bearish reversal?Fiber (EUR/USD) is reacting off the pivot and could reverse to the 1st support, which is a pullback support.

Pivot: 1.1749

1st Support: 1.1680

1st Resistance: 1.1806

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

[EURNZD] Long then Short approximately 200 pips round tripEarlier long setup with higher risk in progress. Second setup with confirmation and higher success rate is active, long targeting approximately 200 pips then short targeting approximately 200pips. Short setup will need to confirm in LTF for entry. Not trading advice.

Heading towards key resistance?EUR/CHF is rising towards the resistance level, which is an overlap resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.92574

Why we like it:

There is an overlap resistance that aligns with the 61.8% Fibonacci retracement.

Stop loss: 0.93628

Why we lik eit:

There is a pullback resistance level.

Take profit: 0.92574

Why we like it:

There is an overlap support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish reversal setup?AUD/CAD is rising towards the resistance level which is a pullback resistance that lines up with the 50% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 0.9165

Why we like it:

There is a pullback resistance that aligns with the 50% Fibonacci retracement.

Stop loss: 0.9183

Why we like it:

There is a pullback resistance level.

Take profit: 0.91312

Why we like it:

There is a pullback support that is slightly above the 61.8% Fibonacci retracement

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

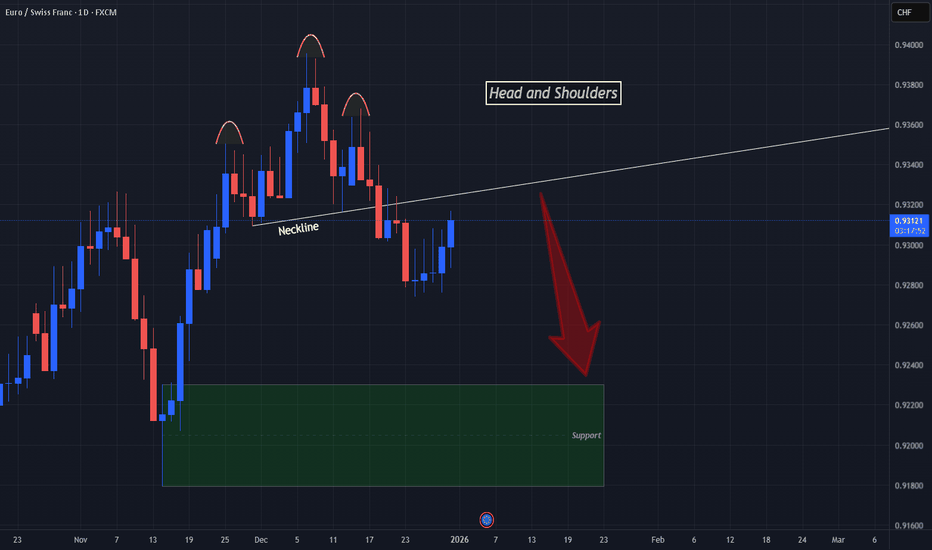

EURCHF Looking To "Head" Down To Next Support??OANDA:EURCHF has made a successful formation and breakout of a Head and Shoulders, a strong Bearish Reversal Pattern!

Now all we need is a Successful Retest of the Breakout of the "Neckline" or Support Level that helped form the pattern.

Currently, price is trading @ .9312

Looking for a Retest around .9320 - .9325

If the Retest is successful and price is rejected down, this will generate a great Short Opportunity to take price down to the next Support level from the Low @ .9230 - .9180!

Bullish reversal off 61.8% Fib support?NZD/JPY has bounced off the support level, which is a pullback support that aligns with the 61.8% Fibonacci retracement and could rise from this level to our take profit.

Entry: 90.05

Why we like it:

There is a pullback support level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 89.74

Why we like it:

There is a pullback support that aligns with the 78.6% Fibonacci retracement.

Take profit: 90.49

Why we like it:

There is a pullback resistance level that is slightly below the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EUR/USD Bearish Continuation Inside Descending ChannelThis is a EUR/USD 2-hour chart showing price action moving inside a descending channel, suggesting a short-term bearish structure. Price recently rejected from a clearly marked resistance zone near the upper boundary of the channel and is now consolidating below it.

Key horizontal levels are highlighted around 1.1754 and 1.1726, acting as interim support targets. The chart also marks a lower demand zone near the 1.1700 area, which could be a potential reaction point if bearish momentum continues.

The projected arrows indicate a continuation move to the downside, aligning with the overall channel trend and lower highs/lows structure.